Bio-Based Nutraceuticals Market Synopsis:

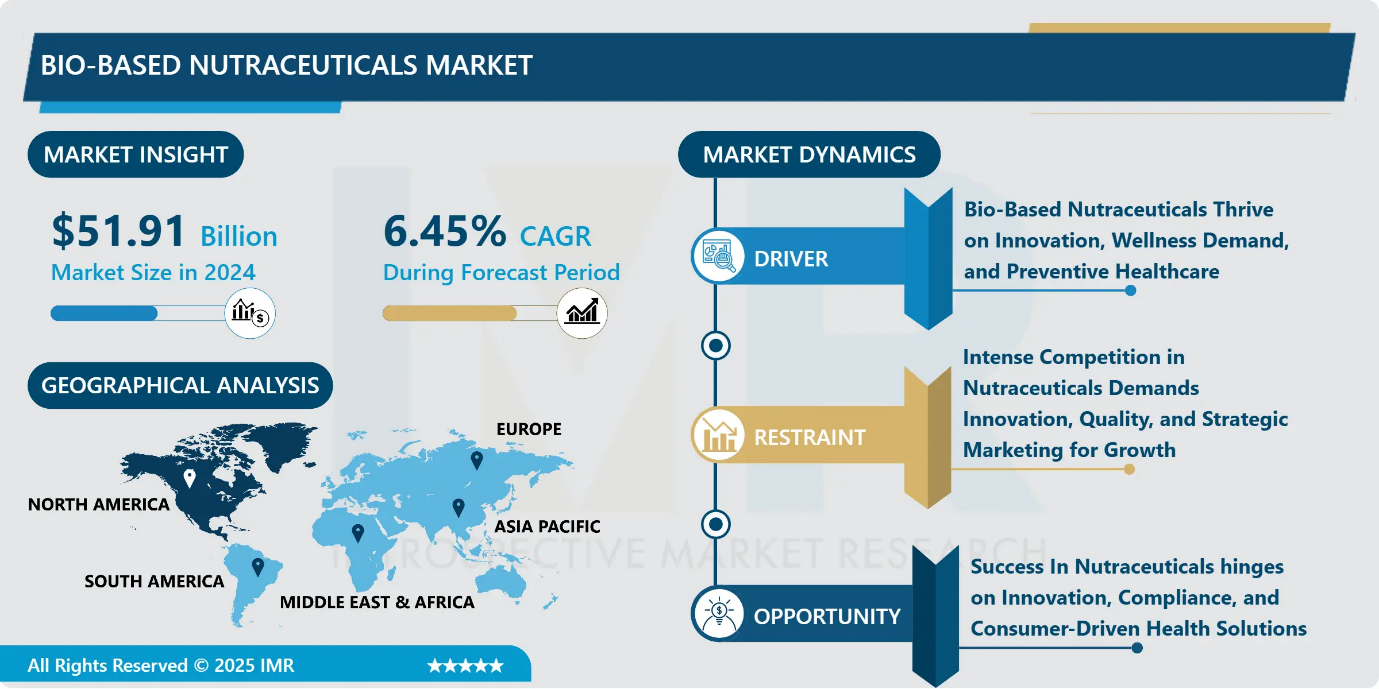

Bio-Based Nutraceuticals Market Size Was Valued at USD 51.91 Billion in 2024 and is Projected to Reach USD 85.59 Billion by 2032, Growing at a CAGR of 6.45% From 2024-2032.

Nutraceuticals as health-promoting agents have received great attention from both the scientific community and the general public in the past decades. They have been found from diversified resources, possessing a wide range of beneficial effects in biological systems. Bio-based nutraceuticals are derived from natural renewable resources, Researchers have identified nutraceuticals across multiple types of resources which demonstrate multiple health-producing actions throughout biological systems. Bio-based nutraceuticals derive from natural renewable resources through two extraction methods: first as biomaterial fractions and second through bioprocessing.

Nutraceuticals comprise a wide range of bioactive derivatives accumulated in edible sources including antioxidants, phytochemicals, fatty acids, amino acids, and probiotics. With either established previously or potential effects, nutraceuticals are well-known for their role of being involved in disease treatment and prevention, anti-aging properties, and malignancy prevention.

Customers' increasing demand for nutraceutical products has resulted in global nutraceutical exploitation. This is a result of the escalating healthcare costs linked to conventional medicines, the frequent side effects of pharmaceutical products, and the widespread belief that compounds that resemble food are safe in comparison to conventional medications.

Bio-Based Nutraceuticals Market Growth and Trend Analysis:

Bio-Based Nutraceuticals Thrive on Innovation, Wellness Demand, and Preventive Healthcare.

- The global Bio-Based nutraceuticals market demonstrates quick development through higher customer interest in wellness-related products. The market expansion for nutraceuticals primarily results from consumer desire for different products along with newness. Consumer demand for novel formulations an assortment of tastes and convenient delivery methods makes brands expand their product ranges. Illuminating innovation in product lines increases market share and brings about better brand recognition alongside increased customer connection that leads to sustained health-conscious consumer relationships.

- Several essential factors drive the expansion of the bio-based nutraceuticals market. The rising awareness about the healthcare benefits of nutraceuticals drives the increasing consumer demand. Rising health-related education brings more people to recognize the vital role of nutrition both for disease prevention and maintaining general wellness. The healthcare industry expansion together with a rising number of chronic diseases has pushed the healthcare system toward preventive care which nutraceuticals now play an essential role. Bio-based nutraceuticals continue to be a promising field in both medical treatment and nutrition, with emerging technologies like nutrigenomics and nanotechnology expected to drive future advancements?

Intense Competition in Nutraceuticals Demands Innovation, Quality, and Strategic Marketing for Growth.

- The growing number of nutraceutical products intensified competition across the entire industry sector. Competition has become more challenging due to the market contains numerous similar products. The reduction of production costs has eliminated barriers for consumers to change products since they can simply switch brands that feature equivalent advantages. A company's essential growth through diversification needs scientific groundwork and quality checks combined with market-focused promotion techniques to succeed in this fast-changing industry.

Success In Nutraceuticals Hinges on Innovation, Compliance, and Consumer-Driven Health Solutions

- The nutraceutical industry stands at the intersection of consumer health trends, scientific innovation, and regulatory complexity. For companies in the pharmaceutical, nutritional, and animal health sectors, this market offers significant growth potential. Success in this space requires a multifaceted approach, staying attuned to consumer preferences, investing in product innovation, ensuring regulatory compliance, and developing packaging solutions that enhance product efficacy and appeal.

- As the line between food and medicine continues to blur, companies that can deliver safe, effective, and appealing nutraceutical products will be well-positioned to capture market share and contribute to global health and wellness. The future of nutraceuticals is bright, driven by consumer demand for proactive health solutions, and supported by advancing scientific understanding of the role of nutrition in overall health.

Regulatory and Standardization Issues

- The bio-based nutraceuticals market is growing globally, but it faces several critical challenges that limit its full-scale development and consumer penetration. Regulatory and Standardization Issues remain at the forefront, as varying international and regional standards create confusion around product approvals, labeling, and claims, often delaying time-to-market. High Production Costs and Pricing Pressures also act as major barriers, as sourcing bio-based ingredients and maintaining sustainable practices significantly increase manufacturing expenses, resulting in higher prices that may not appeal to cost-conscious consumers.

Bio-Based Nutraceuticals Market Segment Analysis:

Bio-Based Nutraceuticals Market is segmented based on application, ingredients, distribution channel, and region.

By Application, the Dietary Supplements segment is expected to dominate the market during the forecast period

- Dietary supplements play a crucial role in promoting health by providing essential nutrients that might be lacking in a person's diet. dietary supplements include vitamins, minerals, herbs, amino acids, and other substances intended to supplement the diet. Unlike conventional foods or pharmaceuticals, dietary supplements are classified under the broader category of "foods" and are available in various forms such as tablets, capsules, liquids, and powders. Their primary function is to address nutritional deficiencies, enhance overall health, and support physiological functions.

- Improve health and wellness, dietary supplements primarily address nutrient deficiencies through singular components e.g., vitamins and minerals. Through continuous research dietary supplements continue to gain scientific backing as essential tools for maintaining long-term health and preventing chronic illnesses.

- For Instance, in December 2024, nutraceutical leader SUANNUTRA, S.L. has developed a digital platform, SuanBlend, to support its customers in creating novel products. The new interactive platform allows dietary supplement companies to dive into the world of science-based ingredients and botanical extracts, combined with SUANNUTRA ’s vast capabilities. Where clients can create customized blend formulations targeting various health categories and beauty-from-within. The platform will offer a hands-on approach, giving clients greater flexibility and control over the formulation process and allowing them to experiment with various ingredient combinations. This will streamline the optimization of their products according to market needs. As consumer preferences shift toward personalized nutrition and functional supplements, platforms will enhance product innovation and differentiation, these advancements support the expansion of the dietary supplements segment, reinforcing its dominance in the global nutraceuticals market.

By Distribution Channel, the Online Retail segment held the largest share in 2023

- In addition, the accessibility and convenience of bio-based nutraceuticals are significantly contributing to market growth. E-commerce platforms have made it easier for consumers to research and purchase a wide range of products, while the increased availability of convenient formats, such as gummies, powders, and drinks, has broadened the market appeal.

- Furthermore, the ongoing endorsement of bio-based nutraceuticals by healthcare professionals and fitness influencers is strengthening consumer trust and driving adoption. This combination of factors, from increased accessibility to trusted endorsements, is expected to continue driving the rapid expansion of the global nutraceuticals industry.

Bio-Based Nutraceuticals Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Consumers increasingly prioritize organic products due to concerns about synthetic chemicals, pesticides, and their potential health impacts. Organic plant-based supplements, derived from organically grown plants and produced without synthetic additives, appeal to health-conscious individuals seeking cleaner, more sustainable options. This demand surge aligns with broader lifestyle shifts emphasizing environmental sustainability and personal well-being.

- For instance, Group Berkem Expands into North America with Strategic Acquisition of i.Bioceuticals In a significant move to strengthen its presence in the North American nutraceuticals market, Groupe Berkem has announced the acquisition of i.Bioceuticals, is the exclusive distributor of nutritional supplements from the Dutch company INC (International Nutrition Company). This acquisition, finalized in February 2023, marks an important milestone for Groupe Berkem, enabling the company to expand its bio-based product offerings in a high-growth sector.

- Moreover, this acquisition is immediately accretive, meaning it is expected to generate positive financial returns and contribute to the company’s revenue and profitability from the outset. The move aligns with Groupe Berkem’s broader vision of expanding its bio-based portfolio, reinforcing its commitment to sustainability and innovation within the nutraceutical industry. With this expansion, Groupe Berkem is well-positioned to capitalize on the growing market demand for bio-based nutritional supplements, leveraging i.Bioceuticals' expertise and established market presence to accelerate its growth in North America.

Bio-Based Nutraceuticals Market Active Players:

- Aker BioMarine (Norway)

- Archer Daniels Midland Company (USA)

- BASF (Germany)

- Bellring Brands (USA)

- Danone (France)

- Glanbia (Ireland)

- Herbalife (USA)

- Ingredion (USA)

- International Flavors & Fragrances (USA)

- Jamieson Wellness (Canada)

- Medifast (USA)

- Meiji Holdings (Japan)

- Nature's Sunshine (USA)

- Nestlé (Switzerland)

- Otsuka (Japan)

- Perrigo Company (Ireland)

- Royal DSM (Netherlands)

- Tate & Lyle (UK)

- USANA Health Sciences (USA)

- Yakult Honsha (Japan)

- Other Active Players

Key Industry Developments in the Bio-Based Nutraceuticals Market:

- In November 2024, Danone strategically capitalized on the escalating functional beverage market by introducing ST?K Cold Brew Energy. This product line extension leverages the popularity of their existing ST?K Cold Brew brand, positioning it to capture consumers seeking both caffeine and enhanced performance. By blending coffee with energy drink attributes, including 195mg of caffeine, B vitamins, ginseng, and guarana, Danone targets a clear consumer need with a differentiated "energy coffee" offering.

- In December 2024, Akums Drugs & Pharmaceuticals Ltd., India’s largest contract development and manufacturing organization (CDMO), entered into an in-licensing agreement with Caregen Co., Ltd., a global biotechnology leader based in South Korea. This strategic alliance marks a significant step in introducing specialty nutraceuticals, Pharmaceuticals, differentiated topical and injectable cosmeceuticals including advanced Skinceuticals and Hairceuticals tailored to meet the unique needs of Indian consumers.

|

Bio-Based Nutraceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 51.91 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 85.59 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By Ingredients |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: India Bio-based Nutraceuticals Market by Applications

4.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

4.2 India Bio-based Nutraceuticals Market Overview

4.3 Dietary Supplements

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Dietary Supplements: Geographic Segmentation Analysis

4.4 Functional Foods and Beverages

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Functional Foods and Beverages: Geographic Segmentation Analysis

4.5 Personalized Nutrition

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Personalized Nutrition: Geographic Segmentation Analysis

4.6 Traditional Medicine Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Traditional Medicine Systems: Geographic Segmentation Analysis

4.7 Sports Nutrition

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Sports Nutrition: Geographic Segmentation Analysis

4.8 Cosmetics and Personal Care

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Cosmetics and Personal Care: Geographic Segmentation Analysis

4.9 Animal Nutrition

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Animal Nutrition: Geographic Segmentation Analysis

4.10 and Pharmaceutical Applications

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 and Pharmaceutical Applications: Geographic Segmentation Analysis

Chapter 5: India Bio-based Nutraceuticals Market by Ingredients

5.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

5.2 India Bio-based Nutraceuticals Market Overview

5.3 Probiotics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Probiotics: Geographic Segmentation Analysis

5.4 Prebiotics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Prebiotics: Geographic Segmentation Analysis

5.5 Aloe vera

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aloe vera: Geographic Segmentation Analysis

5.6 Amino acids

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Amino acids: Geographic Segmentation Analysis

5.7 Botanical Ingredients

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Botanical Ingredients: Geographic Segmentation Analysis

5.8 and Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 and Others: Geographic Segmentation Analysis

Chapter 6: India Bio-based Nutraceuticals Market by Distribution Channel

6.1 India Bio-based Nutraceuticals Market Snapshot and Growth Engine

6.2 India Bio-based Nutraceuticals Market Overview

6.3 Hypermarkets/Supermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hypermarkets/Supermarkets: Geographic Segmentation Analysis

6.4 Convenience Stores

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Convenience Stores: Geographic Segmentation Analysis

6.5 Online Retail

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Retail: Geographic Segmentation Analysis

6.6 and Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 India Bio-based Nutraceuticals Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DABUR INDIA

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HIMALAYA WELLNESS

7.4 PATANJALI AYURVED

7.5 AMWAY INDIA

7.6 BAIDYANATH

7.7 ZANDU REALTY

7.8 CHARAK PHARMA

7.9 HERBALIFE NUTRITION

7.10 SUN PHARMA

7.11 CIPLA HEALTH

7.12 ABBOTT INDIA

7.13 GSK CONSUMER HEALTHCARE

7.14 NESTLÉ INDIA

7.15 EMAMI

7.16 APEX LABORATORIES

7.17 ALKEM LABORATORIES

7.18 MANKIND PHARMA

7.19 TORRENT PHARMACEUTICALS

7.20 INTAS PHARMACEUTICALS

7.21 AND NEPTUNE LIFESCIENCES

7.22 OTHER ACTIVE PLAYERS.

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Bio-Based Nutraceuticals Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 51.91 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 85.59 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By Ingredients |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||