Plant Protein Ingredients Market Synopsis

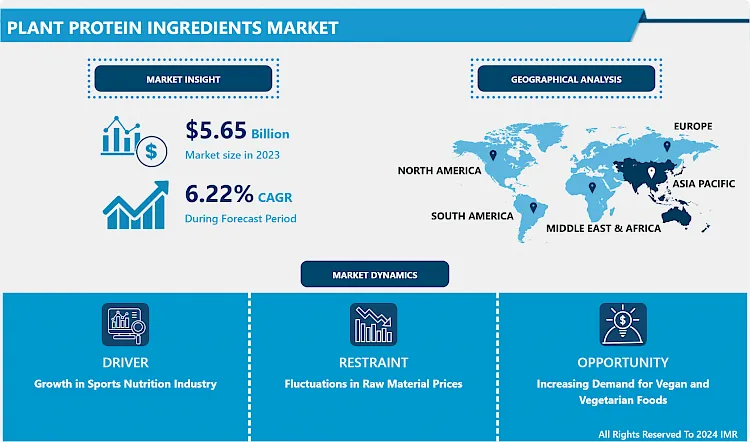

The Global Plant Protein Ingredients Market Size Was Valued at USD 5.65 Billion in 2023, and is Projected to Reach USD 9.16 Billion by 2032, Growing at a CAGR of 6.22 % From 2024-2032.

Plant protein ingredients are protein sources obtained from plants, including peas, soybeans, lentils, and hemp. These ingredients are utilized in diverse food and beverage items as a sustainable and nutritious substitute for animal-based proteins.

Plant protein ingredients have diverse applications within the food and beverage industry, commonly found in plant-based meat substitutes, dairy alternatives, protein bars, snacks, and baked goods. Their adaptability enables manufacturers to produce a broad array of products catering to different dietary preferences, including vegan, vegetarian, and flexitarian diets. Additionally, plant protein ingredients are increasingly utilized in sports nutrition products, functional foods, and infant formula, meeting the rising demand for healthier and more sustainable dietary choices.

The benefits of plant protein ingredients are numerous. They provide essential nutrients such as amino acids, fiber, vitamins, and minerals, contributing to overall health and wellness. Moreover, plant protein ingredients offer environmental advantages, boasting a lower carbon footprint and requiring fewer resources compared to animal-based proteins. With increasing consumer awareness of health, sustainability, and ethical considerations, the demand for plant protein ingredients is projected to soar. This trend is bolstered by the growing preference for plant-based diets and advancements in food technology and ingredient innovation.

Plant Protein Ingredients Market Trend Analysis:

Plant Protein Ingredients Market Trend Analysis:

Growth in Sports Nutrition Industry

- The expansion of the sports nutrition sector plays a significant role in boosting the demand for plant protein ingredients. As people increasingly prioritize health and wellness, there is a growing need for nutrient-rich products, especially among athletes and fitness enthusiasts. Plant-based proteins have become popular as they provide a sustainable and healthier option compared to animal-derived proteins. With the global sports nutrition market witnessing substantial growth, there is a corresponding increase in the use of plant protein ingredients by manufacturers to meet the needs of this expanding consumer base.

- Furthermore, the trend toward plant-based diets among athletes contributes to the growing demand for plant protein ingredients. Many professional athletes and fitness influencers are advocating for plant-based lifestyles due to their health benefits and environmental sustainability. This movement not only boosts the visibility of plant protein products but also creates a positive perception among consumers, leading to higher adoption rates across the sports nutrition industry. Consequently, manufacturers are integrating plant protein ingredients into their products to take advantage of this lucrative market trend.

- Additionally, advancements in food technology and ingredient development are driving the growth of the plant protein ingredients market in the sports nutrition sector. Companies are investing in research and development to improve the taste, texture, and nutritional value of plant-based protein products, making them more appealing to consumers. With ongoing enhancements in formulation techniques and ingredient sourcing, plant protein ingredients are becoming increasingly versatile and attractive to a wider audience, further stimulating growth in the sports nutrition industry.

Increasing demand for vegan and vegetarian foods

- The rising interest in vegan and vegetarian foods presents a significant opening for the plant protein ingredients market. As more individuals embrace plant-based diets for health, environmental, and ethical motives, there's a growing requirement for alternative protein sources. Plant protein ingredients offer a sustainable and nutritious solution to fulfill this demand, playing a crucial role in various vegan and vegetarian food items. This shift reflects changing consumer preferences toward healthier and more environmentally conscious eating habits, establishing a favorable market environment for plant protein ingredients.

- Moreover, the increasing availability and diversity of plant-based food options contribute to the expansion of the plant protein ingredients market. Food producers are innovating to create a wide array of plant-based substitutes for traditional animal-derived products, such as plant-based meat alternatives, dairy alternatives, and protein-rich snacks. Plant protein ingredients are essential in crafting these items, providing both texture and taste alongside nutritional benefits. With consumers seeking greater variety and flavor in plant-based alternatives, the demand for plant protein ingredients is anticipated to keep growing, propelling market expansion.

- Furthermore, the emergence of flexitarianism presents an additional avenue for plant protein ingredients. Flexitarians primarily adhere to a vegetarian diet but occasionally consume meat or animal products. This growing consumer group aims to reduce their meat consumption for health or environmental reasons while still indulging in meat-based dishes from time to time. Plant protein ingredients empower food manufacturers to develop products that cater to flexitarian dietary preferences, offering the taste and texture of meat while predominantly being plant-based. As flexitarianism gains traction, the demand for plant protein ingredients is predicted to rise, paving the way for market growth and product innovation.

Plant Protein Ingredients Market Segment Analysis:

Plant Protein Ingredients Market Segmented on the basis of Type, Form and Application

By Application, Sports & Nutrition segment is expected to dominate the market during the forecast period

- The Sports & Nutrition sector is positioned to lead the market due to several significant factors. the growing focus on health and fitness among global consumers is driving the demand for sports nutrition items. As individuals become more health-conscious and actively participate in physical activities, there's a heightened understanding of the significance of proper nutrition to support athletic performance and recovery. This trend spurs the need for specialized sports nutrition goods, such as protein supplements, energy bars, and dietary supplements.

- Additionally, advancements in sports science and nutrition research in the segment's growth. Athletes and fitness enthusiasts continuously seek innovative products and formulations to enhance their performance and achieve their fitness objectives. In response, the sports nutrition industry develops state-of-the-art products tailored to meet the specific nutritional requirements of athletes and active individuals. With ongoing progress in product development and rising consumer demand, the Sports & Nutrition segment is anticipated to maintain its prominence in the market.

By Type, Pea Protein segment held the largest share of 54.38% in 2022

- The Pea Protein segment has secured the largest market share due to several pivotal reasons. pea protein is renowned for its exceptional nutritional value and adaptability, making it highly favored among consumers seeking plant-based protein alternatives. Pea protein boasts a complete amino acid profile, rendering it comparable to animal-based proteins in its ability to foster muscle growth and repair. Additionally, pea protein is hypoallergenic and easily digestible, appealing particularly to individuals with dietary restrictions or sensitivities.

- Furthermore, the escalating demand for sustainable and eco-friendly food choices has propelled the popularity of pea protein. Peas stand out as a sustainable crop with minimal environmental impact, requiring less water and land compared to animal farming. With consumers increasingly mindful of their ecological footprint, the preference for plant-based protein sources like pea protein continues to rise. Given its nutritional advantages and sustainability credentials, the pea protein segment is poised to maintain its dominant position in the market.

Plant Protein Ingredients Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is positioned to lead the market for several compelling reasons. the region's rapidly expanding population, along with increasing urbanization and growing disposable incomes, fuels the demand for various consumer goods, including food and beverages. This burgeoning consumer base presents an extensive market opportunity for manufacturers and suppliers of food ingredients, particularly plant protein ingredients. Additionally, changing dietary preferences and a heightened awareness of health and wellness contribute to the growing adoption of plant-based diets across the Asia Pacific region.

- Moreover, the Asia Pacific region encompasses several key emerging economies like China, India, and Southeast Asian nations, which are undergoing rapid industrialization and economic growth. Consequently, there is an increasing need for sustainable and environmentally friendly food ingredients to align with evolving consumer preferences and regulatory standards. With its expansive and dynamic market landscape, coupled with shifting consumer trends towards healthier and more sustainable lifestyles, Asia Pacific is poised to dominate the market for plant protein ingredients in the foreseeable future.

Plant Protein Ingredients Market Top Key Players:

- DuPont (US)

- ADM - Archer Daniels Midland Company (US)

- The Scoular Company (US)

- CHS, Inc. (US)

- Mead Johnson & Company, LLC (US)

- Bunge Limited (US)

- Cargill, Incorporated (US)

- MGP (US)

- Ingredion (US)

- Axiom Foods (US)

- Puris (US)

- Prinova Group LLC (US)

- Burcon (Canada)

- Nutri-Pea (Canada)

- CropEnergies AG (Germany)

- DSM (Netherlands)

- Louis Dreyfus Company (Netherlands)

- Barentz (Netherlands)

- Roquette Freres (France)

- Tate & Lyle (UK)

- Tessenderlo Group (Belgium)

- Kerry Inc. (Ireland)

- Glanbia Plc (Ireland)

- Givaudan (Switzerland)

- Kewpie Corporation (Japan)

- Fonterra Co-Operative Group (New Zealand), and Other Major Players.

Key Industry Developments in the Plant Protein Ingredients Market:

- In May 2024, Roquette, a global leader in plant-based ingredients, launched Nutralys Fava S900M, its first fava bean protein isolate, in Europe and North America. Part of the Nutralys plant protein range, the product delivers 90% protein content and is designed for various applications, including meat substitutes, non-dairy alternatives, and baked goods. Nutralys Fava S900M offers a clean taste, light color, and functional excellence, making it a versatile ingredient for the growing plant-based market. This innovative launch highlights Roquette's commitment to advancing plant-based ingredient solutions for a more sustainable and nutritious future.

- In June 2023, Roquette, a global leader in plant-based ingredients, launched its new Food Innovation Center today at its historic Lestrem site in the heart of Europe. This state-of-the-art facility aims to support the food industry in tackling global challenges like population growth, aging, and the demand for healthier, sustainable diets. The center offers formulators access to advanced technical support, R&D expertise, cutting-edge equipment, labs, and scale-up testing. Roquette’s Food Innovation Center will drive innovation and accelerate the market introduction of new products, reinforcing the company’s commitment to fostering sustainability and meeting the evolving needs of the food industry.

|

Plant Protein Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.22 % |

Market Size in 2032: |

USD 9.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Plant Protein Ingredients Market by Type (2018-2032)

4.1 Plant Protein Ingredients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pea Protein

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Potato Protein

4.5 Soy Protein

4.6 Rice Protein

4.7 Hemp Protein

4.8 Wheat Protein

Chapter 5: Plant Protein Ingredients Market by Form (2018-2032)

5.1 Plant Protein Ingredients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Isolates

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Concentrates

Chapter 6: Plant Protein Ingredients Market by Application (2018-2032)

6.1 Plant Protein Ingredients Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Clinical Nutrition

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Functional Food & Beverages

6.5 Infant Nutrition

6.6 Fortified Food & Beverages

6.7 Sports & Nutrition

6.8 Bakery

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Plant Protein Ingredients Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PHARMACEUTICAL ASSOCIATES (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NOW HEALTH GROUP INC. (US)

7.4 TRADITIONAL MEDICINALS (US)

7.5 HERB PHARM (US)

7.6 GAIA HERBS (US)

7.7 PLANETARY HERBALS (US)

7.8 NUTRALIFE LABS (US)

7.9 DR. MERCOLA (US)

7.10 NATURE'S WAY (US)

7.11 TWININGS (UNITED KINGDOM)

7.12 INDENA SPA (ITALY)

7.13 NUTRA GREEN BIOTECHNOLOGY (CHINA)

7.14 SHASHI PHYTOCHEMICAL INDUSTRIES (INDIA)

7.15 SAB HERBAL AND NUTRACEUTICALS PVT. LTD. (INDIA)

7.16 APEX AYURVEDA PVT. LTD. (INDIA)

7.17 HIMALAYA WELLNESS (INDIA)

7.18 ORGANIC INDIA (INDIA)

7.19 BIOPREX LABS (INDIA)

7.20 AMSAR PVT. LTD. (INDIA)

7.21 FRUTAROM HEALTH (ISRAEL)

7.22

Chapter 8: Global Plant Protein Ingredients Market By Region

8.1 Overview

8.2. North America Plant Protein Ingredients Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Pea Protein

8.2.4.2 Potato Protein

8.2.4.3 Soy Protein

8.2.4.4 Rice Protein

8.2.4.5 Hemp Protein

8.2.4.6 Wheat Protein

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Isolates

8.2.5.2 Concentrates

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Clinical Nutrition

8.2.6.2 Functional Food & Beverages

8.2.6.3 Infant Nutrition

8.2.6.4 Fortified Food & Beverages

8.2.6.5 Sports & Nutrition

8.2.6.6 Bakery

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Plant Protein Ingredients Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Pea Protein

8.3.4.2 Potato Protein

8.3.4.3 Soy Protein

8.3.4.4 Rice Protein

8.3.4.5 Hemp Protein

8.3.4.6 Wheat Protein

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Isolates

8.3.5.2 Concentrates

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Clinical Nutrition

8.3.6.2 Functional Food & Beverages

8.3.6.3 Infant Nutrition

8.3.6.4 Fortified Food & Beverages

8.3.6.5 Sports & Nutrition

8.3.6.6 Bakery

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Plant Protein Ingredients Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Pea Protein

8.4.4.2 Potato Protein

8.4.4.3 Soy Protein

8.4.4.4 Rice Protein

8.4.4.5 Hemp Protein

8.4.4.6 Wheat Protein

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Isolates

8.4.5.2 Concentrates

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Clinical Nutrition

8.4.6.2 Functional Food & Beverages

8.4.6.3 Infant Nutrition

8.4.6.4 Fortified Food & Beverages

8.4.6.5 Sports & Nutrition

8.4.6.6 Bakery

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Plant Protein Ingredients Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Pea Protein

8.5.4.2 Potato Protein

8.5.4.3 Soy Protein

8.5.4.4 Rice Protein

8.5.4.5 Hemp Protein

8.5.4.6 Wheat Protein

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Isolates

8.5.5.2 Concentrates

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Clinical Nutrition

8.5.6.2 Functional Food & Beverages

8.5.6.3 Infant Nutrition

8.5.6.4 Fortified Food & Beverages

8.5.6.5 Sports & Nutrition

8.5.6.6 Bakery

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Plant Protein Ingredients Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Pea Protein

8.6.4.2 Potato Protein

8.6.4.3 Soy Protein

8.6.4.4 Rice Protein

8.6.4.5 Hemp Protein

8.6.4.6 Wheat Protein

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Isolates

8.6.5.2 Concentrates

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Clinical Nutrition

8.6.6.2 Functional Food & Beverages

8.6.6.3 Infant Nutrition

8.6.6.4 Fortified Food & Beverages

8.6.6.5 Sports & Nutrition

8.6.6.6 Bakery

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Plant Protein Ingredients Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Pea Protein

8.7.4.2 Potato Protein

8.7.4.3 Soy Protein

8.7.4.4 Rice Protein

8.7.4.5 Hemp Protein

8.7.4.6 Wheat Protein

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Isolates

8.7.5.2 Concentrates

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Clinical Nutrition

8.7.6.2 Functional Food & Beverages

8.7.6.3 Infant Nutrition

8.7.6.4 Fortified Food & Beverages

8.7.6.5 Sports & Nutrition

8.7.6.6 Bakery

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Plant Protein Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.22 % |

Market Size in 2032: |

USD 9.16 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||