Physician Office Diagnostic Market Synopsis:

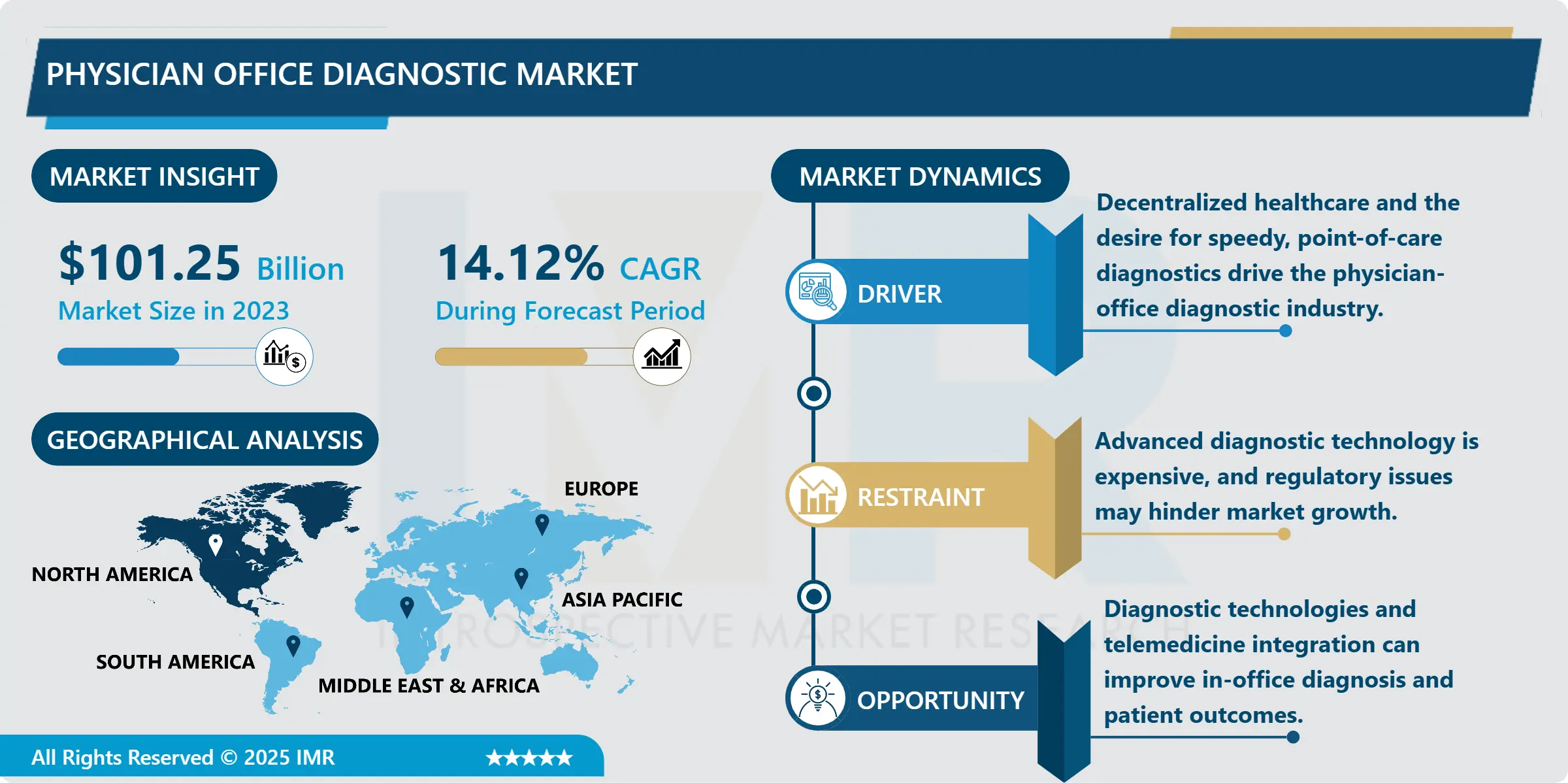

Physician Office Diagnostic Market Size Was Valued at USD 101.25 Billion in 2023, and is Projected to Reach USD 379.25 Billion by 2032, Growing at a CAGR of 14.12% From 2024-2032.

The physician office diagnostic market is closely related to a large number of medical testing products and services to be performed in the physician office, which enables quicker diagnosis. This market is motivated by the trend toward receiving results as soon as possible, which may shorten the time for making decisions, as well as increase a patient’s quality of care. Current physician office diagnostics include Point of Care (POC) devices, imaging equipment and rapid testing kits which are applicable to specialties like cardiology, infectious disease, and oncology. Physician office diagnostics are on the rise considering they mean convenient service to the patient as well as increased efficiency to the healthcare provider.

- Another factor likely to drive the physician office diagnostic market is the shift from the traditional system of a doctor making the decision about the diagnostic test in a patient’s treatment plan to a system where the patient is allowed to participate in the decision-making process. Through the use of diagnostics within physicians offices, patients are able to be diagnosed more quickly and therefore receive their diagnoses from their doctors rather than having to be referred to an outside facility. That also explains the increase in demand for outpatient care services – medical services rendered outside of a hospital environment. These new paradigms of healthcare are supported by physician office diagnostics conduct tests and diagnose inside practices for diseases, manage chronic illnesses, and provide preventive care.

- Moreover, the increasing innovation in the diagnostic products including portable diagnostic instruments, individuals friendly digital platforms is the major driver that is energizing the growth of the market. These innovations make it easier for physicians to perform accurate test within a short time and within the comfort of their offices. Furthermore as… the demand for cost effective diagnostic procedure is high especially with rising cost of healthcare. Since the physician office diagnostic market is gradually moving to become more accessible along with significant technological advancements occurring in near future, this market is believed to have a strong prospect in the years to come.

Physician Office Diagnostic Market Trend Analysis:

Rise in Point-of-Care Testing Technologies

-

The physician office diagnostic industry is experiencing a fast growth of point of care testing (POCT) techniques that can deliver immediate test results. These technologies allow doctors and physicians to prescribe tests for everyday illnesses like diabetes, cardiovascular diseases, and other diseases you can think of to be conducted in their offices and not the traditional hospitals, and the results are as good as instantly. Mobile and compact diagnostic tools are propelling the use of POCT devices in the primary care section with the help of portable and handheld diagnostic tools that promise reliable and easy to use with high accuracy devices.

Integration of Digital Health Solutions

-

The physician office diagnostic market also has another significant trend: the enhancement of system adopting from digital health solutions like the responsibility to suggest a telemedicine-compatible diagnostic tool and a cloud-based patient management system. As noted earlier, it enables patients to share data between devices and healthcare givers and enhances diagnosis and patient record keeping. This integration also allows for follow-up examination as well as ongoing care monitoring from a distance – a aspect that is very useful for chronic diseases. Continuing advancements of digital capabilities in HC organizations lead to improved utilization by physician-office diagnostics to enhance practice operational efficiencies and patient support.

Physician Office Diagnostic Market Segment Analysis:

Physician Office Diagnostic Market is Segmented on the basis of Product Type, End-User, and Region.

By Product Type, the Point-of-Care Testing (POCT) Devices segment is expected to dominate the market during the forecast period

-

Based on the product, the physician office diagnostic market includes Point of Care Testing, Clinical Chemistry Analyzers, Immunoassay Systems, Molecular Diagnostics and Urinalysis Systems among which these devices have different functions and are suited to the physician office setting. Portable Oral Care Testing kits popular with patients mainly because they yield results in a short time for certain diseases that require immediate decision-making. Automated clinical chemistry analyzers and immunoassay systems play important operational roles for a variety of tests, including metabolic, hormone and protein profile which are significant in managing chronic disease conditions. Molecular diagnostic tests, which are often performed in reference laboratories, are being brought into the outpatient in increasing numbers with a clear focus on infectious diseases testing. Se also the importance of routine urinalysis systems in diagnosis of the kidney and urinary tract diseases as well as health status of metabolic systems. Combined, these various types of products provide physician offices with a complete range of diagnostic tools, which help in the proper and optimal utilization of outpatient services for the benefit of the patient.

By End-User, Urgent Care Centers segment expected to held the largest share

-

Physician office diagnostic market is relatively diversified with principal end-users including the physician offices/ clinics, urgent care centers & ambulatory surgical/medical centers playing a vital role the growth of the market. The largest segment of this market is physician offices and clinics because of the increasing need for accurate, speedy tests that are integrated with the care process and assist clinicians in the decision-making process. Another driver to the market is the urgent care centers since they need a fast diagnostic platform for numerous patients presenting acute conditions that need attention. Centers of ambulatory care are oriented on the provision of acute and convenient care based on outpatient services, where diagnostic platforms play an important role for patients avoiding admissions to the hospital. Collectively, these end-user segments reflect the increasing focus on affordable and localized heath care delivery and support the need for accurate, on premise diagnostic tools.

Physician Office Diagnostic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

It is expected that the physician office diagnostic market in North America will have the biggest share of the market during the coming years because of various factors such as the good healthcare platform, increased usage of sophisticated diagnostic equipment, and increasing client-centered care. The growth of innovation in healthcare has been implemented in the region; consequently, the continuous availability of point-of-care testing (POCT) devices and digital health solutions for the improvement of diagnostic capacity has developed within physician offices. Moreover, another factor that boosts the in-office diagnostic demand is the increased rate of chronic disease, and favorable reimbursement policies. As technology is developing in the healthcare field and since there is a trend towards ambulatory care, it is pointed out that North America is a suitable market for physician office diagnostics.

Active Key Players in the Physician Office Diagnostic Market

- Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Abbott Laboratories (USA)

- Thermo Fisher Scientific Inc. (USA)

- Danaher Corporation (USA)

- Sysmex Corporation (Japan)

- Becton, Dickinson and Company (USA)

- Bio-Rad Laboratories, Inc. (USA)

- Quidel Corporation (USA)

- Hologic, Inc. (USA)

- Ortho Clinical Diagnostics (USA)

- Beckman Coulter, Inc. (a subsidiary of Danaher Corporation) (USA)

- BioMérieux SA (France)

- Trinity Biotech plc (Ireland)

- EKF Diagnostics Holdings plc (UK),

- Other Active Players.

|

Global Physician Office Diagnostic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 101.25 Billion |

|

Forecast Period 2024-32 CAGR: |

14.12% |

Market Size in 2032: |

USD 379.25 Billion |

|

|

By Product Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Physician Office Diagnostic Market by Product Type

4.1 Physician Office Diagnostic Market Snapshot and Growth Engine

4.2 Physician Office Diagnostic Market Overview

4.3 Point-of-Care Testing (POCT) Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Point-of-Care Testing (POCT) Devices: Geographic Segmentation Analysis

4.4 Clinical Chemistry Analyzers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Clinical Chemistry Analyzers: Geographic Segmentation Analysis

4.5 Immunoassay Systems

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Immunoassay Systems: Geographic Segmentation Analysis

4.6 Molecular Diagnostics

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Molecular Diagnostics: Geographic Segmentation Analysis

4.7 and Urinalysis Systems

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Urinalysis Systems: Geographic Segmentation Analysis

Chapter 5: Physician Office Diagnostic Market by End-User

5.1 Physician Office Diagnostic Market Snapshot and Growth Engine

5.2 Physician Office Diagnostic Market Overview

5.3 Physician Offices & Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Physician Offices & Clinics: Geographic Segmentation Analysis

5.4 Urgent Care Centers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Urgent Care Centers: Geographic Segmentation Analysis

5.5 and Ambulatory Care Centers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Ambulatory Care Centers: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Physician Office Diagnostic Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HOFFMANN-LA ROCHE LTD (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SIEMENS HEALTHINEERS AG (GERMANY)

6.4 ABBOTT LABORATORIES (USA)

6.5 THERMO FISHER SCIENTIFIC INC. (USA)

6.6 DANAHER CORPORATION (USA)

6.7 SYSMEX CORPORATION (JAPAN)

6.8 BECTON

6.9 DICKINSON AND COMPANY (USA)

6.10 BIO-RAD LABORATORIES INC. (USA)

6.11 QUIDEL CORPORATION (USA)

6.12 HOLOGIC INC. (USA)

6.13 ORTHO CLINICAL DIAGNOSTICS (USA)

6.14 BECKMAN COULTER INC. (A SUBSIDIARY OF DANAHER CORPORATION) (USA)

6.15 BIOMÉRIEUX SA (FRANCE)

6.16 TRINITY BIOTECH PLC (IRELAND)

6.17 EKF DIAGNOSTICS HOLDINGS PLC (UK)

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Physician Office Diagnostic Market By Region

7.1 Overview

7.2. North America Physician Office Diagnostic Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Point-of-Care Testing (POCT) Devices

7.2.4.2 Clinical Chemistry Analyzers

7.2.4.3 Immunoassay Systems

7.2.4.4 Molecular Diagnostics

7.2.4.5 and Urinalysis Systems

7.2.5 Historic and Forecasted Market Size By End-User

7.2.5.1 Physician Offices & Clinics

7.2.5.2 Urgent Care Centers

7.2.5.3 and Ambulatory Care Centers

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Physician Office Diagnostic Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Point-of-Care Testing (POCT) Devices

7.3.4.2 Clinical Chemistry Analyzers

7.3.4.3 Immunoassay Systems

7.3.4.4 Molecular Diagnostics

7.3.4.5 and Urinalysis Systems

7.3.5 Historic and Forecasted Market Size By End-User

7.3.5.1 Physician Offices & Clinics

7.3.5.2 Urgent Care Centers

7.3.5.3 and Ambulatory Care Centers

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Physician Office Diagnostic Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Point-of-Care Testing (POCT) Devices

7.4.4.2 Clinical Chemistry Analyzers

7.4.4.3 Immunoassay Systems

7.4.4.4 Molecular Diagnostics

7.4.4.5 and Urinalysis Systems

7.4.5 Historic and Forecasted Market Size By End-User

7.4.5.1 Physician Offices & Clinics

7.4.5.2 Urgent Care Centers

7.4.5.3 and Ambulatory Care Centers

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Physician Office Diagnostic Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Point-of-Care Testing (POCT) Devices

7.5.4.2 Clinical Chemistry Analyzers

7.5.4.3 Immunoassay Systems

7.5.4.4 Molecular Diagnostics

7.5.4.5 and Urinalysis Systems

7.5.5 Historic and Forecasted Market Size By End-User

7.5.5.1 Physician Offices & Clinics

7.5.5.2 Urgent Care Centers

7.5.5.3 and Ambulatory Care Centers

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Physician Office Diagnostic Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Point-of-Care Testing (POCT) Devices

7.6.4.2 Clinical Chemistry Analyzers

7.6.4.3 Immunoassay Systems

7.6.4.4 Molecular Diagnostics

7.6.4.5 and Urinalysis Systems

7.6.5 Historic and Forecasted Market Size By End-User

7.6.5.1 Physician Offices & Clinics

7.6.5.2 Urgent Care Centers

7.6.5.3 and Ambulatory Care Centers

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Physician Office Diagnostic Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Point-of-Care Testing (POCT) Devices

7.7.4.2 Clinical Chemistry Analyzers

7.7.4.3 Immunoassay Systems

7.7.4.4 Molecular Diagnostics

7.7.4.5 and Urinalysis Systems

7.7.5 Historic and Forecasted Market Size By End-User

7.7.5.1 Physician Offices & Clinics

7.7.5.2 Urgent Care Centers

7.7.5.3 and Ambulatory Care Centers

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Physician Office Diagnostic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 101.25 Billion |

|

Forecast Period 2024-32 CAGR: |

14.12% |

Market Size in 2032: |

USD 379.25 Billion |

|

|

By Product Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||