IoT Managed Services Market Synopsis

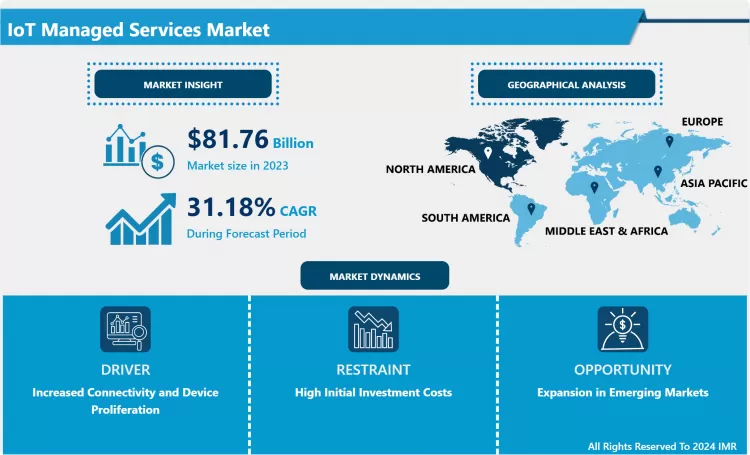

IoT Managed Services Market Size Was Valued at USD 81.76 Billion in 2023, and is Projected to Reach USD 940.48 Billion by 2032, Growing at a CAGR of 31.18% From 2024-2032.

The IoT Managed Services Market can be defined as a combination of third-party services necessary for the correct management of Internet of Things (IoT and IoT applications). These services include: Network management; Security management; Device management; Infrastructure management and others to provide organizations with ways to implement and manage IoT solutions and operations devoid of diverting their attention to their primary businesses.

- The global Internet of Things (IoT) Managed Services Market has also evolved over the past few years because of the enhanced use of IoT technologies in different sectors. Enterprises continue to adopt IoT technology to boost performance, optimize processes and make smarter decision, besides exploring other possibilities for innovation. MSPs are coming to help organizations to solve the problem of IoT ecosystem management with the possibilities of device management, Data analysis, networks’ management, and security. This demand is mainly because IoT initiatives present a highly technical challenge to organizations that many lack internal expertise and knowledge to effectively undertake. It means that if organizations outsource these roles to MSPs, they will be able to focus on their main business, at the same time being confident that their IoT systems are managed efficiently.

- Moreover, they bring in the ability to offer the needed skills, best practices, cost –effective solutions that are also flexible to meet the future demands of companies. Over the recent years there have been numerous developments in IoT causes challenges the in operation of organizations such as overwhelming data, compatibility, and real time analysis. These challenges are managed by the infrastructure offered by a managed service to help meet integration and flow between IoT devices and platforms. Furthermore, due to increasing awareness of the threats posed by cyber-criminals to the ever increasing volume of data, MSPs play the role of ensuring adequate measures to secure information created by IoT devices. They offer security services including data protection, threat detection services, compliance services that would help organizations mitigate risks that are likely to be caused by the use of IoT.

- There is also a trend towards solutions by vertical since the focus on managed services increase while seeking services adapted to specific markets. This trend shows that people begin to realize that industries like healthcare, manufacturing and smart city require different approaches and solutions with IoT. In offering such services that meet such needs, MSPs become of more value since organizations can hence utilise IoT in the suitable manner. Such an industry-specific approach appears to be an effective way of enhancing the growth of the IoT Managed Services Market in the future since more businesses are adopting IoT solutions that meet their unique business goals.

- This means that the significance of the managed services will continue to rise as a core facet of IoT as these concerns shape the future of the IoT environment. The latest development of IoT technologies, as well as the increasing user and customer demands on data services, will drive new growth points for managed service providers to continuously develop new and diversified services. MPS look to the future of the IoT Managed Services Market as key drivers for the customer experience, operational efficiency, and improving solutions thereby positioning MSPs to help drive the future developments of the IoT industry. The increasing use of IoT in business strategies will require a partnership with managed service providers to optimise the results of IoT deployment.

IoT Managed Services Market Trend Analysis

Enhanced Security Solutions

- The constantly increasing number of entities connected to the IoT, security has become a major issue for companies.. The risks posed by cyber espionage and cyber attacks to IoT have turned more complex, thus the need of having measures to safeguard jeopardized data and system. Consequently, the propagation of the adoption of sophisticated security arrangements in connection with the domain of IoT managed services is on the rise. Security has become a major concern for providers with encryption and intrusion detection systems and monitoring being priority features for inclusion in services and devices.• Furthermore, the rising concerns over data privacy and protection standards and norms make organizations strengthen security solutions.ng IoT devices have become more sophisticated, necessitating enhanced security measures to protect sensitive data and maintain system integrity. As a result, the trend towards implementing advanced security solutions within IoT managed services is gaining momentum. Providers are focusing on integrating robust security frameworks, including encryption, intrusion detection systems, and real-time monitoring, into their service offerings to safeguard devices and networks.

- Moreover, the increasing regulatory scrutiny regarding data privacy and protection is driving organizations to invest in comprehensive security solutions. By engaging in managed services that focus on security, industry can prevent risks and this will help them always meet the required standards especially whenever there are new amendments. In addition to using this concept in protection of key resources, it also promotes customer loyalty, thereby supporting the increased growth of the IoT managed services market.

Expansion in Emerging Markets

- IoT Managed Services have bandwidth for growth in emerging markets for market players to consider.. Since IoT solutions are being sought after by developing countries as they continue to go through a process of digital transformation, the need will arise to seek out IoT solutions. Most companies in these regions are eager to find ways of using IoT technologies to optimize business operations, deliver superior customers’ experience, and gain competitive advantage. Thus, IoT managed service providers can exploit this opportunity to proffer suitable solutions that fit the various existing issues of the companies in these markets. Also, continuous investments made globally in smart city programs and smart infrastructure in the developing world are expected to fuel the Internet of Things IoT solutions.T solutions is on the rise. Many organizations in these regions are looking to leverage IoT technologies to enhance operational efficiency, improve customer experiences, and gain a competitive edge. IoT managed service providers have the potential to tap into this demand by offering tailored solutions that address the unique challenges faced by businesses in these markets.

- Additionally, the increasing investments in smart city initiatives and infrastructure development in emerging economies are expected to drive the adoption of IoT solutions. When governments and big private companies start building integration models, decision-makers will definitely face the issue of strong demand for proper managed services. The IoT managed service providers can build a new source of revenues and participate in the creation of IoT sustainable markets.

IoT Managed Services Market Segment Analysis:

IoT Managed Services Market Segmented based on Service , End User, and Organization Size.

By Service, Network Management segment is expected to dominate the market during the forecast period

- The P&C Insurance Market is adapted with IoT Managed Services and thus experiencing a change. The following are key support services for insurers in dealing with risks relating to property and casualty cover; Network Management, Security Management, Device Management and Infrastructure Management. IoT technologies help bring timely information about assets for better evaluation of risks and underwriting. For instance, information generated by telematics devices in cars gives insurers a perfect opportunity for insurance premiums and risk assessment.

- This shows that as the growth and distribution of P&C insurance goes on, more clients are going to require custom IoT managed services. These services have grown popular with insurers to automate processes, improve on clients’ satisfaction, and also on data analysis. The opportunities to monitor and mitigate new risks in advance alongside with increasing operational advantages give insurers a tool to sustain their place in the market.

By End User , IT & Telecom segment held the largest share in 2023

- The major industries involved in the end user segments include automotive and transportation, IT and telecom, healthcare, BFSI and manufacture in the Property & Casualty Insurance Market which are the most significant to be targeted for IoT managed services. Automotive industry is the most examples of this phenomenon that begun its transition into using telematics and connected vehicles. Motor insurers are applying the IoT data to analyse risk, and as a result, provide policies and premiums according to driving patterns in real-time.

- Likewise, the healthcare industry is primarily using IoT solutions for risk management in concepts including medical devices and patient observation. When implemented, IoT managed services will also be of benefit to insurers, through the improvement of the underwriting process and claims handling. Increasingly, the end-user sectors are adopting IoT technologies, which will create the need for customized managed services to support P&C insurance market expansion.

IoT Managed Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America continues to hold the largest market share in the IoT Managed Services Market due to the technological growth and higher IoT adoption in the region.. Ded and competition from big players such as Google, Apple, Amazon and innovative start-ups has encouraged the development of IoT managed services. Businesses in North America have fundamentally understood how IoT could augment their work, this triggered a greater spending on managed services associated with IoT device management, security, and analysis.• In addition, the North American regulatory environment recognizes IoT solutions such as security and compliance improvements. and widespread adoption of IoT solutions across various industries. The presence of major technology companies and innovative startups has fostered a competitive landscape, facilitating the growth of IoT managed services. Enterprises in North America are increasingly recognizing the importance of IoT for operational efficiency, leading to heightened investments in managed services that support device management, network security, and data analytics.

- Moreover, the regulatory environment in North America encourages the adoption of IoT solutions to enhance security and compliance. Fields of using the IoT tend to concentrate on the healthcare and finance sectors to enhance the risk management and the flow of processes. As the North American companies are actively investing in digital transformation and IoT plans it will be possible to retain the leadership in the managed services market.

Active Key Players in the IoT Managed Services Market

- IBM (United States)

- Cisco Systems (United States)

- Accenture (Ireland)

- Infosys (India)

- Wipro (India)

- HCL Technologies (India)

- Tata Consultancy Services (India)

- NTT Data (Japan)

- Tech Mahindra (India)

- Capgemini (France)

- Others Key Player

Key Industry Developments in the IoT Managed Services Market

- December 2022: KORE, a global provider of Internet of Things (IoT) solutions and global IoT connectivity-as-a-service (IoT CaaS), recently announced the formation of a go-to-market partnership with Google Cloud to enable IoT functionality for organizations worldwide. With the support of KORE's IoT Solutions and Google Cloud infrastructure and capabilities, businesses could develop effective IoT solutions.

- May 2022: HCL Technologies and SAP collaboration were announced on industry-relevant IoT packaged offerings and services. HCL Technologies is a worldwide technology corporation and Internet of Things (IoT) approved business. When implementing Industry 4.0 transformations, companies must deal with a fragmented and complex solution stack. HCL Technologies will package pertinent SAP software with services and hardware that can speed up and simplify this process.

- March 2024 (Partnership): XL Axiata partnered with Cisco to launch a cloud-based IoT connectivity management platform in Indonesia, aimed at helping customers securely innovate and scale their IoT businesses. This platform, named IoT Connectivity+, offers AI-powered anomaly detection, enterprise-grade security, and cost management features, effectively addressing the complexity of managing diverse IoT endpoints and improving service reliability. Furthermore, this platform is anticipated to support Indonesia's projected growth in IoT connections, which is expected to reach 404 million by 2028.

- November 2023 (Launch): IIJ and Murata announced the launch of the Crossborder Co-DataBiz IoT data service platform, combining their expertise in networking, sensing, and data analytics. This platform was developed to provide a comprehensive solution for setting up and operating cross-border data collection and analysis, including sensor devices, cloud infrastructure, networks, and security systems. The platform complies with local regulations in Southeast Asia and offers customization options for operational data management.

|

Global IoT Managed Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 107.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

31.18% |

Market Size in 2032: |

USD 940.48 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: IoT Managed Services Market by Service (2018-2032)

4.1 IoT Managed Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Network Management

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Security Management

4.5 Device Management

4.6 Infrastructure Management

4.7 Others

Chapter 5: IoT Managed Services Market by End User (2018-2032)

5.1 IoT Managed Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive & Transport

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 IT & Telecom

5.5 Healthcare

5.6 BFSI

5.7 Manufacturing

5.8 Others

Chapter 6: IoT Managed Services Market by Organization Size (2018-2032)

6.1 IoT Managed Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 SMEs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 IoT Managed Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IBM (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CISCO SYSTEMS (UNITED STATES)

7.4 ACCENTURE (IRELAND)

7.5 INFOSYS (INDIA)

7.6 WIPRO (INDIA)

7.7 HCL TECHNOLOGIES (INDIA)

7.8 TATA CONSULTANCY SERVICES (INDIA)

7.9 NTT DATA (JAPAN)

7.10 TECH MAHINDRA (INDIA)

7.11 CAPGEMINI (FRANCE)

7.12 OTHERS KEY PLAYER

Chapter 8: Global IoT Managed Services Market By Region

8.1 Overview

8.2. North America IoT Managed Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Service

8.2.4.1 Network Management

8.2.4.2 Security Management

8.2.4.3 Device Management

8.2.4.4 Infrastructure Management

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by End User

8.2.5.1 Automotive & Transport

8.2.5.2 IT & Telecom

8.2.5.3 Healthcare

8.2.5.4 BFSI

8.2.5.5 Manufacturing

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Organization Size

8.2.6.1 SMEs

8.2.6.2 Large Enterprises

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe IoT Managed Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Service

8.3.4.1 Network Management

8.3.4.2 Security Management

8.3.4.3 Device Management

8.3.4.4 Infrastructure Management

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by End User

8.3.5.1 Automotive & Transport

8.3.5.2 IT & Telecom

8.3.5.3 Healthcare

8.3.5.4 BFSI

8.3.5.5 Manufacturing

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Organization Size

8.3.6.1 SMEs

8.3.6.2 Large Enterprises

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe IoT Managed Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Service

8.4.4.1 Network Management

8.4.4.2 Security Management

8.4.4.3 Device Management

8.4.4.4 Infrastructure Management

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by End User

8.4.5.1 Automotive & Transport

8.4.5.2 IT & Telecom

8.4.5.3 Healthcare

8.4.5.4 BFSI

8.4.5.5 Manufacturing

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Organization Size

8.4.6.1 SMEs

8.4.6.2 Large Enterprises

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific IoT Managed Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Service

8.5.4.1 Network Management

8.5.4.2 Security Management

8.5.4.3 Device Management

8.5.4.4 Infrastructure Management

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by End User

8.5.5.1 Automotive & Transport

8.5.5.2 IT & Telecom

8.5.5.3 Healthcare

8.5.5.4 BFSI

8.5.5.5 Manufacturing

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Organization Size

8.5.6.1 SMEs

8.5.6.2 Large Enterprises

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa IoT Managed Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Service

8.6.4.1 Network Management

8.6.4.2 Security Management

8.6.4.3 Device Management

8.6.4.4 Infrastructure Management

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by End User

8.6.5.1 Automotive & Transport

8.6.5.2 IT & Telecom

8.6.5.3 Healthcare

8.6.5.4 BFSI

8.6.5.5 Manufacturing

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Organization Size

8.6.6.1 SMEs

8.6.6.2 Large Enterprises

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America IoT Managed Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Service

8.7.4.1 Network Management

8.7.4.2 Security Management

8.7.4.3 Device Management

8.7.4.4 Infrastructure Management

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by End User

8.7.5.1 Automotive & Transport

8.7.5.2 IT & Telecom

8.7.5.3 Healthcare

8.7.5.4 BFSI

8.7.5.5 Manufacturing

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Organization Size

8.7.6.1 SMEs

8.7.6.2 Large Enterprises

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global IoT Managed Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 107.25 Bn. |

|

Forecast Period 2024-32 CAGR: |

31.18% |

Market Size in 2032: |

USD 940.48 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the IoT Managed Services Market research report is 2024-2032.

IBM (United States),Cisco Systems (United States),Accenture (Ireland),Infosys (India),Wipro (India),HCL Technologies (India),Tata Consultancy Services (India),and Other Major Players.

The IoT Managed Services Market is segmented into Serivce , End User, Organization Size and Region. By Services, the market is categorized into Network Management,Security Management ,Device Management, Infrastructure Management, Others.By End-Users, the market is categorized into Automotive & Transport, IT & Telecom, Healthcare, BFSI, Manufacturing,Others.By Organization Size , the market is categorized into SMEs, Large Enterprises. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The IoT Managed Services Market can be defined as a combination of third-party services necessary for the correct management of Internet of Things (IoT and IoT applications). These services include: Network management; Security management; Device management; Infrastructure management and others to provide organizations with ways to implement and manage IoT solutions and operations devoid of diverting their attention to their primary businesses.

IoT Managed Services Market Size Was Valued at USD 81.76 Billion in 2023, and is Projected to Reach USD 940.48 Billion by 2032, Growing at a CAGR of 31.18% From 2024-2032.