Metagenomics Market Synopsis

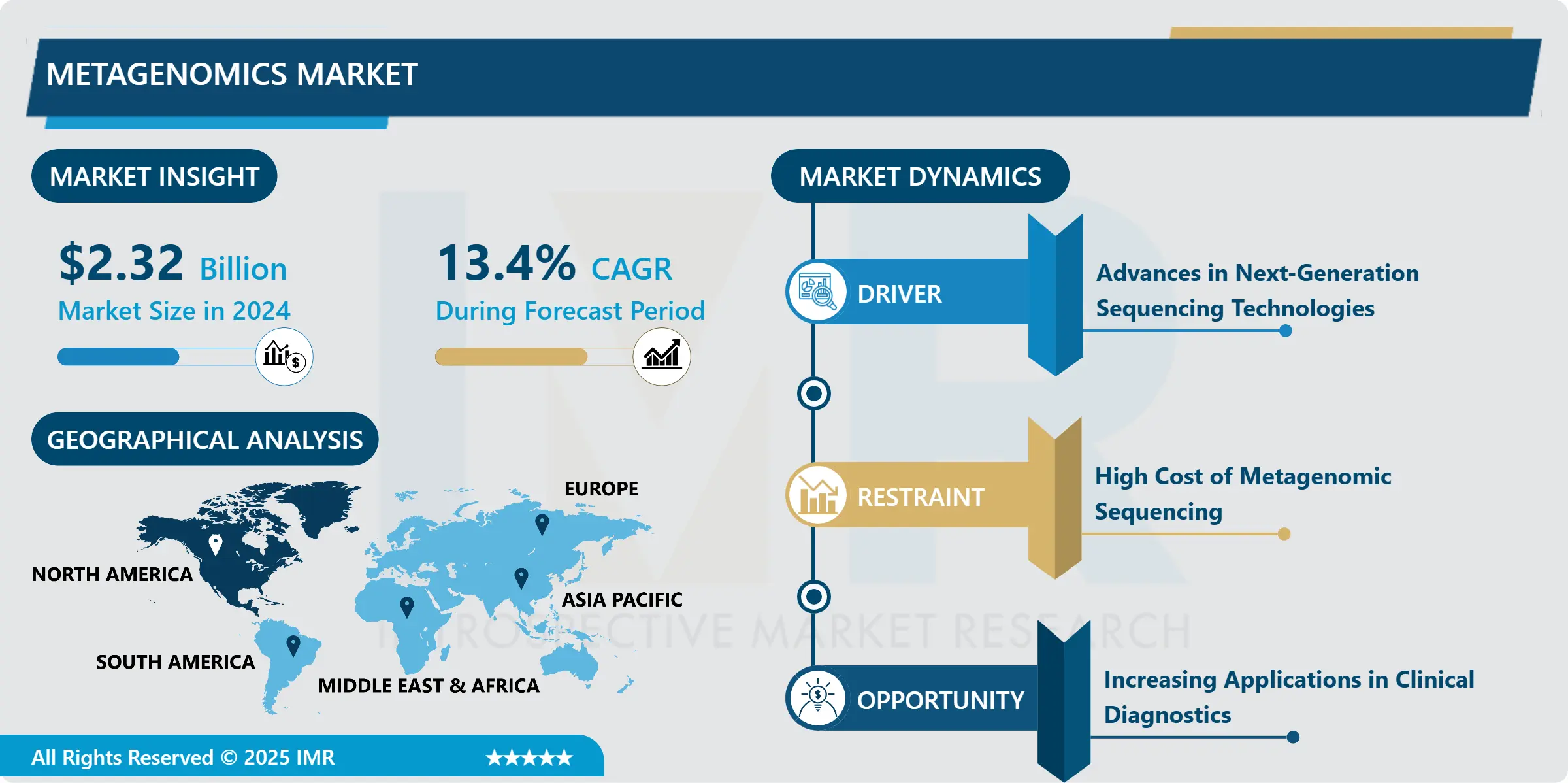

Metagenomics Market Size Was Valued at USD 2.32 Billion in 2024, and is Projected to Reach USD 9.25 Million by 2035, Growing at a CAGR of 13.4% From 2025-2035.

The metagenomics market falls under the broad biotechnology market and is a growing field whose growth is propped up by improvements in DNA sequencing and analytical tools. Metagenomics technique can be defined as the analysis of genomic information derived directly from samples of the environment, which yields an extensive description of the microbial content of different environments. They have fundamentally transformed the ways in which we approach the study of microbial richness, population dynamics and functional potential of microbial communities in ecosystems. Thus, the metagenomic market comprises the following solutions: sequencing platforms and software, reagents, and consumable products, as well as analytical services.

Consequently, the significance of the metagenomics market to the whole picture is rather complicated. Firstly, it provides the possibility not only to find and characterize of unidentified microorganisms that can also help to consider the opportunities to find new genes, new enzymes, and bioactive compounds that can be presumably relevant for industries and pharmacy. For example, enzymes that have been discovered from metagenomic analysis are being used in agriculture, food processing, and biofuel because metagenomic analysis helps to discover new enzymes for commercial use hence putting the knowledge into productive use. Moreover, metagenomics can be used for environmental assessment and bioremediation approaches, thanks to the information about microbial community and its susceptibility to contamination it provides.

Furthermore it is feasible that metagenomics market is highly relevant for management of human diseases, distress, and overall well-being. With the advanced usage of metagenomic strategies, significant roles of the human microbiome on health, disease and treatment responses have been defined. This has led to the development of pharma’s new concept of the microbiome which is treatments and prescriptions that is dependent on the make up of the gut bacteria. For instance, microbiota profiling is being employed in the creation of therapies through probiotics and diets that offer health with no disease burden similarly to obesity, diabetes, and inflammatory bowel disease. Furthermore, metagenomics is very useful in monitoring and managing numerous infectious disease outbreaks due to its capability for fast identification of pathogens of disease or resistance.

In the industrial process, the metagenomics market improves the outcomes of several vital biotechnological processes. Metagenomic information is used in industrial microbiology, waste management, and the generation of new bio-products, amongst many other applications. At a community level microbial Interactions and Functions help industries capitalize in enhancing the production, diminishing general expenses and incorporating sustainability. In summary, the worldwide metagenomics market does more than make substantive scientific and biomedical contributions; it also supports the growth of the global economy and the development of ethical, green industries across broad sectors of the modern environment.

Metagenomics Market Trend Analysis

Rising Application of Next-Generation Sequencing (NGS) Technologies

- The application of Next-Generation Sequencing (NGS) in metagenomic studies shifted the methodology to high-throughput, precise, and global resolution analysis of microbial assemblages. Illumina sequencing and colon sequencing, as well as newer technologies like Oxford Nanopore sequencing offers deeper complex and robust quantification, and precise identification of microbial species. This advancement is important for studying the intricate relationships between micro organisms in various state of hosts such as humans, nutrition and soil, plants, and animals.

- One primary advantage of metagenomic sequencing by NGS is the identification of low-complexity microorganisms, which are otherwise imperceptible using classical techniques. This sensitivity is especially relevant in clinical detection, where early recognition of pathogens saves time on diagnosis and the consequent efficacious treatment. Further, samples containing thousands of samples can be analyzed simultaneously with NGS thereby decreasing the time and costs of large scale metagenomic investigation.

- In addition, the new platform of NGS and decreasing cost sequence is expected to expand the existing technology among a larger section of academics and research organizations. New generation portable and real-time sequencing technologies, including the MINION by Oxford Nanopore technologies are offering new avenues in using NGS for adopting metagenomics approach in field-based systems. This trend is likely to create an enormous demand for metagenomic research across more industries as they realize the power of NGS in identifying the microbial roles and variety.

Expansion of Bioinformatics Tools and Databases

- This proliferation of newly produced Metagenomic data has led to the need to produce, expand and advance tools and databases for data management, analysis and interpretation. These tools are required for efficient merging and labeling of metagenomic sequences, and for alignment of these sequences to look for new microbial genes, pathways, and activities. The most successful and widely used tools for metagenomic analysis are QIIME, MetaPhlAn, and MEGAHIT software platforms, which allow to solve various problems quickly and efficiently.

- The two striking trends in bioinformatics for metagenomics that have become apparent in recent years are the demands for optimizing the computational methods used for identification. Since sequencing technologies generate more data, algorithms cannot remain sensitive to variations while processing that much data. Current advancements in machine learning and artificial intelligence (AI) are being integrated into bioinformatics pipelines for improving the predictive learning, pattern discovery and functional assignment of metagenome sequences. These are important improvements that enable the conversion of one sequence data to a significant biological information.

- Furthermore, the creation of large-scale and open access metagenomic databases is also described as important by the authors. To date, metagenomic databases including MG-RAST, SILVA, and IMG are comprehensive in reaching researchers with annotated metagenomic sequences for comparison and meta-analysis. These resources allow data to be disseminated, best practices to be established and consistency followed, and international cooperation to occur more readily. Growing and improving bioinformatics tools and database seems to contribute immensely to metagenomic research outcomes; and make major impacts across various fields of study.

Metagenomics Market Segment Analysis:

Metagenomics Market is segmented based on Product, Technology, Workflow, and Application

By Product, Kits & Reagents Segment is Expected to Dominate the Market During the Forecast Period

- The Kits & Reagents segment is anticipated to hold the largest market share of the metagenomics market since they are critical components in any metagenomics process and the growing demand for proficient and accurate reagents. Metagenomic kits and reagents are essential to the metagenomic process since they contain all the materials needed for DNA extraction amplification and library preparation. Most of metagenomic techniques are relatively new in many fields such as clinical diagnostic lab and environmental biotechnology, hence the need for kits and specialized reagents to provide precise and reproducible data. In addition, new reagent formulations were developed and ready-to-use kits to increase the performance and usability of the reagents, which are the main reasons for the high usage.

- Furthermore, the growth of R & D projects, and the number of metagenomic investigations provokes the need for kits and reagents. The constant development of the focus on individualized treatment together with the constant demand for proper identification of microbes in the clinic also contribute to the market’s growth. Maintaining the dominance of this segment in the metagenomics market during the forecast period, companies are investing in enhancing the existing kits and reagents, as well as, developing new ones as the needs and requirement of researchers and clinicians is constantly changing.

By Technology, Shotgun Sequencing Segment Held the Largest Share

- The Shotgun Sequencing segment accounted for the largest share of the metagenomics market because of the high efficiency in the identification of microbial communities without selecting niche organisms for analysis. Compared with other methods, shotgun sequencing allows the detection and relative abundance of all types of DNA in a sample at once, giving a highly accurate ‘picture’ of microbial composition and activity. This technology is most beneficial in samples where microbial richness is high as in soil, marine environments, and the human microbiome. Since it can recognize known and unknown organism, it is often favored in metagenomics researches.

- In addition, the up-to-date enhancements in the sequencing technologies and decrease in the costs of sequencing also made shotgun sequencing feasible. Including but not limited to, the shotgun sequencing produces high-resolution data that is can be used for environmental mapping, disease outbreak detection, and biotechnology. Through an understanding of the several attributes presented in this study, researchers and industries will continue to invest in microbial overview analysis, thus enhancing the market for shotgun sequencing and maintaining its position at the forefront of the metagenomics market.

Metagenomics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America will dominate the metagenomics market because of the developed healthcare system, high investment in R&D, and popularization of significant market participants. However, the United States, especially, has a highly developed biotechnology industry, and many colleges and universities, together with research centers, are engaged in metagenomics research. This active research atmosphere allows for sustained advancement and the creation of novel metagenomics technologies and thus the market growth in the area.

- Moreover, North America has a supportive government policy on genomics and has a large amount of budget allocation for genomics activities. Organisation like the National Institutes of Health (NIH) and Human Microbiome Project have shown great financial and social support to boost the metagenomics study. These programs not only improve the knowledge of microbial communities and its functions and relationship with health and disease but also advance the commercialization of metagenomic products. Another aspect which supports the positive trends in the market is the availability of the srong regulatory requirements in the use of such technologies while the positive outlook underlines its safe and effective implementation.

- In addition, an increase in chronic diseases and the recent focus on precision medicine in North America have catalyzed the need for metagenomics. Gain an understanding of the intricate systems of microbes that inhabit an individual and how these systems interact with the host is important so as to establish unique therapeutic treatments. Further appreciation of metagenomics in the prevention, diagnosis, and treatment of diseases by healthcare providers and researchers will ensure the continued growth of this market in North America is sustained during the forecast period and will retain its predominance.

Active Key Players in the Metagenomics Market

- Bio-Rad Laboratories, Inc. (United States)

- Illumina, Inc. (United States)

- PerkinElmer, Inc. (United States)

- Thermo Fisher Scientific, Inc. (United States)

- Novogene Co., Ltd. (China)

- Promega Corporation (United States)

- QIAGEN (Netherlands)

- Takara Bio, Inc. (Japan)

- Oxford Nanopore Technologies (United Kingdom)

- F. Hoffmann-La Roche Ltd. (Switzerland)

|

Metagenomics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.32 Bn. |

|

Forecast Period 2025-35 CAGR: |

13.4% |

Market Size in 2035: |

USD 9.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Workflow |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Metagenomics Market by Product (2018-2035)

4.1 Metagenomics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Kits & Reagents

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sequencing & Data Analytics Services

4.5 Software

Chapter 5: Metagenomics Market by Technology (2018-2035)

5.1 Metagenomics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Shotgun Sequencing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 16S Sequencing

5.5 Whole Genome Sequencing

5.6 Others

Chapter 6: Metagenomics Market by Workflow (2018-2035)

6.1 Metagenomics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pre-sequencing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Sequencing

6.5 Data Analysis

Chapter 7: Metagenomics Market by Application (2018-2035)

7.1 Metagenomics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Environmental

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinical Diagnostics

7.5 Drug Discovery

7.6 Biotechnology

7.7 Food & nutrition

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Metagenomics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BIO-RAD LABORATORIES INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ILLUMINA INC. (UNITED STATES)

8.4 PERKINELMER INC. (UNITED STATES)

8.5 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

8.6 NOVOGENE COLTD. (CHINA)

8.7 PROMEGA CORPORATION (UNITED STATES)

8.8 QIAGEN (NETHERLANDS)

8.9 TAKARA BIO INC. (JAPAN)

8.10 OXFORD NANOPORE TECHNOLOGIES (UNITED KINGDOM)

8.11 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

8.12

Chapter 9: Global Metagenomics Market By Region

9.1 Overview

9.2. North America Metagenomics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Kits & Reagents

9.2.4.2 Sequencing & Data Analytics Services

9.2.4.3 Software

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Shotgun Sequencing

9.2.5.2 16S Sequencing

9.2.5.3 Whole Genome Sequencing

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Workflow

9.2.6.1 Pre-sequencing

9.2.6.2 Sequencing

9.2.6.3 Data Analysis

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Environmental

9.2.7.2 Clinical Diagnostics

9.2.7.3 Drug Discovery

9.2.7.4 Biotechnology

9.2.7.5 Food & nutrition

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Metagenomics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Kits & Reagents

9.3.4.2 Sequencing & Data Analytics Services

9.3.4.3 Software

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Shotgun Sequencing

9.3.5.2 16S Sequencing

9.3.5.3 Whole Genome Sequencing

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Workflow

9.3.6.1 Pre-sequencing

9.3.6.2 Sequencing

9.3.6.3 Data Analysis

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Environmental

9.3.7.2 Clinical Diagnostics

9.3.7.3 Drug Discovery

9.3.7.4 Biotechnology

9.3.7.5 Food & nutrition

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Metagenomics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Kits & Reagents

9.4.4.2 Sequencing & Data Analytics Services

9.4.4.3 Software

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Shotgun Sequencing

9.4.5.2 16S Sequencing

9.4.5.3 Whole Genome Sequencing

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Workflow

9.4.6.1 Pre-sequencing

9.4.6.2 Sequencing

9.4.6.3 Data Analysis

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Environmental

9.4.7.2 Clinical Diagnostics

9.4.7.3 Drug Discovery

9.4.7.4 Biotechnology

9.4.7.5 Food & nutrition

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Metagenomics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Kits & Reagents

9.5.4.2 Sequencing & Data Analytics Services

9.5.4.3 Software

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Shotgun Sequencing

9.5.5.2 16S Sequencing

9.5.5.3 Whole Genome Sequencing

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Workflow

9.5.6.1 Pre-sequencing

9.5.6.2 Sequencing

9.5.6.3 Data Analysis

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Environmental

9.5.7.2 Clinical Diagnostics

9.5.7.3 Drug Discovery

9.5.7.4 Biotechnology

9.5.7.5 Food & nutrition

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Metagenomics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Kits & Reagents

9.6.4.2 Sequencing & Data Analytics Services

9.6.4.3 Software

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Shotgun Sequencing

9.6.5.2 16S Sequencing

9.6.5.3 Whole Genome Sequencing

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Workflow

9.6.6.1 Pre-sequencing

9.6.6.2 Sequencing

9.6.6.3 Data Analysis

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Environmental

9.6.7.2 Clinical Diagnostics

9.6.7.3 Drug Discovery

9.6.7.4 Biotechnology

9.6.7.5 Food & nutrition

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Metagenomics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Kits & Reagents

9.7.4.2 Sequencing & Data Analytics Services

9.7.4.3 Software

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Shotgun Sequencing

9.7.5.2 16S Sequencing

9.7.5.3 Whole Genome Sequencing

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Workflow

9.7.6.1 Pre-sequencing

9.7.6.2 Sequencing

9.7.6.3 Data Analysis

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Environmental

9.7.7.2 Clinical Diagnostics

9.7.7.3 Drug Discovery

9.7.7.4 Biotechnology

9.7.7.5 Food & nutrition

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Metagenomics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.32 Bn. |

|

Forecast Period 2025-35 CAGR: |

13.4% |

Market Size in 2035: |

USD 9.25 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Workflow |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||