Key Market Highlights

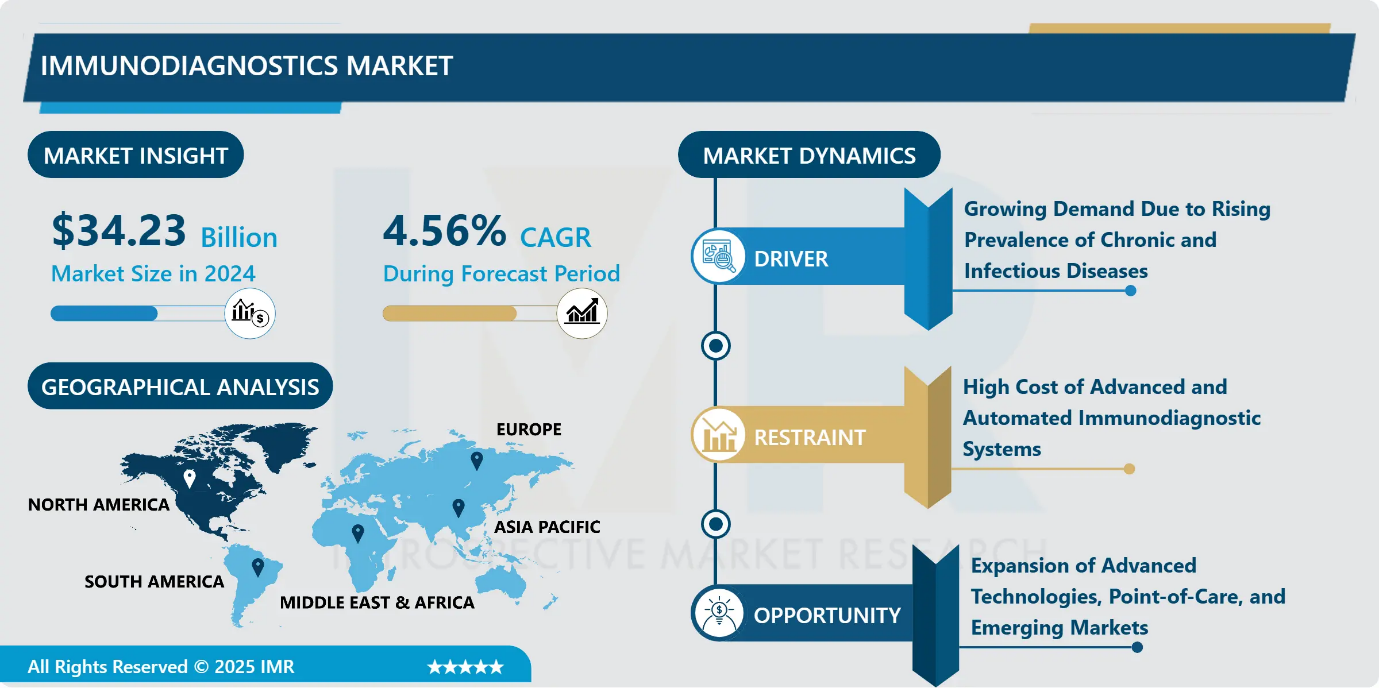

Immunodiagnostics Market Size Was Valued at USD 34.23 Billion in 2024, and is Projected to Reach USD 55.90 Billion by 2035, Growing at a CAGR of 4.56% from 2025-2035.

- Market Size in 2024: USD 34.23 Billion

- Projected Market Size by 2035: USD 55.90 Billion

- CAGR (2025–2035): 4.56%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Product: The Reagents & Kits, segment is anticipated to lead the market by accounting for 38.23% of the market share throughout the forecast period.

- By Technology: The Enzyme-Linked Immunosorbent Assay (ELISA) segment is expected to capture 26.64% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.45% of the market share during the forecast period.

- Active Players: Abbott Laboratories (United States), Agilent Technologies, Inc. (United States), Becton, Dickinson and Company (United States), bioMérieux SA (France), Danaher Corporation (United States), and Other Active Players.

Immunodiagnostics Market Synopsis:

Immunodiagnostics refers to in-vitro diagnostic techniques that detect diseases by identifying antigen–antibody interactions within the immune system. It plays a critical role in early diagnosis, disease monitoring, and personalized medicine. The immunodiagnostics market is witnessing strong growth due to the rising prevalence of infectious and chronic diseases, increasing geriatric population, and growing demand for rapid and accurate diagnostic solutions. Technological advancements in immunoassays such as ELISA, CLIA, and fluorescent immunoassays, along with expanding point-of-care testing, are improving diagnostic efficiency. Favorable regulatory support, increasing healthcare investments, and expanding applications across hospitals, laboratories, and research institutes continue to strengthen overall market conditions.

Immunodiagnostics Market Dynamics and Trend Analysis:

Immunodiagnostics Market Growth Driver - Growing Demand Due to Rising Prevalence of Chronic and Infectious Diseases

-

The increasing global incidence of chronic diseases such as cancer, cardiovascular disorders, diabetes, and autoimmune conditions, along with the continued spread of infectious diseases, is a major driver of the immunodiagnostics market. Healthcare systems are increasingly adopting immunodiagnostic solutions due to their high sensitivity, specificity, and ability to support early disease detection and treatment monitoring. Advancements in multi-parameter biomarker panels, automated high-throughput platforms, and rapid immunoassay tests are improving diagnostic accuracy and efficiency. Additionally, the shift toward preventive healthcare and personalized medicine, coupled with growing demand for cost-effective and timely diagnostics, is significantly accelerating market adoption worldwide. ?

Immunodiagnostics Market Limiting Factor - High Cost of Advanced and Automated Immunodiagnostic Systems

-

The immunodiagnostics market is constrained by the high capital and operational costs associated with advanced automated and multiplex diagnostic systems. Sophisticated platforms such as chemiluminescence and multiplex immunoassay analyzers require substantial upfront investment, along with ongoing expenses for reagents, maintenance, facility upgrades, and skilled personnel. These costs limit adoption, particularly among small laboratories and healthcare facilities in low- and middle-income regions. Additionally, expensive raw materials and stringent quality control increase production costs, raising end-user prices. Regulatory compliance and reimbursement challenges further restrict accessibility, thereby slowing the widespread adoption of next-generation immunodiagnostic technologies.

Immunodiagnostics Market Expansion Opportunity - Expansion of Advanced Technologies, Point-of-Care, and Emerging Markets

-

The immunodiagnostics market presents strong growth opportunities driven by technological advancements and expanding access to decentralized testing. Innovations such as microfluidic platforms, bead-based immunoassays, nanomaterials, and highly sensitive detection reagents are enhancing assay speed, accuracy, and automation. The rising adoption of point-of-care and home-based rapid tests is reshaping diagnostic delivery by enabling faster, cost-effective, and remote disease screening. Additionally, increasing healthcare investments, government screening initiatives, and improved insurance coverage in emerging economies are expanding market reach. Growing R&D activities and the shift toward self-testing and preventive healthcare are expected to create substantial opportunities for market expansion.

Immunodiagnostics Market Challenge and Risk - Standardization Complexity and Stringent Regulatory Requirements

-

The immunodiagnostics market faces notable restraints due to challenges in standardization, quality assessment, and complex regulatory landscapes. Variability in pre-analytical handling of labile biomarkers such as cytokines and complement proteins can impact test accuracy, leading to inconsistent results. Ensuring proper sample integrity throughout collection and processing remains critical yet difficult. Additionally, the lack of global harmonization in regulatory frameworks across regions increases development costs and approval timelines. Divergent requirements from regulatory authorities, particularly for multiplex, genetic, and AI-enabled diagnostics, necessitate multiple validation studies, slowing product launches and limiting innovation scalability across international markets.

Immunodiagnostics Market Trend - Rapid Technological Advancements in Automated and High-Throughput Immunodiagnostics

-

A key trend shaping the immunodiagnostics market is the rapid advancement of automated, high-throughput, and digitally integrated diagnostic platforms. Innovations in microfluidics, lab-on-a-chip technologies, multiplex immunoassays, and digital immunoassays are improving testing speed, sensitivity, and accuracy while reducing manual intervention. The integration of artificial intelligence and machine learning is optimizing laboratory workflows, minimizing errors, and accelerating result interpretation. Fully automated analyzers now support large test volumes with faster turnaround times, enhancing clinical decision-making. Additionally, seamless integration with digital health systems enables efficient data sharing and remote monitoring, reinforcing the shift toward intelligent, connected, and convenience-driven diagnostic solutions.

Immunodiagnostics Market Segment Analysis:

Immunodiagnostics Market is segmented based on Product, Technology, Sample Type, Application, End-User and Region.

By Product, Reagents segment is expected to dominate the market with around 38.23% share during the forecast period.

-

The reagents segment dominated the immunodiagnostics market in 2024, capturing the largest revenue share of 38.23%. This dominance is attributed to the indispensable role of reagents such as antibodies, antigens, substrates, and buffers in every immunoassay procedure, resulting in continuous and recurring demand. Unlike instruments, reagents are consumed with each test, ensuring consistent revenue generation across hospitals, clinical laboratories, and research institutions. The rising adoption of automated and high-throughput immunoassay systems, increasing infectious and chronic disease testing, and growing demand for high-sensitivity and point-of-care diagnostics further strengthen the leadership of the reagents segment.

By Technology, Enzyme-Linked Immunosorbent Assay (ELISA) is expected to dominate with close to 26.64% market share during the forecast period.

-

The Enzyme-Linked Immunosorbent Assay (ELISA) segment dominated the immunodiagnostics market in 2024, accounting for the largest revenue share. ELISA remains the gold standard technology due to its high sensitivity, specificity, and proven reliability across a wide range of applications, including infectious diseases, autoimmune disorders, allergies, and endocrinology. Its cost-effectiveness, standardized protocols, and ability to process high sample volumes make it widely adopted in hospitals, clinical laboratories, and research institutions. Additionally, the extensive availability of validated ELISA kits and compatibility with routine laboratory workflows support its continued dominance, particularly in emerging economies where affordability and diagnostic accuracy are critical factors.

Immunodiagnostics Market Regional Insights:

North America region is estimated to lead the market with around 31.45% share during the forecast period.

-

North America dominated the immunodiagnostics market in 2024, accounting for over 45% of global revenue, driven by advanced healthcare infrastructure, high diagnostic testing rates, and strong adoption of automated immunoassay platforms. The region benefits from a large elderly population and a high prevalence of chronic and infectious diseases, increasing demand for early and accurate diagnosis. Supportive reimbursement policies, substantial NIH funding, and accelerated FDA approval pathways enable rapid commercialization of innovative immunodiagnostic solutions.

- The presence of leading industry players and active collaborations in companion diagnostics further strengthens market leadership. Continuous replacement of legacy analyzers with fully automated systems, coupled with high healthcare expenditure per capita, positions North America as the dominant market for immunodiagnostics globally.

Immunodiagnostics Market Active Players:

- Abbott Laboratories (United States)

- Agilent Technologies, Inc. (United States)

- Becton, Dickinson and Company (United States

- bioMérieux SA (France)

- Danaher Corporation (United States)

- DiaSorin SpA (Italy)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Illumina, Inc. (United States)

- NeoGenomics Laboratories (United States)

- PerkinElmer, Inc. (United States)

- QIAGEN N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

- Thermo Fisher Scientific Inc. (United States)

- Werfen S.A. (Spain)

- Other Active Players

Key Industry Developments in the Immunodiagnostics Market:

-

In April 2025, Abbott Laboratories completed the acquisition of Celera Diagnostics, a molecular diagnostics firm focused on infectious disease testing. This strategic move enhanced Abbott’s immunodiagnostics and molecular diagnostics capabilities, enabling broader test offerings and improved disease detection accuracy. The acquisition supports Abbott’s long-term strategy of integrating advanced molecular technologies into its diagnostic portfolio.

- In September 2024, QIAGEN introduced the QIAcuityDx digital PCR system designed for clinical oncology applications. The launch marked a significant expansion of QIAGEN’s diagnostic solutions across North America and the European Union. This platform offers high sensitivity and precision for cancer testing, supporting personalized medicine initiatives. The rollout reinforces QIAGEN’s leadership in advanced molecular and immunodiagnostic technologies.

Advanced Immunoassay Technologies, Automation, and Digital Integration Driving Technical Evolution in the Global Immunodiagnostics Market

-

The immunodiagnostics market is driven by advanced technologies that detect and quantify antigen–antibody interactions to diagnose and monitor a wide range of diseases. Core platforms include enzyme-linked immunosorbent assays (ELISA), chemiluminescence immunoassays (CLIA), fluorescent immunoassays, radioimmunoassays, and rapid lateral flow tests. These technologies employ highly specific antibodies, enzymes, fluorescent labels, or luminescent substrates to generate measurable signals proportional to analyte concentration.

- Recent technical advancements focus on automation, multiplexing, and miniaturization, enabling simultaneous detection of multiple biomarkers from small sample volumes. Integration of microfluidics, lab-on-a-chip systems, and digital immunoassays enhances sensitivity, reduces turnaround time, and minimizes manual errors. Artificial intelligence and data analytics are increasingly embedded in immunoassay analyzers to optimize workflow, quality control, and result interpretation. Collectively, these innovations improve diagnostic accuracy, scalability, and efficiency across clinical laboratories, point-of-care settings, and research applications.

|

Immunodiagnostics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 34.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.56% |

Market Size in 2035: |

USD 55.90 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Sample Type |

|

||

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Immunodiagnostics Market by Product (2018-2035)

4.1 Immunodiagnostics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reagents & Kits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Instruments

4.5 Software & Services

Chapter 5: Immunodiagnostics Market by Technology (2018-2035)

5.1 Immunodiagnostics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Enzyme-Linked Immunosorbent Assay (ELISA)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Chemiluminescence Immunoassay (CLIA)

5.5 Fluorescent Immunoassay

5.6 Radioimmunoassay (RIA)

5.7 Rapid Tests

5.8 Others

Chapter 6: Immunodiagnostics Market by Sample Type (2018-2035)

6.1 Immunodiagnostics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Blood

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Urine

6.5 Saliva

6.6 Tissue

6.7 Other Bodily Fluids

Chapter 7: Immunodiagnostics Market by Application (2018-2035)

7.1 Immunodiagnostics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Infectious Diseases

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Oncology & Endocrinology

7.5 Autoimmune Diseases

7.6 Hepatitis & Retrovirus

7.7 Cardiac Biomarkers

7.8 Bone & Mineral Disorders

7.9 Allergies

7.10 Others

Chapter 8: Immunodiagnostics Market by End User (2018-2035)

8.1 Immunodiagnostics Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Clinical & Diagnostic Laboratories

8.5 Academic & Research Institutes

8.6 Pharmaceutical & Biotechnology Companies

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Immunodiagnostics Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ABBOTT LABORATORIES (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 AGILENT TECHNOLOGIES

9.4 INC. (UNITED STATES)

9.5 BECTON

9.6 DICKINSON AND COMPANY (UNITED STATES)

9.7 BIOMÉRIEUX SA (FRANCE)

9.8 DANAHER CORPORATION (UNITED STATES)

9.9 DIASORIN SPA (ITALY)

9.10 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

9.11 ILLUMINA

9.12 INC. (UNITED STATES)

9.13 NEOGENOMICS LABORATORIES (UNITED STATES)

9.14 PERKINELMER

9.15 INC. (UNITED STATES)

9.16 QIAGEN N.V. (NETHERLANDS)

9.17 SIEMENS HEALTHINEERS AG (GERMANY)

9.18 SYSMEX CORPORATION (JAPAN)

9.19 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

9.20 WERFEN S.A. (SPAIN) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Immunodiagnostics Market By Region

10.1 Overview

10.2. North America Immunodiagnostics Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Immunodiagnostics Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Immunodiagnostics Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Immunodiagnostics Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Immunodiagnostics Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Immunodiagnostics Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Immunodiagnostics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 34.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.56% |

Market Size in 2035: |

USD 55.90 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Sample Type |

|

||

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||