Power Cutter Market Overview

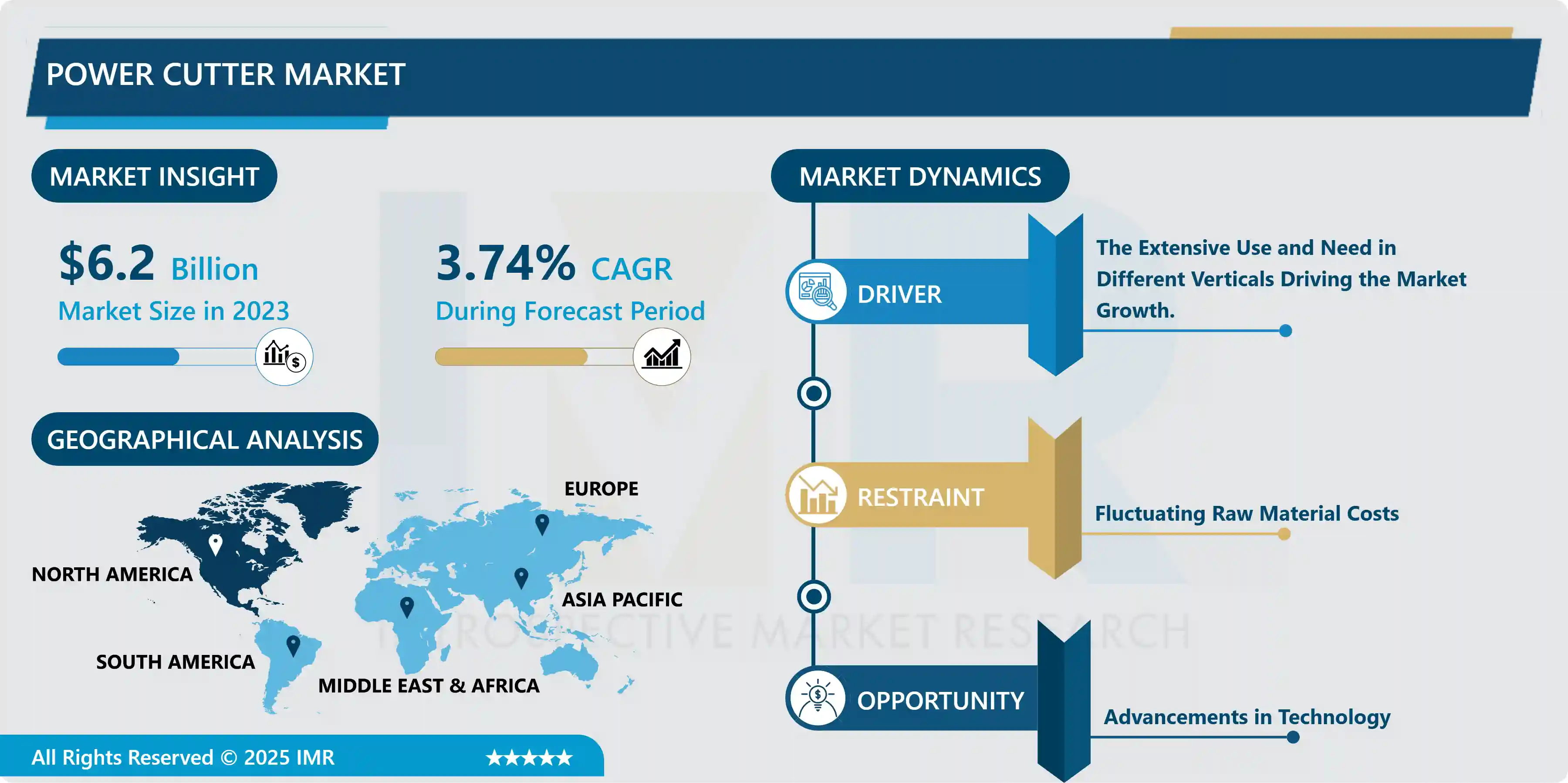

Power Cutter Market Size Was Valued at USD 6.2 Billion in 2023, and is Projected to Reach USD 8.6 Billion by 2032, Growing at a CAGR of 3.74% From 2024-2032.

Power Cutter is an essential machine used in multiple industries to cut hard surfaces like wooden logs, plywood, metal objects, concrete blocks, and other related items. Power cutter allows to cut various objects with battery or direct power-operated motor can cut through objects with high RPM blade. Within the defense sector, cutting tools enable the creation of specialized ships, vehicles, and planes that move troops. And within the oil and gas industry, they make precise incisions in wells and pipes. These are just a few of the many applications for customized cutting tools that come in all shapes and sizes. Except for the cutting disc, this instrument is quite similar to an angle grinder, chop saw, or even a die grinder (a circular diamond blade, or resin-bonded abrasive cutting wheel for a disc cutter vs. an abrasive grinding wheel for an angle grinder). When compared to hand tools, this equipment is extremely effective at cutting extremely hard materials. Hence, large applications and extensive demand can boost the market growth in the coming years.

Market Dynamics and Factors For Power Cutter:

Drivers

The extensive use and need in different verticals driving the market growth.

- The industry is largely driven by increasing global industrialization and developing applications in the home and commercial sectors. Automobile, aircraft, construction, electronics, and shipbuilding are all sectors that employ power cutters. They may also be used for a variety of domestic tasks, including stripping paint, soldering wire, thawing pipes, and other DIY projects. The surge in demand for cutting tools has been fueled by the expansion of Li-ion batteries and infrastructure upgrades.

The notable shift towards DIY projects boosting the domestic market.

- General contractors and subcontractors that build new homes and modify existing homes are involved in the construction and renovation of residences. External constructions such as gardens, garages, and lawns are frequently included in home improvement projects. In 2020, the total amount spent on house improvements in the United States was 457 billion dollars. Homeowners make improvements to their houses to make them more comfortable, such as upgrading air conditioning and heating systems, waterproofing roofs and basements, soundproofing rooms, and extending their homes to save energy. By doing the work themselves, the number of garage tools and power tool sales has increased tremendously. Power Cutter is one of the tools that have a large share in total sales. It has also contributed majorly to the overall growth of the market.

Restraints

- Several organizations are focusing on automating their production processes. However, this comes with a considerable expense in terms of machine purchase, training, and maintenance. Fluctuating raw material costs are also one of the primary variables influencing the market growth. Furthermore, organizations are having difficulty adapting to the changing demands of the hour due to the continuous epidemic. Companies are now experiencing a severe financial shortage, and as a result, they are being forced to downsize and cut their workforce. Based on the severity of the present economic situation as a result of the pandemic, this is projected to have an impact on company revenue in the following years.

Opportunities

- Advanced Power Cutters have realized the universal applications of intelligent cutting and formed an integrated process. The process includes computer-aided management of production operations and the material consumption budget, the computer-aided design of parts, the automatic nesting of cutting parts, and the direct generation of an NC code for processing. This makes cutting becomes more stable, faster, and more efficient. Key technologies, such as the cutting database, automatic servo feed control system, and multi-fluid cooling system enable foreign band sawing machines, whose production is headed by German company BEHRINGER. With the adoption from leading companies, intelligent power-cutting tools are expected to take over the market during the forecasted period.

Challenge

- Most businesses still focus on the manufacturing of medium and low-grade machine tools due to a lack of unique innovation. The structure of the power cutter and equipment business is made up of fierce rivalry in the low-grade product area, chaos in the intermediate product region, and full inefficiency in the advanced product area. Foreign power cutter manufacturers have fully integrated machine design, Internet and information technology, and artificial intelligence technology to better answer consumers' demands for high speed, composite, intelligent, and environmentally friendly cutting machines. To adopt such technology in power cutting tools and utilization is where power cutting manufacturers are struggling. Hence, it impacted market growth and challenging factors to address by industry leaders.

Market Segmentation

- By Power Type, the Gas-powered cutter is dominating the Power Cutter Market. During the projection period, rising demand in the construction and automotive industries would aid this category in gaining market share. The oxyfuel process is the most common in the gas power cutter. Because it can cut thicknesses ranging from 0.5mm to 250mm, the oxyfuel process is the most extensively used industrial thermal cutting technique. The equipment is low-cost and may be used manually or mechanically. There are fuel gas and nozzle design variations available that can improve cut quality and speed dramatically. Power cutters are often chosen based on variables such as storage, mobility, performance, and safety. Hydraulic equipment market development is fueled by the worldwide construction sector's expansion. The demand for these devices is fueled by rapid industrialization and increased infrastructure expenditure. During the projected period, a spike in demand for material handling equipment in sectors such as oil and gas, marine, automotive, and others is likely to provide attractive growth prospects for major players.

- By Cutter Type, Ring cutter is dominating the Power Cutter Market. Materials such as wood, stone, plastic, and metal are cut with ring cutters. They are often driven by electricity, but they may also be powered by a gasoline engine or a hydraulic motor, allowing them to be tied to heavy machinery without requiring a separate energy source. Because they are easy to use and operate well in limited locations, cordless circular power cutters are becoming more popular. Wood and wood products are best cut using cordless saws. Cutting ice, falling trees, bucking, trimming, and cutting firebreaks in wildland fire control, gathering firewood, and cutting concrete during construction developments are all tasks that power cutters assist with. Operators of gasoline-powered chain power cutters are exposed to dangerous carbon monoxide (CO) gas, particularly while working inside. Due to a lack of sufficient norms and safety procedures, this is likely to stifle market expansion in emerging and undeveloped countries. As a result, the rise of gasoline-powered chain cutters is projected to be hampered by stricter environmental laws.

- By End-User Industry, the industrial end-user sector contributed the most revenue to the market, and this trend is expected to continue throughout the forecast period. The worldwide industrial industry is under increasing pressure to increase output volume while maintaining quality standards, necessitating the use of efficient cutting tools. Furthermore, during the predicted period, the dynamic needs for precision cutting may boost demand for power cutters. Metal cutting, maintenance, and repair are all common uses for power cutters in the business sector. The breadth of power cutter tools is expanding as firms extend their footprint and production operations in developed and emerging nations, consequently increasing the extent of commercial building activities.

Players Covered in Power Cutter market are :

- Makita

- Braun Maschinenfabrik

- Bosch Tools

- STIHL

- Saint-Gobain

- Hilti

- Stanley Black & Decker

- Panasonic

- Ferm International

- Festool

- Dynabrade

- Apex Tool Group

- Honda

- Atlas Copco

- Husqvarna Construction and other major players.

Regional Analysis of Power Cutter Market

- The growth in the US cutting tool market has been about 1.5% annually for the last five years - approximately in line with GDP. The industry has begun to expand during the same period, with cutting-tool firms carrying out more than 200 mergers and acquisitions, accounting for more than $4 billion in sales since 2000. The prevalence of DIY culture is still prevalent in North America. Cutting power tools continue to use in domestic applications, including maintenance, paint scraping, and several other tasks. With growing technical innovations and rising people's buying power, the North American power cutter market is projected to expand significantly in residential, commercial, and industrial sectors during the forecast period.

- The Asia Pacific is the fastest-growing region in the Power Cutter Market. In the APAC region market is accelerating as businesses are getting back to normal phase since the pandemic started. Therefore, demand for overall power tools has seen significant growth since last year. Asia Pacific region was estimated at around 7.7 billion and expected to reach USD 11.7 Billion by 2027. Power cutter holds a significant share in the overall power tool segment. The rising number of construction projects generates the demand from the commercial contractor with the requirement of large units. As New local competitors provide cost-efficient power cutters, which certainly impact the international manufacturers' share. However, with strong presence of Hilti, Bosch, and Makita and a large number of portfolios specially designed for the Asian region has caused a significant rise in demand for power cutters. Rising DIY trends and domestic demand are boosting the growth of the Power Cutter Market in the region during the forecasted period.

Key Developments of Power Cutter Market

-

In February 2024, Robert Bosch GmbH introduced the new AdvancedDrill and AdvancedImpact 18V-80 QuickSnap, enabling powerful screwing and drilling even in tight spots. These cordless tools are part of Bosch's '18V Power for All System', which covers over 70 DIY tools and appliances. With a single 18V lithium-ion battery and charger, users save space and money, while reducing environmental impact. Equipped with Syneon Technology for optimal performance and endurance, Bosch tools maintain full power until the battery is drained, ensuring efficient drilling and screwing throughout the task.

-

In February 2024, Makita U.S.A., Inc. launched the 5" Paddle Switch Angle Grinder with AC/DC Switch (9558HP), providing another choice for professionals in metal fabrication shops, as well as the electrical, mechanical, and plumbing trades. This addition expands Makita’s grinding options, offering users 7.5 AMPs and 10,000 RPM in a compact 4.5 lb grinder.

|

Power Cutter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.74 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Power Type |

|

|

|

By Cutter Type |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Cutter Market by Power Type (2018-2032)

4.1 Power Cutter Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery-Powered

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Electric-Powered

4.5 Pneumatic-Powered

4.6 Gas-Powered

4.7 Hydraulic-Powered

Chapter 5: Power Cutter Market by Cutter Type (2018-2032)

5.1 Power Cutter Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ring Cutter

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Chain Cutter

Chapter 6: Power Cutter Market by End User Industry (2018-2032)

6.1 Power Cutter Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Industrial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Domestic

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Power Cutter Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAOTOU DONGBAO BIOTECHNOLOGY CO. LTD. (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONNOILS LLC (US)

7.4 DARLING INGREDIENTS INC (US); GELITA AG (GERMANY)

7.5 GELNEX (BRAZIL)

7.6 ITALGEL S.R.L. (ITALY)

7.7 LAPI GELATINE S.P.A. (ITALY)

7.8 NIPPI INC. (JAPAN)

7.9 NITTA GELATIN (INDIA)

7.10 NUTRA FOOD INGREDIENTS (US)

7.11 RABJ CO. LTD (THAILAND)

7.12 VINH HOAN (VIETNAM)

7.13 VITAL PROTEINS (US)

7.14 WEISHARDT GROUP (FRANCE)

Chapter 8: Global Power Cutter Market By Region

8.1 Overview

8.2. North America Power Cutter Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Power Type

8.2.4.1 Battery-Powered

8.2.4.2 Electric-Powered

8.2.4.3 Pneumatic-Powered

8.2.4.4 Gas-Powered

8.2.4.5 Hydraulic-Powered

8.2.5 Historic and Forecasted Market Size by Cutter Type

8.2.5.1 Ring Cutter

8.2.5.2 Chain Cutter

8.2.6 Historic and Forecasted Market Size by End User Industry

8.2.6.1 Industrial

8.2.6.2 Commercial

8.2.6.3 Domestic

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Power Cutter Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Power Type

8.3.4.1 Battery-Powered

8.3.4.2 Electric-Powered

8.3.4.3 Pneumatic-Powered

8.3.4.4 Gas-Powered

8.3.4.5 Hydraulic-Powered

8.3.5 Historic and Forecasted Market Size by Cutter Type

8.3.5.1 Ring Cutter

8.3.5.2 Chain Cutter

8.3.6 Historic and Forecasted Market Size by End User Industry

8.3.6.1 Industrial

8.3.6.2 Commercial

8.3.6.3 Domestic

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Power Cutter Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Power Type

8.4.4.1 Battery-Powered

8.4.4.2 Electric-Powered

8.4.4.3 Pneumatic-Powered

8.4.4.4 Gas-Powered

8.4.4.5 Hydraulic-Powered

8.4.5 Historic and Forecasted Market Size by Cutter Type

8.4.5.1 Ring Cutter

8.4.5.2 Chain Cutter

8.4.6 Historic and Forecasted Market Size by End User Industry

8.4.6.1 Industrial

8.4.6.2 Commercial

8.4.6.3 Domestic

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Power Cutter Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Power Type

8.5.4.1 Battery-Powered

8.5.4.2 Electric-Powered

8.5.4.3 Pneumatic-Powered

8.5.4.4 Gas-Powered

8.5.4.5 Hydraulic-Powered

8.5.5 Historic and Forecasted Market Size by Cutter Type

8.5.5.1 Ring Cutter

8.5.5.2 Chain Cutter

8.5.6 Historic and Forecasted Market Size by End User Industry

8.5.6.1 Industrial

8.5.6.2 Commercial

8.5.6.3 Domestic

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Power Cutter Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Power Type

8.6.4.1 Battery-Powered

8.6.4.2 Electric-Powered

8.6.4.3 Pneumatic-Powered

8.6.4.4 Gas-Powered

8.6.4.5 Hydraulic-Powered

8.6.5 Historic and Forecasted Market Size by Cutter Type

8.6.5.1 Ring Cutter

8.6.5.2 Chain Cutter

8.6.6 Historic and Forecasted Market Size by End User Industry

8.6.6.1 Industrial

8.6.6.2 Commercial

8.6.6.3 Domestic

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Power Cutter Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Power Type

8.7.4.1 Battery-Powered

8.7.4.2 Electric-Powered

8.7.4.3 Pneumatic-Powered

8.7.4.4 Gas-Powered

8.7.4.5 Hydraulic-Powered

8.7.5 Historic and Forecasted Market Size by Cutter Type

8.7.5.1 Ring Cutter

8.7.5.2 Chain Cutter

8.7.6 Historic and Forecasted Market Size by End User Industry

8.7.6.1 Industrial

8.7.6.2 Commercial

8.7.6.3 Domestic

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Power Cutter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.74 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Power Type |

|

|

|

By Cutter Type |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||