Offshore Pipeline Market Synopsis

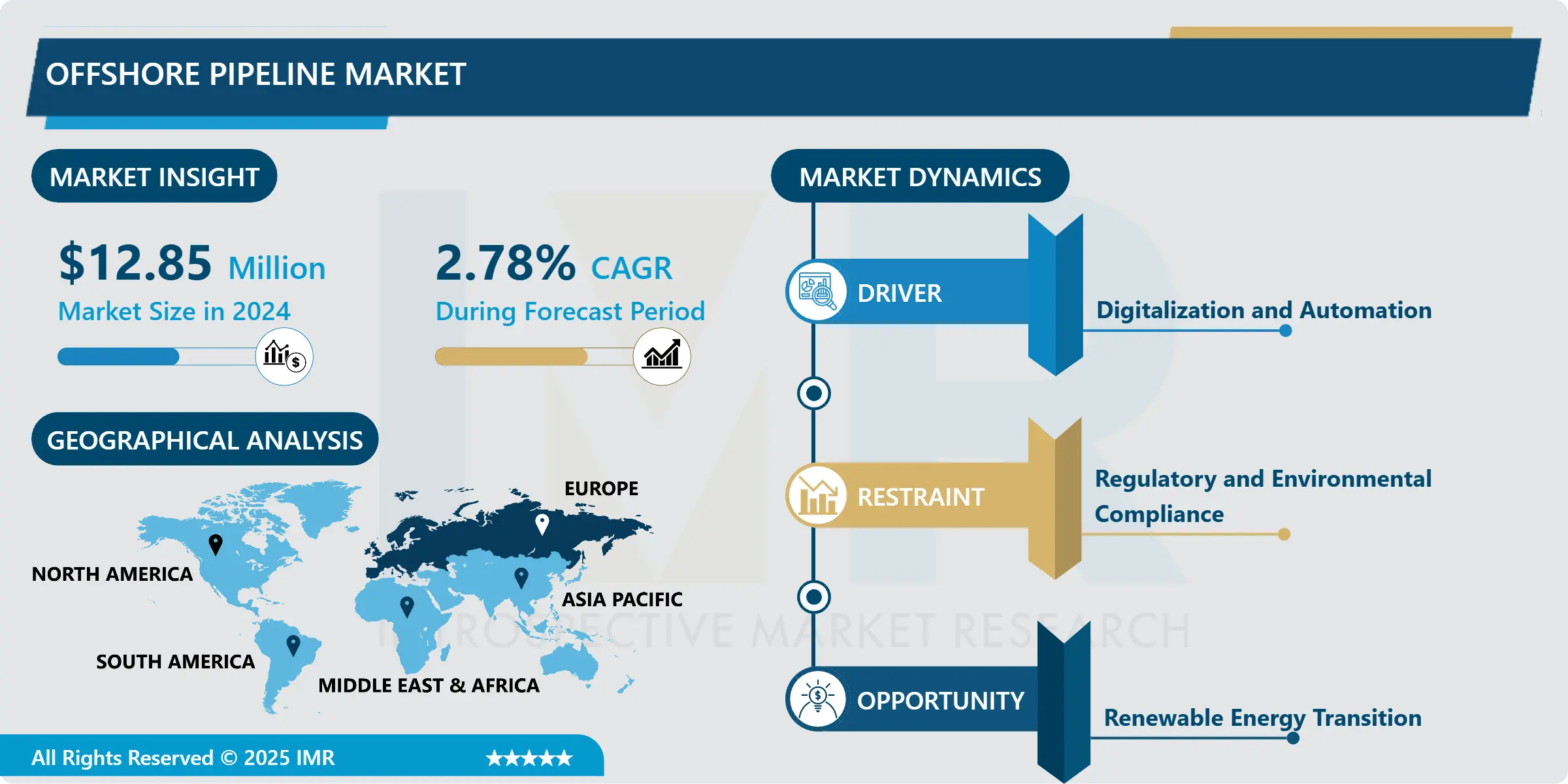

Offshore Pipeline Market Size Was Valued at USD 12.85 Billion in 2024, and is Projected to Reach USD 16.00 Billion by 2032, Growing at a CAGR of 2.78% From 2025-2032.

Offshore pipeline acts as a critical link in the oil and gas value chain which involves moving the recoveries from upstream offshore production fields to downstream processing facilities. If anything, the need for energy sources is set to increase further especially in the developing nations and this has seen the offshore pipeline industry expanding and transforming. This is due to the new opportunities for the realization of new fields for oil and natural gas, as well as the expansion of offshore wind farms, and the beginning development of CCS projects. The desire to develop deep-water and ultra-deep-water explorations and production is one of the most influential factors positively impacting the market for offshore pipelines. Since shallower source involves more easily recoverable reserves which are gradually depleted, the firms are exploring various deep water that needs several complex pipeline systems for effective energy transportation. This trend is moving offshore pipeline markets into high pressure pipelines and analogous operating conditions in the pipeline systems, thus stimulating developments in pipeline systems.

In addition, it is worth pointing out that with an increasing focus on utilizing renewable energy sources like offshore wind, offshore pipeline is expected to grow in this sector as well. Off-shore wind farms would fundamentally call for the creation of abundant subsea electrical wiring and connections necessary to feed electricity produced from off-shore structures to on-shore systems. The offshore pipelines’ market is predicted to grow in the future years due to growing demands for new capacitive offshore wind turbines fueled by renewable energy targets set by governments of several emerging and developed countries.

As well as the conventional ON/Office pipeline systems, there is a growing focus on the use of offshore pipeline systems for CCS applications. CCS entails the removal of carbon dioxide pollutants through industrial processes with the aim of preventing climate change by pumping the gases into underground cavities. Offshore pipelines serve as crucial linkages that connect onshore capture facilities for CO2 with adequate offshore injection and storage locations where the CO2 can be injected and stored for longer terms.

However, the offshore pipeline market is not totally immune to several risks such as, regulatory policies, jeopardy to environment and predominant geopolitical risks. As for offshore pipeline projects, the approval process at often time-consuming and bureaucratic, requiring the involvement of many parties and strict environmental / legal regulation.

In addition, Geopolitical risks arise where offshore pipeline projects are undertaken in regions where there is an existing reserve of hydrocarbons and play out in the form of conflict affecting the pipeline development feasibility and investment. Yet, given the ever-promising technological evolution and a continuously increasing global energy consumption the offshore pipeline market is set to experience definite development and evolution in the imitating years.

Offshore Pipeline Market Trend Analysis

Offshore Pipeline Market Growth Drivers- Digitalization and Automation

- Though some of the issues like unstable prices of oil, and more Kazakh policy concerning environmental protection, the offshore pipeline market is gradually expanding by increasing energy demands in the global markets. The usage of pipeline structures is also expected to increase due to the growing demand from the emerging economies mostly in the Asia-Pacific and Africa regions, for expansion along with modernization.

- The use of technology especially in the digital platform has changed the way offshore pipeline operations are carried. Critical assets maintenance is improved due to availed data analytics systems, internet of things sensors and mechanisms, and the ability to predict machine faults so as to avoid their occurrence. It allows great control over pipeline design, and its operation since it can be a realistic model of actual systems about which digital twins are created.

- In this paper, the understanding of Role of Automation in Offshore Pipeline Safety and Efficiency is properly developed and clarified with the following argument. Most inspection procedures rely on the use of drone and ROVs to carry out inspections on pipelines, and this has made the process easier and safer especially in the offshore settings. Standards also regulate inventories and automated control systems improve the dependability of pipelines and lessen the influence of mistakes by operators.

- Smart technologies, such as digitalization and automation, allow for monitoring and controlling of offshore pipeline systems even from a distance. This trend is especially evident in the current era of COVID-19 where remote functioning means that everybody continues to work without having to meet in close contact. Teleoperated systems provide better management and control; they also reduce expenses and operational risks as the human element is greatly reduced.

Offshore Pipeline Market Opportunities- Transition to Renewable Energy

- Due to the threat and issues related to climate change and environment pollution across the globe, government and industrial sectors are shifting their focus away from the use of fossil fuels towards cleaner energy like wind and solar energy.

- As a result of this, governments are enacting strict polices and standards to ensure that they adapt to the use of renewable energy sources and minimize the emission of carbon. There are – tax incentives, subsidies, and catalog arrangements – working to promote the development of offshore wind farms and other RE projects.

- The second is technological changes affecting the operation of wind turbines: the availability of offshore bigger turbines and better foundation construction contributed to the development of cheaper and dependable offshore wind energy. Furthermore, advancements in SO pipelines, materials and installation have made it easier to establish renewable energy infrastructure.

- There remain vast business opportunities to explore as the world shifts and transforms to using renewable sources of energy in the offshore pipeline market. Increased demand for offshore wind farms and other RE projects, measured by number of planned fixed and floating wind turbines, also implies heightened demand for pipelines for energy resources transportation.

By Application, Tracking & Navigation segment held the largest share in 2024

Offshore Pipeline Market Segment Analysis:

Offshore Pipeline Market is Segmented based on Product, Basis of Line, and Diameter

By Product, Refined Product is expected to dominate the market during the forecast period.

- With incessant increase in global energy demand especially in the developing countries the transportation system from offshore fields to onshore facilities for oil, gas and refined products takes a central stage.

- Technological development in pipe line construction engineering both civil and mechanical design and monitoring system has improved efficiency safety and also environmentally friendly pipeline construction leading to more investment on new pipelines offshore.

- Existing conflicts in many oil and gas producing nations have underlined the need for additional pipelines, with the trend towards the construction of the offshore pipelines to diversify the supply to minimize disruption and risk.

- There is an increased awareness of the environment, and the measures being taken are leading to implementation of environment-friendly energy sources and safer approaches and designs for offshore pipeline systems to be used when investing on the projects.

By Basis of Line, Export Line segment held the largest share in 2024

- The offshore pipeline market share can be estimated with the help of the pipeline type, where export pipelines and transport pipelines play the most crucial roles in the functionality of oil and gas operations. Export lines are essential channels through which extracted hydrocarbons are transferred from offshore production facilities to on shore refineries or export depots. These pipelines are designed to operate in harsh marine conditions, and in many cases the details are made from materials that can resist corrosion or get eroded.

- On the other hand, transport lines enable the conveyance of processed or refined production such as oil and gas products from onshore dependent facilities to offshore platforms or distribution facilities. These pipelines are essential to maintain the supply chain for the petroleum products and secure delivery of an extensive region of off-shore service.

- Some important factors having a direct influence on the development of the offshore pipeline market are growing offshore E&P operations, the growing energy needs and demands, new technologies in construction of the pipelines as well as their inspection, and increasing focus on safety and ecological norms.

- Furthermore, as part of the offshore pipeline systems there is need to extend the existing networks to reach new fields of oil and gas reserves that are found in deeper offshore regions. Pipeline decison-makers continuously commit resources on research and development to create better materials for pipelines and its construction with aims to providing more reliable, long lasting, and environmentally friendly facilities.

- In summary, the offshore pipeline business offers rich prospects for not only pipeline makers and engineering companies that deal in pipelines and supportive equipment, but also in hydrocarbon processing industries in the light of increasing offshore exploration and production across the world.

Offshore Pipeline Market Regional Insights:

Europe dominated the largest market in 2024

- The offshore pipeline industry identified Europe to be the largest market as it captures several factors and changes. Firstly, Europe is situated strategically on several coastlines with access deep into the offshore fields and resources elsewhere worldwide and therefore is leading the market. This geographical aspect has made ample accommodation for offshore pipeline establishment and maintenance proving attractive to locals and foreigners’ investments.

- Secondly, Europe can be credited for green energy investment and particularly for the offshore pipeline growth caused by the interest in wind power. The shift towards cleaner sources of energy especially from offshore wind farms as well as the need to create several pipeline networks to transport electricity generated from offshore wind farms to the onshore grids has been a driving force to the market.

- Thirdly, high levels of environmental standards and legal reforms in Europe have called for the use of technology and expertise in pipeline infrastructure among others. Such a focus on environmental sensitivity has produced prospects for novel solutions suppliers to manage throughout the European offshore pipeline totally.

- Finally, due to EU’s aggressiveness to energy security and diversification, enhanced investment in offshore pipeline system for the transportation of natural gas and oil from offshore field to onshore facility has great the EU consolidating its position as the global market leader in offshore pipeline. In summary, theoretical, excrement, and emerging market advantages, environmental consciousness, compatibility, and energy security priorities point to Europe’s solid dominance in the scope of the largest market for offshore pipelines in 2024.

Active Key Players in the Offshore Pipeline Market

- TechnipFMC Plc (UK)

- Petrofac Limited (UK)

- McDermott (US)

- Fugro (The Netherlands)

- Saipem (Italy)

- Enbridge Inc. (Canada)

- Cortez Subsea (UK) , and Other Active Players

Key Industry Developments in the Offshore Pipeline Market:

- In January 2024, TotalEnergies signed an agreement with European Energy to develop offshore wind projects in Denmark, Finland, and Sweden. This includes acquiring stakes in Denmark's Jammerland Bugt (240 MW) and Lillebaelt South (165 MW) projects, both expected to start by 2030.

- In February 2023, DNV launched the second phase of H2Pipe, a joint industry project to develop a new code for offshore hydrogen pipelines. DNV’s Hydrogen Forecast to 2050 predicts over 50% of hydrogen pipelines will be repurposed from natural gas networks, costing less than 35% of new builds.

|

Global Offshore Pipeline Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.85 Mn. |

|

Forecast Period 2024-32 CAGR: |

2.78% |

Market Size in 2032: |

USD 16.00 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Basis of Line |

|

||

|

By Diameter |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Offshore Pipeline Market by Product Type (2018-2032)

4.1 Offshore Pipeline Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gas

4.5 Refined Product

Chapter 5: Offshore Pipeline Market by Basis of Line (2018-2032)

5.1 Offshore Pipeline Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Export Line

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Transport Line

Chapter 6: Offshore Pipeline Market by Diameter (2018-2032)

6.1 Offshore Pipeline Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Below 24’

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Greater than 24’

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Offshore Pipeline Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TECHNIPFMC PLC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PETROFAC LIMITED (UK)

7.4 MCDERMOTT (US)

7.5 FUGRO (THE NETHERLANDS)

7.6 SAIPEM (ITALY)

7.7 ENBRIDGE INC. (CANADA)

7.8 CORTEZ SUBSEA (UK)

7.9 AND OTHER KEY PLAYERS

Chapter 8: Global Offshore Pipeline Market By Region

8.1 Overview

8.2. North America Offshore Pipeline Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Oil

8.2.4.2 Gas

8.2.4.3 Refined Product

8.2.5 Historic and Forecasted Market Size by Basis of Line

8.2.5.1 Export Line

8.2.5.2 Transport Line

8.2.6 Historic and Forecasted Market Size by Diameter

8.2.6.1 Below 24’

8.2.6.2 Greater than 24’

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Offshore Pipeline Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Oil

8.3.4.2 Gas

8.3.4.3 Refined Product

8.3.5 Historic and Forecasted Market Size by Basis of Line

8.3.5.1 Export Line

8.3.5.2 Transport Line

8.3.6 Historic and Forecasted Market Size by Diameter

8.3.6.1 Below 24’

8.3.6.2 Greater than 24’

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Offshore Pipeline Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Oil

8.4.4.2 Gas

8.4.4.3 Refined Product

8.4.5 Historic and Forecasted Market Size by Basis of Line

8.4.5.1 Export Line

8.4.5.2 Transport Line

8.4.6 Historic and Forecasted Market Size by Diameter

8.4.6.1 Below 24’

8.4.6.2 Greater than 24’

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Offshore Pipeline Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Oil

8.5.4.2 Gas

8.5.4.3 Refined Product

8.5.5 Historic and Forecasted Market Size by Basis of Line

8.5.5.1 Export Line

8.5.5.2 Transport Line

8.5.6 Historic and Forecasted Market Size by Diameter

8.5.6.1 Below 24’

8.5.6.2 Greater than 24’

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Offshore Pipeline Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Oil

8.6.4.2 Gas

8.6.4.3 Refined Product

8.6.5 Historic and Forecasted Market Size by Basis of Line

8.6.5.1 Export Line

8.6.5.2 Transport Line

8.6.6 Historic and Forecasted Market Size by Diameter

8.6.6.1 Below 24’

8.6.6.2 Greater than 24’

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Offshore Pipeline Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Oil

8.7.4.2 Gas

8.7.4.3 Refined Product

8.7.5 Historic and Forecasted Market Size by Basis of Line

8.7.5.1 Export Line

8.7.5.2 Transport Line

8.7.6 Historic and Forecasted Market Size by Diameter

8.7.6.1 Below 24’

8.7.6.2 Greater than 24’

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Offshore Pipeline Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.85 Mn. |

|

Forecast Period 2024-32 CAGR: |

2.78% |

Market Size in 2032: |

USD 16.00 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Basis of Line |

|

||

|

By Diameter |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||