Global Plant-Based Ingredient Market Overview

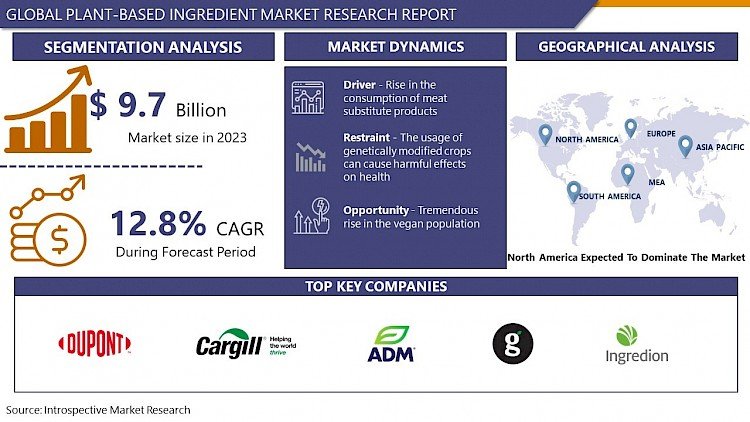

Global Plant-Based Ingredient Market size is expected to grow from USD 9.7 billion in 2023 to USD 23.34 billion by 2032, at a CAGR of 12.8% during the forecast period (2024–2032)

Ingredients are a certain type of plant obtained mixtures that are added to the food and beverages in small amounts which enhances the taste and nutritional value of the end food and beverages product. Moreover, some plant-based ingredients are used in the pharmaceutical and cosmetic industries. These plant-based ingredients are in human civilization from ancient times. Nowadays, the majority of the population is shifting towards a vegan diet this would be boosting the market growth during the forecast period. Plant-based ingredients are obtained from various parts of the plant like roots, leaves, trunk, flowers, seeds, and buds. Plant-based food and beverages are globally growing in demand. Recent studies have shown that plant-based products have the possible potential for anti-inflammatory and anti-aging qualities.

Moreover, plant-based meat products are showing healthy signs because these products are low in fat content which will decline the increase in obese people, and as result, there will be minimal cases of cardiovascular diseases. According to the Plant-Based Food Association (PBFA) & Good Food Institute (GFI), covers the total U.S. grocery marketplace and display that U.S. retail sales of plant-based foods continued to rise by double digits in 2020, increasing 27 percent and bringing the total plant-based market value to $7 billion. This development in dollar sales was consistent in the US, with more than 25 percent growth in every U.S. census region. Plant-based foods sales have grown 43 percent in the past two years- nine times higher than total food sales. In 2020, 57 percent of all U.S. households bought plant-based foods (that's over 71 million households) up from 53 percent in 2019. Rising demand for a healthy lifestyle would promote the growth of plant-based ingredients during the forecast period

Market Dynamics and Factors for the Plant-Based Ingredients Market

Rise in The Consumption of Meat Substitute Products

Increasing consumer awareness towards meat substitutes products is probably to accelerate plant-based ingredients market growth. The plant-based ingredients prevent different chronic diseases such as diabetes & obesity and supply major nutritional content to the body. These products are receiving popularity due to the better and useful characteristics such as sustainable nature, ease of digestibility, and non-allergic nature, thereby turning the market growth.

Growing demand for clean label trends and desire for a healthy lifestyle should encourage plant-based ingredients industry growth. Companies are now focused on producing new advanced food items to promote a healthy lifestyle. Plant-based ingredients overcome the cholesterol level, supply required vitamins, minerals, and amino acids essential for the body, and boost the life span of consumers, thereby hastening market demand. Furthermore, the rising demand for dietary supplements due to the growing benefits of proteins among consumers will further accelerate the market growth. Consumers opted for protein drinks & shake produced from natural sources which contribute to general health and wellness, which may trigger product demand.

The Usage of Genetically Modified Crops Can Cause Harmful Effects on Health

Soy protein one of the generally used plant-based ingredients holds a group of chemicals known as oxalates which is the main cause of creating kidney stones. It is used as a genetically modified crop which raises the risk of allergic reactions and other health-associated diseases if they do not meet the food safety criteria. The utilization of this GMO crop can cause possible liver damage and other harmful effects on human health and the environment which might hamper the industry growth.

Tremendous Rise in The Vegan Population

There are certain innovations in the market that will create lucrative opportunities for the producers of plant-based ingredients. The growing number of health-conscious consumers and vegan consumers globally will eventually create a high demand for plant-based ingredients. Planning for proper awareness among the consumers about plant-based ingredients will have a beneficial impact on the plant-based ingredients market.

Plant-Based Ingredient Market Segment Analysis:

Plant-Based Ingredient Market Segmented on the basis of Type,Source, Application, and Sales Channel

By Application ,Food & Beverages segment is expected to dominate the market during the forecast period

The plant-based ingredient market in the food and beverage sector is growing due to the growing demand for healthier, sustainable dietary options. Consumers are increasingly aware of the health benefits of plant-based diets, including reduced chronic disease risk, weight management, and overall well-being, leading them to seek products incorporating plant-based ingredients into their daily meals. The food and beverage industry is focusing on environmental sustainability by adopting plant-based ingredients to reduce carbon footprints, promote eco-friendly practices, and reduce greenhouse gas emissions, land and water usage, and deforestation compared to traditional animal-based agriculture.

The food and beverage industry is introducing innovative plant-based products, including meats, dairy alternatives, and snacks, to cater to changing consumer preferences, including vegetarians and vegans, as well as mainstream consumers seeking healthier options without compromising taste and texture. Government regulations, incentives, and research investments are driving the growth of the plant-based ingredient market in the food and beverage sector. This encourages companies to explore new ingredients, production techniques, and flavor profiles, further driving market expansion. The food and beverage sector is driving the growth of the plant-based ingredient market due to the demand for healthier, sustainable food options and the industry's commitment to environmental responsibility. As consumer preferences shift towards plant-based alternatives, this market is poised for continued growth and development.

Regional Analysis for the Plant-Based Ingredients Market:

North America region, driven by the Canada, Mexico, and the U.S. market size. Due to the rising awareness for diseases and healthy lifestyle. Increasing awareness for health which has raised the demand for health clubs and fitness centers is probably to enhance sports nutrition demand in the region. Key players are manufacturing organic whole plant protein shakes, and meals that do not carry sugar and cater to the same taste which has led to t increase in vegan trends and meat alternatives products, further improving product demand.

Europe industry demand led by Germany, UK, France, Italy, and Spain may register significant gains during the forecast period owing to rising baked products demand. Technological development has made it feasible for producers to focus on innovation of new baked products which comprise whole wheat, gluten-free and sugar-free products. The rising demand for organic baked low-fat, and multigrain products will foster regional plant-based ingredients market size.

The Asia Pacific led by India, Japan, and China market size may record higher gains over the projected period. China recorded a substantial growth in the meat alternatives market in the region due to the shifting lifestyle and consciousness of health concerns associated with animal-based meat protein. The shift in consumer preference towards natural plant proteins and growing meat prices will hasten the plant-based ingredients market size in the region.

Players Covered in Plant-Based Ingredient Market are:

- Cargill (Us)

- Impossible Foods (Us)

- Beyond Meat (Us)

- Eat Just (Us)

- Greenleaf Foods (Us)

- Bi Nutraceuticals, Inc. (Us)

- Axiom Foods (Us)

- Archer Daniels Midland Company (Us)

- Ingredion (Us)

- The Scoular Company (Us)

- Trader Joe’s (Us)

- Dupont De Nemours, Inc. (Us)

- Puris Proteins LLC (Us)

- Sweet Earth Natural Foods (Us)

- Lightlife (Us)

- Sunopta Inc. (Canada)

- Dohler Gmbh (Germany)

- Kerry (Ireland)

- Tate & Lyle Plc (Uk)

- Kerry (Ireland)

- Olam International (Singapore)

- Vezlay Food Pvt Ltd (India)

- Vegeta Gold (India)

- Urban Platter (India)

- Good Dot (India), and Other Major Players

Key Industry Development in Plant-Based Ingredients Market

- In April 2024, Roquette, a global leader in plant-based ingredients and a leading provider of nutraceutical and pharmaceutical excipients, is set to showcase a new flexible addition to its LYCAGEL® hydroxypropyl pea starch excipient range at Vitafoods Europe 2024, along with a fresh vision for developing vegetarian and vegan dietary supplements in softgels.

- In March 2024, Louis Dreyfus Company (LDC), a leading global merchant and processor of agricultural goods, is showcasing its range of plant-based ingredients and packaged cooking oils, as a first-time participant at the Food Ingredients China (FIC) exhibition.

|

Global Plant-Based Ingredient Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.7 Bn. |

|

|

CAGR (2024-2032): |

12.8% |

Market Size in 2032: |

USD 23.34 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Source |

|

|

||

|

By Application |

|

|

||

|

By Sales Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PLANT-BASED INGREDIENT MARKET BY TYPE (2016-2030)

- PLANT-BASED INGREDIENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EMULSIFIERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BINDING AGENTS & STABILIZERS

- PRESERVATIVES

- OTHERS

- PLANT-BASED INGREDIENT MARKET BY SOURCE (2016-2030)

- PLANT-BASED INGREDIENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PULSES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREALS

- NUTS

- COCONUT PEANUT

- OTHERS

- PLANT-BASED INGREDIENT MARKET BY APPLICATION (2016-2030)

- PLANT-BASED INGREDIENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMAL FEED

- BAKERY & CONFECTIONERY

- OTHERS

- PLANT-BASED INGREDIENT MARKET BY SALES CHANNEL (2016-2030)

- PLANT-BASED INGREDIENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONVENIENCE STORE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- ONLINE RETAIL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Plant-Based Ingredient Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CARGILL (US)

- IMPOSSIBLE FOODS (US)

- BEYOND MEAT (US)

- EAT JUST (US)

- GREENLEAF FOODS (US)

- BI NUTRACEUTICALS INC. (US)

- AXIOM FOODS (US)

- ARCHER DANIELS MIDLAND COMPANY (US)

- INGREDION (US)

- THE SCOULAR COMPANY (US)

- TRADER JOE’S (US)

- DUPONT DE NEMOURS, INC.

- PURIS PROTEINS LLC (US)

- SWEET EARTH NATURAL FOODS (US)

- LIGHTLIFE (US)

- SUNOPTA INC. (CANADA)

- DOHLER GMBH (GERMANY)

- KERRY (IRELAND)

- TATE & LYLE PLC (UK)

- KERRY (IRELAND)

- OLAM INTERNATIONAL (SINGAPORE)

- VEZLAY FOOD PVT LTD (INDIA)

- VEGETA GOLD (INDIA)

- URBAN PLATTER (INDIA)

- GOOD DOT (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL PLANT-BASED INGREDIENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Sales Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Plant-Based Ingredient Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.7 Bn. |

|

|

CAGR (2024-2032): |

12.8% |

Market Size in 2032: |

USD 23.34 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Source |

|

|

||

|

By Application |

|

|

||

|

By Sales Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PLANT-BASED INGREDIENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PLANT-BASED INGREDIENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PLANT-BASED INGREDIENT MARKET COMPETITIVE RIVALRY

TABLE 005. PLANT-BASED INGREDIENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. PLANT-BASED INGREDIENT MARKET THREAT OF SUBSTITUTES

TABLE 007. PLANT-BASED INGREDIENT MARKET BY TYPE

TABLE 008. EMULSIFIERS MARKET OVERVIEW (2016-2030)

TABLE 009. BINDING AGENTS & STABILIZERS MARKET OVERVIEW (2016-2030)

TABLE 010. PRESERVATIVES MARKET OVERVIEW (2016-2030)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 012. PLANT-BASED INGREDIENT MARKET BY SOURCE

TABLE 013. PULSES MARKET OVERVIEW (2016-2030)

TABLE 014. CEREALS MARKET OVERVIEW (2016-2030)

TABLE 015. NUTS MARKET OVERVIEW (2016-2030)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 017. PLANT-BASED INGREDIENT MARKET BY APPLICATION

TABLE 018. FOOD & BEVERAGES MARKET OVERVIEW (2016-2030)

TABLE 019. ANIMAL FEED MARKET OVERVIEW (2016-2030)

TABLE 020. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2030)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 022. NORTH AMERICA PLANT-BASED INGREDIENT MARKET, BY TYPE (2016-2030)

TABLE 023. NORTH AMERICA PLANT-BASED INGREDIENT MARKET, BY SOURCE (2016-2030)

TABLE 024. NORTH AMERICA PLANT-BASED INGREDIENT MARKET, BY APPLICATION (2016-2030)

TABLE 025. N PLANT-BASED INGREDIENT MARKET, BY COUNTRY(2016-2030)

TABLE 026. EUROPE PLANT-BASED INGREDIENT MARKET, BY TYPE (2016-2030)

TABLE 027. EUROPE PLANT-BASED INGREDIENT MARKET, BY SOURCE (2016-2030)

TABLE 028. EUROPE PLANT-BASED INGREDIENT MARKET, BY APPLICATION (2016-2030)

TABLE 029. PLANT-BASED INGREDIENT MARKET, BY COUNTRY (2016-2030)

TABLE 030. ASIA PACIFIC PLANT-BASED INGREDIENT MARKET, BY TYPE (2016-2030)

TABLE 031. ASIA PACIFIC PLANT-BASED INGREDIENT MARKET, BY SOURCE (2016-2030)

TABLE 032. ASIA PACIFIC PLANT-BASED INGREDIENT MARKET, BY APPLICATION (2016-2030)

TABLE 033. PLANT-BASED INGREDIENT MARKET, BY COUNTRY (2016-2030)

TABLE 034. MIDDLE EAST & AFRICA PLANT-BASED INGREDIENT MARKET, BY TYPE (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA PLANT-BASED INGREDIENT MARKET, BY SOURCE (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA PLANT-BASED INGREDIENT MARKET, BY APPLICATION (2016-2030)

TABLE 037. PLANT-BASED INGREDIENT MARKET, BY COUNTRY (2016-2030)

TABLE 038. SOUTH AMERICA PLANT-BASED INGREDIENT MARKET, BY TYPE (2016-2030)

TABLE 039. SOUTH AMERICA PLANT-BASED INGREDIENT MARKET, BY SOURCE (2016-2030)

TABLE 040. SOUTH AMERICA PLANT-BASED INGREDIENT MARKET, BY APPLICATION (2016-2030)

TABLE 041. PLANT-BASED INGREDIENT MARKET, BY COUNTRY (2016-2030)

TABLE 042. CARGILL: SNAPSHOT

TABLE 043. CARGILL: BUSINESS PERFORMANCE

TABLE 044. CARGILL: PRODUCT PORTFOLIO

TABLE 045. CARGILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. IMPOSSIBLE FOODS: SNAPSHOT

TABLE 046. IMPOSSIBLE FOODS: BUSINESS PERFORMANCE

TABLE 047. IMPOSSIBLE FOODS: PRODUCT PORTFOLIO

TABLE 048. IMPOSSIBLE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. BEYOND MEAT: SNAPSHOT

TABLE 049. BEYOND MEAT: BUSINESS PERFORMANCE

TABLE 050. BEYOND MEAT: PRODUCT PORTFOLIO

TABLE 051. BEYOND MEAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. EAT JUST: SNAPSHOT

TABLE 052. EAT JUST: BUSINESS PERFORMANCE

TABLE 053. EAT JUST: PRODUCT PORTFOLIO

TABLE 054. EAT JUST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. GREENLEAF FOODS: SNAPSHOT

TABLE 055. GREENLEAF FOODS: BUSINESS PERFORMANCE

TABLE 056. GREENLEAF FOODS: PRODUCT PORTFOLIO

TABLE 057. GREENLEAF FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. GOOD DOT: SNAPSHOT

TABLE 058. GOOD DOT: BUSINESS PERFORMANCE

TABLE 059. GOOD DOT: PRODUCT PORTFOLIO

TABLE 060. GOOD DOT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VEZLAY FOOD PVT LTD: SNAPSHOT

TABLE 061. VEZLAY FOOD PVT LTD: BUSINESS PERFORMANCE

TABLE 062. VEZLAY FOOD PVT LTD: PRODUCT PORTFOLIO

TABLE 063. VEZLAY FOOD PVT LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. VEGETA GOLD: SNAPSHOT

TABLE 064. VEGETA GOLD: BUSINESS PERFORMANCE

TABLE 065. VEGETA GOLD: PRODUCT PORTFOLIO

TABLE 066. VEGETA GOLD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. URBAN PLATTER: SNAPSHOT

TABLE 067. URBAN PLATTER: BUSINESS PERFORMANCE

TABLE 068. URBAN PLATTER: PRODUCT PORTFOLIO

TABLE 069. URBAN PLATTER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. AXIOM FOODS: SNAPSHOT

TABLE 070. AXIOM FOODS: BUSINESS PERFORMANCE

TABLE 071. AXIOM FOODS: PRODUCT PORTFOLIO

TABLE 072. AXIOM FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ARCHER DANIELS MIDLAND COMPANY: SNAPSHOT

TABLE 073. ARCHER DANIELS MIDLAND COMPANY: BUSINESS PERFORMANCE

TABLE 074. ARCHER DANIELS MIDLAND COMPANY: PRODUCT PORTFOLIO

TABLE 075. ARCHER DANIELS MIDLAND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. INGREDION: SNAPSHOT

TABLE 076. INGREDION: BUSINESS PERFORMANCE

TABLE 077. INGREDION: PRODUCT PORTFOLIO

TABLE 078. INGREDION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. KERRY: SNAPSHOT

TABLE 079. KERRY: BUSINESS PERFORMANCE

TABLE 080. KERRY: PRODUCT PORTFOLIO

TABLE 081. KERRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. DU POINT: SNAPSHOT

TABLE 082. DU POINT: BUSINESS PERFORMANCE

TABLE 083. DU POINT: PRODUCT PORTFOLIO

TABLE 084. DU POINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. TATE & LYLE PLC: SNAPSHOT

TABLE 085. TATE & LYLE PLC: BUSINESS PERFORMANCE

TABLE 086. TATE & LYLE PLC: PRODUCT PORTFOLIO

TABLE 087. TATE & LYLE PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 088. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 089. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 090. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PLANT-BASED INGREDIENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PLANT-BASED INGREDIENT MARKET OVERVIEW BY TYPE

FIGURE 012. EMULSIFIERS MARKET OVERVIEW (2016-2030)

FIGURE 013. BINDING AGENTS & STABILIZERS MARKET OVERVIEW (2016-2030)

FIGURE 014. PRESERVATIVES MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 016. PLANT-BASED INGREDIENT MARKET OVERVIEW BY SOURCE

FIGURE 017. PULSES MARKET OVERVIEW (2016-2030)

FIGURE 018. CEREALS MARKET OVERVIEW (2016-2030)

FIGURE 019. NUTS MARKET OVERVIEW (2016-2030)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 021. PLANT-BASED INGREDIENT MARKET OVERVIEW BY APPLICATION

FIGURE 022. FOOD & BEVERAGES MARKET OVERVIEW (2016-2030)

FIGURE 023. ANIMAL FEED MARKET OVERVIEW (2016-2030)

FIGURE 024. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2030)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 026. NORTH AMERICA PLANT-BASED INGREDIENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. EUROPE PLANT-BASED INGREDIENT MARKET OVERVIEW BY COUNTRY(2016-2030)

FIGURE 028. ASIA PACIFIC PLANT-BASED INGREDIENT MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. MIDDLE EAST & AFRICA PLANT-BASED INGREDIENT MARKET OVERVIEW BY COUNTRY(2016-2030)

FIGURE 030. SOUTH AMERICA PLANT-BASED INGREDIENT MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Plant-Based Ingredient Market research report is 2024-2032.

Cargill (Us), Impossible Foods (Us),Beyond Meat (Us),Eat Just (Us),Greenleaf Foods (Us),Bi Nutraceuticals Inc. (Us),Axiom Foods (Us),Archer Daniels Midland Company (Us),Ingredion (Us),The Scoular Company (Us),Trader Joe’s (Us),Dupont De Nemours, Inc. (Us),Puris Proteins Llc (Us),Sweet Earth Natural Foods (Us),Lightlife (Us),Sunopta Inc. (Canada),Dohler Gmbh (Germany),Kerry (Ireland),Tate & Lyle Plc (Uk),Kerry (Ireland),Olam International (Singapore),Vezlay Food Pvt Ltd (India),Vegeta Gold (India),Urban Platter (India),Good Dot (India), and Other Major Players

The Plant-Based Ingredient Market is segmented into Type, Source, Application, Sales Channel , and Region. By Type, the market is categorized into Emulsifiers, binding Agents & Stabilizers, Preservatives, and Others. By Source the market is categorized into Pulses, Cereals, Nuts, Coconut Peanuts, and Others. By Application, the market is categorized into Food & Beverages, Animal Feed, Bakery & Confectionery, and Others.By Sales Channel,the market is categorized into Convenience Store, Specialty Stores, Online Retail, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ingredients are a certain type of plant obtained mixtures that are added to the food and beverages in small amounts which enhances the taste and nutritional value of the end food and beverages product. Moreover, some plant-based ingredients are used in the pharmaceutical and cosmetic industries.

Global Plant-Based Ingredient Market size is expected to grow from USD 9.7 billion in 2023 to USD 23.34 billion by 2032, at a CAGR of 12.8% during the forecast period (2024–2032).