Global Luxury Footwear Market Overview

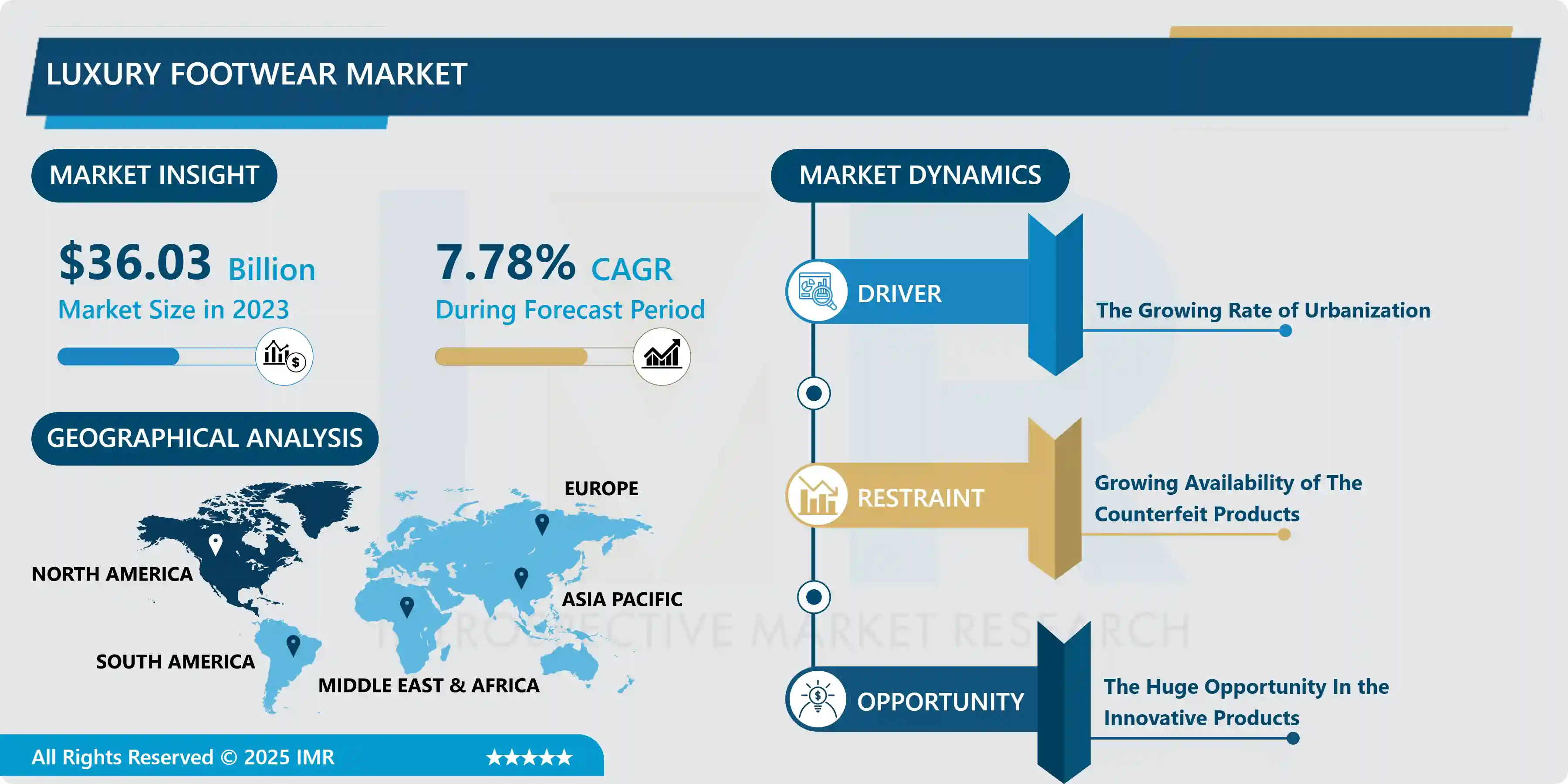

The Global Luxury Footwear Market size is expected to grow from USD 36.03 billion in 2023 to USD 70.71 billion by 2032, at a CAGR of 7.78% during the forecast period (2024-2032).

Luxury footwear is one of the types of the luxury products that are generally associated with the wealthy or affluent. The luxury footwear products include athletic footwear, leather footwear, sneakers, textile footwear, shoes, sandals, and other product types. Beauty, rarity, higher prices, premium quality, aesthetics, symbolism, and extraordinariness are the most common qualities of luxury footwear. The popularity of luxury footwear is increased lately in developed and also developing countries. This is owing to the launching of new footwear by major players in a variety of designs. For instance, in September 2020, Adizero Adios Pro is the new, next standard of professional running footwear specially made for athletes introduced by Adidas. Thus, the growing innovation in the designs of luxury footwear and high individual net worth fuelling the growth of the luxury footwear market.

Market Dynamics And Factors For Luxury Footwear Market

Drivers:

The Growing Rate of Urbanization

- In recent years increasing the urban population is the major factor that provides growth for the luxury footwear market. Urban society impacts the way and the standard the people live. In urban society, peoples have to change lifestyles, have high disposable income, and have a high corporate culture, thus people are largely interested to purchase luxury goods. The following chart shows the population of urban areas worldwide by the cities in 2020.

- Thus, due to the growing population in urban areas, the demand for luxury footwear is increased. Additionally, in developed countries rising the influx of multinational companies, the consumer culture of costly and luxury footwear has been popularized. Owing to growing internet penetration in urban areas the growing online sales of various products. Online sales offer the facility the work from home. Due to hectic lifestyles and high technical knowledge people buy products online. Luxury footwears are available on various online platforms in different types of designs and presents discount on purchase. Therefore, the demand for luxury footwear is increased which propels the growth of the market.

Restraints:

Growing Availability of The Counterfeit Products

- In developed and developing countries growing the availability of counterfeit goods in retail footwear and volatile economic conditions is the key that hampers the growth of the luxury footwear market. Counterfeit goods include a trademark or logo that is identical to the trademark of another. Moreover, the fluctuation in the currency and limited brand outlets among the emerging region also decrease the demand for luxury footwear that factors can be responsible for restricting the growth of the Luxury footwear market.

Opportunity:

The Huge Opportunity In the Innovative Products

- The growing number of the launching of new products provides a lucrative opportunity for the luxury footwear market during the forecast year. Several manufacturing industries are focused on the research and development of new luxury footwear. For instance, a Germany-based company, Adidas, a designer, and producer of apparel, luxury footwear, sports equipment, and accessories developed the plant-based leather material in 2020. This material is made from mycelium which is part of the fungus. Additionally, in the same year, the company developed 15 million pairs of shoes. These shoes are made from recycled plastic waste collected from beaches and coastal. Thus the growing research and development activity in the designing of footwear will provide a remunerative opportunity for the luxury footwear market in the forecast period.

Segmentation Analysis Of Luxury Footwear Market

- By Product Type, the formal shoe is expected to have maximum market growth in the luxury footwear market. The formal shoe is one of the parts of professionalism in the workplace specifically in the corporate and fashion industries. In the past few years, more peoples give preference to working in the corporate sector. Thus, the number of corporate sectors is growing. According to Statista, in 2021 there were 333.34 million companies present in the world. Hence increasing the demand for the luxury formal shoe. The popularity of formal shoes in the fashion industry is also rising owing to their offering elegance, attractive look, and unique design. It is used on various occasions consisting of a party, concerts, and other public gatherings. Moreover, more people have a growing interest to work in the fashion industry. Henceforth, the maximum sale of the formal shoe in the luxury footwear market.

- By End-Users, women are projected to have the highest market growth in the luxury footwear market. Women as compared to men are more fascinated by shopping. They like to live in a standard and modern way. They invest more in the purchase of luxury products including luxury footwear. Luxury footwear is more adopted in the fashion industries and in these industries, the women population is high. Thus, the demand for luxury footwear is increasing. Additionally, the rising population of women around the world. For instance, Statista stated that about 3.85 billion women population in 2020. Henceforth, with rising women population increases the demand for luxury footwear that support the growth of the market over the forecast year.

- By Distribution Channels, the online segment is expected to have maximum market growth in the luxury footwear market. In this new generation growing the trend of the purchase goods via online mode. Statista stated that in 2021 more than 2.14 billion people in the world purchase goods or services online. There are various reasons to purchase the product online such as free delivery, coupons, discounts, easy return policy, easy and quick online checkout policies, loyalty points, next-day delivery, knowing the product is environmentally friendly, and the flexibility of the payment mode. Because of these benefits peoples prefers online platform for shopping. Moreover, an increasing number of online platforms for shopping and growing internet penetration in the world. After the covid-19, most people changed their way of shopping. They prefer online platforms over offline ones. Thus, online channels have the maximum market share in the distribution of the luxury footwear market.

Regional Analysis Of Luxury Footwear Market

- North America is the dominating region in the luxury footwear market owing to people in this region being more fascinated to purchase modern goods. North America is a well-developed and financially strong region. Thus, they can easily purchase luxury goods. Peoples in this region prefer the modern lifestyle. Additionally, the corporate sectors and fashion industries in this region are rapidly growing. Thus, the demand for luxury footwear in this region. Moreover, the high proliferation of smart devices and high internet penetration that increasing the online platforms for shopping. So, people in this region purchase goods online including luxury footwear. In addition to these, a growing number of the manufacturing industries of footwear in this region develop a huge potential for growth of the North American region in the luxury footwear market.

- Europe is the second-dominated region in the luxury footwear market. Europe is a well-developed country and people in this region have disposable income. They are more interested in purchasing luxury goods and having a high capacity to spend on luxury footwear. Additionally, In this region high number of corporate sectors that necessary for employees to wear luxury footwear as a part of professionalism. European likes to live modern lifestyles. Also, the Fashion industry in this region is increased that increasing the demand for luxury footwear. The manufacturers of footwear continuously engaged in the production of newly designed footwear to meet the likes and needs of the consumer. Thus, the market for luxury footwear in Europe is rapidly growing.

- Asia Pacific have significant growth in the luxury footwear market. India is the world's second-largest footwear producer, trailing only China. Luxury footwear includes leather footwear. The Indian footwear industry is made up of the leather and non-leather segments, which are driven by a strong domestic market. According to Invest India's report on the 'Non-leather footwear Industry in India,' the sector is expected to grow eightfold by 2030. Due to shifting consumer preferences, 86% of global footwear consumption is now non-leather by volume, and India is following suit. Leather footwear, on the other hand, remains a significant part of the industry and a major export category for India. The United Kingdom is a major export destination for Indian leather footwear. Moreover, with rising disposable income and the emergence of fashion-conscious and discerning consumers, the Indian shoe and footwear market is poised to grow by double digits in the coming years. The shoe industry, as a labor-intensive industry, also provides unique 'social' opportunities, with the potential to create more than 200,000 jobs in the coming years. Thus, Asia Pacific is fastly growing in the luxury footwear market.

Top Key Players Covered In Luxury Footwear Market

- Chanel S.A.(France)

- Burberry (UK)

- Silvano Lattanzi(Italy)

- Prada S.p.A (Italy)

- A.Testoni (Italy)

- Dr. Martens (UK)

- Base London (UK)

- John Lobb Bootmaker (UK)

- Salvatore Ferragamo (Italy)

- Lottusse – Mallorca (Baleares)

- LVMH (France)

- Adidas AG(India), and other major players.

Key Industry Development In The Luxury Footwear Market

- In Apr 2023, Luxury brands Gucci and Burberry joined Labell-D's new platform, the Luxury Asset Exchange, aimed at protecting the value of luxury products through validated pricing. Powered by blockchain technology, the marketplace connected first and second-hand markets, fostering sustainable consumption. Julia Vendramin, CEO and Co-Founder, highlighted the platform's ability to authenticate ownership history and enable a circular economy. The UK-based start-up secured seed funding from prominent angel investors, supporting over 75,000 active users.

|

Global Luxury Footwear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 36.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.78% |

Market Size in 2032: |

USD 70.71 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-Users |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Luxury Footwear Market by Product Type (2018-2032)

4.1 Luxury Footwear Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Formal Shoes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Casual Shoes

Chapter 5: Luxury Footwear Market by End-Users (2018-2032)

5.1 Luxury Footwear Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Men

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Women

5.5 Children

Chapter 6: Luxury Footwear Market by Distribution Channels (2018-2032)

6.1 Luxury Footwear Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Luxury Footwear Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LEXMARK (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PRINTEK (UNITED STATES)

7.4 OLIVETTI (ITALY)

7.5 WINPOS (FINLAND)

7.6 JOLIMARK (CHINA)

7.7 ZONERICH (CHINA)

7.8 NEW BEIYANG (CHINA)

7.9 GAINSCHA (CHINA)

7.10 ICOD (CHINA)

7.11 SPRT (CHINA)

7.12 EPSON (JAPAN)

7.13 FUJITSU (JAPAN)

7.14 OKI (JAPAN)

7.15 TOSHIBA (JAPAN)

7.16 STAR (JAPAN)

7.17 BIXLON (KOREA)

7.18

Chapter 8: Global Luxury Footwear Market By Region

8.1 Overview

8.2. North America Luxury Footwear Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Formal Shoes

8.2.4.2 Casual Shoes

8.2.5 Historic and Forecasted Market Size by End-Users

8.2.5.1 Men

8.2.5.2 Women

8.2.5.3 Children

8.2.6 Historic and Forecasted Market Size by Distribution Channels

8.2.6.1 Online

8.2.6.2 Offline

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Luxury Footwear Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Formal Shoes

8.3.4.2 Casual Shoes

8.3.5 Historic and Forecasted Market Size by End-Users

8.3.5.1 Men

8.3.5.2 Women

8.3.5.3 Children

8.3.6 Historic and Forecasted Market Size by Distribution Channels

8.3.6.1 Online

8.3.6.2 Offline

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Luxury Footwear Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Formal Shoes

8.4.4.2 Casual Shoes

8.4.5 Historic and Forecasted Market Size by End-Users

8.4.5.1 Men

8.4.5.2 Women

8.4.5.3 Children

8.4.6 Historic and Forecasted Market Size by Distribution Channels

8.4.6.1 Online

8.4.6.2 Offline

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Luxury Footwear Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Formal Shoes

8.5.4.2 Casual Shoes

8.5.5 Historic and Forecasted Market Size by End-Users

8.5.5.1 Men

8.5.5.2 Women

8.5.5.3 Children

8.5.6 Historic and Forecasted Market Size by Distribution Channels

8.5.6.1 Online

8.5.6.2 Offline

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Luxury Footwear Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Formal Shoes

8.6.4.2 Casual Shoes

8.6.5 Historic and Forecasted Market Size by End-Users

8.6.5.1 Men

8.6.5.2 Women

8.6.5.3 Children

8.6.6 Historic and Forecasted Market Size by Distribution Channels

8.6.6.1 Online

8.6.6.2 Offline

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Luxury Footwear Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Formal Shoes

8.7.4.2 Casual Shoes

8.7.5 Historic and Forecasted Market Size by End-Users

8.7.5.1 Men

8.7.5.2 Women

8.7.5.3 Children

8.7.6 Historic and Forecasted Market Size by Distribution Channels

8.7.6.1 Online

8.7.6.2 Offline

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Luxury Footwear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 36.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.78% |

Market Size in 2032: |

USD 70.71 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End-Users |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||