Magnetic Ink Character Recognition Printer Market Synopsis:

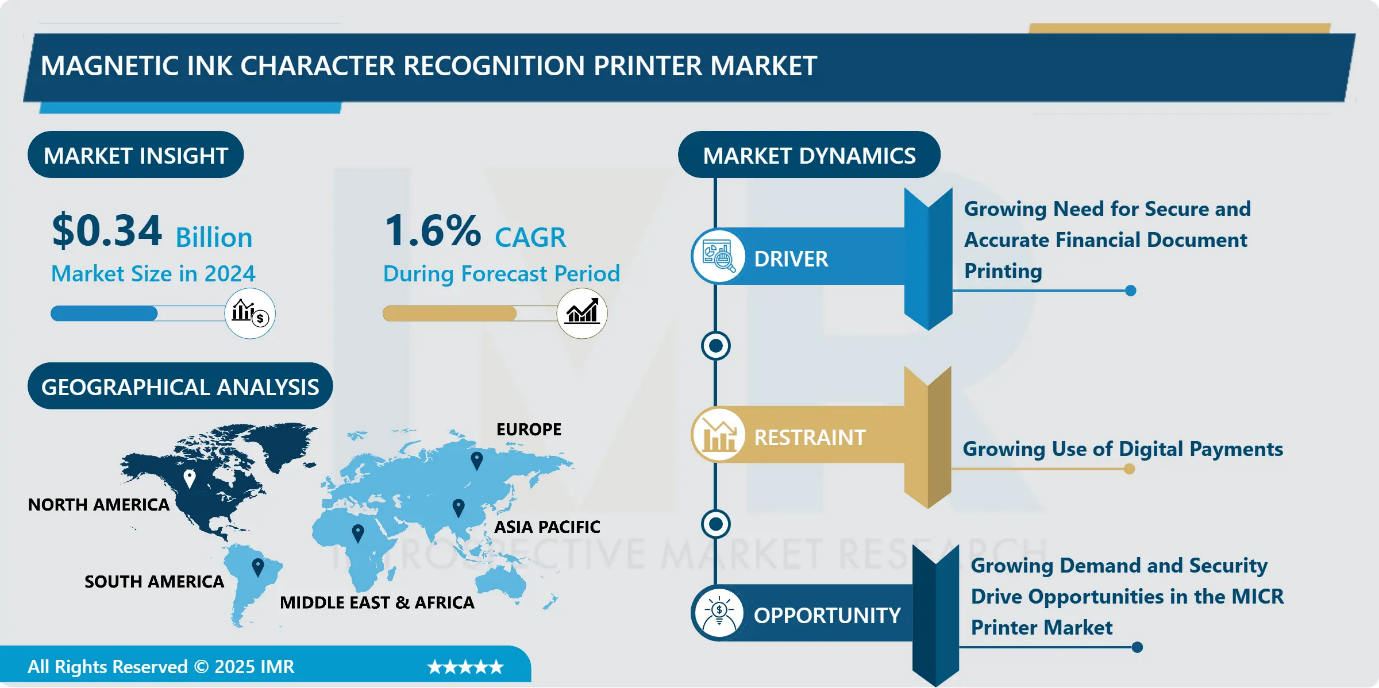

Magnetic Ink Character Recognition Printer Market Size Was Valued at USD 0.34 Billion in 2024, and is projected to reach USD 0.40 Billion by 2035, growing at a CAGR of 1.6% from 2025–2035

The Magnetic Ink Character Recognition (MICR) Printer Market is the business of making and selling special printers that use magnetic ink to print important documents like checks. These printers help banks and companies print papers that machines can read easily and securely, making sure the documents are safe and accurate.

Magnetic Ink Character Recognition (MICR) is a special printing technology used mostly in banks and financial institutions. It uses magnetic ink and a special type of writing, called a MICR font, that machines can easily read. This makes it possible for banks to quickly and safely process important documents like checks. Because the writing is magnetic, machines can still read it even if the check is smudged or dirty. This helps reduce mistakes and protects against fraud.

The demand for MICR printers is growing, especially in the banking and finance industries. These industries need secure and accurate ways to print and handle sensitive documents. MICR printers help make sure that printed checks and other financial papers are correct and safe to use. With the increase in financial activities around the world, especially in developing countries, more banks and businesses are buying MICR printers.

Magnetic Ink Character Recognition Printer Market Growth and Trend Analysis:

Magnetic Ink Character Recognition Printer Market Growth Driver - Growing Need for Secure and Accurate Financial Document Printing

-

A major reason for the growth of the MICR printer market is the strong need for safe and accurate printing of important financial documents, especially checks. Even though digital payments like online transfers, mobile wallets, and credit cards are becoming more popular, many banks, companies, and government offices still use paper checks for different types of transactions. These checks must be printed clearly and securely to avoid mistakes and fraud.

- MICR printers use special magnetic ink and a unique type of writing that machines can read easily. This helps banks and other businesses process checks faster and more safely. It also makes it hard for criminals to change or copy checks, which helps reduce fraud. As financial fraud becomes a bigger concern, more organizations are choosing MICR printers to keep their documents secure.

- Many countries also have strict rules and laws about how financial documents should be printed. MICR printers help companies follow these rules. They make sure that printed checks and statements meet the legal standards for security and accuracy.

- Also, as more businesses move to digital systems, they are still keeping MICR printers to work with their digital tools. This helps them manage both paper and online payments smoothly. The mix of security needs, legal requirements, and the ongoing use of paper checks is pushing the demand for MICR printers higher. The need for secure and correct printing of financial documents is a big reason why the MICR printer market is growing steadily.

Magnetic Ink Character Recognition Printer Market Limiting Factor - Growing Use of Digital Payments

-

One of the main challenges for the MICR printer market is the fast growth of digital payments. More people and businesses now use online banking, mobile apps, and credit cards to send and receive money. These digital methods are quick, easy, and don’t need paper checks. Because of this, fewer checks are being printed, which lowers the demand for MICR printers.

- Many companies are also trying to become paperless to save money and help the environment. Digital documents are easier to store and manage. They also reduce printing costs. As a result, more businesses are moving away from paper checks and using electronic payment systems instead.

- Younger generations are more comfortable with mobile payments and online banking, and they rarely use checks. In some countries, especially developed ones, checks are used less and less each year.

- Because MICR printers are mostly used for check printing, this shift to digital payments is a big limitation for the market. It may cause slower growth or lower sales in the future.

Magnetic Ink Character Recognition Printer Market Expansion Opportunity - Growing Demand and Security Drive Opportunities in the MICR Printer Market

-

The MICR printer market has many good chances to grow because of changes in how people and businesses pay for things. Even though digital payments like online transfers and mobile wallets are becoming more common, there is still a strong need for safe and secure check printing. Banks and businesses want to keep using MICR printers as part of their digital systems to follow rules and keep payments safe. This is making more organizations buy and use MICR printers with their digital work processes.

- Another big chance comes from the rise of omnichannel payment systems. This means customers can pay in many different ways online, in stores, or through apps. MICR printers that can work well with these new systems, like those connected to the cloud or that come with special money-handling software, will be in high demand. Some new MICR printers also have smart features like mobile printing and the ability to collect and analyse data. These features help businesses work faster and better, opening more doors for growth.

- Security is also very important. Since money and financial information are sensitive, companies want printers that stop fraud and protect their data. Printer makers can offer new security tools such as strong coding (encryption), fingerprint locks, and safe printing methods. They can also work with software companies to make better systems for checking and processing payments safely.

- Overall, as businesses focus more on security and many payment methods, the MICR printer market will keep growing. Companies that build smart, safe, and connected printers will have the best chances to succeed.

Magnetic Ink Character Recognition Printer Market Challenge and Risk - High Cost of MICR Printers and Maintenance

-

One big challenge in the MICR printer market is the high cost of the printers and their maintenance. MICR printers are not like normal printers. They use special magnetic ink and unique fonts to print checks and financial documents safely. Because of these features, MICR printers are often more expensive to buy.

- But the cost doesn’t stop after buying the printer. These printers need special ink or toner, which costs more than regular ink. They also need regular maintenance to keep them working properly. If something breaks or wears out, replacing parts can be costly. These ongoing expenses can be hard for small businesses or organizations that have limited budgets.

- Another challenge is training. Staff members need to learn how to use MICR printers the right way. If not used correctly, it can lead to mistakes in printing checks, which can cause problems with banks and even lead to fraud. Also, some older MICR printers may not work well with modern digital systems. Upgrading to new software or systems can be expensive and time-consuming. This makes some companies hesitate to invest in new MICR printers.

- Because of these high costs and added challenges, some businesses may choose cheaper digital payment methods instead of printing checks. The high price of buying, running, and keeping MICR printers in good shape is a big problem. To grow the market, companies need to make more affordable and easy-to use MICR printers for all types of users.

Magnetic Ink Character Recognition Printer Market Segment Analysis:

Magnetic Ink Character Recognition Printer Market is segmented based on Type, Application, End-Users, and Region

- Laser MICR printers are fast and print with high quality. They are best for banks and big companies that print a lot of checks every day. These printers use laser technology to create clear and smudge-free documents, which is very important for financial papers. New laser printers are also more energy efficient, which helps companies save money on electricity.

- Inkjet MICR printers are becoming more popular because they cost less to buy and are good for small businesses. Even though they are slower than laser printers, they still produce good quality prints. These printers are great for places that don’t need to print large volumes. Technology improvements have made inkjet printers better with ink usage and more reliable.

- The choice between laser and inkjet depends on what the user needs. Big companies usually choose laser printers for speed and performance. Small and medium-sized businesses often go with inkjet printers to save money and have more flexibility. Many companies are also looking for eco-friendly printers. This means printers that use less energy, create less waste, and use safer inks. As businesses try to protect the environment, the demand for green printers is growing.

- There is strong competition between laser and inkjet printers. Companies are offering better prices, new features like wireless printing, and strong security. This helps customers get more options that fit their needs while pushing printer companies to keep improving their products.

By Application, Banks and Financial segment held the largest share in 2024

-

MICR printers are mostly used in banks and financial companies. These printers help print checks and other important papers in a safe and accurate way. They use special ink and letters that machines can read easily. This helps stop fraud and makes sure the printed documents are correct. Banks use MICR printers to follow rules and keep their documents safe. Even though banking is becoming more digital, printing checks is still important, and MICR printers help with that.

- Government offices also use MICR printers. They need to print things like tax forms, benefit checks, and official letters that must be real and secure. MICR printers help make sure no one can change or copy these documents. As governments do more work online, they still need MICR printers to print safe and trusted papers.

- Stores and shops (retail sector) use MICR printers too. They use them to print checks, gift cards, and reward program documents. These papers must be clear and secure, so MICR printers are a good choice. As shopping moves both online and in stores, secure printing is still important.

- Other places like hospitals and schools also use MICR printers. Hospitals print safe bills and patient records. Schools use them to print certificates and other financial papers that must be correct and trusted. The MICR printers are helpful in many areas because they make printing safe, clear, and trustworthy. As more companies and groups want better security, MICR printers will continue to be useful and in demand.

Magnetic Ink Character Recognition Printer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period.

-

North America plays an important role in the Magnetic Ink Character Recognition (MICR) printer market. This is mainly because the region has a strong and well-developed banking and financial system. Banks in North America need to print checks and other financial documents in a secure way. MICR printers are used for this purpose because they use special magnetic ink that helps prevent fraud and ensures the checks can be read by machines easily. In 2023, North America made up about 35% of the total global MICR printer market. This means more than one-third of the world’s MICR printers were used or sold in this region. One reason for this is that many large MICR printer companies are based in North America. These companies keep developing better and safer printing technology, which keeps the market growing.

- Another reason for the demand is that North American banks and financial companies must follow strict rules for security and document handling. MICR printers help meet these rules by offering high-quality, secure printing. As more banks focus on protecting customer data and making their processes faster and more efficient, they continue to invest in MICR printers.

- In summary, North America is a key region for the MICR printer market due to its strong financial sector, focus on security, and the presence of top printer companies. This trend is likely to continue, keeping the demand for MICR printers high in the coming years.

Magnetic Ink Character Recognition Printer Market Active Players

- AstroNova, Inc. (USA)

- BIXOLON Co., Ltd. (South Korea)

- Canon Solutions America (USA)

- Cisco Systems, Inc. (USA)

- Citizen Systems Japan Co., Ltd. (Japan)

- Datacard Group (Entrust) (USA)

- Datamax-O’Neil (USA)

- Dell EMC (USA)

- Dymo Corporation (USA)

- Eastman Kodak Company (USA)

- Gestetner (UK)

- Honeywell International Inc. (USA)

- HP Inc. (USA)

- IBM Corporation (USA)

- Intermec Technologies (USA)

- Kofax Inc. (USA)

- Lanier (USA)

- Lexmark Canada Inc. (Canada)

- Muratec America, Inc. (USA)

- Nuance Communications (USA)

- OKI Data Americas (USA)

- Printronix LLC (USA)

- Ricoh Europe PLC (UK)

- RISO Kagaku Corporation (Japan)

- SATO Holdings Corporation (Japan)

- Savin (USA)

- Star Micronics Co., Ltd. (Japan)

- TallyGenicom (USA)

- TSC Auto ID Technology Co., Ltd. (Taiwan)

- Wasp Barcode Technologies (USA)

- Other active Players

Key Industry Developments in the Magnetic Ink Character Recognition Printer Market:

- TROY Group, Inc., a provider of on-demand printing solutions entered into a partnership with Loffler Companies, Inc. a managed service provider, to offer MICR check printing solution.

- Seiko Epson Corporation, a supplier of value-added financial services and payments solutions, launched innovative next generation multifunction teller devices for financial services industry.

- Canon, Inc., a provider of inkjet printers & professional printers entered into partnership with McAfee Corp., an American global computer security software company to expand its printing solutions by increasing endpoint security protection on multifunction printers.

|

Magnetic Ink Character Recognition Printer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.34 Billion |

|

Forecast Period 2025-35 CAGR: |

1.6% |

Market Size in 2035: |

USD 0.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Magnetic Ink Character Recognition (Micr) Printer Market by Product (2018-2035)

4.1 Magnetic Ink Character Recognition (Micr) Printer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Laser MICR Printers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Inkjet MICR Printers

Chapter 5: Magnetic Ink Character Recognition (Micr) Printer Market by Application (2018-2035)

5.1 Magnetic Ink Character Recognition (Micr) Printer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Banking and Financial Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Government

5.5 Retail

5.6 Others

Chapter 6: Magnetic Ink Character Recognition (Micr) Printer Market by Distribution Channel (2018-2035)

6.1 Magnetic Ink Character Recognition (Micr) Printer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline Stores

Chapter 7: Magnetic Ink Character Recognition (Micr) Printer Market by End User (2018-2035)

7.1 Magnetic Ink Character Recognition (Micr) Printer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Commercial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Industrial

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Magnetic Ink Character Recognition (Micr) Printer Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ASTRONOVA

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 INC. (USA)

8.4 BIXOLON CO.

8.5 LTD. (SOUTH KOREA)

8.6 CANON SOLUTIONS AMERICA (USA)

8.7 CISCO SYSTEMS

8.8 INC. (USA)

8.9 CITIZEN SYSTEMS JAPAN CO.

8.10 LTD. (JAPAN)

8.11 DATACARD GROUP (ENTRUST) (USA)

8.12 DATAMAX-O’NEIL (USA)

8.13 DELL EMC (USA)

8.14 DYMO CORPORATION (USA)

8.15 EASTMAN KODAK COMPANY (USA)

8.16 GESTETNER (UK)

8.17 HONEYWELL INTERNATIONAL INC. (USA)

8.18 HP INC. (USA)

8.19 IBM CORPORATION (USA)

8.20 INTERMEC TECHNOLOGIES (USA)

8.21 KOFAX INC. (USA)

8.22 LANIER (USA)

8.23 LEXMARK CANADA INC. (CANADA)

8.24 MURATEC AMERICA

8.25 INC. (USA)

8.26 NUANCE COMMUNICATIONS (USA)

8.27 OKI DATA AMERICAS (USA)

8.28 PRINTRONIX LLC (USA)

8.29 RICOH EUROPE PLC (UK)

8.30 RISO KAGAKU CORPORATION (JAPAN)

8.31 SATO HOLDINGS CORPORATION (JAPAN)

8.32 SAVIN (USA)

8.33 STAR MICRONICS CO.

8.34 LTD. (JAPAN)

8.35 TALLYGENICOM (USA)

8.36 TSC AUTO ID TECHNOLOGY CO.

8.37 LTD. (TAIWAN)

8.38 WASP BARCODE TECHNOLOGIES (USA)

8.39 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Magnetic Ink Character Recognition (Micr) Printer Market By Region

9.1 Overview

9.2. North America Magnetic Ink Character Recognition (Micr) Printer Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Magnetic Ink Character Recognition (Micr) Printer Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Magnetic Ink Character Recognition (Micr) Printer Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Magnetic Ink Character Recognition (Micr) Printer Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Magnetic Ink Character Recognition (Micr) Printer Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Magnetic Ink Character Recognition (Micr) Printer Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Magnetic Ink Character Recognition Printer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 0.34 Billion |

|

Forecast Period 2025-35 CAGR: |

1.6% |

Market Size in 2035: |

USD 0.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||