Automobile Cables Market Synopsis

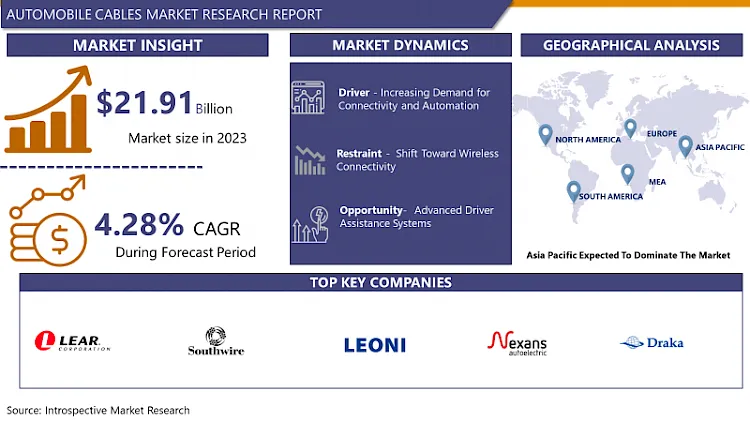

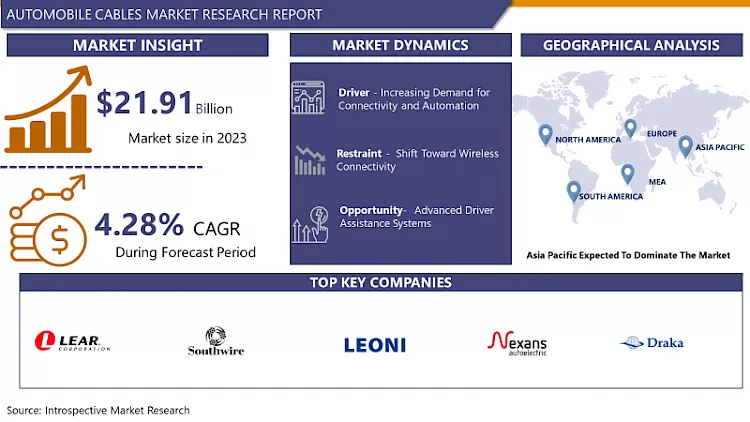

Automobile Cables Market Size Was Valued at USD 21.91 Billion in 2023 and is Projected to Reach USD 31.95 Billion by 2032, Growing at a CAGR of 4.28% From 2024-2032.

Automobile Cablesrefer to the electrical cables and wiring systems used in vehicles to transmit power, signals, and data between various components such as the engine, transmission, lights, sensors, and entertainment systems. These cables are essential for the functioning of a vehicle's electrical and electronic systems, enabling the operation of critical functions such as starting the engine, powering headlights, operating brakes, and controlling the vehicle's onboard computer systems. Automobile cables are designed to withstand the harsh conditions of the automotive environment, including high temperatures, vibrations, moisture, and exposure to chemicals, to ensure reliable and safe operation of the vehicle.

- Automobile cables are essential components in connecting various electrical components and systems within a vehicle, such as the battery, alternator, starter motor, ignition system, lighting system, sensors, switches, and electronic control units (ECUs). They ensure efficient power distribution and transmit electrical signals between components and systems, including engine control, vehicle diagnostics, communication between ECUs, and data transmission for sensors and instruments. Control systems use automobile cables to transmit signals between driver inputs and corresponding control actuators.

- Heating and ventilation systems use cables to control fans, blowers, motors, and temperature sensors, facilitating air distribution for comfort and climate control. Safety systems use cables to transmit signals and data between sensors, ECUs, and actuators to ensure proper operation of safety features. Additionally, automobile cables are used in audio systems, navigation systems, infotainment systems, and communication devices to connect speakers, amplifiers, antennas, displays, and control units.

- The increasing trend towards vehicle electrification, including electric vehicles, hybrid vehicles, and plug-in hybrid vehicles, has led to a growing demand for cables in electric powertrains, batteries, and charging systems. Advanced vehicle technologies, such as sensors, cameras, and driver assistance systems, require complex cables for power supply, data transmission, and communication. As automotive systems become more complex, the demand for specialized cables for various applications is increasing.

- Manufacturers are focusing on lightweight and compact cables to improve fuel efficiency and performance. Environmental regulations are driving the adoption of electric and hybrid vehicles, which require specialized cables for high-voltage applications, battery management, and power distribution. Safety and reliability standards are crucial in automotive cables. The automotive industry's growth, particularly in emerging markets, contributes to the overall demand for automotive cables.

Automobile Cables Market Trend Analysis

Increasing Demand for Connectivity and Automation

- The Automobile Cables Market is driven by the growing demand for connectivity and automation in vehicles. This trend involves the integration of advanced electronic systems, sensors, and communication networks to enable various functionalities like vehicle-to-vehicle communication, vehicle-to-infrastructure communication, and vehicle-to-everything connectivity. This leads to advancements in driver assistance systems (ADAS), enhanced infotainment systems, telematics and remote diagnostics, autonomous driving capabilities, and connectivity with external networks.

- Advanced driver assistance systems rely on sensors, cameras, and communication networks to detect potential hazards and assist drivers in avoiding accidents. Telematics systems transmit diagnostic data, performance metrics, and maintenance alerts in real time, improving vehicle reliability and reducing downtime.

- Autonomous driving capabilities require extensive wiring and cable networks for data communication, sensor fusion, and decision-making algorithms. The demand for seamless user experience between vehicles and digital devices, such as smartphones, tablets, and wearable devices, drives the demand for advanced cable solutions that enable reliable data transmission and communication between different devices and systems within the vehicle.

Restraints

Shift Toward Wireless Connectivity

- The Automobile cable market is facing challenges due to the increasing adoption of wireless connectivity for communication, data transfer, and connectivity within vehicles. This shift is driven by factors such as reduced reliance on physical connections, integration of wireless protocols like Bluetooth, Wi-Fi, and cellular connectivity, space and weight savings, technological advancements like 5G connectivity, and consumer demand for seamless connectivity. Traditional automotive cables are less in demand for applications like audio systems, infotainment, and smartphone integration.

- Modern vehicles are equipped with wireless protocols, offering convenience, flexibility, and enhanced user experience. Technological advancements, such as 5G, make wireless connectivity more appealing for automotive applications. Consumers increasingly expect seamless connectivity and integration of mobile devices with vehicle features, making wireless connectivity a significant challenge.

Opportunity

Advanced Driver Assistance Systems

- The Automobile Cables Market is experiencing growth due to the increasing adoption of Advanced Driver Assistance Systems (ADAS) in vehicles. These systems enhance vehicle safety, improve driver comfort, and provide autonomous driving capabilities. The integration of ADAS presents opportunities for the automobile cable market, including high-speed data transmission, increased complexity of cable assemblies, and the development of specialized cables.

- The growth in vehicle production, regulatory mandates, consumer demand for safety features, and advancements in automotive technology contribute to the demand for automobile cables to support ADAS integration. As ADAS technologies evolve, the demand for advanced cable solutions to support these functionalities is expected to increase.

- The retrofitting of existing vehicles with aftermarket ADAS systems presents additional opportunities for the automobile cables market, as custom cable solutions are often required to integrate new sensors, cameras, and control modules into older vehicle models.

Challenges

Rapid Technological Advancements

- Modern vehicles have advanced electrical and electronic systems, requiring a complex network of cables to transmit power, data, and signals. As vehicle technologies evolve, there is a growing demand for cables with higher performance capabilities, such as increased power handling capacity, reliability, durability, and resistance to environmental factors. Technological advancements in materials science and manufacturing processes have led to the development of innovative materials and technologies for automobile cables, such as high-strength conductors, advanced insulation materials, and improved shielding techniques.

- Integrating these new materials into cable designs while ensuring compatibility with existing systems and manufacturing processes can be challenging. Additionally, automobile cables must comply with emerging standards and protocols, such as Ethernet, CAN FD, FlexRay, and LIN, to facilitate connectivity and interoperability between vehicle components and external systems. Balancing cost considerations with innovation and performance improvement is a significant challenge for cable manufacturers in highly competitive markets.

Automobile Cables Market Segment Analysis:

Automobile Cables Market Segmented based on type, function, and material.

By Type, TXL segment is expected to dominate the market during the forecast period

- TXL is a cross-linked, extra-thin automotive wire used for applications with thinner spaces. The TXL wire is the thinnest or smallest of the automotive wires classified under XLPE. For this reason, it is the lightest and as such, have found use cases in applications where a small overall diameter is necessary. Despite the smaller diameter, the TXL wire has a higher durability. This is why it is preferred for automotive applications that require lightweight wire.

- It is also required for automotive applications that require higher reliability, especially in extreme cold and high-heat temperatures. As the thinnest and smallest wiring option for automobiles, it is used in applications that require higher reliability, smaller spaces, and higher durability. TXL cables are a type of automotive cable known for their thin-wall construction, allowing for a smaller overall diameter. They are designed to withstand high temperatures, ensuring reliable performance in hot environments.

- TXL cables are also resistant to fluids and chemicals commonly found in automotive environments, such as oil, gasoline, brake fluid, and coolant. They offer excellent electrical properties, including low resistance and high insulation resistance, ensuring efficient power transmission and minimizing the risk of electrical faults. TXL cables meet or exceed industry standards, making them a preferred choice for automotive manufacturers and aftermarket suppliers.

By Function, Battery Cables segment held the largest share of 22.43% in 2023

- Battery cables are essential for the functioning of an automotive electrical system, connecting the battery to various components like the starter motor, alternator, and electrical system. They are in high demand in traditional vehicles and are subject to wear and tear over time due to exposure to heat, vibration, and chemical corrosion.

- The growth in electric and hybrid vehicles also drives demand for high-voltage cables to connect the battery to the electric powertrain, motors, inverters, and charging systems. Safety and reliability requirements for battery cables are stringent, leading to a preference for high-quality, durable cables.

- Technological advancements, such as higher energy density and faster charging, may necessitate the development of specialized cables for handling higher currents and voltages.

Automobile Cables Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific, home to major automotive manufacturers like China, Japan, South Korea, and India, is experiencing significant growth in automotive production. This growth is driven by rising vehicle ownership rates, a shift towards electric vehicles, and the expansion of the automotive aftermarket. The demand for automobile cables for powertrain, chassis, and electrical systems is also increasing.

- The region is also a hub for technological advancements, with manufacturers investing in research and development to develop advanced cables for modern vehicles. Government initiatives and investments in infrastructure development, such as transportation networks and smart cities, also drive the demand for automotive cables. The region's strong presence of cable manufacturers, including multinational corporations and local suppliers, enables efficient production and distribution of automobile cables.

Automobile Cables Market Top Key Players:

- Lear Corporation (US)

- Southwire Company, LLC (US)

- LEONI AG (Germany)

- Nexans autoelectric GmbH (Germany)

- Draka Automotive GmbH (Germany)

- Coroplast Fritz Müller GmbH & Co. KG (Germany)

- Kromberg & Schubert GmbH & Co. KG (Germany)

- Dräxlmaier Group (Germany)

- Delphi Technologies (UK)

- Nexans S.A. (France)

- Prysmian Group (Italy)

- Aptiv PLC (Ireland)

- TE Connectivity Ltd. (Switzerland)

- Samvardhana Motherson Group (India)

- Sumitomo Electric Industries, Ltd. (Japan)

- Yazaki Corporation (Japan)

- Furukawa Automotive Systems Inc. (Japan)

- Hitachi Automotive Systems, Ltd. (Japan), and other major players

Key Industry Developments in the Automobile Cables Market:

- In October 2023, Leoni optimized the design of its charging cables, making them easier for electric car owners to handle while simultaneously consuming fewer resources. Charging electric vehicles depends on the power output at the connected source, the charging technology fitted to the vehicle, and the size of the vehicle’s battery. The charging cable’s design is a key factor for short charging times. Leoni presents a new generation of AC charging cables with its two LEONI EcoSense® Nxt and LEONI EcoSense® Nxt+ innovations.

- In September 2023, Southwire Company, LLC, and Resideo Technologies, Inc. announced today a definitive agreement for the sale by Resideo to Southwire of its Genesis Wire & Cable business, a leading low-voltage wire and cable manufacturer based in Pleasant Prairie, Wis. The transaction is anticipated to close in the next 30 days, subject to customary closing conditions.

|

Global Automobile Cables Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

21.91 Bn |

|

Forecast Period 2023-30 CAGR: |

4.28 % |

Market Size in 2032: |

31.95 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automobile Cables Market by Type (2018-2032)

4.1 Automobile Cables Market Snapshot and Growth Engine

4.2 Market Overview

4.3 TXL

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 GXL

4.5 SXL

Chapter 5: Automobile Cables Market by Function (2018-2032)

5.1 Automobile Cables Market Snapshot and Growth Engine

5.2 Market Overview

5.3 General Cables

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Module Cables

5.5 Battery Cables

5.6 Shield Cables

5.7 High Voltage Cables

5.8 Others

Chapter 6: Automobile Cables Market by Material (2018-2032)

6.1 Automobile Cables Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aluminium

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Copper

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automobile Cables Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SMITH & NEPHEW PLC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ZIMMER BIOMET (US)

7.4 INTEGRATED MEDICAL TECHNOLOGIES INC. (US)

7.5 TECOMET INC. (US)

7.6 SANDVIK A (SWEDEN)

7.7 PRECISION EDGE SURGICAL (US)

Chapter 8: Global Automobile Cables Market By Region

8.1 Overview

8.2. North America Automobile Cables Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 TXL

8.2.4.2 GXL

8.2.4.3 SXL

8.2.5 Historic and Forecasted Market Size by Function

8.2.5.1 General Cables

8.2.5.2 Module Cables

8.2.5.3 Battery Cables

8.2.5.4 Shield Cables

8.2.5.5 High Voltage Cables

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by Material

8.2.6.1 Aluminium

8.2.6.2 Copper

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automobile Cables Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 TXL

8.3.4.2 GXL

8.3.4.3 SXL

8.3.5 Historic and Forecasted Market Size by Function

8.3.5.1 General Cables

8.3.5.2 Module Cables

8.3.5.3 Battery Cables

8.3.5.4 Shield Cables

8.3.5.5 High Voltage Cables

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by Material

8.3.6.1 Aluminium

8.3.6.2 Copper

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automobile Cables Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 TXL

8.4.4.2 GXL

8.4.4.3 SXL

8.4.5 Historic and Forecasted Market Size by Function

8.4.5.1 General Cables

8.4.5.2 Module Cables

8.4.5.3 Battery Cables

8.4.5.4 Shield Cables

8.4.5.5 High Voltage Cables

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by Material

8.4.6.1 Aluminium

8.4.6.2 Copper

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automobile Cables Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 TXL

8.5.4.2 GXL

8.5.4.3 SXL

8.5.5 Historic and Forecasted Market Size by Function

8.5.5.1 General Cables

8.5.5.2 Module Cables

8.5.5.3 Battery Cables

8.5.5.4 Shield Cables

8.5.5.5 High Voltage Cables

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by Material

8.5.6.1 Aluminium

8.5.6.2 Copper

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automobile Cables Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 TXL

8.6.4.2 GXL

8.6.4.3 SXL

8.6.5 Historic and Forecasted Market Size by Function

8.6.5.1 General Cables

8.6.5.2 Module Cables

8.6.5.3 Battery Cables

8.6.5.4 Shield Cables

8.6.5.5 High Voltage Cables

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by Material

8.6.6.1 Aluminium

8.6.6.2 Copper

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automobile Cables Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 TXL

8.7.4.2 GXL

8.7.4.3 SXL

8.7.5 Historic and Forecasted Market Size by Function

8.7.5.1 General Cables

8.7.5.2 Module Cables

8.7.5.3 Battery Cables

8.7.5.4 Shield Cables

8.7.5.5 High Voltage Cables

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by Material

8.7.6.1 Aluminium

8.7.6.2 Copper

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Automobile Cables Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

21.91 Bn |

|

Forecast Period 2023-30 CAGR: |

4.28 % |

Market Size in 2032: |

31.95 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automobile Cables Market research report is 2024-2032.

Lear Corporation (US), Southwire Company, LLC (US), LEONI AG (Germany), Leoni AG (Germany), Nexans autoelectric GmbH (Germany), Draka Automotive GmbH (Germany), Coroplast Fritz Müller GmbH & Co. KG (Germany), Kromberg & Schubert GmbH & Co. KG (Germany), Dräxlmaier Group (Germany), Delphi Technologies (UK), Nexans S.A. (France), Prysmian Group (Italy), Aptiv PLC (Ireland), TE Connectivity Ltd. (Switzerland), Samvardhana Motherson Group (India), Sumitomo Electric Industries, Ltd. (Japan), Yazaki Corporation (Japan), Furukawa Automotive Systems Inc. (Japan), Hitachi Automotive Systems, Ltd. (Japan), and Other Major Players.

The Automobile Cables Market is segmented into Type, Function, Material, and region. By Type, the market is categorized into TXL, GXL, and SXL. By Function, the market is categorized into General Cables, Module Cables, Battery Cables, Shield Cables, High Voltage Cables, and Others. By Material, the market is categorized into Aluminium and copper. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Automobile Cables Market refers to the global industry involved in the manufacturing, distribution, and sale of cables used in automotive applications. These cables are essential components of vehicles, providing electrical connectivity between various systems and components, such as the battery, engine, sensors, lights, entertainment systems, and control modules. The automobile cables market encompasses a wide range of cable types, including battery cables, wiring harnesses, sensor cables, communication cables, and high-voltage cables for electric and hybrid vehicles. As the automotive industry evolves with technological advancements, such as electrification, connectivity, and autonomous driving, the demand for innovative and high-performance automobile cables continues to grow.

Automobile Cables Market Size Was Valued at USD 21.91 Billion in 2023 and is Projected to Reach USD 31.95 Billion by 2032, Growing at a CAGR of 4.28% From 2024-2032.