Packaged Chicken Market Synopsis

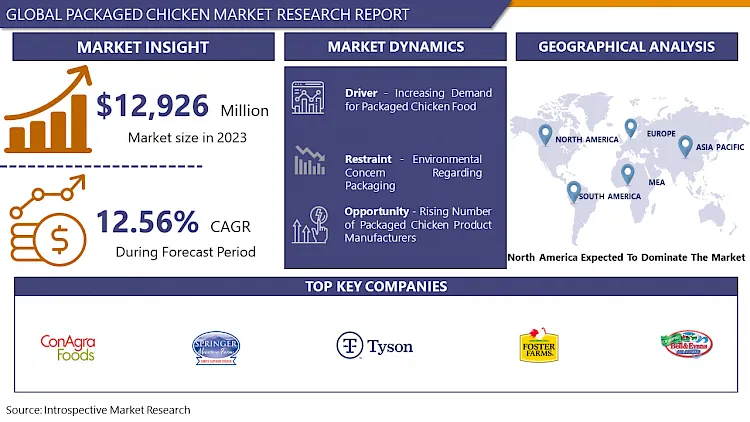

Packaged Chicken Market Size Was Valued at USD 12,926 Million in 2023, and is Projected to Reach USD 37490.47 Million by 2032, Growing at a CAGR of 12.56% From 2024-2032.

Chicken is the most common poultry in the world. Due to the relative ease and low cost of raising chickens (compared to mammals such as cattle or pigs), chicken meat and eggs have become popular in many cuisines.

Chicken is one of the most popular foods on earth. It is an excellent source of protein and significantly cheaper compared to other types of meat such as beef and seafood. That's why many people eat chicken regularly. Chicken can be prepared in a number of ways, including roasting, grilling, grilling, roasting, and boiling. Since the second half of the 20th century, prepared chicken has become fast food. Chicken is sometimes said to be healthier than red meat because it has less cholesterol and saturated fat. The poultry industry involved in the production of chickens takes different forms in different parts of the world.

In industrialized countries, chickens are usually raised using intensive farming methods, while in less developed areas, chickens are raised using more traditional farming methods. According to the United Nations, there are currently 19 billion chickens on Earth, that's more than two people. Vacuum-packed chicken breast meat (80) was stored in either conventional refrigeration (TC; 2–4 °C) or supercooling (SC; ?1.3 ± 0.1 °C). Due to increased availability, innovation and product development, competitive pricing, and increased distribution channels, the market has the potential to grow and attract new consumers.

Packaged Chicken Market Trend Analysis

Packaged Chicken Market Trend Analysis

Increasing Demand for Packaged Chicken Food

- Eating chicken has several health advantages for the body. Niacin, phosphorous, and protein all of which are good for the body are abundant in chicken. Due to greater awareness and accessibility of ready-to-eat food, there is an increase in the demand for packaged food. The packed chicken goes through a number of processing procedures to make it healthier and extend its shelf life. It is liked by homes, eateries, and other eating establishments.

- Moreover, rapid urbanization and rising demand for ready-to-cook thighs, marinated wings, and various varieties of packaged chicken are the main drivers of the worldwide packaged chicken market's expansion. The meat can be obtained quickly and cooked using packaged chicken. The drivers boosting the market's growth include packaging and the rise in demand for chicken products with a long shelf life. With the increasing number of working people, the demand for packaged food is increasing which drives the growth of the market.

Rising Number of Packaged Chicken Product Manufacturers create an Opportunity for Packaged Chicken Market

- The growing number of packaged chicken producers is indeed an opportunity for the packaged chicken market. The increasing number of manufacturers of packaged chicken products means that consumers have access to a greater variety of products, including fresh, frozen, and processed chicken products. Increased availability can increase demand for packaged chicken products because consumers are more likely to buy them if they are readily available.

- The increase in the number of manufacturers of packaged chicken products has also increased innovation and product development in the market. Manufacturers are introducing new products, flavors, and package formats to appeal to different consumer segments, such as organic and natural chicken products, which can attract health-conscious consumers. Moreover, with the presence of more players, competition will increase, which can lead to the more competitive pricing of packaged chicken products. This can benefit consumers as they find cheaper alternatives.

- As more packaged chicken producers enter the market, they may also adopt new distribution channels. This can increase the availability of packaged chicken products in various retail channels such as supermarkets, convenience stores, and online platforms. Henceforth, the growth in the number of producers of packaged chicken products creates opportunities for the packaged chicken market.

Packaged Chicken Market Segment Analysis:

Packaged Chicken Market Segmented on the basis of Type, Application, and Distribution Channels.

By Type, Frozen segment is expected to dominate the market during the forecast period

- Storing frozen meat is a common method of conservation. This reduces post-mortem enzyme activity, prevents the spread of microbes, and increases market shelf life. Frozen meat packaged and stored at 0°C is safe to eat. Therefore, frozen meat is often transported overseas or internationally. Some foods and meats are seasonal and only available in a certain region, so the introduction of freezer technology makes it possible to store food all year round and serve it anywhere in the world.

- The growing preferences of customers for frozen goods and interest in increasing information and the desire to experience multiple nutritional values are the main business learning. Due to the ease of use and time-saving of the product, the popularity of the market is growing among consumers, especially young professionals.

- This is expected to offer potential opportunities in the market with the introduction of new product varieties. Over the past few years, steady economic growth accompanied by a booming mining industry has increased job opportunities and thus increased the average income of consumers. In addition, with fast-paced lifestyles due to the spread of e-commerce and online delivery services, eateries and restaurants around the world rely on frozen meat products to meet the demand for meat dishes which drives the frozen packed chicken demand.

By Application, Restaurant segment held the largest share of 62% in 2022

- The packaged chicken market is witnessing significant growth, with the restaurant segment poised to dominate the industry. The surge in demand for packaged chicken in restaurants can be attributed to several factors that align with changing consumer preferences and industry trends.

- The convenience factor plays a pivotal role. Restaurants, particularly fast-food and casual dining establishments, are increasingly opting for packaged chicken products due to their convenience in handling, storage, and preparation. This allows restaurants to streamline their operations and maintain consistent quality in their menu offerings.

- Moreover, the rise in consumer awareness regarding food safety and hygiene has driven restaurants to choose packaged chicken, which undergoes rigorous quality control processes, ensuring a safer and healthier food supply chain. This aligns with the growing emphasis on food traceability and quality assurance among consumers.

Packaged Chicken Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The United States is the largest consumer of chicken in North America. For instance, according to the World Population Review, the United States consumes about 15,000 tons of chicken annually. America adds chicken to almost everything. For example, many people consume chicken wings while watching sporting events. Poultry is also a popular soup ingredient. People even stuff the chicken with other ingredients. That's why chicken is incredibly popular in the United States. Moreover, the fast-paced lifestyle and emerging modern retail industry are a few of the factors driving the growth of packaged chicken in the region.

- In North America owing to people's high disposable income, changing eating habits, and hectic lifestyle, along with a preference for ready-to-eat products in this region's countries boosting the growth of the market. For instance, according to Statista, the per capita consumption of meat was highest in North America, as it was roughly 98.5 kilos per person in the period between 2019 to 2021. By comparison, the average person living in Africa consumed about 12.7 kilos per year during the same period.

Packaged Chicken Market Top Key Players:

- Bell & Evans Organic(US)

- ConAgra Foods (US)

- Tyson Foods (US)

- Pilgrim's Pride (US)

- Springer Mountain Farms (US)

- Venkys (India)

- Koch Foods (US)

- Perdue (US)

- Foster Farms (US)

- Delightful Gourmet Pvt. Ltd. (India)

- Ingham's Group Limited (Australia)

Key Industry Developments in the Packaged Chicken Market:

- In April 2023, Crescent Foods expanded its frozen line for retail, club, and e-commerce. From kababs to casseroles, consumers looking for flexibility with last-minute meals have a new option in the frozen section Crescent Foods Individually Frozen Halal Hand-Cut Boneless Skinless Chicken Thighs. The packaging has been designed to catch shoppers' attention with bright colors; yellow for the chicken thighs and blue for the chicken breasts.

- In May 2024, PERDUE®, the number-one brand of fresh chicken in the U.S., announced the expansion of its SHORT CUTS® product line with the introduction of PERDUE® SHORT CUTS® Hickory Smoked Chicken Breast Strips and PERDUE® SHORT CUTS® Shredded Roasted White Meat Chicken. The new offerings tapped into trending flavors and preparation techniques that brought simplicity to dinnertime without skimping on flavor.

- In January 2024, Tyson Foods, Inc. officially opened its new $355 million food production facility in Bowling Green, Kentucky. Built to support a significant expansion of its bacon production capabilities, the new plant positioned Tyson Foods to capitalize on its category leadership and the increasing market for its products. The 400,000-square-foot plant, which represented a significant investment in the local community, was expected to produce two million pounds a week of premium quality Jimmy Dean® and Wright® Brand bacon retail products and bacon used in foodservice.

|

Packaged Chicken Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12,926 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.56% |

Market Size in 2032: |

USD 37490.47 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Packaged Chicken Market by Type (2018-2032)

4.1 Packaged Chicken Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fresh

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Frozen

Chapter 5: Packaged Chicken Market by Application (2018-2032)

5.1 Packaged Chicken Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Restaurant

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Household

Chapter 6: Packaged Chicken Market by Distribution Channels (2018-2032)

6.1 Packaged Chicken Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Convenience Store

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hypermarket and Supermarket

6.5 Specialty Store

6.6 E-Commerce

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Packaged Chicken Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HOMETOWN FOOD COMPANY (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SUNNYLANDS MILLS (U.S.)

7.4 BOB’S REDMILL NATURAL FOODS INC. (U.S.)

7.5 CELNAT (FRANCE)

7.6 INARI AGRICULTURE INC. (U.S.)

7.7 MITSIDES PUBLIC COMPANY LIMITED. (CYPRUS)

7.8 SHILOH FARMS(U.S.)

7.9 CERES ORGANIC HARVEST INC. (U.S.)

7.10 TIPIAK GROUP (FRANCE)

7.11 THE HAIN CELESTIAL GROUP (U.S.)

7.12 ROLAND FOODS LLC (U.S.)

7.13 AGT FOODS AND INGREDIENTS (CANADA)

7.14 DURU BULGUR GIDA SEN (TURKEY)

7.15

Chapter 8: Global Packaged Chicken Market By Region

8.1 Overview

8.2. North America Packaged Chicken Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Fresh

8.2.4.2 Frozen

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Restaurant

8.2.5.2 Household

8.2.6 Historic and Forecasted Market Size by Distribution Channels

8.2.6.1 Convenience Store

8.2.6.2 Hypermarket and Supermarket

8.2.6.3 Specialty Store

8.2.6.4 E-Commerce

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Packaged Chicken Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Fresh

8.3.4.2 Frozen

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Restaurant

8.3.5.2 Household

8.3.6 Historic and Forecasted Market Size by Distribution Channels

8.3.6.1 Convenience Store

8.3.6.2 Hypermarket and Supermarket

8.3.6.3 Specialty Store

8.3.6.4 E-Commerce

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Packaged Chicken Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Fresh

8.4.4.2 Frozen

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Restaurant

8.4.5.2 Household

8.4.6 Historic and Forecasted Market Size by Distribution Channels

8.4.6.1 Convenience Store

8.4.6.2 Hypermarket and Supermarket

8.4.6.3 Specialty Store

8.4.6.4 E-Commerce

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Packaged Chicken Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Fresh

8.5.4.2 Frozen

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Restaurant

8.5.5.2 Household

8.5.6 Historic and Forecasted Market Size by Distribution Channels

8.5.6.1 Convenience Store

8.5.6.2 Hypermarket and Supermarket

8.5.6.3 Specialty Store

8.5.6.4 E-Commerce

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Packaged Chicken Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Fresh

8.6.4.2 Frozen

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Restaurant

8.6.5.2 Household

8.6.6 Historic and Forecasted Market Size by Distribution Channels

8.6.6.1 Convenience Store

8.6.6.2 Hypermarket and Supermarket

8.6.6.3 Specialty Store

8.6.6.4 E-Commerce

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Packaged Chicken Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Fresh

8.7.4.2 Frozen

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Restaurant

8.7.5.2 Household

8.7.6 Historic and Forecasted Market Size by Distribution Channels

8.7.6.1 Convenience Store

8.7.6.2 Hypermarket and Supermarket

8.7.6.3 Specialty Store

8.7.6.4 E-Commerce

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Packaged Chicken Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12,926 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.56% |

Market Size in 2032: |

USD 37490.47 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||