Global Infrared Detector Market Overview

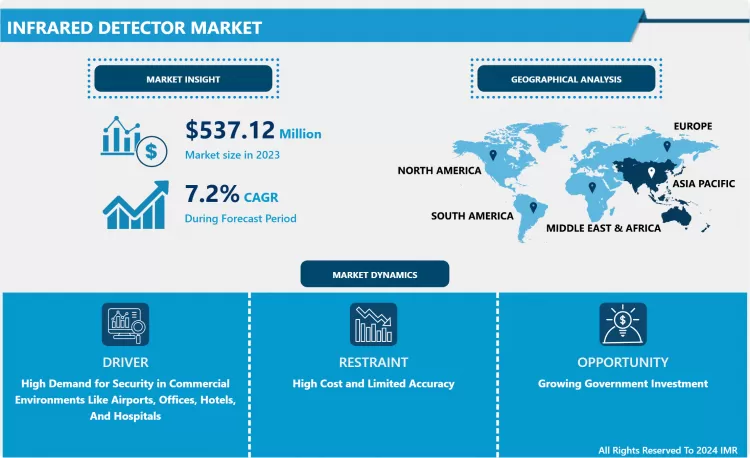

Infrared Detector Market Size Was Valued at USD 537.12 Million In 2023 And Is Projected to Reach USD 1004.21 Million By 2032, Growing at A CAGR of 7.2%% From 2024-2032.

Infrared detectors are optoelectronics components that are used to detect temperature detection, gas leak detection, flame sensors, and also non-contact temperature measurement. An infrared detector is based on infrared radiation which emits electromagnetic radiation. The temperature of an object can be determined in a contact way by analyzing radiation intensity. Infrared detectors provide high flexibility in measurement substances, management of familiar composition in overlying bands. It is also used in the identification of unknown substances which is a cost-effective, robust, and compact solution and application in numerous industries. The general and wide use of infrared detectors is in motion detection in various security and detection applications. Other industrial application of Infrared detectors includes non-dispersive infrared gas analysis (NDIR gas analysis) and infrared flame sensing and monitoring. Also, pyroelectric infrared detectors are used for spectroscopy or radiometry. Due to the low-cost solution and long life of the detection sensors, the infrared detector market has seen a tremendous boost from various verticals of the industry.

Market Dynamics and Factors For Infrared Detector:

Drivers

The demand for motion sensors and human scanning gear is increasing rapidly. In addition, infrared detectors are on the advance in the field of robotics, as they are used to detect the relative movement of bodies emitting infrared rays and to measure distances, which is done with both the proximity sensor and the passive infrared sensor (PIR) can be achieved. It can be used to detect a human body or a heated object, as well as fire (flame) detection. It detects within 4.5 m of the detection area, while an IR proximity sensor can be used to measure distances and is accurate for short distances of around 10 to 35 cm. However, it is not an ideal solution for detecting glass and mirror surfaces. These detectors are also used in people and motion sensing applications in the automotive industry, mainly to increase driver safety.

The high demand for security in commercial environments like airports, offices, hotels, and hospitals is expected to drive the growth of the infrared detector market. The increasing demand for consumer electronics applications such as smart televisions, tablets, and smartphones should also boost sales of infrared detectors. Factors such as the lower price of infrared detectors in the coming years and the use of night vision functions in military applications support the growth of the Infrared Detector market. In addition, the development of infrared detectors in terms of size, weight, and performance, as well as the emergence of large consumer electronics applications is having a positive impact on the growth of the infrared detector market. Infrared Detector Market the United States and Japan are the leading regions in the infrared detector market due to the presence of the largest infrared detector manufacturers in these regions.

Restraints

The International Traffic in Arms Regulations (ITAR) introduced by the U.S. Department of State require merchandise jurisdiction approval for the sale of restricted infrared cameras in the U.S. Infrared cannot trade its products with any natural or legal person in the United States or abroad. Without an export permit and are subject to penalties for non-compliance. Merchants also require approval from the product jurisdiction to sell these products. This increases the buying and selling of infrared cameras in the US. This adds complications and costs to buying and selling infrared cameras in the United States, preventing manufacturers from expanding their reach outside of the United States It also restricts infrared camera manufacturers based outside the United States from expanding their reach in that country. Some manufacturers such as Sensors Unlimited, FLIR Systems, and Xenics also offer infrared cameras that do not. require the consent of the merchandise management. However, due to the critical nature of infrared camera applications, many manufacturers and distributors must obtain approval more than once.

Opportunities

The demand for infrared detectors from emerging APAC countries, the Middle East, and South America is increasing. Increasing building automation is one of the key factors in accelerating the demand for infrared detectors in emerging countries. Property owners and managers are constantly working to make buildings more efficient, sustainable, and safer. Smart buildings use IoT connectivity, sensors, and the cloud to remotely monitor and control a wide variety of building systems such as heating and air conditioning, lighting and infrared sensors, and photon detection technologies offer a wide variety of functions to improve human-machine interaction. Used for motion detection, human presence monitoring and temperature measurement. These sensors enable intelligent buildings to regulate themselves by monitoring and adjusting temperature, controlling lighting, cameras, security and theft systems and the intelligence and autonomy of various intelligent ones Improve devices. Government investment and incentives to modernize the military and Defense sectors are also driving demand for infrared detectors in emerging economies.

Challenges

Infrared detectors have several applications in chemical and petrochemical plants which is gas leakage from the plant in or outer environment. But catalytic detector is an alternative for Infrared detectors in gas detection applications. The main advantage of catalytic detectors is that they can easily identify hydrogen gas, which infrared detectors have a late response time. In addition, these detectors are easy to use, easy to install, standardized, and have a long service life with lower replacement costs. Catalytic detectors can operate in humid, dusty, and high temperatures and detect flammable hydrocarbons and gases such as methane, ethane, propane, butane, hexane, butadiene, propylene, ethylene oxide, propylene oxide, isopropylamine, ethanol, and methanol. These factors lead to the proliferation of catalytic detectors in gas detection applications, which affects the sales of infrared detectors.

Market Segmentation For Infrared Detectors Market

By Type, Photonic is the dominating type segment of the Infrared Detector Market. The photonic detector is an infrared photodetector that uses electronic intersubband transition to absorb photons in quantum well. The photonic detector is widely used in the long wave infrared detectors which has a wide application in thermal detection in solar farms as well as home inspection devices. The infrared-sensitive photonic optoelectronic component is used specifically for the detection of electromagnetic radiation in the wavelength range from 2 to 14 µm. A receiver chip in a pyroelectric infrared detector consists of monocrystalline lithium tantalate. An extremely low-temperature coefficient with the excellent long-term stability of the signal voltage makes it a highly demanding type of Infrared detector in the segment supplementing the growth of the Infrared Detector Market.

By Range, Long Wave Detector is dominating the Infrared Detector Market. Long Wavelength Infrared is used as the primary device in temperature review practices. The long wave detector can sense different temperature differences which is important in the home inspection field for envisioning poor insulation, water damage, and damaged electronics goods. Long Wave infrared can be used in detection cameras which are stationery or drones to scan Solar fields, home inspections, or farms and produce analysis. Long Wave Detector is used extensively worldwide which certainly elevates the growth of the Infrared Detector Market

By Application, People and Motion Sensing is dominating in the application in Infrared Detector Market. People and motion-sensing have always been prominent application areas of infrared detectors. Infrared Detectors are used in numerous devices for human motion detection, which includes human counting sensors, security cameras, intruder alarms, safety lighting, motion-activated security systems, and garage doors. China has the largest public surveillance infrastructure in the world. China contributes largely to the adoption of infrared detection sensors in people motion sensing which has reflected on the growth of the Infrared Detector Market.

Players Covered in Infrared Detector market are :

• Texas Instruments Inc.

• Honeywell International Inc

• Omron Corporation

• Excelitas Technologies Corp

• Hamamatsu Photonics K.K.

• Murata Manufacturing Co. Ltd.

• Teledyne FLIR LLC

• Nippon Ceramic Co.

• InfraTec GmbH

• Lynred

• TE Connectivity

• Raytheon Technologies Corporation

• Honeywell International Inc.

• Sofradir

Regional Analysis of Infrared Detector Market

The Asia Pacific is expected to dominate the Infrared Detector Market during the forecasted period. The Asia Pacific has a strong market for electronic goods in residential, commercial as well as industrial applications. Also, Asia Pacific is the largest exporter of electronic goods with the highest contrition from China, India, South Korea, and Japan. There is a missive small and medium-sized industry that manufactures infrared-based devices which are exported to Europe and North America. Government support to the electronic manufacturing industry generates massive employment in the region.

North America is one of the fastest-growing regions in the Infrared Detector Market. Growing demand in the security and surveillance industry provides the higher sale of infrared motion detectors, Human scanning and detectors, Thermal scanners, and extensive use in military equipment which owes to the growth in the Infrared Detector Market. Major players like Raytheon, Texas Instruments Inc, and Honeywell International are based in the United States which dominated the region in terms of sales and distribution. Major government and military contracts are bagged by these companies which boosted the Infrared Detector Market in North America.

Key Developments of Infrared Detector Market

- September 2021, Excelitas Technologies launched a new online lens configurator for designers and engineers of machine vision systems. Documentation to optimize the integration planning process.

- August 2021, Hamamatsu Photonics presented a new profile sensor with an integrated calculation function. This sensor, named Model S15366256, is specifically designed to calculate incident light spot signals within its processing chip.

Covid19 Impact on Infrared Detector Market

The pandemic affected the entire global economy in early 2020, causing unprecedented confusion and change among individuals and organizations around the world. The infrared Detector Market experienced a slow demand from industrial and commercial application deployment. The majority of the industry has paused or postponed the installation and up-gradation of infrared-based sensors and units in new facilities as well as existing premises. Asia Pacific countries have seen slack in the production volume of Infrared Detector during the pandemic. Although Infrared Detector Market has taken a toll during this period, demand for Non-contact Temperature Assessment Devices has boosted exponentially. Infrared temperature detection devices are widely used during a pandemic to keep social distance and monitor the human temperature in public places, offices, and social gathering spots to curb the virus. High sales noted in residential application of infrared temperature monitoring devices. Several studies suggest that temperature measurements can detect more than half of infected people. Such insights helped to boost the demand in Infrared Detector Market.

|

Infrared Detector Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 537.12 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 1004.21 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Range |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Infrared Detector Market by Type (2018-2032)

4.1 Infrared Detector Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Thermal

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Photonic

Chapter 5: Infrared Detector Market by Range (2018-2032)

5.1 Infrared Detector Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Short Wave

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium Wave

5.5 Long Wave

Chapter 6: Infrared Detector Market by Application (2018-2032)

6.1 Infrared Detector Market Snapshot and Growth Engine

6.2 Market Overview

6.3 People and Motion Sensing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Temperature Measurement

6.5 Security and Surveillance

6.6 Gas & Fire Detection

6.7 Spectroscopy and Biomedical Imaging

6.8 Scientific Applications

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Infrared Detector Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GOODIX (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SHENZHEN GOODIX TECHNOLOGY CO. LTD (CHINA)

7.4 CRUCIALTEC (SOUTH KOREA)

7.5 APPLE INC. (US)

7.6 FINGERPRINT CARDS AB (SWEDEN)

7.7 EGIS TECHNOLOGIES INC. (TAIWAN)

7.8 QUALCOMM TECHNOLOGIES INC. (THE US)

7.9 ELAN MICROELECTRONICS CORP. (TAIWAN)

7.10 IDEX BIOMETRICS ASA (NORWAY)

7.11 SYNAPTICS INCORPORATED (US)

7.12 PRECISE BIOMETRICS (SWEDEN)

7.13 IDEMIA (FRANCE)

7.14 TOUCH BIOMETRIX (UK)

7.15 MANTRA SOFTECH (INDIA) PVT. LTD (INDIA)

Chapter 8: Global Infrared Detector Market By Region

8.1 Overview

8.2. North America Infrared Detector Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Thermal

8.2.4.2 Photonic

8.2.5 Historic and Forecasted Market Size by Range

8.2.5.1 Short Wave

8.2.5.2 Medium Wave

8.2.5.3 Long Wave

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 People and Motion Sensing

8.2.6.2 Temperature Measurement

8.2.6.3 Security and Surveillance

8.2.6.4 Gas & Fire Detection

8.2.6.5 Spectroscopy and Biomedical Imaging

8.2.6.6 Scientific Applications

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Infrared Detector Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Thermal

8.3.4.2 Photonic

8.3.5 Historic and Forecasted Market Size by Range

8.3.5.1 Short Wave

8.3.5.2 Medium Wave

8.3.5.3 Long Wave

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 People and Motion Sensing

8.3.6.2 Temperature Measurement

8.3.6.3 Security and Surveillance

8.3.6.4 Gas & Fire Detection

8.3.6.5 Spectroscopy and Biomedical Imaging

8.3.6.6 Scientific Applications

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Infrared Detector Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Thermal

8.4.4.2 Photonic

8.4.5 Historic and Forecasted Market Size by Range

8.4.5.1 Short Wave

8.4.5.2 Medium Wave

8.4.5.3 Long Wave

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 People and Motion Sensing

8.4.6.2 Temperature Measurement

8.4.6.3 Security and Surveillance

8.4.6.4 Gas & Fire Detection

8.4.6.5 Spectroscopy and Biomedical Imaging

8.4.6.6 Scientific Applications

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Infrared Detector Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Thermal

8.5.4.2 Photonic

8.5.5 Historic and Forecasted Market Size by Range

8.5.5.1 Short Wave

8.5.5.2 Medium Wave

8.5.5.3 Long Wave

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 People and Motion Sensing

8.5.6.2 Temperature Measurement

8.5.6.3 Security and Surveillance

8.5.6.4 Gas & Fire Detection

8.5.6.5 Spectroscopy and Biomedical Imaging

8.5.6.6 Scientific Applications

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Infrared Detector Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Thermal

8.6.4.2 Photonic

8.6.5 Historic and Forecasted Market Size by Range

8.6.5.1 Short Wave

8.6.5.2 Medium Wave

8.6.5.3 Long Wave

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 People and Motion Sensing

8.6.6.2 Temperature Measurement

8.6.6.3 Security and Surveillance

8.6.6.4 Gas & Fire Detection

8.6.6.5 Spectroscopy and Biomedical Imaging

8.6.6.6 Scientific Applications

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Infrared Detector Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Thermal

8.7.4.2 Photonic

8.7.5 Historic and Forecasted Market Size by Range

8.7.5.1 Short Wave

8.7.5.2 Medium Wave

8.7.5.3 Long Wave

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 People and Motion Sensing

8.7.6.2 Temperature Measurement

8.7.6.3 Security and Surveillance

8.7.6.4 Gas & Fire Detection

8.7.6.5 Spectroscopy and Biomedical Imaging

8.7.6.6 Scientific Applications

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Infrared Detector Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 537.12 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 1004.21 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Range |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Infrared Detector Market research report is 2024-2032.

Texas Instruments Inc., Honeywell International Inc, Omron Corporation, Excelitas Technologies Corp, Hamamatsu Photonics K.K., Flir Systems, Inc., Murata Manufacturing Co., Ltd., Raytheon Company, Sofradir, Nippon Avionics Co., Ltd. and other major players.

The Infrared Detector Market is segmented into Type, Range, Application, and region. By Type, the market is categorized into Thermal, Photonic. By Range, the market is categorized into Short Wave, Medium Wave, and Long Wave. By Application, the market is categorized into People & Motion Sensing, Temperature Measurement, Security & Surveillance, Gas & Fire Detection, Spectroscopy & Biomedical Imaging, and Scientific Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Infrared detector are optoelectronics components that are used to detect temperature detection, gas leak detection, flame sensors, and also non-contact temperature measurement. An infrared detector is based on infrared radiation which emits electromagnetic radiation.

Infrared Detector Market Size Was Valued at USD 537.12 Million In 2023 And Is Projected to Reach USD 1004.21 Million By 2032, Growing at A CAGR of 7.2%% From 2024-2032.