India Bio-Based Nutraceuticals Market Synopsis:

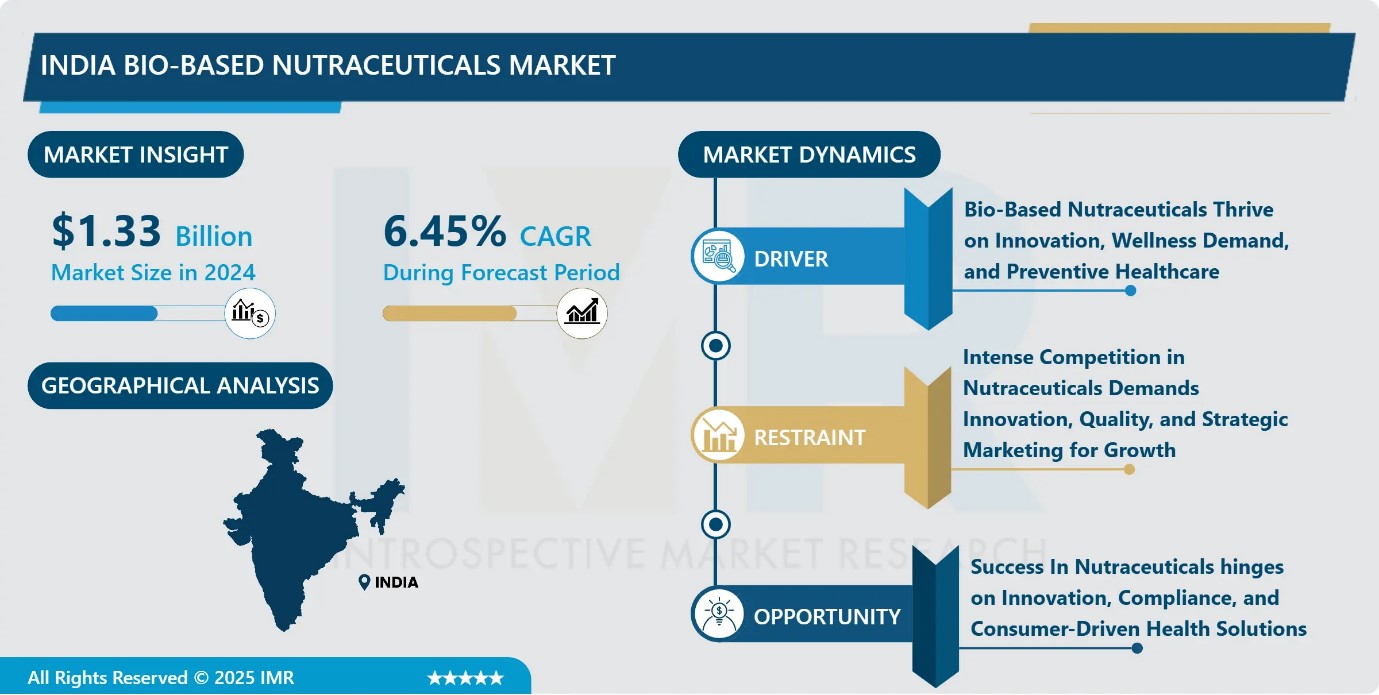

India Bio-Based Nutraceuticals Market Size Was Valued at USD 1.33 Billion in 2024 and is Projected to Reach USD 2.19 Billion by 2032, Growing at a CAGR of 6.45% From 2024-2032.

Naturally derived biologically active compounds that deliver health benefits superior to basic nutritional needs belong to the category of bio-based nutraceuticals. The functional benefits of these naturally derived products come from plant and microorganism and marine and bioresources sources which support disease prevention alongside immune health and well-being enhancements.

The focus on sustainable practices through natural ingredients remains the main difference between synthetic supplements and bio-based nutraceuticals besides clean label requirements and chemical-free manufacturing procedures. Functional food applications with dietary supplements alongside pharmaceutical use rely on five main bioactive categories consisting of plant-based antioxidants and probiotics omega-3 fatty acids and polyphenols and dietary fibers and bioactive peptides.

Modern consumers analyze all ingredients before purchasing while they prioritize eating food based on plants instead of artificial substances. The desire for both ingredient clarity and natural extracts in nutraceutical products drives customers to prefer compounds derived from botanical and plant-based substances like fruits and vegetables and herbs.

New extraction methods together with processing innovations help manufacturers generate advanced bioavailable natural ingredients in their formulations. The consumer interest in ethical and sustainable production methods extends its reach beyond the sourcing of ingredients by influencing consumer purchasing behavior.

India Bio-Based Nutraceuticals Market Growth and Trend Analysis:

Strategic Initiatives, Global Collaborations, and a Focus on Both Urban and Rural Market Expansion

- The growth patterns of bio-based nutraceuticals demand increased funding for research and development and manufacturing infrastructure and promotion methods to expand market penetration. The efficient acquisition of raw materials and the implementation of advanced process methods serve to minimize costs specifically within India since its ingredient access depends heavily on regional differences. The development of bio-based nutraceuticals now focuses on addressing health problems of specific demographic groups. On July 2024 the Kerala Cabinet gave its approval for establishing the Centre of Excellence in Nutraceuticals in Thiruvananthapuram as a partnership among the Kerala Development and Innovation Strategic Council (K-DISC) and Kerala State Council for Science Technology and Environment and Kerala State Industrial Development Corporation.

- Additionally, expanding into rural markets presents immense potential for future growth. Many rural consumers are becoming more aware of the benefits of natural health products, yet accessibility remains a challenge. Companies that focus on improving distribution networks, conducting awareness campaigns, and offering affordable bio-based nutraceutical options tailored to rural populations can tap into this largely untapped segment. By addressing both urban and rural demand, the bio-based nutraceutical industry can establish a strong foothold in India's growing health and wellness sector.

- Through the Department of Commerce, India has showcased its nutraceutical strengths at global trade fairs, enhancing visibility and forging connections with international stakeholders. The collaboration between the Task Force and the Central Board of Indirect Taxes and Customs (CBIC) is working toward a unique HSN code to streamline exports and simplify customs procedures.

- With these strategic initiatives, India’s nutraceutical sector is set for unprecedented growth. India aims to position itself as a global leader in nutraceuticals, combining traditional knowledge with modern science to attract global partnerships and investments.

Regulatory Uncertainty and Inconsistent Standards

- Currently, the regulatory scenario for bio-based nutraceuticals is far from being as clear-cut with specific regulations because of their nomenclature-related classification and further approval. Its regulations vary along regional lines along with the varying product categories, due to which regulatory compliance is multi-faceted for the industry. Furthermore, a lack of quality control and safety testing standards would make it impossible to have similar products that meet the same criteria. Regulatory uncertainty can slow innovation and entry into the market and create challenges for companies seeking to expand their reach globally.

Growth of E-Commerce

- Bio-based nutraceuticals have the potential for significant marketplace success through the fast-expanding e-commerce market in India. Digital platforms continue to penetrate the market alongside consumer choices for doorstep delivery so online retail channels allow brands to easily connect with more customers. The shift benefits small and new brands due to their lack of visibility in traditional physical retail outlets. Online export figures from Indian sellers through Amazon's platform are expected to exceed USD 5 billion by 2024, according to the company's projections, which emphasize the positive potential of this market.

Regulatory Ambiguity is a Significant Barrier

- The Indian bio-based nutraceuticals market faces several key challenges that hinder its growth and mainstream adoption. Regulatory ambiguity is a significant barrier, with unclear or evolving guidelines around classification, quality standards, and approvals for bio-based products, leading to delays and compliance complexities. Consumer awareness and trust remain limited, as many Indian consumers are unfamiliar with the benefits of bio-based nutraceuticals compared to conventional supplements.

India Bio-Based Nutraceuticals Market Segment Analysis:

India Bio-Based Nutraceuticals Market is segmented based on application, ingredients, and distribution channel.

By Ingredients, the Probiotics segment is expected to dominate the market during the forecast period

- Starter cultures produced by lactic acid bacteria (LAB) function as fundamental elements in multiple fermentation processes of various food products. LAB-derived bioactive substances receive heightened interest from the nutraceutical sector due to consumers actively seeking functional foods that support health promotion along with disease risk reduction

- During the forecast period the India bio-based nutraceuticals market will feature probiotics as its leading segment because LAB-derived probiotics are gaining popularity coupled with their established health benefits. A wide range of functional foods alongside supplements and fermented dairy products make use of LAB probiotic strains as their basis for production.

- LAB produces indispensable pharmaceutical compounds and dietary antioxidants together with bio-preservatives and exopolysaccharide and folate substances which hold relevance in pharmaceutical and nutraceutical applications. The dominance of the Indian bio-based nutraceuticals market's probiotic segment will continue to rise due to increasing consumer interest in gut health and immunity along with multiple production benefits derived from LAB.

By Applications, the Functional Food segment held the largest share during the forecast period

- The market for nutraceuticals has rapidly grown due to their medical advantages alongside their role as substitute treatments for modern pharmaceutical products. A wide range of nutrients along with herbal products and dietary supplements comprise nutraceuticals that help preserve health status and fight diseases to deliver better life quality. The future success of India's nutraceutical industry depends on the rate of sector growth and research development as well as the resolution of regulatory issues standardization advances and strategic marketing and quality assurance measures.

- One of the driving factors behind the dominance of functional foods in India’s nutraceutical industry is their deep-rooted cultural acceptance and historical use in daily diets. The traditional diets of India naturally incorporate functional food components such as turmeric ashwagandha and amla that offer well-known health advantages. Consumer demand for these products keeps rising because of the growing health mindset and increasing urban populations and greater buying power.

India Bio-Based Nutraceuticals Market Active Players:

- Abbott India

- Alkem Laboratories

- Amway India

- Apex Laboratories

- Baidyanath

- Charak Pharma

- Cipla Health

- Dabur India

- Emami

- GSK Consumer Healthcare

- Herbalife Nutrition

- Himalaya Wellness

- Intas Pharmaceuticals

- Mankind Pharma

- Neptune Lifesciences

- Nestlé India

- Patanjali Ayurved

- Sun Pharma

- Torrent Pharmaceuticals

- Zandu Realty

- Other Active Players

Key Industry Developments in the India Bio-Based Nutraceuticals Market:

- In September 2024, Aayush Wellness witnessed rapid expansion in the Herbal & Nutraceuticals market, reporting 6300% revenue growth and strong stock returns.

- In July 2024, Ingredient supplier NutriOriginal launched TurmiMax Bio, a turmeric extract standardized to 95% curcuminoids, which is formulated for enhanced bioavailability and absorption, as well as full dispersion and solubility in water. The ingredient, which was developed in collaboration with Star-Hi Herbs in India, contains a patented blend of curcuminoids standardized through the company’s OptiBio Assurance process. These technologies enable the curcuminoids in the ingredient to be optimally assimilated and utilized by the body.

|

India Bio-Based Nutraceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.33 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 2.19 bn. |

|

Segments Covered: |

By Applications |

|

|

|

By Ingredients |

|

||

|

Distribution Channel |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: India Bio-based Nutraceuticals Market by Applications

4.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

4.2 India Bio-based Nutraceuticals Market Overview

4.3 Dietary Supplements

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Dietary Supplements: Geographic Segmentation Analysis

4.4 Functional Foods and Beverages

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Functional Foods and Beverages: Geographic Segmentation Analysis

4.5 Personalized Nutrition

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Personalized Nutrition: Geographic Segmentation Analysis

4.6 Traditional Medicine Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Traditional Medicine Systems: Geographic Segmentation Analysis

4.7 Sports Nutrition

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Sports Nutrition: Geographic Segmentation Analysis

4.8 Cosmetics and Personal Care

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Cosmetics and Personal Care: Geographic Segmentation Analysis

4.9 Animal Nutrition

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Animal Nutrition: Geographic Segmentation Analysis

4.10 and Pharmaceutical Applications

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 and Pharmaceutical Applications: Geographic Segmentation Analysis

Chapter 5: India Bio-based Nutraceuticals Market by Ingredients

5.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

5.2 India Bio-based Nutraceuticals Market Overview

5.3 Probiotics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Probiotics: Geographic Segmentation Analysis

5.4 Prebiotics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Prebiotics: Geographic Segmentation Analysis

5.5 Aloe vera

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aloe vera: Geographic Segmentation Analysis

5.6 Amino acids

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Amino acids: Geographic Segmentation Analysis

5.7 Botanical Ingredients

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Botanical Ingredients: Geographic Segmentation Analysis

5.8 and Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 and Others: Geographic Segmentation Analysis

Chapter 6: India Bio-based Nutraceuticals Market by Distribution Channel

6.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

6.2 India Bio-based Nutraceuticals Market Overview

6.3 Hypermarkets/Supermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hypermarkets/Supermarkets: Geographic Segmentation Analysis

6.4 Convenience Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Convenience Stores: Geographic Segmentation Analysis

6.5 Online Retail

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Retail: Geographic Segmentation Analysis

6.6 and Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 India Bio-based Nutraceuticals Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DABUR INDIA

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HIMALAYA WELLNESS

7.4 PATANJALI AYURVED

7.5 AMWAY INDIA

7.6 BAIDYANATH

7.7 ZANDU REALTY

7.8 CHARAK PHARMA

7.9 HERBALIFE NUTRITION

7.10 SUN PHARMA

7.11 CIPLA HEALTH

7.12 ABBOTT INDIA

7.13 GSK CONSUMER HEALTHCARE

7.14 NESTLÉ INDIA

7.15 EMAMI

7.16 APEX LABORATORIES

7.17 ALKEM LABORATORIES

7.18 MANKIND PHARMA

7.19 TORRENT PHARMACEUTICALS

7.20 INTAS PHARMACEUTICALS

7.21 AND NEPTUNE LIFESCIENCES

7.22 OTHER ACTIVE PLAYERS.

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

India Bio-Based Nutraceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.33 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 2.19 bn. |

|

Segments Covered: |

By Applications |

|

|

|

By Ingredients |

|

||

|

Distribution Channel |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||