Inspection Camera System Market Synopsis

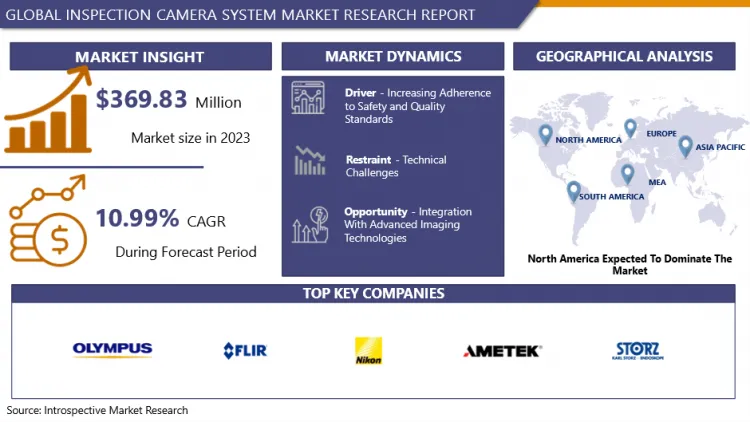

Inspection Camera System Market Size Was Valued at USD 410.47 Million in 2024, and is Projected to Reach USD 945.27 Million by 2032, Growing at a CAGR of 10.99% From 2025-2032.

A camera system for inspection, also called a borescope or endoscope, is utilized for visually examining hard-to-reach areas. It includes a camera connected to a tube - either flexible or rigid - that is placed into the desired area. The camera sends live video or pictures to a screen, enabling the user to see and identify problems in inaccessible areas.

Improvements in camera technology have resulted in higher quality through increased resolution, superior image sensors, and better lighting choices. More petite, more condensed camera systems enable inspections in more confined spaces. Wireless and digital features such as live video streaming and data analytics improve how easily something can be used and its effectiveness.

Increased demand for non-destructive testing (NDT) is leading industries to increase their utilization of preventive maintenance and inspection cameras to prevent downtime and prolong the life of equipment. Increased demand is also being fueled by stricter regulations in the oil, gas, aviation, and construction industries.

Increased demand in industries such as infrastructure, automotive, oil and gas, and aerospace is leading to a requirement for frequent inspections. Ensuring safety, compliance, and operational efficiency is vital in construction, automotive manufacturing, pipeline safety, and aircraft performance. The Inspection Camera System Market involves the production, distribution, and use of specialized cameras and related equipment for visual inspection in different applications. These systems generally consist of cameras, cables, monitors, and lighting sources, and are widely used in industries such as manufacturing, automotive, aerospace, healthcare, and other sectors.

Inspection Camera System Market Trend Analysis

Inspection Camera System Market Growth Drivers- Increasing Adherence to Safety and Quality Standards

- Inspection cameras play a crucial role in manufacturing quality control by detecting defects and ensuring products meet strict standards. Ongoing surveillance on assembly lines ensures the quality and dependability of products while also decreasing the need for rework and warranty claims. Segments such as aerospace, automotive, pharmaceuticals, healthcare, and food processing are required to adhere to stringent government regulations set by organizations such as FDA, FAA, OSHA, EPA, and ISO. Ensuring compliance requires frequent inspections to ensure safety, quality, and environmental standards are met, along with adherence to industry-specific standards and certifications.

- Safety is the top priority for industries working in dangerous environments. Inspection cameras permit inspections from a distance without invading the area, identifying equipment malfunctions early on to reduce risks and maintain a safe work environment for workers in the oil and gas, chemical processing, and mining sectors. Advances in technology for high-resolution imaging have resulted in the creation of HD, 4K, and thermal cameras, which offer detailed images for inspections. The merging of AI and machine learning enhances efficiency by automating defect detection and predicting maintenance.

- Utilizing inspection cameras for preventive and predictive maintenance helps to decrease downtime, prolong equipment lifespan, and cut maintenance costs. Continuous monitoring identifies signs of wear and potential failures at an early stage. Inspection cameras are essential for checking aircraft parts in the aerospace industry to ensure safety regulations are met, while in healthcare, they allow for minimally invasive procedures and surgeries, providing doctors with real-time visual feedback for precise treatments.

Inspection Camera System Market Opportunity- Integration With Advanced Imaging Technologies

- Advanced imaging technologies like high-resolution sensors, image processing algorithms, and augmented reality (AR) features enhance the accuracy and precision of inspection duties. This enables more thorough and trustworthy examinations, minimizing mistakes and enhancing quality control as a whole. Incorporating advanced imaging technologies expands the capabilities of inspection camera systems for a variety of applications. For instance, they have the ability to conduct advanced inspections in sectors like aerospace, automotive, electronics, and pharmaceuticals, where accurate visual examination is crucial.

- Advanced imaging technologies improve inspection procedures by automating specific tasks, speeding up inspection times, and decreasing downtime. This increase in efficiency improves productivity and operational efficiency for businesses that utilize inspection camera systems. Advanced imaging technologies in inspection camera systems improve regulatory compliance, effectively meeting industry standards. Incorporating these technologies differentiates companies in the market, demonstrating innovation and advanced solutions. This distinction appeals to customers looking for enhanced functions and establishes these businesses as frontrunners in technological progress.

- Incorporation of IoT and Industry 4.0 links inspection camera systems to allow for immediate data gathering, analysis, and decision-making. This integration helps with predictive maintenance, remote monitoring, and proactive problem-solving for better asset management and operational workflows. Sophisticated imaging technologies provide convenient interfaces and improved access for simpler use and reliable functionality.

Inspection Camera System Market Segment Analysis:

Inspection Camera System Market is segmented on the basis of Component, Video Quality, Distribution Channel, Application, End-User, And Region.

By Component Type, Hardware Segment Is Expected to Dominate the Market During the Forecast Period

- Cameras are necessary for recording images and videos with superior resolution and sensor technology such as CCD and CMOS. Display units play a vital role in viewing information in real-time. Probes and tubes provide entry to areas that are difficult to reach. Lighting systems use either LED lights or fiber optics to give illumination. Control units oversee camera operations and monitoring zones. Technological advancements consist of enhanced image quality through High-Definition and 4K cameras, reduced hardware size for compact areas, and wireless capabilities for immediate data transfer and device connection.

- Investment in hardware for inspection camera systems is substantial, ultimately influencing market value. Continuous improvements are essential to sustain excellent performance and stay current with technological advancements. Customized solutions for different sectors with specialized equipment such as heat-resistant cameras for industrial assessments, waterproof cameras for underwater assessments, and robust structures for dependability.

- Inspection cameras are highly sought after in diverse sectors such as manufacturing, maintenance, oil and gas, infrastructure, and construction. Robust hardware components are critical in tasks like building inspections, municipal infrastructure maintenance, and oil and gas operations to ensure quality, reliability, and durability. Advanced camera technology is used in medical endoscopy for accurate and dependable medical diagnosis. Quality inspection tools are necessary for ensuring safety during aircraft and vehicle inspections.

By End-User, Industrial Segment Held the Largest Share In 2024

- Inspection cameras are crucial in different sectors like manufacturing and oil and gas. They are utilized in quality control to identify flaws, in maintenance to avert breakdowns, in pipeline inspections to monitor integrity, and in refinery equipment inspections for safety and efficiency purposes. They have a wide range of uses in various industrial sectors. Cameras are used for evaluations in the energy and utilities sector for power plants and renewable energy, as well as in the field of aerospace for aircraft maintenance and space exploration to identify deterioration, guarantee function, safety, and adherence to regulations.

- Cutting-edge technologies such as advanced cameras, artificial intelligence, machine learning, wireless/IoT integration, and thermal imaging are transforming the field of inspections. HD/4K cameras yield sharp visuals, AI streamlines defect identification, wireless/IoT support instant monitoring, and thermal cameras locate heat anomalies to uncover problems like overheating or electrical malfunctions. Sectors such as oil, gas, aerospace, and manufacturing are required to adhere to stringent safety and environmental regulations. Routine assessments must be conducted to verify compliance with industry regulations established by agencies such as OSHA, EPA, FAA, ISO, and ASME.

- Regularly inspecting equipment for Preventive and Predictive Maintenance can save money by identifying problems early, preventing breakdowns, cutting maintenance expenses, and avoiding downtimes. It improves operational efficiency, decreases energy usage, and allows for predictive maintenance using AI and machine learning. Regular inspections are needed for safety and efficiency in industrial facilities with extensive infrastructure. Industrial sectors are putting more money into cutting-edge technologies such as inspection systems. Strong inspection programs are critical for continued reliability and safety.

Inspection Camera System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States, is a center for revolutionary advancements in sophisticated inspection technologies. Prominent corporations such as FLIR Systems, Olympus Corporation, and General Electric propel advancement with significant investments in research and development within this industry. Technological innovation involves the use of high-resolution cameras to improve image quality, AI and machine learning for identifying defects and maintenance, and wireless/IoT integration for immediate data transmission and monitoring.

- North America has a robust industrial sector that includes manufacturing and oil and gas sectors, which require frequent inspections to ensure quality control, upkeep, and ongoing monitoring of infrastructure. Regular inspections and maintenance are needed for safety and compliance of aging infrastructure in North America, as well as diligent inspections for new construction projects. Aerospace depends on inspection systems for engine maintenance, structural assessments, and ensuring safety standards are met.

- Industries such as construction, oil and gas, and aerospace must comply with strict regulatory standards by undergoing regular inspections and maintaining high safety and environmental standards. Government programs allocate funds for infrastructure projects, which increases the need for inspection technologies. Furthermore, there is a push for backing technological advancements in advanced inspection systems. A robust economy enables funding for cutting-edge technologies and infrastructure improvements. Industries and consumers rapidly embrace emerging technologies. Growing interest in inspection cameras is observed in the residential market.

Inspection Camera System Market Active Players

- Olympus Corporation (Japan)

- FLIR Systems, Inc. (USA)

- AMETEK, Inc. (USA)

- Nikon Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- GE Inspection Technologies (USA)

- Sony Corporation (Japan)

- Panasonic Corporation (Japan)

- SKF Group (Sweden)

- YXLON International GmbH (Germany)

- Testo SE & Co. KGaA (Germany)

- FLUKE Corporation (USA)

- Stryker Corporation (USA)

- Bosch Security Systems, Inc. (USA)

- Sonatest Ltd. (UK)

- VIVAX-METROTECH Corp. (USA)

- MISTRAS Group, Inc. (USA)

- Extech Instruments (USA)

- Wohler USA Inc. (USA)

- Lenox Instrument Company, Inc. (USA)

- Ridgid Tool Company (USA)

- Inuktun Services Ltd. (Canada)

- HIOKI E.E. Corporation (Japan)

- IT Concepts GmbH (Germany)

- JME Technologies (USA)

- 3M (USA)

- Other Active Players

|

Global Inspection Camera System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 410.47 Million |

|

Forecast Period 2024-32 CAGR: |

10.99 % |

Market Size in 2032: |

USD 945.27 Million |

|

Segments Covered: |

By Component |

|

|

|

By Video Quality |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Inspection Camera System Market by Component (2018-2032)

4.1 Inspection Camera System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Inspection Camera System Market by Video Quality (2018-2032)

5.1 Inspection Camera System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Standard Definition (SD)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 High Definition (HD)

5.5 Full High Definition (FHD)

5.6 Ultra-High Definition (UHD)

5.7 4K

Chapter 6: Inspection Camera System Market by Distribution Channel (2018-2032)

6.1 Inspection Camera System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Specialty Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electronics Stores

6.5 E-commerce Platforms

6.6 Hypermarket and Supermarket

Chapter 7: Inspection Camera System Market by Application (2018-2032)

7.1 Inspection Camera System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pipeline Inspection

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Drain and Sewer Inspection

7.5 Electrical Conduit Inspection

7.6 HVAC Duct Inspection

7.7 Building and Construction Inspection

7.8 Others {Manufacturing and Assembly Line Inspection

7.9 Aerospace Inspection

7.10 Automotive Inspection}

Chapter 8: Inspection Camera System Market by End-User (2018-2032)

8.1 Inspection Camera System Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Industrial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

8.5 Residential

8.6 Government

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Inspection Camera System Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 OLYMPUS CORPORATION (JAPAN)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 FLIR SYSTEMS INC. (USA)

9.4 AMETEK INC. (USA)

9.5 NIKON CORPORATION (JAPAN)

9.6 KARL STORZ SE & CO. KG (GERMANY)

9.7 GE INSPECTION TECHNOLOGIES (USA)

9.8 SONY CORPORATION (JAPAN)

9.9 PANASONIC CORPORATION (JAPAN)

9.10 SKF GROUP (SWEDEN)

9.11 YXLON INTERNATIONAL GMBH (GERMANY)

9.12 TESTO SE & CO. KGAA (GERMANY)

9.13 FLUKE CORPORATION (USA)

9.14 STRYKER CORPORATION (USA)

9.15 BOSCH SECURITY SYSTEMS INC. (USA)

9.16 SONATEST LTD. (UK)

9.17 VIVAX-METROTECH CORP. (USA)

9.18 MISTRAS GROUP INC. (USA)

9.19 EXTECH INSTRUMENTS (USA)

9.20 WOHLER USA INC. (USA)

9.21 LENOX INSTRUMENT COMPANY INC. (USA)

9.22 RIDGID TOOL COMPANY (USA)

9.23 INUKTUN SERVICES LTD. (CANADA)

9.24 HIOKI E.E. CORPORATION (JAPAN)

9.25 IT CONCEPTS GMBH (GERMANY)

9.26 JME TECHNOLOGIES (USA)

9.27 3M (USA)

9.28 ROHDE & SCHWARZ GMBH & CO. KG (GERMANY)

Chapter 10: Global Inspection Camera System Market By Region

10.1 Overview

10.2. North America Inspection Camera System Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Hardware

10.2.4.2 Software

10.2.4.3 Services

10.2.5 Historic and Forecasted Market Size by Video Quality

10.2.5.1 Standard Definition (SD)

10.2.5.2 High Definition (HD)

10.2.5.3 Full High Definition (FHD)

10.2.5.4 Ultra-High Definition (UHD)

10.2.5.5 4K

10.2.6 Historic and Forecasted Market Size by Distribution Channel

10.2.6.1 Specialty Stores

10.2.6.2 Electronics Stores

10.2.6.3 E-commerce Platforms

10.2.6.4 Hypermarket and Supermarket

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Pipeline Inspection

10.2.7.2 Drain and Sewer Inspection

10.2.7.3 Electrical Conduit Inspection

10.2.7.4 HVAC Duct Inspection

10.2.7.5 Building and Construction Inspection

10.2.7.6 Others {Manufacturing and Assembly Line Inspection

10.2.7.7 Aerospace Inspection

10.2.7.8 Automotive Inspection}

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Industrial

10.2.8.2 Commercial

10.2.8.3 Residential

10.2.8.4 Government

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Inspection Camera System Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Hardware

10.3.4.2 Software

10.3.4.3 Services

10.3.5 Historic and Forecasted Market Size by Video Quality

10.3.5.1 Standard Definition (SD)

10.3.5.2 High Definition (HD)

10.3.5.3 Full High Definition (FHD)

10.3.5.4 Ultra-High Definition (UHD)

10.3.5.5 4K

10.3.6 Historic and Forecasted Market Size by Distribution Channel

10.3.6.1 Specialty Stores

10.3.6.2 Electronics Stores

10.3.6.3 E-commerce Platforms

10.3.6.4 Hypermarket and Supermarket

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Pipeline Inspection

10.3.7.2 Drain and Sewer Inspection

10.3.7.3 Electrical Conduit Inspection

10.3.7.4 HVAC Duct Inspection

10.3.7.5 Building and Construction Inspection

10.3.7.6 Others {Manufacturing and Assembly Line Inspection

10.3.7.7 Aerospace Inspection

10.3.7.8 Automotive Inspection}

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Industrial

10.3.8.2 Commercial

10.3.8.3 Residential

10.3.8.4 Government

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Inspection Camera System Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Hardware

10.4.4.2 Software

10.4.4.3 Services

10.4.5 Historic and Forecasted Market Size by Video Quality

10.4.5.1 Standard Definition (SD)

10.4.5.2 High Definition (HD)

10.4.5.3 Full High Definition (FHD)

10.4.5.4 Ultra-High Definition (UHD)

10.4.5.5 4K

10.4.6 Historic and Forecasted Market Size by Distribution Channel

10.4.6.1 Specialty Stores

10.4.6.2 Electronics Stores

10.4.6.3 E-commerce Platforms

10.4.6.4 Hypermarket and Supermarket

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Pipeline Inspection

10.4.7.2 Drain and Sewer Inspection

10.4.7.3 Electrical Conduit Inspection

10.4.7.4 HVAC Duct Inspection

10.4.7.5 Building and Construction Inspection

10.4.7.6 Others {Manufacturing and Assembly Line Inspection

10.4.7.7 Aerospace Inspection

10.4.7.8 Automotive Inspection}

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Industrial

10.4.8.2 Commercial

10.4.8.3 Residential

10.4.8.4 Government

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Inspection Camera System Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Hardware

10.5.4.2 Software

10.5.4.3 Services

10.5.5 Historic and Forecasted Market Size by Video Quality

10.5.5.1 Standard Definition (SD)

10.5.5.2 High Definition (HD)

10.5.5.3 Full High Definition (FHD)

10.5.5.4 Ultra-High Definition (UHD)

10.5.5.5 4K

10.5.6 Historic and Forecasted Market Size by Distribution Channel

10.5.6.1 Specialty Stores

10.5.6.2 Electronics Stores

10.5.6.3 E-commerce Platforms

10.5.6.4 Hypermarket and Supermarket

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Pipeline Inspection

10.5.7.2 Drain and Sewer Inspection

10.5.7.3 Electrical Conduit Inspection

10.5.7.4 HVAC Duct Inspection

10.5.7.5 Building and Construction Inspection

10.5.7.6 Others {Manufacturing and Assembly Line Inspection

10.5.7.7 Aerospace Inspection

10.5.7.8 Automotive Inspection}

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Industrial

10.5.8.2 Commercial

10.5.8.3 Residential

10.5.8.4 Government

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Inspection Camera System Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Hardware

10.6.4.2 Software

10.6.4.3 Services

10.6.5 Historic and Forecasted Market Size by Video Quality

10.6.5.1 Standard Definition (SD)

10.6.5.2 High Definition (HD)

10.6.5.3 Full High Definition (FHD)

10.6.5.4 Ultra-High Definition (UHD)

10.6.5.5 4K

10.6.6 Historic and Forecasted Market Size by Distribution Channel

10.6.6.1 Specialty Stores

10.6.6.2 Electronics Stores

10.6.6.3 E-commerce Platforms

10.6.6.4 Hypermarket and Supermarket

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Pipeline Inspection

10.6.7.2 Drain and Sewer Inspection

10.6.7.3 Electrical Conduit Inspection

10.6.7.4 HVAC Duct Inspection

10.6.7.5 Building and Construction Inspection

10.6.7.6 Others {Manufacturing and Assembly Line Inspection

10.6.7.7 Aerospace Inspection

10.6.7.8 Automotive Inspection}

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Industrial

10.6.8.2 Commercial

10.6.8.3 Residential

10.6.8.4 Government

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Inspection Camera System Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Hardware

10.7.4.2 Software

10.7.4.3 Services

10.7.5 Historic and Forecasted Market Size by Video Quality

10.7.5.1 Standard Definition (SD)

10.7.5.2 High Definition (HD)

10.7.5.3 Full High Definition (FHD)

10.7.5.4 Ultra-High Definition (UHD)

10.7.5.5 4K

10.7.6 Historic and Forecasted Market Size by Distribution Channel

10.7.6.1 Specialty Stores

10.7.6.2 Electronics Stores

10.7.6.3 E-commerce Platforms

10.7.6.4 Hypermarket and Supermarket

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Pipeline Inspection

10.7.7.2 Drain and Sewer Inspection

10.7.7.3 Electrical Conduit Inspection

10.7.7.4 HVAC Duct Inspection

10.7.7.5 Building and Construction Inspection

10.7.7.6 Others {Manufacturing and Assembly Line Inspection

10.7.7.7 Aerospace Inspection

10.7.7.8 Automotive Inspection}

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Industrial

10.7.8.2 Commercial

10.7.8.3 Residential

10.7.8.4 Government

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Inspection Camera System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 410.47 Million |

|

Forecast Period 2024-32 CAGR: |

10.99 % |

Market Size in 2032: |

USD 945.27 Million |

|

Segments Covered: |

By Component |

|

|

|

By Video Quality |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||