Optical Character Recognition Market Synopsis

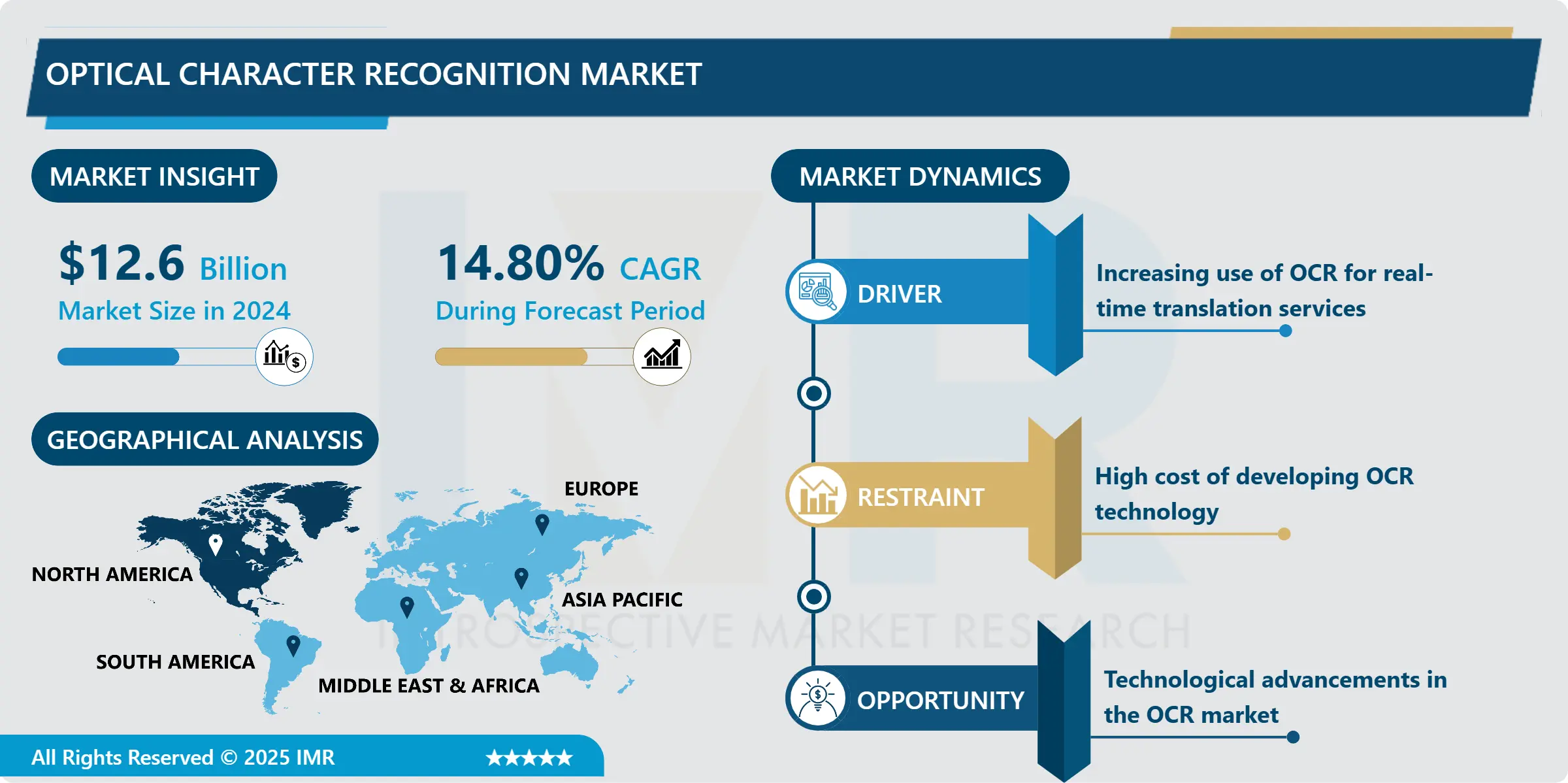

Optical Character Recognition Market Size Was Valued at USD 12.6 Billion in 2024, and is Projected to Reach USD 43.5 Billion by 2032, Growing at a CAGR of 14.80% From 2025-2032.

The method of changing the images of text into a machine-readable form is called optical character recognition. Optical character recognition (OCR) designates the operation that entails text recognition from pictures of typewritten, printed or handwritten text to electronic or mechanical formats.

One of its alternative names is optical character viewer. All types of scanned documents, photos of photos, scene photographs, or text with subtitles superimposed on images are all suitable for this technology. The most important benefit of the OCR data processing technique is that it allows one to carry out all-around text searches of all digitalized documents. The search process can be sped up with the use of this because professionals can easily pick numbers, addresses, names or the other elements that differentiate a document they are looking for.

Key Market Highlights

- Market Size in 2024: USD 12.6 Billion

- Projected Market Size by 2032: USD 43.5 Billion

- CAGR (2025-2032): 14.80%

- Fastest-Growing Market: North America

- By Type: The Software segment is anticipated to lead the market by holding 59.34% of market share throughout the forecast period.

- By End-use: The B2B segment is expected to grab 62.15% market share to maintain dominance over the forecast period.

- By Region: North America is projected to hold 32.09% market share during the forecast period.

- Active Players: ABBYY, Adobe, Anyline GmbH, ATAPY Software, Captricity Inc., and Other Major Players.

Optical Character Recognition Market Trend Analysis

Augmenting industry-wide automation and digitization

- The remarkable exponential growth of the digital and automation domains in all industry sectors is clearly evident in the recent years. Moreover, the application of OCR in the government sector is highly appreciable as it has raised the use of OCR to enhance operational efficiency, service delivery speed, and transparency. Similarly, the growth of automation and digitization among BFSI, retail and e-commerce, healthcare, and education industries, etc. will accelerate the market development. Further adoption of OCR by businesses to optimize resources, and heighten efficiency and productivity will also fuel the growth in the market.

- For companies looking for a semi-automated data capture and tracking solution for shipments, professional optical character recognition (OCR) manual stations are provided by outside service providers. PRO-CAP is a hardware and software concept developed by Prolistic that comprises of an OCR machine (machine and handwriting) and BCR used for the data monitoring (and rectification of incorrect). The system is unique in the fact that it is very fast (up to 650 shipments per hour) and has an adaptive and ergonomic design with the aim of helping the internal logistics of with parcel and mail service providers, making their operations more efficient and faster. Additionally, it considerably augments the quality of data. According to Prolistic, there is an ever-growing market demand for customized solutions especially within the e-commerce market for the mailing process.

Technological advancements in artificial intelligence, machine learning and deep learning

- Artificial intelligence (AI) and optical character recognition (OCR) have been revolutionized by developments in machine learning, deep learning, and AI that have bestowed engineers and innovators with the power to refine the precision, accuracy, and speed as well as enhancing the output quality of OCR technologies. The increasing penetration of artificial intelligence and machine learning technologies will define the evolution of the OCR market, consequently, the wider adoption of OCR technologies will be coming in the forecast period.

- "K" LINE, Japanese maritime operator, admitted the development of a unique system that disked dry bulk vessels laytime statements via the Optical Character Recognition (OCR) driven by artificial intelligence (AI). The novel CHRONUS system is integrated with Cinnamon Inc..'s AI-OCR technology. This emerging technology leverages artificial intelligence (AI) to discriminate any digitally captured handwritten or printed text. Furthermore, it is able to collect key information automatically via the exportation and importation data. The integrated software of the system will after that do the demurrage and dispatch fees computation automatically by use of Statements of Fact from the company's dry bulk carriers. Furthermore, a downloadable laytime statement will be created to record the difference between the authorized cargo handling time and the time used for the cargo operation.

Optical Character Recognition Market Segment Analysis:

Optical Character Recognition Market Segmented based on Type, vertical, and end-use.

By Type, software segment is expected to dominate the market during the forecast period

- In 2022, the software market was the leader with a share of more than 81% of the planetary income. There are so many kinds of OCR software including desktop based OCR, cloud based OCR, and mobile based OCR. As the need to reduce reliance on physical documents and convert them to digital in order to save resources, time, and money has become more acute, this has contributed to the software sector growth. Another point worth mentioning is the fact that augmented reality is also seeing heightened adoption in other sectors like Healthcare, BFSI, and Retail. For instance, nRoad, a US-based organization, unveiled Convus, an AI OCR system that is aimed at helping companies draw data from unorganized data storage like pictures, audio files, videos, and text. Such collaboration would allow Smart Engine to offer in-depth document recognition leading to accelerated form-filling and the automated extraction of data from documents. Furthermore, this technology includes the next generation biometric passports which has intelligent engine identification scanning and Green Flight Technology.

- The services sector is expected to have the most significant CAGR (compound annual growth rate) during the period of forecast. Data-gathering is a difficult and time-consuming task often undertaken by business owners to obtain a consolidated report which can be used to improve the decision-making process. There are a large number of companies out there that offer contracting for optical character recognition functions. For example, Data Entry Inc. offers comprehensive outsourcing OCR services which among other services include OCR error control, OCR bulk volumes, OCR databases, and OCR data conversion cleansing. For instance, an OCR AI-enabled intelligence platform called Convus, designed by the American nRoad company to assist organizations in extracting information from unstructured data was introduced in the US in February 2022. The findings of regulating and legal documentation that relate to investments, the eradication of fraud risk in the loan application phase, the validation of the contracts and contract violations are among them.

By End-use, B2B segment held the largest share in 2023

- The B2B sector was more prevalent in the market last year, generating up to 78% of the overall revenue. During this foreseeable period, the B2B segment is expected to make significant progress. The fact that various organizations are adopting software solutions which encompass eye smart functionalities as well as optical recognition technology in order to provide customers with a platform for pulling data from stored forms has constantly contributed to the expansion. It will give businesses a digital tool to store and retrieve data. Besides, there is no human input for data entry. Tata CLiQ, as an instance, in the month of October 2021, dedicated 10 days to their Festive Carnival. , which is a digital platform of the Tata Group, is expanding its business with help from Adobe, offering its customers with a custom digital purchasing experience on website and mobile applications.

- The B2C sector is expected to witness mild growth across the forecast period. OCR is utilized by organizations to process information in searchable PDF files. This software enables the conversion of PDF files and the papers which have pictures on them to the formats that are searchable, including the adding of an invisible layer that contains text and can be searched over a scanned bit map image project of the paper document. It enables the use of digital file systems as a searchable database where through key words, phrases or names information can be located. Given the fact that OCR solutions are used by government agencies and officials to scan legal papers, such as vehicle licenses, insurance certificates, passports and license plates as well.

Optical Character Recognition Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2022, market was dominated by North America which accounted for nearly 38% of the global revenue. The dominance of the United States region can be attributed to the early adoption of new technologies by businesses and the existence of large-scale market actors in the United States. For example, AlphaSense, Inc., a United States-based market intelligence organization, had Series C funding of USD 180 million in October 2021, which increased its total funding to USD 263 million. Firstly, CognitiveScale, a digital platform that is fueled by artificial intelligence, launched the latest one, Cortex Fabric 6, a low-code developer platform meant to simplify the automation, enhancement, and transformation of digital experiences, in July 2021. This tech would assist organizations in deploying trustworthy AI apps sooner and more cost-effectively.

Active Key Players in the Optical Character Recognition Market

- ABBYY

- Adobe

- Anyline GmbH

- ATAPY Software

- Captricity Inc.

- Creaceed S.P.R.L.

- CVISION Technologies, Inc.

- Exper-OCR, Inc.

- Google LLC

- International Business Machines Corporation

- IntSig Information Co., Ltd. Corporation

- IRIS S.A.

- LEAD Technologies, Inc.

- Microsoft

- NAVER Corp.

- Nuance Communications, Inc.

- Open Text Corporation

- Other Key Players

Key Industry Developments in the Optical Character Recognition Market:

- Citi, the financial services company, joined forces with Traydstream, a provider of trade documentation, in December 2023 to provide its clients with the access to automated trade document handling processes. The Traydstream modular technology incorporates advanced artificial intelligence and optical character recognition (OCR) technologies, providing a streamlined service that fulfills customer needs and expectations.

- The AI landing platform was introduced to the market in September 2023 by Landing AI, an AI provider of computer vision platforms. This advanced host of use-case and app repository is done to assist the developers in the development of AI based applications of Landing. Besides that, users will also be given the opportunity to build their own applications including those that combine OCR functions with the Landing AI platform through this App Space.

- In May of 2023, an alliance between ABBYY and Pipefy was established. The objective of this partnership is to build an integrated solution that helps move digital transformation efforts across the different sectors, such as insurance, financial services and people operations. By integrating ABBYY's OCR technology with Pipefy's process automation system, a good approach was given that enabled the automation, optimization, and streamlining of processes and workflows.

|

Global Optical Character Recognition Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.6 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.80% |

Market Size in 2032: |

USD 43.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vertical |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Optical Character Recognition Market by Type (2018-2032)

4.1 Optical Character Recognition Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Optical Character Recognition Market by Vertical (2018-2032)

5.1 Optical Character Recognition Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Retail

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 BFSI

5.5 Government

5.6 Education

5.7 Transport And Logistics

5.8 Healthcare

5.9 IT & Telecom

5.10 Manufacturing

5.11 Others

Chapter 6: Optical Character Recognition Market by End-use (2018-2032)

6.1 Optical Character Recognition Market Snapshot and Growth Engine

6.2 Market Overview

6.3 B2B

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 B2C

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Optical Character Recognition Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 4ME (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AISERA (US)

7.4 ALEMBA (UK)

7.5 ATLASSIAN (AUSTRALIA)

7.6 BMC SOFTWARE (US)

7.7 BROADCOM (US)

7.8 EASYVISTA (US)

7.9 EFECTE (FINLAND)

7.10 FRESHWORKS (US)

7.11 GOTO (US)

7.12 HALOLTSM (US)

7.13 HORNBILL (UK)

7.14 IBM (US)

7.15 IFS (SWEDEN)

7.16 INVGATE (US

7.17 ITARAIN (US)

7.18 IVANTI (US)

7.19 MANAGEENGINE (INDIA)

7.20 MICROSOFT (US)

7.21 NINJAONE (US)

7.22 OPENTEXT (CANADA)

7.23 SERVICENOW (US)

7.24 SOLARWINDS (US)

7.25 SYMPHONYAL SUMMIT (US)

7.26 SYSAID (ISRAEL)

7.27 TEAMDYNAMIX (US)

7.28 TOPDESK (NETHERLANDS)

7.29 ZENDESK (US)

7.30 OTHER KEY PLAYERS

7.31

Chapter 8: Global Optical Character Recognition Market By Region

8.1 Overview

8.2. North America Optical Character Recognition Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Software

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size by Vertical

8.2.5.1 Retail

8.2.5.2 BFSI

8.2.5.3 Government

8.2.5.4 Education

8.2.5.5 Transport And Logistics

8.2.5.6 Healthcare

8.2.5.7 IT & Telecom

8.2.5.8 Manufacturing

8.2.5.9 Others

8.2.6 Historic and Forecasted Market Size by End-use

8.2.6.1 B2B

8.2.6.2 B2C

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Optical Character Recognition Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Software

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size by Vertical

8.3.5.1 Retail

8.3.5.2 BFSI

8.3.5.3 Government

8.3.5.4 Education

8.3.5.5 Transport And Logistics

8.3.5.6 Healthcare

8.3.5.7 IT & Telecom

8.3.5.8 Manufacturing

8.3.5.9 Others

8.3.6 Historic and Forecasted Market Size by End-use

8.3.6.1 B2B

8.3.6.2 B2C

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Optical Character Recognition Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Software

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size by Vertical

8.4.5.1 Retail

8.4.5.2 BFSI

8.4.5.3 Government

8.4.5.4 Education

8.4.5.5 Transport And Logistics

8.4.5.6 Healthcare

8.4.5.7 IT & Telecom

8.4.5.8 Manufacturing

8.4.5.9 Others

8.4.6 Historic and Forecasted Market Size by End-use

8.4.6.1 B2B

8.4.6.2 B2C

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Optical Character Recognition Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Software

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size by Vertical

8.5.5.1 Retail

8.5.5.2 BFSI

8.5.5.3 Government

8.5.5.4 Education

8.5.5.5 Transport And Logistics

8.5.5.6 Healthcare

8.5.5.7 IT & Telecom

8.5.5.8 Manufacturing

8.5.5.9 Others

8.5.6 Historic and Forecasted Market Size by End-use

8.5.6.1 B2B

8.5.6.2 B2C

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Optical Character Recognition Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Software

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size by Vertical

8.6.5.1 Retail

8.6.5.2 BFSI

8.6.5.3 Government

8.6.5.4 Education

8.6.5.5 Transport And Logistics

8.6.5.6 Healthcare

8.6.5.7 IT & Telecom

8.6.5.8 Manufacturing

8.6.5.9 Others

8.6.6 Historic and Forecasted Market Size by End-use

8.6.6.1 B2B

8.6.6.2 B2C

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Optical Character Recognition Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Software

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size by Vertical

8.7.5.1 Retail

8.7.5.2 BFSI

8.7.5.3 Government

8.7.5.4 Education

8.7.5.5 Transport And Logistics

8.7.5.6 Healthcare

8.7.5.7 IT & Telecom

8.7.5.8 Manufacturing

8.7.5.9 Others

8.7.6 Historic and Forecasted Market Size by End-use

8.7.6.1 B2B

8.7.6.2 B2C

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Optical Character Recognition Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.6 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.80% |

Market Size in 2032: |

USD 43.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vertical |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||