Paper Straw Market Synopsis

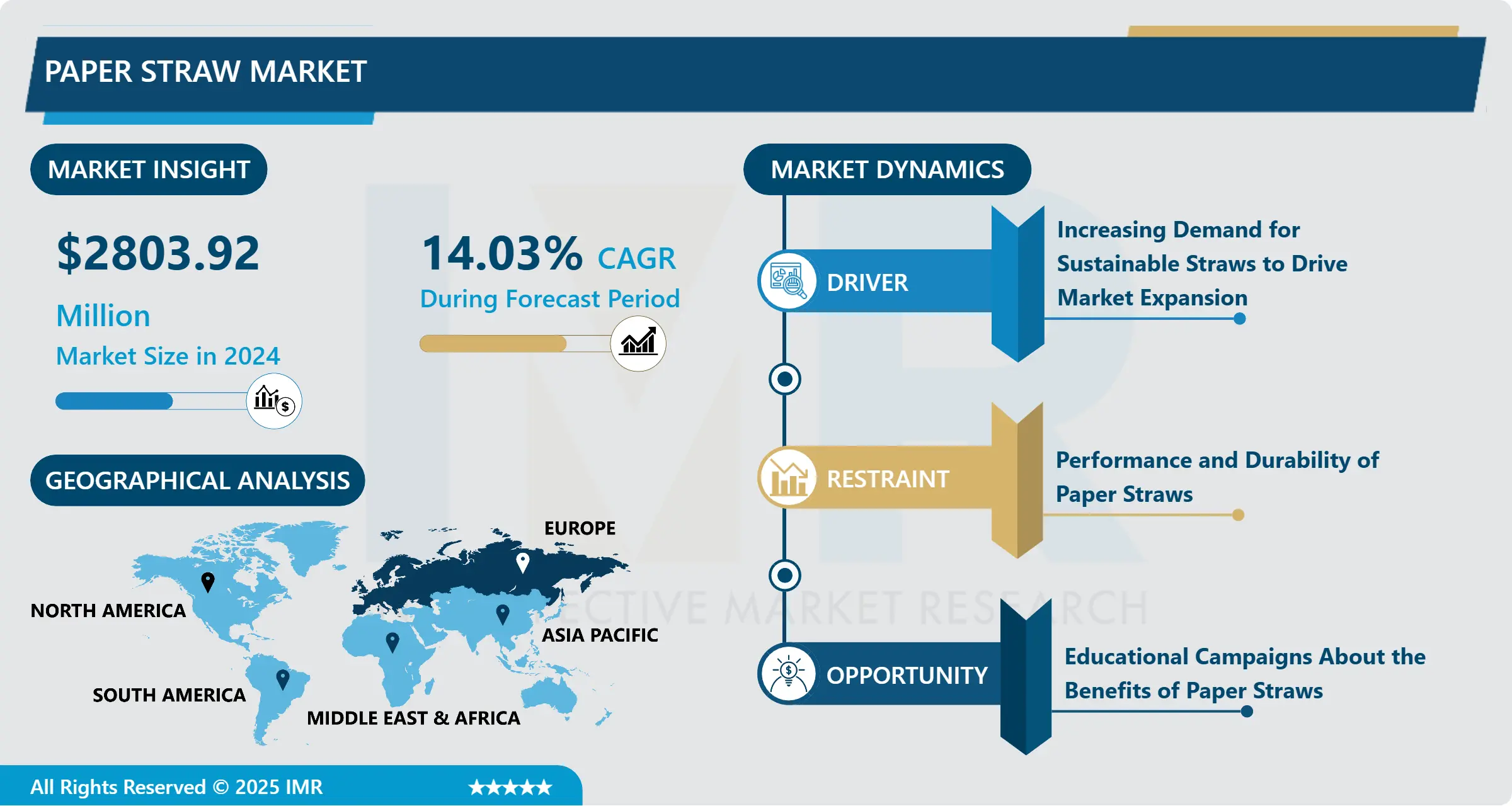

The global Paper Straw Market was valued at USD 2803.92 million in 2024 and is likely to reach USD 8168.37 million by 2032, increasing at a CAGR of 14.03% from 2025 to 2032.

A paper drinking straw or drinking tube is a small pipe that allows its user to more conveniently consume a beverage. A thin tube of paper is used by placing one end in the mouth and the other in the beverage.

Drinking straws can be straight or have an angle-adjustable bellows portion. A few companies have intentionally prohibited or reduced the number of plastic straws disseminated from their premises. Paper straw is gathering energy due to ban imposed on the use of single use plastics. Manufacturing paper straws may be a totally diverse prepare to creating plastic straws. Ordinarily developed of 3 plies of paper, the utilizes are bonded beside a little sum of water-based cement employing a core-winding machine, or hot melt cements employing a space noz007Ale machine for very fast production lines. The choice of the paper and adhesive quality encompasses a principal impact on the execution of the paper straw and the productivity of manufacture.

Paper drinking straw is expected to have the high showcase development due to rising request of the paper drinking straw as the bundling industry is seeing move towards non-plastic maintainable materials from plastic items. Consumers are broadly utilizing the paper drinking straws at home, parties, on-the-go drinks, concession stands, nourishment service, schools, organization and others. The worldwide drinking straw advertise is segmented based on sort as plastic drinking straw, and paper drinking straw.

Paper drinking straw is anticipated to have the tall advertise development due to rising request of the paper drinking straw as the bundling industry is seeing move towards non-plastic economical materials from plastic items. Customers are broadly utilizing the paper drinking straws at domestic, parties, on the- go drinks, concession stands, food service, schools, organization and others.

Plastic drinking straw section is anticipated to have the negative advertise development over the forecasted period due to the prohibiting of the plastic straws. Organizations, regions, and governments are forcing bans on the plastic straws.

Paper Straw Market Trend Analysis

Paper Straw Market Growth Drivers- Increasing Demand for Sustainable Straws to Drive Market Expansion

- Due to meeting their business responsibilities, the trademark proprietors arrange to supply clients with eco-friendly packaging and utensils. Producers, companies who claim brands and dealers give bundling arrangements that can be reused, reused, or decayed actually. In 2021, Canadian company A. Lassonde Inc. uncovered that Sun-Rype Items would be exchanging from plastic to reusable paper straws in all 200ml single-serve refreshment holders in Canada. SunRype 200ml 100% Juice and 200ml 60% Reduced Sugar Juice items drop beneath this category. The market potential of eco-friendly straws is expected to rise due to shopper mindfulness of climate alter, decreased plastic utilization center, and government directions on plastic squander diminishment.

- In 2019, Rema in Rwanda prohibited single-use plastic items to secure the environment and decrease plastic squander. The startup moreover collaborated with tribal communities in northeast India to form bamboo utensils, packs, and shrieks. As an outline, in January of 2022, Bambrew secured near to $2.35 million in a pre-Series A subsidizing circular. The startup extreme to extend its conveyance capabilities utilizing this subsidizing. Additionally, Bambrew's center on inquire about and advancement and endeavors to develop its group have contributed to the fast development of the worldwide paper straw showcase, driven by the boycott of plastic straws in various nations.

- There's an expectation of a rise in customer intrigued for long-lasting and naturally inviting alternatives to plastic straws within the coming estimate period. In October 2021, Nestlé Brazil uncovered it arrange to switch to 100% paper straws for its Nescau, Nesquik, Ninho, and Farinha Láctea brands in Colombia. The company arranged of 10 million plastic straws and wrappers. Groups in Malaysia and Indonesia have too ceased the utilize of 70 million.

Paper Straw Market Opportunities- Educational Campaigns About the Benefits of Paper Straws

- Educational campaigns are a crucial opportunity to boost the paper straw market by expanding customer awareness and acknowledgment. Conducting focused on awareness programs can educate the open approximately the noteworthy natural benefits of utilizing paper straws over plastic ones. These campaigns can highlight how paper straws diminish plastic contamination, are biodegradable, and contribute to a more beneficial planet. Such activities can be executed through different channels, counting social media, open benefit declarations, and collaborations with natural organizations. By teaching customers around the natural effect of their choices, these campaigns can drive a move in shopper behavior towards more feasible alternatives, in this manner expanding request for paper straws.

- Joining eco-friendly hones into school curriculums presents a long-term technique to cultivate maintainable habits from a young age. Schools can incorporate lessons on natural preservation, the harmful impacts of plastic contamination, and the benefits of biodegradable options like paper straws. Hands-on exercises, such as reusing ventures and natural clubs, can encourage fortify these concepts.

- By instilling these values early on, children can develop up with a solid awareness of maintainability, affecting their future purchasing choices and pushing for eco-friendly items. This approach not as it were supports a era that values and practices sustainability but moreover guarantees a relentless, long-term request for paper straws as these youthful buyers develop into naturally conscious grown-ups.

Market Segment Analysis:

Market Segmented based on Product, by Material, by Length, by Diameter, by End-User and region.

By Product, Printed Straws Is Expected to Dominate the Market During the Forecast Period 2025-2032

There are many segmentations By Product as Printed, Non-Printed

- Printed paper straws dominate the market primarily due to their stylish request, customization alternatives and vital part in branding and promoting. Businesses, particularly within the restaurant and neighbourliness industry, utilize printed whistles to reinforce their brand personality with logos, topics or uncommon plans. This personalization not as it were works as a marketing tool, but moreover makes a special and important client involvement. Consumers discover them outwardly engaging, and the bright colours and designs make drinks more appealing and pleasant, which is particularly acknowledged amid occasions and parties.

- When it comes to differentiation and market position, printed whistles offer companies a distinct advantage in a competitive showcase. The capacity to offer special and eye-catching plans makes a difference brand stand out and draw in more clients. In expansion, the reality that printed shrieks contain high-quality items permits companies to legitimize higher prices and pull in buyers searching for a premium or personalized encounter. This high-quality concept fits well with the current market drift towards custom-made and high-quality products. Marketing and promoting moreover play an imperative part in overseeing printed paper straws. These shrieks can be utilized as viable special apparatuses in different campaigns such as occasion specials or restricted time offers, expanding buyer intrigued and engagement. For uncommon events such as weddings, parties and corporate occasions, custom printed shrieks that coordinate the subject or brand of the occasion are exceedingly prescribed, increasing the demand.

- In expansion, shopper patterns and social media have expanded the ubiquity of printed paper straws. Within the age of Instagram and other social media stages, stylishly satisfying items are often broadly dispersed, expanding their perceivability and request. Whistles printed with alluring designs are more likely to seem in social media posts, making "Instagrammable minutes" that reverberate more broadly. Also, eco-conscious shoppers who still need in vogue and in vogue items discover printed paper straws an perfect elective. They offer the choice of being naturally inviting without compromising on appearance, satisfying the twin wants of toughness and style. This combination of tasteful request, advertise potential and versatility to buyer trends ensures that printed paper straws will stay the prevailing choice within the market.

By Material, Virgin Paper held the largest share

By Material, segmentations are Virgin Paper, Recycled Paper

- Virgin paper, made from new wood mash, gives prevalent quality and consistency, which are basic for the execution and strength of paper straws. Paper straws got to withstand drawn out contact with fluids without deteriorating or losing their structural integrity. Virgin paper offers the essential quality and smoothness, guaranteeing that the straws keep up their shape and convenience for a longer period.

- This reliability is vital for both producers and buyers, who prioritize a positive client encounter. In addition, the fabricating prepare for virgin paper permits for more prominent control over the paper's properties, such as thickness and surface, driving to a more uniform and aesthetically pleasing item. These qualities are imperative for businesses within the nourishment and refreshment industry, where introduction and usefulness are key. Printed plans to show up more dynamic and clearer on virgin paper, which is invaluable for branding and customization purposes.

- While reused paper is an ecologically inviting alternative and adjusts with supportability objectives, it frequently falls brief in terms of execution and toughness. Reused paper strands are shorter and weaker due to the rehashed preparing cycles, which can lead to speedier corruption when uncovered to dampness. This impediment makes reused paper less appropriate for paper straws, which require a certain level of strength.

- Virgin paper is more promptly accessible and less demanding to source in large quantities, giving a steady supply chain for producers. This accessibility guarantees that generation can meet the developing advertise request without interferences. On the other hand, the supply of high-quality reused paper can be conflicting, posturing challenges for keeping up generation measures.

Market Regional Insights:

Europe Region is Expected to Dominate the Market Over the Forecast Period

- Europe's dominance within the paper straw market can be credited to a few key variables that work synergistically to boost request and generation. Firstly, rigid natural directions, such as the European Union's mandate forbidding single-use plastics, have altogether driven the move towards paper straws. This administrative push is complemented by solid national commitments to supportability, making a favorable environment for eco-friendly items. High buyer awareness in Europe also plays a significant part, as naturally cognizant consumers effectively look for feasible options, cultivating a solid market request for paper straws. The social emphasis on decreasing plastic squander advance opens up this slant, making eco-friendly items a favored choice among European buyers.

- Corporate responsibility is another basic factor, with numerous European companies embracing sustainable practices to adjust with their corporate social duty objectives. Major nourishment and refreshment companies, retailers, and hospitality businesses are driving this move by switching to paper straws, setting a standard for the industry and normalizing their utilize. Retailers moreover play a imperative part, as their back for paper straws makes a difference to solidify consumer acknowledgment and drive market development.

- Advancement in manufacturing and a robust supply chain infrastructure enhance Europe's position within the market. European companies are at the forefront of creating high-quality paper straws that meet consumer demands for strength and functionality. The solid supply chain guarantees reliable accessibility and productive conveyance of these items over the continent.

- At last, the collaboration between open and private segments, counting government and NGO activities, has been instrumental in advancing maintainable hones. European governments and teach give subsidizing and support for inquire about into feasible materials, cultivating innovation and market development. These collaborative endeavours offer assistance to development the selection of eco-friendly items like paper straws, guaranteeing proceeded development and authority within the market.

Market Top Key Players:

The top key companies in the Paper Straw Market are:

- Aardvark Straws (United States)

- Hoffmaster Group, Inc. (United States)

- Transcend Packaging Ltd. (United Kingdom)

- Tetra Pak (Sweden)

- Huhtamäki Oyj (Finland)

- Vegware (United Kingdom)

- Footprint LLC (United States)

- Sulapac Ltd. (Finland)

- Stora Enso Oyj (Finland)

- Tetra Pak (Switzerland)

- Biopac (United Kingdom)

- Vegware (United States)

- OkStraw Paper Straws (United States)

- Austraw Pty Ltd. (Australia)

- Transcend Packaging Ltd. (United States)

- SipPap LLC (United States)

- Huhtamäki Oyj (United States)

- Greenlid (Canada)

- Eco-Products, Inc. (United States)

- Packnwood (United States)

- KRAKUS (Poland)

- Transcend Packaging Ltd. (United Kingdom)

- Genpak (United States)

- Hoffmaster Group, Inc. (Canada)

- Pappco Greenware (India)

- Green Bay Packaging Inc. (United States)

- Soton Straws (China)

- Harfield Components Ltd. (United Kingdom)

- Evergreen Packaging LLC (United States)

- Pudocu (United States) and Other Active Players.

Key Industry Developments in the Market:

- In Aug 2023, Paper drinking straws may be even worse than plastic for the environment and your health; A new study claims that paper straws may not be more environmentally friendly than plastic straws and may also pose significant health risks to users. Studies show that these straws contain "forever chemicals," compounds that can last for thousands of years, linking them to cancer, thyroid and liver problems.

- In Feb 2023, February 2023: Tetra Pak began research on fibre-based sustainable food packaging with

|

Global Paper Straw Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 2803.92 Mn |

|

Forecast Period 2024-32 CAGR: |

14.03% |

Market Size In 2032: |

USD 8168.37 Mn |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Length |

|

||

|

By Diameter |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Paper Straw Market by Product (2018-2032)

4.1 Paper Straw Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Printed

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non- Printed

Chapter 5: Paper Straw Market by Material (2018-2032)

5.1 Paper Straw Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Virgin Paper

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Recycled Paper

Chapter 6: Paper Straw Market by Length (2018-2032)

6.1 Paper Straw Market Snapshot and Growth Engine

6.2 Market Overview

6.3 <5.75 Inches

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 5.75-7.75 Inches

6.5 7.75-8.5 Inches

6.6 8.5-10.5 Inches

6.7 >10.5 Inches

Chapter 7: Paper Straw Market by Diameter (2018-2032)

7.1 Paper Straw Market Snapshot and Growth Engine

7.2 Market Overview

7.3 <0.15 Inches

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 0.15 – 0.196 Inches

7.5 0.196 – 0.25 Inches

7.6 0.25 – 0.4 Inches

7.7 >0.4 Inches

Chapter 8: Paper Straw Market by End-User (2018-2032)

8.1 Paper Straw Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Foodservice

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Institutional

8.5 Household

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Paper Straw Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AARDVARK STRAWS (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 HOFFMASTER GROUP INC. (UNITED STATES)

9.4 TRANSCEND PACKAGING LTD. (UNITED KINGDOM)

9.5 TETRA PAK (SWEDEN)

9.6 HUHTAMÄKI OYJ (FINLAND)

9.7 VEGWARE (UNITED KINGDOM)

9.8 FOOTPRINT LLC (UNITED STATES)

9.9 SULAPAC LTD. (FINLAND)

9.10 STORA ENSO OYJ (FINLAND)

9.11 TETRA PAK (SWITZERLAND)

9.12 BIOPAC (UNITED KINGDOM)

9.13 VEGWARE (UNITED STATES)

9.14 OKSTRAW PAPER STRAWS (UNITED STATES)

9.15 AUSTRAW PTY LTD. (AUSTRALIA)

9.16 TRANSCEND PACKAGING LTD. (UNITED STATES)

9.17 SIPPAP LLC (UNITED STATES)

9.18 HUHTAMÄKI OYJ (UNITED STATES)

9.19 GREENLID (CANADA)

9.20 ECO-PRODUCTS INC. (UNITED STATES)

9.21 PACKNWOOD (UNITED STATES)

9.22 KRAKUS (POLAND)

9.23 TRANSCEND PACKAGING LTD. (UNITED KINGDOM)

9.24 GENPAK (UNITED STATES)

9.25 HOFFMASTER GROUP INC. (CANADA)

9.26 PAPPCO GREENWARE (INDIA)

9.27 GREEN BAY PACKAGING INC. (UNITED STATES)

9.28 SOTON STRAWS (CHINA)

9.29 HARFIELD COMPONENTS LTD. (UNITED KINGDOM)

9.30 EVERGREEN PACKAGING LLC (UNITED STATES)

9.31 PUDOCU (UNITED STATES)

Chapter 10: Global Paper Straw Market By Region

10.1 Overview

10.2. North America Paper Straw Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product

10.2.4.1 Printed

10.2.4.2 Non- Printed

10.2.5 Historic and Forecasted Market Size by Material

10.2.5.1 Virgin Paper

10.2.5.2 Recycled Paper

10.2.6 Historic and Forecasted Market Size by Length

10.2.6.1 <5.75 Inches

10.2.6.2 5.75-7.75 Inches

10.2.6.3 7.75-8.5 Inches

10.2.6.4 8.5-10.5 Inches

10.2.6.5 >10.5 Inches

10.2.7 Historic and Forecasted Market Size by Diameter

10.2.7.1 <0.15 Inches

10.2.7.2 0.15 – 0.196 Inches

10.2.7.3 0.196 – 0.25 Inches

10.2.7.4 0.25 – 0.4 Inches

10.2.7.5 >0.4 Inches

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Foodservice

10.2.8.2 Institutional

10.2.8.3 Household

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Paper Straw Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product

10.3.4.1 Printed

10.3.4.2 Non- Printed

10.3.5 Historic and Forecasted Market Size by Material

10.3.5.1 Virgin Paper

10.3.5.2 Recycled Paper

10.3.6 Historic and Forecasted Market Size by Length

10.3.6.1 <5.75 Inches

10.3.6.2 5.75-7.75 Inches

10.3.6.3 7.75-8.5 Inches

10.3.6.4 8.5-10.5 Inches

10.3.6.5 >10.5 Inches

10.3.7 Historic and Forecasted Market Size by Diameter

10.3.7.1 <0.15 Inches

10.3.7.2 0.15 – 0.196 Inches

10.3.7.3 0.196 – 0.25 Inches

10.3.7.4 0.25 – 0.4 Inches

10.3.7.5 >0.4 Inches

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Foodservice

10.3.8.2 Institutional

10.3.8.3 Household

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Paper Straw Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product

10.4.4.1 Printed

10.4.4.2 Non- Printed

10.4.5 Historic and Forecasted Market Size by Material

10.4.5.1 Virgin Paper

10.4.5.2 Recycled Paper

10.4.6 Historic and Forecasted Market Size by Length

10.4.6.1 <5.75 Inches

10.4.6.2 5.75-7.75 Inches

10.4.6.3 7.75-8.5 Inches

10.4.6.4 8.5-10.5 Inches

10.4.6.5 >10.5 Inches

10.4.7 Historic and Forecasted Market Size by Diameter

10.4.7.1 <0.15 Inches

10.4.7.2 0.15 – 0.196 Inches

10.4.7.3 0.196 – 0.25 Inches

10.4.7.4 0.25 – 0.4 Inches

10.4.7.5 >0.4 Inches

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Foodservice

10.4.8.2 Institutional

10.4.8.3 Household

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Paper Straw Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product

10.5.4.1 Printed

10.5.4.2 Non- Printed

10.5.5 Historic and Forecasted Market Size by Material

10.5.5.1 Virgin Paper

10.5.5.2 Recycled Paper

10.5.6 Historic and Forecasted Market Size by Length

10.5.6.1 <5.75 Inches

10.5.6.2 5.75-7.75 Inches

10.5.6.3 7.75-8.5 Inches

10.5.6.4 8.5-10.5 Inches

10.5.6.5 >10.5 Inches

10.5.7 Historic and Forecasted Market Size by Diameter

10.5.7.1 <0.15 Inches

10.5.7.2 0.15 – 0.196 Inches

10.5.7.3 0.196 – 0.25 Inches

10.5.7.4 0.25 – 0.4 Inches

10.5.7.5 >0.4 Inches

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Foodservice

10.5.8.2 Institutional

10.5.8.3 Household

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Paper Straw Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product

10.6.4.1 Printed

10.6.4.2 Non- Printed

10.6.5 Historic and Forecasted Market Size by Material

10.6.5.1 Virgin Paper

10.6.5.2 Recycled Paper

10.6.6 Historic and Forecasted Market Size by Length

10.6.6.1 <5.75 Inches

10.6.6.2 5.75-7.75 Inches

10.6.6.3 7.75-8.5 Inches

10.6.6.4 8.5-10.5 Inches

10.6.6.5 >10.5 Inches

10.6.7 Historic and Forecasted Market Size by Diameter

10.6.7.1 <0.15 Inches

10.6.7.2 0.15 – 0.196 Inches

10.6.7.3 0.196 – 0.25 Inches

10.6.7.4 0.25 – 0.4 Inches

10.6.7.5 >0.4 Inches

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Foodservice

10.6.8.2 Institutional

10.6.8.3 Household

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Paper Straw Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product

10.7.4.1 Printed

10.7.4.2 Non- Printed

10.7.5 Historic and Forecasted Market Size by Material

10.7.5.1 Virgin Paper

10.7.5.2 Recycled Paper

10.7.6 Historic and Forecasted Market Size by Length

10.7.6.1 <5.75 Inches

10.7.6.2 5.75-7.75 Inches

10.7.6.3 7.75-8.5 Inches

10.7.6.4 8.5-10.5 Inches

10.7.6.5 >10.5 Inches

10.7.7 Historic and Forecasted Market Size by Diameter

10.7.7.1 <0.15 Inches

10.7.7.2 0.15 – 0.196 Inches

10.7.7.3 0.196 – 0.25 Inches

10.7.7.4 0.25 – 0.4 Inches

10.7.7.5 >0.4 Inches

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Foodservice

10.7.8.2 Institutional

10.7.8.3 Household

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Paper Straw Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 2803.92 Mn |

|

Forecast Period 2024-32 CAGR: |

14.03% |

Market Size In 2032: |

USD 8168.37 Mn |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Length |

|

||

|

By Diameter |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||