Molecular Biosensors market Synopsis

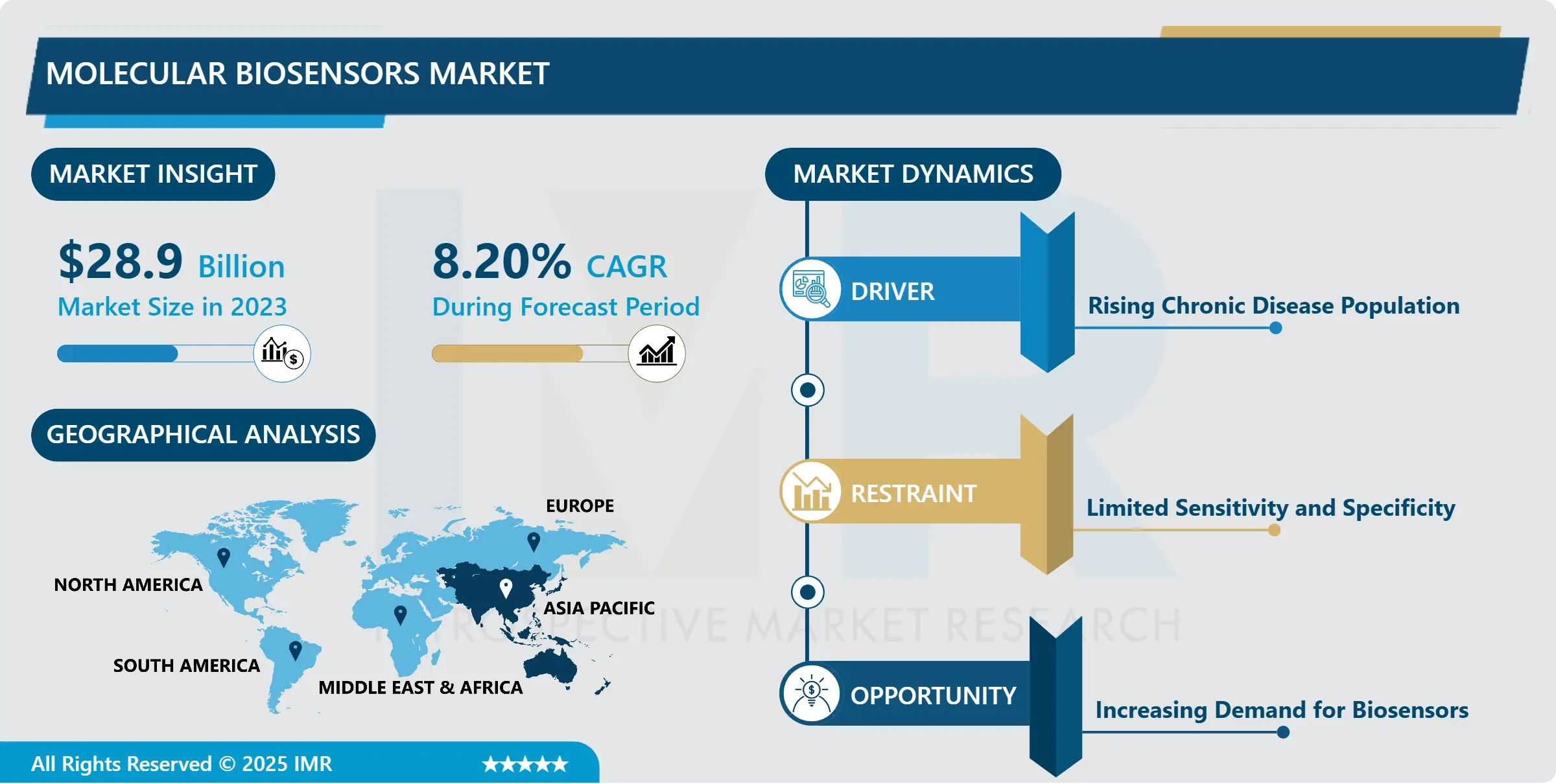

Molecular Biosensors market size is expected to grow from USD 28.9 Billion in 2023 to USD 58.74 Billion by 2032, at a CAGR of 8.20% during the forecast period (2024-2032)

Medical biosensors are devices designed for the detection of biological markers or analytics, providing valuable diagnostic information in healthcare. These innovative tools leverage various technologies, such as electrochemical, optical, or piezoelectric, to convert biological responses into measurable signals. Used in hospitals, clinics, and point-of-care settings, medical biosensors play an important role in diagnosing diseases, monitoring health parameters, and enabling rapid, on-site testing.

Molecular biosensors are advanced analytical devices designed to detect specific biological molecules, providing insights into various fields, including medicine, environmental monitoring, and biotechnology. These biosensors utilize diverse technologies such as electrochemical, optical, or piezoelectric methods to transduce molecular interactions into measurable signals. Their applications span from medical diagnostics, identifying DNA or proteins, to environmental monitoring, detecting pollutants.

Their applications range from glucose monitoring for diabetes management to identifying specific biomolecules indicative of various medical conditions. With advancements in miniaturization and wearable technology, medical biosensors contribute to personalized and real-time patient care.

Advantages of molecular biosensors include high sensitivity, rapid response times, and specificity in detecting target molecules. They help in enabling real-time monitoring, aiding in early disease diagnosis, and are integral to the development of personalized medicine. The market trend for molecular biosensors is rapid growth due to increasing demand for point-of-care testing, advancements in nanotechnology, and a growing emphasis on healthcare decentralization. The demand is growing by their versatility in applications, ranging from detecting biomarkers for diseases to ensuring food safety and environmental compliance. Research and development in molecular biosensors are impacting diagnostics and monitoring, providing efficient, portable, and accurate analytical tools across various industries.

Molecular Biosensors Market Trend Analysis:

Rising Chronic Disease Population

- Chronic diseases, such as diabetes, cardiovascular diseases, and various forms of cancer, raise substantial global health challenges. Molecular biosensors offer a revolutionary approach to disease detection and monitoring, providing accurate and rapid identification of specific biomarkers associated with these conditions. The ability of molecular biosensors to detect molecular interactions at the molecular level makes them invaluable in diagnosing and managing chronic diseases.

- Molecular biosensors play an important role in facilitating early diagnosis and allow healthcare professionals to initiate timely treatment strategies and disease management plans. Chronic diseases are growing due to changes in lifestyle and the aging population, has raised the demand for technologies to enable proactive healthcare measures. Molecular biosensors enhance personalized medicine and global healthcare by treating individual, and patient profiles, addressing chronic conditions, and playing an important role in diagnostics and patient care.

Increasing Demand for Biosensors

- Chronic diseases like diabetes and cancer are on the rise, demanding early detection and precise monitoring. Biosensors are transforming healthcare by offering rapid, accurate measurements of key biomarkers, enabling early intervention and personalized treatment plans. Think real-time glucose monitoring for diabetics or instant cancer detection on a chip. This translates to better health outcomes, reduced healthcare costs, and a shift towards proactive preventative care.

- Point-of-care (POC) testing, powered by biosensors, revolutionizes healthcare by providing instant, lab-quality results, and empowering patients, decentralizing care, and streamlining diagnostics for a more convenient future. Industries such as agriculture, food and beverage, and environmental science benefit from the ability of biosensors to deliver accurate and timely information, ensuring compliance with regulatory standards.

- Biosensors are becoming indispensable tools in various industries due to their integration with IoT and wearable devices, expanding their applications across agriculture, environmental monitoring, and consumer electronics.

Molecular Biosensors Market Segment Analysis:

Molecular Biosensors Market Segmented based on Product Type, Technology, and Application

By Product Type, the Wearable Biosensors segment is expected to dominate the market during the forecast Period

- Wearable biosensors provide real-time data on various biomarkers, enabling individuals to proactively manage their health. The convenience and comfort offered by wearable biosensors, such as smartwatches and fitness trackers, make them attractive to consumers. The integration of molecular biosensors into wearable devices aligns with growing consumer interest in wellness and fitness. These biosensors can monitor various markers, including glucose levels, hormones, and biomolecules, indicative of specific health conditions. The ease of use, portability, and connectivity of wearable biosensors contribute to the dominance of Wearable Biosensors in the Molecular Biosensors Market.

Molecular Biosensors Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific is expected to dominate the Molecular Biosensors market due to factors such as the increasing prevalence of chronic diseases and the aging population in countries like China, Japan, and India. These countries require advanced diagnostic technologies for early and accurate disease detection. The region is also witnessing substantial investments in healthcare infrastructure and research, with governments and private entities focusing on the biotechnology and life sciences sectors.

- The region's strong manufacturing capabilities and key market players contribute to the accessibility and affordability of molecular biosensor technologies. The increasing awareness of personalized medicine and point-of-care testing in the region drives the demand for molecular biosensors, offering rapid and on-site detection of specific biomarkers. With market-friendly policies, technological advancements, and a growing healthcare market, Asia Pacific is positioned to lead the Molecular Biosensors market.

Key Players Covered in Molecular Biosensors Market:

- Regal Rexnord Corporation (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Dellner Bubenzer (U.S.)

- Parker Hannifin Corp (U.S.)

- Moog Inc. (U.S.)

- KTR Systems GmbH (Germany)

- Schaeffler AG (Germany)

- Romheld GmbH (Germany)

- SIBRE (Germany)

- Schneider Electric SE (France)

- Danfoss (Denmark)

- Eaton Corporation plc (Ireland)

- Wartsila Corporation (Finland)

- Sulzer Ltd (Switzerland)

- Trebu Technology (Netherlands)

- Toshiba Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Fuji Electric FA Components & Systems Co., Ltd (Japan)

- Nidec Corporation (Japan)

- Hitachi, Ltd. (Japan)

- KSB Limited (India), and Other Major Players

Key Industry Developments in the Molecular Biosensors Market:

- In June 2023, GrapheneDx, General Graphene Corporation, and Sapphires announced a strategic partnership aimed at revolutionizing point-of-care and consumer diagnostics through the industrialization of graphene-based biosensors. This collaboration will leverage the unique properties of graphene to create advanced medical devices capable of diagnosing a variety of diseases quickly and accurately. The partnership promises to enhance the accessibility and efficiency of diagnostics in both clinical and consumer settings, marking a significant advancement in medical technology. This initiative underscores the potential of graphene as a transformative material in the healthcare industry.

- December 2023, Abbott Laboratories announced the development of a new point-of-care molecular biosensor for rapid detection of antibiotic resistance in bacteria. Aims to improve antibiotic selection and combat antimicrobial resistance.

|

Molecular Biosensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.9 Billion. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 58.74 Billion. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Molecular Biosensors Market by Product Type (2018-2032)

4.1 Molecular Biosensors Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wearable Biosensors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Handheld and Portable Biosensors

4.5 Implantable Biosensors

Chapter 5: Molecular Biosensors Market by Technology (2018-2032)

5.1 Molecular Biosensors Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Optical Biosensors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Thermal Biosensors

5.5 Electrochemical Biosensors

5.6 Piezoelectric Biosensors

Chapter 6: Molecular Biosensors Market by Application (2018-2032)

6.1 Molecular Biosensors Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Medical Diagnostics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food and Beverages

6.5 Environment Safety

6.6 Defense and Security

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Molecular Biosensors Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JABIL INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 E INK HOLDINGS INC. (US)

7.4 BEBOP SENSORS INC. (US)

7.5 DOWDUPONT INC. (US)

7.6 HOLST AND DUPONT (US)

7.7 MOLEX (US)

7.8 NEXTFLEX (US)

7.9 ALANGO TECHNOLOGIES (US)

7.10 VISTA MEDICAL LTD. (CANADA)

7.11 COATEMA (GERMANY)

7.12 HENKEL (GERMANY)

7.13 HEXOSKIN (FRANCE)

7.14 SENSING TEX S.L. (SPAIN)

7.15 HOLST CENTRE (NETHERLANDS)

7.16 PRINTED ELECTRONICS APPLICATIONS (PEA) (UK)

7.17 AGFA-GEVAERT (BELGIUM)

7.18 FLEX LTD. (SINGAPORE)

7.19 POLYMATECH JAPAN CO. LTD. (JAPAN)

7.20 NISSHA (JAPAN)

7.21 COGNIVA (ISRAEL)

7.22

Chapter 8: Global Molecular Biosensors Market By Region

8.1 Overview

8.2. North America Molecular Biosensors Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Wearable Biosensors

8.2.4.2 Handheld and Portable Biosensors

8.2.4.3 Implantable Biosensors

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Optical Biosensors

8.2.5.2 Thermal Biosensors

8.2.5.3 Electrochemical Biosensors

8.2.5.4 Piezoelectric Biosensors

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Medical Diagnostics

8.2.6.2 Food and Beverages

8.2.6.3 Environment Safety

8.2.6.4 Defense and Security

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Molecular Biosensors Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Wearable Biosensors

8.3.4.2 Handheld and Portable Biosensors

8.3.4.3 Implantable Biosensors

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Optical Biosensors

8.3.5.2 Thermal Biosensors

8.3.5.3 Electrochemical Biosensors

8.3.5.4 Piezoelectric Biosensors

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Medical Diagnostics

8.3.6.2 Food and Beverages

8.3.6.3 Environment Safety

8.3.6.4 Defense and Security

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Molecular Biosensors Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Wearable Biosensors

8.4.4.2 Handheld and Portable Biosensors

8.4.4.3 Implantable Biosensors

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Optical Biosensors

8.4.5.2 Thermal Biosensors

8.4.5.3 Electrochemical Biosensors

8.4.5.4 Piezoelectric Biosensors

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Medical Diagnostics

8.4.6.2 Food and Beverages

8.4.6.3 Environment Safety

8.4.6.4 Defense and Security

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Molecular Biosensors Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Wearable Biosensors

8.5.4.2 Handheld and Portable Biosensors

8.5.4.3 Implantable Biosensors

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Optical Biosensors

8.5.5.2 Thermal Biosensors

8.5.5.3 Electrochemical Biosensors

8.5.5.4 Piezoelectric Biosensors

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Medical Diagnostics

8.5.6.2 Food and Beverages

8.5.6.3 Environment Safety

8.5.6.4 Defense and Security

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Molecular Biosensors Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Wearable Biosensors

8.6.4.2 Handheld and Portable Biosensors

8.6.4.3 Implantable Biosensors

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Optical Biosensors

8.6.5.2 Thermal Biosensors

8.6.5.3 Electrochemical Biosensors

8.6.5.4 Piezoelectric Biosensors

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Medical Diagnostics

8.6.6.2 Food and Beverages

8.6.6.3 Environment Safety

8.6.6.4 Defense and Security

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Molecular Biosensors Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Wearable Biosensors

8.7.4.2 Handheld and Portable Biosensors

8.7.4.3 Implantable Biosensors

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Optical Biosensors

8.7.5.2 Thermal Biosensors

8.7.5.3 Electrochemical Biosensors

8.7.5.4 Piezoelectric Biosensors

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Medical Diagnostics

8.7.6.2 Food and Beverages

8.7.6.3 Environment Safety

8.7.6.4 Defense and Security

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Molecular Biosensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.9 Billion. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 58.74 Billion. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||