Millimeter Wave Technology Market Overview

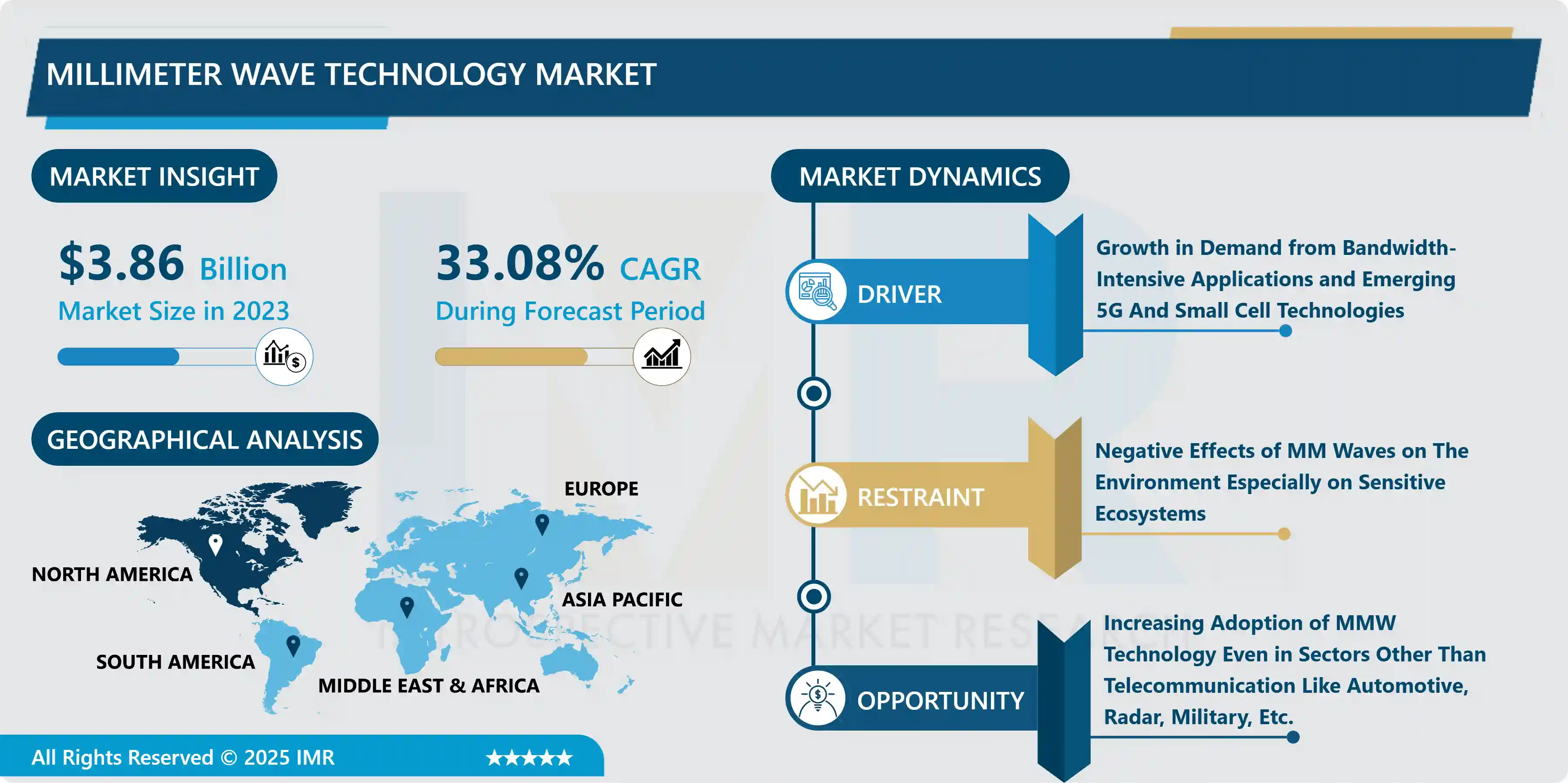

The Millimeter Wave Technology Market size is expected to grow from USD 3.86 Billion in 2023 to USD 50.54 Billion by 2032, at a CAGR of 33.08% during the forecast period of 2024-2032

Millimeter Wave (MMW) which is also known as millimeter band, E-band, V-band, or Millimeter Wave technology is the spectrum band with wavelengths ranging between 10 millimeters (30 GHz) and 1-millimeter (300 GHz) due to which Millimeter Wave Technology is called as the extremely high frequency (EHF) band by the International Telecommunication Union (ITU). Presently, mmW technology plays a very crucial rule of integrating with emerging high-end technologies like 5G & 6G, IEEE 802.11ad WiGig technology, and others. In such technologies, a wide range of devices and technologies exists for the delivery of high throughput, fibre optic cable were considered to be the highest standard. But, fiber optics remains unmatched, especially when all economic factors are considered. In the same scene, Millimeter wave wireless technology offers the potential to deliver bandwidth comparable to that of fibre optics but without the logistical and financial drawbacks of the deployments.

MMW is being rapidly adopted across various technologies for users ranging from enterprise-level data centers to single consumers with smartphones requiring higher bandwidth, the demand for newer technologies to deliver these higher data transmission rates is huge and is rising drastically. High-end applications of MMW technology are leading to rise of Millimeter Wave Technology Market. For example, Commercial Millimeter Wave (MMW) links from Cable Free feature high-performance, reliable, high capacity wireless networking with the latest generation features. The features like High bandwidth, High network speed along with the ever-increasing use of smartphones, computers, and videogame consoles will act as the main growth driving factor for Global Millimeter Wave Technology in upcoming years.

Market Dynamics and Factors of the Global Millimeter Wave Technology Market

Drivers:

- Growth in Demand from Bandwidth-Intensive Applications and Emerging 5G And Small Cell Technologies

Restraints:

- Negative Effects of MM Waves on The Environment Especially on Sensitive Ecosystems

Opportunities:

- Increasing Adoption of MMW Technology Even in Sectors Other Than Telecommunication Like Automotive, Radar, Military, Etc.

Challenges:

- Higher Costs in The Manufacturing of Greater Precision Hardware Components of Smaller Size

Regional Analysis Of Millimeter Wave Technology Market

- The North American region dominates the Market of Millimeter Wave Technology Globally, the region has achieved the largest market size in the last year. The primary reason behind the success of the market in North America is the rapid acceptance and adoption of any advanced and intricate technology by the market players. Prominent countries residing in the region such as the U.S. and Canada are early adopters of upcoming and emerging technologies. Moreover, the region has seen a significant rise in the sales of smartphones, computers, and other telecom devices in the last few years which is eventually followed by the development and usage of several data-intensive software, all this has resulted in the greater demand of mmWave Technologies to advance further to effectuate the market demand. Imaging and Scanning devices using higher bands are also been incorporated at various prominent places in North American Countries. Along with this, the increasing use of Millimeter Bands in healthcare applications like cardiovascular disorders, gastrointestinal disorders, diabetes, wound healing, pain relief, dermatitis, etc. are creating vast possibilities for MMW technology across different sectors in North America.

Top Key Players Covered In the Global Millimeter Wave Technology Market

- Axxcss Wireless Solution (US)

- NEC Corporation(Japan)

- Siklu Communication Ltd. (Israel)

- Aviat Networks Inc. (US)

- Sage Millimeter Inc. (US)

- Anokiwave Inc. (US)

- Bridgewave Communications Inc. (US)

- TLC Precision Wafer Technology (US)

- Farran Technologies (Ireland)

- Pacific Antenna Systems LLC (US)

- Aura Intelligent Systems Inc. (US)

- Smiths Interconnect Inc. (UK)

- E-band Communications LLC (US)

- MixZon Inc. (US)

- Dymenso LLC ( US) and Other Major Players

Key Industry Developments in the Global Millimeter Wave Technology Market

- In January 2023, NEC Corporation developed a power amplifier that will have an essential role in mobile access and fronthaul/backhaul wireless communication equipment which will help to enable high-speed, high-capacity communications for 5G Advanced and 6G networks. The newly developed power amplifier uses a commercially available 0.1-?m gallium arsenide (GaAs) pseudomorphic high electron mobility transistor (pHEMT) process that has achieved the world’s highest output power (*) of 10 mW in the 150 GHz band with high operation voltage and lower initial costs for mass production. With its development, NEC aims to fast-track both equipment development and social implementation.

- In November 2022, Anokiwave Inc., an innovative company providing highly integrated silicon ICs for millimeter-wave (mmW) ICs, and MilliBox, a mmW test setup manufacturer, today announced a collaboration to develop a unique and efficient Over the Air (OTA) test capability for mmW phased array antennas that provide an accurate high-volume test capability and that are an important part of the newly emerging mmW 5G and SATCOM communications systems.

|

Millimeter Wave Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.08% |

Market Size in 2032: |

USD 50.54 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By License Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Millimeter Wave Technology Market by Product (2018-2032)

4.1 Millimeter Wave Technology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Telecommunication Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Imaging & Scanning Systems

4.5 Radar & Satellite Communication Systems

Chapter 5: Millimeter Wave Technology Market by Component (2018-2032)

5.1 Millimeter Wave Technology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Antennas and Transceivers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Imaging Components

5.5 Amplifiers

5.6 Radio and RF Components

5.7 Frequency Meters

5.8 Others

Chapter 6: Millimeter Wave Technology Market by License Type (2018-2032)

6.1 Millimeter Wave Technology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Light Licensed Frequency

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Unlicensed Frequency

6.5 Fully Licensed Frequency

Chapter 7: Millimeter Wave Technology Market by Application (2018-2032)

7.1 Millimeter Wave Technology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Telecommunication

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive

7.5 Healthcare

7.6 Defense and Security

7.7 Electronics

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Millimeter Wave Technology Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AREBD (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 3M (U.S.)

8.4 COPAN DIAGNOSTICS INC. (U.S.)

8.5 ROCHE DIAGNOSTICS (SWITZERLAND)

8.6 FL MEDICAL SRL (ITALY)

8.7 DLS MEDICAL (U.K.)

8.8 DYNAREX (U.S.)

8.9 AVACARE PHARMA (INDIA)

8.10 PURITAN MEDICAL PRODUCTS (U.S.)

Chapter 9: Global Millimeter Wave Technology Market By Region

9.1 Overview

9.2. North America Millimeter Wave Technology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Telecommunication Equipment

9.2.4.2 Imaging & Scanning Systems

9.2.4.3 Radar & Satellite Communication Systems

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Antennas and Transceivers

9.2.5.2 Imaging Components

9.2.5.3 Amplifiers

9.2.5.4 Radio and RF Components

9.2.5.5 Frequency Meters

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by License Type

9.2.6.1 Light Licensed Frequency

9.2.6.2 Unlicensed Frequency

9.2.6.3 Fully Licensed Frequency

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Telecommunication

9.2.7.2 Automotive

9.2.7.3 Healthcare

9.2.7.4 Defense and Security

9.2.7.5 Electronics

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Millimeter Wave Technology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Telecommunication Equipment

9.3.4.2 Imaging & Scanning Systems

9.3.4.3 Radar & Satellite Communication Systems

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Antennas and Transceivers

9.3.5.2 Imaging Components

9.3.5.3 Amplifiers

9.3.5.4 Radio and RF Components

9.3.5.5 Frequency Meters

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by License Type

9.3.6.1 Light Licensed Frequency

9.3.6.2 Unlicensed Frequency

9.3.6.3 Fully Licensed Frequency

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Telecommunication

9.3.7.2 Automotive

9.3.7.3 Healthcare

9.3.7.4 Defense and Security

9.3.7.5 Electronics

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Millimeter Wave Technology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Telecommunication Equipment

9.4.4.2 Imaging & Scanning Systems

9.4.4.3 Radar & Satellite Communication Systems

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Antennas and Transceivers

9.4.5.2 Imaging Components

9.4.5.3 Amplifiers

9.4.5.4 Radio and RF Components

9.4.5.5 Frequency Meters

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by License Type

9.4.6.1 Light Licensed Frequency

9.4.6.2 Unlicensed Frequency

9.4.6.3 Fully Licensed Frequency

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Telecommunication

9.4.7.2 Automotive

9.4.7.3 Healthcare

9.4.7.4 Defense and Security

9.4.7.5 Electronics

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Millimeter Wave Technology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Telecommunication Equipment

9.5.4.2 Imaging & Scanning Systems

9.5.4.3 Radar & Satellite Communication Systems

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Antennas and Transceivers

9.5.5.2 Imaging Components

9.5.5.3 Amplifiers

9.5.5.4 Radio and RF Components

9.5.5.5 Frequency Meters

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by License Type

9.5.6.1 Light Licensed Frequency

9.5.6.2 Unlicensed Frequency

9.5.6.3 Fully Licensed Frequency

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Telecommunication

9.5.7.2 Automotive

9.5.7.3 Healthcare

9.5.7.4 Defense and Security

9.5.7.5 Electronics

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Millimeter Wave Technology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Telecommunication Equipment

9.6.4.2 Imaging & Scanning Systems

9.6.4.3 Radar & Satellite Communication Systems

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Antennas and Transceivers

9.6.5.2 Imaging Components

9.6.5.3 Amplifiers

9.6.5.4 Radio and RF Components

9.6.5.5 Frequency Meters

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by License Type

9.6.6.1 Light Licensed Frequency

9.6.6.2 Unlicensed Frequency

9.6.6.3 Fully Licensed Frequency

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Telecommunication

9.6.7.2 Automotive

9.6.7.3 Healthcare

9.6.7.4 Defense and Security

9.6.7.5 Electronics

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Millimeter Wave Technology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Telecommunication Equipment

9.7.4.2 Imaging & Scanning Systems

9.7.4.3 Radar & Satellite Communication Systems

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Antennas and Transceivers

9.7.5.2 Imaging Components

9.7.5.3 Amplifiers

9.7.5.4 Radio and RF Components

9.7.5.5 Frequency Meters

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by License Type

9.7.6.1 Light Licensed Frequency

9.7.6.2 Unlicensed Frequency

9.7.6.3 Fully Licensed Frequency

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Telecommunication

9.7.7.2 Automotive

9.7.7.3 Healthcare

9.7.7.4 Defense and Security

9.7.7.5 Electronics

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Millimeter Wave Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.08% |

Market Size in 2032: |

USD 50.54 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By License Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||