Passive Electronic Components Market Synopsis

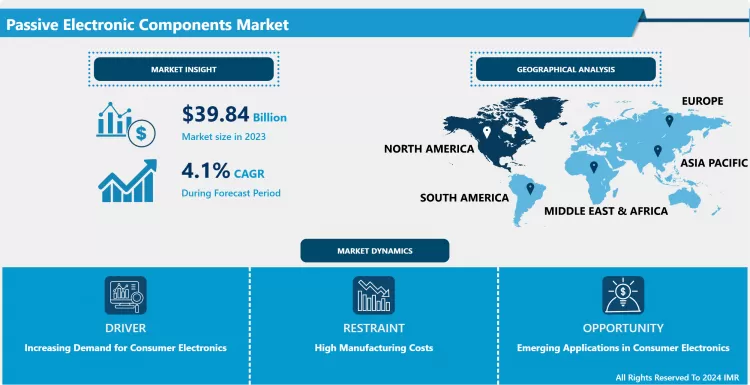

Passive Electronic Components Market Size is Valued at USD 39.84 Billion in 2024, and is Projected to Reach USD 54.98 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.

The Passive Electronic Components Market involves the part of electronic components that need no source of energy to power them such as resistors, capacitors and inductors. All of these components are used for signal processing, filtering and signal conditioning in electronic systems and are applied for electronics products, automobiles and industrial products. Drives of the market include consumer’s demand for electronic devices, advancement in technology, and the size and efficiency of electronic devices.

- The Passive Electronic Components market is categorized by the growing progress in consumer electronics technology and the application of advanced electronic devices. As a result of mass production of portable and wearable electronic devices such as smart phones, tablets, and wearable technologies, high performance passive component solutions are needed for improved performance and reliability. On the same note, the auto electronics industry of EVs and ADAS resulting from the need for better efficiency, has created a market need for improved passive components in managing power and signal integrity to drive the market.

- It is also attributed to newly born opportunities such as the advancement of the telecommunications industry especially with the introduction of 5G networks. It is imperative to have elements such as capacitors and inductors with high frequency and stability as well as excellent efficiency to meet the data transfer rates and connectivity which 5G entails. Further, in today’s world consistent innovation in the area of industrial automation, aerospace and defense is also fueling the demand for unique passive electronic components that are capable to withstand harsh environments and yield superior performance. All these factors taken together define the development and competition in the passive electronic components industry.

Passive Electronic Components Market Trend Analysis

Evolving Landscape of the Passive Electronic Components Market, Trends and Opportunities

- passengers additionally made Passive Electronic Components Market they’re rather large and technology is steadily influencing extremities of varied industries regarding for example auto-making, consumeristic equipment making, and telecommunication manufacture amongst others. The incorporation of electronics in automobiles such as electric vehicles and ADAS is creating the need for superior capacitors and inductors. Likewise, the growth of consumer electronics with the future smart products and wearable products demands the incorporation of passive circuits that are compact in nature and highly efficient. The incorporation of passive components in such gadgets improves its capability, dependability, and dimensionality, propelling the market.

- Also, there is some threat to the passive electronic components market with the advancement of 5G networks, and increased focus on clean energy. There is need for passive components in the signal processing and filtering when deploying 5G networks and also, the change to renewable energy sources creates a need for dependable and high throughput passive elements in power control systems. As industries keep on advancing and incorporating more technology in there production, the Turn-To-Passive electronic component market will still grow mainly focusing on efficiency of the components, miniaturization and performance.

Capitalizing on Growth, Opportunities in Passive Electronic Components

- The passive electronic component market offers promising prospects because of the aggressive growth of the electronics industry in various industries. With increased consumer electronics, automobiles, and industrial applications requiring more innovations and advanced technologies, passive components particularly resistors, capacitors and inductors among others become more demanded in society. The electronics industry especially the smartphone market, wearable electronics, and advanced automotive systems push for smaller and high-performance electronic devices. Further, the automotive industry consisting of electric vehicles and renewables also drives the search for high voltage and hostile environment products with passive components.

- Regionally, the Asia Pacific presents the most attractive market, because of the established manufacturing industry and constantly improving technology. The electronics industry of the world relies highly on such countries as China, Japan, and South Korea where many electronic equipment developers require numerous passive components. Moreover, continuous capital investments and technological advancement in structures of the global emerging economies are the new opportunities for the market players. The necessity for incorporating smart systems and IoT solutions in different industries also highlights the potential for novel and sophisticated passive components, thus providing the groundwork for the market’s future expansion.

Passive Electronic Components Market Segment Analysis:

Passive Electronic Components Market Segmented on the basis of type, Material, application, and end-users.

By Type, Resistors segment is expected to dominate the market during the forecast period

- There is a passive electronic component market which can be sub divided on the basis of type into resistors, capacitors, inductors, and others parts which include varistors and thermistors. Resistors regulate current, capacitors either hold and release electrical charge or act as open-close switches for the circuits, while inductors control magnetic circuits in a given circuit. Other products like varistors and thermistors have other uses like regulating inputs in voltage for different specialized uses in the electronics market.

By Application, Power Supply segment held the largest share in 2024

- The Passive Electronic Components Market can also be discussed with regard to the applications in power supply, signal conditioning, filtering, timing, protection, and others. Analog circuits involve power supplies to provide stable energy to the system, whereas signal conditioning to amplify and improve the quality of the signal present in a circuit. As for the pertinent AC components, filtering applications assist in distinguishing between frequencies that are not required, timing elements for controlling the electronic operations, and protective elements for protecting circuits. The other application relates to specific needs which are essential for various electronic systems.

Passive Electronic Components Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The passive electronic components market in North America is a large segment of the electronics industry as the region offers enhanced support system to the electronics demands of the world. Currently, the United States and Canada dominate this market due to impressive consumer electronics, automotive, telecommunications industries and industries for production of various hardware equipment. Some of the major market forces include; rising uses of electronics equipments and products, rapidly growing demand for application specific electronic parts in automobiles, and constantly improving telecommunication technology. Furthermore, smart technologies as well as internet of things (IoT) applications are also picking up good momentum and thus are fueling the growth of the said market.

- The market appears to be highly consolidated to some big names while there are lots of focus in the development and improvement of products in the form of innovation and conducting lots of R&D on their products. Currently, the key market players located in North America are rather interested in creating new passive components that would possess superior performance and reliability for end consumers. The inherent skilled workforce, traditional stronghold in manufacturing and technological advancement aids in the development of the market. Nevertheless, some problems like the problem of supply chain and the problem of jumping, the prices of the raw material can affect the market. All in all, the market in North America is also anticipated to sustain its growth pattern driven by technology and the growth of uses in almost all industries of electronics parts.

Active Key Players in the Passive Electronic Components Market

- Murata Manufacturing Co., Ltd. (Japan)

- TDK Corporation (Japan)

- KEMET Corporation (United States)

- Vishay Intertechnology, Inc. (United States)

- AVX Corporation (United States)

- Samsung Electro-Mechanics (South Korea)

- Nitto Denko Corporation (Japan)

- Yageo Corporation (Taiwan)

- Panasonic Corporation (Japan)

- Walsin Technology Corporation (Taiwan) and Others Major Players

Passive Electronic Components Market Scope:

|

Global Passive Electronic Components Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 39.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 54.98 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Passive Electronic Components Market by Type (2018-2032)

4.1 Passive Electronic Components Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Resistors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Capacitors

4.5 Inductors

4.6 Others (e.g.

4.7 varistors

4.8 thermistors)

Chapter 5: Passive Electronic Components Market by Material (2018-2032)

5.1 Passive Electronic Components Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ceramic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Film

5.5 Tantalum

5.6 Aluminum

5.7 Other materials

Chapter 6: Passive Electronic Components Market by Application (2018-2032)

6.1 Passive Electronic Components Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Power Supply

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Signal Conditioning

6.5 Filtering

6.6 Timing

6.7 Protection

6.8 Others

Chapter 7: Passive Electronic Components Market by End User (2018-2032)

7.1 Passive Electronic Components Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Consumer Electronics

7.5 Telecommunications

7.6 Industrial

7.7 Healthcare

7.8 Aerospace & Defense

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Passive Electronic Components Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MURATA MANUFACTURING COLTD. (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TDK CORPORATION (JAPAN)

8.4 KEMET CORPORATION (UNITED STATES)

8.5 VISHAY INTERTECHNOLOGY INC. (UNITED STATES)

8.6 AVX CORPORATION (UNITED STATES)

8.7 SAMSUNG ELECTRO-MECHANICS (SOUTH KOREA)

8.8 NITTO DENKO CORPORATION (JAPAN)

8.9 YAGEO CORPORATION (TAIWAN)

8.10 PANASONIC CORPORATION (JAPAN)

8.11 WALSIN TECHNOLOGY CORPORATION (TAIWAN) OTHERS MAJOR PLAYERS

8.12

Chapter 9: Global Passive Electronic Components Market By Region

9.1 Overview

9.2. North America Passive Electronic Components Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Resistors

9.2.4.2 Capacitors

9.2.4.3 Inductors

9.2.4.4 Others (e.g.

9.2.4.5 varistors

9.2.4.6 thermistors)

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Ceramic

9.2.5.2 Film

9.2.5.3 Tantalum

9.2.5.4 Aluminum

9.2.5.5 Other materials

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Power Supply

9.2.6.2 Signal Conditioning

9.2.6.3 Filtering

9.2.6.4 Timing

9.2.6.5 Protection

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Automotive

9.2.7.2 Consumer Electronics

9.2.7.3 Telecommunications

9.2.7.4 Industrial

9.2.7.5 Healthcare

9.2.7.6 Aerospace & Defense

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Passive Electronic Components Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Resistors

9.3.4.2 Capacitors

9.3.4.3 Inductors

9.3.4.4 Others (e.g.

9.3.4.5 varistors

9.3.4.6 thermistors)

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Ceramic

9.3.5.2 Film

9.3.5.3 Tantalum

9.3.5.4 Aluminum

9.3.5.5 Other materials

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Power Supply

9.3.6.2 Signal Conditioning

9.3.6.3 Filtering

9.3.6.4 Timing

9.3.6.5 Protection

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Automotive

9.3.7.2 Consumer Electronics

9.3.7.3 Telecommunications

9.3.7.4 Industrial

9.3.7.5 Healthcare

9.3.7.6 Aerospace & Defense

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Passive Electronic Components Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Resistors

9.4.4.2 Capacitors

9.4.4.3 Inductors

9.4.4.4 Others (e.g.

9.4.4.5 varistors

9.4.4.6 thermistors)

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Ceramic

9.4.5.2 Film

9.4.5.3 Tantalum

9.4.5.4 Aluminum

9.4.5.5 Other materials

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Power Supply

9.4.6.2 Signal Conditioning

9.4.6.3 Filtering

9.4.6.4 Timing

9.4.6.5 Protection

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Automotive

9.4.7.2 Consumer Electronics

9.4.7.3 Telecommunications

9.4.7.4 Industrial

9.4.7.5 Healthcare

9.4.7.6 Aerospace & Defense

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Passive Electronic Components Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Resistors

9.5.4.2 Capacitors

9.5.4.3 Inductors

9.5.4.4 Others (e.g.

9.5.4.5 varistors

9.5.4.6 thermistors)

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Ceramic

9.5.5.2 Film

9.5.5.3 Tantalum

9.5.5.4 Aluminum

9.5.5.5 Other materials

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Power Supply

9.5.6.2 Signal Conditioning

9.5.6.3 Filtering

9.5.6.4 Timing

9.5.6.5 Protection

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Automotive

9.5.7.2 Consumer Electronics

9.5.7.3 Telecommunications

9.5.7.4 Industrial

9.5.7.5 Healthcare

9.5.7.6 Aerospace & Defense

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Passive Electronic Components Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Resistors

9.6.4.2 Capacitors

9.6.4.3 Inductors

9.6.4.4 Others (e.g.

9.6.4.5 varistors

9.6.4.6 thermistors)

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Ceramic

9.6.5.2 Film

9.6.5.3 Tantalum

9.6.5.4 Aluminum

9.6.5.5 Other materials

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Power Supply

9.6.6.2 Signal Conditioning

9.6.6.3 Filtering

9.6.6.4 Timing

9.6.6.5 Protection

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Automotive

9.6.7.2 Consumer Electronics

9.6.7.3 Telecommunications

9.6.7.4 Industrial

9.6.7.5 Healthcare

9.6.7.6 Aerospace & Defense

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Passive Electronic Components Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Resistors

9.7.4.2 Capacitors

9.7.4.3 Inductors

9.7.4.4 Others (e.g.

9.7.4.5 varistors

9.7.4.6 thermistors)

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Ceramic

9.7.5.2 Film

9.7.5.3 Tantalum

9.7.5.4 Aluminum

9.7.5.5 Other materials

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Power Supply

9.7.6.2 Signal Conditioning

9.7.6.3 Filtering

9.7.6.4 Timing

9.7.6.5 Protection

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Automotive

9.7.7.2 Consumer Electronics

9.7.7.3 Telecommunications

9.7.7.4 Industrial

9.7.7.5 Healthcare

9.7.7.6 Aerospace & Defense

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Passive Electronic Components Market Scope:

|

Global Passive Electronic Components Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 39.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 54.98 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Passive Electronic Components Market research report is 2024-2032.

Murata Manufacturing Co., Ltd. (Japan), TDK Corporation (Japan), KEMET Corporation (United States), Vishay Intertechnology, Inc. (United States), AVX Corporation (United States), Samsung Electro-Mechanics (South Korea), Nitto Denko Corporation (Japan), Yageo Corporation (Taiwan), Panasonic Corporation (Japan), Walsin Technology Corporation (Taiwan). and Other Major Players.

The Passive Electronic Components Market is segmented into by Type (Resistors, Capacitors, Inductors, Others), Material (Ceramic, Film, Tantalum, Aluminum, Other materials), Application (Power Supply, Signal Conditioning, Filtering, Timing, Protection, Others), End-User (Automotive, Consumer Electronics, Telecommunications, Industrial, Healthcare, Aerospace & Defense, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Passive Electronic Components Market involves the part of electronic components that need no source of energy to power them such as resistors, capacitors and inductors. All of these components are used for signal processing, filtering and signal conditioning in electronic systems and are applied for electronics products, automobiles and industrial products. Drives of the market include consumer’s demand for electronic devices, advancement in technology, and the size and efficiency of electronic devices.

Passive Electronic Components Market Size is Valued at USD 39.84 Billion in 2024, and is Projected to Reach USD 54.98 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.