LEO and GEO Satellite Market Synopsis

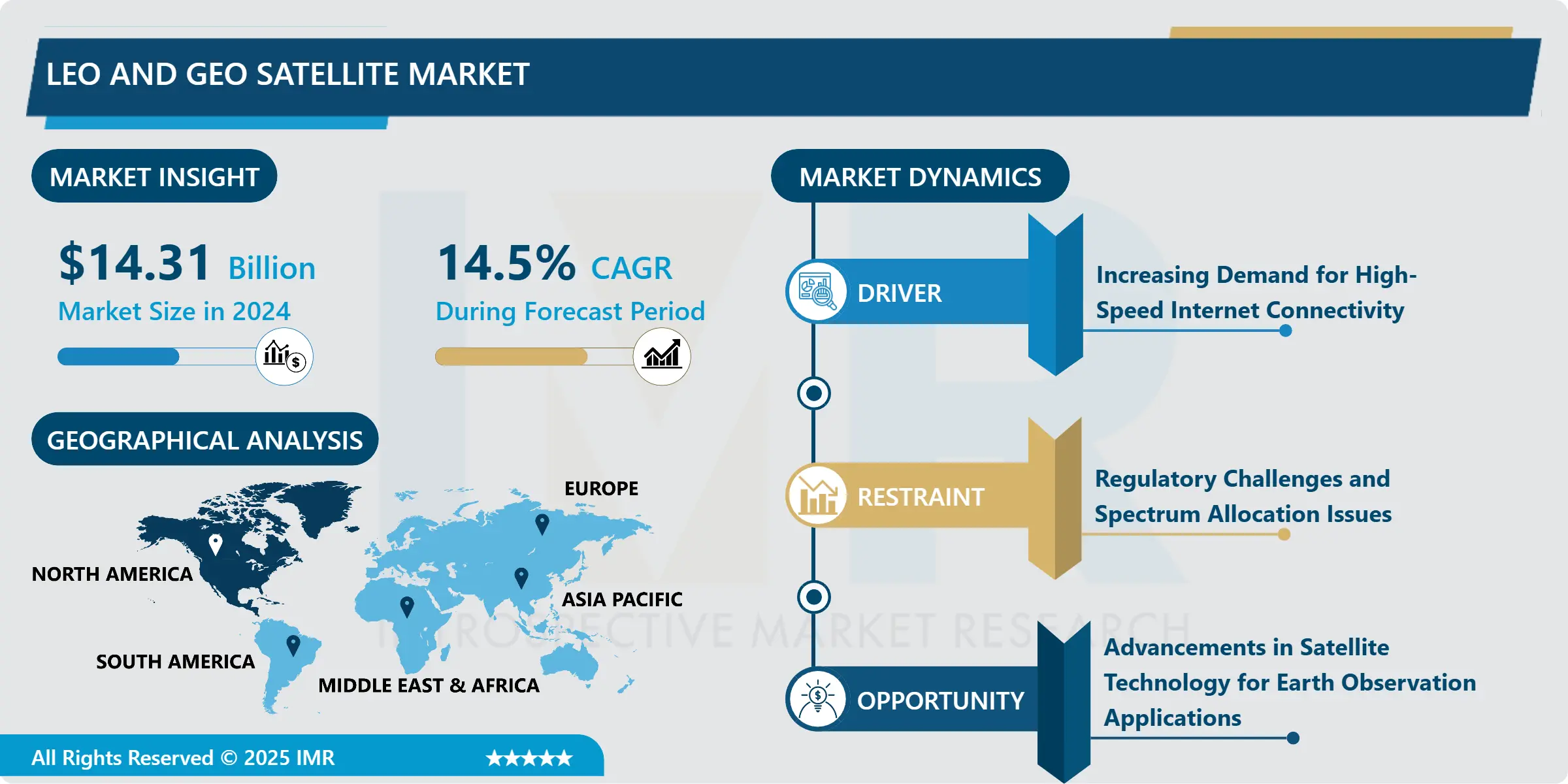

LEO and GEO Satellite Market Size Was Valued at USD 14.31 Billion in 2024, and is Projected to Reach USD 42.27 Billion by 2032, Growing at a CAGR of 14.5% From 2025-2032.

The global Low Earth Orbit (LEO) and Geostationary Orbit (GEO) satellite market form a critical backbone of the modern telecommunications and remote sensing infrastructure. LEO satellites, positioned closer to Earth, are ideal for providing high-speed internet access, Earth observation, and other data-intensive applications. GEO satellites, stationed at fixed points above the equator, are primarily used for broadcasting, communication, and weather monitoring. Together, they enable seamless global connectivity, supporting everything from international telecommunications to disaster response and environmental monitoring.

This market's significance lies in its ability to facilitate a wide range of essential services across various industries. In telecommunications, LEO satellites are revolutionizing connectivity by offering broadband access to remote and underserved areas, bridging the digital divide. They also play a crucial role in disaster management, providing real-time data and communication channels during emergencies. Furthermore, GEO satellites ensure uninterrupted television broadcasting, global positioning services, and secure communication networks, essential for both civilian and military operations.

The satellite industry's continual innovation and expansion are driving economic growth and fostering technological advancements. With the emergence of small satellite technology and reusable launch vehicles, the cost of satellite deployment has decreased significantly, opening up new opportunities for startups and reducing barriers to entry for emerging markets. Moreover, the integration of satellite data with artificial intelligence and big data analytics is unlocking new insights into climate change, agriculture, urban planning, and resource management, benefiting governments, businesses, and society at large.

LEO and GEO Satellite Market Trend Analysis

LEO and GEO Satellite Market Growth Drivers- Increased Demand for Small Satellites in LEO

- In recent years, there has been a noticeable surge in the demand for small satellites operating in Low Earth Orbit (LEO). These satellites, typically weighing less than 500 kilograms, are preferred for their cost-effectiveness, flexibility, and ability to quickly replace or upgrade constellations. One prominent driver behind this trend is the rise of commercial satellite ventures focusing on Earth observation, communication, and remote sensing applications. Companies like SpaceX's Starlink, OneWeb, and Planet Labs have been leading the charge by deploying large constellations of small satellites, driving the need for more launches and increasing competition in the market.

- Technological advancements in miniaturization have played a crucial role in facilitating the growth of small satellites in LEO. These advancements have led to significant reductions in the size, weight, and power requirements of satellite components, enabling the development of highly capable small satellites at lower costs. Moreover, the miniaturization of sensors, processors, and communication systems has enhanced the performance and functionality of small satellites, allowing them to capture high-resolution imagery, provide global internet coverage, and support various other applications. As a result, traditional satellite operators, government agencies, and new entrants alike are increasingly leveraging small satellites to meet their mission objectives in a more agile and cost-effective manner.

- Another factor driving the demand for small satellites in LEO is the emergence of mega constellations aimed at providing global broadband internet connectivity. These constellations comprise thousands of small satellites distributed across LEO, promising to deliver high-speed internet access to underserved and remote regions worldwide. The potential market for satellite-based internet services has attracted significant investments from both established aerospace companies and venture capital firms, further fueling the growth of small satellite deployments. However, this trend also raises challenges related to orbital debris mitigation, spectrum management, and regulatory compliance, necessitating close collaboration among industry stakeholders, policymakers, and international organizations to ensure the sustainable development of LEO satellite constellations.

LEO and GEO Satellite Market Opportunities- Advancements in High Throughput Satellites (HTS) for GEO

- High Throughput Satellites (HTS) operating in Geostationary Orbit (GEO) have witnessed significant advancements in recent years, driven by the growing demand for high-speed broadband connectivity, multimedia broadcasting, and other data-intensive applications. Unlike traditional GEO satellites, which use wide beams to cover large geographic areas, HTS employ spot beams and frequency reuse techniques to deliver higher data rates and better spectral efficiency. This enables HTS operators to meet the increasing bandwidth demands of consumers and enterprises more efficiently, particularly in densely populated urban areas and maritime environments.

- One of the key technological trends in HTS is the adoption of advanced digital signal processing (DSP) techniques to maximize the throughput and spectral efficiency of satellite communication systems. By employing sophisticated modulation and coding schemes, adaptive power control, and interference mitigation algorithms, HTS operators can optimize the utilization of available satellite resources and deliver higher-quality services to end-users. Furthermore, the integration of software-defined networking (SDN) and network function virtualization (NFV) technologies enables dynamic allocation of bandwidth and prioritization of traffic, allowing HTS operators to offer flexible service plans and Quality of Service (QoS) guarantees tailored to specific customer requirements.

- Another notable trend in the HTS market is the deployment of next-generation satellites with enhanced payloads and capabilities. These satellites feature larger onboard processing capabilities, higher frequency reuse factors, and more advanced antenna architectures, allowing them to support a wider range of applications and services with greater efficiency and resilience. Moreover, the use of electric propulsion systems and lightweight materials enables HTS operators to launch larger and more complex satellites while minimizing launch costs and maximizing operational lifespan. As a result, HTS platforms are poised to play a central role in enabling the digital transformation of industries such as telecommunications, media, aviation, and maritime, driving innovation and economic growth on a global scale.

LEO and GEO Satellite Market Segment Analysis:

LEO and GEO Satellite Market is segmented based on Orbit Type, Application, and End-User

By Orbit Type: Low Earth Orbit (LEO) Dominates the Global Satellite Market

In the realm of orbit types, Low Earth Orbit (LEO) satellites stand out as the dominating force in the global satellite market. This dominance stems from several key factors. Firstly, LEO satellites operate at lower altitudes compared to their Geostationary Earth Orbit (GEO) counterparts, resulting in lower latency and better connectivity, making them ideal for applications such as high-speed internet services, earth observation, and remote sensing. Moreover, advancements in miniaturization and launch technologies have made deploying LEO satellites more cost-effective, fostering a surge in satellite internet constellations and remote sensing ventures, further bolstering their dominance.

Secondly, the versatility of LEO satellites makes them highly adaptable to a wide range of applications, from telecommunications to scientific research and beyond. Their agility allows for swift orbital adjustments, enabling enhanced coverage and responsiveness, crucial for applications like global broadband internet coverage and disaster monitoring. Additionally, the proliferation of small satellites and CubeSats, which primarily operate in LEO, has democratized access to space, fueling innovation and entrepreneurship in the satellite industry, consolidating LEO's position as the leading orbit type in the global satellite market.

By Application: Telecommunication Emerges as the Dominant Segment

In the multifaceted landscape of satellite applications, telecommunications emerges as the dominant segment, exerting a significant influence on the global satellite market. This dominance is driven by the ever-increasing demand for connectivity, especially in remote and underserved regions where terrestrial infrastructure is lacking or economically unviable. Satellites, particularly those in Geostationary Earth Orbit (GEO) and Low Earth Orbit (LEO), play a pivotal role in providing broadband internet, mobile communication, and broadcasting services to a global audience.

The prevalence of smartphones, IoT devices, and digital services has propelled the need for ubiquitous, high-speed connectivity, which satellites can efficiently deliver. Furthermore, the emergence of mega-constellations comprising hundreds or even thousands of small satellites in LEO aims to revolutionize global internet coverage, promising low-latency, high-bandwidth connectivity on a scale previously unattainable. As telecommunications continue to evolve and expand, fueled by technological advancements and market dynamics, its dominance within the satellite application landscape is expected to persist and even intensify in the foreseeable future.

LEO and GEO Satellite Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is poised to dominate the global Low Earth Orbit (LEO) and Geostationary Orbit (GEO) satellite market for several reasons. Firstly, the region houses some of the world's leading satellite manufacturers and service providers, including SpaceX, Boeing, and Lockheed Martin. These companies possess advanced technological capabilities and significant financial resources, allowing them to develop cutting-edge satellite systems and maintain a competitive edge in the market. Additionally, North America benefits from a robust regulatory framework and government support for the space industry, fostering innovation and investment in satellite technology.

- Furthermore, the increasing demand for satellite-based communication, navigation, and remote sensing services in various sectors such as telecommunications, defense, and agriculture further drives the dominance of North America in the LEO and GEO satellite market. The region's strong economic growth and technological advancement create a conducive environment for the adoption of satellite-based solutions, driving market expansion. Moreover, the presence of a large number of tech-savvy consumers and businesses in North America fuels the demand for high-speed internet connectivity and other satellite-enabled services, contributing to market dominance.

- Moreover, North America's strategic alliances and partnerships with other global players, such as the European Space Agency (ESA) and Japan Aerospace Exploration Agency (JAXA), strengthen its position in the global satellite market. These collaborations facilitate knowledge exchange, joint research, and technology transfer, enabling North American companies to stay at the forefront of satellite innovation. Additionally, the region's favorable investment climate and venture capital ecosystem attract startups and entrepreneurs in the space sector, fostering further growth and innovation in LEO and GEO satellite technologies. Overall, North America's technological prowess, market demand, and collaborative initiatives position it as the dominating region in the global LEO and GEO satellite market over the forecast period.

Active Key Players in the LEO and GEO Satellite Market

- Airbus S.A.S. (France)

- Furuno Electric (Japan)

- Inmarsat plc. (United Kingdom)

- INTELSAT S.A. (United States)

- Israel Aerospace Industries Ltd. (Israel)

- L3 Harris Corporation (United States)

- Lockheed Martin Corporation (United States)

- Mitsubishi Electric Corporation (Japan)

- Qualcomm Inc (United States)

- Texas Instruments (United States)

- Thales Group (France)

- The Boeing Company (United States)

- Topcon Corporation (Japan), and Other Active Players

|

Global LEO and GEO Satellite Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.5% |

Market Size in 2032: |

USD 42.27 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Organization Size |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: LEO and GEO Satellite Market by Type (2018-2032)

4.1 LEO and GEO Satellite Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Enterprise Security

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Endpoint Security

4.5 Cloud Security

4.6 Network Security

4.7 Application Security

Chapter 5: LEO and GEO Satellite Market by Organization Size (2018-2032)

5.1 LEO and GEO Satellite Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large Enterprise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 SMEs

Chapter 6: LEO and GEO Satellite Market by Industry Verticals (2018-2032)

6.1 LEO and GEO Satellite Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IT and Telecom

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail

6.5 BFSI

6.6 Healthcare

6.7 Government and defense

6.8 Automotive

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 LEO and GEO Satellite Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIRBUS S.A.S. (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FURUNO ELECTRIC (JAPAN)

7.4 INMARSAT PLC. (UNITED KINGDOM)

7.5 INTELSAT S.A. (UNITED STATES)

7.6 ISRAEL AEROSPACE INDUSTRIES LTD. (ISRAEL)

7.7 L3 HARRIS CORPORATION (UNITED STATES)

7.8 LOCKHEED MARTIN CORPORATION (UNITED STATES)

7.9 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.10 QUALCOMM INC (UNITED STATES)

7.11 TEXAS INSTRUMENTS (UNITED STATES)

7.12 THALES GROUP (FRANCE)

7.13 THE BOEING COMPANY (UNITED STATES)

7.14 TOPCON CORPORATION (JAPAN)

7.15 AND OTHER KEY PLAYERS

7.16

Chapter 8: Global LEO and GEO Satellite Market By Region

8.1 Overview

8.2. North America LEO and GEO Satellite Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Enterprise Security

8.2.4.2 Endpoint Security

8.2.4.3 Cloud Security

8.2.4.4 Network Security

8.2.4.5 Application Security

8.2.5 Historic and Forecasted Market Size by Organization Size

8.2.5.1 Large Enterprise

8.2.5.2 SMEs

8.2.6 Historic and Forecasted Market Size by Industry Verticals

8.2.6.1 IT and Telecom

8.2.6.2 Retail

8.2.6.3 BFSI

8.2.6.4 Healthcare

8.2.6.5 Government and defense

8.2.6.6 Automotive

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe LEO and GEO Satellite Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Enterprise Security

8.3.4.2 Endpoint Security

8.3.4.3 Cloud Security

8.3.4.4 Network Security

8.3.4.5 Application Security

8.3.5 Historic and Forecasted Market Size by Organization Size

8.3.5.1 Large Enterprise

8.3.5.2 SMEs

8.3.6 Historic and Forecasted Market Size by Industry Verticals

8.3.6.1 IT and Telecom

8.3.6.2 Retail

8.3.6.3 BFSI

8.3.6.4 Healthcare

8.3.6.5 Government and defense

8.3.6.6 Automotive

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe LEO and GEO Satellite Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Enterprise Security

8.4.4.2 Endpoint Security

8.4.4.3 Cloud Security

8.4.4.4 Network Security

8.4.4.5 Application Security

8.4.5 Historic and Forecasted Market Size by Organization Size

8.4.5.1 Large Enterprise

8.4.5.2 SMEs

8.4.6 Historic and Forecasted Market Size by Industry Verticals

8.4.6.1 IT and Telecom

8.4.6.2 Retail

8.4.6.3 BFSI

8.4.6.4 Healthcare

8.4.6.5 Government and defense

8.4.6.6 Automotive

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific LEO and GEO Satellite Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Enterprise Security

8.5.4.2 Endpoint Security

8.5.4.3 Cloud Security

8.5.4.4 Network Security

8.5.4.5 Application Security

8.5.5 Historic and Forecasted Market Size by Organization Size

8.5.5.1 Large Enterprise

8.5.5.2 SMEs

8.5.6 Historic and Forecasted Market Size by Industry Verticals

8.5.6.1 IT and Telecom

8.5.6.2 Retail

8.5.6.3 BFSI

8.5.6.4 Healthcare

8.5.6.5 Government and defense

8.5.6.6 Automotive

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa LEO and GEO Satellite Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Enterprise Security

8.6.4.2 Endpoint Security

8.6.4.3 Cloud Security

8.6.4.4 Network Security

8.6.4.5 Application Security

8.6.5 Historic and Forecasted Market Size by Organization Size

8.6.5.1 Large Enterprise

8.6.5.2 SMEs

8.6.6 Historic and Forecasted Market Size by Industry Verticals

8.6.6.1 IT and Telecom

8.6.6.2 Retail

8.6.6.3 BFSI

8.6.6.4 Healthcare

8.6.6.5 Government and defense

8.6.6.6 Automotive

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America LEO and GEO Satellite Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Enterprise Security

8.7.4.2 Endpoint Security

8.7.4.3 Cloud Security

8.7.4.4 Network Security

8.7.4.5 Application Security

8.7.5 Historic and Forecasted Market Size by Organization Size

8.7.5.1 Large Enterprise

8.7.5.2 SMEs

8.7.6 Historic and Forecasted Market Size by Industry Verticals

8.7.6.1 IT and Telecom

8.7.6.2 Retail

8.7.6.3 BFSI

8.7.6.4 Healthcare

8.7.6.5 Government and defense

8.7.6.6 Automotive

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global LEO and GEO Satellite Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.5% |

Market Size in 2032: |

USD 42.27 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Organization Size |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||