Photocatalyst Market Synopsis

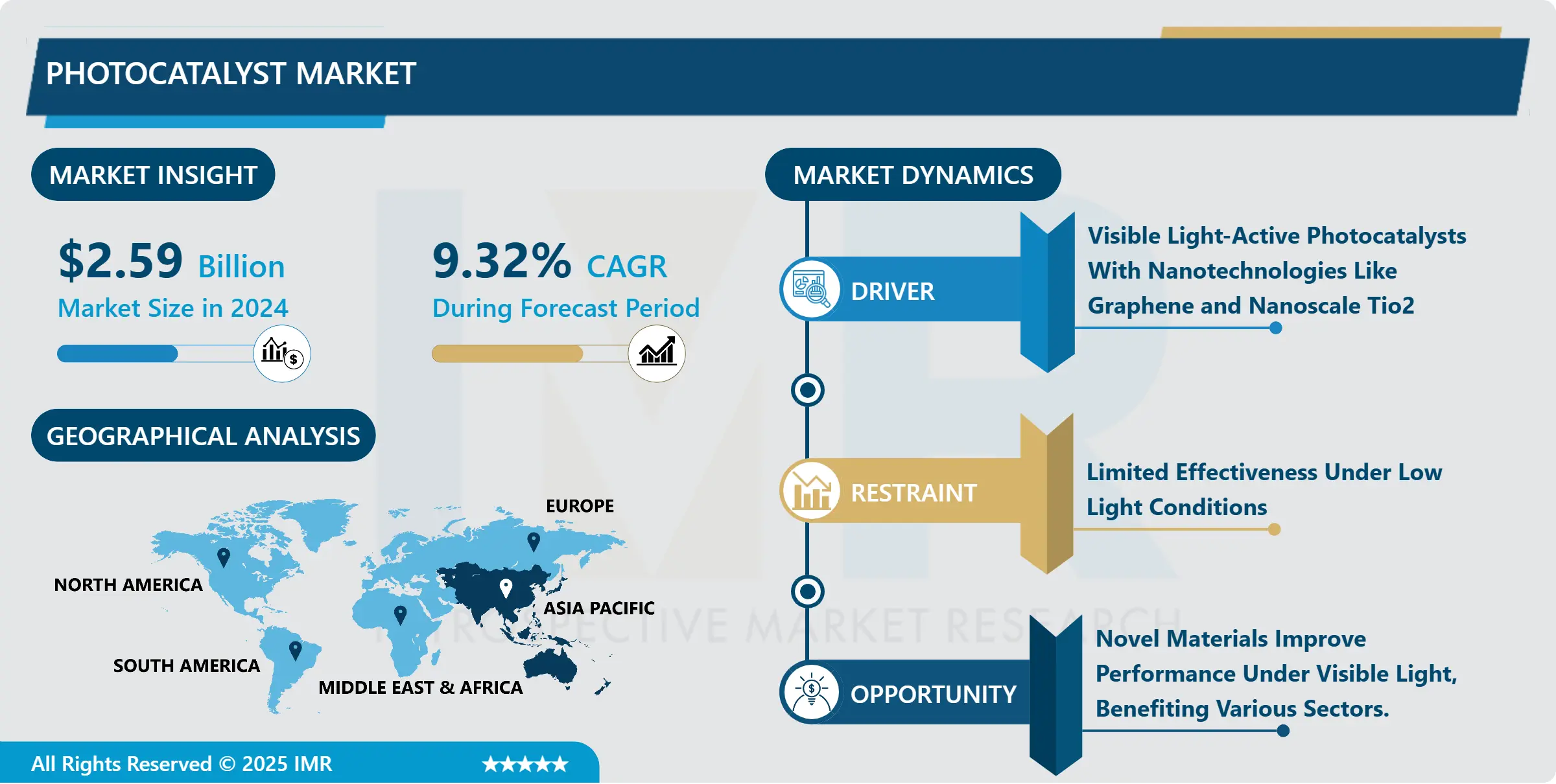

Photocatalyst Market Size Was Valued at USD 2.59 Billion in 2024, and is Projected to Reach USD 6.9 Billion by 2035, Growing at a CAGR of 9.32% From 2025-2035.

Photocatalysts are nanoparticles (NPs) with semiconducting features such as light absorption, charge transfer, and favorable electronic structure, among others. Photoactive NPs serve as catalysts in a variety of applications, including sustainable energy production and environmental remediation. When compared with bulk materials, photocatalysts have exceptional structures and a higher surface area-to-volume ratio, which boosts their actions. As a result, controlling the shape and size of photocatalytic materials in the nanoscale range allows for the creation and fabrication of materials appropriate for use in innovative applications. Green photoactive NPs can be made from a variety of biological sources, including plant materials and microorganisms. This synthesis approach is environmentally friendly, green, biocompatible, and cost-e?ective. Green synthesis nano photocatalysts exhibit improved catalytic activity while reducing the usage of costly and dangerous chemicals.

Photocatalyst Market Trend Analysis

Visible Light-Active Photocatalysts With Nanotechnologies Like Graphene and Nanoscale Tio2

- The market for photocatalysts is moving towards using visible light-active photocatalysts to increase efficiency in regular sunlight, as well as integrating nanotechnology by incorporating materials such as graphene and nanoscale TiO2 to improve performance.

- Growing interest in using photocatalysts for air purification is driven by the escalating worries about air pollution, particularly in urban regions. This has resulted in an increasing need for innovative materials in urban, business, and manufacturing environments. Expansion is also observed in construction use.

- There is growing interest in photocatalytic hydrogen production as a sustainable energy source. The use of photocatalysts is increasing in consumer products such as self-cleaning glass and air purifiers in response to the desire for cleaner living spaces. Urbanization and government support for environmental technologies are fueling the market in the Asia-Pacific region.

Novel Materials Improve Performance Under Visible Light, Benefiting Various Sectors.

- The demand for photocatalysts is being driven by emerging markets in Southeast Asia, Latin America, and Africa. Creating novel materials that have improved performance when exposed to visible light may result in significant advancements across different sectors.

- Photocatalysts show promise in combining with sustainable energy technologies for the effective production of clean energy. They can be used in water treatment to break down pollutants, tackling worldwide water problems.

- The emergence of smart cities and sustainable urban development provides an opportunity for the extensive application of photocatalysts in public infrastructure. There is an increasing need for photocatalyst-based antimicrobial coatings in the healthcare industry. Partnerships between research institutions and industry are spurring innovation in photocatalytic technologies.

Photocatalyst Market Segment Analysis:

Photocatalyst Market Segmented based on Material Type, Application, and Forms, End-Use.

By Material Type, Titanium Dioxide (TiO2) Segment Is Expected to Dominate the Market During the Forecast Period

- Titanium Dioxide (TiO2) is the leading choice in the photocatalyst industry because of its exceptional photocatalytic characteristics, such as high performance in UV light, superior ability to produce reactive oxygen species, and lasting effectiveness in different environments thanks to its chemical stability.

- TiO2 is considered safe for both humans and the environment, which is why it is perfect for applications such as water treatment for those concerned about safety. Its lack of toxicity is in line with sustainability objectives. Due to its plentiful natural resources, TiO2 is economical to manufacture and extensively utilized in various industries.

- TiO2 is utilized in water treatment for breaking down organic pollutants in wastewater and enhancing water quality. It is also used in air purification to disintegrate airborne pollutants and in self-cleaning surfaces to resist water and organic matter. The antimicrobial qualities of TiO2 make it well-suited for use in healthcare settings as coatings. Furthermore, TiO2 is stable under light exposure, guaranteeing reliable performance and durability of the product. Due to its versatility, it can enhance the properties of different materials and is utilized in advanced applications such as solar cells and drug delivery systems.

By End-Use, Construction Segment Held the Largest Share

- The market for photocatalysts is mainly driven by the construction sector, as photocatalytic materials are widely used in building materials, infrastructure, and urban settings. The main driving force behind this is

The dog ran quickly through the park, chasing after a squirrel. The widespread implementation of self-cleaning materials on building facades and windows decreases the frequency of cleaning and maintenance required.

- This country has a rich cultural heritage that spans centuries. Utilizing photocatalytic materials on roads and public structures in cities for air purification, aiding in achieving sustainability objectives and promoting cleaner air.

- Photocatalytic coatings provide enduring, extended performance in different environments, immune to UV radiation and weathering for application in construction materials. They decrease maintenance expenses through cleanliness, aid in energy efficiency by controlling heat and light, and reduce the environmental effects of building operations.

- Regulations and incentives provided by governments worldwide promote sustainable construction. Photocatalytic materials are utilized in urban renewal projects to enhance air quality. They provide advantages in appearance and are highly sought after in developing countries.

Photocatalyst Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region's dominance in the photocatalyst market is due to rapid economic growth, industrial development, and a focus on environmental sustainability. Factors like rapid industrialization, urbanization, government policies, and sustainability initiatives drive the adoption of photocatalytic technologies in the construction, automotive, and consumer goods industries. Countries like China, India, Japan, and South Korea lead in green technologies and photocatalytic research, boosting their global market presence.

- Government efforts in the Asia-Pacific area are focused on fighting pollution by implementing pollution control schemes and offering rewards for clean technologies, such as photocatalytic materials. The materials are heavily utilized by the construction and automotive sectors to make building materials, coatings, and vehicles, aiming to reduce pollution and enhance air quality. Furthermore, there is a rising demand for eco-friendly products in the region, such as consumer goods that utilize photocatalytic materials.

- Investing in the research and development of photocatalytic materials in countries within the Asia-Pacific region, such as Japan and South Korea, is driving advancements that enhance efficiency and competitiveness on a global scale. A solid manufacturing foundation, interconnected supply chains, and growing consumer interest in sustainable technologies all contribute to the success of mass production.

Photocatalyst Market Active Players

- Kronos Worldwide, Inc. (USA)

- Cristal Global (a subsidiary of Tronox Holdings plc) (Saudi Arabia/USA)

- Tayca Corporation (Japan)

- Ishihara Sangyo Kaisha, Ltd. (Japan)

- Toto Corporation (Japan)

- Showa Denko K.K. (Japan)

- Kon Corporation (Japan)

- Daikin Industries, Ltd. (Japan)

- Green Millennium (USA)

- The Chemours Company (USA)

- Evonik Industries AG (Germany)

- Sachtleben Chemie GmbH (part of Venator Materials) (Germany)

- Pidilite Industries Ltd. (India)

- Osaka Titanium Technologies Co., Ltd. (Japan)

- Millennium Chemicals (USA)

- Nippon Soda Co., Ltd. (Japan)

- TitanPE Technologies, Inc. (China)

- Fujifilm Corporation (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Saint-Gobain S.A. (France)

- LyondellBasell Industries N.V. (Netherlands)

- Perstorp Group (Sweden)

- Advanced Materials-JTJ s.r.o. (Czech Republic)

- Huntsman Corporation (USA)

- Hitachi Chemical Co., Ltd. (Japan)

- AGC Inc. (Japan)

- Ineos Group Holdings S.A. (UK/Switzerland)

- BASF SE (Germany)

- Ecopro Co., Ltd. (South Korea)

Key Industry Developments in the Photocatalyst Market:

- In February 2024, Alfa Chemistry introduced three types of photochemistry-related materials, i.e., photocatalysts, photosensitizers, and quantum dots, to its versatile product portfolios.

- In February 2024, A professor from the Department of Chemistry at the University of Hong Kong (HKU) led a research project by creating a new heterogeneous copper photocatalyst that effectively forms cyclobutane rings.

- In March 2024, Samsung Electronics developed a new model of its premium air purifier series featuring an innovative photocatalyst filter that eliminates the need for periodic filter replacements.

|

Photocatalyst Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.3% |

Market Size in 2035: |

USD 6.9 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By Forms |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Photocatalyst Market by Material Type (2018-2035)

4.1 Photocatalyst Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Titanium Dioxide (TiO2)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Zinc Oxide (ZnO)

4.5 Cadmium Sulfide (CdS)

Chapter 5: Photocatalyst Market by Application (2018-2035)

5.1 Photocatalyst Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Water Treatment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Air Purification

5.5 Self-Cleaning Surfaces

5.6 Antimicrobial Coatings

5.7 Energy Production

Chapter 6: Photocatalyst Market by Forms (2018-2035)

6.1 Photocatalyst Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fines

6.5 Sponge

6.6 Bars/Blocks

6.7 Granules

6.8 Ingots

Chapter 7: Photocatalyst Market by End-Use (2018-2035)

7.1 Photocatalyst Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Construction

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive

7.5 Chemical

7.6 Healthcare

7.7 Energy

7.8 Consumer Products

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Photocatalyst Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 KRONOS WORLDWIDE INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CRISTAL GLOBAL (A SUBSIDIARY OF TRONOX HOLDINGS PLC) (SAUDI ARABIA/USA)

8.4 TAYCA CORPORATION (JAPAN)

8.5 ISHIHARA SANGYO KAISHA LTD. (JAPAN)

8.6 TOTO CORPORATION (JAPAN)

8.7 SHOWA DENKO K.K. (JAPAN)

8.8 KON CORPORATION (JAPAN)

8.9 DAIKIN INDUSTRIES LTD. (JAPAN)

8.10 GREEN MILLENNIUM (USA)

8.11 THE CHEMOURS COMPANY (USA)

8.12 EVONIK INDUSTRIES AG (GERMANY)

8.13 SACHTLEBEN CHEMIE GMBH (PART OF VENATOR MATERIALS) (GERMANY)

8.14 PIDILITE INDUSTRIES LTD. (INDIA)

8.15 OSAKA TITANIUM TECHNOLOGIES COLTD. (JAPAN)

8.16 MILLENNIUM CHEMICALS (USA)

8.17 NIPPON SODA COLTD. (JAPAN)

8.18 TITANPE TECHNOLOGIES INC. (CHINA)

8.19 FUJIFILM CORPORATION (JAPAN)

8.20 KAWASAKI HEAVY INDUSTRIES LTD. (JAPAN)

8.21 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

8.22 SAINT-GOBAIN S.A. (FRANCE)

8.23 LYONDELLBASELL INDUSTRIES N.V. (NETHERLANDS)

8.24 PERSTORP GROUP (SWEDEN)

8.25 ADVANCED MATERIALS-JTJ S.R.O. (CZECH REPUBLIC)

8.26 HUNTSMAN CORPORATION (USA)

8.27 HITACHI CHEMICAL COLTD. (JAPAN)

8.28 AGC INC. (JAPAN)

8.29 INEOS GROUP HOLDINGS S.A. (UK/SWITZERLAND)

8.30 BASF SE (GERMANY)

8.31 ECOPRO COLTD. (SOUTH KOREA)

Chapter 9: Global Photocatalyst Market By Region

9.1 Overview

9.2. North America Photocatalyst Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Material Type

9.2.4.1 Titanium Dioxide (TiO2)

9.2.4.2 Zinc Oxide (ZnO)

9.2.4.3 Cadmium Sulfide (CdS)

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Water Treatment

9.2.5.2 Air Purification

9.2.5.3 Self-Cleaning Surfaces

9.2.5.4 Antimicrobial Coatings

9.2.5.5 Energy Production

9.2.6 Historic and Forecasted Market Size by Forms

9.2.6.1 Powder

9.2.6.2 Fines

9.2.6.3 Sponge

9.2.6.4 Bars/Blocks

9.2.6.5 Granules

9.2.6.6 Ingots

9.2.7 Historic and Forecasted Market Size by End-Use

9.2.7.1 Construction

9.2.7.2 Automotive

9.2.7.3 Chemical

9.2.7.4 Healthcare

9.2.7.5 Energy

9.2.7.6 Consumer Products

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Photocatalyst Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Material Type

9.3.4.1 Titanium Dioxide (TiO2)

9.3.4.2 Zinc Oxide (ZnO)

9.3.4.3 Cadmium Sulfide (CdS)

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Water Treatment

9.3.5.2 Air Purification

9.3.5.3 Self-Cleaning Surfaces

9.3.5.4 Antimicrobial Coatings

9.3.5.5 Energy Production

9.3.6 Historic and Forecasted Market Size by Forms

9.3.6.1 Powder

9.3.6.2 Fines

9.3.6.3 Sponge

9.3.6.4 Bars/Blocks

9.3.6.5 Granules

9.3.6.6 Ingots

9.3.7 Historic and Forecasted Market Size by End-Use

9.3.7.1 Construction

9.3.7.2 Automotive

9.3.7.3 Chemical

9.3.7.4 Healthcare

9.3.7.5 Energy

9.3.7.6 Consumer Products

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Photocatalyst Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Material Type

9.4.4.1 Titanium Dioxide (TiO2)

9.4.4.2 Zinc Oxide (ZnO)

9.4.4.3 Cadmium Sulfide (CdS)

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Water Treatment

9.4.5.2 Air Purification

9.4.5.3 Self-Cleaning Surfaces

9.4.5.4 Antimicrobial Coatings

9.4.5.5 Energy Production

9.4.6 Historic and Forecasted Market Size by Forms

9.4.6.1 Powder

9.4.6.2 Fines

9.4.6.3 Sponge

9.4.6.4 Bars/Blocks

9.4.6.5 Granules

9.4.6.6 Ingots

9.4.7 Historic and Forecasted Market Size by End-Use

9.4.7.1 Construction

9.4.7.2 Automotive

9.4.7.3 Chemical

9.4.7.4 Healthcare

9.4.7.5 Energy

9.4.7.6 Consumer Products

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Photocatalyst Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Material Type

9.5.4.1 Titanium Dioxide (TiO2)

9.5.4.2 Zinc Oxide (ZnO)

9.5.4.3 Cadmium Sulfide (CdS)

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Water Treatment

9.5.5.2 Air Purification

9.5.5.3 Self-Cleaning Surfaces

9.5.5.4 Antimicrobial Coatings

9.5.5.5 Energy Production

9.5.6 Historic and Forecasted Market Size by Forms

9.5.6.1 Powder

9.5.6.2 Fines

9.5.6.3 Sponge

9.5.6.4 Bars/Blocks

9.5.6.5 Granules

9.5.6.6 Ingots

9.5.7 Historic and Forecasted Market Size by End-Use

9.5.7.1 Construction

9.5.7.2 Automotive

9.5.7.3 Chemical

9.5.7.4 Healthcare

9.5.7.5 Energy

9.5.7.6 Consumer Products

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Photocatalyst Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Material Type

9.6.4.1 Titanium Dioxide (TiO2)

9.6.4.2 Zinc Oxide (ZnO)

9.6.4.3 Cadmium Sulfide (CdS)

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Water Treatment

9.6.5.2 Air Purification

9.6.5.3 Self-Cleaning Surfaces

9.6.5.4 Antimicrobial Coatings

9.6.5.5 Energy Production

9.6.6 Historic and Forecasted Market Size by Forms

9.6.6.1 Powder

9.6.6.2 Fines

9.6.6.3 Sponge

9.6.6.4 Bars/Blocks

9.6.6.5 Granules

9.6.6.6 Ingots

9.6.7 Historic and Forecasted Market Size by End-Use

9.6.7.1 Construction

9.6.7.2 Automotive

9.6.7.3 Chemical

9.6.7.4 Healthcare

9.6.7.5 Energy

9.6.7.6 Consumer Products

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Photocatalyst Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Material Type

9.7.4.1 Titanium Dioxide (TiO2)

9.7.4.2 Zinc Oxide (ZnO)

9.7.4.3 Cadmium Sulfide (CdS)

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Water Treatment

9.7.5.2 Air Purification

9.7.5.3 Self-Cleaning Surfaces

9.7.5.4 Antimicrobial Coatings

9.7.5.5 Energy Production

9.7.6 Historic and Forecasted Market Size by Forms

9.7.6.1 Powder

9.7.6.2 Fines

9.7.6.3 Sponge

9.7.6.4 Bars/Blocks

9.7.6.5 Granules

9.7.6.6 Ingots

9.7.7 Historic and Forecasted Market Size by End-Use

9.7.7.1 Construction

9.7.7.2 Automotive

9.7.7.3 Chemical

9.7.7.4 Healthcare

9.7.7.5 Energy

9.7.7.6 Consumer Products

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Photocatalyst Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.3% |

Market Size in 2035: |

USD 6.9 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By Forms |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||