Power Electronics Market Synopsis

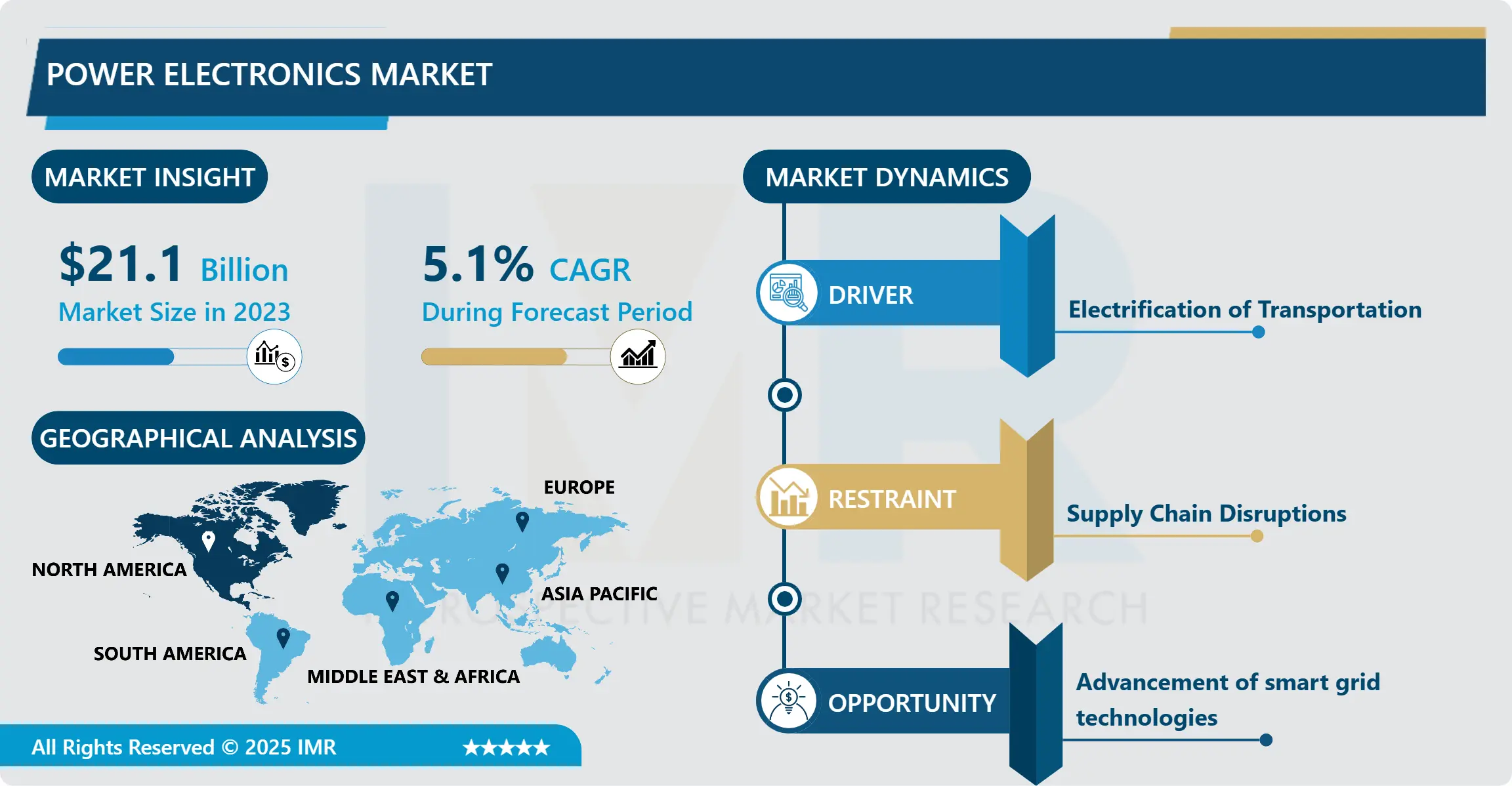

Power Electronics Market Size Was Valued at USD 21.1 Billion in 2023 and is Projected to Reach USD 33 Billion by 2032, Growing at a CAGR of 5.1% From 2024-2032.

Power electronics can be defined as the study of using semiconductor devices such as diodes, transistors, and thyristors to control and manage electrical power. It covers the aspects of designing and use of circuits and systems to transform electrical power from one form to the other, for instance, conversion of A. C to D. C (Rectification), D. C to A. C (Inversion), and Voltage or Current adjustment. Some of the power electronics end-use applications include renewable energy generation systems, electric and hybrid vehicles, industrial spindle and adjustable speed drives, and mobile electronics, where conversion and control of power significantly impact energy value and efficiency.

The global power electronics market has also had an up surge on demand for energy efficient solutions in the current global market. Some of them are based on the increased utilization of RE sources such as solar and wind power, which entail the use of advanced power conversion systems to interface with existent power grids. Also, with growth in the popularity of electric vehicle (EVs) and hybrid electric vehicles (HEVs), power electronics finds application in the vehicle propulsion system and charging stations. Motor drives and UPS systems are used across industries and contribute to the market growth because industries strive to improve energy efficiency and reliability.

By location, Asia Pacific holds the largest power electronics market because of the fast rate of industrialization and infrastructure establishment in nations such as China, Japan, and South Korea. North America and Europe come next, benefited from the improvement of automobile industries and renewable energies. It describes the ever-evolving market in terms of fast mushrooming of all advanced semiconductors technology, enhanced design of power modules and the inclusion of digital control for better efficiency in many fields.

Power Electronics Market Trend Analysis

Increasing integration of wide-bandgap (WBG) semiconductors such as silicon carbide (SiC) and gallium nitride (GaN)

- There has been observed the rising of use of wide-bandgap (WBG) semiconductors in power electronics applications of SiC and/or GaN. These materials proposed are characterizes with higher performance compared to silicon base-devices: higher efficiency and frequency of switching, possibility of operation at higher temperature and voltages. Therefore, WBG semiconductors are progressively being used in power electronics applications especially in electric vehicle applications, renewable energy conversion systems, and industrial motor control.

- It has been necessitated by necessity of greater power density and smaller volumes in power delivery with reliability in more hostile environments. With further evolution of the technology, the costs are decreasing and effectiveness of manufacturing WBG semiconductors is increasing; thus, the application of WBG semiconductors is expected to expand and there will be a significant change in the development of power electronics.

Advancement of smart grid technologies

- Another great area of development in the domain of power electronics is identified in the enhancement of smart grid systems. Smart grids use the advanced communication and control technologies with power electronics features in the electricity production, transmission and consumption processes. This integration allows utilities to tailor the levels of peak demand, stability of electricity, and incorporation of renewable resources as well as electric cars into the grid.

- Smart grid technologies introduce contingency for manufacturers of power electronics to devise techniques like grid-tied inverters, energy storage systems, and demand response gadgets. They can improve the capabilities of an electrical grid, decrease energy losses, and provide a better use of resources. Also, as government and utilities of the world are adding smart grid dollars, there is a market need for advanced power electronics for next generation smart grid applications.

Power Electronics Market Segment Analysis:

Power Electronics Market Segmented on the basis of material, application.

By Material, Sapphire segment is expected to dominate the market during the forecast period

- Sapphire segment is expected to become the most dominant segment at the time of forecast year across the several industries with specific reference to electronics & optoelectronics industries. Due to its high hardness, wide range of transparency, and good thermal conductivity among the other properties, Sapphire is a material of choice for use in various fields. Sapphire substrates are vital in electronics since they are strong materials that can be used to make semiconductors, light emitting diodes (LEDs), and radio frequency integrated circuits (RFICs) among other product due to their attribute of electrical insulation.

- In the field of optoelectronics, it is very useful as it has low transmission loss and does not scratch or corrode easily due to which it is used for optical windows, lenses and substrates in laser, sensors and imaging systems. With technology enhancing the production of sapphire and other relevant instruments, its market control is set to rise even higher, thus innovating various sectors with an emphasis on the ones that require high-performing materials.

By Application, Consumer Electronics segment expected to held the largest share

- Out of all the various fields, the consumer electronics segment is expected to have the largest market share for power electronics in the future due to an escalating need for efficient power electronics devices in regular consumer use. This segment includes smartphones, laptops, tablets, TVs, home appliances, wearable devices, etc. , that without a doubt, require efficient power electronic components for power management/control. Consumers are now more inclined towards the battery life of devices, their charging time or the energy consumed by these devices leading to the incorporation of high efficiency voltage regulators, power converters and DC-DC converters.

- Also, the increased use of IoT devices and excellence for smart homes also pushes the need for power electronic solutions to control power relationships and efficiency. The dynamics of the consumer electronics segment presents the market with an upward trajectory in the way it influences the advance of power electronics through power efficient and superior performers innovations.

Power Electronics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The global power electronics market is set to continue with North America’s supremacy over the forecast period for several reasons. There is a wide and solid industry base, and the region demonstrates high technological development in automotive, aerospace, and telecommunications industries that highly require advanced power electronics solutions. In addition, increasing government standards to enhance the efficiency of energy power and attempt to reduce the utilization of carbon also contributes to the integration of power electronics in Renewable energy systems and electrical vehicles in the continent of America.

- Also, the well-developed infrastructure in North America, along with the large-scale application of Smart Grid technologies, provides extra impetus to the use of power electronics for efficient power management and resilience in the energy sector. With such developments, research and developments in new semiconductor technologies will go on promoting efficiency and functionality of power electronics devices. Claiming proactive steps toward sustainable energy solutions and continuous capital buffer for the enhancement of infrastructure in liberal countries North America is devising formidably to sustain the supremacy in the power electronic market all over the world in the near future.

Active Key Players in the Power Electronics Market

- ABB Ltd. (Switzerland)

- Delta Electronics, Inc. (Taiwan)

- Fuji Electric Co., Ltd. (Japan)

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (United States)

- Mitsubishi Electric Corporation (Japan)

- NXP Semiconductors N.V. (Netherlands)

- ON Semiconductor Corporation (United States)

- Renesas Electronics Corporation (Japan)

- Schneider Electric SE (France)

- Semikron International GmbH (Germany)

- STMicroelectronics NV (Switzerland)

- Texas Instruments Incorporated (United States)

- Toshiba Corporation (Japan)

- Vishay Intertechnology, Inc. (United States) and Other key Players

|

Power Electronics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.1 % |

Market Size in 2032: |

USD 33 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Electronics Market by Material (2018-2032)

4.1 Power Electronics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sapphire

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Silicon

4.5 Gallium Nitride

4.6 Silicon Carbide

4.7 Others

Chapter 5: Power Electronics Market by Application (2018-2032)

5.1 Power Electronics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Consumer Electronics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial

5.5 ICT

5.6 Aerospace & Defense

5.7 Automotive

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Power Electronics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB LTD. (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DELTA ELECTRONICS INC. (TAIWAN)

6.4 FUJI ELECTRIC COLTD. (JAPAN)

6.5 INFINEON TECHNOLOGIES AG (GERMANY)

6.6 MICROCHIP TECHNOLOGY INC. (UNITED STATES)

6.7 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

6.8 NXP SEMICONDUCTORS N.V. (NETHERLANDS)

6.9 ON SEMICONDUCTOR CORPORATION (UNITED STATES)

6.10 RENESAS ELECTRONICS CORPORATION (JAPAN)

6.11 SCHNEIDER ELECTRIC SE (FRANCE)

6.12 SEMIKRON INTERNATIONAL GMBH (GERMANY)

6.13 STMICROELECTRONICS NV (SWITZERLAND)

6.14 TEXAS INSTRUMENTS INCORPORATED (UNITED STATES)

6.15 TOSHIBA CORPORATION (JAPAN)

6.16 VISHAY INTERTECHNOLOGY INC. (UNITED STATES) OTHER KEY PLAYERS

6.17

Chapter 7: Global Power Electronics Market By Region

7.1 Overview

7.2. North America Power Electronics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Material

7.2.4.1 Sapphire

7.2.4.2 Silicon

7.2.4.3 Gallium Nitride

7.2.4.4 Silicon Carbide

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Consumer Electronics

7.2.5.2 Industrial

7.2.5.3 ICT

7.2.5.4 Aerospace & Defense

7.2.5.5 Automotive

7.2.5.6 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Power Electronics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Material

7.3.4.1 Sapphire

7.3.4.2 Silicon

7.3.4.3 Gallium Nitride

7.3.4.4 Silicon Carbide

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Consumer Electronics

7.3.5.2 Industrial

7.3.5.3 ICT

7.3.5.4 Aerospace & Defense

7.3.5.5 Automotive

7.3.5.6 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Power Electronics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Material

7.4.4.1 Sapphire

7.4.4.2 Silicon

7.4.4.3 Gallium Nitride

7.4.4.4 Silicon Carbide

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Consumer Electronics

7.4.5.2 Industrial

7.4.5.3 ICT

7.4.5.4 Aerospace & Defense

7.4.5.5 Automotive

7.4.5.6 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Power Electronics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Material

7.5.4.1 Sapphire

7.5.4.2 Silicon

7.5.4.3 Gallium Nitride

7.5.4.4 Silicon Carbide

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Consumer Electronics

7.5.5.2 Industrial

7.5.5.3 ICT

7.5.5.4 Aerospace & Defense

7.5.5.5 Automotive

7.5.5.6 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Power Electronics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Material

7.6.4.1 Sapphire

7.6.4.2 Silicon

7.6.4.3 Gallium Nitride

7.6.4.4 Silicon Carbide

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Consumer Electronics

7.6.5.2 Industrial

7.6.5.3 ICT

7.6.5.4 Aerospace & Defense

7.6.5.5 Automotive

7.6.5.6 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Power Electronics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Material

7.7.4.1 Sapphire

7.7.4.2 Silicon

7.7.4.3 Gallium Nitride

7.7.4.4 Silicon Carbide

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Consumer Electronics

7.7.5.2 Industrial

7.7.5.3 ICT

7.7.5.4 Aerospace & Defense

7.7.5.5 Automotive

7.7.5.6 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Power Electronics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.1 % |

Market Size in 2032: |

USD 33 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||