Poland Data Center Colocation Market Synopsis:

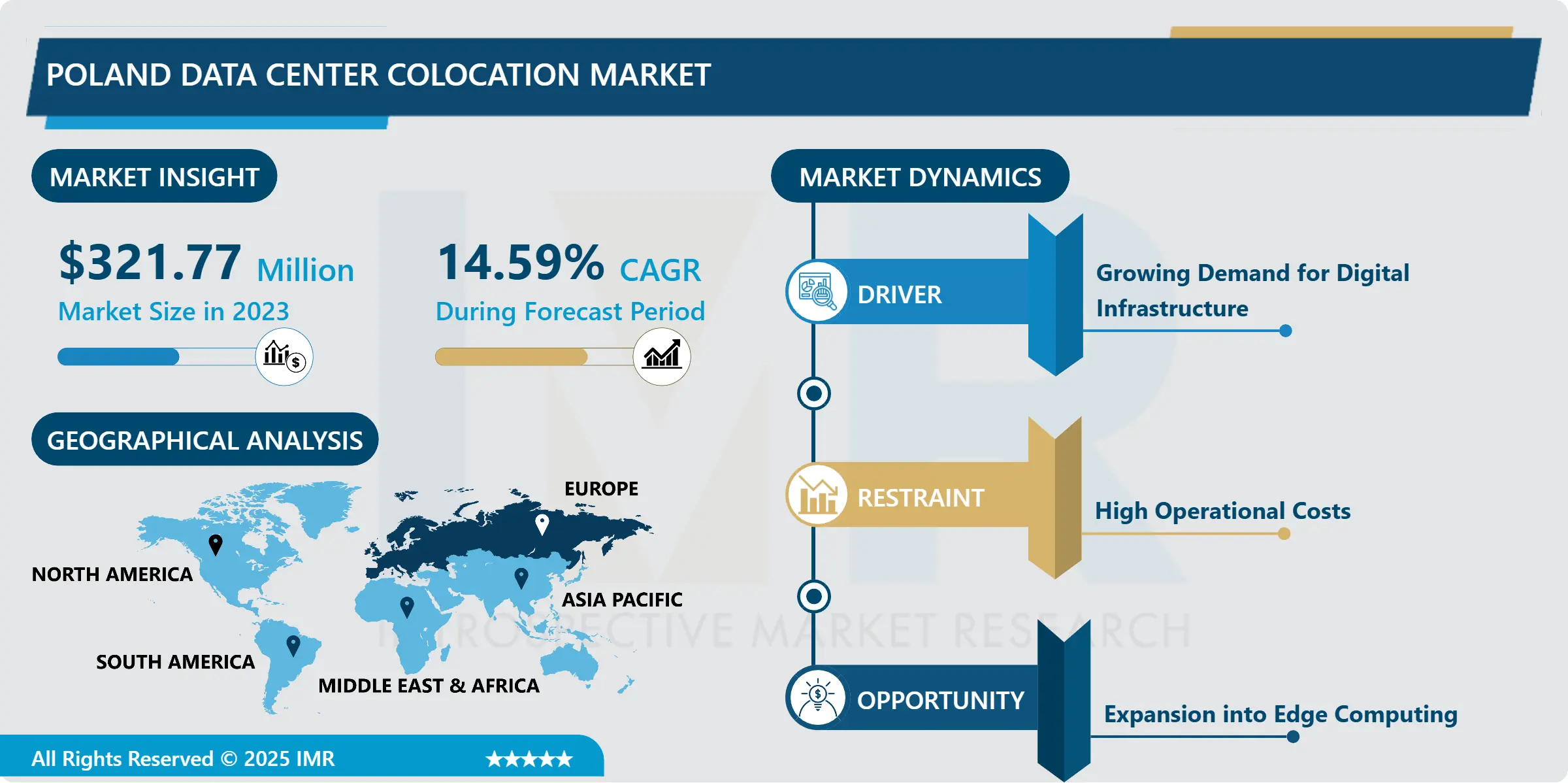

Poland Data Center Colocation Market Size Was Valued at USD 321.77 Million in 2023, and is Projected to Reach USD 1,096.14 Million by 2032, Growing at a CAGR of 14.59% From 2024-2032.

The Poland Data Center Colocation Market refers to the activities in which managed enterprises procure facilities space, power, and cooling from providers unrelated to the enterprises for their IT equipment. This market is essential for business organizations requiring scalable, robust, inexpensive and have no requirements to own and manage data centers. This is because Poland is fast becoming the Center of Gravity for the CEE Digitalization Revolution and colocation is fueled by the demand for cloud, big data, and IoT solutions.

The imminent growth in Poland's data center colocation market is expected to come from the increasing digitization in sectors like BFSI, healthcare, telecom, etc., since cost-cutting and improvement in productivity make enterprises continue data management outsourcing to third-party colocation service providers. Three main reasons makes Poland a preferred investment location for the data center: First, its position on central Europe; Second, satisfactory and effective connection standards; Third, strong government promotion and support for technology-oriented new ventures.

The direct prerequisites for the colocation services in Poland are the entrance of the global cloud service providers and the launch of edge computing services. So the enterprises require a flexible solution, which can be addressed through an integration of the cloud and colocation as the center of their approach. Turning to internal factors, the openness of the Polish colocation service market, and the possibility to afford colocation services at relatively lower prices compared to other European countries also help the enterprises to adopt the colocation services.

Poland Data Center Colocation Market Trend Analysis:

Rising Focus on Green Data Centers

- The social and ESG responsibilities impact are starting to become an important trend in the Poland Data Center Colocation Market. Today, most colocation providers are only beginning to engage with concepts of green data centers that can be powered by renewable energy sources, effectively cooled in ways that are quite innovative, all the while emitting very little carbon dioxide during their operation. This change is as result of the policies that check on emissions, customer push for green organizations and businesses, and global call for reduction in CO2 emissions.

- Most of colocation investors from Poland are establishing partnerships with renewable energy companies and utilize added value services including liquid cooling and energy management systems based on the artificial intelligence. This agrees with Poland general policies to shift towards the use of sustainable energy solutions as well as to attract companies that have consideration for the environment.

Strategic Growth through Connectivity Hubs

- Since Poland is located between Western and Eastern Europe interconnectivity to data center providers becomes strategic. The increase in the volume of cross-border data transfers and globalization of business require quick access to the European market is a massive opportunity to colocation services.

- With increased investments in submarine cables, fiber optics, and 5G networks planned for Poland hyperscale and retail colocation providers have emerged. The developing market of edge data centers in Poland enables it to satisfy the demand of industries that apply such applications with low latency demands as gaming, media streaming, or financial services.

Poland Data Center Colocation Market Segment Analysis:

Poland Data Center Colocation Market is Segmented on the basis of Type, Size, Service, and Region.

By Type, Retail Colocation segment is expected to dominate the market during the forecast period

- The Retail Colocation segment has been identified as the largest in Poland Data Center Colocation Market for the period under analysis. Retail colocation is targeting SMEs and start-ups to bring these clients the best solutions for owning their IT infrastructure and minimizing major investments. This segment is slowly expanding, as there are more SMEs for whom the adaptations to new forms of work mean their need for structurally sound and efficient storage solutions.

- Retail colocation facilities provide the client with space within a data center to house their equipment enabling businesses to access world-class security systems, cooling, and power with no need to invest capital. Poland’s SME sector is still emerging and, therefore, the retail colocation market will only increase as time goes on while offering specific solutions to data storage, cloud services, and business continuity.

By Size, the Tier 3 segment is expected to hold the largest share

- The Tier 3 segment will hold a significant position in the Poland Data Center Colocation Market due to the market’s reliability and operational effectiveness simultaneously. Third-level data centers offer availability at 99,982% level, power, and cooling; thus, availability is the unique option to reduce risks noticeably.

- Facilities are chosen by large enterprises and also by industries that cannot operate in parallel with disruptions in service, for example, BFSI and healthcare. However, because Tier 3 services can be scalable and meet the Tier 3 of international standards, Tier 3 is also preferred by global cloud service-providing companies and colocation clients

Active Key Players in the Poland Data Center Colocation Market:

- Atman (Poland)

- Beyond.pl (Poland)

- Chmura Krajowa (Poland)

- Colt Technology Services (UK)

- Data4 Group (France)

- Equinix (USA)

- Global Switch (UK)

- Iron Mountain Data Centers (USA)

- NTT Global Data Centers (Japan)

- OVHcloud (France)

- Polcom Data Centers (Poland)

- Rittal (Germany)

- T-Mobile Polska (Poland)

- Telehouse (UK)

- Verne Global (Iceland), and Other Active Players

|

Global Poland Data Centre Colocation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

321.77 Million |

|

Forecast Period 2024-32 CAGR: |

14.59% |

Market Size in 2032: |

1,096.14 Million |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Service |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Poland Data Center Colocation Market by Component

4.1 Poland Data Center Colocation Market Snapshot and Growth Engine

4.2 Poland Data Center Colocation Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Software: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

Chapter 5: Poland Data Center Colocation Market by Application

5.1 Poland Data Center Colocation Market Snapshot and Growth Engine

5.2 Poland Data Center Colocation Market Overview

5.3 Product Design & Development

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Product Design & Development: Geographic Segmentation Analysis

5.4 Manufacturing Process Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Manufacturing Process Management: Geographic Segmentation Analysis

5.5 Quality & Compliance Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Quality & Compliance Management: Geographic Segmentation Analysis

5.6 Maintenance

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Maintenance: Geographic Segmentation Analysis

5.7 Repair & Overhaul (MRO

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Repair & Overhaul (MRO: Geographic Segmentation Analysis

Chapter 6: Poland Data Center Colocation Market by Industry

6.1 Poland Data Center Colocation Market Snapshot and Growth Engine

6.2 Poland Data Center Colocation Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive: Geographic Segmentation Analysis

6.4 Aerospace & Defense

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aerospace & Defense: Geographic Segmentation Analysis

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation Analysis

6.6 Electronics & High-tech

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Electronics & High-tech: Geographic Segmentation Analysis

6.7 Industrial Machinery & Equipment

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Industrial Machinery & Equipment: Geographic Segmentation Analysis

6.8 Energy & Utilities

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Energy & Utilities: Geographic Segmentation Analysis

6.9 Consumer Goods & Retail

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Consumer Goods & Retail: Geographic Segmentation Analysis

6.10 Others

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Poland Data Center Colocation Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ATMAN (POLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BEYOND.PL (POLAND)

7.4 CHMURA KRAJOWA (POLAND)

7.5 COLT TECHNOLOGY SERVICES (UK)

7.6 DATA4 GROUP (FRANCE)

7.7 EQUINIX (USA)

7.8 GLOBAL SWITCH (UK)

7.9 IRON MOUNTAIN DATA CENTERS (USA)

7.10 NTT GLOBAL DATA CENTERS (JAPAN)

7.11 OVHCLOUD (FRANCE)

7.12 POLCOM DATA CENTERS (POLAND)

7.13 RITTAL (GERMANY)

7.14 T-MOBILE POLSKA (POLAND)

7.15 TELEHOUSE (UK)

7.16 VERNE GLOBAL (ICELAND)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Poland Data Center Colocation Market By Region

8.1 Overview

8.2. North America Poland Data Center Colocation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Software

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Product Design & Development

8.2.5.2 Manufacturing Process Management

8.2.5.3 Quality & Compliance Management

8.2.5.4 Maintenance

8.2.5.5 Repair & Overhaul (MRO

8.2.6 Historic and Forecasted Market Size By Industry

8.2.6.1 Automotive

8.2.6.2 Aerospace & Defense

8.2.6.3 Healthcare

8.2.6.4 Electronics & High-tech

8.2.6.5 Industrial Machinery & Equipment

8.2.6.6 Energy & Utilities

8.2.6.7 Consumer Goods & Retail

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Poland Data Center Colocation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Software

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Product Design & Development

8.3.5.2 Manufacturing Process Management

8.3.5.3 Quality & Compliance Management

8.3.5.4 Maintenance

8.3.5.5 Repair & Overhaul (MRO

8.3.6 Historic and Forecasted Market Size By Industry

8.3.6.1 Automotive

8.3.6.2 Aerospace & Defense

8.3.6.3 Healthcare

8.3.6.4 Electronics & High-tech

8.3.6.5 Industrial Machinery & Equipment

8.3.6.6 Energy & Utilities

8.3.6.7 Consumer Goods & Retail

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Poland Data Center Colocation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Software

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Product Design & Development

8.4.5.2 Manufacturing Process Management

8.4.5.3 Quality & Compliance Management

8.4.5.4 Maintenance

8.4.5.5 Repair & Overhaul (MRO

8.4.6 Historic and Forecasted Market Size By Industry

8.4.6.1 Automotive

8.4.6.2 Aerospace & Defense

8.4.6.3 Healthcare

8.4.6.4 Electronics & High-tech

8.4.6.5 Industrial Machinery & Equipment

8.4.6.6 Energy & Utilities

8.4.6.7 Consumer Goods & Retail

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Poland Data Center Colocation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Software

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Product Design & Development

8.5.5.2 Manufacturing Process Management

8.5.5.3 Quality & Compliance Management

8.5.5.4 Maintenance

8.5.5.5 Repair & Overhaul (MRO

8.5.6 Historic and Forecasted Market Size By Industry

8.5.6.1 Automotive

8.5.6.2 Aerospace & Defense

8.5.6.3 Healthcare

8.5.6.4 Electronics & High-tech

8.5.6.5 Industrial Machinery & Equipment

8.5.6.6 Energy & Utilities

8.5.6.7 Consumer Goods & Retail

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Poland Data Center Colocation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Software

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Product Design & Development

8.6.5.2 Manufacturing Process Management

8.6.5.3 Quality & Compliance Management

8.6.5.4 Maintenance

8.6.5.5 Repair & Overhaul (MRO

8.6.6 Historic and Forecasted Market Size By Industry

8.6.6.1 Automotive

8.6.6.2 Aerospace & Defense

8.6.6.3 Healthcare

8.6.6.4 Electronics & High-tech

8.6.6.5 Industrial Machinery & Equipment

8.6.6.6 Energy & Utilities

8.6.6.7 Consumer Goods & Retail

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Poland Data Center Colocation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Software

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Product Design & Development

8.7.5.2 Manufacturing Process Management

8.7.5.3 Quality & Compliance Management

8.7.5.4 Maintenance

8.7.5.5 Repair & Overhaul (MRO

8.7.6 Historic and Forecasted Market Size By Industry

8.7.6.1 Automotive

8.7.6.2 Aerospace & Defense

8.7.6.3 Healthcare

8.7.6.4 Electronics & High-tech

8.7.6.5 Industrial Machinery & Equipment

8.7.6.6 Energy & Utilities

8.7.6.7 Consumer Goods & Retail

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Poland Data Centre Colocation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

321.77 Million |

|

Forecast Period 2024-32 CAGR: |

14.59% |

Market Size in 2032: |

1,096.14 Million |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Service |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||