Global Plant-Based Protein Market Synopsis

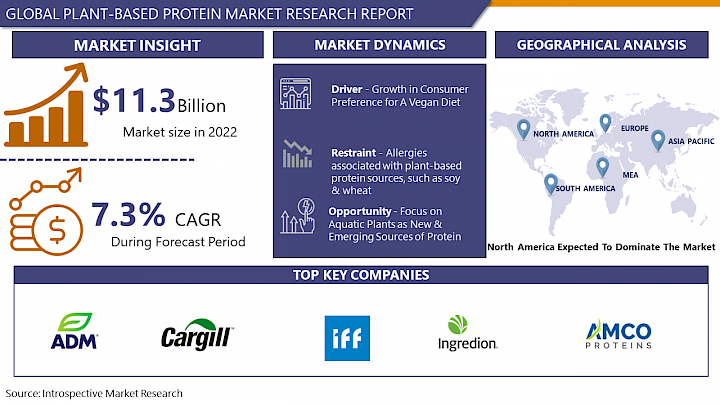

Global Plant-Based Protein Market Size Was Valued at USD 11.3 Billion in 2022, and is Projected to Reach USD 19.86 Billion by 2030, Growing at a CAGR of 7.3% From 2023-2030.

Plant-based protein refers to the protein derived from plant sources such as legumes (beans, lentils), nuts, seeds, grains, and certain vegetables. It serves as an essential dietary component for individuals opting for a vegetarian or vegan lifestyle and also forms a significant part of diverse diets worldwide. These proteins are rich in nutrients like fiber, vitamins, minerals, and antioxidants, providing a holistic nutritional package.

- Plant-based proteins offer a wide variety of options, enabling individuals to meet their protein requirements without relying on animal products. They contribute to sustainable food choices by reducing the environmental impact associated with animal agriculture. Additionally, incorporating a diverse range of plant-based proteins in one's diet can offer numerous health benefits, including lower risks of certain chronic diseases like heart disease and type 2 diabetes, while promoting overall well-being.

- The global plant-based protein market has experienced remarkable growth in recent years, driven by a surge in consumer interest in sustainable, ethical, and healthier food choices. This market encompasses a wide array of plant-derived protein sources, including soy, pea, wheat, canola, and others, catering to various dietary preferences such as vegetarian, vegan, and flexitarian lifestyles. This surge in demand has been fuelled by increasing awareness of the environmental impact of animal agriculture, coupled with a growing emphasis on personal health and wellness.

- Several factors contribute to the expansion of the plant-based protein market, including innovative product development, technological advancements in food processing, and a shift in consumer attitudes toward more plant-centric diets. Notably, food companies and manufacturers are investing heavily in research and development to create appealing plant-based alternatives to meat, dairy, and other animal-based products. This expansion has led to a broader availability of plant-based protein options in supermarkets, restaurants, and food service establishments worldwide. As consumer preferences continue to evolve and the focus on sustainability intensifies, the plant-based protein market is expected to maintain its upward trajectory, offering diverse and accessible alternatives to traditional animal-based proteins.

Global Plant-Based Protein Market Trend Analysis

Growth in Consumer Preference for a Vegan Diet

- The burgeoning consumer preference for a vegan diet has emerged as a significant driving force behind the exponential growth of the global plant-based protein market. A fundamental shift in dietary choices is being witnessed worldwide, with an increasing number of individuals opting for plant-based lifestyles for various reasons. Concerns about animal welfare, environmental sustainability, and personal health are pivotal factors propelling this shift. The vegan diet, which abstains from all animal products, including meat, dairy, eggs, and other animal-derived ingredients, relies heavily on plant-based proteins to meet nutritional needs.

- This growing consumer inclination towards veganism has led to an upsurge in demand for plant-based protein alternatives. Consumers are actively seeking protein-rich plant sources such as soy, pea, lentils, and nuts to replace or reduce their consumption of animal-based proteins. This shift in dietary habits is reflected in the increased availability and diversity of plant-based protein products in the market, including plant-based meat substitutes, dairy alternatives, and protein-enriched snacks. As the awareness of the ethical, environmental, and health benefits associated with a vegan diet continues to spread, the demand for plant-based protein is projected to soar, further propelling the growth and expansion of the global plant-based protein market.

Focus on Aquatic Plants as New & Emerging Sources of Protein

- The exploration of aquatic plants as novel and emerging sources of protein has garnered significant attention in recent years. With rising concerns about food sustainability and the need for alternative protein sources, aquatic plants present a promising avenue due to their nutritional value and efficient resource utilization. Species like seaweed, algae, water lentils, and duckweed are gaining traction as they offer high protein content along with essential vitamins, minerals, and omega-3 fatty acids.

- Aquatic plants have the advantage of requiring minimal land, water, and resources for cultivation compared to traditional crops. Their rapid growth rates and ability to thrive in diverse aquatic environments make them a sustainable and eco-friendly protein source. Additionally, ongoing research and technological advancements are focusing on refining extraction methods and enhancing the palatability of these aquatic plants to make them more appealing for consumption. As interest and investment in alternative protein sources continue to grow, the potential for aquatic plants to contribute significantly to the global protein market is becoming increasingly evident, positioning them as a compelling and viable option for meeting future nutritional demands.

- Based on this Graph Plant-based foods, however, maintained 6.6% sales growth in 2022, up from 5.9% in 2021, with only a 10% increase in average retail price. While there is still a retail price gap between plant-based and animal-based foods, due primarily to lack of scale, subsidies, and lack of expanded space in retail stores, the consistent plant-based growth and lower inflation bubble signal the overall health of the category.

Global Plant-Based Protein Market Segment Analysis:

Global Plant-Based Protein Market Segmented on the basis of Source, Type, Form, Nature, and Application.

By Source, Soy segment is expected to dominate the market during the forecast period

- The dominance of soy within this segment is also propelled by its extensive cultivation and global availability. Its adaptability to different climates and regions, coupled with efficient farming practices, has ensured a consistent and substantial supply chain. Moreover, the innovations in soy-based products, such as tofu, soy milk, and meat substitutes, have significantly contributed to its market stronghold. While wheat and pea also play significant roles in various sectors, soy's widespread use and adaptability have positioned it as the primary source within this particular market segment.

By Type, isolates segment held the largest share of 34.45% in 2022.

- Isolates have emerged as the go-to choose within the plant-based protein market, owing to their exceptional purity and versatility. These concentrated protein sources are prized for their pivotal role as primary ingredients in the creation of an array of products, including meat substitutes, dairy alternatives, and sports nutrition offerings. Their appeal lies not only in their high protein content but also in their neutral flavour profile and remarkable solubility, attributes that enable seamless integration into various food and beverage formulations

Global Plant-Based Protein Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American market has been a pioneer in driving the plant-based protein industry. The United States and Canada have witnessed a surge in consumer demand for plant-based products due to health consciousness, environmental concerns, and animal welfare considerations.

- Major players in this region have introduced a wide array of plant-based protein products, including soy-based, pea-based, and others, targeting both retail and foodservice sectors.

Global Plant-Based Protein Market Top Key Players:

- ADM (US)

- Cargill, Incorporated (US)

- International Flavors & Fragrances Inc. (US)

- Ingredion (US)

- AMCO Proteins (US)

- Axiom Foods, Inc (US)

- The Green Labs LLC. (US)

- Nutraferma, Inc. (US)

- MycoTechnology (US)

- The Green Labs LLC. (US)

- PURIS (US)

- AGT Food and Ingredients (Canada)

- Burcon NutraScience Corporation (Canada)

- Roquette Frères (France)

- Biopress SAS (France)

- Glanbia plc (Ireland)

- Kerry Group PLC (Ireland)

- BENEO GmbH (Germany)

- Emsland Group (Germany)

- Südzucker AG (Germany)

- European Protein A/S (Denmark)

- Australian Plant Proteins Pty Ltd (Australia)

- Wilmar International Ltd. (Singapore)

- Crown Soya Protein Group (China)

- Biopress SAS (France), and Other Major Players

Key Industry Developments in the Global Plant-Based Protein Market:

In April 2022, ADM made an investment of USD 300 million to boost the production of alternative proteins at its plant in Decatur, Illinois, which will double the facility’s soy extrusion capacity. ADM, as part of the investment, is also building a Protein Innovation Center, including labs, test kitchens, and pilot-scale production capabilities, which will boost the company’s R&D capabilities.

In April 2022, Ingredion expanded its production capacity by setting up a new manufacturing plant at Vanscoy, Canada, through the acquisition of Verdient Foods (Canada). This strategic initiative would vastly increase the company’s production capacity to produce plant-based protein.

|

Global Plant-Based Protein Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 11.3 Bn. |

|

|

CAGR (2023-2030) : |

7.3% |

Market Size in 2030: |

USD 19.86 Bn. |

|

|

Segments Covered: |

By Source |

|

|

|

|

By Type |

|

|

||

|

By Form |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PLANT-BASED PROTEIN MARKET BY SOURCE (2016-2030)

- PLANT-BASED PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WHEAT

- PEA

- PLANT-BASED PROTEIN MARKET BY TYPE (2016-2030)

- PLANT-BASED PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONCENTRATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ISOLATES

- TEXTURE

- PLANT-BASED PROTEIN MARKET BY SEGMENT3 (2016-2030)

- PLANT-BASED PROTEIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PLANT-BASED PROTEIN Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ADM

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- Cargill, Incorporated

- International Flavors & Fragrances Inc.

- Ingredion

- AMCO Proteins

- Axiom Foods, Inc

- The Green Labs LLC.

- Nutraferma, Inc.

- MycoTechnology

- The Green Labs LLC.

- PURIS

- AGT Food and Ingredients

- Burcon NutraScience Corporation

- Roquette Frères

- Biopress SAS

- Glanbia plc

- Kerry Group PLC

- BENEO GmbH

- Emsland Group

- COMPETITIVE LANDSCAPE

- GLOBAL PLANT-BASED PROTEIN MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Plant-Based Protein Market |

||||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 11.3 Bn. |

|

|

CAGR (2023-2030) : |

7.3% |

Market Size in 2030: |

USD 19.86 Bn. |

|

|

Segments Covered: |

By Source |

|

|

|

|

By Type |

|

|

||

|

By Form |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PLANT-BASED PROTEIN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PLANT-BASED PROTEIN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PLANT-BASED PROTEIN MARKET COMPETITIVE RIVALRY

TABLE 005. PLANT-BASED PROTEIN MARKET THREAT OF NEW ENTRANTS

TABLE 006. PLANT-BASED PROTEIN MARKET THREAT OF SUBSTITUTES

TABLE 007. PLANT-BASED PROTEIN MARKET BY SOURCE

TABLE 008. SOY MARKET OVERVIEW (2016-2028)

TABLE 009. WHEAT MARKET OVERVIEW (2016-2028)

TABLE 010. PEA MARKET OVERVIEW (2016-2028)

TABLE 011. RICE MARKET OVERVIEW (2016-2028)

TABLE 012. POTATO MARKET OVERVIEW (2016-2028)

TABLE 013. CORN MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. PLANT-BASED PROTEIN MARKET BY TYPE

TABLE 016. CONCENTRATES MARKET OVERVIEW (2016-2028)

TABLE 017. ISOLATES MARKET OVERVIEW (2016-2028)

TABLE 018. TEXTURED MARKET OVERVIEW (2016-2028)

TABLE 019. PLANT-BASED PROTEIN MARKET BY FORM

TABLE 020. DRY MARKET OVERVIEW (2016-2028)

TABLE 021. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 022. PLANT-BASED PROTEIN MARKET BY APPLICATION

TABLE 023. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 024. ANIMAL FEED MARKET OVERVIEW (2016-2028)

TABLE 025. NUTRITIONAL SUPPLEMENTS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA PLANT-BASED PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 027. NORTH AMERICA PLANT-BASED PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 028. NORTH AMERICA PLANT-BASED PROTEIN MARKET, BY FORM (2016-2028)

TABLE 029. NORTH AMERICA PLANT-BASED PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 030. N PLANT-BASED PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE PLANT-BASED PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 032. EUROPE PLANT-BASED PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 033. EUROPE PLANT-BASED PROTEIN MARKET, BY FORM (2016-2028)

TABLE 034. EUROPE PLANT-BASED PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 035. PLANT-BASED PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC PLANT-BASED PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 037. ASIA PACIFIC PLANT-BASED PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 038. ASIA PACIFIC PLANT-BASED PROTEIN MARKET, BY FORM (2016-2028)

TABLE 039. ASIA PACIFIC PLANT-BASED PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 040. PLANT-BASED PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA PLANT-BASED PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA PLANT-BASED PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA PLANT-BASED PROTEIN MARKET, BY FORM (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA PLANT-BASED PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 045. PLANT-BASED PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA PLANT-BASED PROTEIN MARKET, BY SOURCE (2016-2028)

TABLE 047. SOUTH AMERICA PLANT-BASED PROTEIN MARKET, BY TYPE (2016-2028)

TABLE 048. SOUTH AMERICA PLANT-BASED PROTEIN MARKET, BY FORM (2016-2028)

TABLE 049. SOUTH AMERICA PLANT-BASED PROTEIN MARKET, BY APPLICATION (2016-2028)

TABLE 050. PLANT-BASED PROTEIN MARKET, BY COUNTRY (2016-2028)

TABLE 051. CARGILL INCORPORATED: SNAPSHOT

TABLE 052. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 053. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 054. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ARCHER DANIELS MIDLAND COMPANY (ADM): SNAPSHOT

TABLE 055. ARCHER DANIELS MIDLAND COMPANY (ADM): BUSINESS PERFORMANCE

TABLE 056. ARCHER DANIELS MIDLAND COMPANY (ADM): PRODUCT PORTFOLIO

TABLE 057. ARCHER DANIELS MIDLAND COMPANY (ADM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. DUPONT: SNAPSHOT

TABLE 058. DUPONT: BUSINESS PERFORMANCE

TABLE 059. DUPONT: PRODUCT PORTFOLIO

TABLE 060. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KERRY GROUP: SNAPSHOT

TABLE 061. KERRY GROUP: BUSINESS PERFORMANCE

TABLE 062. KERRY GROUP: PRODUCT PORTFOLIO

TABLE 063. KERRY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. DSM: SNAPSHOT

TABLE 064. DSM: BUSINESS PERFORMANCE

TABLE 065. DSM: PRODUCT PORTFOLIO

TABLE 066. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. WILMAR INTERNATIONAL: SNAPSHOT

TABLE 067. WILMAR INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 068. WILMAR INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 069. WILMAR INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. COSUCRA GROUPE: SNAPSHOT

TABLE 070. COSUCRA GROUPE: BUSINESS PERFORMANCE

TABLE 071. COSUCRA GROUPE: PRODUCT PORTFOLIO

TABLE 072. COSUCRA GROUPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. EMSLAND GROUP: SNAPSHOT

TABLE 073. EMSLAND GROUP: BUSINESS PERFORMANCE

TABLE 074. EMSLAND GROUP: PRODUCT PORTFOLIO

TABLE 075. EMSLAND GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. AXIOM FOODS: SNAPSHOT

TABLE 076. AXIOM FOODS: BUSINESS PERFORMANCE

TABLE 077. AXIOM FOODS: PRODUCT PORTFOLIO

TABLE 078. AXIOM FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. INGREDION: SNAPSHOT

TABLE 079. INGREDION: BUSINESS PERFORMANCE

TABLE 080. INGREDION: PRODUCT PORTFOLIO

TABLE 081. INGREDION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. ROQUETTE FRÈRES: SNAPSHOT

TABLE 082. ROQUETTE FRÈRES: BUSINESS PERFORMANCE

TABLE 083. ROQUETTE FRÈRES: PRODUCT PORTFOLIO

TABLE 084. ROQUETTE FRÈRES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. PURIS: SNAPSHOT

TABLE 085. PURIS: BUSINESS PERFORMANCE

TABLE 086. PURIS: PRODUCT PORTFOLIO

TABLE 087. PURIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. BURCON NUTRASCIENCE CORP.: SNAPSHOT

TABLE 088. BURCON NUTRASCIENCE CORP.: BUSINESS PERFORMANCE

TABLE 089. BURCON NUTRASCIENCE CORP.: PRODUCT PORTFOLIO

TABLE 090. BURCON NUTRASCIENCE CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. SOTEXPRO: SNAPSHOT

TABLE 091. SOTEXPRO: BUSINESS PERFORMANCE

TABLE 092. SOTEXPRO: PRODUCT PORTFOLIO

TABLE 093. SOTEXPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. GLANBIA: SNAPSHOT

TABLE 094. GLANBIA: BUSINESS PERFORMANCE

TABLE 095. GLANBIA: PRODUCT PORTFOLIO

TABLE 096. GLANBIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. BATORY FOODS: SNAPSHOT

TABLE 097. BATORY FOODS: BUSINESS PERFORMANCE

TABLE 098. BATORY FOODS: PRODUCT PORTFOLIO

TABLE 099. BATORY FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. AGT FOOD & INGREDIENTS: SNAPSHOT

TABLE 100. AGT FOOD & INGREDIENTS: BUSINESS PERFORMANCE

TABLE 101. AGT FOOD & INGREDIENTS: PRODUCT PORTFOLIO

TABLE 102. AGT FOOD & INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. PROLUPIN GMBH: SNAPSHOT

TABLE 103. PROLUPIN GMBH: BUSINESS PERFORMANCE

TABLE 104. PROLUPIN GMBH: PRODUCT PORTFOLIO

TABLE 105. PROLUPIN GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. AMINOLA: SNAPSHOT

TABLE 106. AMINOLA: BUSINESS PERFORMANCE

TABLE 107. AMINOLA: PRODUCT PORTFOLIO

TABLE 108. AMINOLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. HERBLINK BIOTECH CORPORATION: SNAPSHOT

TABLE 109. HERBLINK BIOTECH CORPORATION: BUSINESS PERFORMANCE

TABLE 110. HERBLINK BIOTECH CORPORATION: PRODUCT PORTFOLIO

TABLE 111. HERBLINK BIOTECH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. BENEO: SNAPSHOT

TABLE 112. BENEO: BUSINESS PERFORMANCE

TABLE 113. BENEO: PRODUCT PORTFOLIO

TABLE 114. BENEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. ET CHEM: SNAPSHOT

TABLE 115. ET CHEM: BUSINESS PERFORMANCE

TABLE 116. ET CHEM: PRODUCT PORTFOLIO

TABLE 117. ET CHEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. SHANDONG JIANYUAN GROUP: SNAPSHOT

TABLE 118. SHANDONG JIANYUAN GROUP: BUSINESS PERFORMANCE

TABLE 119. SHANDONG JIANYUAN GROUP: PRODUCT PORTFOLIO

TABLE 120. SHANDONG JIANYUAN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. THE GREEN LABS LLC: SNAPSHOT

TABLE 121. THE GREEN LABS LLC: BUSINESS PERFORMANCE

TABLE 122. THE GREEN LABS LLC: PRODUCT PORTFOLIO

TABLE 123. THE GREEN LABS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. PARABEL: SNAPSHOT

TABLE 124. PARABEL: BUSINESS PERFORMANCE

TABLE 125. PARABEL: PRODUCT PORTFOLIO

TABLE 126. PARABEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 127. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 128. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 129. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PLANT-BASED PROTEIN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PLANT-BASED PROTEIN MARKET OVERVIEW BY SOURCE

FIGURE 012. SOY MARKET OVERVIEW (2016-2028)

FIGURE 013. WHEAT MARKET OVERVIEW (2016-2028)

FIGURE 014. PEA MARKET OVERVIEW (2016-2028)

FIGURE 015. RICE MARKET OVERVIEW (2016-2028)

FIGURE 016. POTATO MARKET OVERVIEW (2016-2028)

FIGURE 017. CORN MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. PLANT-BASED PROTEIN MARKET OVERVIEW BY TYPE

FIGURE 020. CONCENTRATES MARKET OVERVIEW (2016-2028)

FIGURE 021. ISOLATES MARKET OVERVIEW (2016-2028)

FIGURE 022. TEXTURED MARKET OVERVIEW (2016-2028)

FIGURE 023. PLANT-BASED PROTEIN MARKET OVERVIEW BY FORM

FIGURE 024. DRY MARKET OVERVIEW (2016-2028)

FIGURE 025. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 026. PLANT-BASED PROTEIN MARKET OVERVIEW BY APPLICATION

FIGURE 027. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 028. ANIMAL FEED MARKET OVERVIEW (2016-2028)

FIGURE 029. NUTRITIONAL SUPPLEMENTS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA PLANT-BASED PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE PLANT-BASED PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC PLANT-BASED PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA PLANT-BASED PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA PLANT-BASED PROTEIN MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Plant-Based Protein Market research report is 2023-2030.

ADM (US), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), AMCO Proteins (US), Axiom Foods, Inc (US), The Green Labs LLC. (US), Nutraferma, Inc. (US), MycoTechnology (US), The Green Labs LLC. (US), PURIS (US), AGT Food and Ingredients (Canada), Burcon NutraScience Corporation (Canada), Roquette Frères (France), Biopress SAS (France), Glanbia plc (Ireland), Kerry Group PLC (Ireland), BENEO GmbH (Germany), Emsland Group (Germany), Südzucker AG (Germany), European Protein A/S (Denmark), Australian Plant Proteins Pty Ltd (Australia), Wilmar International Ltd. (Singapore), Crown Soya Protein Group (China), Biopress SAS (France)and Other Major Players.

The Global Plant-Based Protein Market is segmented into Source, Type, Form, and region. By Source, the market is categorized into Soy, Wheat, Pea By Type, the market is categorized into Concentrates, Isolates, Texture. By Form, the market is categorized into Dry, Liquid By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Plant-based protein refers to the protein derived from plant sources such as legumes (beans, lentils), nuts, seeds, grains, and certain vegetables. It serves as an essential dietary component for individuals opting for a vegetarian or vegan lifestyle and also forms a significant part of diverse diets worldwide. These proteins are rich in nutrients like fiber, vitamins, minerals, and antioxidants, providing a holistic nutritional package.

Global Plant-Based Protein Market Size Was Valued at USD 11.3 Billion in 2022, and is Projected to Reach USD 19.86 Billion by 2030, Growing at a CAGR of 7.3% From 2023-2030.