Pharmacogenomics Market Synopsis

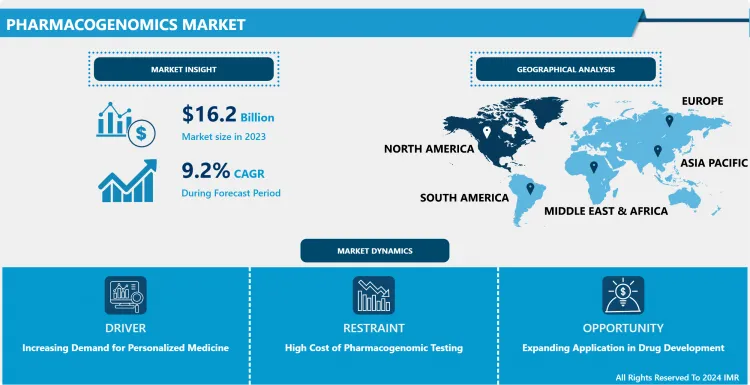

Pharmacogenomics Market Size Was Valued at USD 16.2 Billion in 2023, and is Projected to Reach USD 35.8 Billion by 2032, Growing at a CAGR of 9.2% From 2024-2032.

Pharmacogenomic is an aspect of pharmacogenetics that deals with the relationship between a person and the drug that is prescribed to him or her. Pharmacogenomics aims at using information concerning genetic factors that influence drug metabolism, effectiveness and toxicity to shape determinate treatment plans so as to maximise effectiveness while minimising side-effects. This field integrates Pharmacology and genomics to facilitate treatment and dosing therefore bringing about better health solutions. Pharmacogenomic evaluation is therefore central in enhancing effectiveness of drug therapies, limiting use of drugs whose outcomes are too often unpredictable as well as in the creation of efficient individualized therapeutic interventions.

The market for pharmacogenomics has expanded rapidly over the past years, thanks to the rising genomic technologies and the trend in personalized medicine. With the world moving towards more personalised medicine, the application of pharmacogenomic testing has gained traction, as clients seek to get the best in terms of results while incurring less on their healhtcare costs. The inclusion of pharmacogenomics in practices makes it possible for medical practitioners to anticipate how well or badly a particular patient will respond to a certain drug. This market is characterized by advanced technology which such as next-generation sequencing (NGS), with has made it easier to process the variations.

Furthermore, advancements in pharmacogenomic technologies have benefited from increasing first-world chronic diseases and first-world adverse drug reactions. Large multinational pharmaceutical companies are gradually awakening to the fact that pharmacogenomics should be included as a relevant factor while developing drugs, because it can be useful during trial phases to make ‘the right patient receive the right drug in the right dose’. Furthermore, the regulatory authorities are gradually recognising that the concept of pharmacogenomics is important enough in drug naming and approval to warrant its inclusion in contemporary healthcare. Based on the current interactions between the healthcare industry, academic institutions, and Biotechnology companies, it is believed that pharmacogenomic markets will be expanded further, which will indicate the importance of the pharmacogenomic markets as a part of personalized medicine.

Pharmacogenomics Market Trend Analysis

Rising Adoption of Pharmacogenomic Testing

- Another issue that defines the trend in the pharmacogenomics market is that there is a growing willingness of medical centers to adopt pharmacogenomic testing. In the context of the changing face of healthcare, there is increased appreciation for the importance of mining patients’ genetic makeup for treatment purposes. They noted that this trend is being aided by the improvement in the genomic testing technologies where the cost of carrying out the tests has been reduced over the recent past.

- Prescribers are increasingly using PG tests to inform decisions about the choice and dosage of drugs, especially in the oncology and psychiatric arenas, and in cardiovascular diseases where PTs are profoundly informative. The clinical data on the benefits of pharmacogenomic testing are accumulative, which means more healthcare gurus encourage the incorporation of the tests into practice thereby availing better results to patients. In addition, pc patients are now seeking pharmacogenomic tests and more such tests are on the increase which in one way puts pressure on health care systems to embrace such practices.

Integration of Pharmacogenomics into Drug Development

- One of the biggest opportunities in the pharmacogenomics market is therefore the use of pharmacogenomic information in the drug development process. Pharmacogenomics is also becoming important to drug developers as an avenue through which drug developers can improve drug outcome measures during clinical trial phases. Several observational studies have shown that by including genetic testing in the early stages of therapy development, companies can determine patient populations that respond well to a specific medication.

- This integration also alleviates the problem of late stage trial failures thereby cutting down on the overall time required for the development of new drugs; an important factor in today’s fast growing pharmaceutical industry. Furthermore, as assessment and monitoring organizations embrace pharmacogenomic approaches, then there is an increased motivation for developers of drugs to embrace them as part of developing personalized remedies, thus enhancing the overall acceptance of the remedies in conventional medicine.

Pharmacogenomics Market Segment Analysis:

Pharmacogenomics Market Segmented on the basis of Technology, application and end user.

By technology, the polymerase chain reaction segment hit a market share of around 37.1% in 2023

- The pharmacogenomics market was further segmented based on PCR segment which gained the most significant market share of approximately 37.1% by 2023. This large share is indication of the importance of PCR technology in the process of amplification of specific DNA sequences which is very important in areas such as genetic analysis as well as differentiation of patients for unique solutions. PCR has become commonplace because it can detect very low levels of DNA amplification, works quickly and is highly sensitive when compared to other techniques used in the study of pharmacogenomic applications where accurate amounts of genetic data are crucial.

- Additionally, steps have also been made in the PCR right through to the quantitative PCR (qPCR) and digital PCR resulting into even better utilization as it has improved in the accuracy in analyzing genetic changes in the drugs and their effects. With healthcare overtime under increased pressure to provide patient tailored medical treatments, PCR technology’s importance in pharmacogenomics is expected to increase further cementing its role as a pillar of genetic testing and precision medicine.

By application, the oncology segment has accounted for the highest revenue share of over 31.1% in 2023

- The oncology segment held a significant market share of the pharmacogenomics market in 2023, with a revenue of more than 31.1% for the entire market. This big share underlines the key role of pharmacogenomics in the oncology since the genes of a neoplastic process and patient need to be considered closely. Highly specialized treatment for cancer means that pharmacogenomic knowledge enables the chosen treatment regimen to be further molded according to an individual patient’s genetic makeup to achieve the best outcome with the least risk.

- New technologies such as the next-generation sequencing (NGS) has allowed for the identification of unique mutations and biomarkers with respect to different kinds of cancer leading to the rise in pharmacogenomic tests in oncology. For this reason, oncologists can make informed decisions in regards to targeted therapies and immunotherapies enhancing patient survival. The steady increase of the cancer incidence and the expansion of the field of molecular medicine, particularly the trend of using customized therapy will help propel the oncology sector, which has maintained its position as one of the main applications of pharmacogenomics.

Pharmacogenomics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The pharmacogenomics market has grown tremendously and in 2023, North America stood as the largest region in the market, controlling about 45% of the global market. These reasons include the availability of effective health care facilities, or emphasis on research activities, and or high levels of investment in biotechnology and genomics. The United States has especially shown the most interest in pharmacogenomic progress, as many outstanding academic centers and biotechnology companies invest in personalized medicine programs.

- Moreover, problems in North America proves to have a conducive environment with the administration becoming encouraging of private health care lab offering pharmacogenomic tests to healthcare facilities. given the region’s dedication to implementing pharmacogenomics into the practice, awareness and consequently, the demand for genetic tests have risen placing the region as the leader in the global pharmacogenomics market.

Active Key Players in the Pharmacogenomics Market

- Abbott Laboratories (USA)

- Agilent Technologies, Inc. (USA)

- Asuragen, Inc. (USA)

- Celerion, Inc. (USA)

- Exact Sciences Corporation (USA)

- Genomic Health, Inc. (USA)

- Horizon Discovery Group plc (UK)

- Illumina, Inc. (USA)

- Invitae Corporation (USA)

- MedGenome Labs Ltd. (India)

- Myriad Genetics, Inc. (USA)

- Natera, Inc. (USA)

- Qiagen N.V. (Netherlands)

- Roche Holding AG (Switzerland)

- Thermo Fisher Scientific Inc. (USA)

- Other key Players

|

Global Pharmacogenomics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.2% |

Market Size in 2032: |

USD 35.8 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pharmacogenomics Market by Technology (2018-2032)

4.1 Pharmacogenomics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 DNA Sequencing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Microarray

4.5 Polymerase Chain Reaction

4.6 Electrophoresis

4.7 Mass Spectrometry

Chapter 5: Pharmacogenomics Market by Application (2018-2032)

5.1 Pharmacogenomics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drug Discovery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pain management

5.5 Neurology

5.6 Oncology

5.7 Cardiovascular diseases

5.8 Infectious diseases

5.9 Psychiatry

5.10 Others

Chapter 6: Pharmacogenomics Market by End User (2018-2032)

6.1 Pharmacogenomics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Research institute

6.6 Medical

6.7 academic institute

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmacogenomics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AGILENT TECHNOLOGIES INC. (USA)

7.4 ASURAGEN INC. (USA)

7.5 CELERION INC. (USA)

7.6 EXACT SCIENCES CORPORATION (USA)

7.7 GENOMIC HEALTH INC. (USA)

7.8 HORIZON DISCOVERY GROUP PLC (UK)

7.9 ILLUMINA INC. (USA)

7.10 INVITAE CORPORATION (USA)

7.11 MEDGENOME LABS LTD. (INDIA)

7.12 MYRIAD GENETICS INC. (USA)

7.13 NATERA INC. (USA)

7.14 QIAGEN N.V. (NETHERLANDS)

7.15 ROCHE HOLDING AG (SWITZERLAND)

7.16 THERMO FISHER SCIENTIFIC INC. (USA)

7.17 OTHER KEY PLAYERS

7.18

Chapter 8: Global Pharmacogenomics Market By Region

8.1 Overview

8.2. North America Pharmacogenomics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Technology

8.2.4.1 DNA Sequencing

8.2.4.2 Microarray

8.2.4.3 Polymerase Chain Reaction

8.2.4.4 Electrophoresis

8.2.4.5 Mass Spectrometry

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Drug Discovery

8.2.5.2 Pain management

8.2.5.3 Neurology

8.2.5.4 Oncology

8.2.5.5 Cardiovascular diseases

8.2.5.6 Infectious diseases

8.2.5.7 Psychiatry

8.2.5.8 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Research institute

8.2.6.4 Medical

8.2.6.5 academic institute

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pharmacogenomics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Technology

8.3.4.1 DNA Sequencing

8.3.4.2 Microarray

8.3.4.3 Polymerase Chain Reaction

8.3.4.4 Electrophoresis

8.3.4.5 Mass Spectrometry

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Drug Discovery

8.3.5.2 Pain management

8.3.5.3 Neurology

8.3.5.4 Oncology

8.3.5.5 Cardiovascular diseases

8.3.5.6 Infectious diseases

8.3.5.7 Psychiatry

8.3.5.8 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Research institute

8.3.6.4 Medical

8.3.6.5 academic institute

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pharmacogenomics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Technology

8.4.4.1 DNA Sequencing

8.4.4.2 Microarray

8.4.4.3 Polymerase Chain Reaction

8.4.4.4 Electrophoresis

8.4.4.5 Mass Spectrometry

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Drug Discovery

8.4.5.2 Pain management

8.4.5.3 Neurology

8.4.5.4 Oncology

8.4.5.5 Cardiovascular diseases

8.4.5.6 Infectious diseases

8.4.5.7 Psychiatry

8.4.5.8 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Research institute

8.4.6.4 Medical

8.4.6.5 academic institute

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pharmacogenomics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Technology

8.5.4.1 DNA Sequencing

8.5.4.2 Microarray

8.5.4.3 Polymerase Chain Reaction

8.5.4.4 Electrophoresis

8.5.4.5 Mass Spectrometry

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Drug Discovery

8.5.5.2 Pain management

8.5.5.3 Neurology

8.5.5.4 Oncology

8.5.5.5 Cardiovascular diseases

8.5.5.6 Infectious diseases

8.5.5.7 Psychiatry

8.5.5.8 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Research institute

8.5.6.4 Medical

8.5.6.5 academic institute

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pharmacogenomics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Technology

8.6.4.1 DNA Sequencing

8.6.4.2 Microarray

8.6.4.3 Polymerase Chain Reaction

8.6.4.4 Electrophoresis

8.6.4.5 Mass Spectrometry

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Drug Discovery

8.6.5.2 Pain management

8.6.5.3 Neurology

8.6.5.4 Oncology

8.6.5.5 Cardiovascular diseases

8.6.5.6 Infectious diseases

8.6.5.7 Psychiatry

8.6.5.8 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Research institute

8.6.6.4 Medical

8.6.6.5 academic institute

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pharmacogenomics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Technology

8.7.4.1 DNA Sequencing

8.7.4.2 Microarray

8.7.4.3 Polymerase Chain Reaction

8.7.4.4 Electrophoresis

8.7.4.5 Mass Spectrometry

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Drug Discovery

8.7.5.2 Pain management

8.7.5.3 Neurology

8.7.5.4 Oncology

8.7.5.5 Cardiovascular diseases

8.7.5.6 Infectious diseases

8.7.5.7 Psychiatry

8.7.5.8 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Research institute

8.7.6.4 Medical

8.7.6.5 academic institute

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pharmacogenomics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.2% |

Market Size in 2032: |

USD 35.8 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||