Lamp Market Synopsis

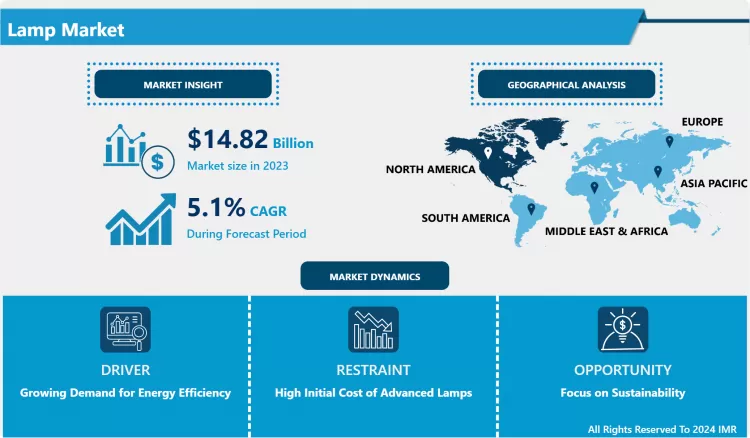

Lamp Market Size Was Valued at USD 14.82 Billion in 2023 and is Projected to Reach USD 23.19 Billion by 2032, Growing at a CAGR of 5.1% From 2023-2032.

The lamp market encompasses a diverse range of lighting products designed for various purposes across residential, commercial, and industrial settings. Defined broadly, lamps are devices that produce light through the emission of electromagnetic radiation, typically in the visible spectrum.

- These products include traditional incandescent bulbs, fluorescent tubes, LED (Light Emitting Diode) lamps, and specialized lighting solutions such as halogen lamps and compact fluorescent lamps (CFLs). Each type of lamp offers distinct advantages in terms of energy efficiency, lifespan, color rendering, and environmental impact, influencing consumer preferences and market trends.

- In recent years, the lamp market has undergone significant transformation driven by technological advancements and sustainability concerns. The shift from traditional incandescent bulbs to more energy-efficient alternatives like LEDs has been a major trend. LEDs, in particular, have gained widespread adoption due to their superior energy efficiency, longer lifespan, and decreasing costs over time. This transition has not only reshaped consumer choices but also influenced regulatory policies aimed at reducing energy consumption and carbon emissions globally.

- Moreover, the lamp market is characterized by a competitive landscape with numerous players ranging from large multinational corporations to specialized niche manufacturers. Innovation in design, functionality, and smart lighting solutions has further diversified the market, catering to evolving consumer preferences for customizable and interconnected lighting systems. As smart home technology continues to integrate with lighting solutions, the market has seen the emergence of smart lamps capable of remote operation, color adjustments, and integration with other smart devices, expanding the market's appeal beyond basic illumination needs.

- Overall, the lamp market reflects a dynamic industry shaped by technological innovation, regulatory changes, and shifting consumer demands towards sustainability and enhanced functionality. As the market continues to evolve, future trends are likely to focus on advancements in smart lighting technology, further improvements in energy efficiency, and the integration of lighting solutions into broader smart home ecosystems.

Lamp Market Trend Analysis

Integration of Advanced Technologies

- The lamp market has been increasingly influenced by advanced technologies, transforming the industry in significant ways. One prominent trend is the integration of smart technology into lamps. Smart lamps incorporate features such as wireless connectivity, voice control, and automation, allowing users to adjust lighting settings remotely via smartphone apps or voice assistants. This integration not only enhances convenience but also improves energy efficiency through precise control of lighting levels and schedules.

- Another key trend is the adoption of LED technology. LED lamps have gained popularity due to their energy efficiency, longevity, and design flexibility. As advancements in LED technology continue, lamps are becoming more compact, durable, and capable of producing a wide range of colors and intensities. The shift towards LEDs also aligns with global efforts towards sustainability, as these lamps consume less energy and have a lower environmental impact compared to traditional incandescent or fluorescent bulbs.

- Furthermore, the incorporation of sensor technologies is revolutionizing the lamp market. Sensors can detect motion, ambient light levels, and even occupancy, enabling lamps to adjust their brightness automatically based on environmental conditions or user presence. This not only enhances user comfort but also contributes to energy savings by ensuring that lights are only in use when needed. As sensor technology becomes more sophisticated and affordable, its integration into lamps is likely to become more widespread, further driving the evolution of the lamp market towards smarter and more efficient lighting solutions.

Expansion into New Application

- The lamp market is undergoing a significant transformation driven by technological advancements and shifting consumer preferences. Traditionally dominated by incandescent and fluorescent lighting, the market has expanded with the introduction of LED and smart lighting solutions. LED lamps, in particular, have revolutionized the industry due to their energy efficiency, longer lifespan, and versatility in design. This shift has not only catered to consumer demands for eco-friendly and cost-effective lighting solutions but has also opened doors to new applications.

- One key opportunity lies in the integration of smart technologies with lamps. Smart lamps, equipped with connectivity features like Wi-Fi or Bluetooth, enable remote control and automation through mobile apps or voice assistants. This innovation enhances convenience and allows for personalized lighting experiences, appealing to both residential and commercial markets. Applications span from mood lighting and energy management in homes to sophisticated lighting systems in offices and retail spaces, where dynamic lighting can enhance productivity and ambiance.

- Moreover, the growth of smart cities and infrastructure projects presents another avenue for lamp market expansion. Street lighting, for instance, is increasingly adopting LED technology for its energy efficiency and lower maintenance costs. Beyond illumination, smart lampposts can host sensors for environmental monitoring, traffic management, and even public Wi-Fi, transforming urban spaces into interconnected hubs of data and services. This convergence of lighting with IoT (Internet of Things) technologies not only improves urban efficiency but also creates new revenue streams for lamp manufacturers through service-based models and data analytics.

- In conclusion, the lamp market's evolution into new applications like smart lighting and urban infrastructure presents exciting opportunities. By embracing technological advancements and consumer trends, manufacturers can not only meet current demands for efficient and customizable lighting solutions but also pioneer innovations that shape the future of urban living and connectivity. As these trends continue to develop, collaboration across industries and strategic investments in research and development will be crucial in capitalizing on these expanding opportunities.

Lamp Market Segment Analysis:

- Lamp Market Segmented on the basis of Product, type, and application.

By Product, Desk Lamp segment is expected to dominate the market during the forecast period

- In the lamp market, the segment dominated by desk lamps tends to hold a prominent position compared to floor lamps. Desk lamps are highly versatile and cater to a broad range of applications across residential, commercial, and institutional settings. They are essential for focused task lighting, such as reading, studying, or working at a desk. Their compact size and adjustable features make them popular among consumers looking for efficient lighting solutions in smaller spaces or specific workstations. Moreover, advancements in LED technology have enhanced the appeal of desk lamps by offering energy efficiency and longer lifespan, aligning with growing consumer preferences for sustainable lighting options.

- On the other hand, floor lamps, while also important in the market, occupy a slightly narrower niche compared to desk lamps. Floor lamps are valued for their ability to provide ambient or accent lighting in larger spaces, such as living rooms, hallways, or hotel lobbies. They often serve decorative purposes as well, contributing to the overall aesthetics of an interior environment. However, their usage is typically more limited compared to desk lamps, as they are less frequently employed for direct task lighting. Floor lamps also face competition from other types of lighting fixtures, such as ceiling lights and wall-mounted fixtures, which can provide similar ambient or accent lighting effects.

- Overall, desk lamps dominate the lamp market due to their widespread utility and practicality across various settings. Their functionality in providing task-specific lighting solutions, combined with advancements in energy efficiency and design versatility, positions them as a preferred choice among consumers and businesses alike. Floor lamps, while significant in their own right for ambient and decorative lighting purposes, cater to a more specific segment of the market and face competition from alternative lighting options for general illumination needs.

By Type, Reading Lamp segment held the largest share in 2023

- In the lamp market, reading lamps tend to dominate over decorative lamps in terms of overall consumer demand and market presence. Reading lamps, also known as task lamps, are designed specifically to provide focused and adjustable lighting for activities such as reading, studying, or working at a desk. They are highly functional, featuring attributes like adjustable arms, brightness controls, and sometimes specialized light color temperatures to enhance visibility and reduce eye strain. This functionality makes reading lamps essential in both residential and professional settings where precise task lighting is required, contributing to their widespread adoption and market dominance.

- On the other hand, decorative lamps serve primarily aesthetic purposes in interior design. These lamps emphasize style, artistry, and ambiance rather than purely functional lighting. Decorative lamps include a wide variety of designs such as table lamps with ornate bases, sculptural floor lamps, or artistic pendant lights. While they play a crucial role in enhancing the visual appeal of spaces, their market share is often more niche compared to reading lamps due to their secondary role in providing illumination. Decorative lamps are often chosen to complement interior décor themes, but their purchase frequency and application are typically lower compared to functional reading lamps.

- Overall, the dominance of reading lamps in the lamp market reflects their essential role in everyday tasks and functional lighting needs across different environments. Their emphasis on practicality, ergonomic design, and task-specific functionality resonates strongly with consumers seeking efficient lighting solutions. In contrast, while decorative lamps add aesthetic value and contribute to the overall ambiance of spaces, their market segment is more specialized and influenced by design trends and personal taste rather than universal practicality, contributing to a smaller overall market share.

Lamp Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the lamp market for several reasons, primarily driven by economic factors, technological advancements, and consumer behavior. Firstly, the region's strong economic position and high consumer spending power play a crucial role. North America has a large population with significant disposable income, which fuels demand for various types of lighting solutions, including decorative, industrial, and residential lamps.

- Technological advancements and innovation in lighting technologies have been particularly robust in North America. The region is home to many leading lighting manufacturers and innovators who continuously develop energy-efficient and aesthetically pleasing lamp designs. This technological edge not only attracts domestic consumers but also positions North American companies competitively in global markets.

- Consumer preferences in North America often favor products that combine functionality with stylish design. Lamps are not only viewed as functional items but also as decorative pieces that enhance interior aesthetics. This preference drives the demand for a wide range of lamp styles and designs, catering to diverse tastes across residential, commercial, and industrial sectors.

- Overall, North America's dominance in the lamp market can be attributed to its economic strength, technological innovation, and consumer-driven demand for both functional and aesthetically pleasing lighting solutions. These factors collectively contribute to the region's significant market share and influence in the global lighting industry.

Active Key Players in the Lamp Market

- Acuity Brands (United States)

- Cree Inc. (United States)

- Eaton Corporation (Ireland)

- Fagerhult Group (Sweden)

- Feilo Sylvania (China)

- General Electric (United States)

- Havells (India)

- Hubbell Incorporated (United States)

- Ikea Group (Sweden)

- Lutron Electronics (United States)

- NVC Lighting Technology Corporation (China)

- Osram (Germany)

- Panasonic Corporation (Japan)

- Philips Lighting (Netherlands)

- Schneider Electric (France)

- Signify (Netherlands)

- Targetti Sankey S.p.A. (Italy)

- Thorn Lighting (United Kingdom)

- Toshiba Lighting and Technology (Japan)

- Zumtobel Group (Austria) and Other Major Players

Key Industry Developments in the Lamp Market:

- In April 2023, Signify introduced a newer version of Philips Ultra Efficient LED bulbs that use 40% less energy and have a 3x longer lifespan than standard bulbs.

- In April 2023, Xiaomi introduced the MIJIA multifunctional and rechargeable desk lamp, which features a 2000mAh lithium battery and 360-degree flexibility. The vertical desk lamp's magnetic suction construction allows it to function as a clamp lamp or flashlight as well. The lamp has four different lighting modes and lasts at least four hours at full brightness.

|

Global Lamp Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.82 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.1% |

Market Size in 2032: |

USD 23.19 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lamp Market by Product (2018-2032)

4.1 Lamp Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Desk Lamp

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Floor Lamp

Chapter 5: Lamp Market by Type (2018-2032)

5.1 Lamp Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Reading Lamp

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Decorative Lamp

Chapter 6: Lamp Market by Application (2018-2032)

6.1 Lamp Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential/Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial/Hospitality

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Lamp Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACUITY BRANDS (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CREE INC. (UNITED STATES)

7.4 EATON CORPORATION (IRELAND)

7.5 FAGERHULT GROUP (SWEDEN)

7.6 FEILO SYLVANIA (CHINA)

7.7 GENERAL ELECTRIC (UNITED STATES)

7.8 HAVELLS (INDIA)

7.9 HUBBELL INCORPORATED (UNITED STATES)

7.10 IKEA GROUP (SWEDEN)

7.11 LUTRON ELECTRONICS (UNITED STATES)

7.12 NVC LIGHTING TECHNOLOGY CORPORATION (CHINA)

7.13 OSRAM (GERMANY)

7.14 PANASONIC CORPORATION (JAPAN)

7.15 PHILIPS LIGHTING (NETHERLANDS)

7.16 SCHNEIDER ELECTRIC (FRANCE)

7.17 SIGNIFY (NETHERLANDS)

7.18 TARGETTI SANKEY S.P.A. (ITALY)

7.19 THORN LIGHTING (UNITED KINGDOM)

7.20 TOSHIBA LIGHTING AND TECHNOLOGY (JAPAN)

7.21 ZUMTOBEL GROUP (AUSTRIA)

Chapter 8: Global Lamp Market By Region

8.1 Overview

8.2. North America Lamp Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Desk Lamp

8.2.4.2 Floor Lamp

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Reading Lamp

8.2.5.2 Decorative Lamp

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Residential/Retail

8.2.6.2 Commercial/Hospitality

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Lamp Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Desk Lamp

8.3.4.2 Floor Lamp

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Reading Lamp

8.3.5.2 Decorative Lamp

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Residential/Retail

8.3.6.2 Commercial/Hospitality

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Lamp Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Desk Lamp

8.4.4.2 Floor Lamp

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Reading Lamp

8.4.5.2 Decorative Lamp

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Residential/Retail

8.4.6.2 Commercial/Hospitality

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Lamp Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Desk Lamp

8.5.4.2 Floor Lamp

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Reading Lamp

8.5.5.2 Decorative Lamp

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Residential/Retail

8.5.6.2 Commercial/Hospitality

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Lamp Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Desk Lamp

8.6.4.2 Floor Lamp

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Reading Lamp

8.6.5.2 Decorative Lamp

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Residential/Retail

8.6.6.2 Commercial/Hospitality

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Lamp Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Desk Lamp

8.7.4.2 Floor Lamp

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Reading Lamp

8.7.5.2 Decorative Lamp

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Residential/Retail

8.7.6.2 Commercial/Hospitality

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Lamp Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.82 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.1% |

Market Size in 2032: |

USD 23.19 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Lamp Market research report is 2023-2032.

Acuity Brands (United States), Cree Inc. (United States), Eaton Corporation (Ireland), Fagerhult Group (Sweden), Feilo Sylvania (China), General Electric (United States), Havells (India), Hubbell Incorporated (United States), Ikea Group (Sweden), Lutron Electronics (United States), NVC Lighting Technology Corporation (China), Osram (Germany), Panasonic Corporation (Japan), Philips Lighting (Netherlands), Schneider Electric (France), Signify (Netherlands), Targetti Sankey S.p.A. (Italy), Thorn Lighting (United Kingdom), Toshiba Lighting and Technology (Japan), Zumtobel Group (Austria) and Other Major Players.

The Lamp Market is segmented into Product, Type, Application, and region. By Product, the market is categorized into Desk Lamp and Floor Lamp. By Type, the market is categorized into Reading Lamp, Decorative Lamp. By Application, the market is categorized into Residential/Retail, Commercial/Hospitality. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A lamp is often a light-producing device that is powered by electricity. It is made up of a fixture that houses a bulb or light source and may include accessories like a shade or reflector to direct or disperse the light. Lamps are extensively used for illumination in homes, offices, and other locations, serving as both utilitarian and decorative features. They come in a variety of shapes, sizes, and sorts to meet individual needs and aesthetic tastes.

Lamp Market Size Was Valued at USD 14.82 Billion in 2023 and is Projected to Reach USD 23.19 Billion by 2032, Growing at a CAGR of 5.1% From 2023-2032.