Nutraceutical Products Market Synopsis

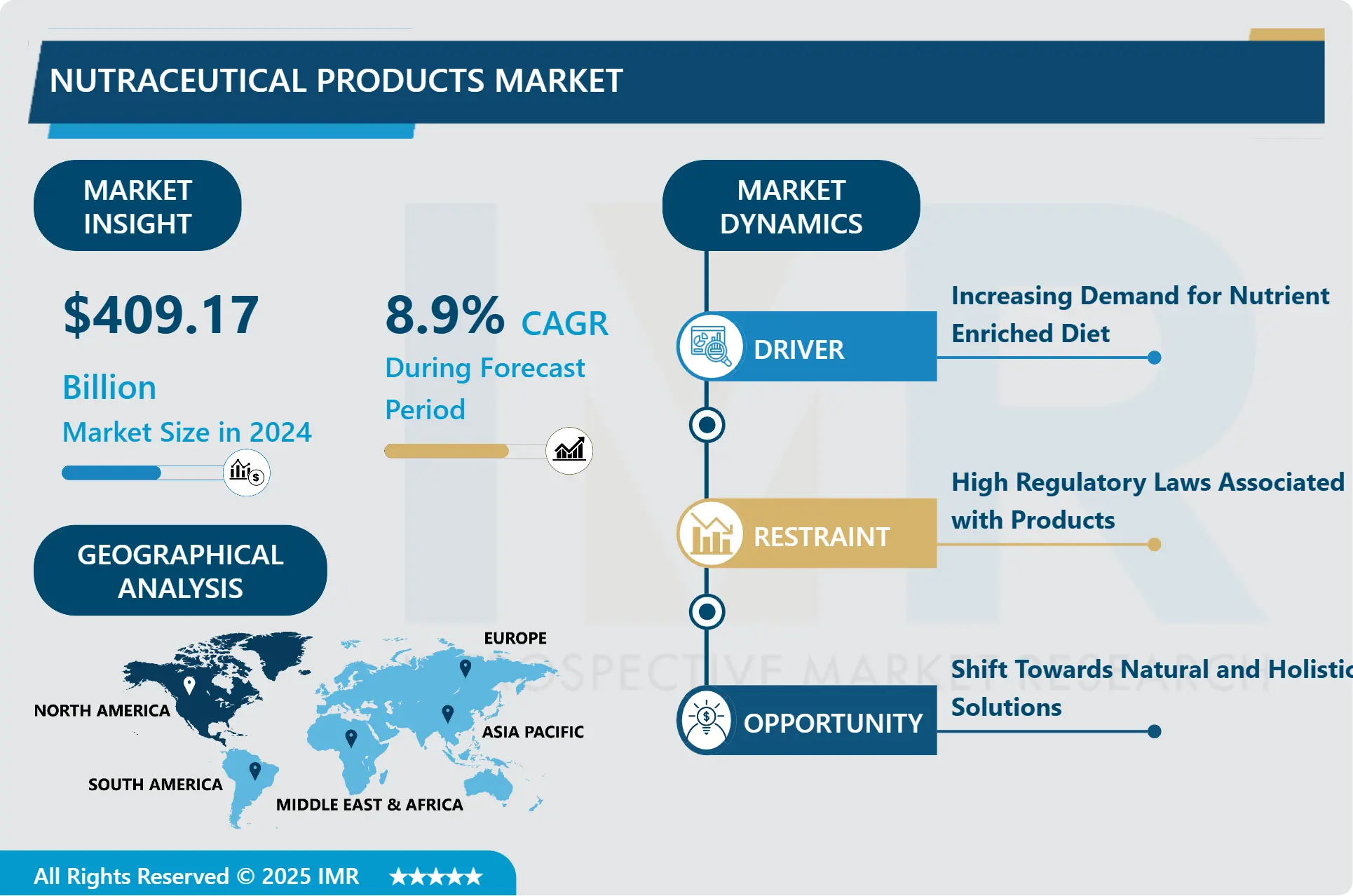

Nutraceutical Products Market Size Was Valued at USD 409.17 Billion in 2024, and is Projected to Reach USD 809.33 Billion by 2032, Growing at a CAGR of 8.9% From 2025-2032.

Nutraceutical products that are derived from food sources and are believed to provide extra health benefits beyond basic nutrition. Nutraceuticals can include a wide range of products such as dietary supplements, functional foods, and beverages fortified with vitamins, minerals, herbs, or other bioactive substances.

Nutraceuticals assist individuals achieve their nutritional demands and preserve good health by supplementing their meals with vital vitamins, minerals, and other substances that are often lacking. Nutraceuticals promote wellness and prevent chronic diseases by using antioxidants, phytochemicals, and other bioactive components to maintain cellular health, improve the immune system, and combat oxidative stress.

Nutraceuticals provide personalised health management by delivering a variety of products tailored to individual needs and tastes, allowing users to choose supplements that correspond with their health goals, lifestyle, and dietary needs. Nutraceuticals are available in capsules, pills, powders, liquids, and functional meals, making them a handy and accessible option for daily use. As the world's population ages, there is an increase in demand for products that address age-related health issues such as joint health, cognitive function, heart health, and healthy ageing.

Nutraceuticals provide specialised solutions to these unique demands. There is a shift towards preventative healthcare techniques, in which people prioritise preserving good health over curing disorders. Nutraceuticals are viewed as a proactive approach to health management, offering nutritional assistance while also promoting wellness. Modern lives frequently result in dietary imbalances, stress, sedentary behaviour, and exposure to environmental pollutants. Nutraceuticals fill the gap by supplying critical nutrients, antioxidants, and bioactive chemicals that may be absent in standard diets.

This statistic shows size of the total global dietary supplements market from 2018 to 2024. By 2024, the dietary supplements market was generated around 235 billion U.S. dollars worldwide.

Nutraceutical Products Market Trend Analysis

Nutraceutical Products Market Growth Driver- Increasing Demand for Nutrient Enriched Diet

- As consumers become more aware of the benefits of nutrient-dense diets, demand for fortified dietary supplements rises. These supplements may contain vitamins, minerals, antioxidants, amino acids, or other bioactive components that closely resemble the nutrient profile found in enhanced foods. Nutraceutical firms are working on creating functional foods that replicate the nutrient enrichment seen in whole foods. The move towards personalised nutrition is propelling innovation in the nutraceutical industry.

- Companies are looking into ways to provide customised nutrient blends based on individual health needs and preferences. This could include personalised supplement packs, nutritional consultations, or digital platforms that use nutritional data to promote certain items. Nutraceutical firms are focusing on the bioavailability and absorption of nutrients in their products. Consumers looking for maximum efficacy from their supplements are increasingly interested in formulations that improve nutrient absorption, such as liposomal delivery systems, nano-emulsions, and bioenhancers.

- Nutraceutical products are increasingly being advertised for their specific health advantages, which aligns with the nutrient enrichment trend. Products created for immune support, bone health, cognitive function, gut health, and skin nutrition are examples of how corporations use enriched formulations to address specific consumer demands. Consumers prefer nutraceutical items that have clear labels, natural ingredients, and few additives. Nutrient-rich supplements made from plant sources, organic ingredients, and non-GMO formulations are gaining popularity among health-conscious consumers who value transparency and sustainability.

Nutraceutical Products Market Opportunity- Shift Towards Natural and Holistic Solutions

- Consumers are increasingly seeking natural alternatives and are concerned about the substances in the items they consume. This has resulted in increased demand for plant-based nutraceuticals, organic supplements, and goods free of artificial additives, preservatives, and synthetic chemicals. Herbal and botanical supplements are becoming increasingly popular due to their medical benefits.

- Nutraceutical businesses are capitalising on this trend by creating herbal extracts, adaptogens, and phytonutrient-rich formulations that provide comprehensive health benefits. Customers value transparency in product labelling and origin. Nutraceutical companies that prioritise clean labels, ethical sourcing, non-GMO ingredients, and environmentally friendly manufacturing procedures are gaining customer trust and market share.

- As people look for easy ways to add health-promoting components into their diets, the market for functional foods and beverages has grown dramatically. Nutraceutical firms are inventing with fortified snacks, beverages, and meal replacements that provide nutritional benefit beyond basic nourishment.

Nutraceutical Products Market Segment Analysis:

Nutraceutical Products Market is Segmented on the basis of Product Type, Source, Form, Application, Distribution Channel and Region.

By Type, Functional Food segment is expected to dominate the market during the forecast period

- Functional foods allow customers to incorporate health-enhancing components into their daily diets without having to take separate supplements. This convenience element adds to their appeal and widespread acceptance. Products in the functional food area include fortified cereals, beverages, snacks, dairy products, baked goods, and meal replacements. This diversity allows consumers to choose items that fit their taste preferences, dietary demands, and health goals.

- Functional meals are designed to deliver additional health advantages beyond basic nutrition. This focused strategy appeals to consumers looking for holistic wellness solutions. Interest in functional foods has grown as consumers become more aware of the link between nutrition and health. Educational initiatives, health blogs, media attention, and healthcare professionals' endorsements have all helped to shape consumer attitudes and drive demand for functional products.

- Nutraceutical firms are continually developing new ingredients and formulations to provide functional foods with increased bioavailability, efficacy, and sensory appeal. This involves introducing new ingredients including superfoods, plant extracts, probiotics, prebiotics, and bioactive chemicals known for their health benefits.

By Application, Weight Management Segment Held the Largest Share In 2024

- The global increase in obesity rates has raised awareness and worry about weight management and other health issues. Consumers are looking for ways to promote healthy weight loss or maintenance, which is increasing demand for weight management products. Weight management products have grown in popularity due to larger health and wellness trends such as a focus on fitness, nutrition, and preventive treatment.

- Consumers are taking a more holistic approach to health, which frequently includes dietary supplements or functional foods aimed at weight control. Weight management goods include meal replacement shakes, appetite suppressants, fat burners, metabolism boosters, carb blockers, and more. These items appeal to those with a variety of weight control goals and preferences. The combination of weight management products, sports nutrition, and fitness supplements has increased market reach.

- Athletes, fitness enthusiasts, and others who live active lifestyles frequently add weight management pills into their regimens to help them reach their fitness goals. Weight management products must adhere to regulatory standards and health claims laws in order to ensure customer safety and efficacy. Weight management supplements' credibility is dependent on its adherence to quality standards, labelling rules, and transparency in marketing health claims.

Nutraceutical Products Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has a sizable population, with a strong emphasis on health and wellness. The region's huge consumer base fuels demand for a diverse range of nutraceutical items, such as nutritional supplements, functional foods, and drinks. In North America, there is a strong culture of health consciousness, with people actively pursuing products that improve their well-being, solve specific health concerns, and encourage a healthy lifestyle. This trend boosts the popularity and expansion of the nutraceutical business.

- Advanced Healthcare Infrastructure: The region has advanced healthcare infrastructure, which includes strong regulatory frameworks, research institutes, healthcare personnel, and consumer education programmes. This infrastructure facilitates the development, marketing, and distribution of nutraceuticals. Many major players in the nutraceutical sector are headquartered in North America, including global corporations, pharmaceutical companies expanding into nutraceuticals, innovative startups, and research-focused organisations.

- Many players propel innovation, product development, and market competitiveness. The United States and Canada have well-established regulatory requirements for nutraceuticals, which ensure product safety, efficacy, and high quality. Compliance with laws, such as FDA (Food and Drug Administration) recommendations in the United States and Health Canada rules in Canada, is critical for market access and consumer trust.

Nutraceutical Products Market Key Players

- Amway Corporation (USA)

- Nestle Health Science (Switzerland)

- Abbott Laboratories (USA)

- DuPont Nutrition & Biosciences (USA)

- DSM Nutritional Products (Netherlands)

- BASF SE (Germany)

- Herbalife Nutrition Ltd. (USA)

- Glanbia plc (Ireland)

- ADM (Archer Daniels Midland Company) (USA)

- Pfizer Inc. (USA)

- Perrigo Company plc (Ireland)

- Kerry Group (Ireland)

- Lonza Group (Switzerland)

- Cargill, Incorporated (USA)

- Nature's Bounty Co. (USA)

- Suntory Holdings Limited (Japan)

- Nutricia (Danone) (France)

- Chr. Hansen Holding A/S (Denmark)

- L'Oréal SA (Clichy, France)

- Otsuka Holdings Co., Ltd. (Japan)

- Bayer AG (Germany)

- The Clorox Company (USA)

- Shaklee Corporation (USA)

- RichVit Nutraceutical Co. Ltd. (China)

- ACG Group (India)

- Resource Label Group (USA) and Other Active Players.

Key Industry Developments in the Nutraceutical Products Market:

- In April 2024, As General Mills’ oldest cereal brand, Wheaties is building upon its rich history and expanding its legacy with its newest offering. Wheaties Protein now comes in two fresh flavours, Maple Almond and Honey Pecan, consisting of whole grain flakes with nuts, pumpkin seeds, and honey or maple syrup. It is the perfect answer for a crispy, tasty cereal.

|

Global Nutraceutical Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 409.17 Billion |

|

Forecast Period 2025-32 CAGR: |

8.9 % |

Market Size in 2032: |

USD 809.33 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Amway Corporation (USA), Nestle Health Science (Switzerland), Abbott Laboratories (USA), DuPont Nutrition & Biosciences (USA), DSM Nutritional Products (Netherlands), BASF SE (Germany)and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nutraceutical Products Market by Product Type (2018-2032)

4.1 Nutraceutical Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Functional Food

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Functional Beverages

4.5 Dietary Supplements

4.6 Personal Care

4.7 Pharmaceuticals

Chapter 5: Nutraceutical Products Market by Source (2018-2032)

5.1 Nutraceutical Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fatty Acids

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Amino Acids

5.5 Peptides

5.6 Vitamins

5.7 Minerals

5.8 Phytochemicals

5.9 Probiotics

5.10 Prebiotics

Chapter 6: Nutraceutical Products Market by Form (2018-2032)

6.1 Nutraceutical Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Capsule or Tablet

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

6.5 Powder

6.6 Chewable

Chapter 7: Nutraceutical Products Market by Application (2018-2032)

7.1 Nutraceutical Products Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Immune Support

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Brain Health

7.5 Weight Management

7.6 Joint and Bone Health

7.7 Skin and Beauty

7.8 Energy and Vitality

Chapter 8: Nutraceutical Products Market by Distribution Channel (2018-2032)

8.1 Nutraceutical Products Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Speciality Stores

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Druggist and Pharmaceutical Stores

8.5 Supermarket and Hypermarket

8.6 Online Retails stores

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Nutraceutical Products Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AMWAY CORPORATION (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 NESTLE HEALTH SCIENCE (SWITZERLAND)

9.4 ABBOTT LABORATORIES (USA)

9.5 DUPONT NUTRITION & BIOSCIENCES (USA)

9.6 DSM NUTRITIONAL PRODUCTS (NETHERLANDS)

9.7 BASF SE (GERMANY)

9.8 HERBALIFE NUTRITION LTD. (USA)

9.9 GLANBIA PLC (IRELAND)

9.10 ADM (ARCHER DANIELS MIDLAND COMPANY) (USA)

9.11 PFIZER INC. (USA)

9.12 PERRIGO COMPANY PLC (IRELAND)

9.13 KERRY GROUP (IRELAND)

9.14 LONZA GROUP (SWITZERLAND)

9.15 CARGILL INCORPORATED (USA)

9.16 NATURE'S BOUNTY CO. (USA)

9.17 SUNTORY HOLDINGS LIMITED (JAPAN)

9.18 NUTRICIA (DANONE) (FRANCE)

9.19 CHR. HANSEN HOLDING A/S (DENMARK)

9.20 L'ORÉAL SA (CLICHY

9.21 FRANCE)

9.22 OTSUKA HOLDINGS COLTD. (JAPAN)

9.23 BAYER AG (GERMANY)

9.24 THE CLOROX COMPANY (USA)

9.25 SHAKLEE CORPORATION (USA)

9.26 RICHVIT NUTRACEUTICAL CO. LTD. (CHINA)

9.27 ACG GROUP (INDIA)

9.28 RESOURCE LABEL GROUP (USA) OTHER ACTIVE KEY PLAYERS.

Chapter 10: Global Nutraceutical Products Market By Region

10.1 Overview

10.2. North America Nutraceutical Products Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Functional Food

10.2.4.2 Functional Beverages

10.2.4.3 Dietary Supplements

10.2.4.4 Personal Care

10.2.4.5 Pharmaceuticals

10.2.5 Historic and Forecasted Market Size by Source

10.2.5.1 Fatty Acids

10.2.5.2 Amino Acids

10.2.5.3 Peptides

10.2.5.4 Vitamins

10.2.5.5 Minerals

10.2.5.6 Phytochemicals

10.2.5.7 Probiotics

10.2.5.8 Prebiotics

10.2.6 Historic and Forecasted Market Size by Form

10.2.6.1 Capsule or Tablet

10.2.6.2 Liquid

10.2.6.3 Powder

10.2.6.4 Chewable

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Immune Support

10.2.7.2 Brain Health

10.2.7.3 Weight Management

10.2.7.4 Joint and Bone Health

10.2.7.5 Skin and Beauty

10.2.7.6 Energy and Vitality

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Speciality Stores

10.2.8.2 Druggist and Pharmaceutical Stores

10.2.8.3 Supermarket and Hypermarket

10.2.8.4 Online Retails stores

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Nutraceutical Products Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Functional Food

10.3.4.2 Functional Beverages

10.3.4.3 Dietary Supplements

10.3.4.4 Personal Care

10.3.4.5 Pharmaceuticals

10.3.5 Historic and Forecasted Market Size by Source

10.3.5.1 Fatty Acids

10.3.5.2 Amino Acids

10.3.5.3 Peptides

10.3.5.4 Vitamins

10.3.5.5 Minerals

10.3.5.6 Phytochemicals

10.3.5.7 Probiotics

10.3.5.8 Prebiotics

10.3.6 Historic and Forecasted Market Size by Form

10.3.6.1 Capsule or Tablet

10.3.6.2 Liquid

10.3.6.3 Powder

10.3.6.4 Chewable

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Immune Support

10.3.7.2 Brain Health

10.3.7.3 Weight Management

10.3.7.4 Joint and Bone Health

10.3.7.5 Skin and Beauty

10.3.7.6 Energy and Vitality

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Speciality Stores

10.3.8.2 Druggist and Pharmaceutical Stores

10.3.8.3 Supermarket and Hypermarket

10.3.8.4 Online Retails stores

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Nutraceutical Products Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Functional Food

10.4.4.2 Functional Beverages

10.4.4.3 Dietary Supplements

10.4.4.4 Personal Care

10.4.4.5 Pharmaceuticals

10.4.5 Historic and Forecasted Market Size by Source

10.4.5.1 Fatty Acids

10.4.5.2 Amino Acids

10.4.5.3 Peptides

10.4.5.4 Vitamins

10.4.5.5 Minerals

10.4.5.6 Phytochemicals

10.4.5.7 Probiotics

10.4.5.8 Prebiotics

10.4.6 Historic and Forecasted Market Size by Form

10.4.6.1 Capsule or Tablet

10.4.6.2 Liquid

10.4.6.3 Powder

10.4.6.4 Chewable

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Immune Support

10.4.7.2 Brain Health

10.4.7.3 Weight Management

10.4.7.4 Joint and Bone Health

10.4.7.5 Skin and Beauty

10.4.7.6 Energy and Vitality

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Speciality Stores

10.4.8.2 Druggist and Pharmaceutical Stores

10.4.8.3 Supermarket and Hypermarket

10.4.8.4 Online Retails stores

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Nutraceutical Products Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Functional Food

10.5.4.2 Functional Beverages

10.5.4.3 Dietary Supplements

10.5.4.4 Personal Care

10.5.4.5 Pharmaceuticals

10.5.5 Historic and Forecasted Market Size by Source

10.5.5.1 Fatty Acids

10.5.5.2 Amino Acids

10.5.5.3 Peptides

10.5.5.4 Vitamins

10.5.5.5 Minerals

10.5.5.6 Phytochemicals

10.5.5.7 Probiotics

10.5.5.8 Prebiotics

10.5.6 Historic and Forecasted Market Size by Form

10.5.6.1 Capsule or Tablet

10.5.6.2 Liquid

10.5.6.3 Powder

10.5.6.4 Chewable

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Immune Support

10.5.7.2 Brain Health

10.5.7.3 Weight Management

10.5.7.4 Joint and Bone Health

10.5.7.5 Skin and Beauty

10.5.7.6 Energy and Vitality

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Speciality Stores

10.5.8.2 Druggist and Pharmaceutical Stores

10.5.8.3 Supermarket and Hypermarket

10.5.8.4 Online Retails stores

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Nutraceutical Products Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Functional Food

10.6.4.2 Functional Beverages

10.6.4.3 Dietary Supplements

10.6.4.4 Personal Care

10.6.4.5 Pharmaceuticals

10.6.5 Historic and Forecasted Market Size by Source

10.6.5.1 Fatty Acids

10.6.5.2 Amino Acids

10.6.5.3 Peptides

10.6.5.4 Vitamins

10.6.5.5 Minerals

10.6.5.6 Phytochemicals

10.6.5.7 Probiotics

10.6.5.8 Prebiotics

10.6.6 Historic and Forecasted Market Size by Form

10.6.6.1 Capsule or Tablet

10.6.6.2 Liquid

10.6.6.3 Powder

10.6.6.4 Chewable

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Immune Support

10.6.7.2 Brain Health

10.6.7.3 Weight Management

10.6.7.4 Joint and Bone Health

10.6.7.5 Skin and Beauty

10.6.7.6 Energy and Vitality

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Speciality Stores

10.6.8.2 Druggist and Pharmaceutical Stores

10.6.8.3 Supermarket and Hypermarket

10.6.8.4 Online Retails stores

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Nutraceutical Products Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Functional Food

10.7.4.2 Functional Beverages

10.7.4.3 Dietary Supplements

10.7.4.4 Personal Care

10.7.4.5 Pharmaceuticals

10.7.5 Historic and Forecasted Market Size by Source

10.7.5.1 Fatty Acids

10.7.5.2 Amino Acids

10.7.5.3 Peptides

10.7.5.4 Vitamins

10.7.5.5 Minerals

10.7.5.6 Phytochemicals

10.7.5.7 Probiotics

10.7.5.8 Prebiotics

10.7.6 Historic and Forecasted Market Size by Form

10.7.6.1 Capsule or Tablet

10.7.6.2 Liquid

10.7.6.3 Powder

10.7.6.4 Chewable

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Immune Support

10.7.7.2 Brain Health

10.7.7.3 Weight Management

10.7.7.4 Joint and Bone Health

10.7.7.5 Skin and Beauty

10.7.7.6 Energy and Vitality

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Speciality Stores

10.7.8.2 Druggist and Pharmaceutical Stores

10.7.8.3 Supermarket and Hypermarket

10.7.8.4 Online Retails stores

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Nutraceutical Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 409.17 Billion |

|

Forecast Period 2025-32 CAGR: |

8.9 % |

Market Size in 2032: |

USD 809.33 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Amway Corporation (USA), Nestle Health Science (Switzerland), Abbott Laboratories (USA), DuPont Nutrition & Biosciences (USA), DSM Nutritional Products (Netherlands), BASF SE (Germany)and Other Active Players. |

||