IoT Connectivity Market Synopsis

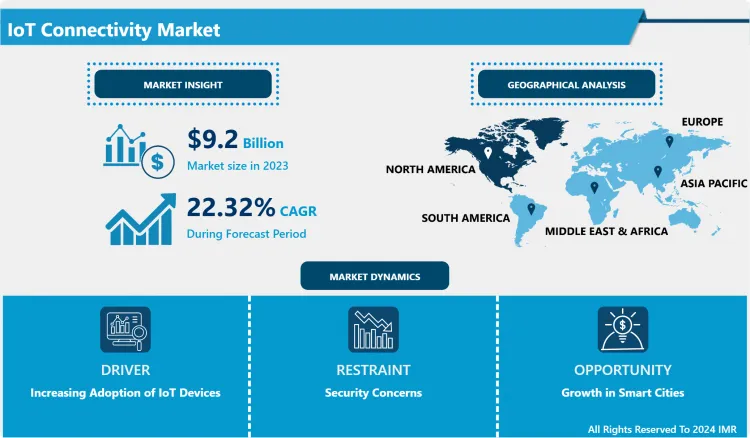

IoT Connectivity Market Size Was Valued at USD 9.2 Billion in 2023, and is Projected to Reach USD 56.40 Billion by 2032, Growing at a CAGR of 22.32% From 2024-2032.

IoT Connectivity Market aims at all the technologies and services, which make devices and systems in Internet of Things environment communicate with each other and with the Internet through data exchange and response. This market include number of connectivity solutions as cellular, satellite, Wi-Fi, Bluetooth and LPWAN in smart homes, manufacturing and industry, health and other sectors.

- A study on market of IoT connectivity has revealed that market has had outstanding growth in recent years, the growing use of smart devices and the need for integrated solutions in different sectors. Thus, the core of this market lies in the interoperability of devices and real-time interaction and data sharing and control. IoT connectivity refers to the broad area that involves the way gadgets are connected through various technologies to form the IoT, such as cellular, Wi-Fi, Bluetooth, Zigbee, and LoRaWAN among others, based on the use. Mobile networks, especially 4G and the soon to be established 5G, in terms of speed and geographical coverage; are ideal for applications including smart automobiles, remote health, and industrial applications. Low-power transmission protocols that are used are Zigbee and LoRaWAN technologies due to their low energy consumption required for applications such as smart meters and environmental monitoring.

- While IoT solutions are being implemented by organizations, the need for efficient connectivity that is secure grows as well. Risks of connected device use include the derivation of private data, as well as unauthorized invasion of the connected devices, meaning that the dependable authentication and encryption policies are direly needed. Furthermore, the number of devices that has to be controlled and the requirements of the different IoT systems complicating connectivity solutions. The challenges have surfaced as trends, and edge computing has gained popularity as a technique that performs data computation closer to the data source, resulting in minimal latency and improved response. As devices ask computers to share data and perform analysis on site, edge computing helps to save bandwidth and mitigate burden on clouds. Moreover, IoT augmented by AI and machine learning means that data analysis is also intelligent, besides being capable of supporting predictive maintenance, intelligent automation and resource management.

- The structure of IoT connectivity in the global market is fragmented, as different participants present platforms, hardware, and services for various industries. ISPs – wired and wireless, are also getting into the IoT connectivity space by extending their current infrastructures to address corporations interested in deploying M2M connections. In addition, it is emerging to increase adoption, especially from business+manufacturing and logistics industries that require specific encrypted networks to control their operations. Thirdly, cooperation of high-tech firms, device makers and service providers is on the rise bringing synergy and speeding up development of combined IoT applications. In the case of IoT connectivity, further growth based on the expansion of options will be faster as standards and legislation act as two main parameters for compatibility and trust between users and stakeholders.

- Future work will be focused on identifying additional market prospects for IoT connectivity as more sectors decide to develop their digital platforms and leverage IoT connectivity. As technologies in communication continues to develop with the addition of 5G networks, it will create a further improvement of the IoT applications and opens the door for IoT applications that was once impossible. Also, it is acknowledged that the concept of sustainability is slowly coming into focus especially since same organizations preferred a green IoT technology that conserved resources as compared to wasteful technologies. As the new customer expectations are set to smarter and more efficient technologies, the IoT connectivity market must evolve to respond to such factors as scalability, security and interoperability. In conclusion, this market still depends on its capability of giving the right connection to the IoT devices while maintaining security in the connectivity, efficiency, and effectiveness in the various sectors to encourage organizations towards growth.

IoT Connectivity Market Trend Analysis

Expansion of 5G Networks

- The IoT Connectivity Market includes the trend of 5G networks, which can significantly increase the speed of Internet communication, reduce the time of data transfer, and provide the connection of a huge number of devices simultaneously.. This is especially valuable to markets that need very short reaction times like self-driving cars, remote health, and connected manufacturing. Consider that with 5G networks in place, new and higher level applications of IoT that hitherto were unthinkable will be made possible; thus yielding new value added services.• Currently there is a rising interest by the firms all around the world in the IoT solutions that are created by using 5G networks. to connect a massive number of devices simultaneously. 5G technology significantly enhances the performance of IoT applications, enabling real-time data processing and communication. This is particularly beneficial for industries requiring immediate response times, such as autonomous vehicles, telemedicine, and smart manufacturing. The deployment of 5G networks is expected to facilitate the development of advanced IoT applications that were previously unfeasible, driving innovation and creating new business opportunities.

- As 5G technology continues to roll out globally, businesses are increasingly investing in IoT solutions that leverage this advanced connectivity. It is currently being applied within several industries, and its potential application areas include remote monitoring, condition-based monitoring, smart city, etc. The growth of faster and more reliable connectivity is expected to define the IoT device usage and make embedded systems more effective in increasing the organizational performance and customer satisfaction. In addition, the improved characteristics of 5G are anticipated to draw more players into the market and ensure the market stays competitive and will continue to drive IoT connectivity solutions.

Growth in Smart Cities

- The market for IoT connectivity has a lot to gain from smart cities as the world’s population becomes increasingly urbanized and cities seek more efficiency and livability.. It is essential to note that smart city solutions range from ITS or Intelligent Transportation Systems to smart waste management and efficient ways to build energy-efficient modern structures that depend on Internet of Things (IoT) connections. The abundance of governmental and municipal investments in infrastructure enhancements, and adoption of smart technologies for societies, cities and homes will create new sources of income for IoT connectivity. In addition, business models are linked to smart city development by public and private stakeholders, as more projects are being developed as partnerships between government and technological corporations.lity. Smart city initiatives encompass a wide range of applications, including intelligent transportation systems, smart waste management, and energy-efficient buildings, all of which rely heavily on IoT connectivity. As governments and municipalities invest in infrastructure upgrades and adopt smart technologies, the demand for reliable connectivity solutions will surge, creating new revenue streams for IoT connectivity providers.

- Moreover, public-private partnerships are increasingly facilitating the implementation of smart city projects, encouraging collaboration between government agencies and technology companies. Such cooperation does not only drive a faster implementation of Internet of Things connectivity solutions but also a targeted one that addresses the needs of communities. Using the growing trend of smart cities, IoT connectivity providers can leverage themselves to play an important role within smart cities which in the long run will positively impact the quality of life for citizens as well as the business itself.

IoT Connectivity Market Segment Analysis:

IoT Connectivity Market Segmented based on Component , Application, Enterprise Size and End User.

By Component, Service segment is expected to dominate the market during the forecast period

- Similar to what has been observed with solutions and services in the Property & Casualty Insurance Market, the segmentation of the industry’s components has changed with a focus toward the digital aspect and the inclusion of IoT. Measures that are data analytical tools, risk assessment tools, policy administration systems, underwriting tools and techniques, claims handling tools among others are vital assets when it comes to underwriting precision and efficient claims handling. The use of connected gadgets, for example, connected cars fitted with telematics or connected homes via various sensors help to present insurers with real-time information on potentially risky areas hence helping them design better suited policies as well as come up with better preventive measures.

- On the other side, the Property & Casualty Insurance Market services involve consulting, implementation, and support services are critical to insurers that want to get the most efficiency while using technology. Insurance companies are in a continuous search for solutions that fit their operating model from technology providers. With time, there will be increased changes in the market with a shift more emphasis on integrated solutions and services to support their client through the insurance market circuit.

By Application , Smart Energy and Utility segment held the largest share in 2023

- The Property & Casualty Insurance Market by application segmentation demonstrates the various potential roles of insurance providers concerning IoT. In the building and smart homes, the phenomena are using the IoT devices to track buildings for hazards such as fire outbreaks, water leakage, or breaks-in to name but a few, and fix the issues as soon as possible. Smart energy and utility applications help insurers identify customers’ energy consumption patterns, which leads to application of better rates and even incentives towards more efficient use of energy by policyholders.

- Due to IoT, the areas of smart manufacturing and smart transportation enable the insurance companies to understand the actual performance and risk factors for developing policies based on information feedback. For instance, wireless applications in cars allows insurers to monitor behaviour on the road and provide premiums for pay-as-you-drive insurance. Thanks to the penetration of IoT solutions to various industries, the Property and Casualty Insurance Market will have to expand the range of its services and products that will improve further risk management and satisfaction of customers..

IoT Connectivity Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American area is now considered the leaders of the Internet of Things connectivity market mostly attributable to the well developed technological background, high uptake of IoT gadgets and relevant manufacturers’ presence. The IoT initiatives should benefit from the region’s well-developed telecommunications system, as well as from the continuous expansion of 5G services there. Furthermore, sectors including healthcare, manufacturing, automotive are putting more into IoT solutions to ensure more efficiency and effective customer satisfaction thus the need for connectivity services.

- In addition to this, the increasing concern for developing smart cities in North America is fostering the IoT Connectivity Market. Micro-players purposively: Governments and municipalities are engaging in smart infrastructure development as agencies and sub-national governments to resolve urban issues, driving them into active collaboration with technology suppliers. Such strategy has proactively allowed the creation of an environment for the development of new IoT applications. In view of the tremendous propelling demand for connectivity, North America shall continue to reign as the global hub in the IoT Connectivity Market thus paving way for next phase of evolution.

Active Key Players in the IoT Connectivity Market

- Cisco Systems (USA)

- IBM (USA)

- Ericsson (Sweden)

- Vodafone Group (UK)

- Qualcomm (USA)

- AT&T Inc. (USA)

- Microsoft (USA)

- Huawei Technologies (China)

- Amazon Web Services (USA)

- Intel Corporation (USA)

- Others Key Player

|

Global IoT Connectivity Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.32% |

Market Size in 2032: |

USD 56.40 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Enterprise Size |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: IoT Connectivity Market by Component (2018-2032)

4.1 IoT Connectivity Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: IoT Connectivity Market by Application (2018-2032)

5.1 IoT Connectivity Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Buildings and Home Automation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Smart Energy and Utility

5.5 Smart Manufacturing

5.6 Smart Retail

5.7 Smart Transportation

5.8 Others

Chapter 6: IoT Connectivity Market by Enterprise Size (2018-2032)

6.1 IoT Connectivity Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: IoT Connectivity Market by End User Industry (2018-2032)

7.1 IoT Connectivity Market Snapshot and Growth Engine

7.2 Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Travel and Hospitality

7.6 Defense and Aerospace

7.7 IT and Telecommunication

7.8 Retail and E-Commerce

7.9 Manufacturing

7.10 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 IoT Connectivity Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CISCO SYSTEMS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 IBM (USA)

8.4 ERICSSON (SWEDEN)

8.5 VODAFONE GROUP (UK)

8.6 QUALCOMM (USA)

8.7 AT&T INC. (USA)

8.8 MICROSOFT (USA)

8.9 HUAWEI TECHNOLOGIES (CHINA)

8.10 AMAZON WEB SERVICES (USA)

8.11 INTEL CORPORATION (USA)

8.12 OTHERS KEY PLAYER

8.13

Chapter 9: Global IoT Connectivity Market By Region

9.1 Overview

9.2. North America IoT Connectivity Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Solutions

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Buildings and Home Automation

9.2.5.2 Smart Energy and Utility

9.2.5.3 Smart Manufacturing

9.2.5.4 Smart Retail

9.2.5.5 Smart Transportation

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Enterprise Size

9.2.6.1 Small and Medium-sized Enterprises

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by End User Industry

9.2.7.1 BFSI

9.2.7.2 Healthcare

9.2.7.3 Travel and Hospitality

9.2.7.4 Defense and Aerospace

9.2.7.5 IT and Telecommunication

9.2.7.6 Retail and E-Commerce

9.2.7.7 Manufacturing

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe IoT Connectivity Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Solutions

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Buildings and Home Automation

9.3.5.2 Smart Energy and Utility

9.3.5.3 Smart Manufacturing

9.3.5.4 Smart Retail

9.3.5.5 Smart Transportation

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Enterprise Size

9.3.6.1 Small and Medium-sized Enterprises

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by End User Industry

9.3.7.1 BFSI

9.3.7.2 Healthcare

9.3.7.3 Travel and Hospitality

9.3.7.4 Defense and Aerospace

9.3.7.5 IT and Telecommunication

9.3.7.6 Retail and E-Commerce

9.3.7.7 Manufacturing

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe IoT Connectivity Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Solutions

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Buildings and Home Automation

9.4.5.2 Smart Energy and Utility

9.4.5.3 Smart Manufacturing

9.4.5.4 Smart Retail

9.4.5.5 Smart Transportation

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Enterprise Size

9.4.6.1 Small and Medium-sized Enterprises

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by End User Industry

9.4.7.1 BFSI

9.4.7.2 Healthcare

9.4.7.3 Travel and Hospitality

9.4.7.4 Defense and Aerospace

9.4.7.5 IT and Telecommunication

9.4.7.6 Retail and E-Commerce

9.4.7.7 Manufacturing

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific IoT Connectivity Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Solutions

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Buildings and Home Automation

9.5.5.2 Smart Energy and Utility

9.5.5.3 Smart Manufacturing

9.5.5.4 Smart Retail

9.5.5.5 Smart Transportation

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Enterprise Size

9.5.6.1 Small and Medium-sized Enterprises

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by End User Industry

9.5.7.1 BFSI

9.5.7.2 Healthcare

9.5.7.3 Travel and Hospitality

9.5.7.4 Defense and Aerospace

9.5.7.5 IT and Telecommunication

9.5.7.6 Retail and E-Commerce

9.5.7.7 Manufacturing

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa IoT Connectivity Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Solutions

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Buildings and Home Automation

9.6.5.2 Smart Energy and Utility

9.6.5.3 Smart Manufacturing

9.6.5.4 Smart Retail

9.6.5.5 Smart Transportation

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Enterprise Size

9.6.6.1 Small and Medium-sized Enterprises

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by End User Industry

9.6.7.1 BFSI

9.6.7.2 Healthcare

9.6.7.3 Travel and Hospitality

9.6.7.4 Defense and Aerospace

9.6.7.5 IT and Telecommunication

9.6.7.6 Retail and E-Commerce

9.6.7.7 Manufacturing

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America IoT Connectivity Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Solutions

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Buildings and Home Automation

9.7.5.2 Smart Energy and Utility

9.7.5.3 Smart Manufacturing

9.7.5.4 Smart Retail

9.7.5.5 Smart Transportation

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Enterprise Size

9.7.6.1 Small and Medium-sized Enterprises

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by End User Industry

9.7.7.1 BFSI

9.7.7.2 Healthcare

9.7.7.3 Travel and Hospitality

9.7.7.4 Defense and Aerospace

9.7.7.5 IT and Telecommunication

9.7.7.6 Retail and E-Commerce

9.7.7.7 Manufacturing

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global IoT Connectivity Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.32% |

Market Size in 2032: |

USD 56.40 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Enterprise Size |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the IoT Connectivity Market research report is 2024-2032.

Cisco Systems (USA),IBM (USA),Ericsson (Sweden),Vodafone Group (UK),Qualcomm (USA),AT&T Inc. (USA),Microsoft (USA),and Other Major Players.

The IoT Connectivity Market is segmented into Component , Application, Enterprise Size ,End User Industry and Region. By Component , the market is categorized into Solutions, Services. By Application , the market is categorized into Buildings and Home Automation, Smart Energy and Utility, Smart Manufacturing, Smart Retail, Smart Transportation, and Others.By Enterprise Size , the market is categorized into Small and Medium-sized Enterprises, Large Enterprises. By End Use Industry , the market is categorized into BFSI, Healthcare, Travel and Hospitality, Defense and Aerospace, IT and Telecommunication, Retail and E-Commerce, Manufacturing, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

IoT Connectivity Market refers to all the technologies and services that can make devices and systems in the IoT environment interact with each other and the Internet through exchanging data and responding to one another. This market covers several connectivity options such as cellular, satellite, Wi-Fi, Bluetooth, and LPWAN (Low Power Wide Area Network) for the support of applications in smart homes, manufacturing and industry, healthcare, and other segments.

IoT Connectivity Market Size Was Valued at USD 9.2 Billion in 2023, and is Projected to Reach USD 56.40 Billion by 2032, Growing at a CAGR of 22.32% From 2024-2032.