Gin Market Synopsis

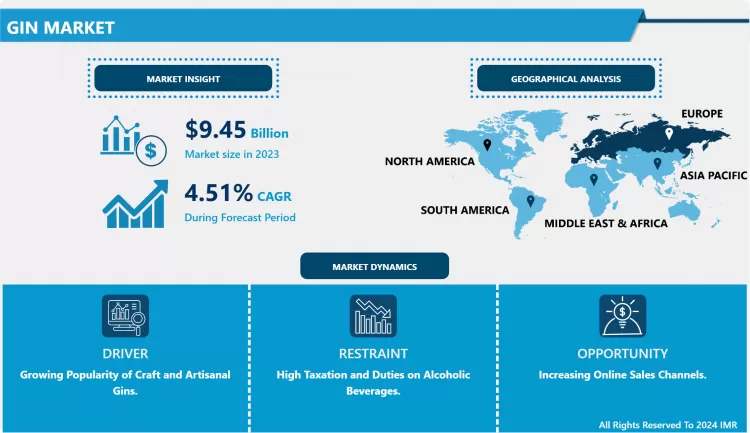

Gin Market Size is Valued at USD 9.45 Billion in 2023 and is Projected to Reach USD 14.07 Billion by 2032, Growing at a CAGR of 4.51% From 2024-2032.

The gin market therefore describes a broad category of alcoholic drinks that is mainly sourced from juniper fruits and spiced with a blend of herbs. Some of the subtypes are London Dry, Plymouth, and flavored gins, and they are consumed across the world through on-trade, which is bars and restaurants and off-trade, which is shops and online platforms. The market is classified by price band and area of the world, thus isolating economic preferences and market trends in North America, European, Asia-Pacific, Latin American, and Middle East & Africa.

- The gin market has experienced many influencing factors that enable it to be popular and widely used across the world. First of all, there has been an upsurge in per capita and increased consumers’ awareness towards craft spirits and premium products most especially gin in the premium and super-premium categories. Customers are paying immense attention to the aspect of personalized and crafted contents thus making craft gin distilleries popular across the world.

- Secondly, it will be worthwhile to state that the modern trends in cocktail use and mixology have only contributed to the growth of the gin market. gin is highly useful as it can fit into so many different cocktails; the classic gin and tonic cocktail to the newly formulated sophisticated niche cocktails. This diversification has opened up gin to the newer territories from its typical gin-consuming areas in its absorption with the youthful generation of drinkers willing to explore the various tastes of gin. Furthermore, the increasing trend of botanical flavoured and natural products has widened the prospect on gin market among the health-conscious persons who prefer natural and tasty products. Consequently, gin is a product that still records extremely high growth, both in the traditional gin consuming countries and the newly developed markets due to innovation, shift to the premium segment, and changes in consumers’ preferences.

Gin Market Trend Analysis

Gin Revival, Tradition Meets Innovation in the Spirits Industry

- Currently, gin is on the rise internationally and this is substantiated by shifting consumers’ pallet towards quality and niche beverages. Current trends include an increasing tendency of people to switch to gin cocktails and an increasing number of artisanal gin distilleries. Multiple consumer drives are tilted toward the novel taste and the diseases affinities with botanical blends creating aptitude within the segment. There is a trend of premiumisation where consumers are willing to go deep pocket to acquire a higher class of products with different taste.

- Also, geographical diversification is observable in the gin market as Asia Pacific and Latin America are being discovered to have a growing market. Such shifts in the regions compelling people to adopt the western drinking habits and the increasing demand for craft drinks are enlightening the market growth. Moreover, materials and environmental responsibility are getting to be essential aspects in customers’ decision-making process, and thus, brands turn to focus on making their manufacturing organic and packing sustainable more than ever. In general, the gin market remains a very active segment in the spirits industry that sees constant development on the basis of tradition with elements of innovation and shifts in consumers’ preferences all over the globe.

Navigating Growth, Market Dynamics of the Global Gin Sector

- The market for gin could be effectively described as a tempting one due to changes in the consumers’ behaviour and increasing the scope of the gin’s international distribution. The enthusiasm of the consumer for craft spirits and the exclusive experience has introduced more opportunities for ‘craft’ and ‘small batch’ gins. Also, the appearance of gin is flexible to be used in cocktail, it has been consumed in future generation across the age range and for all types of occasions which increases the extent of the market.

- There are also, geographical expansion, and the innovation of different flavors as some of the reasons for growth. Currently, new markets that have not been explored as yet are the Asia Pacific and Latin America whereas Europe, North and South America remain as virgin markets. Moreover, today’s choices with flavored gins as well as eco-friendly production standards are changing the requirements for consumers, strongly influencing the competitors. In summary, the gin market has promising potential for growth based on the result of the interplay of craftsmanship, consumer changes, and diversified market approaches.

Gin Market Segment Analysis:

Gin Market Segmented on the basis of type, Distribution Channel, Price Range.

By Type, London Dry Gin segment is expected to dominate the market during the forecast period

- Gin can be segmented into numerous types and in the course of continuous changes in the consumers ‘preferences within the gin industry. Some of the old world styles include the London Dry Gin and the Plymouth styles which maintains their traditional profile, popular for their dryness with juniper berry as the main note. Old Tom Gin is sweeter as the historic gin for cocktails was preferred this taste. On the other hand, New Western or International Style Gin, offers new botanist combinations, sometimes underlining unexpected ingredients for a modernistic approach. On the other hand, the flavoured gin with frutis, herbs or spices are also seen to attract the new generation consumers who are in search of new and different tastes of taking their gins. Altogether the abovementioned gin types depict the diversified gin market which is in the constant development due to both classic and novel tendencies.

By Price Range, Economy segment held the largest share in 2024

- The segmentation by price of gin is done into economy gin, premium gin, and super premium gin depending on the consumers’ ability to purchase. Economy gins also provide the required affordability while at the same time ensuring they deliver quality products that suit the pocket of any client. Premium gins are over fancy and focus on gin aficionados who would be willing to pay more for a better material and workmanship on their gin.

- Super premium gin is defined as the highest and most elaborate segment of the gin market as it prides itself in its specialty, novelty, and class, equated to superiority in the gin industry through enhanced botanicals mix, superior method of distillation among other features. All these price segments show different social marketing concept of targeting the market in a numbered and classified way by offering products of different tastes and quality which can be afforded by the different social classes.

Gin Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Currently, the gin market in Europe can be described as mature but populated with a wide array of vs products with a long history. The region is commonly associated with the production of old school gin and is home to many such producing nations such as the United Kingdom, Spain, and the Netherlands. London Dry Gin is still regarded as one of the most popular types It has a very defined, intensive juniper aroma, and its taste is rather clean Since the days of Martin Scorsese or the famous documentary the Gin and Tonic, London Dry Gin has never gone out of fashion. Over the last 5 years, manufacturers started to release flavoured gins, giving the consumers more choice and options between citrus, floral and of course more exotic botanical gins. It also encompasses the luxury and craft gin where firms market gin made from small batch distilleries that concentrate on producing high quality gin.

- Relatively strong performance of Europe on the aspect of consumption can be attributed to the well-developed ‘On-trade’ country where bars along with restaurants highly influence the penchant of gins and introduce newer variants. Retail stores and online selling platforms are also commonly used by consumers and off-trade accounts for a large proportion of gin sales since it has a vast selection of gin brands to choose from – domestic and imported brands. In conclusion, the above analysis of the European gin market depicts how the European gin market is an amalgamation of the heritage of tradition and innovation that uses modern technological tools to incorporate innovation through customization of its products to meet the consumers’ changing demands of the quality and kind of gin they prefer.

Active Key Players in the Gin Market

- Bacardi Limited (Bermuda)

- The East India Company Ltd (U.K.)

- William Grant & Sons Ltd (U.K.)

- Ginebra San Miguel Inc. (Philippines)

- The Poshmakers Ltd (U.K.)

- Forest Dry Gin (Belgium)

- West End Drinks Ltd (U.K.)

- Boudier Gabriel Ets SA (France)

- Diageo plc (U.K.)

- Pernod Ricard S.A. (France)

- Suntory Holdings Limited (Japan)

- The Sustainable Spirit Co. (U.K.)

- Davide Campari-Milano S.p.A. (Italy)

- The Black Bottle Distillery (U.K.)

- Langtons Gin Ltd (U.K.)

- Others

|

Global Gin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.51 % |

Market Size in 2032: |

USD 14.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Distribution Channel |

|

||

|

By Price Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gin Market by Type (2018-2032)

4.1 Gin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 London Dry Gin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plymouth Gin

4.5 Old Tom Gin

4.6 New Western or International Style Gin

4.7 Flavored Gin

4.8 Distribution Channel

4.9 On-trade

4.10 Off-trade

Chapter 5: Gin Market by Price Range (2018-2032)

5.1 Gin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Economy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Premium

5.5 Super Premium

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Gin Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BACARDI LIMITED (BERMUDA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 THE EAST INDIA COMPANY LTD (U.K.)

6.4 WILLIAM GRANT & SONS LTD (U.K.)

6.5 GINEBRA SAN MIGUEL INC. (PHILIPPINES)

6.6 THE POSHMAKERS LTD (U.K.)

6.7 FOREST DRY GIN (BELGIUM)

6.8 WEST END DRINKS LTD (U.K.)

6.9 BOUDIER GABRIEL ETS SA (FRANCE)

6.10 DIAGEO PLC (U.K.)

6.11 PERNOD RICARD S.A. (FRANCE)

6.12 SUNTORY HOLDINGS LIMITED (JAPAN)

6.13 THE SUSTAINABLE SPIRIT CO. (U.K.)

6.14 DAVIDE CAMPARI-MILANO S.P.A. (ITALY)

6.15 THE BLACK BOTTLE DISTILLERY (U.K.)

6.16 LANGTONS GIN LTD (U.K.)

6.17 OTHERS

Chapter 7: Global Gin Market By Region

7.1 Overview

7.2. North America Gin Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 London Dry Gin

7.2.4.2 Plymouth Gin

7.2.4.3 Old Tom Gin

7.2.4.4 New Western or International Style Gin

7.2.4.5 Flavored Gin

7.2.4.6 Distribution Channel

7.2.4.7 On-trade

7.2.4.8 Off-trade

7.2.5 Historic and Forecasted Market Size by Price Range

7.2.5.1 Economy

7.2.5.2 Premium

7.2.5.3 Super Premium

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Gin Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 London Dry Gin

7.3.4.2 Plymouth Gin

7.3.4.3 Old Tom Gin

7.3.4.4 New Western or International Style Gin

7.3.4.5 Flavored Gin

7.3.4.6 Distribution Channel

7.3.4.7 On-trade

7.3.4.8 Off-trade

7.3.5 Historic and Forecasted Market Size by Price Range

7.3.5.1 Economy

7.3.5.2 Premium

7.3.5.3 Super Premium

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Gin Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 London Dry Gin

7.4.4.2 Plymouth Gin

7.4.4.3 Old Tom Gin

7.4.4.4 New Western or International Style Gin

7.4.4.5 Flavored Gin

7.4.4.6 Distribution Channel

7.4.4.7 On-trade

7.4.4.8 Off-trade

7.4.5 Historic and Forecasted Market Size by Price Range

7.4.5.1 Economy

7.4.5.2 Premium

7.4.5.3 Super Premium

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Gin Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 London Dry Gin

7.5.4.2 Plymouth Gin

7.5.4.3 Old Tom Gin

7.5.4.4 New Western or International Style Gin

7.5.4.5 Flavored Gin

7.5.4.6 Distribution Channel

7.5.4.7 On-trade

7.5.4.8 Off-trade

7.5.5 Historic and Forecasted Market Size by Price Range

7.5.5.1 Economy

7.5.5.2 Premium

7.5.5.3 Super Premium

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Gin Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 London Dry Gin

7.6.4.2 Plymouth Gin

7.6.4.3 Old Tom Gin

7.6.4.4 New Western or International Style Gin

7.6.4.5 Flavored Gin

7.6.4.6 Distribution Channel

7.6.4.7 On-trade

7.6.4.8 Off-trade

7.6.5 Historic and Forecasted Market Size by Price Range

7.6.5.1 Economy

7.6.5.2 Premium

7.6.5.3 Super Premium

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Gin Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 London Dry Gin

7.7.4.2 Plymouth Gin

7.7.4.3 Old Tom Gin

7.7.4.4 New Western or International Style Gin

7.7.4.5 Flavored Gin

7.7.4.6 Distribution Channel

7.7.4.7 On-trade

7.7.4.8 Off-trade

7.7.5 Historic and Forecasted Market Size by Price Range

7.7.5.1 Economy

7.7.5.2 Premium

7.7.5.3 Super Premium

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Gin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.51 % |

Market Size in 2032: |

USD 14.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Distribution Channel |

|

||

|

By Price Range |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Gin Market research report is 2024-2032.

Bacardi Limited (Bermuda), The East India Company Ltd (U.K.), William Grant & Sons Ltd (U.K.), Ginebra San Miguel Inc. (Philippines), The Poshmakers Ltd (U.K.), Forest Dry Gin (Belgium), West End Drinks Ltd (U.K.), Boudier Gabriel Ets SA (France), Diageo plc (U.K.), Pernod Ricard S.A. (France), Suntory Holdings Limited (Japan), The Sustainable Spirit Co. (U.K.), Davide Campari-Milano S.p.A. (Italy), The Black Bottle Distillery (U.K.), Langtons Gin Ltd (U.K.), Others and Other Major Players.

The Gin Market is segmented into by Type (London Dry Gin, Plymouth Gin, Old Tom Gin, New Western or International Style Gin, Flavored Gin), Distribution Channel (On-trade, Off-trade), Price Range (Economy, Premium, Super Premium). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The gin market therefore describes a broad category of alcoholic drinks that is mainly sourced from juniper fruits and spiced with a blend of herbs. Some of the subtypes are London Dry, Plymouth, and flavored gins, and they are consumed across the world through on trade, which is bars and restaurants and off-trade, which is shops and online platforms. The market is classified by price band and area of the world, thus isolating economic preferences and market trends in North America, European, Asia-Pacific, Latin American, and Middle East & Africa.

Gin Market Size is Valued at USD 9.45 Billion in 2023, and is Projected to Reach USD 14.07 Billion by 2032, Growing at a CAGR of 4.51% From 2024-2032.