Isoamylene Market Synopsis

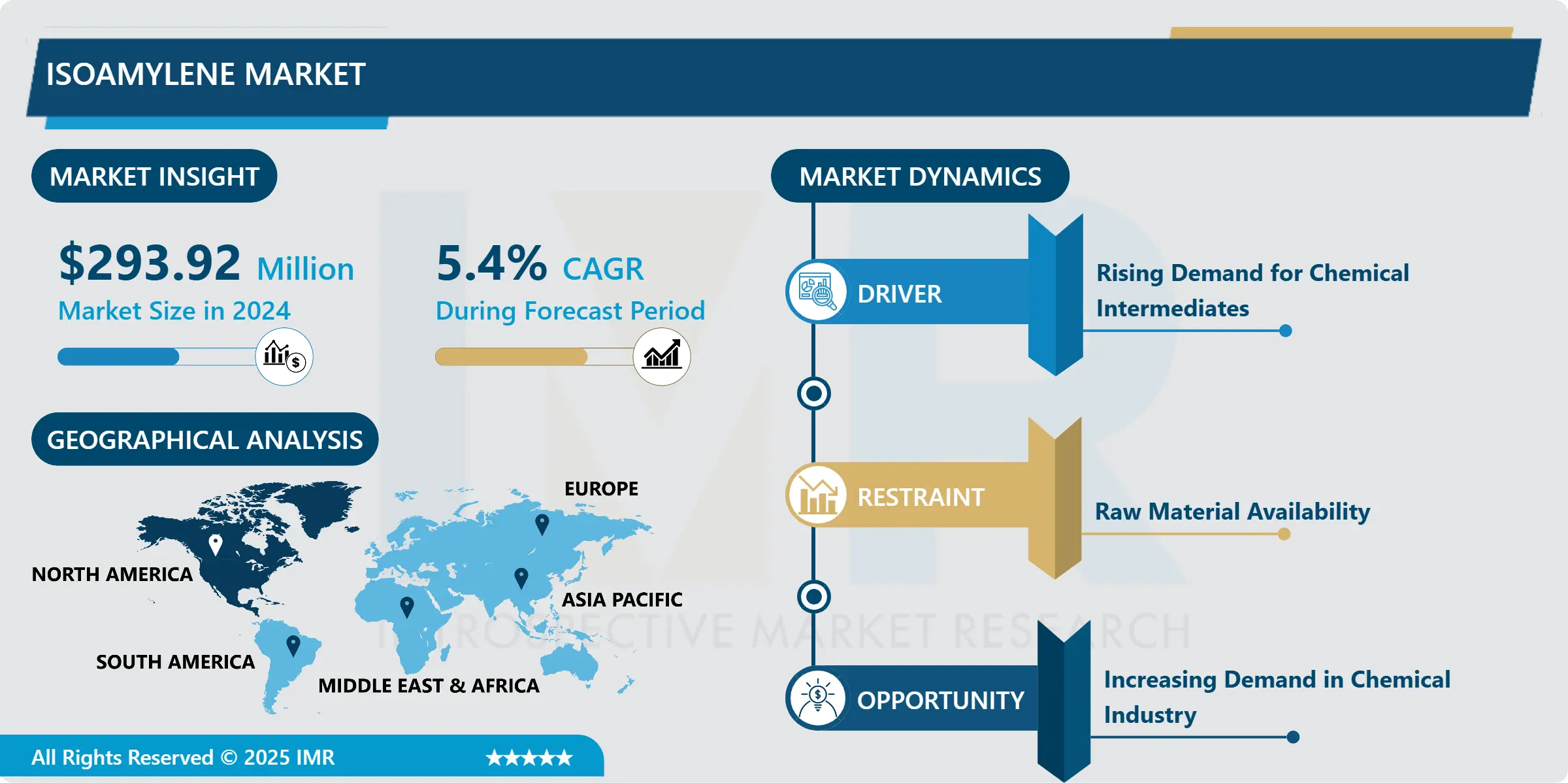

Isoamylene market was worth USD 293.92 million in 2024. As such, the forecast is that the market is expected to reach USD 524.17 million by 2035 with a CAGR of 5.4% over the period from 2025 to 2035.

Isoamylene, known as 2-methylbut-2-ene, is a significant chemical compound used in various industries. Its versatile applications range from the production of specialty chemicals to its use as a precursor in synthesizing pesticides, pharmaceuticals, and synthetic rubber.

The market for isoamylene has seen steady growth, driven by increasing demand from end-use industries such as automotive, adhesives, and sealants. The expanding automotive sector, particularly in emerging economies, has fueled the demand for synthetic rubber, thereby boosting the consumption of isoamylene.

Additionally, the rising focus on sustainable practices and eco-friendly products has spurred research and development efforts towards bio-based isoamylene production, further driving market growth. However, challenges such as volatile raw material prices and stringent environmental regulations pose potential hindrances to market expansion

Geographically, Asia-Pacific dominates the isoamylene market due to the presence of key manufacturing hubs and robust industrial infrastructure. North America and Europe also contribute significantly to market revenue owing to their well-established chemical industries and technological advancements.

Isoamylene Market Trend Analysis

Rising Demand for Chemical Intermediates

- The Isoamylene market has experienced significant growth, primarily fueled by rising demand for chemical intermediates across various industries. Chemical intermediates are crucial components in the production of numerous end products, including pesticides, pharmaceuticals, and synthetic rubber. Isoamylene, a key chemical intermediate, finds extensive application in the manufacturing process of various products.

- The rising demand for chemical intermediates like Isoamylene is the expanding industrial sector worldwide. As industries continue to grow, there's a parallel increase in the need for intermediate chemicals to support manufacturing processes.

- Moreover, Isoamylene's versatility and compatibility with multiple applications make it a preferred choice among manufacturers. Its usage in the production of chemicals like antioxidants, flavors, and fragrances further amplifies its demand.

- Additionally, advancements in chemical synthesis technologies have enhanced the efficiency and cost-effectiveness of Isoamylene production, making it more accessible to a wider range of industries.

Increasing Demand in Chemical Industry Creates an Opportunity for the Global Isoamylene Market

- The emergence of cloud-based solutions has revolutionized the landscape of Isoamylene, offering a plethora of opportunities for market growth and innovation. Cloud-based Isoamylene provides businesses with unprecedented flexibility, scalability, and accessibility, driving increased efficiency and productivity across industries.

- Cloud-based solutions is their ability to streamline inventory processes through real-time data access and synchronization. With cloud-based Isoamylene, businesses can effortlessly track inventory levels, monitor stock movements, and manage orders from any location with internet connectivity. This agility enables companies to make informed decisions promptly, optimize stock levels, and reduce the risk of stockouts or overstocking.

- Cloud-based Isoamylene offers enhanced integration capabilities, allowing seamless connectivity with other business systems such as accounting software, e-commerce platforms, and supply chain management tools. This integration facilitates automated workflows, data sharing, and cross-functional collaboration, enabling businesses to achieve greater operational efficiency and accuracy in inventory management.

Isoamylene Market Segment Analysis:

The Global Isoamylene Market Segment is divided into Type, and Application.

By Type, High-grade Isoamylene is expected to dominate the market during the forecast period.

- High-grade isoamylene is anticipated to hold a significant share in the isoamylene market due to several key factors. Isoamylene, also known as 2-methyl-2-butene, is a vital chemical compound used in various applications, including the production of antioxidants, pesticides, and pharmaceuticals. High-grade isoamylene, characterized by its purity and quality, offers enhanced performance and reliability in these applications, thus driving its dominance in the market.

- One of the primary drivers for the dominance of high-grade isoamylene is its superior quality, which ensures better performance and efficiency in end products. Industries such as pharmaceuticals and agrochemicals demand high-purity isoamylene to maintain the quality and effectiveness of their final products. This demand propels the dominance of high-grade isoamylene in the market.

- Moreover, stringent regulatory standards and quality requirements further emphasize the preference for high-grade isoamylene. Industries are compelled to use high-quality raw materials to comply with regulations and ensure product safety and efficacy. Manufacturers prefer high-grade isoamylene to meet these standards, thereby boosting its dominance in the market.

- Additionally, technological advancements in production processes have enabled the cost-effective manufacturing of high-grade isoamylene, making it more accessible to a wider range of industries. This affordability coupled with its superior quality makes high-grade isoamylene the preferred choice for various applications, consolidating its dominance in the isoamylene market.

By Application, the Aliphatic Hydrocarbon Modification segment held the largest share of 39.57% in 2024.

- The Aliphatic Hydrocarbon Modification segment is poised to maintain dominance in the Isoamylene Market, driven by its versatile applications across various industries. Isoamylene, a key chemical derived from catalytic dehydrogenation of isobutane, finds extensive usage in the production of various downstream products, with the aliphatic hydrocarbon modification sector being a significant contributor.

- Isoamylene in aliphatic hydrocarbon modification is its use as a precursor in the synthesis of specialty chemicals such as antioxidants, lubricant additives, and surfactants. These chemicals are integral in enhancing the performance and functionality of a wide range of end products across industries including automotive, industrial, and consumer goods.

- Isoamylene serves as a vital building block in the synthesis of high-value intermediates like isooctane, which is a crucial component in gasoline blending to improve octane ratings and reduce emissions.

- The dominance of the Aliphatic Hydrocarbon Modification segment is also supported by the increasing demand for eco-friendly and sustainable alternatives in chemical manufacturing. Isoamylene-based products offer advantages such as high efficiency, low toxicity, and reduced environmental impact compared to traditional counterparts.

Isoamylene Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America boasts a robust petrochemical industry, providing a solid foundation for isoamylene production. With access to ample feedstock and advanced manufacturing capabilities, the region can meet the demand for isoamylene efficiently.

- Moreover, the growing demand for isoamylene-derived products, such as antioxidants, pesticides, and flavoring agents, further fuels market growth. Industries like agriculture, food processing, and healthcare rely heavily on these products, thereby driving the demand for isoamylene.

- Additionally, technological advancements and innovation in isoamylene production processes enhance efficiency and reduce production costs, making it more competitive in the North American market.

- Favorable regulatory frameworks and government initiatives support the expansion of the isoamylene market in North America. Policies promoting sustainable practices and the adoption of eco-friendly chemicals encourage market players to invest in isoamylene production.

Isoamylene Market Top Key Players:

- SINOPEC (China)

- Chevron Phillips Chemical [United States]

- INEOS Oligomers [United Kingdom]

- LANXESS [Germany]

- S. Fanda [India]

- Zibo Liantan Chemical [China]

- Shanghai Petrochemical Company [China]

- Jinhai Chenguang [China]

- Shandong Yuhuang Chemical [China]

- Sunny Industrial System GmbH [Germany]

- Biesterfeld AG [Germany]

- Ningbo Jinhai Chenguang Chemical Corporation [China]

- China Petrochemical Corporation [China]

- Sumitomo Chemical (Japan)

- Formosa Plastics Corporation (Taiwan)

- INEOS (Switzerland)

- Chevron Phillips Chemical Company (USA)

- Reliance Industries Limited (India)

- PTT Global Chemical (Thailand)

- LG Chem (South Korea)

- Braskem (Brazil)

- Arkema (France)

- Evonik Industries (Germany)

- Eastman Chemical Company (USA), Other Active Players

|

Isoamylene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 293.92 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.4% |

Market Size in 2035: |

USD 524.17 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Isoamylene Market by Type (2018-2032)

4.1 Isoamylene Market Snapshot and Growth Engine

4.2 Market Overview

4.3 High-Grade Isoamylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Common Isoamylene

Chapter 5: Isoamylene Market by Application (2018-2032)

5.1 Isoamylene Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Aliphatic Hydrocarbon Modification

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Flavor And Fragrance Chemicals

5.5 Polymer Antioxidants

5.6 Specialty Chemicals

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Isoamylene Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SOMFY SYSTEMS INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 LUTRON ELECTRONICS COINC. (UNITED STATES)

6.4 HUNTER DOUGLAS N.V. (UNITED STATES)

6.5 SPRINGS WINDOW FASHIONS

6.6 LLC(UNITED STATES)

6.7 GRABER (UNITED STATES)

6.8 ROLLEASE ACMEDA (UNITED STATES)

6.9 BTX INTELLIGENT FASHION LLC (UNITED STATES)

6.10 ELECTRIC BLINDS COMPANY (UNITED STATES)

6.11 AUTOMATED SHADE (UNITED STATES)

6.12 MECHO (UNITED STATES)

6.13 QMOTION SHADES (UNITED STATES)

6.14 SILENT GLISS INC. (UNITED STATES)

6.15 ELERO GMBH (GERMANY)

6.16 MHZ HACHTEL GMBH & CO. KG (GERMANY)

6.17 RADEMACHER ELECTRONICS GMBH (GERMANY)

6.18 MARANTEC DEUTSCHLAND GMBH (GERMANY)

6.19 ANTEA AUTOMASJON AS (NORWAY)

6.20 A-OK BLINDS AND SHUTTERS PTY LTD (AUSTRALIA)

6.21 BLINDS DIRECT (AUSTRALIA)

6.22 SILENT GLISS UK LTD (UNITED KINGDOM)

6.23 GKB BLINDS (UNITED KINGDOM)

6.24 HOME AUTOMATION ASIA (UNITED KINGDOM)

6.25 SUNRAY SOLUTIONS SDN BHD (SINGAPORE)

6.26 A-LIVING TECHNOLOGY COLTD. (MALAYSIA)

6.27 DOOYA (GUANGZHOU)

6.28 TECHNOLOGY COLTD. (CHINA)

Chapter 7: Global Isoamylene Market By Region

7.1 Overview

7.2. North America Isoamylene Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 High-Grade Isoamylene

7.2.4.2 Common Isoamylene

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Aliphatic Hydrocarbon Modification

7.2.5.2 Flavor And Fragrance Chemicals

7.2.5.3 Polymer Antioxidants

7.2.5.4 Specialty Chemicals

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Isoamylene Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 High-Grade Isoamylene

7.3.4.2 Common Isoamylene

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Aliphatic Hydrocarbon Modification

7.3.5.2 Flavor And Fragrance Chemicals

7.3.5.3 Polymer Antioxidants

7.3.5.4 Specialty Chemicals

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Isoamylene Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 High-Grade Isoamylene

7.4.4.2 Common Isoamylene

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Aliphatic Hydrocarbon Modification

7.4.5.2 Flavor And Fragrance Chemicals

7.4.5.3 Polymer Antioxidants

7.4.5.4 Specialty Chemicals

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Isoamylene Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 High-Grade Isoamylene

7.5.4.2 Common Isoamylene

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Aliphatic Hydrocarbon Modification

7.5.5.2 Flavor And Fragrance Chemicals

7.5.5.3 Polymer Antioxidants

7.5.5.4 Specialty Chemicals

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Isoamylene Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 High-Grade Isoamylene

7.6.4.2 Common Isoamylene

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Aliphatic Hydrocarbon Modification

7.6.5.2 Flavor And Fragrance Chemicals

7.6.5.3 Polymer Antioxidants

7.6.5.4 Specialty Chemicals

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Isoamylene Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 High-Grade Isoamylene

7.7.4.2 Common Isoamylene

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Aliphatic Hydrocarbon Modification

7.7.5.2 Flavor And Fragrance Chemicals

7.7.5.3 Polymer Antioxidants

7.7.5.4 Specialty Chemicals

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Isoamylene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 293.92 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.4% |

Market Size in 2035: |

USD 524.17 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||