Medical Gases and Equipment Market Synopsis

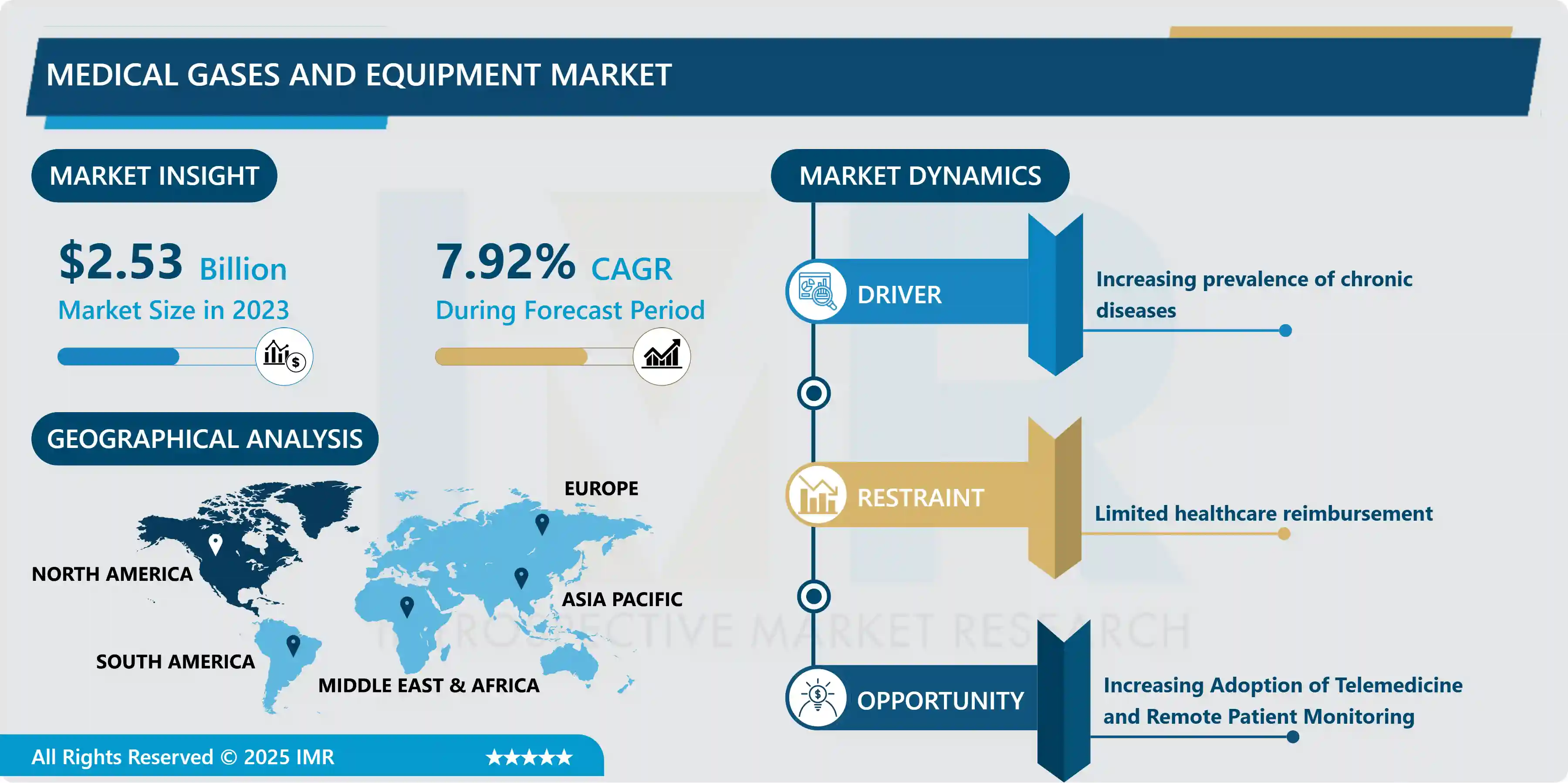

Medical Gases and Equipment Market Size Was Valued at USD 2.53 Billion in 2023 and is Projected to Reach USD 5.02 Billion by 2032, Growing at a CAGR of 7.92% From 2024-2032.

Medical gases and equipment are crucial supplies in healthcare settings for administering, storing, and monitoring gases like oxygen, nitrous oxide, and carbon dioxide. They are essential for therapeutic applications like respiratory support, anesthesia, and imaging. Medical gas equipment includes devices like regulators, flowmeters, and cylinders, ensuring precise delivery and safety in patient care.

Medical gases and equipment are crucial in modern healthcare, providing essential support for patients with respiratory conditions, enabling oxygenation and ventilation, and facilitating anesthesia administration during surgeries. They are versatile and adaptable to various settings, from hospitals to home care environments. They serve a wide range of applications across healthcare domains, including oxygen therapy for managing respiratory illnesses, nitrous oxide for dental procedures, carbon dioxide for laparoscopic surgeries, and diagnostic imaging techniques like MRI and CT scans.

The demand for medical gases and equipment is increasing due to the increasing prevalence of respiratory diseases, aging populations, and advancements in medical technology. The expanding home healthcare sector also drives the need for portable and user-friendly medical gas solutions. Key market trends include technological innovations in gas delivery systems, such as digital flow meters and integrated monitoring devices, and the growing focus on environmentally sustainable practices. Market players are also expanding their product portfolios and geographic presence through strategic collaborations and acquisitions to capitalize on emerging opportunities in developing healthcare markets.

The medical gases and equipment market is expected to grow due to technological innovation, expanding healthcare access, and evolving healthcare delivery paradigms. The shift towards value-based care models, focusing on cost-effectiveness and patient outcomes, drives healthcare facilities to invest in advanced medical gas equipment. Telemedicine and remote patient monitoring also drive demand for portable and integrated solutions. Regulatory initiatives ensure product safety and quality standards.

Medical Gases and Equipment Market Trend Analysis

Increasing prevalence of chronic diseases

- Chronic diseases, such as COPD, asthma, cardiovascular diseases, and diabetes, are the leading causes of morbidity and mortality worldwide. These diseases require ongoing management and treatment, leading to sustained demand for medical gases and equipment to support patient care and improve outcomes. Respiratory conditions like COPD and asthma require medical gases like oxygen for supplemental therapy, while cardiovascular diseases like heart failure and ischemic heart disease may require medical gases like nitric oxide for pulmonary hypertension or inhaled medications.

- Patients undergoing cardiac surgeries or interventions often require anesthesia, which involves precise delivery of medical gases to induce and maintain unconsciousness safely. Diabetes, another prevalent chronic condition, can lead to complications like diabetic ketoacidosis, which may require treatment with intravenous fluids and electrolytes delivered through specialized infusion pumps and equipment.

- Chronic diseases require long-term management and monitoring, leading to a sustained demand for medical gases and equipment. Patients may require continuous oxygen therapy, nebulized medications, or other respiratory support modalities. Advancements in medical technology have led to the development of innovative devices like portable oxygen concentrators and smart inhalers, enhancing convenience and compliance for patients with chronic respiratory conditions. As the global burden of chronic diseases increases, the medical gases and equipment market is poised for sustained growth to provide effective and accessible care.

Increasing Adoption of Telemedicine and Remote Patient Monitoring

- The rising uptake of telemedicine and remote patient monitoring offers significant prospects for the medical gases and equipment market. Telemedicine facilitates the provision of remote healthcare services and consultations, while remote patient monitoring enables continual tracking of patient health metrics beyond traditional medical settings. These advancements create fresh avenues for integrating medical gases and equipment into decentralized healthcare delivery models.

- There are opportunities for developing integrated solutions in medical gas equipment that support telemedicine consultations and remote patient monitoring. For instance, portable oxygen concentrators and inhalation devices enable patients with respiratory ailments to receive oxygen therapy or medication administration at home, while remote monitoring capabilities allow healthcare providers to monitor treatment adherence and adjust therapy as necessary.

- The merging of medical gas equipment with telemedicine platforms allows for real-time monitoring of gas delivery parameters and patient vital signs during virtual consultations, thereby enhancing the quality and safety of remote healthcare delivery. With the continued expansion of telemedicine and remote patient monitoring, there is anticipated growth in demand for innovative medical gases and equipment solutions tailored to these applications, offering lucrative opportunities for industry players.

Medical Gases and Equipment Market Segment Analysis:

Medical Gases and Equipment Market Segmented on the basis of Type, Application, and End-user.

By Type, Medical Gases segment is expected to dominate the market during the forecast period

- The dominance of the medical gases segment within the broader realm of medical gases and equipment is expected for several reasons. Primarily, medical gases serve as indispensable therapeutic agents utilized across a spectrum of healthcare applications, including respiratory support, anesthesia, and diagnostic procedures. Given their pivotal role in medical treatments, there exists a consistent and robust demand for these gases across diverse healthcare settings.

- The escalating prevalence of respiratory ailments globally, such as COPD and asthma, contributes significantly to the sustained need for medical gases. Factors like pollution, smoking habits, and aging populations further amplify the occurrence of respiratory conditions, consequently driving the demand for oxygen therapy and other respiratory support gases.

- Continuous advancements in medical gas technology, such as the innovation of sophisticated gas delivery systems and portable oxygen concentrators, play a pivotal role in propelling the growth of the medical gases segment. These technological strides enhance the efficacy, safety, and convenience of medical gas administration, consolidating the segment's stronghold within the medical gases and equipment market.

By Application, the Therapeutic segment is expected to dominate the market during the forecast period

- The therapeutic segment is poised to lead the medical gases and equipment market for several reasons. Firstly, the global rise in respiratory diseases like chronic obstructive pulmonary disease (COPD), asthma, and pneumonia necessitates the use of medical gases such as oxygen for respiratory therapy. Additionally, the aging population, prone to respiratory ailments and other chronic conditions, drives the demand for medical gases and equipment for prolonged treatment and care.

- Advancements in medical technology have introduced innovative therapeutic solutions like portable oxygen concentrators and nebulizers, enhancing convenience and mobility for patients requiring respiratory support. Moreover, the expansion of home healthcare services and the integration of telemedicine facilitate the distribution of therapeutic gases and equipment to patients beyond conventional healthcare settings. These factors collectively reinforce the dominance of the therapeutic segment in the medical gases and equipment market. In summary, the therapeutic segment is anticipated to maintain its lead due to the escalating prevalence of chronic diseases and the growing need for effective respiratory therapies.

Medical Gases and Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to lead the medical gases and equipment market for several reasons. Firstly, the region benefits from advanced healthcare infrastructure and substantial healthcare spending, facilitating the widespread availability of medical gases and equipment across diverse healthcare facilities. Additionally, North America hosts numerous renowned manufacturers and suppliers of medical gases and equipment, fostering a competitive market environment and driving innovation.

- The region's high prevalence of chronic illnesses and aging demographic results in continuous demand for medical gases and equipment for therapeutic purposes such as respiratory support and anesthesia. The increasing adoption of telemedicine and remote patient monitoring technologies in North America also presents opportunities for integrating medical gases and equipment into decentralized healthcare delivery models, thereby fueling market expansion.

- North America upholds stringent regulatory standards and prioritizes product quality and safety, ensuring the efficacy and reliability of medical gases and equipment. This commitment bolsters consumer trust and facilitates market penetration. Altogether, these factors establish North America as a dominant force in the global medical gases and equipment arena.

Medical Gases and Equipment Market Top Key Players:

- Air Products and Chemicals, Inc. (US)

- Airgas, Inc. (US)

- Ohio Medical Corporation (US)

- Allied Healthcare Products, Inc. (US)

- CryoGas International (US)

- Norco, Inc. (US)

- Cramer Decker Medical, Inc. (US)

- Aerotec International Inc. (US)

- BeaconMedaes (US)

- Amico Corporation (Canada)

- Smiths Medical (UK)

- Medical Gas Solutions Ltd. (UK)

- BPR Medical Ltd. (UK)

- Air Liquide (France)

- SOL Group (Italy)

- Messer Group (Germany)

- Atlas Copco AB (Sweden)

- GCE Group (Czech Republic)

- Rotarex S.A. (Luxembourg)

- Linde plc (Ireland)

- Taiyo Nippon Sanso Corporation (Japan), Other Major Players.

Key Industry Developments in the Medical Gases and Equipment Market:

- In October 2022, Tenex Capital Management revealed the sale of Ohio Medical, LLC, a respected manufacturer of oxygen regulators and central gas systems, to ESAB Corporation, a prominent provider of fabrication and gas control technology. This acquisition is poised to expedite ESAB Corporation's global growth strategy.

- In February 2022, Gasworld introduced a fresh event tailored for the medical gases community, aiming to foster greater connectivity and equity within the healthcare sector.

|

Global Medical Gases and Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.92 % |

Market Size in 2032: |

USD 5.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Gases and Equipment Market by Type (2018-2032)

4.1 Medical Gases and Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Medical gases

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medical gas equipment

4.5 Medical Gas Mixtures

Chapter 5: Medical Gases and Equipment Market by Application (2018-2032)

5.1 Medical Gases and Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Therapeutic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diagnostic

5.5 Pharmaceutical Manufacturing & Research

Chapter 6: Medical Gases and Equipment Market by End-user (2018-2032)

6.1 Medical Gases and Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory care facilities

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Gases and Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIR PRODUCTS AND CHEMICALS INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AIRGAS INC. (US)

7.4 OHIO MEDICAL CORPORATION (US)

7.5 ALLIED HEALTHCARE PRODUCTS INC. (US)

7.6 CRYOGAS INTERNATIONAL (US)

7.7 NORCO INC. (US)

7.8 CRAMER DECKER MEDICAL INC. (US)

7.9 AEROTEC INTERNATIONAL INC. (US)

7.10 BEACONMEDAES (US)

7.11 AMICO CORPORATION (CANADA)

7.12 SMITHS MEDICAL (UK)

7.13 MEDICAL GAS SOLUTIONS LTD. (UK)

7.14 BPR MEDICAL LTD. (UK)

7.15 AIR LIQUIDE (FRANCE)

7.16 SOL GROUP (ITALY)

7.17 MESSER GROUP (GERMANY)

7.18 ATLAS COPCO AB (SWEDEN)

7.19 GCE GROUP (CZECH REPUBLIC)

7.20 ROTAREX S.A. (LUXEMBOURG)

7.21 LINDE PLC (IRELAND)

7.22 TAIYO NIPPON SANSO CORPORATION (JAPAN)

7.23 OTHER MAJOR PLAYERS.

Chapter 8: Global Medical Gases and Equipment Market By Region

8.1 Overview

8.2. North America Medical Gases and Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Medical gases

8.2.4.2 Medical gas equipment

8.2.4.3 Medical Gas Mixtures

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Therapeutic

8.2.5.2 Diagnostic

8.2.5.3 Pharmaceutical Manufacturing & Research

8.2.6 Historic and Forecasted Market Size by End-user

8.2.6.1 Hospitals

8.2.6.2 Ambulatory care facilities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medical Gases and Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Medical gases

8.3.4.2 Medical gas equipment

8.3.4.3 Medical Gas Mixtures

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Therapeutic

8.3.5.2 Diagnostic

8.3.5.3 Pharmaceutical Manufacturing & Research

8.3.6 Historic and Forecasted Market Size by End-user

8.3.6.1 Hospitals

8.3.6.2 Ambulatory care facilities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medical Gases and Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Medical gases

8.4.4.2 Medical gas equipment

8.4.4.3 Medical Gas Mixtures

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Therapeutic

8.4.5.2 Diagnostic

8.4.5.3 Pharmaceutical Manufacturing & Research

8.4.6 Historic and Forecasted Market Size by End-user

8.4.6.1 Hospitals

8.4.6.2 Ambulatory care facilities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medical Gases and Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Medical gases

8.5.4.2 Medical gas equipment

8.5.4.3 Medical Gas Mixtures

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Therapeutic

8.5.5.2 Diagnostic

8.5.5.3 Pharmaceutical Manufacturing & Research

8.5.6 Historic and Forecasted Market Size by End-user

8.5.6.1 Hospitals

8.5.6.2 Ambulatory care facilities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medical Gases and Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Medical gases

8.6.4.2 Medical gas equipment

8.6.4.3 Medical Gas Mixtures

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Therapeutic

8.6.5.2 Diagnostic

8.6.5.3 Pharmaceutical Manufacturing & Research

8.6.6 Historic and Forecasted Market Size by End-user

8.6.6.1 Hospitals

8.6.6.2 Ambulatory care facilities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medical Gases and Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Medical gases

8.7.4.2 Medical gas equipment

8.7.4.3 Medical Gas Mixtures

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Therapeutic

8.7.5.2 Diagnostic

8.7.5.3 Pharmaceutical Manufacturing & Research

8.7.6 Historic and Forecasted Market Size by End-user

8.7.6.1 Hospitals

8.7.6.2 Ambulatory care facilities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Medical Gases and Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.92 % |

Market Size in 2032: |

USD 5.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||