Global Neurotechnology Market Overview

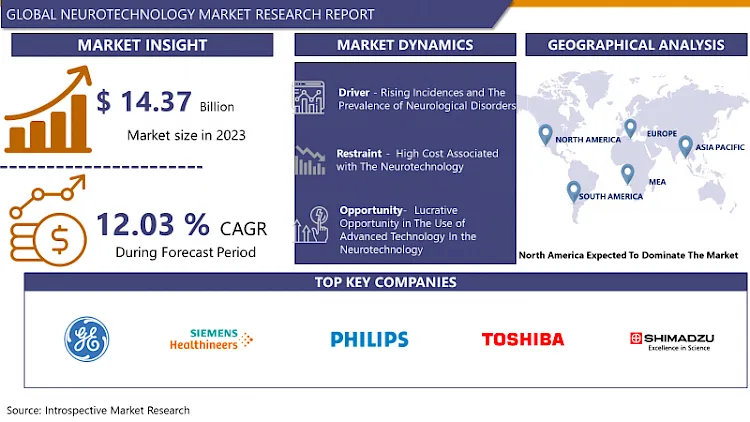

The Global Neurotechnology Market size is expected to grow from USD 14.37 billion in 2023 to USD 39.95 billion by 2032, at a CAGR of 12.03 % during the forecast period (2024-2032)

Neurotechnology, an interdisciplinary field integrating neuroscience, engineering, and computer science, focuses on creating methods and devices that interface with the nervous system to monitor, influence, or augment neural activity.

- This technology holds immense potential, especially in understanding and treating neurological disorders, enhancing cognitive functions, and even augmenting human capabilities. While neurotechnology has roots in earlier medical and scientific endeavors, its advancement has accelerated rapidly with the rise of artificial intelligence (AI) and machine learning, which offer sophisticated tools to analyze and interpret complex brain data.

- The potential applications of neurotechnology are vast and varied. It promises breakthroughs in treating conditions such as Parkinson's disease, epilepsy, and depression through deep brain stimulation and neuroprosthetics. Additionally, brain-computer interfaces (BCIs) are being developed to restore lost sensory or motor functions, potentially allowing paralyzed individuals to control prosthetic limbs or communicate through thought alone. Beyond medical applications, neurotechnology also extends into enhancing human cognition and memory, raising the possibility of superhuman abilities.

- However, the integration of neurotechnology and AI raises ethical and societal concerns. The merging of brain and machine blurs the lines between human identity and technological augmentation, leading to debates over the potential loss of privacy, autonomy, and mental integrity. These concerns have sparked discussions around "neuro-rights," which advocate for the protection of mental privacy, identity, and free will in the face of advancing neurotechnologies. As neurotechnology continues to evolve, it offers both transformative possibilities and significant ethical challenges. The future of this field will likely involve balancing the immense benefits of brain-machine integration with the need to safeguard individual rights and societal values.

Market Dynamics And Factors For Neurotechnology Market

Drivers:

Rising Incidences and The Prevalence of The Neurological Disorders

The growing prevalence of disease-related neurology such as Stroke, Alzheimer's Disease, Epilepsy, Parkinson’s, Multiple Sclerosis, Migraines, and Meningitis is the key factor that supported the growth of the market. According to WHO, 15 million people experience strokes every year. Stroke is caused due to various factors including smoking, high blood pressure, high cholesterol level, and diabetes. Dementia is one of the neurological diseases that cause the loss of memory, and language, and problems interfere with daily life more than 55 million people were living with dementia in 2020. Alzheimer’s disease is a common type of dementia.

According to Statista, 6.1 million people were affected by Alzheimer's Disease in the year 2020. Parkinson's disease is the second most common neurological disorder after Alzheimer's, affecting 7–10 million individuals worldwide each year. According to Statista, Japan has the population with the highest percentage of senior citizens. Most cases of neurological diseases are found in older people. Thus, the growing prevalence of neurological disorders and rising demand for various neurotechnology for diagnosis purposes propels the growth of the neurotechnology market.

Restraints:

Present Technologies Are Far From Being Highly Scalable

Despite their potential, current neurotechnologies are far from reliable enough for use in daily work and life. Existing systems frequently and repeatedly make errors in decoding users' mental states or intentions from their neurophysiological signals. This low reliability can be attributed to a variety of factors, including imperfect neurophysiological sensors, particularly Electroencephalography (EEG) and functional Near Infrared Spectroscopy (fNIRS), which only record data with low Signal-to-Noise-Ratio (SNR). These physiological signals are extremely sensitive to systemic artifacts originating from non-neuronal sources, such as muscles (Electromyography), eyes (Electrooculography), motions for EEG, or from various light sources or motions for fNIRS, or from the environment itself. This deterioration of neurophysiological signals due to artifacts is even more pronounced in real-life situations with potentially mobile users and noisy environments, which is also the target use case of Neuroergonomics thus, hampering the development of the neurotechnology market over the forecasted period.

Opportunity:

Lucrative Opportunity in The Use of Advanced Technology In the Neurotechnology

The various innovative technology used in neurotechnology improves the efficiency of the neurotechnology which provide a huge opportunity for the market during the forecast period.

The adoption of new neurotechnologies such as biohybrid neuronics and in-vivo optogenetics is increased to improve neurological disorders. Optogenetics is one of the novel technologies that modulate neuron activities. Moreover, the use of MEMS, and AI in neurotechnology to improve efficiency. Owing to the prevalence of chronic neurological disorders the key players and government of various countries rising their investment in the research and development of novel neurotechnology that offers a remunerative opportunity for the neurotechnology market in the projected timeframe.

Segmentation Analysis Of The Neurotechnology Market

By Type, Neurostimulation is expected to have the maximum market share in neurotechnology. Neurostimulation is the most popular and purposeful modulation for monitoring the activity of the nervous system. It is the technology that improves the quality of those people who suffer from severe paralyzing, losses various sense organs, and permanent reduction of severe chronic pain. Neurostimulation therapies contain invasive and noninvasive approaches which consist of electrical stimulation application to improve the neural function within a circuit. The neurostimulation devices include a deep brain stimulator, transcutaneous electrical nerve stimulation [TENS], a spinal cord stimulator, and a vagus nerve stimulator. The demand for neurostimulation devices is rising due to the growing prevalence of the lifestyle diseases such as chronic pain, depression, urinary and fecal incontinence, essential tremor, and other neurological disorders. Moreover, High investment in neurological R&D by researchers and market players from various countries. For instance, in January 2021, Abbott launched Neuso Spheremy Path to track and report on patient-perceived pain relief. Additionally, neurostimulators are also used for interstitial cystitis, obsessive-compulsive disorders, and asthma. The growing geriatric population and major players emphasize technological advancement that provides growth for the neurotechnology market.

By Application, diagnosis holds the largest share of the neurotechnology market. The diagnosis of neurological disorders helps doctors to decide the option for treatment and prevent future health risks to patients. The physician and researcher use various diagnostic imaging techniques, chemicals, and metabolic tests for the detection, management, and treatment of neurological diseases. The diagnostic test includes a CT scan, electroencephalogram (EEG), MRI, electromyography, nerve conductive velocity, position emission tomography (PET), arteriogram, spinal tap, myelogram, ultrasound, and other tests. These diagnostic tests help to detect the cancer disease type and monitor its progression, through which physicians can take decisions about the proper treatment of a disease. The diagnostic test is performed in the hospital as well as diagnostic centers. The growing incidence of neurologic disorder, and growing research and development activity that helps to increase the number of diagnostic centers that provides the growth for neurotechnology market.

Regional Analysis Of The Neurotechnology Market

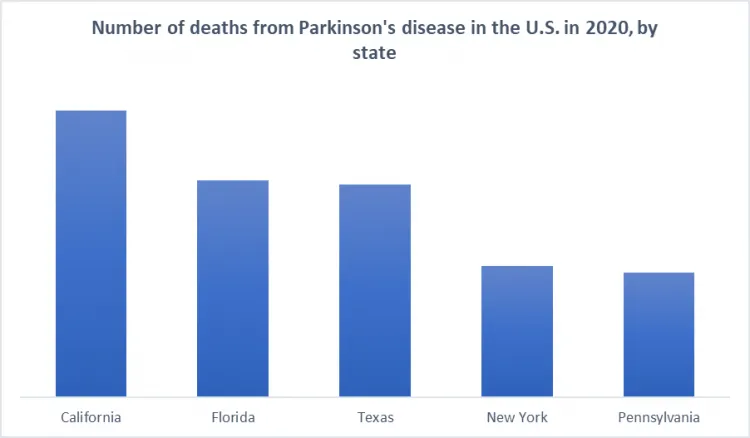

North America is the dominating country in the neurotechnology market owing to the growing prevalence of neurological disorders. The rising aging population, unhealthy eating habits, and hectic lifestyles are the common causes of neurological disorders. According to Statista, 32.51 million people smoked cigarettes in 2020. Cigarette smoking is the major cause of neurological disorders. The following figure shows the number of Parkinson's disease deaths in the U.S. in 2020 by state.

Moreover, about 60,000 Americans are diagnosed with Parkinson’s disease. For the treatment of such neurological disorders, the demand for neurotechnology is increased from the hospital as well as diagnostic centers in this region. Therefore, the research center and governments of the various countries of this region increase their investment in the research and development activity of neurotechnology that supports the growth of the neurotechnology market over the forecast period.

The Asia Pacific is the second-dominated region in the neurotechnology market owing to the large population base with the highest number of people living with neurological disorders. The aging population of the APAC region is rapidly growing. Thus, the number of cases of neurological disorder is also increased. By Statista, in China, there are 81% of the population suffers from psychological disorders and about 10 million people live with epilepsy. APAC is a developing region, thereby increasing the adoption of unhealthy habits, and poor diets cause neurological disorders. Additionally, peoples in this region live hectic lifestyles is the main cause of migraine, strokes, and depression. Thus, the population with neurological diseases is increasing in this region. Moreover, the high investment by the government and major key players of neurotechnology in the research and development of the new technology provides the opportunity for increasing the neurotechnology market during the forecast period.

Europe has significant growth in the neurotechnology market due to the growing prevalence of neurological disorders. Peoples in this region live with unhealthy habits like consumption of alcohol, smoking, and hectic lifestyle that support an increase in the prevalence of neurological disease. For instance, Statista stated that in 2021, there were 2.7 million people in Italy suffering from neurological disorders. Thus, the adoption of neurotechnology in diagnostic, hospitals, and clinics is increased. Therefore, the government and research centers in this region more spend on the development of novel neurotechnology that provides growth for the neurotechnology market of this region.

Top Key Players Covered In Neurotechnology Market

- General Electric Company (The U.S)

- Siemens Healthineers (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Toshiba Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- Hitachi Medical Corporation (Japan)

- Elekta AB (Sweden)

- Tristan Technologies, Inc. (The U.S)

- Natus Medical Incorporated (The U.S)

- Medtronic plc (U.S.)

- Boston Scientific Corporation (U.S.)

- NeuroPace, Inc. (U.S.)

- LivaNova PLC (UK)

- St. Jude Medical (now part of Abbott Laboratories) (U.S.)

- NeuroSigma, Inc. (U.S.)

- Ceregate (Germany)

- Axovant Gene Therapies Ltd. (U.S.)

- Nervana Medical (U.S.)

- Magstim (UK), and other major players.

Key Industry Development In The Neurotechnology Market

- In May 2024, Allianz Trade and Inclusive Brains collaborated to enhance disability inclusion through AI and neurotechnology. Allianz Trade, a global leader in trade credit insurance, and Inclusive Brains, a French start-up specializing in advanced neural interfaces driven by generative AI, teamed up to create Prometheus. This innovative brain-machine interface converted diverse neurophysiological data—such as brainwaves, heart activity, facial expressions, and eye movements—into mental commands. The technology aimed to assist individuals unable to use their hands or speak, enabling them to operate workstations, and connected devices, and navigate digital environments without keyboards, touchscreens, or vocal commands, ultimately advancing autonomy and access to education and employment.

- In April 2024, Tether, the company behind the stablecoin USDT, acquired a majority stake in Blackrock Neurotech, a leading brain-computer-interface (BCI) developer, in a strategic investment. The $200 million deal, announced in a press release on April 29, granted Tether a controlling interest in Blackrock Neurotech. Blackrock Neurotech, recognized for its pioneering advancements in BCI technology, had been at the forefront of creating systems that facilitated direct communication between the human brain and external devices, as stated in the release.

|

Global Neurotechnology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 14.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.03 % |

Market Size in 2032: |

USD 39.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Neurotechnology Market by Type (2018-2032)

4.1 Neurotechnology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Neurostimulation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Imaging Modalities

4.5 Neurological Implants

4.6 Cranial Surface Measurement

4.7 Others

Chapter 5: Neurotechnology Market by Application (2018-2032)

5.1 Neurotechnology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diagnostic Centers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ambulatory Surgical Centers

5.5 Hospitals

5.6 Clinics

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Neurotechnology Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABERCROMBIE & KENT USA

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 LLC. (USA)

6.4 COX & KINGS LTD. (INDIA)

6.5 BUTTERFIELD & ROBINSON INC. (CANADA)

6.6 SCOTT DUNN LTD. (UK)

6.7 KENSINGTON TOURS LTD. (US)

6.8 MICATO SAFARIS (INDIA)

6.9 THOMAS COOK LTD. (INDIA)

6.10 MEREDITH CORPORATION

6.11 LLC (US)

6.12 TRAVCOA CORPORATION (CALIFORNIA)

6.13 BELMOND LTD. (UK)

6.14 FOUR SEASONS HOTELS AND RESORTS (CANADA)

6.15 AMAN RESORTS (SINGAPORE)

6.16 THE RITZ-CARLTON HOTEL COMPANY (USA)

6.17 LUXURY TRAVEL GROUP (AUSTRALIA)

6.18 PRIVATEFLY (UK)

6.19 HURTIGRUTEN EXPEDITIONS (NORWAY)

6.20 TAUCK (USA)

6.21 SILVERSEA CRUISES (LUXEMBOURG)

6.22 VIRTUOSO (USA)

6.23 TUI AG

6.24 (GERMANY)

6.25

Chapter 7: Global Neurotechnology Market By Region

7.1 Overview

7.2. North America Neurotechnology Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Neurostimulation

7.2.4.2 Imaging Modalities

7.2.4.3 Neurological Implants

7.2.4.4 Cranial Surface Measurement

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Diagnostic Centers

7.2.5.2 Ambulatory Surgical Centers

7.2.5.3 Hospitals

7.2.5.4 Clinics

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Neurotechnology Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Neurostimulation

7.3.4.2 Imaging Modalities

7.3.4.3 Neurological Implants

7.3.4.4 Cranial Surface Measurement

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Diagnostic Centers

7.3.5.2 Ambulatory Surgical Centers

7.3.5.3 Hospitals

7.3.5.4 Clinics

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Neurotechnology Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Neurostimulation

7.4.4.2 Imaging Modalities

7.4.4.3 Neurological Implants

7.4.4.4 Cranial Surface Measurement

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Diagnostic Centers

7.4.5.2 Ambulatory Surgical Centers

7.4.5.3 Hospitals

7.4.5.4 Clinics

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Neurotechnology Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Neurostimulation

7.5.4.2 Imaging Modalities

7.5.4.3 Neurological Implants

7.5.4.4 Cranial Surface Measurement

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Diagnostic Centers

7.5.5.2 Ambulatory Surgical Centers

7.5.5.3 Hospitals

7.5.5.4 Clinics

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Neurotechnology Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Neurostimulation

7.6.4.2 Imaging Modalities

7.6.4.3 Neurological Implants

7.6.4.4 Cranial Surface Measurement

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Diagnostic Centers

7.6.5.2 Ambulatory Surgical Centers

7.6.5.3 Hospitals

7.6.5.4 Clinics

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Neurotechnology Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Neurostimulation

7.7.4.2 Imaging Modalities

7.7.4.3 Neurological Implants

7.7.4.4 Cranial Surface Measurement

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Diagnostic Centers

7.7.5.2 Ambulatory Surgical Centers

7.7.5.3 Hospitals

7.7.5.4 Clinics

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Neurotechnology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 14.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.03 % |

Market Size in 2032: |

USD 39.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Neurotechnology Market research report is 2023-2032.

General Electric Company (The U.S),Siemens Healthineers (Germany),Koninklijke Philips N.V. (Netherlands),Toshiba Medical Systems Corporation (Japan),Shimadzu Corporation (Japan),Hitachi Medical Corporation (Japan),Elekta AB (Sweden),Tristan Technologies, Inc. (The U.S),Natus Medical Incorporated (The U.S),Medtronic plc (U.S.),Boston Scientific Corporation (U.S.),NeuroPace, Inc. (U.S.),LivaNova PLC (UK),St. Jude Medical (now part of Abbott Laboratories) (U.S.),NeuroSigma, Inc. (U.S.),Ceregate (Germany),Axovant Gene Therapies Ltd. (U.S.),Nervana Medical (U.S.),Magstim (UK), and other major players.

The Neurotechnology Market is segmented into type, application, and region. By Type, the market is categorized into Neurostimulation, Imaging Modalities, Neurological Implants, Cranial Surface Measurement, and Others. By Application, the market is categorized into Diagnostic Centers, Ambulatory Surgical Centers, Hospitals, Clinics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Neurotechnology is an innovative technology that is used to monitor neural activity. This is an electronic device also developed to repair, control, and improve brain functions. The neurotechnologies have common design goals consisting of controlling external devices like neuroprosthetics by using neural activity readings, through neuromodulation changes the neural activity to repair the neural functions affected by neurological disorders.

The Global Neurotechnology Market size is expected to grow from USD 14.37 billion in 2023 to USD 39.95 billion by 2032, at a CAGR of 12.03 % during the forecast period (2024-2032)