Oats Market Synopsis

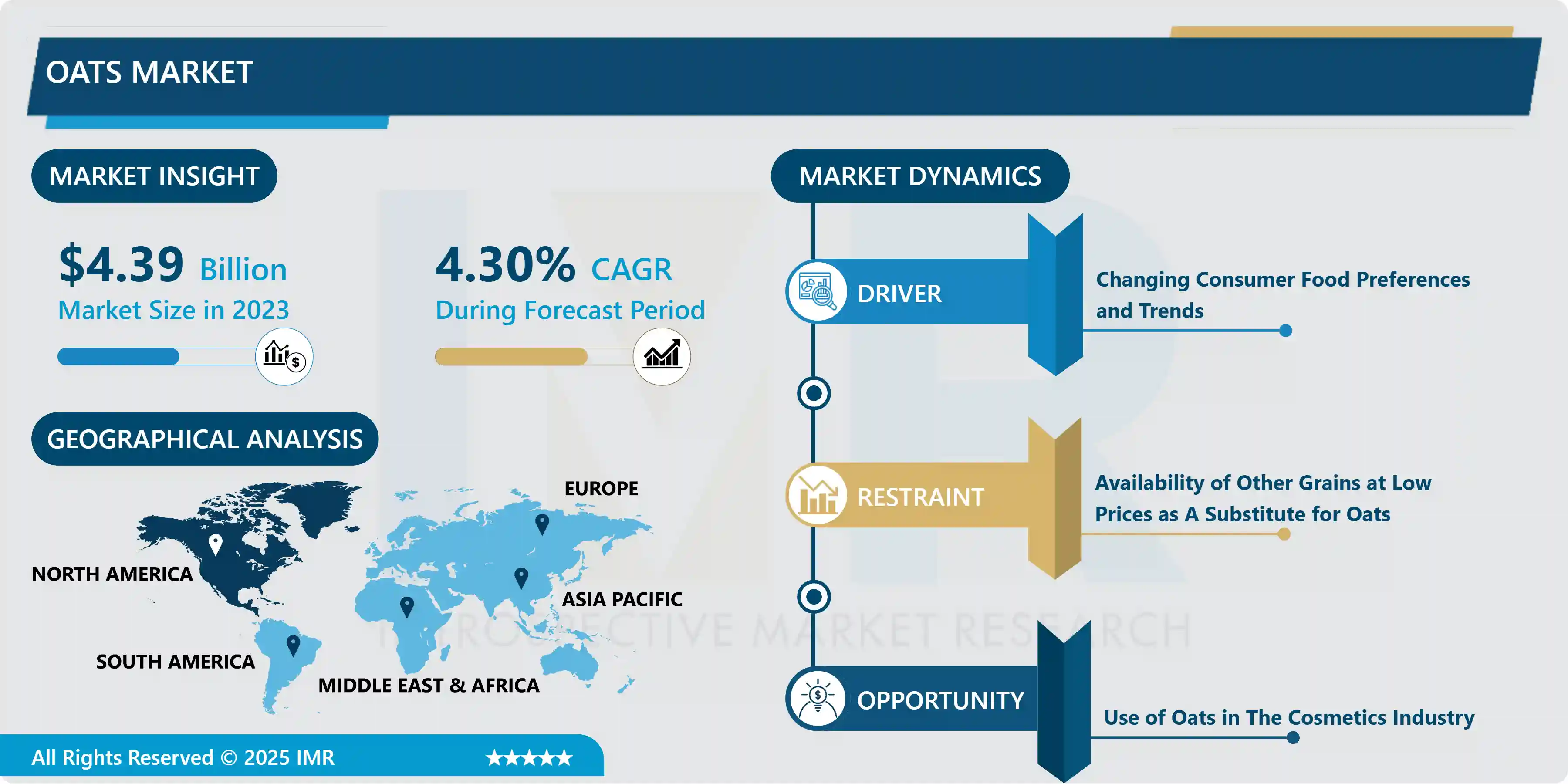

Oats Market Size Was Valued at USD 4.39 Billion in 2023 and is Projected to Reach USD 6.41 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

One well-known and widely eaten breakfast item is oat meals. Husk oat grains that have been steel cut, ground, or rolled are used to make them. Because it is high in protein and sustains hunger for a considerable amount of time, it is highly favored. As a result, it lessens appetite and contributes to total weight loss. Furthermore, it also helps lower blood pressure, cholesterol, and blood sugar levels.

Oats are a cereal grain that is a great source of Fiber (insoluble and soluble), Phosphorus, Thiamine, Magnesium, and Zinc. Oats are primarily cultivated for their seeds, which are commonly consumed as oatmeal, rolled oats, oat flour, and other food products.

Oats can provide a lot of health benefits such as promoting heart health, and skin health, boosting immunity, and controlling diabetes. oats are a major source of beta-glucan, soluble fiber which acts as a protection against heart disease. Oats reduce cholesterol and blood sugar levels.

Oats are used in the food industry for manufacturing cookies, cakes, meals, etc. food products. The production of oat milk can be taken as a substitute for milk. Oats are also used as a thickener in soups. Oat straw is used by cattle producers as bedding. Oat is also used as a feed due to its high hull and fiber content.

Oat consumption has skyrocketed globally in recent years. According to the American Customer Satisfaction Index, which measures the overall quality of American goods and services, the United States saw a 10% rise in sales of the high-protein, gluten-free breakfast cereal in 2021.

Oat-based food products are currently a $2.2 billion business in the US. Eventually, the FDA approved the first oat-based medication to treat inflammatory bowel disease, which affects up to 15 million people in the United States. Oats is keeping its promise to customers who are searching for plant-based, healthful options.

Oats Market Trend Analysis

Changing Consumer Food Preferences and Trends

- Increasing awareness about health is driving the demand for nutritious and whole-grain foods and Oats are often perceived as a healthy option because of their high fiber content. Oats also help to promote heart health and weight loss.

- Oats is gluten gluten-free meal; hence the gluten-free trend has expanded the market for oat-based products. Oats can be easily integrated into quick and convenient snacks, this helps to fulfill the demand for ready-to-eat and convenient food products.

- The growing popularity of plant-based diets and vegan lifestyles contribute to the demand for oat-based products like oat milk.

Opportunity

Use of Oats in The Cosmetics Industry

- Oats contain about 10% fat which is very gentle to the skin. Oats form a thin film on the skin. That thin film protects the skin from external effects such as UV light, and air pollution.

- It is found that oats reduce skin irritation and soothe the skin. Oat extract is used for tension removal and relaxation. Oats extract can be used as night cream. It is also suitable for hair rinsing and the whole body after a shower.

- Oats can also be useful in face masks, night creams, powder, shower gel, shampoo, etc. It can also be used as a scrub for the body and face.

Oats Market Segment Analysis:

Oats Market Segmented based on type, application, end-user, and distribution channel.

By Type, Whole Grain Segment Is Expected to Dominate the Market During the Forecast Period

There are three types, steel cuts, whole grain, and instant oats which whole grain segment is expected to dominate the Oats market during the forecast period.

- Whole grain oats are becoming increasingly popular due to the growing demand of consumers for natural and healthy food products. These grains are utilized in manufacturing various food products such as bakery products, breakfast meals, and nutritional bars.

- Health professionals, dietary guidelines, and nutritionists mainly recommend whole grains as part of a balanced diet. It also offers a nutritious and versatile option for those following a gluten-free diet.

By Application, the Feed Segment Held the Largest Share In 2023

By application, three segments are the food, feed, and cosmetics industries in which the Feed segment is expected to dominate.

- Oat forage and grains are mainly used for livestock and poultry feed. The oats feed is suitable for livestock due to its high fat content which increases the high energy value to the feed.

- Oats feed helps to improve milk production in animals as compared to other cereals. Oat grains are best fed for horses and younger calves for nutrition. The animal feed segment held a larger market share in 2021. Hence, the feed segment is expected to dominate the market during the forecast period.

Oats Market Regional Insights:

- Europe region is expected to dominates the market over the forecast period. The European oats market has 42 mills with an estimated capacity of about 2.4 million tonnes and includes emerging markets coming out of Spain, Scandinavia and the Baltic States. Oats market Oats are commonly used in traditional European dishes such as porridge, muesli, and oatcakes. Also, oats are included in breakfast cereals, manufacturing granola bars, bread, cookies, and dairy alternatives like oat milk and yogurt.

- With changing lifestyles and increasing urbanization, there is an increase in demand for convenient, healthy, and ready-to-eat food options in Europe. European consumers are willing to pay a premium for products that meet these criteria, boosting the oats market.

|

Market |

% of Global Production |

Total Production (2023/2024, Metric Tons) |

|

European Union |

30% |

5.9 Million |

|

Russia |

17% |

3.3 Million |

|

Canada |

14% |

2.64 Million |

|

Brazil |

6% |

1.22 Million |

|

Australia |

6% |

1.1 Million |

|

UK |

4% |

850000 |

|

US |

4% |

828000 |

Oats Key Players

- The Kellogg Company (US)

- Bob's Red Mill Natural Foods (US)

- Avena Foods Ltd. (Canada)

- Morning Foods Ltd. (UK)

- Saffola Oats (India)

- Patanjali Oats (India)

- Bagrry’s White Oats (India)

- Nutriorg Oats (India)

- AGT Foods (Africa)

- Kangaroo Island Oats (Australia)

- Blue Lake Milling (Australia)

- Aussee Oats Milling Pvt. Ltd. (Shri Lanka)

- True Elements Oats (India)

- Eco Valley Hearty Oats (India)

- Shanti Food Chem Private Limited (India)

|

Oats Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3 % |

Market Size in 2032: |

USD 6.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oats Market by Type (2018-2032)

4.1 Oats Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Steel cuts

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Whole grain

4.5 Instant

Chapter 5: Oats Market by Application (2018-2032)

5.1 Oats Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bakery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Breakfast

5.5 Confectionery

5.6 Animal Feed

5.7 Others

Chapter 6: Oats Market by Distribution Channels (2018-2032)

6.1 Oats Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Speciality Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail Stores

6.5 Supermarkets

6.6 Wholesale Distributor

6.7 Online Stores

Chapter 7: Oats Market by End-user (2018-2032)

7.1 Oats Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Feed Industry

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Oats Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THE KELLOGG COMPANY (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BOB'S RED MILL NATURAL FOODS (US)

8.4 AVENA FOODS LTD. (CANADA)

8.5 MORNING FOODS LTD. (UK)

8.6 SAFFOLA OATS (INDIA)

8.7 PATANJALI OATS (INDIA)

8.8 BAGRRY’S WHITE OATS (INDIA)

8.9 NUTRIORG OATS (INDIA)

8.10 AGT FOODS (AFRICA)

8.11 KANGAROO ISLAND OATS (AUSTRALIA)

8.12 BLUE LAKE MILLING (AUSTRALIA)

8.13 AUSSEE OATS MILLING PVT. LTD. (SHRI LANKA)

8.14 TRUE ELEMENTS OATS (INDIA)

8.15 ECO VALLEY HEARTY OATS (INDIA)

8.16 SHANTI FOOD CHEM PRIVATE LIMITED (INDIA)

8.17 ZEROBELI (INDIA)

8.18 GENERAL MILLS PVT. LTD. (INDIA)

8.19 BRITANNIA INDUSTRIES LTD (INDIA)

8.20 DOBRODIYA FOODS LLC (UKRAINE)

8.21 MORNFLAKE (UK)

8.22 WEETABIX (UK)

8.23 NATURE’S PATH (CANADA)

8.24 UNCLE TOBY’S (AUSTRALIA)

8.25 ESKAL (AUSTRALIA)

Chapter 9: Global Oats Market By Region

9.1 Overview

9.2. North America Oats Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Steel cuts

9.2.4.2 Whole grain

9.2.4.3 Instant

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Bakery

9.2.5.2 Breakfast

9.2.5.3 Confectionery

9.2.5.4 Animal Feed

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Distribution Channels

9.2.6.1 Speciality Stores

9.2.6.2 Retail Stores

9.2.6.3 Supermarkets

9.2.6.4 Wholesale Distributor

9.2.6.5 Online Stores

9.2.7 Historic and Forecasted Market Size by End-user

9.2.7.1 Food Industry

9.2.7.2 Feed Industry

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Oats Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Steel cuts

9.3.4.2 Whole grain

9.3.4.3 Instant

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Bakery

9.3.5.2 Breakfast

9.3.5.3 Confectionery

9.3.5.4 Animal Feed

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Distribution Channels

9.3.6.1 Speciality Stores

9.3.6.2 Retail Stores

9.3.6.3 Supermarkets

9.3.6.4 Wholesale Distributor

9.3.6.5 Online Stores

9.3.7 Historic and Forecasted Market Size by End-user

9.3.7.1 Food Industry

9.3.7.2 Feed Industry

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Oats Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Steel cuts

9.4.4.2 Whole grain

9.4.4.3 Instant

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Bakery

9.4.5.2 Breakfast

9.4.5.3 Confectionery

9.4.5.4 Animal Feed

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Distribution Channels

9.4.6.1 Speciality Stores

9.4.6.2 Retail Stores

9.4.6.3 Supermarkets

9.4.6.4 Wholesale Distributor

9.4.6.5 Online Stores

9.4.7 Historic and Forecasted Market Size by End-user

9.4.7.1 Food Industry

9.4.7.2 Feed Industry

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Oats Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Steel cuts

9.5.4.2 Whole grain

9.5.4.3 Instant

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Bakery

9.5.5.2 Breakfast

9.5.5.3 Confectionery

9.5.5.4 Animal Feed

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Distribution Channels

9.5.6.1 Speciality Stores

9.5.6.2 Retail Stores

9.5.6.3 Supermarkets

9.5.6.4 Wholesale Distributor

9.5.6.5 Online Stores

9.5.7 Historic and Forecasted Market Size by End-user

9.5.7.1 Food Industry

9.5.7.2 Feed Industry

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Oats Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Steel cuts

9.6.4.2 Whole grain

9.6.4.3 Instant

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Bakery

9.6.5.2 Breakfast

9.6.5.3 Confectionery

9.6.5.4 Animal Feed

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Distribution Channels

9.6.6.1 Speciality Stores

9.6.6.2 Retail Stores

9.6.6.3 Supermarkets

9.6.6.4 Wholesale Distributor

9.6.6.5 Online Stores

9.6.7 Historic and Forecasted Market Size by End-user

9.6.7.1 Food Industry

9.6.7.2 Feed Industry

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Oats Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Steel cuts

9.7.4.2 Whole grain

9.7.4.3 Instant

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Bakery

9.7.5.2 Breakfast

9.7.5.3 Confectionery

9.7.5.4 Animal Feed

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Distribution Channels

9.7.6.1 Speciality Stores

9.7.6.2 Retail Stores

9.7.6.3 Supermarkets

9.7.6.4 Wholesale Distributor

9.7.6.5 Online Stores

9.7.7 Historic and Forecasted Market Size by End-user

9.7.7.1 Food Industry

9.7.7.2 Feed Industry

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Oats Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3 % |

Market Size in 2032: |

USD 6.41 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||