Lancing Devices & Lancets Market Synopsis

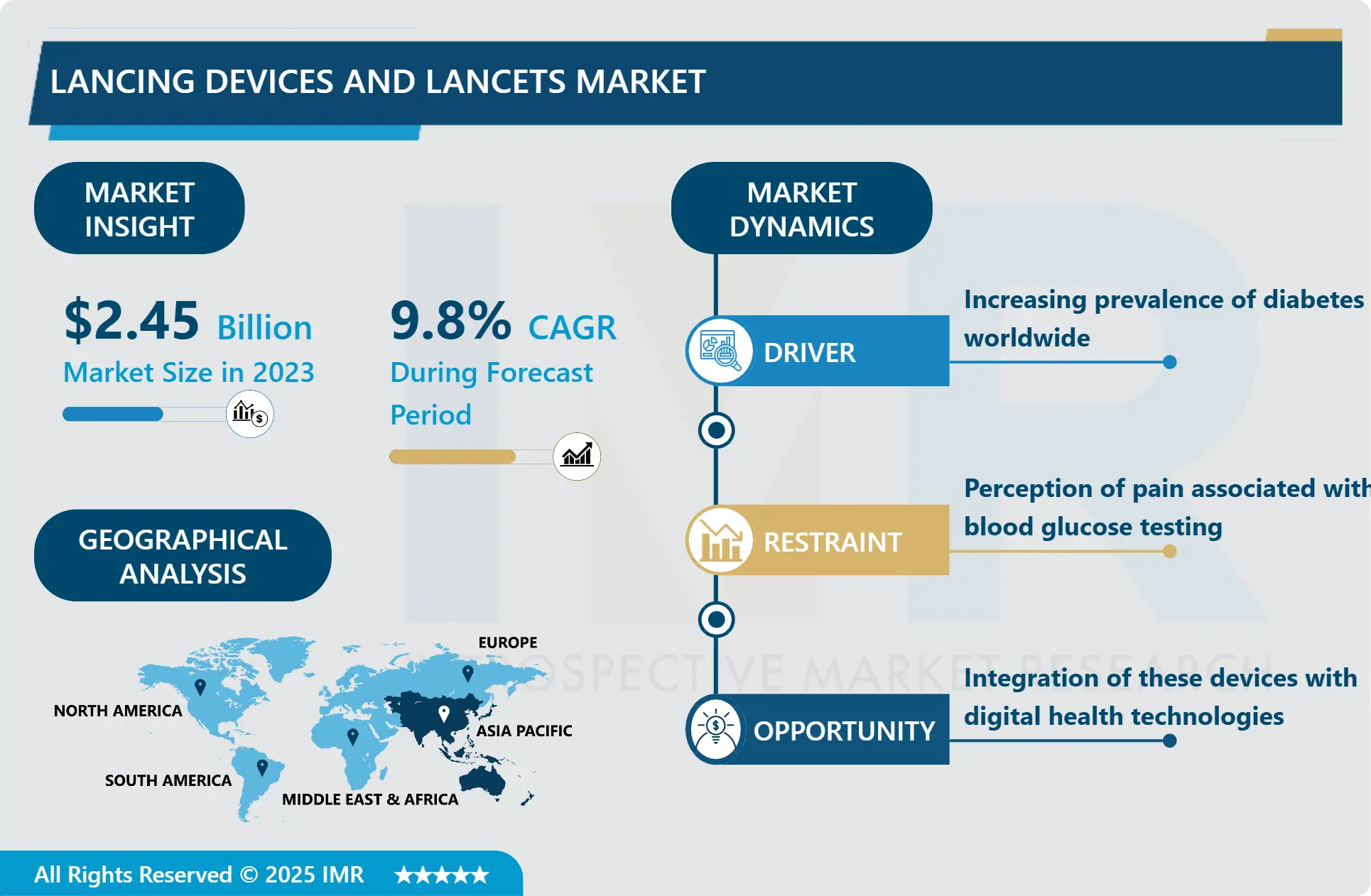

Lancing Devices & Lancets Market Size Was Valued at USD 2.69 Billion in 2024 and is Projected to Reach USD 7.52 Billion by 2035, Growing at a CAGR of 9.8 % From 2025-2035.

The lancing devices and lancets market refers to the devices meant for cutting or piercing to get small blood samples mostly from diabetic patients for glucose level checkups. A lancet is employed to prick one’s skin to draw a blood sample for glucose testing; a lancing device on the other hand is a tiny piece of equipment, which contains lancets. These products are important, especially for those who have to measure their blood sugar level regularly to control the disease. The market consists of a vast array of lancet devices starting from simple spring-loaded lancets to complex devices with adjustable depth and minimum pain offering. The global lancing devices and lancets market is continually growing due to increasing cases of diabetes mellitus and the development of the healthcare sector particularly about retail, cost, accuracy, and comfort of patients.

The lancing devices and lancets market is an important category of the medical devices market mainly supported by the growing incidence of diabetes across the world. These devices have been observed to be of great importance in the monitoring of glucose levels in patients hence making it possible for patients to go for tests regularly. The important drivers of the market also lie in developments that seek to optimize the experience for the patient while increasing the efficacy of the procedures, for example, devices with adjustable depth and technologies that can reduce the pain someone feels while donating blood. Also, the growing knowledge of the condition and the shift towards preventative measures to control the disease are driving the market higher.

Specific market participants alive to the requirements of the users in the lancing devices and lancets segment are devising ways and means of improving the products and services offered in the sector. This is in areas such as designing smart connected devices that work well with digital health management platforms and also in ensuring that the figures produced by these systems meet the harshest regulatory requirements. The market has a high competition structure with a large number of manufacturers, who produce various goods for different patients and different types of healthcare facilities. Hence, due to the increasing focus of the healthcare systems all across the world towards chronic disease treatment, including diabetes, it can be concluded that the lancing devices and lancets market will also experience further development and novation.

Lancing Devices & Lancets Market Trend Analysis

Lancing Devices & Lancets Market Growth Driver- Shift towards pain reduction and enhanced patient comfort

- Among the trends emerging in the researched market is the trend which can be described as minimization of pain for diabetic patients along with facilitation of their usage of the lancing devices and lancets. Corporations are paying more attention to producing devices that do not cause pain during the measurement of blood glucose. They have been prompted as a result of consumers’ reluctance towards major operations and patient’s willingness to undergo frequent tests. Some examples of innovation within the blood sampling products include; lancets that are thin like of a sheet of paper, products that allow the user to adjust the depth to suit the skin density of the client, and devices that minimize the feel of the pain while pricking to draw blood. Not only do such advancements improve the usability for patients, but they furthermore raise compliance with the diabetes care protocols for patients, which enhances the patient’s treatment overall.

Lancing Devices & Lancets Market Opportunity- Integration of these devices with digital health technologies

- It is clear that one of the prospective directions for the market development is integration of the lancing devices and lancets into digital health solutions. A notable current trend is the need for a device that is integrated with the Smartphone or any other digital interface and supports live data acquisition, processing, and remote monitoring. This integration can improve care delivery of diabetes by enabling patients and healthcare practitioners to get real-time glucose data trends and feedback that would enable them to manage the condition better.

- In addition, the use of Artificial Intelligence (AI) and machine learning algorithms is another foreseen opportunity. These technologies can be used in analyzing the raw data obtained from glucose monitoring devices to be able to forecast the trends in addition to identifying specific patterns and making recommendations on diabetes management. Through the integration of AI, manufacturers can create better lancing devices and lancets aside from increasing the accuracy and ergonomics in their design, they can make significant impacts on the disease management plans.

Lancing Devices & Lancets Market Segment Analysis:

Lancing Devices & Lancets Market Segmented based on product type & end-users.

By Product Type, Standard Lancets segment is expected to dominate the market during the forecast period

- In the course of the forecast period, the exclusive ability of the Standard Lancets segment is expected to contribute towards its leading the overall lancing devices and lancets market by product type. Standard lancets, which are inexpensive and easy to use, maintain their popularity in healthcare facilities and with people for daily testing of glycemia. These lancets are normally utilized on traditional spring-activated lancing gadgets and they provide basic techniques for gathering blood samples. Some of the aspects that may have led to this segment becoming dominant include; the fact that these products are relatively cheap, convenient to use, and are manufactured and sold almost in every part of the world including the developed and developing realms.

- Also, the technological innovations made to the improvement of the advanced comfort, effectiveness, and functions of the standard lancets, including more delicate gauge of the needles, progressive patterns, and designs, ensured that its use increases in the healthcare facilities as well as in the patients. This trend is attributable to the rising instances of diabetes on the international level, and healthcare organizations’ emphasis on ensuring access to vital tools, such as lancing devices and lancets, in the Standard Lancets segment.

By End Users, the Hospitals segment expected to hold the largest share

- The hospital segment is expected to occupy the largest market share in the lancing devices and lancets market by end users. The following are the main factors that can account for this dominance; First of all, hospitals are the facilities that act as primary reference points for acute care and chronic disease, including diabetes. This group normally has high-traffic patients whose diabetes needs frequent monitoring through blood glucose testing and therefore is a major user of lancing devices and lancets. In addition, many hospitals enjoy a consolidation of purchasing decisions and possess an organizational framework necessary to acquire and maintain some of the more complex diabetes care instruments and equipment.

- Self-monitoring of blood glucose is also dependent on healthcare practitioners where hospitals, physicians, diabetes educators, and nurses, give patients direction on matters to do with blood glucose monitoring and hence determine the need for better lancing devices, which feature accuracy, simplicity, and patient comfort. With hospitals integrating proper and efficient patient care, the global lancing devices and lancets market is expected to maintain its growth rate in this segment.

Lancing Devices & Lancets Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Several factors make it possible for Asia Pacific to lead the consumption of lancing devices and lancets in the coming years. The prevalence of the diabetic patient pool is large and growing in the region; there is also a rise in the total expenditure on the healthcare sector and improved healthcare access in the region which drives the market. Asia Pacific governments and the healthcare sector are also paying attention to strategies for improving the diabetes care plan which includes insistence on frequent blood sugar level checks.

- The growing health consciousness of people that accelerates the need to diagnose diabetes at an early stage also boosts the usage of lancing devices and lancets in the area. Further, key developments concerning improved healthcare facilities and advanced technology coupled with the global market players’ focus on enlarging their market position in emerging countries are some of the other factors influencing the Asia-Pacific region’s supremacy in the global lancing devices and lancets market.

Active Key Players in the Lancing Devices & Lancets Market

- Abbott Laboratories (United States)

- AgaMatrix (United States)

- ARKRAY, Inc. (Japan)

- Ascensia Diabetes Care (Switzerland)

- Becton, Dickinson and Company (BD) (United States)

- BioSampling (Germany)

- HTL-STREFA (Poland)

- Johnson & Johnson (United States)

- Medtronic plc (Ireland)

- Owen Mumford (United Kingdom)

- Roche Diagnostics (Switzerland)

- Sanofi (France)

- Terumo Corporation (Japan)

- Trividia Health (United States)

- Ypsomed Holding AG (Switzerland) and Other Active Players

|

Global Lancing Devices & Lancets Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.69 Bn |

|

Forecast Period 2025-35 CAGR: |

9.8% |

Market Size in 2035: |

USD 7.52 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lancing Devices & Lancets Market by Product Type (2018-2035)

4.1 Lancing Devices & Lancets Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Standard Lancets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Safety Lancets

4.5 Flake Lancets

4.6 Professional Lancets

4.7 Pressure-activated Lancets

4.8 Push-Button Lancets

4.9 Side-button Lancets

4.10 Personal Lancets

4.11 Fixed Depth Lancets

Chapter 5: Lancing Devices & Lancets Market by End User (2018-2035)

5.1 Lancing Devices & Lancets Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Research and Development

5.5 Home Care and Home Diagnostics

5.6 Clinics

5.7 Diagnostic center

5.8 Medical Institutions

5.9 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Lancing Devices & Lancets Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT LABORATORIES (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AGAMATRIX (UNITED STATES)

6.4 ARKRAY INC. (JAPAN)

6.5 ASCENSIA DIABETES CARE (SWITZERLAND)

6.6 BECTON

6.7 DICKINSON AND COMPANY (BD) (UNITED STATES)

6.8 BIOSAMPLING (GERMANY)

6.9 HTL-STREFA (POLAND)

6.10 JOHNSON & JOHNSON (UNITED STATES)

6.11 MEDTRONIC PLC (IRELAND)

6.12 OWEN MUMFORD (UNITED KINGDOM)

6.13 ROCHE DIAGNOSTICS (SWITZERLAND)

6.14 SANOFI (FRANCE)

6.15 TERUMO CORPORATION (JAPAN)

6.16 TRIVIDIA HEALTH (UNITED STATES)

6.17 YPSOMED HOLDING AG (SWITZERLAND) OTHER KEY PLAYERS

Chapter 7: Global Lancing Devices & Lancets Market By Region

7.1 Overview

7.2. North America Lancing Devices & Lancets Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Standard Lancets

7.2.4.2 Safety Lancets

7.2.4.3 Flake Lancets

7.2.4.4 Professional Lancets

7.2.4.5 Pressure-activated Lancets

7.2.4.6 Push-Button Lancets

7.2.4.7 Side-button Lancets

7.2.4.8 Personal Lancets

7.2.4.9 Fixed Depth Lancets

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Hospitals

7.2.5.2 Research and Development

7.2.5.3 Home Care and Home Diagnostics

7.2.5.4 Clinics

7.2.5.5 Diagnostic center

7.2.5.6 Medical Institutions

7.2.5.7 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Lancing Devices & Lancets Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Standard Lancets

7.3.4.2 Safety Lancets

7.3.4.3 Flake Lancets

7.3.4.4 Professional Lancets

7.3.4.5 Pressure-activated Lancets

7.3.4.6 Push-Button Lancets

7.3.4.7 Side-button Lancets

7.3.4.8 Personal Lancets

7.3.4.9 Fixed Depth Lancets

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Hospitals

7.3.5.2 Research and Development

7.3.5.3 Home Care and Home Diagnostics

7.3.5.4 Clinics

7.3.5.5 Diagnostic center

7.3.5.6 Medical Institutions

7.3.5.7 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Lancing Devices & Lancets Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Standard Lancets

7.4.4.2 Safety Lancets

7.4.4.3 Flake Lancets

7.4.4.4 Professional Lancets

7.4.4.5 Pressure-activated Lancets

7.4.4.6 Push-Button Lancets

7.4.4.7 Side-button Lancets

7.4.4.8 Personal Lancets

7.4.4.9 Fixed Depth Lancets

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Hospitals

7.4.5.2 Research and Development

7.4.5.3 Home Care and Home Diagnostics

7.4.5.4 Clinics

7.4.5.5 Diagnostic center

7.4.5.6 Medical Institutions

7.4.5.7 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Lancing Devices & Lancets Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Standard Lancets

7.5.4.2 Safety Lancets

7.5.4.3 Flake Lancets

7.5.4.4 Professional Lancets

7.5.4.5 Pressure-activated Lancets

7.5.4.6 Push-Button Lancets

7.5.4.7 Side-button Lancets

7.5.4.8 Personal Lancets

7.5.4.9 Fixed Depth Lancets

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Hospitals

7.5.5.2 Research and Development

7.5.5.3 Home Care and Home Diagnostics

7.5.5.4 Clinics

7.5.5.5 Diagnostic center

7.5.5.6 Medical Institutions

7.5.5.7 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Lancing Devices & Lancets Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Standard Lancets

7.6.4.2 Safety Lancets

7.6.4.3 Flake Lancets

7.6.4.4 Professional Lancets

7.6.4.5 Pressure-activated Lancets

7.6.4.6 Push-Button Lancets

7.6.4.7 Side-button Lancets

7.6.4.8 Personal Lancets

7.6.4.9 Fixed Depth Lancets

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Hospitals

7.6.5.2 Research and Development

7.6.5.3 Home Care and Home Diagnostics

7.6.5.4 Clinics

7.6.5.5 Diagnostic center

7.6.5.6 Medical Institutions

7.6.5.7 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Lancing Devices & Lancets Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Standard Lancets

7.7.4.2 Safety Lancets

7.7.4.3 Flake Lancets

7.7.4.4 Professional Lancets

7.7.4.5 Pressure-activated Lancets

7.7.4.6 Push-Button Lancets

7.7.4.7 Side-button Lancets

7.7.4.8 Personal Lancets

7.7.4.9 Fixed Depth Lancets

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Hospitals

7.7.5.2 Research and Development

7.7.5.3 Home Care and Home Diagnostics

7.7.5.4 Clinics

7.7.5.5 Diagnostic center

7.7.5.6 Medical Institutions

7.7.5.7 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Lancing Devices & Lancets Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.69 Bn |

|

Forecast Period 2025-35 CAGR: |

9.8% |

Market Size in 2035: |

USD 7.52 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||