Hyperscale Data Center Market Synopsis

Hyperscale Data Center Market Size Was Valued at USD 146.34 Billion in 2023 and is Projected to Reach USD 963.9 Billion by 2032, Growing at a CAGR of 23.3% From 2024-2032.

A hyperscale data center is a facility designed to support massive-scale computing environments. It is commonly used by large internet-based companies such as Google, Amazon, Facebook, and Microsoft. These data centers are distinguished by their massive size, which often covers several acres of land, as well as their ability to scale up computing resources to meet rising demand rapidly.

The concept of hyperscale data centers developed from the ease with which they could be moved from one compute instance to another, without regard for the machine on which they were running. The introduction of hypervisors as abstraction layers made it possible to easily move applications running in virtual machines (VMs) from one physical hardware to another.

The market for hyperscale data centers is rapidly expanding due to the growing demand for processing, computing power, and data storage. Many applications, including cloud computing, big data analytics, artificial intelligence and machine learning, social media, and online services, rely on these vast resources. Cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) rely on hyperscale data centers to provide their services.

The exponential growth of data generated by individuals, businesses, and connected devices drives the demand for powerful data storage and processing capabilities. The growing reliance on cloud-based services and applications drives demand for hyperscale data centers as the underlying infrastructure. The hyperscale data center market is expected to expand in the coming years, propelled by factors such as rising data volumes, cloud adoption, and technological advancements.

Hyperscale Data Center Market Trend Analysis

Rising Data Generation

- Strong storage infrastructure is required due to the constantly increasing amount of data produced by people, organizations, and connected devices. Hyperscale data centers provide the scalability and capacity needed to efficiently manage this enormous inflow of data. Processing power is needed for data-intensive applications like artificial intelligence, data analytics, and others that are becoming more and more prevalent. The computing power required to complete these difficult jobs effectively is provided by hyperscale data centers.

- The transition to cloud-based services and applications relies heavily on hyperscale data centers as the foundational infrastructure. Cloud providers such as AWS, Azure, and GCP require massive data centers to store and process user data, run applications, and deliver services. Rising data generation necessitates an ongoing demand for storage, processing, and analysis capabilities, all of which hyperscale data centers are uniquely equipped to meet. This makes it a critical driver of market growth and expansion.

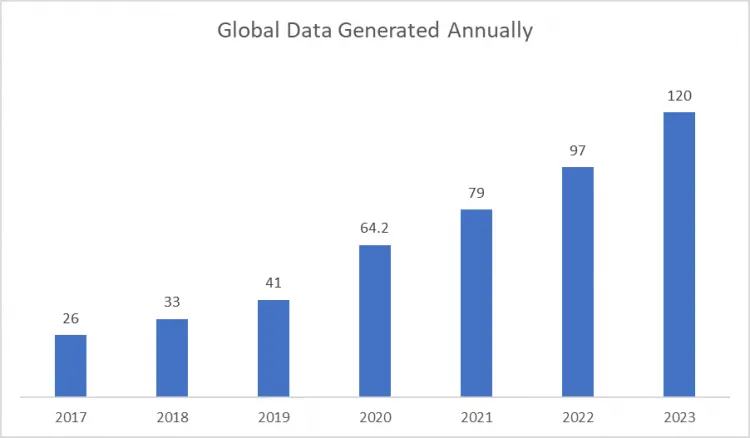

- The bar chart illustrates the consistent growth in data creation over time, with significant increases occurring annually. Between 2017 and 2023, the amount of data created per year has consistently increased, reflecting the growing demand for digital information. The most significant increase occurred between 2022 and 2023, indicating a faster rate of data generation, most likely due to technological advancements, increased internet usage, and the expansion of digital services.

The Growing Adoption of AI and ML Applications

- AI and ML algorithms frequently necessitate massive datasets and significant computational power for training and execution. Hyperscale data centers, with their high-performance computing infrastructure, are well-suited to handling these demanding workloads. The growing complexity of AI models necessitates the use of specialized hardware such as GPUs and TPUs, which are increasingly being deployed in hyperscale data centers to meet the processing requirements of these advanced applications.

- Training and running AI and ML models necessitate massive amounts of storage. Hyperscale data centers provide the scalability and capacity required to store these massive datasets efficiently. Efficient data management is critical for optimizing AI and ML workflows. Hyperscale data centers are investing in advanced data management solutions to ensure faster data access, retrieval, and analysis. The unique requirements of AI and ML workloads are driving the development of specialized data centers tailored to these applications.

- The integration of edge computing results in a hybrid data center ecosystem in which hyperscale facilities collaborate with edge computing nodes. The growing adoption of AI and machine learning applications creates a significant growth opportunity for the hyperscale data center market. Hyperscale data centers are well-positioned to enable the advancement of these transformative technologies by providing the necessary infrastructure, resources, and specialized solutions.

Hyperscale Data Center Market Segment Analysis:

Hyperscale Data Center Market Segmented based on type, application, and end-users.

By Component, Service segment is expected to dominate the market during the forecast period

- Data center operators are increasingly concerned with optimizing their energy consumption and resource utilization. Monitoring services offer valuable insights that can assist operators in identifying areas for improvement and implementing efficiency measures. These facilities house sophisticated hardware, software, and network infrastructure, which must be constantly monitored to ensure peak performance, identify potential problems, and avoid downtimes.

- Hyperscale data centers are vulnerable to cyberattacks and data breaches. Advanced monitoring solutions can detect suspicious activity and potential security risks in real time. Hyperscale data centers are vulnerable to cyberattacks and data breaches. Advanced monitoring solutions can detect suspicious activity and potential security risks in real time. Installation and deployment, as well as maintenance and support, are critical aspects of hyperscale data center operations.

- Automation of maintenance tasks using tools such as remote monitoring and control may reduce the need for manual intervention, slowing the growth of the Maintenance & Support sub-segment. As hyperscale data center designs become more standardized, the complexity of installation and deployment may reduce, potentially affecting the growth rate of this subsegment.

By End-User, Cloud Providers segment held the largest share of 41.13% in 2022

- The global adoption of cloud-based services such as SaaS, PaaS, and IaaS is increasing rapidly, owing to factors such as increased internet penetration, cost-effectiveness, and scalability. This necessitates a strong data center infrastructure to support these services. Leading cloud providers such as AWS, Azure, and GCP are constantly expanding their global infrastructure by building new hyperscale data centers to meet the growing demand for their services.

- Cloud providers are constantly innovating and investing in advanced technologies such as AI, machine learning, and edge computing, which require a strong and scalable data center infrastructure to handle complex workloads and data storage requirements. Businesses are increasingly migrating their IT infrastructure and applications to the cloud, potentially necessitating dedicated or hybrid cloud solutions powered by hyperscale data centers.

- With ongoing advancements in technologies such as artificial intelligence, edge computing, and 5G connectivity, cloud providers are likely to look for new ways to improve the scalability, efficiency, and sustainability of their data center infrastructure. Furthermore, as organizations around the world accelerate their digital transformation initiatives, demand for cloud services is expected to grow even more, driving the expansion of hyperscale data centers and solidifying Cloud Providers' market dominance.

Hyperscale Data Center Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

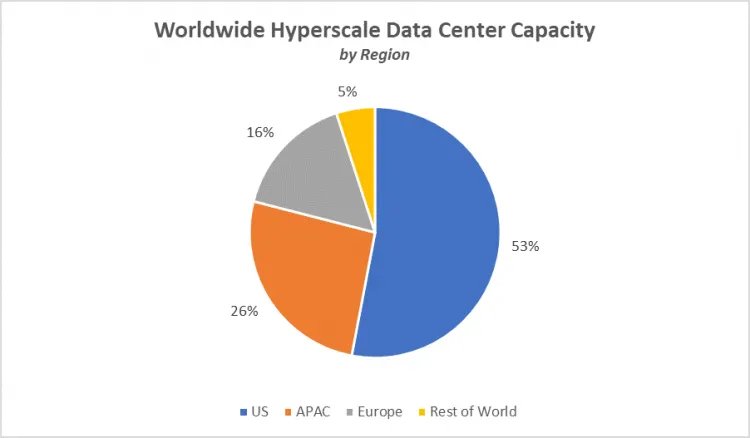

- North America currently has the largest market share in the global hyperscale data center market, due to the presence of leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) headquarters and a significant portion of their data centers in the region. This concentration of major players fuels the demand for hyperscale data centers in the region.

- North America has a more favorable regulatory environment than other regions, with streamlined processes for data center construction and operation. This allows for faster deployment and expansion of hyperscale data centers. The region has a readily available pool of skilled professionals who specialize in data center design, construction, and operation. North America is expected to maintain its dominant position shortly, owing to its existing infrastructure, established ecosystem, and favorable business climate.

- The pie chart illustrates the distribution of worldwide hyperscale data center capacity across different regions. The United States holds the majority share with 53%, followed by the Asia-Pacific (APAC) region at 26%, Europe at 16%, and the Rest of the World accounting for 5%. This highlights the dominance of the US in hyperscale data center infrastructure, with significant contributions from APAC and Europe, while other regions represent a smaller portion of the global capacity.

Hyperscale Data Center Market Top Key Players:

- Amazon (US)

- Microsft (US)

- Google (US)

- IBM (US)

- Oracle (US)

- Cisco (US)

- Apple (US)

- Meta (US)

- Equinix (US)

- Digital Realty (US)

- NTT Global Data Centers (US)

- CyrusOne (US)

- Cyxtera (US)

- QTS Data Centers (US)

- Switch, Inc. (US)

- CloudHQ (US)

- Vantage Data Centers (US)

- STACK Infrastructure (US)

- DataBank (US)

- Colt data center (UK)

- OVHcloud (France)

- Alicloud (China)

- Tencent (China)

- Alibaba (China)

- GDS Holdings (China), and other major players.

Key Industry Developments in the Hyperscale Data Center Market:

- In December 2023, Digital Realty and Blackstone formed a $7 billion joint venture to develop hyperscale data centers. The developments are expected to support approximately 500 megawatts (MW) of total IT load once all campuses are fully built out. Blackstone will acquire an 80% ownership stake in the joint venture in exchange for approximately $700 million in initial capital contributions, while Digital Realty will retain a 20% interest. Following the closure.

- In May 2022, NTT Ltd. in India launched its new hyperscale data center campus in Navi Mumbai, with the first data center, NAV1A. This brings NTT's data center footprint in the country to 12 facilities, totaling more than 2.5 million sq. ft. (232,258 m2) and 220 MW of facility power, solidifying its position as India's market leader in this segment.

|

Global Hyperscale Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 146.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.3 % |

Market Size in 2032: |

USD 963.90 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hyperscale Data Center Market by Component (2018-2032)

4.1 Hyperscale Data Center Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cooling

4.5 Networking

4.6 Power

4.7 Management Software

4.8 Service

4.9 Installation & Deployment

4.10 Maintenance & Support

4.11 Monitoring Services

Chapter 5: Hyperscale Data Center Market by Application (2018-2032)

5.1 Hyperscale Data Center Market Snapshot and Growth Engine

5.2 Market Overview

5.3 BFSI

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 IT and Telecommunications

5.5 Government and Defense

5.6 Healthcare

5.7 Others

Chapter 6: Hyperscale Data Center Market by End-User (2018-2032)

6.1 Hyperscale Data Center Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cloud Providers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Colocation Providers

6.5 Enterprises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hyperscale Data Center Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIR LIQUIDE (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 IWATANI CORPORATION (JAPAN)

7.4 HYDROGENICS (CANADA)

7.5 MESSER GROUP (GERMANY)

7.6 SHOWA DENKO K.K. (JAPAN)

7.7 LINDE (UK)

7.8 EPOCH ENERGY TECHNOLOGY CORPORATION (TAIWAN)

7.9 IDROENERGY SPA (ITALY)

7.10 PRAXAIR INC (U.S.)

7.11 AIR PRODUCTS(U.S.)

7.12 MCPHY (FRANCE)

7.13 LNI SWISS GAS (SWITZERLAND)

7.14 AIRGAS (U.S.)

7.15 PARKER HANNIFIN (U.S.)

7.16 FUEL CELL ENERGY (U.S.)

Chapter 8: Global Hyperscale Data Center Market By Region

8.1 Overview

8.2. North America Hyperscale Data Center Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Solutions

8.2.4.2 Cooling

8.2.4.3 Networking

8.2.4.4 Power

8.2.4.5 Management Software

8.2.4.6 Service

8.2.4.7 Installation & Deployment

8.2.4.8 Maintenance & Support

8.2.4.9 Monitoring Services

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 BFSI

8.2.5.2 IT and Telecommunications

8.2.5.3 Government and Defense

8.2.5.4 Healthcare

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Cloud Providers

8.2.6.2 Colocation Providers

8.2.6.3 Enterprises

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hyperscale Data Center Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Solutions

8.3.4.2 Cooling

8.3.4.3 Networking

8.3.4.4 Power

8.3.4.5 Management Software

8.3.4.6 Service

8.3.4.7 Installation & Deployment

8.3.4.8 Maintenance & Support

8.3.4.9 Monitoring Services

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 BFSI

8.3.5.2 IT and Telecommunications

8.3.5.3 Government and Defense

8.3.5.4 Healthcare

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Cloud Providers

8.3.6.2 Colocation Providers

8.3.6.3 Enterprises

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hyperscale Data Center Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Solutions

8.4.4.2 Cooling

8.4.4.3 Networking

8.4.4.4 Power

8.4.4.5 Management Software

8.4.4.6 Service

8.4.4.7 Installation & Deployment

8.4.4.8 Maintenance & Support

8.4.4.9 Monitoring Services

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 BFSI

8.4.5.2 IT and Telecommunications

8.4.5.3 Government and Defense

8.4.5.4 Healthcare

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Cloud Providers

8.4.6.2 Colocation Providers

8.4.6.3 Enterprises

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hyperscale Data Center Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Solutions

8.5.4.2 Cooling

8.5.4.3 Networking

8.5.4.4 Power

8.5.4.5 Management Software

8.5.4.6 Service

8.5.4.7 Installation & Deployment

8.5.4.8 Maintenance & Support

8.5.4.9 Monitoring Services

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 BFSI

8.5.5.2 IT and Telecommunications

8.5.5.3 Government and Defense

8.5.5.4 Healthcare

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Cloud Providers

8.5.6.2 Colocation Providers

8.5.6.3 Enterprises

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hyperscale Data Center Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Solutions

8.6.4.2 Cooling

8.6.4.3 Networking

8.6.4.4 Power

8.6.4.5 Management Software

8.6.4.6 Service

8.6.4.7 Installation & Deployment

8.6.4.8 Maintenance & Support

8.6.4.9 Monitoring Services

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 BFSI

8.6.5.2 IT and Telecommunications

8.6.5.3 Government and Defense

8.6.5.4 Healthcare

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Cloud Providers

8.6.6.2 Colocation Providers

8.6.6.3 Enterprises

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hyperscale Data Center Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Solutions

8.7.4.2 Cooling

8.7.4.3 Networking

8.7.4.4 Power

8.7.4.5 Management Software

8.7.4.6 Service

8.7.4.7 Installation & Deployment

8.7.4.8 Maintenance & Support

8.7.4.9 Monitoring Services

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 BFSI

8.7.5.2 IT and Telecommunications

8.7.5.3 Government and Defense

8.7.5.4 Healthcare

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Cloud Providers

8.7.6.2 Colocation Providers

8.7.6.3 Enterprises

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Hyperscale Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 146.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.3 % |

Market Size in 2032: |

USD 963.90 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||