Interventional Radiology Market Synopsis:

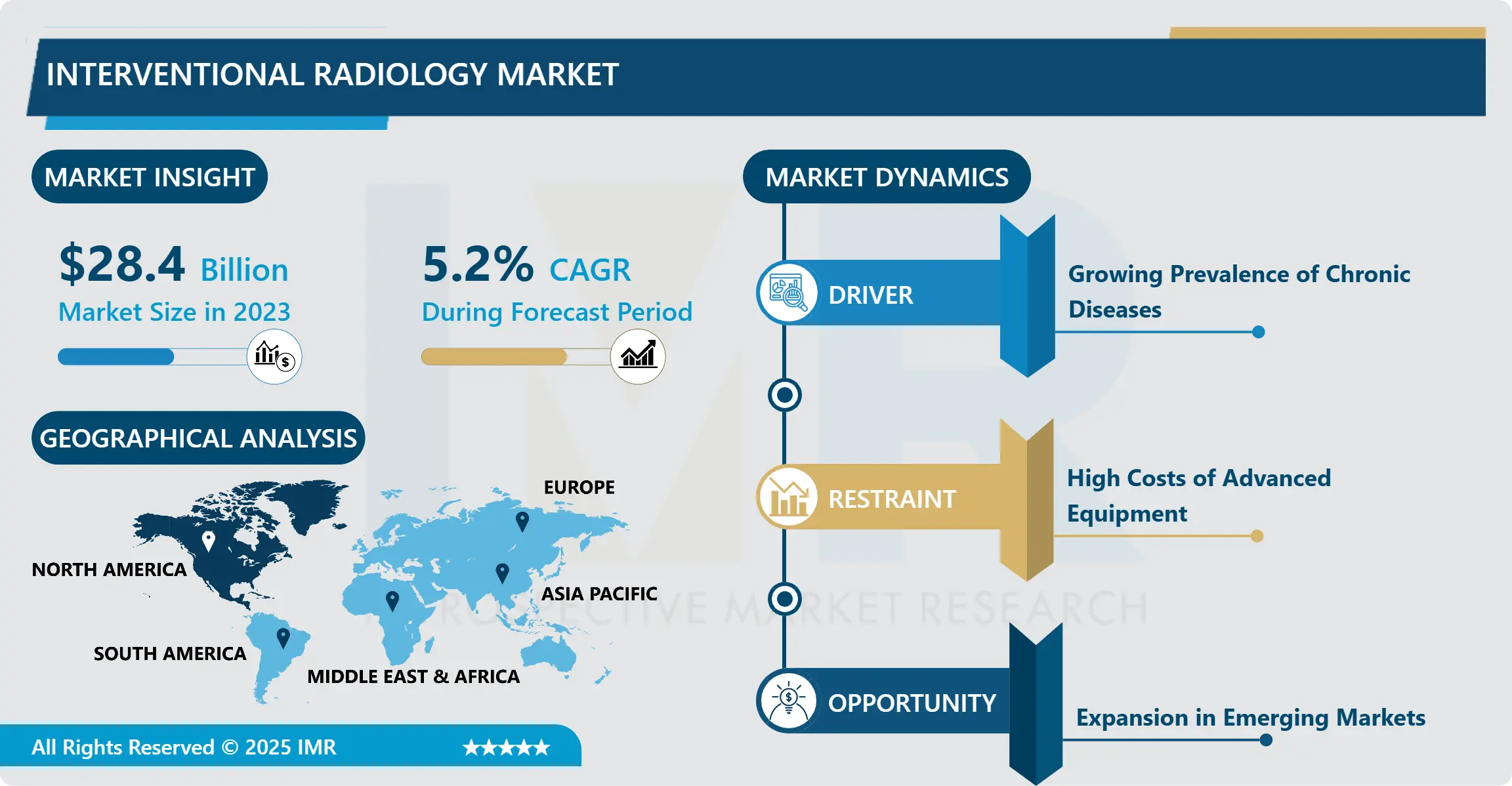

Interventional Radiology Market Size Was Valued at USD 28.4 Billion in 2023, and is Projected to Reach USD 44.82 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Interventional Radiology (IR) is a branch of medicine, which employs the utilization of imaging in the performance of the surgical operation. These procedures are mostly undertaken through minimal access cuts hence giving options to the conventional broad incisions. It is applied to identify, and treat, and manage conditions with less period of recovery and fewer complications.

Interventional radiology is a sub-specialty that has expand significantly within the recent years and Interventional radiology is an invaluable asset to the modern interventional medicine providing effective less invasive procedures for patients with different specialties. It encompasses using an imaging technique as a guide to place a catheter, biopsy, stents or embolization. These procedures can be used to address various diseases like cancer, cardiovascular diseases, and vascular diseases among others and can in the process enhance the patient quality of life, by shortening their hospital stays and time to heal.

The market covering interventional radiology is on the rise; this results from expanded use of minimally invasive treatments from various medical areas. These procedures were the non-invasive procedures compared to regular surgery and therefore have shorter recovery periods and less chance of getting an infection. There are also other drivers that sustained the growth of the IR market which include, the rising population, global population aging, high prevalence of chronic diseases, and ability to advance technologies in imaging as well as advanced in radiology tools. Furthermore, the change of preference towards outpatient care settings and patients’ acceptance to these non-surgical procedures are other drivers of the market.

Interventional radiology market has evolved and expanded owing to technological innovation in this particular area. Magnetic resonance imaging, computer tomography, ultrasound are the examples of imaging techniques which have experience a lot of advancements so the outcomes for the patient are much better now. The latest development of artificial intelligence and machine learning in regard to image processing are improving the efficacy of the IR procedures. In addition, advances in catheter and guidewire equipment broaden the applicability of interventional treatments for being both safer and more intricate. The growing need for these sophisticated systems is also having a huge impact in shaping the market’s growth path.

Interventional Radiology Market Trend Analysis:

Adoption of AI and Automation in Interventional Radiology

-

One of the most important trends in the development of interventional radiology is the use of artificial intelligence and automation in the market. The use of diagnostic imaging will be made more accurate by the help of AI and the rate of making mistakes minimized. Integration of high tech image analysis enables the radiologists to detect irregularities hence enhancing the accuracy and safety of activities such as biopsies and different tumor treatments.

- Incorporation in the design of interventional radiology equipment has also been implemented in order to enhance workflow and also enhance the rate at which various procedures are conducted. In angiography and biopsy needle guidance, increased levels of automation are now available to perform the procedure a lot faster and less likely to result in complications. These technologies are beneficial for patients by extending the scope of work for interventional radiology teams, and as adoption of these solutions increases in the future, the market for these tools should expand rapidly as well.

Expansion in Emerging Markets

-

The first major opportunity in the interventional radiology market thus relates to the potential for growth of medical services in new geographic areas. As the healthcare infrastructure is being developed in Asia-Pacific, Latin America as well as the Middle East, the interest in innovations in interventional radiology tools is increasing. These markets have the potential for huge expansion since more and more healthcare facilities including hospitals and clinics are turning to provide fewer invasive treatments to patients.

- The growth of the global healthcare industry primarily the part associated with the emerging economies has led to the rise of the use of an enhanced diagnostic and therapeutic policy. In addition, increase in populations in middle-income societies and the enhancement of consciousness regarding health status in these areas may help increase the need for interventional radiology. Corporate entities able to increase their spans of coverage of these markets with efficiency and affordable solutions that do not compromise on quality are likely to benefit most from the trend.

Interventional Radiology Market Segment Analysis:

Interventional Radiology Market is Segmented on the basis of Product Type, Application, End User, and Region

By Product Type, MRI Systems segment is expected to dominate the market during the forecast period

-

The product types that are used for interventional radiology market can be segmented into various categories which are as follows;. MRI systems, ultrasound imaging systems and CT Scanners are essential in supplying picture information that assists interventional procedures. Such imaging tools have been developed over the years to offer higher resolution and require shorter time to generate images to help several healthcare providers offer precise minimally invasive treatments.

- Other relevant products consist of angiography systems, fluoroscopy systems and biopsy needles and guidewires which form direct part and paraphernalia of the interventional procedures. For imaging blood vessels angiography systems are widely used while fluoroscopy is used for imaging during the procedures. Biopsy needles and guidewires are the instruments used for tissue sampling, and for steering through body tissues to reach the treatment site respectively. Thus, due to the potential for increasing self-sufficiency in patients requiring implants, the demand for such products will increase and will be aimed at increasing the functional specialization and accuracy of these devices.

By Application, Oncology segment expected to held the largest share

-

Interventional radiology is used in numerous specialties such as oncology, cardiology, urology and nephrology, gastroenterology, neurology and orthopedics. In cancer, interventional radiology is applied in tumor sampling, management of liver cancer, and for control of symptoms. In the cardio logistics it enters in to practice in blocked arteries and in urology & nephrology in procedures that include removal of kidney stones and-placement of dialysis catheters.

- The varied uses in numerous fields present a large business opportunity for the interventional radiology market. The requirements for higher-level minimally invasive procedures in these scientific disciplines increases the market for advanced products and services. This infection will however increase due to increased sensitization of more specialties in interventional radiology due to the current move towards less invasive treatment options.

Interventional Radiology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is the largest regional market for interventional radiology at the moment because of the high level of development of medical care, increased frequency of chronic diseases, and increased capital investment in such technologies. The healthcare industry in the region is some of the most developed in the world with high usage of advanced imaging and interventional procedures. Also, many significant market players are located in North America, which enlarges the rate of innovations’ creation and implementation in this area.

- This is further complimented by a very strong regulatory environment, patronage to medical enhancements by the government in North America and insurance cover for interventional radiology procedures. The rising trend of outpatient procedures and minimally invasive surgeries is going hand-in-hand with the development of interventional radiology; North America stays the leader of this market in the near future.

Active Key Players in the Interventional Radiology Market:

-

Siemens Healthineers (Germany)

- GE Healthcare (United States)

- Philips Healthcare (Netherlands)

- Canon Medical Systems (Japan)

- Medtronic (Ireland)

- Johnson & Johnson (United States)

- Boston Scientific (United States)

- Stryker Corporation (United States)

- Varian Medical Systems (United States)

- Cook Medical (United States)

- Terumo Corporation (Japan)

- Becton Dickinson and Company (United States)

- Other Active Players

Key Industry Developments in the Interventional Radiology Market:

-

In June 2024, GE HealthCare and MediView XR Inc. announced the first installation of the OmnifyXR interventional suite at North Star Vascular and Interventional (NSVI) in Minneapolis, Minnesota. This launch marks a significant expansion of the company's interventional radiology portfolio and is expected to broaden their customer base.

- In June 2024, Royal Philips announced the first implantation of the Duo Venous Stent System, a device designed to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI), following its premarket approval (PMA) from the U.S. Food and Drug Administration (FDA). This milestone is anticipated to enhance the company’s market reputation and strengthen its position in the industry.

|

Interventional Radiology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.4 Billion |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 44.82 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Interventional Radiology Market by Product Type

4.1 Interventional Radiology Market Snapshot and Growth Engine

4.2 Interventional Radiology Market Overview

4.3 MRI Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 MRI Systems: Geographic Segmentation Analysis

4.4 Ultrasound Imaging Systems

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Ultrasound Imaging Systems: Geographic Segmentation Analysis

4.5 CT Scanners

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 CT Scanners: Geographic Segmentation Analysis

4.6 Angiography Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Angiography Systems: Geographic Segmentation Analysis

4.7 Fluoroscopy Systems

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Fluoroscopy Systems: Geographic Segmentation Analysis

4.8 Biopsy Needles

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Biopsy Needles: Geographic Segmentation Analysis

4.9 Guidewires

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Guidewires: Geographic Segmentation Analysis

4.10 Others

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others: Geographic Segmentation Analysis

Chapter 5: Interventional Radiology Market by Application

5.1 Interventional Radiology Market Snapshot and Growth Engine

5.2 Interventional Radiology Market Overview

5.3 Oncology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oncology: Geographic Segmentation Analysis

5.4 Cardiology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cardiology: Geographic Segmentation Analysis

5.5 Urology & Nephrology

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Urology & Nephrology: Geographic Segmentation Analysis

5.6 Gastroenterology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Gastroenterology: Geographic Segmentation Analysis

5.7 Neurology

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Neurology: Geographic Segmentation Analysis

5.8 Orthopedic

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Orthopedic: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Interventional Radiology Market by End User

6.1 Interventional Radiology Market Snapshot and Growth Engine

6.2 Interventional Radiology Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

6.5 Specialty Clinics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Specialty Clinics: Geographic Segmentation Analysis

6.6 Diagnostic Imaging Centers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Diagnostic Imaging Centers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Interventional Radiology Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SIEMENS HEALTHINEERS (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GE HEALTHCARE (UNITED STATES)

7.4 PHILIPS HEALTHCARE (NETHERLANDS)

7.5 CANON MEDICAL SYSTEMS (JAPAN)

7.6 MEDTRONIC (IRELAND)

7.7 JOHNSON & JOHNSON (UNITED STATES)

7.8 BOSTON SCIENTIFIC (UNITED STATES)

7.9 STRYKER CORPORATION (UNITED STATES)

7.10 VARIAN MEDICAL SYSTEMS (UNITED STATES)

7.11 COOK MEDICAL (UNITED STATES)

7.12 TERUMO CORPORATION (JAPAN)

7.13 BECTON DICKINSON AND COMPANY (UNITED STATES)

7.14 .

7.15 OTHER ACTIVE PLAYERS

Chapter 8: Global Interventional Radiology Market By Region

8.1 Overview

8.2. North America Interventional Radiology Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 MRI Systems

8.2.4.2 Ultrasound Imaging Systems

8.2.4.3 CT Scanners

8.2.4.4 Angiography Systems

8.2.4.5 Fluoroscopy Systems

8.2.4.6 Biopsy Needles

8.2.4.7 Guidewires

8.2.4.8 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oncology

8.2.5.2 Cardiology

8.2.5.3 Urology & Nephrology

8.2.5.4 Gastroenterology

8.2.5.5 Neurology

8.2.5.6 Orthopedic

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Specialty Clinics

8.2.6.4 Diagnostic Imaging Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Interventional Radiology Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 MRI Systems

8.3.4.2 Ultrasound Imaging Systems

8.3.4.3 CT Scanners

8.3.4.4 Angiography Systems

8.3.4.5 Fluoroscopy Systems

8.3.4.6 Biopsy Needles

8.3.4.7 Guidewires

8.3.4.8 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oncology

8.3.5.2 Cardiology

8.3.5.3 Urology & Nephrology

8.3.5.4 Gastroenterology

8.3.5.5 Neurology

8.3.5.6 Orthopedic

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Specialty Clinics

8.3.6.4 Diagnostic Imaging Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Interventional Radiology Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 MRI Systems

8.4.4.2 Ultrasound Imaging Systems

8.4.4.3 CT Scanners

8.4.4.4 Angiography Systems

8.4.4.5 Fluoroscopy Systems

8.4.4.6 Biopsy Needles

8.4.4.7 Guidewires

8.4.4.8 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oncology

8.4.5.2 Cardiology

8.4.5.3 Urology & Nephrology

8.4.5.4 Gastroenterology

8.4.5.5 Neurology

8.4.5.6 Orthopedic

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Specialty Clinics

8.4.6.4 Diagnostic Imaging Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Interventional Radiology Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 MRI Systems

8.5.4.2 Ultrasound Imaging Systems

8.5.4.3 CT Scanners

8.5.4.4 Angiography Systems

8.5.4.5 Fluoroscopy Systems

8.5.4.6 Biopsy Needles

8.5.4.7 Guidewires

8.5.4.8 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oncology

8.5.5.2 Cardiology

8.5.5.3 Urology & Nephrology

8.5.5.4 Gastroenterology

8.5.5.5 Neurology

8.5.5.6 Orthopedic

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Specialty Clinics

8.5.6.4 Diagnostic Imaging Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Interventional Radiology Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 MRI Systems

8.6.4.2 Ultrasound Imaging Systems

8.6.4.3 CT Scanners

8.6.4.4 Angiography Systems

8.6.4.5 Fluoroscopy Systems

8.6.4.6 Biopsy Needles

8.6.4.7 Guidewires

8.6.4.8 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oncology

8.6.5.2 Cardiology

8.6.5.3 Urology & Nephrology

8.6.5.4 Gastroenterology

8.6.5.5 Neurology

8.6.5.6 Orthopedic

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Specialty Clinics

8.6.6.4 Diagnostic Imaging Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Interventional Radiology Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 MRI Systems

8.7.4.2 Ultrasound Imaging Systems

8.7.4.3 CT Scanners

8.7.4.4 Angiography Systems

8.7.4.5 Fluoroscopy Systems

8.7.4.6 Biopsy Needles

8.7.4.7 Guidewires

8.7.4.8 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oncology

8.7.5.2 Cardiology

8.7.5.3 Urology & Nephrology

8.7.5.4 Gastroenterology

8.7.5.5 Neurology

8.7.5.6 Orthopedic

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Specialty Clinics

8.7.6.4 Diagnostic Imaging Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Interventional Radiology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.4 Billion |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 44.82 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||