Key Market Highlights

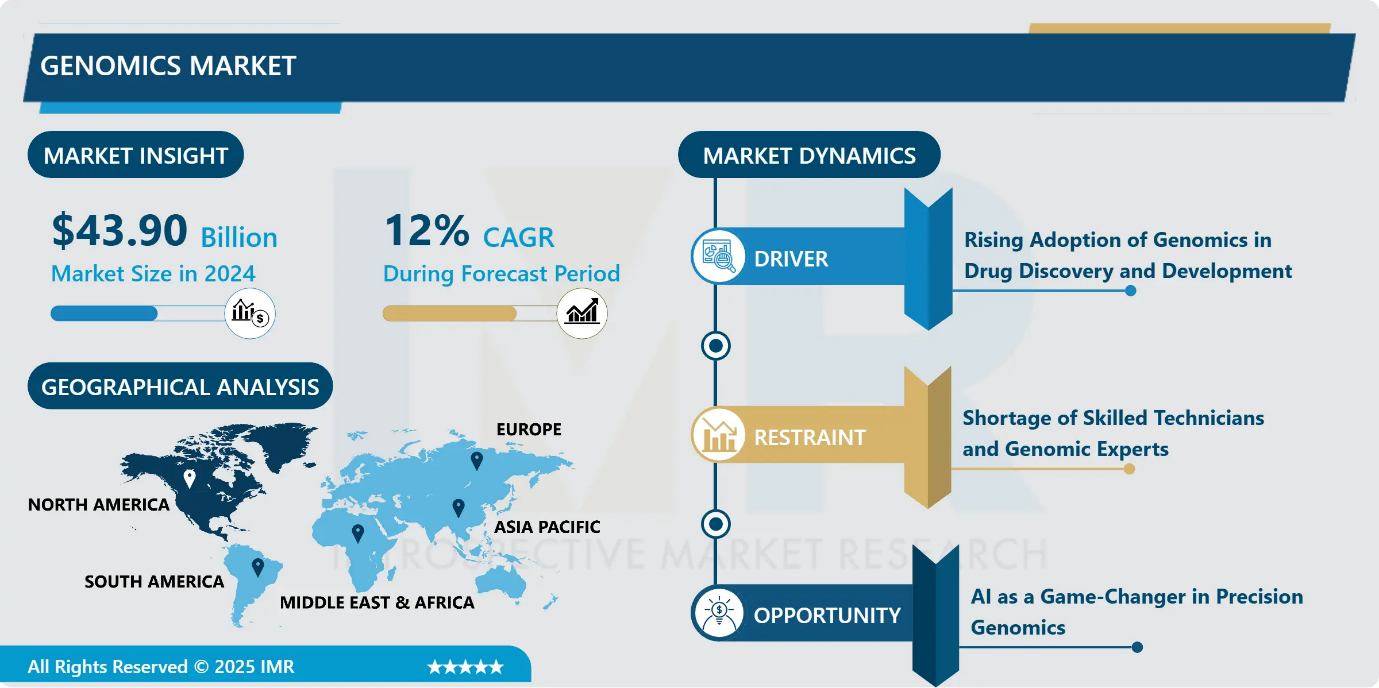

Genomics Market Size Was Valued at USD 43.90 Billion in 2024, and is Projected to Reach USD 152.71 Billion by 2035, Growing at a CAGR of 12% from 2025-2035.

- Market Size in 2024: USD 43.90 Billion

- Projected Market Size by 2035: USD 152.71 Billion

- CAGR (2025–2035): 12%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Technology: The Sequencing segment is anticipated to lead the market by accounting for 33% of the market share throughout the forecast period.

- By End-User: The Pharmaceutical and biotechnology segment is expected to capture 32.7% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 40% of the market share during the forecast period.

- Active Players: Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (U.S.), BGI Group (China), Oxford Nanopore Technologies plc (U.K.) and Other Active Players.

Market Synopsis:

Genomics refers to the comprehensive study and analysis of an organism’s entire genome to identify genetic variations, biological functions, and their applications in healthcare, research, and biotechnology. The genomics market is expanding rapidly as healthcare shifts from traditional treatments to precision medicine. Genomics has proven vital in diagnosing, preventing, and managing complex diseases, with whole-genome sequencing becoming essential for cancer and rare disease detection. The rising global cancer burden projected by the National Cancer Institute to reach 29.5 million new cases annually by 2040 continues to fuel demand for advanced sequencing, storage, and analysis tools. Alongside this, growing applications in agriculture, biotechnology, and environmental sciences are broadening adoption. The genomics market is witnessing sustained growth, supported by rapid advancements in next-generation sequencing (NGS) technologies and the expanding adoption of precision medicine and advanced diagnostic solutions. Increasing government and private sector investments in genomic research are further strengthening market expansion. Moreover, the rising burden of genetic and chronic disorders, along with the growing integration of artificial intelligence (AI) and bioinformatics for efficient data analysis and interpretation, is accelerating the adoption of genomics across research, clinical, and pharmaceutical applications.

Market Dynamics and Trend Analysis:

Market Growth Driver - Rising Adoption of Genomics in Drug Discovery and Development

-

The adoption of genomics in drug discovery and development is accelerating rapidly as pharmaceutical and biotechnology companies integrate advanced sequencing, functional genomics, and computational tools to improve target identification, validate mechanisms of action, and accelerate preclinical pipelines. With NGS and high-throughput platforms enabling deeper, more accurate genomic profiling, researchers are increasingly using whole-genome, exome, and transcriptome datasets to uncover novel biomarkers and stratify patient populations.

- The rise of multi-omics integration combining genomics with proteomics, epigenomics, and metabolomics is supporting the development of precision therapies, especially in oncology, immunology, rare genetic disorders, and metabolic diseases. In recent years, regulatory agencies have also encouraged genomic-driven clinical trials, promoting the use of biomarker-based patient recruitment to increase trial efficiency and success rates. Additionally, collaborations between genomics companies, AI-driven drug discovery platforms, and pharma giants are increasing, aimed at accelerating hit identification, optimizing lead compounds, and reducing R&D costs.

Market Limiting Factor - Shortage of Skilled Technicians and Genomic Experts

-

A major barrier to the growth of the genomics industry is the lack of trained professionals who can operate advanced sequencing systems and analyze complex genomic data. Many developing countries especially face a shortage of technicians with the necessary expertise to manage high-end genomic instruments or perform bioinformatics analysis. This skill gap slows down the adoption of genomic technologies in clinical labs, research centers, and diagnostic facilities. The lack of specialized training programs and limited access to advanced laboratories further widen this workforce deficit, restricting the expansion of genomics-based healthcare and research services.

Market Expansion Opportunity - AI as a Game-Changer in Precision Genomics

-

Artificial intelligence (AI) is rapidly emerging as a transformative force in genomics by enabling the fast and accurate analysis of massive volumes of DNA data. Processes that once required weeks or months can now be completed within minutes, significantly improving the identification of disease-causing mutations, understanding of disease mechanisms, and clinical decision-making.

- Recent research highlights the growing impact of AI in this field. In June 2024, researchers demonstrated that AI models could predict cancer progression using whole genome sequencing data. Similarly, an August 2023 study by the Broad Institute and Google Health showed that AI could accurately detect rare genetic disorders by combining facial analysis with genomic information. These breakthroughs demonstrate how AI is driving earlier diagnosis, greater treatment precision, and improved patient outcomes.

Market Challenge and Risk - High Costs of Genomic Technologies Limiting Adoption

-

Although sequencing technologies have become more affordable over time, the overall cost of genomic testing remains high. Comprehensive genome sequencing, data analysis, data storage, and interpretation require expensive equipment, advanced bioinformatics infrastructure, and skilled personnel. These costs make genomic testing less accessible particularly for small laboratories, hospitals with limited budgets and institutions with low and middle income.

- For example, According, to an October 2023 report by the Global Genomics Alliance, the total cost of whole genome sequencing covering data storage and interpretation still exceeds USD 1,000 per person, making large-scale population studies or routine genomic screening financially challenging. Additionally, high operational costs and limited funding constraints prevent many public healthcare systems from integrating genomics into everyday clinical practice.

Market Trend - New Opportunities Through Technological Integration

-

The genomics market is growing fast because new technologies like next-generation sequencing (NGS) are making DNA testing quicker, more accurate, and cheaper than before. Many new companies are entering the field by offering services such as genetic testing for health, ancestry, and personalized medicine. Big improvements in technology and increasing investment from governments and private companies are helping genomics become more widely used in healthcare.

- A growing trend in the genomics market is the use of multi-omics, which combines genomics with other scientific fields like proteomics, metabolomics, and transcriptomics. This approach gives a fuller picture of how the body works and helps identify new disease markers and treatment options. With the help of AI and advanced data tools, multi-omics is becoming essential for developing personalized therapies, improving diagnostic accuracy, and supporting drug discovery.

Market Segment Analysis:

Genomics Market is segmented based on Technology, Product, Application, End-Users, and Region

By Technology, Sequencing segment is expected to dominate the market with around 33% share during the forecast period.

-

Rapid technological advancements, particularly in next-generation sequencing (NGS) and CRISPR-Cas9 genome-editing technologies, continue to be major drivers of growth in the global genomics market. The increasing number of startups offering sequencing-based solutions for diagnostics, personalized medicine, and research is further accelerating market expansion.

- Advanced NGS platforms have significantly enhanced the speed, accuracy, and cost-efficiency of genomic analysis, enabling wider adoption of large-scale testing. This progress is reinforced by the growing use of long-read and single-molecule sequencing technologies, which enable simultaneous detection of structural variants and methylation patterns, overcoming key limitations of short-read systems. Leading vendors continue to innovate; for instance, Oxford Nanopore’s adaptive sampling enables real-time genomic targeting, while Roche is advancing next-generation nanopore platforms. As a result, sequencing remains the largest technology segment, driven by its essential role across research and clinical diagnostics.

By End-User, Pharmaceutical and biotechnology is expected to dominate with close to 32.7% market share during the forecast period.

-

Pharmaceutical and biotechnology companies hold a dominant share of the genomics market due to their strong engagement in research, development, and commercialization. These companies play a critical role in advancing drug discovery and precision medicine by utilizing genomic data to identify novel drug targets, understand complex disease mechanisms, and develop highly targeted treatment strategies.

- A prominent example is the collaboration between Illumina Inc. and Nashville Biosciences, an affiliate of Vanderbilt University Medical Center, to establish the Alliance for Genomic Discovery (AGD). This initiative includes major pharmaceutical players such as AbbVie, Amgen, AstraZeneca, Bayer, and Merck, who are collectively supporting large-scale sequencing of nearly 250,000 samples to fast-track drug innovation.

Market Regional Insights:

North America region is estimated to lead the market with around 40% share during the forecast period.

-

North America dominates the global genomics market, accounting for nearly 40% of overall growth during the forecast period, supported by its advanced healthcare infrastructure, high R&D investment, and strong presence of leading biotechnology and pharmaceutical companies. The United States is the largest contributor in the region, driven by large-scale national genomics programs, the widespread adoption of next-generation sequencing in clinical diagnostics and oncology, and strong collaboration between academic institutions and industry players. Strategic alliances, such as the partnership between Illumina, Inc. and Nashville Biosciences for clinico-genomic drug development, continue to strengthen the region’s innovation ecosystem.

- Globally, the genomics market is evolving rapidly due to advancements in genome editing, comparative genomics, and gene expression profiling. Technologies such as variant calling tools, network analysis algorithms, epigenetic mapping, and genomic data visualization platforms are improving disease target identification. The growing adoption of personalized medicine, supported by gene editing and gene therapy technologies, is further accelerating global market expansion.

Market Active Players

- 23andMe, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BGI Group (China)

- Bio-Rad Laboratories, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Eurofins Scientific (Luxembourg)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Illumina, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Pacific Biosciences, Inc. – PacBio (U.S.)

- PerkinElmer, Inc. (U.S.)

- QIAGEN N.V. (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Other Active Players

Key Industry Developments in the Genomics Market:

-

In March 2025, Illumina Inc. introduced its advanced NovaSeq X Plus sequencing platform across major global markets, delivering higher throughput, lower per-sample sequencing costs, and integrated AI-driven analytics to accelerate whole-genome sequencing in both clinical and research applications.

- In January 2025, Thermo Fisher Scientific launched the Ion Torrent Genexus Dx Integrated Sequencer, a fully automated next-generation sequencing (NGS) platform developed for clinical diagnostics. The system enables same-day sequencing results and streamlines genomic workflows for applications in oncology and infectious disease testing.

How Genomics is Transforming Disease Detection and Personalized Healthcare

-

In traditional healthcare systems, disease diagnosis and treatment planning were largely based on clinical symptoms, basic laboratory tests, and standardized population-based treatment protocols. Genetic information was rarely used in routine practice due to the high cost of sequencing, long processing times, and limited data interpretation capabilities. As a result, many therapies followed a trial-and-error approach, often leading to delayed diagnoses, variable treatment responses, and an increased risk of adverse drug reactions.

- With the rapid advancement of next-generation sequencing (NGS), high-throughput data analysis, and advanced bioinformatics platforms, genomics has become a core component of modern healthcare. DNA and RNA sequencing now enable precise detection of genetic mutations, pathogenic variants, and inherited disease risks, significantly improving the diagnosis of rare disorders and complex conditions such as cancer, cardiovascular, and neurological diseases. These technologies are also transforming drug development and personalized medicine by enabling targeted therapies tailored to individual genetic profiles, improving treatment outcomes and reducing side effects.

|

Genomics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 202 3 |

Market Size in 2024: |

USD 43.9 BN. |

|

Forecast Period 2025-35 CAGR: |

12% |

Market Size in 2035: |

USD 152.71 BN. |

|

Segments Covered: |

By Technology |

|

|

|

By Product

|

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Genomics Market by Technology (2018-2035)

4.1 Genomics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sequencing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PCR

4.5 CRISPR

4.6 NGS Library Preparation

Chapter 5: Genomics Market by Product (2018-2035)

5.1 Genomics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Instruments

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Reagents & Consumables

5.5 Software & Services

Chapter 6: Genomics Market by Application (2018-2035)

6.1 Genomics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Functional Genomics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Epigenomics

6.5 Pharmacogenomics

6.6 Disease Diagnostics

6.7 Drug Discovery & Development

Chapter 7: Genomics Market by End-User (2018-2035)

7.1 Genomics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Academic & Research Institutions

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical & Biotechnology Companies

7.5 Hospitals & Clinics

7.6 Diagnostic Laboratories

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Genomics Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ILLUMINA INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 THERMO FISHER SCIENTIFIC INC. (U.S.)

8.4 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

8.5 DANAHER CORPORATION (U.S.)

8.6 BGI GROUP (CHINA)

8.7 OXFORD NANOPORE TECHNOLOGIES PLC (U.K.)

8.8 PACIFIC BIOSCIENCES INC. – PACBIO (U.S.)

8.9 AGILENT TECHNOLOGIES INC. (U.S.)

8.10 BIO-RAD LABORATORIES INC. (U.S.)

8.11 QIAGEN N.V. (GERMANY)

8.12 MYRIAD GENETICS INC. (U.S.)

8.13 23ANDME INC. (U.S.)

8.14 PERKINELMER INC. (U.S.)

8.15 EUROFINS SCIENTIFIC (LUXEMBOURG)

8.16 OTHER ACTIVE PLAYERS.

Chapter 9: Global Genomics Market By Region

9.1 Overview

9.2. North America Genomics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Genomics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Genomics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Genomics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Genomics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Genomics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Genomics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 202 3 |

Market Size in 2024: |

USD 43.9 BN. |

|

Forecast Period 2025-35 CAGR: |

12% |

Market Size in 2035: |

USD 152.71 BN. |

|

Segments Covered: |

By Technology |

|

|

|

By Product

|

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||