Power MOSFET Market Synopsis:

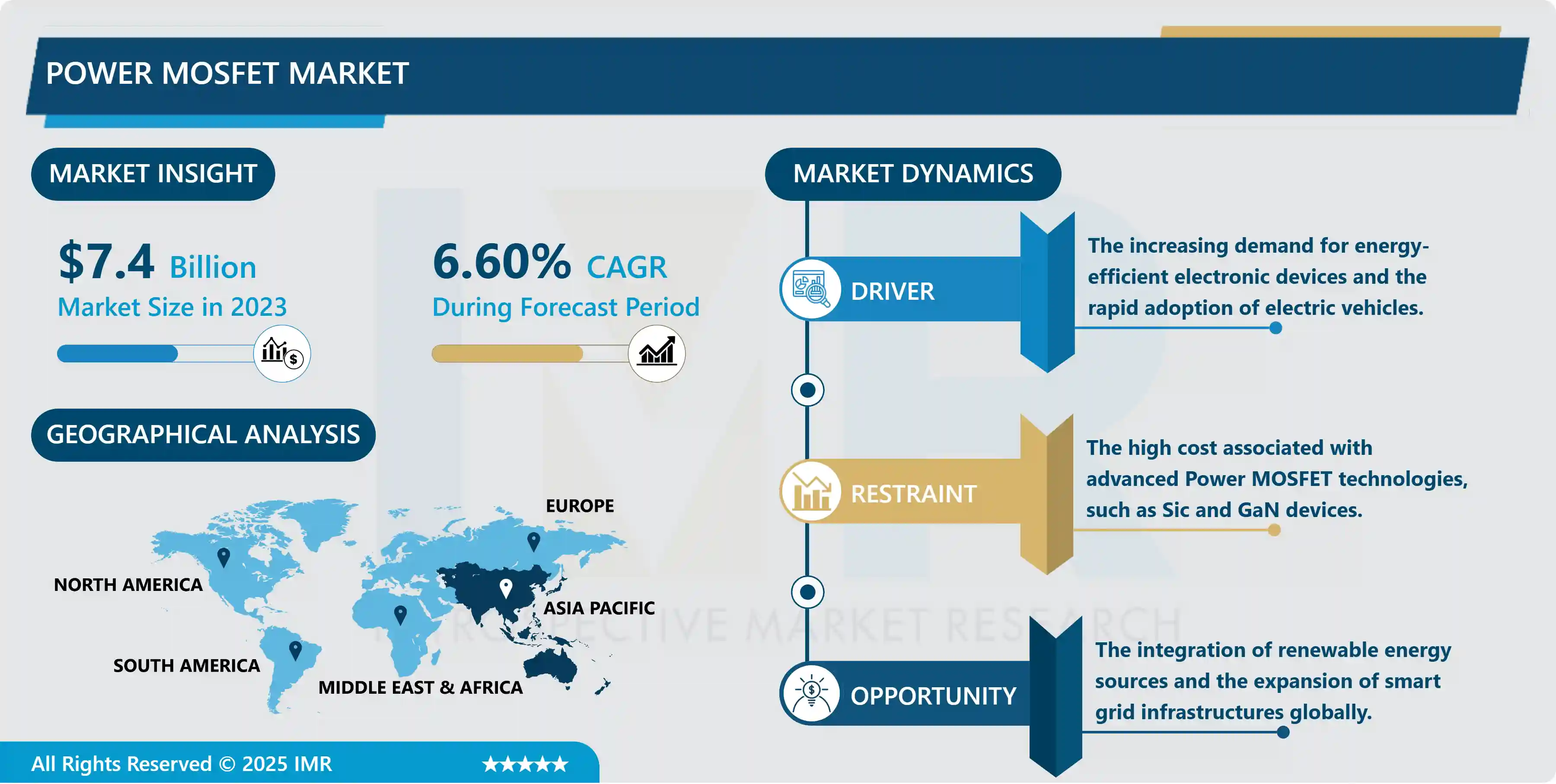

Power MOSFET Market Size Was Valued at USD 7.4 Billion in 2023, and is Projected to Reach USD 13.2 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.

The Power MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor) market concerns the global business sector that focuses on the design, manufacturing, and sale of Power MOSFETs which is critical semiconductor devices that are used for switching and amplification of electronic signals in several applications. These are necessary in power control applications of all industries including automotive, consumer electronics, industrial machines, telecommunications, and renewable energy conversion and control systems.

In the recent past, Power MOSFET market has been rapidly growing due to increasing demand for power saving electronics and increasing use of EV’s. Many automakers transition from internal combustion engines to scheduled EVs and other electrified vehicles, and they require sophisticated power control solutions, in which Power MOSFET has become an essential component of electric powertrains and charging systems for EVs. Furthermore, the increased use of consumer electronics and highlighted by the miniaturization and integration of technologies which require efficient power supplies has also advanced the market. The growing application of Industrial automation systems and the incorporation of the renewable energy resources into the electrical power distribution network have also contributed to the high usage of the Power MOSFETs as are needed in various technological advances.

Some of the trends that exist in the Power MOSFET market are the drive for newer and superior technology devices, simpler structure in devices found in the market, and better heat dissipation systems. The silicon carbide and gallium nitride MOSFETs have been recently developed to provide enhanced efficiency as well as switching performance for high power usage. These innovations have allowed varying and complicated demands to be met by supplying Power MOSFETs into techniques continually proving their significance in the development of electronics.

Power MOSFET Market Trend Analysis:

Rise of Silicon Carbide (Sic) and Gallium Nitride (GaN) Power MOSFETs

- An emerging trend in the Power MOSFET industry is the development of semiconductors such as silicon carbide and gallium nitride in power electronics. These materials provide better electrical performance than the known silicon based MOSFET structures, allowing for higher switching frequencies, increased efficiency and better thermal characteristics. Due to increasing application requirements for industries such as EVs, industrial automation, and renewable energy systems, MOSFETs based on SiC and GaN have received much attention as power switch devices. Specifically, SiC MOSFETs are growing increasingly popular for high voltage, high temperature applications like the EV inverter and solar inverter since they offer less energy conversion loss in severe condition.

- Consequently, GaN-based MOSFETs are gradually becoming popular in uses demanding efficient power conversion and small dimensions such as in portable end products and telecommunication gears. This trend towards wide-bandgap materials for power electronics is also likely to have a consequent impact on the Power MOSFET market over the forecasting period since the innovations of both sub-sectors are essential for the requirements of the electronic systems in the next generations.

Emerging Opportunities in Renewable Energy Integration

- The increasing focus towards availability of sustainable energy solutions can be seen as a major opportunity for the Power MOSFET market worldwide. When countries opt for embraced renewable energy systems including solar power, wind power among others, the global market is in constant search of the most efficient power conversion and management systems.

- Power MOSFETs play a crucial role in these applications to enable easy interconnection of renewable energy into power grids and improving the reliability of energy systems. This trend leading to higher market growth is expected, given that there are increasing shifts to clean energy all over the world.

Power MOSFET Market Segment Analysis:

Power MOSFET Market is Segmented on the basis of Type, Application, Power Rating, and Region.

By Type, Depletion-mode MOSFET segment is expected to dominate the market during the forecast period

- Depletion-mode MOSFETs are also called normally-on devices because they are able to conduct current even when the gate terminal of the device is open. This type is commonly applied in certain specific uses that have needed a steady and continuous current output or fail-safe circuits. Depletion-mode MOSFETs are widely used in current regulators, voltage clamps, and signal amplifiers in low power circuits. As such products, they are used in applications of high reliability systems, maintain reliable performance in adverse environments such as the industrial and telecommunication fields.

- First, the indeed portable enhancement-mode MOSFETs or normally-off devices are widely employed throughout the spectrum, leading to their absolute power MOSFET market dominance. These devices are turned off when there are no voltages applied across them, and they are switched on by a positive gate voltage They are suitable for high-efficiency switching applications. They are used in automotive systems, consumer electronics, renewable energy systems and industries that require high speeds of operations with low power output. Enhancement-mode MOSFETs remain a subject of technological improvement as modern electronic devices require lesser power with more efficiency, yielding incorporation of more advanced materials such as SiC, and GAASn.

By Application, Automotive segment expected to held the largest share

- It is to be noted that the Power MOSFET market finds its largest application in automotive electronics especially in electric vehicles, hybrid electric vehicles and ADAS (Advanced Driver Assistance System). The rising adoption of electric vehicles has compounded the need for advanced power control applications, leading to the enhancement of the Power MOSFET’s role in propulsion systems and charging circuits in EVs, inverters, and battery harvesting gear. The consumer electronics segment remains another huge area of application of these devices that guarantees energy saving operation of laptops, smartphones, home appliances etc. Its capacity to facilitate compact designs along with low energy losses is a major attribute, meeting consumers’ need for portable and high-performance devices.

- In industrial applications Power MOSFETs used in automation systems, motor control and drives, robotics, due to high switching speed as well as well controlled power output. It also features its use in power supplies and signal amplifiers to maintain the communication network in the telecommunication industry. In addition, the renewable energy application area especially in solar and wind power systems relies on the use of power MOSFET for energy conversion and interfacing to the utility grid. Such applications coupled with miscellaneous applications in aerospace & medical device field collectively demonstrate the versatility of Power MOSFETs across the industries.

Power MOSFET Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region become the leading demand in the Power MOSFET market in 2023 by having around 45% dominance of the global market. This dominance has been attributed to high production capacity of consumer electronic and electric vehicles, high usage rates of electric cars and high industrialization rates. H1 the developed countries like China, Japan and South Korea have been funding for technology and infrastructures development in this respect predominantly.

- The region has paid emphasis on industrial automation and the increasing need for smart products, which has made the company to establish a firm ground in the market.

Active Key Players in the Power MOSFET Market:

- Alpha & Omega Semiconductor (USA)

- Digi-Key Electronics (USA)

- Fairchild Semiconductor (USA)

- Infineon Technologies AG (Germany)

- IXYS Corporation (USA)

- Mitsubishi Electric Corporation (Japan)

- NXP Semiconductors (Netherlands)

- ON Semiconductor (USA)

- Renesas Electronics Corporation (Japan)

- ROHM Semiconductor (Japan)

- STMicroelectronics (Switzerland)

- Texas Instruments Inc. (USA)

- Toshiba Corporation (Japan)

- Vishay Inter technology Inc. (USA)

- Wolf speed, Inc. (USA), and Other Active Players.

Key Industries Development in the Power MOSFET Market:

- In September 2023, Infineon Technologies AG has launched its latest OptiMOS 6 40V and OptiMOS 5 25V and 30V power MOSFETs. These advanced MOSFETs are designed to deliver superior efficiency and performance, making them ideal for applications such as synchronous rectification in switched-mode power supplies (SMPS) for servers, telecom systems, portable chargers, and wireless chargers. The new products enhance power density and reduce energy losses, meeting the demands of modern, high-performance electronics.

- In June 2023, Toshiba has introduced the TPH3R10AQM, a cutting-edge N-channel MOSFET leveraging U-MOS X-H fabrication technology. Designed for switching circuits and hot swap circuits, this innovative product ensures efficient performance on the power lines of industrial equipment. Targeted applications include data centers and communications base stations, where reliability and energy efficiency are paramount. With a low on-resistance and optimized design, the TPH3R10AQM offers enhanced power management, addressing the evolving needs of modern industrial systems.

|

Power MOSFET Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 7.4 Billion |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 13.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Power Rating |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power MOSFET Market by Type (2018-2032)

4.1 Power MOSFET Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Depletion-mode MOSFET

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Enhancement-mode MOSFET

Chapter 5: Power MOSFET Market by Application (2018-2032)

5.1 Power MOSFET Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Consumer Electronics

5.5 Industrial

5.6 Telecommunications

5.7 Renewable Energy

5.8 Others

Chapter 6: Power MOSFET Market by Power Rating (2018-2032)

6.1 Power MOSFET Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Low Power (< 250V)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medium Power (250V – 600V)

6.5 High Power (> 600V)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Power MOSFET Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INFINEON TECHNOLOGIES AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NXP SEMICONDUCTORS N.V. (NETHERLANDS)

7.4 TEXAS INSTRUMENTS INC. (USA)

7.5 ON SEMICONDUCTOR CORPORATION (USA)

7.6 STMICROELECTRONICS N.V. (SWITZERLAND)

7.7 RENESAS ELECTRONICS CORPORATION (JAPAN)

7.8 VISHAY INTERTECHNOLOGY INC. (USA)

7.9 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.10 MICROCHIP TECHNOLOGY INC. (USA)

7.11 BROADCOM INC. (USA)

7.12 ROHM SEMICONDUCTOR (JAPAN)

7.13 TOSHIBA CORPORATION (JAPAN)

7.14 SONY SEMICONDUCTOR SOLUTIONS CORPORATION (JAPAN)

7.15 QUALCOMM INC. (USA)

7.16 ANALOG DEVICES INC. (USA)

7.17 MAXIM INTEGRATED (NOW PART OF ANALOG DEVICES) (USA)

7.18 INTERNATIONAL RECTIFIER (NOW PART OF INFINEON TECHNOLOGIES) (USA)

7.19 LINEAR TECHNOLOGY (NOW PART OF ANALOG DEVICES) (USA)

7.20 ALPHA & OMEGA SEMICONDUCTOR LIMITED (USA)

7.21 FAIRCHILD SEMICONDUCTOR (NOW PART OF ON SEMICONDUCTOR) (USA)

7.22 DIODES INCORPORATED (USA)

7.23 MICROSEMI CORPORATION (NOW PART OF MICROCHIP TECHNOLOGY) (USA)

7.24 POWER INTEGRATIONS INC. (USA)

7.25 SEMICONDUCTOR MANUFACTURING INTERNATIONAL CORPORATION (SMIC) (CHINA)

7.26 NAVITAS SEMICONDUCTOR (USA)

7.27 AND

Chapter 8: Global Power MOSFET Market By Region

8.1 Overview

8.2. North America Power MOSFET Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Depletion-mode MOSFET

8.2.4.2 Enhancement-mode MOSFET

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Automotive

8.2.5.2 Consumer Electronics

8.2.5.3 Industrial

8.2.5.4 Telecommunications

8.2.5.5 Renewable Energy

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Power Rating

8.2.6.1 Low Power (< 250V)

8.2.6.2 Medium Power (250V – 600V)

8.2.6.3 High Power (> 600V)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Power MOSFET Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Depletion-mode MOSFET

8.3.4.2 Enhancement-mode MOSFET

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Automotive

8.3.5.2 Consumer Electronics

8.3.5.3 Industrial

8.3.5.4 Telecommunications

8.3.5.5 Renewable Energy

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Power Rating

8.3.6.1 Low Power (< 250V)

8.3.6.2 Medium Power (250V – 600V)

8.3.6.3 High Power (> 600V)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Power MOSFET Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Depletion-mode MOSFET

8.4.4.2 Enhancement-mode MOSFET

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Automotive

8.4.5.2 Consumer Electronics

8.4.5.3 Industrial

8.4.5.4 Telecommunications

8.4.5.5 Renewable Energy

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Power Rating

8.4.6.1 Low Power (< 250V)

8.4.6.2 Medium Power (250V – 600V)

8.4.6.3 High Power (> 600V)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Power MOSFET Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Depletion-mode MOSFET

8.5.4.2 Enhancement-mode MOSFET

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Automotive

8.5.5.2 Consumer Electronics

8.5.5.3 Industrial

8.5.5.4 Telecommunications

8.5.5.5 Renewable Energy

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Power Rating

8.5.6.1 Low Power (< 250V)

8.5.6.2 Medium Power (250V – 600V)

8.5.6.3 High Power (> 600V)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Power MOSFET Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Depletion-mode MOSFET

8.6.4.2 Enhancement-mode MOSFET

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Automotive

8.6.5.2 Consumer Electronics

8.6.5.3 Industrial

8.6.5.4 Telecommunications

8.6.5.5 Renewable Energy

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Power Rating

8.6.6.1 Low Power (< 250V)

8.6.6.2 Medium Power (250V – 600V)

8.6.6.3 High Power (> 600V)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Power MOSFET Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Depletion-mode MOSFET

8.7.4.2 Enhancement-mode MOSFET

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Automotive

8.7.5.2 Consumer Electronics

8.7.5.3 Industrial

8.7.5.4 Telecommunications

8.7.5.5 Renewable Energy

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Power Rating

8.7.6.1 Low Power (< 250V)

8.7.6.2 Medium Power (250V – 600V)

8.7.6.3 High Power (> 600V)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Power MOSFET Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 7.4 Billion |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 13.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Power Rating |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||