Minor Surgical Lights Market Synopsis

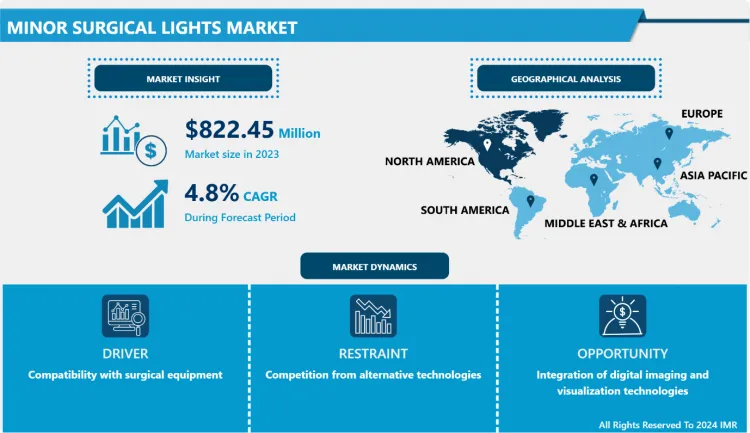

Minor Surgical Lights Market Size Was Valued at USD 861.93 Million in 2024 and is Projected to Reach USD 1254.19 Million by 2032, Growing at a CAGR of 4.8% From 2025-2032.

Minor surgical lights, often referred to as exam lights or procedure lights, are specialized lighting fixtures designed for illuminating small surgical or medical procedures. They provide focused and adjustable illumination to assist healthcare professionals in performing minor procedures, examinations, and treatments in medical facilities such as clinics, doctors' offices, and outpatient centers.

Minor surgical lights are used in various settings, including outpatient clinics, hospitals, and medical examinations, to provide clear visibility during minor procedures like suturing, incision and drainage, biopsies, and wound debridement. They are also used in emergency rooms for urgent medical interventions, dental offices for focused illumination during extractions, root canals, and dental implant placements, and in veterinary medicine for clear visibility of the surgical site during minor procedures and examinations on animals.

Minor surgical procedures require precise lighting to ensure that surgeons have a clear view of the operating area. Minor surgical lights are designed to provide focused, shadow-free illumination, allowing surgeons to work with precision. Adequate lighting is essential for patient safety during surgical procedures. Minor surgical lights help to minimize the risk of errors and complications by ensuring that surgeons can see the surgical site clearly and accurately.

Minor surgical lights are designed to be efficient and easy to use, allowing surgeons to focus on the task at hand without being hindered by inadequate lighting. This can help to improve workflow and reduce the time required to complete minor surgical procedures. Minor surgical lights are often designed to be adjustable and versatile, allowing surgeons to position the light source exactly where it is needed.

Minor Surgical Lights Market Trend Analysis- Compatibility with Surgical Equipment

- In the context of the Minor Surgical Lights market, compatibility with surgical equipment refers to the ability of the surgical lights to seamlessly integrate and work in conjunction with other surgical tools and equipment commonly used during minor surgical procedures. This compatibility ensures smooth operations, enhances workflow efficiency, and minimizes potential disruptions or compatibility issues during surgical procedures.

- The lights should offer various mounting options such as ceiling, wall, or floor mounts to accommodate different surgical setups and equipment configurations. The lights should be adjustable and allow for precise positioning to illuminate the surgical field without obstructing the view or access to other surgical instruments and equipment. The lights should be compatible with standard electrical outlets and voltage requirements commonly found in surgical facilities, ensuring safe and reliable operation.

- The lights should be designed to interface seamlessly with other surgical equipment such as surgical tables, anesthesia machines, and imaging systems, allowing for coordinated and synchronized operation. The materials and construction of the lights should be compatible with standard sterilization methods used in healthcare settings to maintain a sterile surgical environment. The lights may feature integration with centralized control systems or surgical suite management software, allowing for centralized control and coordination of multiple surgical devices and equipment.

Minor Surgical Lights Market Restraints- Competition from Alternative Technologies

- Competition from alternative technologies in the Minor Surgical Lights market refers to the restraint posed by other lighting solutions that may offer similar or superior benefits compared to traditional minor surgical lights. These alternative technologies could include advanced LED lighting systems, fiber-optic illumination, or even emerging technologies such as laser-based lighting.

- LED lighting, gained popularity in recent years due to its energy efficiency, long lifespan, and ability to produce bright, focused light. Fiber-optic lighting systems offer flexibility and precise illumination control, making them attractive for surgical procedures. Laser-based lighting, although still in the early stages of development, has the potential to revolutionize surgical lighting with its intense, focused beams.

- The presence of these alternative technologies puts pressure on traditional minor surgical light manufacturers to innovate and improve their products to remain competitive. They may need to focus on enhancing features such as brightness, color temperature control, flexibility, and ease of use to differentiate themselves in the market.

- However, healthcare facilities may choose alternative technologies if they offer better performance, cost-effectiveness, or other advantages over traditional minor surgical lights. Manufacturers must therefore stay abreast of technological advancements and market trends to adapt their offerings accordingly and maintain their competitive edge.

Minor Surgical Lights Market Opportunity - Integration of Digital Imaging and Visualization Technologies

- The integration of digital imaging and visualization technologies into the Minor Surgical Lights market represents an exciting opportunity to enhance surgical procedures and improve patient outcomes. By incorporating advanced digital imaging capabilities into surgical lights, healthcare providers can benefit from real-time visualization of the surgical field with enhanced clarity and precision.

- These technologies allow for better illumination of the surgical site, reducing shadows and providing surgeons with a clearer view of their operating area. Digital imaging systems can also capture high-resolution images and videos of the surgical procedure, which can be useful for documentation, teaching, and reviewing surgical techniques.

- The integration of visualization technologies enables features such as adjustable light intensity, color temperature control, and even augmented reality overlays, further enhancing the surgeon's ability to perform delicate procedures with accuracy and efficiency.

- The integration of digital imaging and visualization technologies into Minor Surgical Lights presents opportunities for companies to differentiate their products and gain a competitive edge. Healthcare facilities are increasingly seeking advanced surgical equipment that can improve patient outcomes and enhance the overall efficiency of surgical procedures.

Minor Surgical Lights Market Challenge- Limited Access in Rural Areas

- Limited access in rural areas of the Minor Surgical Lights market poses a significant challenge for healthcare facilities and professionals operating in these regions. Rural areas often have fewer resources and infrastructure compared to urban areas, making it difficult to procure and maintain advanced medical equipment such as surgical lights.

- Rural areas are often located far from major cities or medical supply centers, leading to logistical challenges in transporting and delivering surgical lights to these locations. Rural areas may lack adequate infrastructure such as reliable electricity supply or appropriate facilities to install and use surgical lights effectively.

- Healthcare facilities in rural areas may have limited budgets, making it difficult to invest in expensive surgical lighting equipment. Additionally, maintenance and repair costs can be prohibitive in remote areas where specialized technicians may not be readily available. Healthcare professionals in rural areas may have limited access to training and education on the proper use and maintenance of surgical lights, potentially leading to inefficiencies or misuse of the equipment.

Minor Surgical Lights Market Segment Analysis:

Minor Surgical Lights Market Segmented on the basis of product type, application, modality, and end-users.

By Product Type, LED Lights segment is expected to dominate the market during the forecast period

- LED lights are highly energy-efficient compared to traditional lighting technologies. They consume significantly less power while providing equivalent or better illumination, resulting in lower operating costs over time. This efficiency appeals to healthcare facilities seeking to reduce energy expenses and operate more sustainably.

- LED lights have a longer lifespan than traditional lighting options, which reduces the frequency of replacements and associated maintenance costs. In surgical settings where uninterrupted illumination is critical, the longevity of LED lights provides reliability and minimizes downtime for maintenance.

- LED lights offer excellent brightness and color rendering properties, allowing surgeons to have clear visibility and accurate color rendition during procedures. This precision is crucial for performing intricate surgeries where visual clarity is paramount.

- LED lights emit minimal heat compared to traditional lighting sources, which helps in maintaining a comfortable operating environment for both the surgical team and the patient. However, reduced heat emission lowers the risk of tissue desiccation or thermal damage during procedures.

- LED technology continues to evolve, leading to the development of innovative features such as adjustable color temperature, intensity control, and shadow management systems. These advancements enhance the versatility and performance of LED surgical lights, making them more attractive to healthcare providers.

By Application, Surgical Suite segment held the largest share in 2024

- Surgical suites are dedicated areas in hospitals or clinics for performing surgical procedures, requiring effective lighting solutions to ensure precision and accuracy. These spaces accommodate a wide range of procedures, from minor interventions to complex operations, and require versatile lighting to meet specific needs.

- Surgical suites often involve critical and delicate procedures, requiring high-quality lighting to visualize anatomical structures and identify critical tissues. Surgical suites are equipped with advanced technology, such as adjustable intensity, color temperature control, shadow management, and ergonomic designs, to support modern practices.

- Surgical suites also adhere to strict infection control protocols, ensuring patient safety through easy cleaning, disinfection, and maintenance. Lastly, healthcare facilities must comply with regulatory standards and guidelines governing surgical lighting to ensure patient safety and quality of care. Minor surgical lights used in surgical suites must meet these standards.

Minor Surgical Lights Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North Americas strong healthcare infrastructure and a high healthcare expenditure, making it an ideal market for minor surgical lights. The country's large number of hospitals, ambulatory surgical centers, and clinics, equipped with sophisticated surgical suites, drive the demand for these lights.

- North America is also a hub for technological innovation, with manufacturers investing in research and development to improve the performance, efficiency, and safety of these lights. The growing preference for minimally invasive procedures in North America, such as minimally invasive procedures, has led to a growing demand for these lights.

- North America's healthcare facilities prioritize patient safety and comfort, with advanced surgical lighting systems contributing to better outcomes and patient experience. As a result, North America is expected to maintain its dominance in the market of minor surgical lights.

Minor Surgical Lights Market Top Key Players:

- Stryker Corporation (US)

- Hill-Rom Holdings, Inc. (US)

- Excelitas Technologies Corp. (US)

- BihlerMED (US)

- Skytron LLC (US)

- Integra LifeSciences Corporation (US)

- Welch Allyn (US)

- Burton Medical Products Corporation (US)

- Mizuho OSI (US)

- Nuvo Surgical (Canada)

- Amico Corporation (Canada)

- ALVO Medical (Poland)

- Trumpf Medical (Germany)

- KLS Martin Group (Germany)

- Maquet Holding B.V. & Co. KG (Germany)

- Steris plc (UK)

- Brandon Medical Co. Ltd. (UK)

- Merivaara Corporation (Finland)

- Getinge AB (Sweden)

- Sunnex Group (Sweden), and Other Active Players

Key Industry Developments in the Minor Surgical Lights Market:

- In September 2024, Stryker one of the world's leading medical technology companies, unveiled the next-generation of minimally invasive surgical cameras: the 1788 platform. The fully enhanced camera is set to advance surgery across multiple specialties. The all-in-one surgical camera platform offers a more vibrant image with balanced lighting, a wider color gamut and clearer delineation of fluorescence signals.

- In January 2024, Excelitas Technologies® Corp., a leading industrial and medical technology manufacturer announced acquisition of the Noblelight business from Heraeus Group (Hanau, Germany), including operations in Germany, United Kingdom, United States, China and Japan, along with several key application centers and sales offices around the world. Noblelight specializes in the development and manufacture of specialty lighting components and system solutions, from ultraviolet to infrared, used within analytical instrumentation, industrial curing, water treatment, electronics manufacturing, medical and cosmetic therapy, battery production and many others

|

Minor Surgical Lights Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

861.93 Mn |

|

Forecast Period 2025-32 CAGR: |

4.8% |

Market Size in 2032: |

1254.19 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Modality |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Minor Surgical Lights Market by Product Type (2018-2032)

4.1 Minor Surgical Lights Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Conventional Lights

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LED Lights

Chapter 5: Minor Surgical Lights Market by Application (2018-2032)

5.1 Minor Surgical Lights Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Endoscopy Procedures

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Surgical Suite

5.5 Others

Chapter 6: Minor Surgical Lights Market by Modality (2018-2032)

6.1 Minor Surgical Lights Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Ceiling-mounted

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wall-mounted

6.5 Floor stand

Chapter 7: Minor Surgical Lights Market by End-User (2018-2032)

7.1 Minor Surgical Lights Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ambulatory Surgical Centers

7.5 Specialized Clinics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Minor Surgical Lights Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SIEMENS (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 STERIS (UK)

8.4 STRYKER (US)

8.5 ALCON (SWITZERLAND)

8.6 EIZO INC. (JAPAN)

8.7 OLYMPUS CORPORATION (JAPAN)

8.8 BARCO (BELGIUM)

8.9 KONINKLIJKE PHILIPS N.V (NETHERLAND)

8.10 AMBU A/S (DENMARK

8.11 AND OTHER KEY PLAYERS

8.12

Chapter 9: Global Minor Surgical Lights Market By Region

9.1 Overview

9.2. North America Minor Surgical Lights Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Conventional Lights

9.2.4.2 LED Lights

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Endoscopy Procedures

9.2.5.2 Surgical Suite

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by Modality

9.2.6.1 Ceiling-mounted

9.2.6.2 Wall-mounted

9.2.6.3 Floor stand

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Surgical Centers

9.2.7.3 Specialized Clinics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Minor Surgical Lights Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Conventional Lights

9.3.4.2 LED Lights

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Endoscopy Procedures

9.3.5.2 Surgical Suite

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by Modality

9.3.6.1 Ceiling-mounted

9.3.6.2 Wall-mounted

9.3.6.3 Floor stand

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Surgical Centers

9.3.7.3 Specialized Clinics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Minor Surgical Lights Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Conventional Lights

9.4.4.2 LED Lights

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Endoscopy Procedures

9.4.5.2 Surgical Suite

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by Modality

9.4.6.1 Ceiling-mounted

9.4.6.2 Wall-mounted

9.4.6.3 Floor stand

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Surgical Centers

9.4.7.3 Specialized Clinics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Minor Surgical Lights Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Conventional Lights

9.5.4.2 LED Lights

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Endoscopy Procedures

9.5.5.2 Surgical Suite

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by Modality

9.5.6.1 Ceiling-mounted

9.5.6.2 Wall-mounted

9.5.6.3 Floor stand

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Surgical Centers

9.5.7.3 Specialized Clinics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Minor Surgical Lights Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Conventional Lights

9.6.4.2 LED Lights

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Endoscopy Procedures

9.6.5.2 Surgical Suite

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by Modality

9.6.6.1 Ceiling-mounted

9.6.6.2 Wall-mounted

9.6.6.3 Floor stand

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Surgical Centers

9.6.7.3 Specialized Clinics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Minor Surgical Lights Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Conventional Lights

9.7.4.2 LED Lights

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Endoscopy Procedures

9.7.5.2 Surgical Suite

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by Modality

9.7.6.1 Ceiling-mounted

9.7.6.2 Wall-mounted

9.7.6.3 Floor stand

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Surgical Centers

9.7.7.3 Specialized Clinics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Minor Surgical Lights Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

861.93 Mn |

|

Forecast Period 2025-32 CAGR: |

4.8% |

Market Size in 2032: |

1254.19 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Modality |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||