Medium Entropy Alloys Market Synopsis:

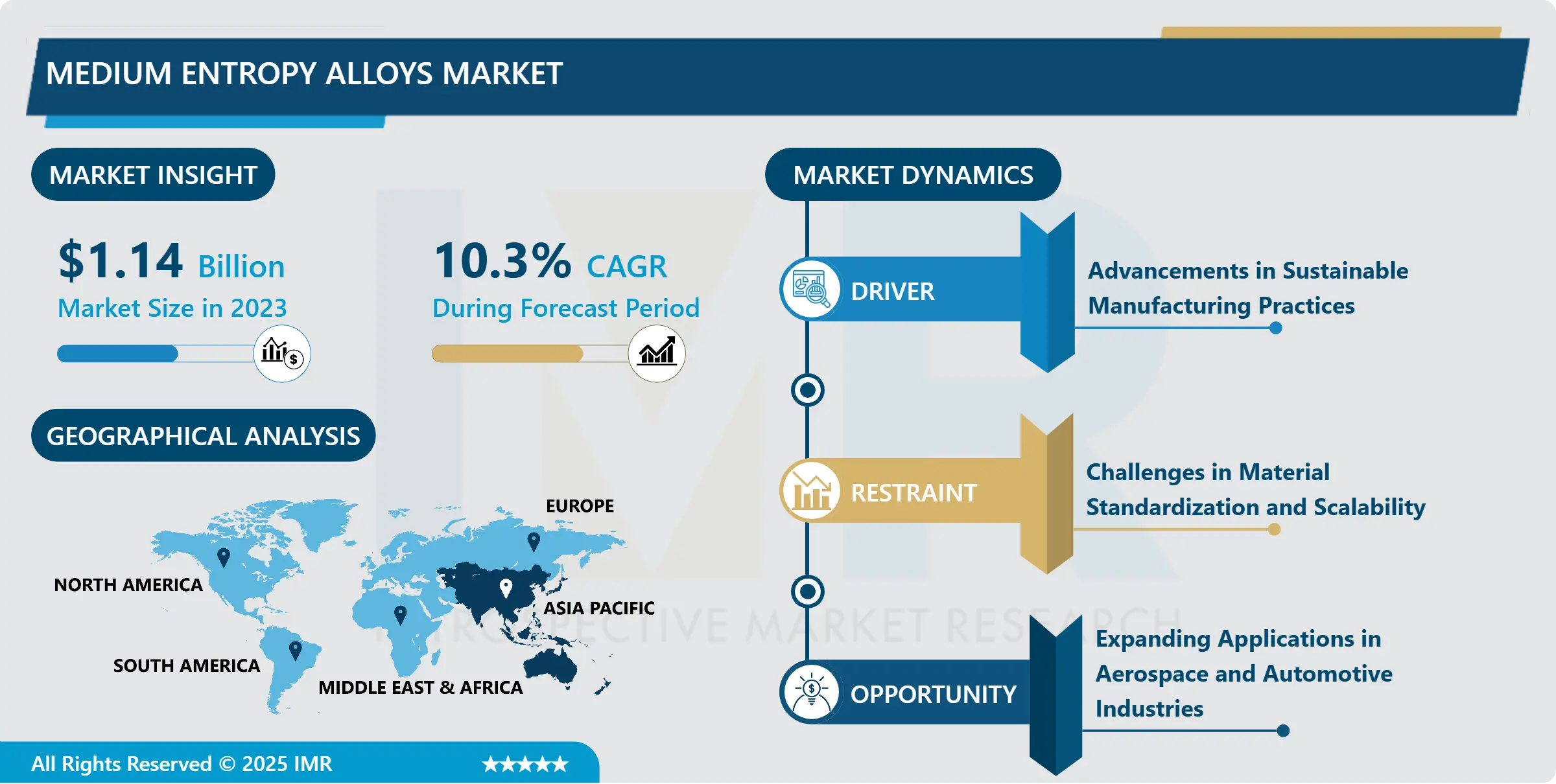

Medium Entropy Alloys Market Size Was Valued at USD 1.14 Billion in 2023 and is Projected to Reach USD 2.75 Billion by 2032, Growing at a CAGR of 10.3% From 2024-2032.

Medium Entropy Alloys (MEAs) are a class of materials containing multiple principal elements, generally having a high number of components including metals that capable of providing excellent performance characteristics such as high strength, high corrosion and heat resistance. These kinds of alloys offer high entropy resulting in unique microstructures that make them suitable for highly stressed uses. They’re being considered for applications across aerospace, automotive and energy, for example, because of the promise that MEAs could offer superior performance to conventional alloys in certain conditions.

The increased need for high-performance materials in the aerospace and automotive industries is the major force behind Medium Entropy Alloys market. MEAs give superior properties such as better mechanical strength, wear resistance, and thermo stability which are central in these industries. As the demand for high performance, high reliability materials grows, MEAs are being used to fulfil the requirements of these industries.

Also, emphasis on manufacturing green processes and energy consumption has led to the deployment of MEAs even further. Due to their outstanding characteristics, they allow the creation of such lightweight and high-strength parts that may contribute to the reduction of energy consumption and improve ecological conditions. Since industries find solutions to develop competitive products in terms of material science, the consumption of MEAs should increase with time in different sectors.

Medium Entropy Alloys Market Trend Analysis:

Continuous improvement of the medium entropy alloys

- Another highly important trend in the Medium Entropy Alloys market is the continuous improvement of the medium entropy alloys based on the optimization of their compositions for their uses. As the main trend, it is contributing to the creation of new advanced MEA designs suited to high-performance applications in aerospace, automotive and energy applications.

- One more credible trend relates to an enhanced focus on the use of additive manufacturing, also known as 3D printing, in connection with Medium Entropy Alloys. Due to the liberty of building intricate and bespoke structures, the MEA component manufacturing employs 3D printing as the most suitable technique. That is why the given trend will help expand the production capacities and availability of MEAs, which will increase their demand from industries requiring lightweight and high-strength materials.

Energy industries primarily in turbines and heat exchange systems

- The aerospace and automotive industries are considered to have major potential in the Medium Entropy Alloys market. As more automobile companies seek materials that are light enough to increase efficiency while at the same time being strong enough to boost performance, MEAs are beginning to form as a better substitute for alloys. This ability to meet the demand necessary in such industries accessorizes new opportunities in targeting the market and creation of new applications.

- In addition, there is substantial application in the energy industries primarily in turbines and heat exchange systems. Global energy demands are on the rise and as more applications require materials suitable for use in high temperature conditions MEAs offer a solution. Their thermal stability and corrosion resistant properties qualify them for usage in extreme conditions, hence is a promising market for PIMs.

Medium Entropy Alloys Market Segment Analysis:

Medium Entropy Alloys Market is Segmented on the basis of Alloy Type, Application, End-User Industry, and Region

Alloy Type, Single-phase Alloys segment is expected to dominate the market during the forecast period

- The Medium Entropy Alloys market can be categorized into two primary alloy types: The Organic Coatings And Plastics Division will continue to provide single phase and multiphase alloys. Single phase structure present in the single-phase alloys makes them uniform as they possess only one crystalline structure. These alloys exhibit well balanced characteristics at different working conditions. The microstructure of multi-phase alloys contains more than one phase; it has been postulated that this type of material would offer better mechanical performance such as increased strength, wear and corrosion resistances. Both types are utilised in numerous materials according to the desired characteristics of the resulting product.

Application, Aerospace segment expected to held the largest share

- Various industries are found to be associated with the Medium Entropy Alloys market. In aerospace and automotive industries MEAs are applied in production of lightweight strong structural components required in enhancing the overall performance of vehicles and airplanes. MEAs are widely used in the energy sector especially on turbines, reactors and heat exchanger because of their high temperature stability and corrosion proof. Thus, the defense industry does not remain indifferent to MEAs, since these can be used as in the production of reliable and durable parts for creating military equipment. In industry of electronics, MEAs are getting popular because of the facts of high conductivity and non-sensitivity to environmental conditions. Besides, recent MEAs are also being searched for in numerous other fields such as medical electronics and industrial application.

Medium Entropy Alloys Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific has currently acquired the largest share the Medium Entropy Alloys market thanks to great manufacturing and industrial growth in countries like China, Japan, and South Korea. These nations have cultivated themselves to become the world player in areas like aerospace, automotive and electronics where MEAs are gaining acceptance due to enhanced performance characteristics. Thus, Asia Pacific can retain its leadership in the market for an unlimited time in the future.

- Besides this, is the emphasis on research and development work in the material science in the region for the utilization of Medium Entropy Alloys. Friendliness of the MEA market to innovation and longer-term sustainable production goals set by governments of countries such as China and Japan are the significant factors that support leadership of the region in the market.

Active Key Players in the Medium Entropy Alloys Market

- ATI Inc. (USA)

- Carpenter Technology Corporation (USA)

- Crucible Industries (USA)

- Eramet (France)

- Haynes International, Inc. (USA)

- Hiperco (USA)

- Osaka Titanium Technologies Co., Ltd. (Japan)

- RUSAL (Russia)

- Samsung Advanced Institute of Technology (South Korea)

- VDM Metals (Germany)

- Other Active Players

|

Medium Entropy Alloys Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.14 Billion |

|

Forecast Period 2024-32 CAGR: |

10.3 %. |

Market Size in 2032: |

USD 2.75 Billion |

|

Segments Covered: |

Alloy Type |

|

|

|

Application |

|

||

|

End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medium Entropy Alloys Market by Alloy Type

4.1 Medium Entropy Alloys Market Snapshot and Growth Engine

4.2 Medium Entropy Alloys Market Overview

4.3 Single-phase Alloys

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Single-phase Alloys: Geographic Segmentation Analysis

4.4 Multi-phase Alloys

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Multi-phase Alloys: Geographic Segmentation Analysis

Chapter 5: Medium Entropy Alloys Market by Application

5.1 Medium Entropy Alloys Market Snapshot and Growth Engine

5.2 Medium Entropy Alloys Market Overview

5.3 Aerospace

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Aerospace: Geographic Segmentation Analysis

5.4 Automotive

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Automotive: Geographic Segmentation Analysis

5.5 Energy

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Energy: Geographic Segmentation Analysis

5.6 Defense

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Defense: Geographic Segmentation Analysis

5.7 Electronics

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Electronics: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Medium Entropy Alloys Market by End-User Industry

6.1 Medium Entropy Alloys Market Snapshot and Growth Engine

6.2 Medium Entropy Alloys Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Manufacturing: Geographic Segmentation Analysis

6.4 Research and Development

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Research and Development: Geographic Segmentation Analysis

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medium Entropy Alloys Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ATI INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CARPENTER TECHNOLOGY CORPORATION (USA)

7.4 HIPERCO (USA)

7.5 SAMSUNG ADVANCED INSTITUTE OF TECHNOLOGY (SOUTH KOREA)

7.6 OSAKA TITANIUM TECHNOLOGIES CO. LTD. (JAPAN)

7.7 CRUCIBLE INDUSTRIES (USA)

7.8 ERAMET (FRANCE)

7.9 RUSAL (RUSSIA)

7.10 HAYNES INTERNATIONAL INC. (USA)

7.11 VDM METALS (GERMANY)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Medium Entropy Alloys Market By Region

8.1 Overview

8.2. North America Medium Entropy Alloys Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Alloy Type

8.2.4.1 Single-phase Alloys

8.2.4.2 Multi-phase Alloys

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Aerospace

8.2.5.2 Automotive

8.2.5.3 Energy

8.2.5.4 Defense

8.2.5.5 Electronics

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End-User Industry

8.2.6.1 Manufacturing

8.2.6.2 Research and Development

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medium Entropy Alloys Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Alloy Type

8.3.4.1 Single-phase Alloys

8.3.4.2 Multi-phase Alloys

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Aerospace

8.3.5.2 Automotive

8.3.5.3 Energy

8.3.5.4 Defense

8.3.5.5 Electronics

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End-User Industry

8.3.6.1 Manufacturing

8.3.6.2 Research and Development

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medium Entropy Alloys Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Alloy Type

8.4.4.1 Single-phase Alloys

8.4.4.2 Multi-phase Alloys

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Aerospace

8.4.5.2 Automotive

8.4.5.3 Energy

8.4.5.4 Defense

8.4.5.5 Electronics

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End-User Industry

8.4.6.1 Manufacturing

8.4.6.2 Research and Development

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medium Entropy Alloys Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Alloy Type

8.5.4.1 Single-phase Alloys

8.5.4.2 Multi-phase Alloys

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Aerospace

8.5.5.2 Automotive

8.5.5.3 Energy

8.5.5.4 Defense

8.5.5.5 Electronics

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End-User Industry

8.5.6.1 Manufacturing

8.5.6.2 Research and Development

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medium Entropy Alloys Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Alloy Type

8.6.4.1 Single-phase Alloys

8.6.4.2 Multi-phase Alloys

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Aerospace

8.6.5.2 Automotive

8.6.5.3 Energy

8.6.5.4 Defense

8.6.5.5 Electronics

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End-User Industry

8.6.6.1 Manufacturing

8.6.6.2 Research and Development

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medium Entropy Alloys Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Alloy Type

8.7.4.1 Single-phase Alloys

8.7.4.2 Multi-phase Alloys

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Aerospace

8.7.5.2 Automotive

8.7.5.3 Energy

8.7.5.4 Defense

8.7.5.5 Electronics

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End-User Industry

8.7.6.1 Manufacturing

8.7.6.2 Research and Development

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Medium Entropy Alloys Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.14 Billion |

|

Forecast Period 2024-32 CAGR: |

10.3 %. |

Market Size in 2032: |

USD 2.75 Billion |

|

Segments Covered: |

Alloy Type |

|

|

|

Application |

|

||

|

End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||