Medical Composites Market Synopsis:

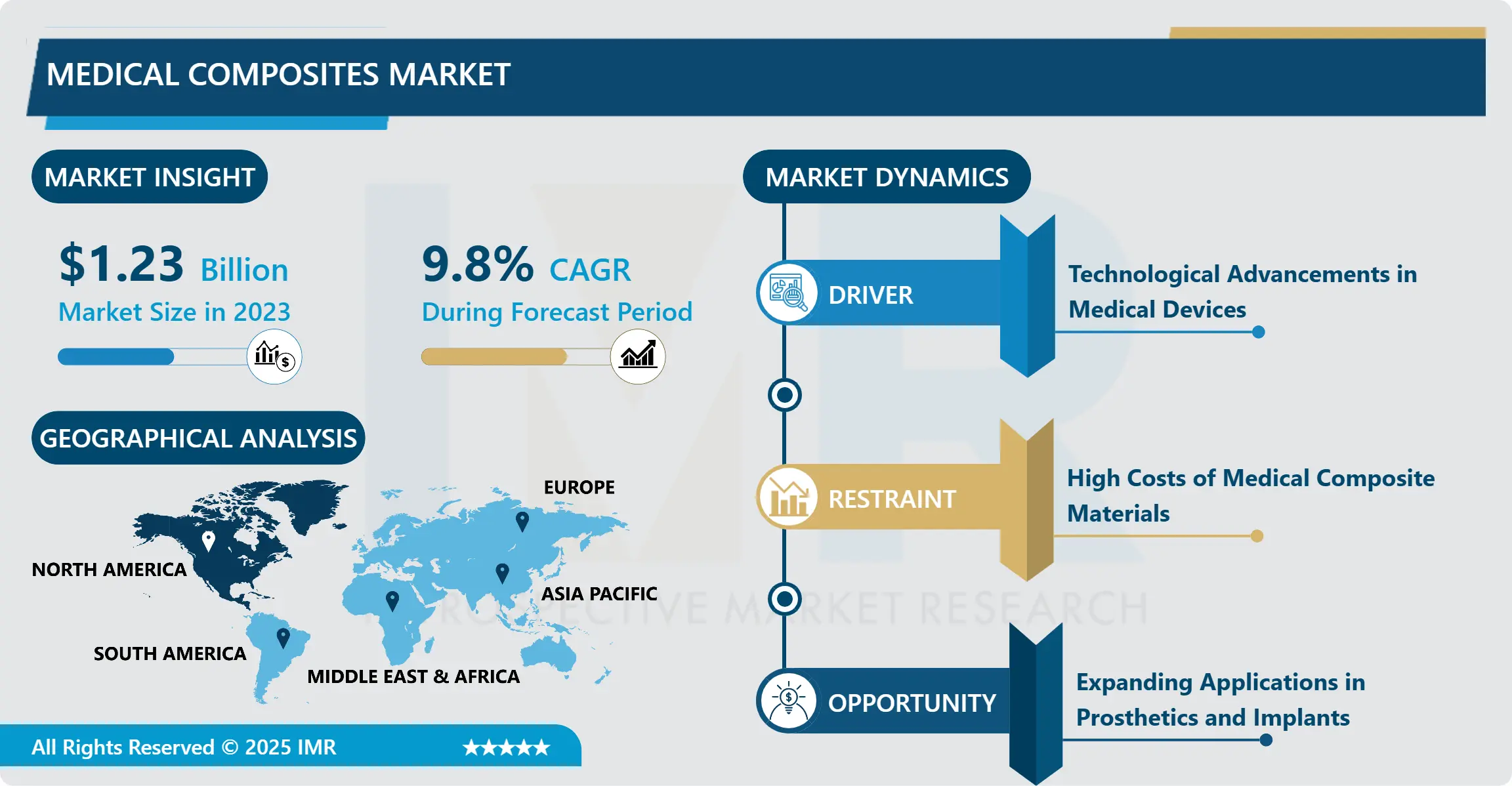

Medical Composites Market Size Was Valued at USD 1.23 Billion in 2023, and is Projected to Reach USD 2.59 Billion by 2032, Growing at a CAGR of 9.8% From 2024-2032.

The medical composites marketplace encompasses the healthcare practice area geared toward the creation and application of innovative substantial composite structures for medical purposes. The latter encompass products that are made from reinforced materials such as carbon fibers, ceramics, or polymers with properties that are light, strong, biocompatible and enduringly wearable. Medical composites are used in almost all areas of biomaterial applications, including prosthetics, diagnostic imaging, surgical tools and implants and in dental field, where their properties enable effective treatment and development of new technologies.

In recent years, there has been a gradual growth of the medical composites market due to the ever-growing customer demand for lightweight yet high-strength materials in the production of medical equipment and more. Medical composites have been useful in changing the landscape of medical devices especially for orthopedic applications, diagnosis and even oral restoration. The use of these materials is mainly provoked by the mechanical characteristics of the metal and its elasticity, biocompatibility, and interaction with tissues. With stakeholders in both the healthcare and manufacturing industries investing in patient-oriented innovations, medical composites represent the key to better, longer-lasting, and as invasive as necessary solutions.

Also, the development of new technologies in material science and increase in healthcare cost all over the world has led to the enhanced demand of medical composites across the world. Medical applications such as in diagnostic imaging equipment and other instruments made from composites that are radiolucent and light weight have been made through composites made from reinforced plastics. Furthermore, the increasing population aged worldwide and increasing incidences of disorders such as osteoarthritis and cardiovascular diseases are likely to work as drivers to the market as this demography will require sophisticated medical devices and treatments that composites can offer.

Medical Composites Market Trend Analysis:

Growing Use of Carbon Fiber in Prosthetics

-

Another great development taking place in the market for medical composites is a growing popularity of carbon fiber to create prosthetics. Carbon fibre reinforced composites are appreciated for their high strength to weight ratio, elasticity and fatigue which makes them suitable for prosthetic limbs and braces. In addition, carbon fiber composites outperform metal-based options in terms of a natural feel and increased mobility which minimizes patient discomfort and increases satisfaction. This trend is also driven by increasing need for individual prosthetic limbs and the possibility to produce these using 3D printing in conjunction with composite materials. Thus, with advancement of the prosthetic technology carbon fiber composites are expected to prevail as the material of choice.

Rising Demand for Minimally Invasive Procedures

-

An evident trend in the medical composites market is increasing use of composite materials for minimally invasive surgical procedures. Since patients are now demanding quick recovery periods and fewer complications, the market also sees a rise in demand for device medical and tools that can help facilitate them. Medical composites have light weighted and high durability and are used in many of the endoscopic tools, catheters, and stents. These instruments demand materials that can survive conditions of stress and still hold accuracy as well as biocompatibility. The increasing trends of minimally invasive surgical procedures are anticipated to boost the market of medical composites for several applications.

Medical Composites Market Segment Analysis:

Medical Composites Market is Segmented on the basis of Fiber Type, Application, and Region

By Type, Carbon Fiber Composites segment is expected to dominate the market during the forecast period

-

The segment, namely, carbon fibre composites is expected to remain the largest one within the medical composites market throughout the forthcoming period since such materials possess enhanced mechanical characteristics and are lightweight in addition to being suitable for numerous applications in the sphere of medicine.. These composites provide enhanced strength to weight ratio, which in return enable production of a robust medical device with ease during handling. Its non-toxic and non-immunogenic behavior is especially useful in applications like surgical pins, artificial joints, artificial limbs and surgical equipment where consumers are always sensitive to material toxicity and antigenicity. Besides, changes in the manufacturing technologies and awareness to the pipe stem looks likely to improve performance of carbon fiber composites and therefore are set to remain popular in the medical industry. Because different healthcare providers are looking for effective and efficient solutions to complex medical issues, the market for carbon fiber composites will gain new momentum in the foreseeable future.

By Application, Diagnostic segment expected to held the largest share

-

Diagnostic is anticipated to dominate the medical composites market throughout the estimated horizon due to an upsurge in applicative requirement for sophisticated diagnostic equipment. Medical composites are used to make MRI machines, CT scanners, and ultrasound equipment because of light weight, high strength and light permeability. They improve the functioning of diagnostic equipment through better imaging and also have added advantages of increasing patient safety and comfort. Furthermore, as the focus on identifying main diseases and diagnosing them early as rapidly developing healthcare systems emphasize, the demand for new methodologies will increase as well. Such a trend is backed by technology and innovation in conjunction with the use of medical composites in the manufacturing of new generation diagnostic tools thus placing the diagnostic segment as the market leader.

Medical Composites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America remains the largest consumer of the medical composites market, and based on revenue generation, represents a large market share in 2023. The leadership of this region is due to a well-developed healthcare system, the implementation of many investments in research and development, and the timely application of effective medical technologies. Out of all the countries, the United States has the largest market share due to the rapidly evolving medical technology industry and a rapidly ageing population in this country. Also, reimbursement policies for new age medical procedures have encouraged its growth in the particular region as well. North America is anticipated to remain the largest market due to its projected 40% share of the global medical composites market in 2023.

Active Key Players in the Medical Composites Market

-

3M (USA)

- Boston Scientific Corporation (USA)

- CeramTec (Germany)

- Composiflex (USA)

- Gurit Holding AG (Switzerland)

- Hexcel Corporation (USA)

- Idemitsu Kosan Co., Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Royal DSM N.V. (Netherlands)

- RTP Company (USA)

- SGL Carbon SE (Germany)

- Teijin Limited (Japan)

- Toray Industries, Inc. (Japan)

- Vesta Inc. (USA)

- Zimmer Biomet Holdings, Inc. (USA)

- Other Active Players

Key Industry Developments in the Medical Composites Market:

-

In April 2019, 3M introduced Filtec Universal, a highly restorative composite product. This shading technique yields incredibly beautiful and effective results.

- In March 2018, with an offer of USD 1091 million, Toray Industries acquired TenCate Advanced Composites. The primary goal of the acquisition was to increase the company's market share and preserve its place in the worldwide carbon fiber industry. This acquisition helped a number of industries, particularly the healthcare industry, who were the final consumers of carbon fibers.

|

Medical Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.23 Billion |

|

Forecast Period 2024-32 CAGR: |

9.8 % |

Market Size in 2032: |

USD 2.59 Billion |

|

Segments Covered: |

By Fiber Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Composites Market by Fiber Type

4.1 Medical Composites Market Snapshot and Growth Engine

4.2 Medical Composites Market Overview

4.3 Carbon Fiber Composites

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Carbon Fiber Composites: Geographic Segmentation Analysis

4.4 Glass Fiber Composites

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Glass Fiber Composites: Geographic Segmentation Analysis

4.5 Aramid Fiber Composites

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Aramid Fiber Composites: Geographic Segmentation Analysis

4.6 and others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and others: Geographic Segmentation Analysis

Chapter 5: Medical Composites Market by Application

5.1 Medical Composites Market Snapshot and Growth Engine

5.2 Medical Composites Market Overview

5.3 Diagnostic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostic: Geographic Segmentation Analysis

5.4 Imaging

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Imaging: Geographic Segmentation Analysis

5.5 Composite Body Implants

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Composite Body Implants: Geographic Segmentation Analysis

5.6 Dental Composites

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Dental Composites: Geographic Segmentation Analysis

5.7 and Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 and Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Medical Composites Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3M (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TORAY INDUSTRIES INC. (JAPAN)

6.4 SGL CARBON SE (GERMANY)

6.5 ROYAL DSM N.V. (NETHERLANDS)

6.6 OTHER ACTIVE PLAYERS

Chapter 7: Global Medical Composites Market By Region

7.1 Overview

7.2. North America Medical Composites Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Fiber Type

7.2.4.1 Carbon Fiber Composites

7.2.4.2 Glass Fiber Composites

7.2.4.3 Aramid Fiber Composites

7.2.4.4 and others

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Diagnostic

7.2.5.2 Imaging

7.2.5.3 Composite Body Implants

7.2.5.4 Dental Composites

7.2.5.5 and Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Medical Composites Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Fiber Type

7.3.4.1 Carbon Fiber Composites

7.3.4.2 Glass Fiber Composites

7.3.4.3 Aramid Fiber Composites

7.3.4.4 and others

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Diagnostic

7.3.5.2 Imaging

7.3.5.3 Composite Body Implants

7.3.5.4 Dental Composites

7.3.5.5 and Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Medical Composites Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Fiber Type

7.4.4.1 Carbon Fiber Composites

7.4.4.2 Glass Fiber Composites

7.4.4.3 Aramid Fiber Composites

7.4.4.4 and others

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Diagnostic

7.4.5.2 Imaging

7.4.5.3 Composite Body Implants

7.4.5.4 Dental Composites

7.4.5.5 and Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Medical Composites Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Fiber Type

7.5.4.1 Carbon Fiber Composites

7.5.4.2 Glass Fiber Composites

7.5.4.3 Aramid Fiber Composites

7.5.4.4 and others

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Diagnostic

7.5.5.2 Imaging

7.5.5.3 Composite Body Implants

7.5.5.4 Dental Composites

7.5.5.5 and Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Medical Composites Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Fiber Type

7.6.4.1 Carbon Fiber Composites

7.6.4.2 Glass Fiber Composites

7.6.4.3 Aramid Fiber Composites

7.6.4.4 and others

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Diagnostic

7.6.5.2 Imaging

7.6.5.3 Composite Body Implants

7.6.5.4 Dental Composites

7.6.5.5 and Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Medical Composites Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Fiber Type

7.7.4.1 Carbon Fiber Composites

7.7.4.2 Glass Fiber Composites

7.7.4.3 Aramid Fiber Composites

7.7.4.4 and others

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Diagnostic

7.7.5.2 Imaging

7.7.5.3 Composite Body Implants

7.7.5.4 Dental Composites

7.7.5.5 and Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Medical Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.23 Billion |

|

Forecast Period 2024-32 CAGR: |

9.8 % |

Market Size in 2032: |

USD 2.59 Billion |

|

Segments Covered: |

By Fiber Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||