Plant Based Leather Market Synopsis

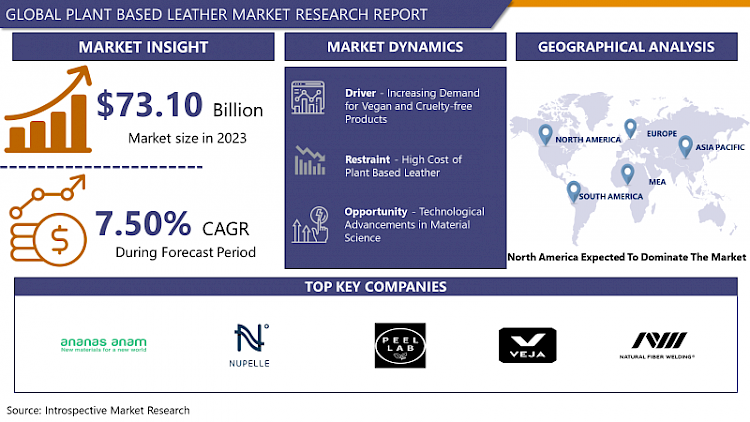

Plant Based Leather Market Size Was Valued at USD 73.10 Million in 2023 and is Projected to Reach USD 140.15 Million by 2032, Growing at a CAGR of 7.50% From 2024-2032.

Bio-leather is an eco-friendly material to animal skin leather; it is made by processing plant resources such as food mushroom, pineapple leaf, cork, and apple peelages. This new material is expected to tread path free of some of the most sensitive concerns surrounding environmental conservation as well as ethical concerns as are evident more often from leather business since it exercises a lot of pressure on the environment through its carbon footprint as well as water consumption not to mention the issue or animal cruelty. As it is made of agricultural by-products and sources that can be replenished in nature, plant-based leather is a greener solution when compared to traditional leather. For instance, Piñatex that is developed from the pineapple leaf fiber and Mylo that is derived from mycelium which is the root structure of mushrooms are being considered due their eco-friendlier and non-leather approach to production.

- The advantages of the plant-based leather are not only in its practical applications rather it has many more advantages with regard to the nature. These materials can also have extraordinary characteristics like improved temperatures, air permeability and elasticity that might even come out improved than leather. Moreover, the innovations are enhancing the endurance and beauty aspects of plant-based leathers, thus making them ideal options for fashion and automotive manufacturers. It is becoming increasingly imperative to consider the aspects of ethical and sustainable production, and with plant-based leather acting as a viable substitution for animal-derived leather, there is immense opportunity to innovate and ultimately, provide society with the best of both worlds.

- The major forces that would propel people towards a plant-based leather are concern for the environment and animal cruelty. Pineapple leaves (Piñatex) replaced chromium tanned leather; apple peels were applied to replace animal fat; and mycelium took the place of staple animal skin leather.

- Plant based leathers exist due to advanced during the development of biotechnology and material sciences. These materials sometimes even provide high levels of durability and touch, as well as look like leather, thus being more sustainable. Currently, companies such as MycoWorks and Bolt Threads work on such developments, making production that is slowly gaining usage in fashion and automotive sectors.There are also plant-based leathers, which are split into categories of Footwear, Fashion accessories, Automotive, and Interiors, Home products. Right now, footwear and fashion accessories have the biggest share in the market; and due to their commitment to sustainable manufacturing, companies like Adidas and Stella McCartney are gradually incorporating plant-based materials in their production.

Plant Based Leather Market Trend Analysis

Growing Demand for Sustainable Fashion

- Sustainable fashion is booming. People are very sensitive to the effects that the production of fabrics has on the environment and are seeking more suitable products. This means going specifically to brands that employ recycled materials in production or organic fabrics and ensuring that the production process is environmentally friendly.

- This directly corresponds to the concern of the sustainable fashion – the use of leather and its substitution. Conventional leather production is resource-intensive, it requires land to rear animals for their skin, for grazing, preparation of tan and has negative impacts to the environment particularly on water bodies. There is an option, especially due to the invention of plant-based leather that is more environmentally friendly.

- The search for more raw materials and increased functionality of the materials being used for plants continues to evolve.Thus, despite the potential benefit that plant-based leather can provide, how this product type compares in terms of wear-enduring capability to traditional leather products remains to be seen. In conclusion, moving on to the third perspective, plant-based leather is another innovation in sustainable fashion that is attracting the attention of consumers and offers a good future for the industry.

Technological Advancements in Material Science

- The consumer has become wary of the ecological implications of their purchases. This is leading to a need to find more effective solutions to using less conventional materials that are not as environmentally friendly like leather.

- There are indications that the number of customers going for these products is increasing due to the tag – cruelty-free, which has contributed to the market for plant-based leather. This technique gives products like leather using living organism as the raw material. Mycelium is the root system of mushrooms, and when used for producing bio-based leather, shows great potential.

- Currently researchers investigate various new fibers from plant residues, for example, from pineapple leaves, apple peels or cork. These materials are environmentally friendly and have been recognized as a more appropriate replacement for animal leather.One of the new innovations is the use of recycled plastic and other waste materials such that new vegan leather is being produced.

- Such trends and developments are all existing and working towards the expansion of the plant-based leather market. PETA says plant leather is faster to produce and cheaper, can beat the Earth’s resources and create better leather that looks like animal leather.New sources of plant-based raw material are being discovered, and its application is beyond fashion- automotive and furniture materials are also being made from plant sources.

- As manufacturing processes continue to improve, PBL is gaining closer to price parity with animal leather, making it more appealing to consumers. All in all, plant-based leather has grown to take up a promising future. Plant-based leather is still innovative while consumer interest for this substitute grows, and becoming widespread is on the horizon.

Plant Based Leather Market Segment Analysis:

Plant Based Leather Market Segmented on the basis of By Product Type and Application Type

By Product, Pineapple Leather is expected to dominate the market during the forecast period.

- Affordable, eco-friendly Pineapple Leather – a new material for wallets, bags, and shoes made from recycled pineapple leaves which resemble leather.Drawn from the core part of prickly pear cacti plants, this reusable material is appreciated for its hardness and ventilation, thus suitable for use in furniture and garments.

- Biomaterial – mycelium (fungi root network) – seems to be surprisingly diverse, it is lightweight and resistant to moisture, which makes it suitable for making watch straps and phone cases.Apple peels which are sourced from apple juice production make up most of the material used in this form and is more commonly employed in the creation of smaller products such as wallets or phone cover.Other opportunities to consider involve shoes made of grape leather from remainders of wine and recycled plastic products.

- Pros of the market Although the market is full of potential it has a few drawbacks. Certain PBLs may need an extra layer for waterproofing, while area provided, is not as great compared to animal leather. Nonetheless, with the most recent innovations in research, plant-based leather is set to occupy a pivotal position in the fashion industry within the contemporary debate on sustainability.

By Application, Tracking & Navigation segment held the largest share in 2023

- The vegan or Plant based leather is the new trend in the fashion industry mainly because of the ethical values associated with it. People today are becoming extremely conscious of their impact on the environment, and so they are looking for materials that are not only fashionable but are also eco-friendly, with brands starting to use this material for clothing, bags, and footwear. It does this while lowering the carbon imprint while in the same process removing animal cruelty from the process of production. Well-known manufacturers of luxury and new generation garments and accessories are using this relatively new but stylish, tough and eco – friendly material for today’s innovative and preferred plant-based leather.

- The automotive industry also uses bio-leather for car interiors As a result of the fight against climate change, the automotive industry has also begun to use plant-based leather. Automakers are using this material for car seats, instrument panels and door panels with intention to minimize the use of natural resources and respond to the preferences of the growing trend of people who are environmentally sensitive. Luxury materials such as plant-based leather are identified to be even more luxurious than other types of conventional leathers in the market due to the numerous attributes that it possesses while being friendly to the environment in terms of production.

- In home interior and design, plant-based leather is used in chairs, sofas, cars, and other forms of decoration. Its strong andnonfabric nature makes it suitable for use in making sofas, chairs and other items that may require decorations to enhance its beauty. Apart from beautifying homes, the use of plant-based leather effectively captures the modern trend of going green by bringing in non-toxic and eco-friendly furniture solutions that are a fraction or often an equal or even superior quality to synthetic or animal-based leathers.

- The market for other material leathers such as vegan leather is on the rise due to the demand of vegan and environment-friendly products in the market. Innovations in the technology of materials are continually improving the efficiency and aesthetic value of synthetic leathers derived from plant sources, a factor that makes them popular in several sectors. Overtime, it has been noted that as awareness of the environment is taken into consideration the use of plant-based leather is likely to increase thereby helping to foster a better and improved environment in future.

Plant Based Leather Market Regional Insights:

North America dominated the largest market in 2023

- There is great market potential to bioleather since consumers today are generally more inclined towards products that are environmentally-friendly. Thus, the increased public concern for reducing the negative effects of the environmental crisis and pollution, as well as more profound understanding of the consequences of conventional leather production, fosters the development of plant-based leathers. Pastic offers the added advantages of sustainability and actual leathers that have become significantly better in quality and are also stronger thanks to technological developments in the material offered by plant sources.

- Based on region, it is further projected that in 2024, North America will account for the largest market for plant-based leather, attributed with consumers’ awareness towards the product along with the supportive regulations that back the use of sustainable products. This is because the region has a relative older manufacturing industry and has been investing heavily in R&D, the consuming populace is also conscious of ethical and sustainability issues. The usage of plant leather by the new-formed companies and the significant brands in the United States and Canada is adding to the market growth.

- Synthetic substances are actually being incorporated in different sectors such as fashion, automobiles, and household products. It can also be used in fashion industry to create new garments, accessories, and footwear as the material that is both more ethically sustainable than the conventional leather. Auto manufacturers are using vegan materials such as leather in the interiors of their cars and vehicles in a bid to reduce the negative impacts of their industries on the environment. In home decorations it is used in furniture and other home decor to supply the needs of environmentally friendly citizen.

- Significant improvements made in creating new applications for the material also point to a steady growth in the market for the future purpose of plant-based leather. Global developments show that firms are sourcing for innovative techniques to enhance texture, resilience, and appearance of the material that imitates animal skin from plants. Since the demand for soy-based candles has been growing due to consumers’ increasing concerns over the impact of their choices on the environment, it is also expected that the market will grow at a faster rate, especially in North America where awareness and support for such products is relatively high.

Active Key Players in the Plant Based Leather Market

- driano Di Marti (Desserto) (Mexico)

- Veja (France)

- Natural Fiber Welding, Inc (USA)

- Veerah (USA)

- Viridis (Italy)

- Will's Vegan (UK)

- Miomojo srl (Italy)

- Mabel (Italy)

- Ananas Anam (Piñatex) (UK)

- Clarino (Philippines)

- Studio Tjeerd Veenhoven (Netherlands)

- Volkswagen (Germany)

- Modern Meadow (USA)

- Malai Studio (Poland), and Other Key Players

Key Industry Developments in the Plant-Based Leather Market:

- In April 2022, The USD 85 million in funding that BMW Ventures, Ralph Lauren Corporation, Advantage Capital, and Central Illinois Angels provided to Natural Fiber Welding, Inc. assisted the company in expanding its production.

Global Plant Based Leather Market Scope:

|

Global Plant Based Leather Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73.10 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.50% |

Market Size in 2032: |

USD 140.15 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PLANT BASED LEATHER MARKET BY PRODUCT TYPE (2017-2032)

- PLANT BASED LEATHER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PINEAPPLE LEATHER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CACTUS LEATHER

- MUSHROOM LEATHER

- APPLE LEATHER

- PLANT BASED LEATHER MARKET BY APPLICATION (2017-2032)

- PLANT BASED LEATHER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FASHION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOTHING

- ACCESSORIES

- FOOTWEAR

- AUTOMOTIVE INTERIOR

- HOME

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Plant Based Leather Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DRIANO DI MARTI (DESSERTO) (MEXICO)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- VEJA (FRANCE)

- NATURAL FIBER WELDING, INC (USA)

- VEERAH (USA)

- VIRIDIS (ITALY)

- WILL'S VEGAN (UK)

- MIOMOJO SRL (ITALY)

- MABEL (ITALY)

- ANANAS ANAM (PIÑATEX) (UK)

- CLARINO (PHILIPPINES)

- STUDIO TJEERD VEENHOVEN (NETHERLANDS)

- VOLKSWAGEN (GERMANY)

- MODERN MEADOW (USA)

- MALAI STUDIO (POLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL PLANT BASED LEATHER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Plant Based Leather Market Scope:

|

Global Plant Based Leather Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 73.10 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.50% |

Market Size in 2032: |

USD 140.15 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PLANT-BASED LEATHER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PLANT-BASED LEATHER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PLANT-BASED LEATHER MARKET COMPETITIVE RIVALRY

TABLE 005. PLANT-BASED LEATHER MARKET THREAT OF NEW ENTRANTS

TABLE 006. PLANT-BASED LEATHER MARKET THREAT OF SUBSTITUTES

TABLE 007. PLANT-BASED LEATHER MARKET BY TYPE

TABLE 008. PINEAPPLE LEATHER (PIÑATEX) MARKET OVERVIEW (2016-2028)

TABLE 009. CACTUS LEATHER MARKET OVERVIEW (2016-2028)

TABLE 010. MUSHROOM LEATHER MARKET OVERVIEW (2016-2028)

TABLE 011. LEAF LEATHER MARKET OVERVIEW (2016-2028)

TABLE 012. VEGAN CORK LEATHER MARKET OVERVIEW (2016-2028)

TABLE 013. GRAIN-BASED LEATHER MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. PLANT-BASED LEATHER MARKET BY APPLICATION

TABLE 016. CLOTHING MARKET OVERVIEW (2016-2028)

TABLE 017. ACCESSORIES MARKET OVERVIEW (2016-2028)

TABLE 018. FOOTWEAR MARKET OVERVIEW (2016-2028)

TABLE 019. AUTOMOTIVE INTERIORS MARKET OVERVIEW (2016-2028)

TABLE 020. HOME INTERIORS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA PLANT-BASED LEATHER MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA PLANT-BASED LEATHER MARKET, BY APPLICATION (2016-2028)

TABLE 024. N PLANT-BASED LEATHER MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE PLANT-BASED LEATHER MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE PLANT-BASED LEATHER MARKET, BY APPLICATION (2016-2028)

TABLE 027. PLANT-BASED LEATHER MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC PLANT-BASED LEATHER MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC PLANT-BASED LEATHER MARKET, BY APPLICATION (2016-2028)

TABLE 030. PLANT-BASED LEATHER MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA PLANT-BASED LEATHER MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA PLANT-BASED LEATHER MARKET, BY APPLICATION (2016-2028)

TABLE 033. PLANT-BASED LEATHER MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA PLANT-BASED LEATHER MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA PLANT-BASED LEATHER MARKET, BY APPLICATION (2016-2028)

TABLE 036. PLANT-BASED LEATHER MARKET, BY COUNTRY (2016-2028)

TABLE 037. ADRIANO DI MARTI (DESSERTO) (MEXICO): SNAPSHOT

TABLE 038. ADRIANO DI MARTI (DESSERTO) (MEXICO): BUSINESS PERFORMANCE

TABLE 039. ADRIANO DI MARTI (DESSERTO) (MEXICO): PRODUCT PORTFOLIO

TABLE 040. ADRIANO DI MARTI (DESSERTO) (MEXICO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. VEJA (FRANCE): SNAPSHOT

TABLE 041. VEJA (FRANCE): BUSINESS PERFORMANCE

TABLE 042. VEJA (FRANCE): PRODUCT PORTFOLIO

TABLE 043. VEJA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NATURAL FIBER WELDING: SNAPSHOT

TABLE 044. NATURAL FIBER WELDING: BUSINESS PERFORMANCE

TABLE 045. NATURAL FIBER WELDING: PRODUCT PORTFOLIO

TABLE 046. NATURAL FIBER WELDING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. INC (USA): SNAPSHOT

TABLE 047. INC (USA): BUSINESS PERFORMANCE

TABLE 048. INC (USA): PRODUCT PORTFOLIO

TABLE 049. INC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. VEERAH (USA): SNAPSHOT

TABLE 050. VEERAH (USA): BUSINESS PERFORMANCE

TABLE 051. VEERAH (USA): PRODUCT PORTFOLIO

TABLE 052. VEERAH (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. VIRIDIS (ITALY): SNAPSHOT

TABLE 053. VIRIDIS (ITALY): BUSINESS PERFORMANCE

TABLE 054. VIRIDIS (ITALY): PRODUCT PORTFOLIO

TABLE 055. VIRIDIS (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. WILL'S VEGAN (UK): SNAPSHOT

TABLE 056. WILL'S VEGAN (UK): BUSINESS PERFORMANCE

TABLE 057. WILL'S VEGAN (UK): PRODUCT PORTFOLIO

TABLE 058. WILL'S VEGAN (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MIOMOJO SRL (ITALY): SNAPSHOT

TABLE 059. MIOMOJO SRL (ITALY): BUSINESS PERFORMANCE

TABLE 060. MIOMOJO SRL (ITALY): PRODUCT PORTFOLIO

TABLE 061. MIOMOJO SRL (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MABEL (ITALY): SNAPSHOT

TABLE 062. MABEL (ITALY): BUSINESS PERFORMANCE

TABLE 063. MABEL (ITALY): PRODUCT PORTFOLIO

TABLE 064. MABEL (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ANANAS ANAM (PIÑATEX) (UK): SNAPSHOT

TABLE 065. ANANAS ANAM (PIÑATEX) (UK): BUSINESS PERFORMANCE

TABLE 066. ANANAS ANAM (PIÑATEX) (UK): PRODUCT PORTFOLIO

TABLE 067. ANANAS ANAM (PIÑATEX) (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CLARINO (PHILIPPINES): SNAPSHOT

TABLE 068. CLARINO (PHILIPPINES): BUSINESS PERFORMANCE

TABLE 069. CLARINO (PHILIPPINES): PRODUCT PORTFOLIO

TABLE 070. CLARINO (PHILIPPINES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. STUDIO TJEERD VEENHOVEN (NETHERLANDS): SNAPSHOT

TABLE 071. STUDIO TJEERD VEENHOVEN (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 072. STUDIO TJEERD VEENHOVEN (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 073. STUDIO TJEERD VEENHOVEN (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. VOLKSWAGEN (GERMANY): SNAPSHOT

TABLE 074. VOLKSWAGEN (GERMANY): BUSINESS PERFORMANCE

TABLE 075. VOLKSWAGEN (GERMANY): PRODUCT PORTFOLIO

TABLE 076. VOLKSWAGEN (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. MODERN MEADOW (USA): SNAPSHOT

TABLE 077. MODERN MEADOW (USA): BUSINESS PERFORMANCE

TABLE 078. MODERN MEADOW (USA): PRODUCT PORTFOLIO

TABLE 079. MODERN MEADOW (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. MALAI STUDIO (POLAND): SNAPSHOT

TABLE 080. MALAI STUDIO (POLAND): BUSINESS PERFORMANCE

TABLE 081. MALAI STUDIO (POLAND): PRODUCT PORTFOLIO

TABLE 082. MALAI STUDIO (POLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PLANT-BASED LEATHER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PLANT-BASED LEATHER MARKET OVERVIEW BY TYPE

FIGURE 012. PINEAPPLE LEATHER (PIÑATEX) MARKET OVERVIEW (2016-2028)

FIGURE 013. CACTUS LEATHER MARKET OVERVIEW (2016-2028)

FIGURE 014. MUSHROOM LEATHER MARKET OVERVIEW (2016-2028)

FIGURE 015. LEAF LEATHER MARKET OVERVIEW (2016-2028)

FIGURE 016. VEGAN CORK LEATHER MARKET OVERVIEW (2016-2028)

FIGURE 017. GRAIN-BASED LEATHER MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. PLANT-BASED LEATHER MARKET OVERVIEW BY APPLICATION

FIGURE 020. CLOTHING MARKET OVERVIEW (2016-2028)

FIGURE 021. ACCESSORIES MARKET OVERVIEW (2016-2028)

FIGURE 022. FOOTWEAR MARKET OVERVIEW (2016-2028)

FIGURE 023. AUTOMOTIVE INTERIORS MARKET OVERVIEW (2016-2028)

FIGURE 024. HOME INTERIORS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA PLANT-BASED LEATHER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE PLANT-BASED LEATHER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC PLANT-BASED LEATHER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA PLANT-BASED LEATHER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA PLANT-BASED LEATHER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Plant Based Leather Market research report is 2024-2032.

Ananas Anam , DESSERTO, NUPELLE, Natural Fiber ,Welding Inc.,PEEL Lab,Pangaia Grado Zero SRL,MABEL SRL,Beyond Leather Materials and Other Key Players

The By Product Type (Pineapple Leather, Cactus Leather, Mushroom Leather, Apple Leather), Application (Fashion (Clothing, Accessories, and Footwear, Automotive Interior, Home) and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Plant-based leather, a sustainable and ethical alternative to traditional leather, is gaining widespread traction across industries. Derived from renewable plant sources such as pineapple leaves, cork, and mushrooms, this innovative material offers a cruelty-free solution without compromising on quality or style. Its versatility allows for applications in fashion, automotive interiors, and home furnishings, where it meets the demands of environmentally conscious consumers. With advancements in technology improving its texture, durability, and performance, plant-based leather is poised to play a pivotal role in shaping a more sustainable future for the fashion and materials industries.

Plant Based Leather Market Size Was Valued at USD 73.10 Million in 2023 and is Projected to Reach USD 140.15 Million by 2032, Growing at a CAGR of 7.50% From 2024-2032.