Poultry Diagnostics Market Synopsis:

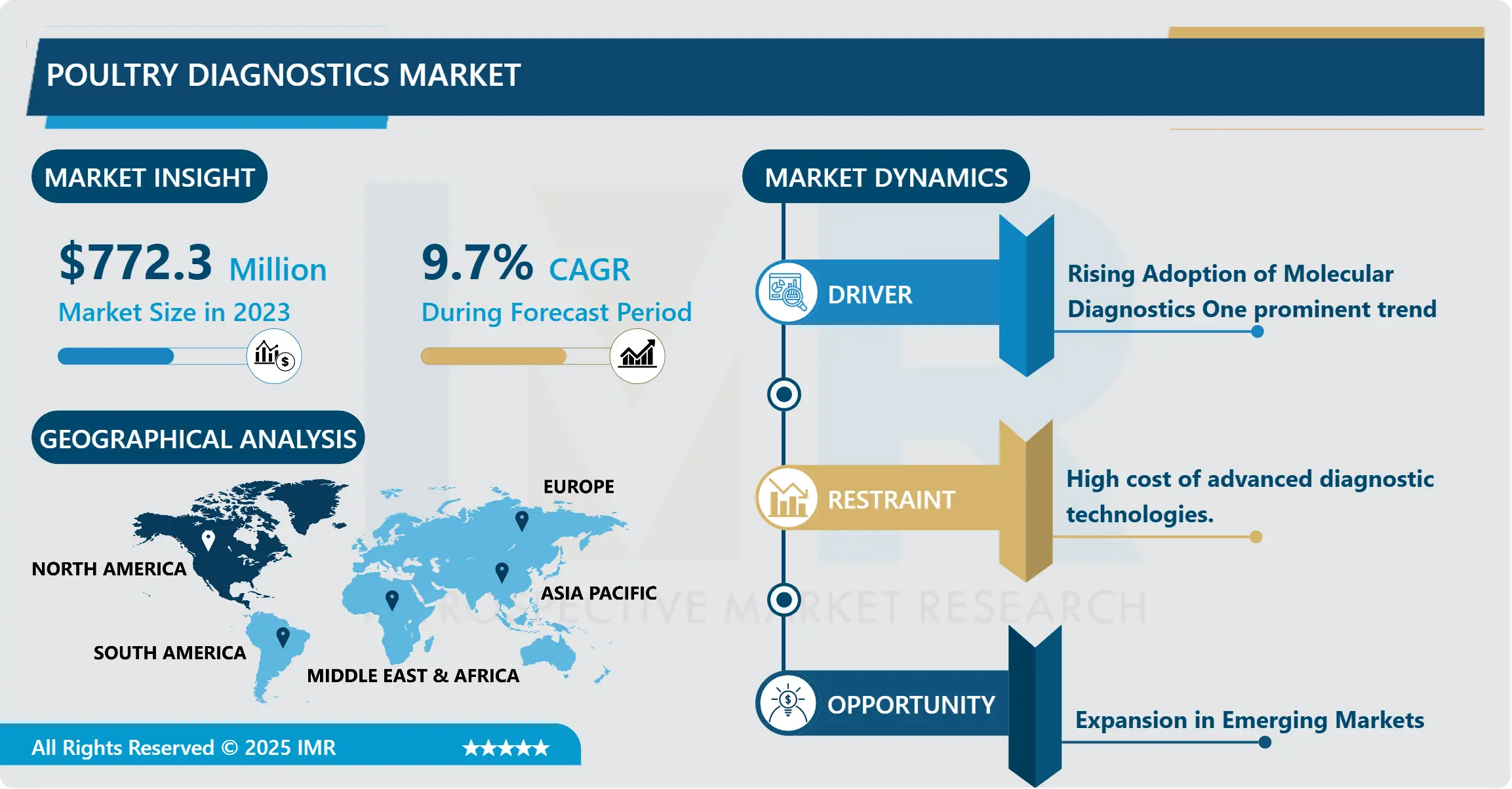

Poultry Diagnostics Market Size Was Valued at USD 772.3 Million in 2023, and is Projected to Reach USD 1776.829 Million by 2032, Growing at a CAGR of 9.7% From 2024-2032.

The poultry diagnostics industry is involved in the diagnosis of avian diseases in poultry which comprisesCli of chickens, turkeys, ducks, and others. This comprises laboratory diagnostic test, point of care diagnostic kits, and genetic and molecular diagnostic methods for identification of infections, pathogens and other conditions affecting poultry. Diagnostics are central in the successful management of poultry diseases that affect food security; stability of poultry businesses.

The market for poultry diagnostics is rapidly expanding, due to the accelerated consumption of poultry products globally and the growing awareness of food safety, bird to human disease transmission, and disease epidemics in poultry flocks. Main products available in the market include molecular diagnostic solutions along with immunodiagnostics solutions and serological tests of different poultry diseases like avian influenza, Newcastle disease, avian coryza etc..

However due to the advances in biosecurity and animal health management the market has embraced changes in diagnostics equipment. Some of the trends include point-of-care diagnostics, rapid test kits and artificial reading of data generated. Also, increased production of poultry, especially in the emerging economy further drives the market growth due to need for efficient diagnostic tools for maintaining production rates and preventing the disease outbreak.

Poultry Diagnostics Market Trend Analysis:

Rising Adoption of Molecular

- One emerging business model in the poultry diagnostics market is that one sees a trend of molecular diagnostics in the market. It is possibilities these two diagnosis tools provide high accuracy rate, short time, and high sensitivity to diagnose diseased poultry farmers at an early stage. Al tactics is used PCR (Polymerase Chain Reaction) and other nucleic acid-based tests that have superior accuracy in terms of pathogen detection at the molecular level. In view of the trends depicting forward integration of technologies in poultry farming and production, molecular based diagnostic methods are playing a crucial role where time factor significantly affects disease determining and aetiology, reduction in the rate of production loss and enhanced measures of biosecurity programs.

Expansion in Emerging Markets

- Currently, one of the biggest possibilities within the context of the poultry diagnostics market is the growth of the poultry farming in the emerging countries of the Asia-Pacific and Latin regions. As the mentioned regions continue to urbanize and have growing population the palaver for chicken and products is increasing. This should present the diagnostic companies with a chance to penetrate into these areas of the globe with affordable and efficient solutions appropriate for their environment. Authorities in these regions are also paying attention to improving standards of animal health and this creates a good environment for the development of the poultry diagnostics market.

Poultry Diagnostics Market Segment Analysis:

Poultry Diagnostics Market Segmented on the basis of test, Disease, Test Category Size, Product, End User, and Region

By Test, ELISA Test segment is expected to dominate the market during the forecast period

- The segmentation of the ELISA test segment captured the largest market share of 56.4% in 2023. This growth is due to the proliferation of using ELISA tests everything related to poultry diseases. Also, a large number of global players are providing ELISA test products with a variety of applications that should lead to even greater use of the segment. These factors are evidently contributing to the segment growth.

- They identified that the PCR segment is expected to grow at a CAGR of 10.6% from 2024 to 2030. These driving forces include use as well as benefits of these tests such as; disease testing in international poultry business, help to the bio security programs to eliminate disease threats, these tests help to meet regulatory demands to promote food security and sound animal health, and last but not the least; enormous capital investment on R&D. These investments have enhanced the efficiency of diagnosing diseases, enhanced the market for these products and growth of the segment.

By Disease, Avian Influenza Disease segment expected to held the largest share

- The avian influenza disease segment formed the largest market revenue share in ASIA PACIFIC in the year 2023 holding 23.4% of the market. Increase in the above diseases is caused by severe health challenges like low egg laying, respiratory diseases, severe infections and high prevalence of diseases that affect the health of birds used in food production among other ailments that affect poultry production. The former challenges leads to a need for better treatment with desirable outcome hence significantly boosting this segment.

- The segment of chicken anemia disease is projected to increase a compound annual growth rate of 11.3% for the years 2024 to 2030. The factors that contributed to this growth are the availability of diseases, the need to diagnose more specific, advances in technology, Government and market initiatives from key players, and trends internationally. These factors are increasing the demand for products offered in this segment and interestingly have greatly boosted its expansion.

Poultry Diagnostics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In the year 2023, the poultry diagnostics market was led by North America because of its high focused poultry farming and the developed veterinary healthcare sector. The largest market that has been identified from this region is the United States specifically; biosecurity measures, disease surveillance as well as Poultry farm diagnostic technologies. The market in North America accounted for a market share of around 35% to 40% in the year 2023. This dominance is anticipated by the rising regulation in the poultry health and the rising adverse effects caused by the zoonotic diseases thus increasing market demand for the diagnostic solutions.

Active Key Players in the Poultry Diagnostics Market:

- Agrolabo (Italy)

- Biochek (Netherlands)

- BioMérieux (France)

- Bionote, Inc. (South Korea)

- Elanco (USA)

- IDEXX Laboratories, Inc. (USA)

- Labtech International (UK)

- Merck & Co. (USA)

- Neogen Corporation (USA)

- Qiagen (Germany)

- Randox Laborato…

- Synbiotics Corporation (USA)

- Thermo Fisher Scientific (USA)

- VMRD, Inc. (USA)

- Zoetis (USA)

- Other Active Players.

|

Poultry Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 772.3 Million |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 1776.829Million |

|

Segments Covered: |

By Test |

|

|

|

By Disease |

|

||

|

Test Category Size |

|

||

|

product |

|

||

|

By End use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Poultry Diagnostics Market by Test

4.1 Poultry Diagnostics Market Snapshot and Growth Engine

4.2 Poultry Diagnostics Market Overview

4.3 ELISA

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 ELISA : Geographic Segmentation Analysis

4.4 PCR

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 PCR : Geographic Segmentation Analysis

4.5 Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Others: Geographic Segmentation Analysis

Chapter 5: Poultry Diagnostics Market by Disease

5.1 Poultry Diagnostics Market Snapshot and Growth Engine

5.2 Poultry Diagnostics Market Overview

5.3 Avian Salmonellosis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Avian Salmonellosis : Geographic Segmentation Analysis

5.4 Avian Influenza

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Avian Influenza : Geographic Segmentation Analysis

5.5 Newcastle Disease

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Newcastle Disease : Geographic Segmentation Analysis

5.6 Avian Mycoplasmosis

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Avian Mycoplasmosis : Geographic Segmentation Analysis

5.7 Infectious Bronchitis

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Infectious Bronchitis : Geographic Segmentation Analysis

5.8 Infectious Bursal Disease

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Infectious Bursal Disease : Geographic Segmentation Analysis

5.9 Avian Pasteurellosis

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Avian Pasteurellosis : Geographic Segmentation Analysis

5.10 Avian Encephalomyelitis

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Avian Encephalomyelitis : Geographic Segmentation Analysis

5.11 Avian Reovirus

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 Avian Reovirus : Geographic Segmentation Analysis

5.12 Chicken Anemia

5.12.1 Introduction and Market Overview

5.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.12.3 Key Market Trends, Growth Factors and Opportunities

5.12.4 Chicken Anemia : Geographic Segmentation Analysis

5.13 Other Diseases

5.13.1 Introduction and Market Overview

5.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.13.3 Key Market Trends, Growth Factors and Opportunities

5.13.4 Other Diseases: Geographic Segmentation Analysis

Chapter 6: Poultry Diagnostics Market by Test Category size

6.1 Poultry Diagnostics Market Snapshot and Growth Engine

6.2 Poultry Diagnostics Market Overview

6.3 Clinical Chemistry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Clinical Chemistry : Geographic Segmentation Analysis

6.4 Hematology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Hematology : Geographic Segmentation Analysis

6.5 Microbiology

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Microbiology : Geographic Segmentation Analysis

6.6 Parasitology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Parasitology : Geographic Segmentation Analysis

6.7 Others (Immunology & Serology

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others (Immunology & Serology : Geographic Segmentation Analysis

6.8 Imaging

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Imaging : Geographic Segmentation Analysis

6.9 Cytopathology

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Cytopathology : Geographic Segmentation Analysis

6.10 Histopathology

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Histopathology: Geographic Segmentation Analysis

Chapter 7: Poultry Diagnostics Market by Product

7.1 Poultry Diagnostics Market Snapshot and Growth Engine

7.2 Poultry Diagnostics Market Overview

7.3 Consumables

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Consumables: Geographic Segmentation Analysis

7.4 Reagents & Kits

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Reagents & Kits : Geographic Segmentation Analysis

7.5 Equipment & Instruments

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Equipment & Instruments: Geographic Segmentation Analysis

Chapter 8: Poultry Diagnostics Market by End User

8.1 Poultry Diagnostics Market Snapshot and Growth Engine

8.2 Poultry Diagnostics Market Overview

8.3 Veterinary hospitals & clinics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Veterinary hospitals & clinics : Geographic Segmentation Analysis

8.4 Reference laboratories

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Reference laboratories : Geographic Segmentation Analysis

8.5 Others

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Poultry Diagnostics Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AGROLABO (ITALY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BIOCHEK (NETHERLANDS)

9.4 BIOMÉRIEUX (FRANCE)

9.5 BIONOTE INC. (SOUTH KOREA)

9.6 ELANCO (USA)

9.7 IDEXX LABORATORIES INC. (USA)

9.8 LABTECH INTERNATIONAL (UK)

9.9 MERCK & CO. (USA)

9.10 NEOGEN CORPORATION (USA)

9.11 QIAGEN (GERMANY)

9.12 RANDOX LABORATORIES (UK)

9.13 SYNBIOTICS CORPORATION (USA)

9.14 THERMO FISHER SCIENTIFIC (USA)

9.15 VMRD INC. (USA)

9.16 ZOETIS (USA)

9.17 OTHER ACTIVE PLAYERS

Chapter 10: Global Poultry Diagnostics Market By Region

10.1 Overview

10.2. North America Poultry Diagnostics Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Test

10.2.4.1 ELISA

10.2.4.2 PCR

10.2.4.3 Others

10.2.5 Historic and Forecasted Market Size By Disease

10.2.5.1 Avian Salmonellosis

10.2.5.2 Avian Influenza

10.2.5.3 Newcastle Disease

10.2.5.4 Avian Mycoplasmosis

10.2.5.5 Infectious Bronchitis

10.2.5.6 Infectious Bursal Disease

10.2.5.7 Avian Pasteurellosis

10.2.5.8 Avian Encephalomyelitis

10.2.5.9 Avian Reovirus

10.2.5.10 Chicken Anemia

10.2.5.11 Other Diseases

10.2.6 Historic and Forecasted Market Size By Test Category size

10.2.6.1 Clinical Chemistry

10.2.6.2 Hematology

10.2.6.3 Microbiology

10.2.6.4 Parasitology

10.2.6.5 Others (Immunology & Serology

10.2.6.6 Imaging

10.2.6.7 Cytopathology

10.2.6.8 Histopathology

10.2.7 Historic and Forecasted Market Size By Product

10.2.7.1 Consumables

10.2.7.2 Reagents & Kits

10.2.7.3 Equipment & Instruments

10.2.8 Historic and Forecasted Market Size By End User

10.2.8.1 Veterinary hospitals & clinics

10.2.8.2 Reference laboratories

10.2.8.3 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Poultry Diagnostics Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Test

10.3.4.1 ELISA

10.3.4.2 PCR

10.3.4.3 Others

10.3.5 Historic and Forecasted Market Size By Disease

10.3.5.1 Avian Salmonellosis

10.3.5.2 Avian Influenza

10.3.5.3 Newcastle Disease

10.3.5.4 Avian Mycoplasmosis

10.3.5.5 Infectious Bronchitis

10.3.5.6 Infectious Bursal Disease

10.3.5.7 Avian Pasteurellosis

10.3.5.8 Avian Encephalomyelitis

10.3.5.9 Avian Reovirus

10.3.5.10 Chicken Anemia

10.3.5.11 Other Diseases

10.3.6 Historic and Forecasted Market Size By Test Category size

10.3.6.1 Clinical Chemistry

10.3.6.2 Hematology

10.3.6.3 Microbiology

10.3.6.4 Parasitology

10.3.6.5 Others (Immunology & Serology

10.3.6.6 Imaging

10.3.6.7 Cytopathology

10.3.6.8 Histopathology

10.3.7 Historic and Forecasted Market Size By Product

10.3.7.1 Consumables

10.3.7.2 Reagents & Kits

10.3.7.3 Equipment & Instruments

10.3.8 Historic and Forecasted Market Size By End User

10.3.8.1 Veterinary hospitals & clinics

10.3.8.2 Reference laboratories

10.3.8.3 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Poultry Diagnostics Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Test

10.4.4.1 ELISA

10.4.4.2 PCR

10.4.4.3 Others

10.4.5 Historic and Forecasted Market Size By Disease

10.4.5.1 Avian Salmonellosis

10.4.5.2 Avian Influenza

10.4.5.3 Newcastle Disease

10.4.5.4 Avian Mycoplasmosis

10.4.5.5 Infectious Bronchitis

10.4.5.6 Infectious Bursal Disease

10.4.5.7 Avian Pasteurellosis

10.4.5.8 Avian Encephalomyelitis

10.4.5.9 Avian Reovirus

10.4.5.10 Chicken Anemia

10.4.5.11 Other Diseases

10.4.6 Historic and Forecasted Market Size By Test Category size

10.4.6.1 Clinical Chemistry

10.4.6.2 Hematology

10.4.6.3 Microbiology

10.4.6.4 Parasitology

10.4.6.5 Others (Immunology & Serology

10.4.6.6 Imaging

10.4.6.7 Cytopathology

10.4.6.8 Histopathology

10.4.7 Historic and Forecasted Market Size By Product

10.4.7.1 Consumables

10.4.7.2 Reagents & Kits

10.4.7.3 Equipment & Instruments

10.4.8 Historic and Forecasted Market Size By End User

10.4.8.1 Veterinary hospitals & clinics

10.4.8.2 Reference laboratories

10.4.8.3 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Poultry Diagnostics Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Test

10.5.4.1 ELISA

10.5.4.2 PCR

10.5.4.3 Others

10.5.5 Historic and Forecasted Market Size By Disease

10.5.5.1 Avian Salmonellosis

10.5.5.2 Avian Influenza

10.5.5.3 Newcastle Disease

10.5.5.4 Avian Mycoplasmosis

10.5.5.5 Infectious Bronchitis

10.5.5.6 Infectious Bursal Disease

10.5.5.7 Avian Pasteurellosis

10.5.5.8 Avian Encephalomyelitis

10.5.5.9 Avian Reovirus

10.5.5.10 Chicken Anemia

10.5.5.11 Other Diseases

10.5.6 Historic and Forecasted Market Size By Test Category size

10.5.6.1 Clinical Chemistry

10.5.6.2 Hematology

10.5.6.3 Microbiology

10.5.6.4 Parasitology

10.5.6.5 Others (Immunology & Serology

10.5.6.6 Imaging

10.5.6.7 Cytopathology

10.5.6.8 Histopathology

10.5.7 Historic and Forecasted Market Size By Product

10.5.7.1 Consumables

10.5.7.2 Reagents & Kits

10.5.7.3 Equipment & Instruments

10.5.8 Historic and Forecasted Market Size By End User

10.5.8.1 Veterinary hospitals & clinics

10.5.8.2 Reference laboratories

10.5.8.3 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Poultry Diagnostics Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Test

10.6.4.1 ELISA

10.6.4.2 PCR

10.6.4.3 Others

10.6.5 Historic and Forecasted Market Size By Disease

10.6.5.1 Avian Salmonellosis

10.6.5.2 Avian Influenza

10.6.5.3 Newcastle Disease

10.6.5.4 Avian Mycoplasmosis

10.6.5.5 Infectious Bronchitis

10.6.5.6 Infectious Bursal Disease

10.6.5.7 Avian Pasteurellosis

10.6.5.8 Avian Encephalomyelitis

10.6.5.9 Avian Reovirus

10.6.5.10 Chicken Anemia

10.6.5.11 Other Diseases

10.6.6 Historic and Forecasted Market Size By Test Category size

10.6.6.1 Clinical Chemistry

10.6.6.2 Hematology

10.6.6.3 Microbiology

10.6.6.4 Parasitology

10.6.6.5 Others (Immunology & Serology

10.6.6.6 Imaging

10.6.6.7 Cytopathology

10.6.6.8 Histopathology

10.6.7 Historic and Forecasted Market Size By Product

10.6.7.1 Consumables

10.6.7.2 Reagents & Kits

10.6.7.3 Equipment & Instruments

10.6.8 Historic and Forecasted Market Size By End User

10.6.8.1 Veterinary hospitals & clinics

10.6.8.2 Reference laboratories

10.6.8.3 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Poultry Diagnostics Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Test

10.7.4.1 ELISA

10.7.4.2 PCR

10.7.4.3 Others

10.7.5 Historic and Forecasted Market Size By Disease

10.7.5.1 Avian Salmonellosis

10.7.5.2 Avian Influenza

10.7.5.3 Newcastle Disease

10.7.5.4 Avian Mycoplasmosis

10.7.5.5 Infectious Bronchitis

10.7.5.6 Infectious Bursal Disease

10.7.5.7 Avian Pasteurellosis

10.7.5.8 Avian Encephalomyelitis

10.7.5.9 Avian Reovirus

10.7.5.10 Chicken Anemia

10.7.5.11 Other Diseases

10.7.6 Historic and Forecasted Market Size By Test Category size

10.7.6.1 Clinical Chemistry

10.7.6.2 Hematology

10.7.6.3 Microbiology

10.7.6.4 Parasitology

10.7.6.5 Others (Immunology & Serology

10.7.6.6 Imaging

10.7.6.7 Cytopathology

10.7.6.8 Histopathology

10.7.7 Historic and Forecasted Market Size By Product

10.7.7.1 Consumables

10.7.7.2 Reagents & Kits

10.7.7.3 Equipment & Instruments

10.7.8 Historic and Forecasted Market Size By End User

10.7.8.1 Veterinary hospitals & clinics

10.7.8.2 Reference laboratories

10.7.8.3 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Poultry Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 772.3 Million |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 1776.829Million |

|

Segments Covered: |

By Test |

|

|

|

By Disease |

|

||

|

Test Category Size |

|

||

|

product |

|

||

|

By End use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||