Gate Driver Integrated Circuit (IC) Market Synopsis

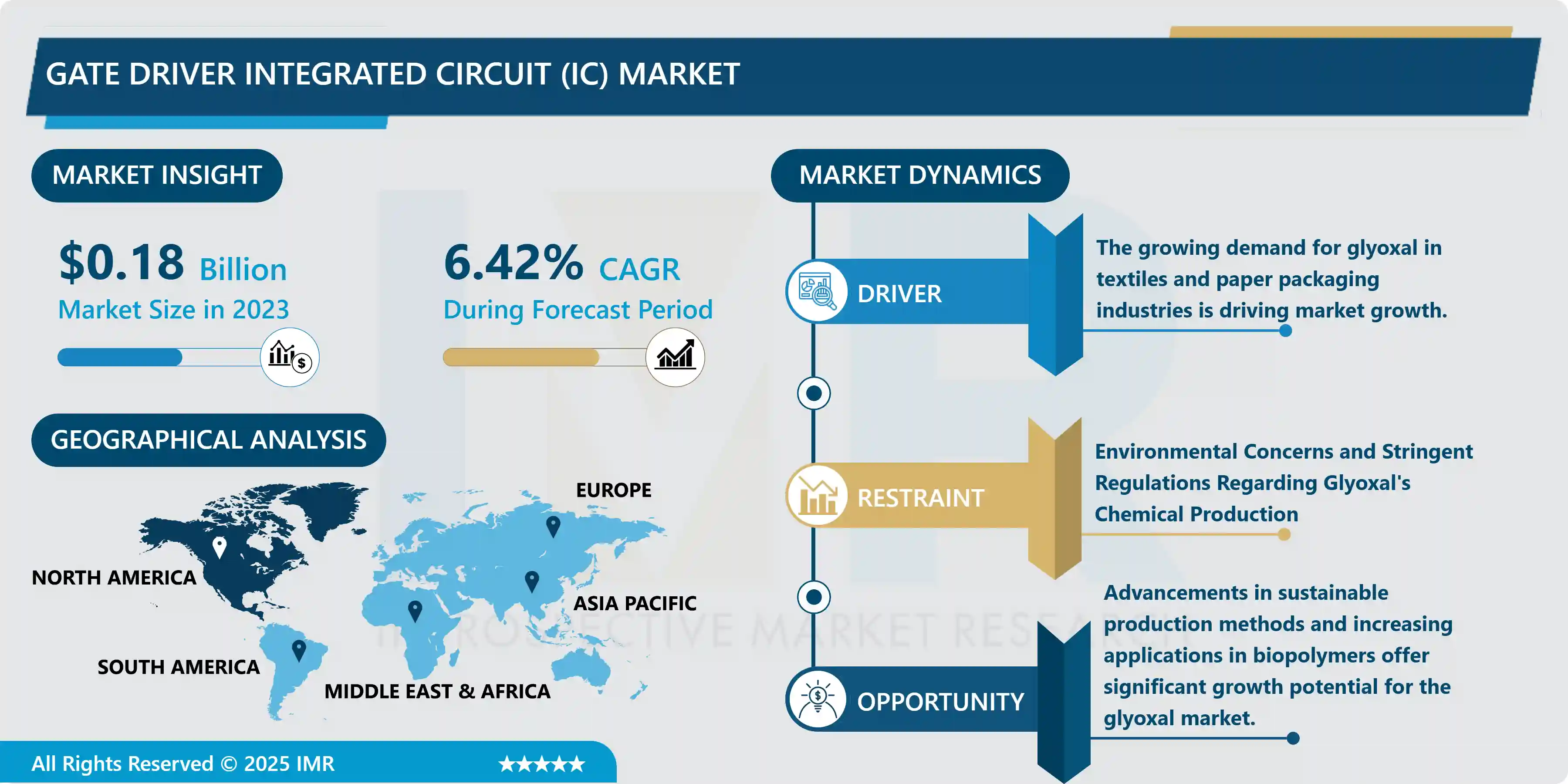

Gate Driver Integrated Circuit (IC) Market Size is Valued at USD 0.18 Billion in 2023, and is Projected to Reach USD 13.39 Billion by 2032, Growing at a CAGR of 6.42% From 2024-2032.

The Gate Driver Integrated Circuit (IC) market continues to expand vigorously for many reasons that include the increasing demands for power electronic devices in situations like automotive electric vehicles, industrial processes, and renewable energy solutions. Gate driver ICs are essential circuit elements to interface and regulate power transistors to include ; MOSFETs and IGBTs for smooth switching operations. With a consistent increase in demand for energy efficient technologies across industries, the rate for gate driver ICs has increased. They have played key roles in minimizing power losses, increasing system efficiency and making them important in today’s power control application.

In detail, the automotive field and especially EV market remain a strong driver of the gate driver IC market. Since the EV manufacturers set the targets of making the vehicles efficient and powerful, hence the gate driver IC plays a more significant role for efficient motor control and power management functions. Also, as there is increasing concern on availability of clean energy such as through use of solar and wind, which require inverters and converters commonly containing ICs for energy conversion, there has been increasing demand for these ICs in energy conversion process.

Among other regions, Asia-Pacific currently occupies the largest share of the market of gate driver ICs owing to the further development of electronics manufacturing and the growing focus on the production of electric vehicles and renewable energy sources. China, Japan, and South Korea are major producers and consumers of these components for electrical and electronic appliances. Conversely, the North America and European markets are also experiencing steady growth because of increased technological adoption and increased shifting toward industrial automation and renewable energy projects.

Gate Driver Integrated Circuit (IC) Market Trend Analysis

Rising Demand from Electric Vehicles (EVs)

- In attribute to global electric mobility, the gate driver integrated circuits demand has expanded rapidly in the past years. Since electric vehicles depend on power electronics for motor control and battery operation, gate driver ICs are critical devices for an energy conversion process and low power losses. Gate driver ICs are becoming popular with manufacturers since they improve on the performance of EVs, optimize on the energy consumption, and one the same note prolong battery life. It is expected that this trend will continue because governments continue to urge car manufacturers and owners to switch from ICE vehicles to EVs to mitigate on climate change impacts.

- In addition, driven by automotive manufacturers’ growing research investments, improvements to gate driver IC technologies are likely to shift more emphasis toward higher efficiency and reliability. This is especially true for high voltage applications as are found in EVs, the inverters and chargers for instance, for which the switching control needs to be accurate and at high speeds. As the world market for electric vehicles grows, so does the demand for gate driver ICs, which will stimulate further development in this field.

Expansion of Renewable Energy Applications

- Solar and wind power systems are being adopted globally at a rapid pace and this has put pressure on gate driver ICs. These ICs play crucial roles in determining the operation of inverters & converters used in renewable power systems for DC-AC conversion. As the number of countries aiming to increase the generation capacities of renewable energy resources, especially of Asia-Pacific and European countries, is scaling up, there is a growing demand for power management solution.

- The developments on renewable energy scale make gate driver ICs be adapted to high power density and efficiency. Recent trends on wide-bandgap semiconductors including SiC and GaN also play their roles to determine the gate driver ICs to occur high frequency switching and low power dissipation. This trend is likely to persist as governments around the world shift towards the use of clean energy sources, thus increasing the demand for optimized gate driver ICs in residential and commercial renewable power systems.

Gate Driver Integrated Circuit (IC) Market Segment Analysis:

- Gate Driver Integrated Circuit (IC) Market Segmented on the basis of By Transistor Type, By Semiconductor Material, By Mode of Attachment , By Isolation Technique and By Application

By Transistor Type, MOSFET segment is expected to dominate the market during the forecast period

- The Gate Driver Integrated Circuit (IC) Market, with respect with transistor kind, can be divided into Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFET) and Insulated-Gate Bipolar Transistors (IGBT). MOSFET gate driver ICs are commonly employed in low to medium power Signal switching applications including consumer electronics, communication products, industrial control equipment and the like because of highs. MOSFET gate driver ICs are commonly employed in low power to medium power Signal switching applications involving various Consumer electronics, telecommunications equipment and industrial control devices and systems and the like because of high S. The increasing usage of MOSFET based gate drivers is due to the increasing requirement of small form factor, high efficiency devices and the increasing trend in EV industry. Due to emerging high voltage and high frequency operations, the demand for efficient heat sinking and reduction in conduction loss, MOSFET gate driver ICs are being developed for applications that need accurate control at high switching speeds.

- At the same time, IGBT gate driver ICs are used in power applications, for example, in renewable power systems, industrial motor applications, and traction systems due to their better capabilities of providing higher voltage and current levels. The increasing concern with the development of renewable power sources such as solar and wind energy is also driving the growth of IGBT gate drivers that are proving resistant enough for power electronics systems in large applications. Consequently, the expansion of new technologies in industries, along with consistent development in the semiconductors technology thereby promoting reduction in power losses is expected to create a reasonable growth for the IGBT gate driver IC market.

By Application, Residential segment held the largest share in 2023

- The Gate Driver Integrated Circuit (IC) market is widely used for various applications like residential, industrial and commercial areas. Within the residential subsegment, gate driver ICs are on the rise in consumer electronics, home appliances and energy management. In recent years, gate driver ICs have become vital components owing to smart homes, and energy-efficient devices such as inverters for the solar power system and energy storage units. With the new trend of using renewable energy and automation in residential consumers, the market for gate driver ICs in this segment is likely to expand.

- Gate driver ICs are used in the industrial and commercial segment in heavy machinery, motor control circuit and industrial applications. These industries require high-performance gate driver IC that improves energy efficiency, reduces power loss and system reliability. Further, in cars, gate driver ICs are used for the control of HVACs, lighting or any other large load management in commercial buildings. The large scale application of energy efficient power electronics in industrial and commercial applications creates the need for highly efficient gate driver IC solutions worldwide.

Gate Driver Integrated Circuit (IC) Market Regional Insights:

North America dominates the gate driver integrated circuit (IC) market

- North America holds the largest share in the gate driver integrated circuit (IC) market because of its developed technological system and active implementation of electric vehicles (EVs) and sustainable power systems. This region works with some of the major semiconductor companies which have played central roles for developments in solutions to power management especially for high performance products. The rising adoption of EVs because of the environmental standard laws and incentives by the government has also fuelled the demand of gate driver ICs in automotive industry heavily. Furthermore, the US and Canada have been spending a lot in renewable power solutions for instance; solar and wind where gate driver ICs are needed so as to control energy conversion and optimization of a system.

- In fact, currently the consumer electronics and industrial markets in North America are also boosting the growth of the gate driver IC market. Locally, the need for high effective power electronics is increased in topics such as industry automation, home automation and other consumer applications. Having several market players like Texas Instruments and ON Semiconductor make the market even stronger; with various researchers dedicating time and resources in finding ways and means of making gate driver ICs much better. Industry in North America is inclined toward wide usage of advanced technologies such as wide-bandgap semiconductors like SiC and GaN and thus, the market for gate driver IC is anticipated to grow further to sustain the domination of the North American industry in the global market.

Active Key Players in the Gate Driver Integrated Circuit (IC) Market

- Infineon Technologies AG (Germany)

- Mitsubishi Electric Corporation (Japan),

- NXP Semiconductor (Netherlands),

- Semiconductor Components Industries, LLC (U.S.),

- ROHM CO., LTD. (Japan),

- Renesas Electronics Corporation (Japan),

- STMicroelectronics (Switzerland),

- Texas Instruments Incorporated (U.S.),

- Semtech (U.S.),

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan),

- Hitachi Power Semiconductor Device, Ltd. (Japan),

- V. P. Electronics (India),

- PERFECT OPTRONICS LIMITED (Hong Kong),

- Princeton Technology Corporation (Taiwan).

- others

|

Global Gate Driver Integrated Circuit (IC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.42% |

Market Size in 2032: |

USD 13.39 Bn. |

|

Segments Covered: |

By Transistor Type |

|

|

|

By Semiconductor Material |

|

||

|

By Mode of Attachment |

|

||

|

By Isolation Technique |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gate Driver Integrated Circuit (IC) Market by Transistor Type (2018-2032)

4.1 Gate Driver Integrated Circuit (IC) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 MOSFET

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 IGBT

Chapter 5: Gate Driver Integrated Circuit (IC) Market by Semiconductor Material (2018-2032)

5.1 Gate Driver Integrated Circuit (IC) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 SiC

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 GaN

Chapter 6: Gate Driver Integrated Circuit (IC) Market by Mode of Attachment (2018-2032)

6.1 Gate Driver Integrated Circuit (IC) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On-chip

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Discrete

Chapter 7: Gate Driver Integrated Circuit (IC) Market by Isolation Technique (2018-2032)

7.1 Gate Driver Integrated Circuit (IC) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Magnetic Isolation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Capacitive Isolation

7.5 Optical Isolation

Chapter 8: Gate Driver Integrated Circuit (IC) Market by Applications (2018-2032)

8.1 Gate Driver Integrated Circuit (IC) Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Residential

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Industrial

8.5 Commercial

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Gate Driver Integrated Circuit (IC) Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 INFINEON TECHNOLOGIES AG (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MITSUBISHI ELECTRIC CORPORATION (JAPAN) NXP SEMICONDUCTOR (NETHERLANDS) SEMICONDUCTOR COMPONENTS INDUSTRIES

9.4 LLC (U.S.) ROHM COLTD. (JAPAN) RENESAS ELECTRONICS CORPORATION (JAPAN) STMICROELECTRONICS (SWITZERLAND) TEXAS INSTRUMENTS INCORPORATED (U.S.) SEMTECH (U.S.) TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (JAPAN) HITACHI POWER SEMICONDUCTOR DEVICE LTD. (JAPAN) V. P. ELECTRONICS (INDIA) PERFECT OPTRONICS LIMITED (HONG KONG) PRINCETON TECHNOLOGY CORPORATION (TAIWAN)OTHERS

9.5

Chapter 10: Global Gate Driver Integrated Circuit (IC) Market By Region

10.1 Overview

10.2. North America Gate Driver Integrated Circuit (IC) Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Transistor Type

10.2.4.1 MOSFET

10.2.4.2 IGBT

10.2.5 Historic and Forecasted Market Size by Semiconductor Material

10.2.5.1 SiC

10.2.5.2 GaN

10.2.6 Historic and Forecasted Market Size by Mode of Attachment

10.2.6.1 On-chip

10.2.6.2 Discrete

10.2.7 Historic and Forecasted Market Size by Isolation Technique

10.2.7.1 Magnetic Isolation

10.2.7.2 Capacitive Isolation

10.2.7.3 Optical Isolation

10.2.8 Historic and Forecasted Market Size by Applications

10.2.8.1 Residential

10.2.8.2 Industrial

10.2.8.3 Commercial

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Gate Driver Integrated Circuit (IC) Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Transistor Type

10.3.4.1 MOSFET

10.3.4.2 IGBT

10.3.5 Historic and Forecasted Market Size by Semiconductor Material

10.3.5.1 SiC

10.3.5.2 GaN

10.3.6 Historic and Forecasted Market Size by Mode of Attachment

10.3.6.1 On-chip

10.3.6.2 Discrete

10.3.7 Historic and Forecasted Market Size by Isolation Technique

10.3.7.1 Magnetic Isolation

10.3.7.2 Capacitive Isolation

10.3.7.3 Optical Isolation

10.3.8 Historic and Forecasted Market Size by Applications

10.3.8.1 Residential

10.3.8.2 Industrial

10.3.8.3 Commercial

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Gate Driver Integrated Circuit (IC) Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Transistor Type

10.4.4.1 MOSFET

10.4.4.2 IGBT

10.4.5 Historic and Forecasted Market Size by Semiconductor Material

10.4.5.1 SiC

10.4.5.2 GaN

10.4.6 Historic and Forecasted Market Size by Mode of Attachment

10.4.6.1 On-chip

10.4.6.2 Discrete

10.4.7 Historic and Forecasted Market Size by Isolation Technique

10.4.7.1 Magnetic Isolation

10.4.7.2 Capacitive Isolation

10.4.7.3 Optical Isolation

10.4.8 Historic and Forecasted Market Size by Applications

10.4.8.1 Residential

10.4.8.2 Industrial

10.4.8.3 Commercial

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Gate Driver Integrated Circuit (IC) Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Transistor Type

10.5.4.1 MOSFET

10.5.4.2 IGBT

10.5.5 Historic and Forecasted Market Size by Semiconductor Material

10.5.5.1 SiC

10.5.5.2 GaN

10.5.6 Historic and Forecasted Market Size by Mode of Attachment

10.5.6.1 On-chip

10.5.6.2 Discrete

10.5.7 Historic and Forecasted Market Size by Isolation Technique

10.5.7.1 Magnetic Isolation

10.5.7.2 Capacitive Isolation

10.5.7.3 Optical Isolation

10.5.8 Historic and Forecasted Market Size by Applications

10.5.8.1 Residential

10.5.8.2 Industrial

10.5.8.3 Commercial

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Gate Driver Integrated Circuit (IC) Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Transistor Type

10.6.4.1 MOSFET

10.6.4.2 IGBT

10.6.5 Historic and Forecasted Market Size by Semiconductor Material

10.6.5.1 SiC

10.6.5.2 GaN

10.6.6 Historic and Forecasted Market Size by Mode of Attachment

10.6.6.1 On-chip

10.6.6.2 Discrete

10.6.7 Historic and Forecasted Market Size by Isolation Technique

10.6.7.1 Magnetic Isolation

10.6.7.2 Capacitive Isolation

10.6.7.3 Optical Isolation

10.6.8 Historic and Forecasted Market Size by Applications

10.6.8.1 Residential

10.6.8.2 Industrial

10.6.8.3 Commercial

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Gate Driver Integrated Circuit (IC) Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Transistor Type

10.7.4.1 MOSFET

10.7.4.2 IGBT

10.7.5 Historic and Forecasted Market Size by Semiconductor Material

10.7.5.1 SiC

10.7.5.2 GaN

10.7.6 Historic and Forecasted Market Size by Mode of Attachment

10.7.6.1 On-chip

10.7.6.2 Discrete

10.7.7 Historic and Forecasted Market Size by Isolation Technique

10.7.7.1 Magnetic Isolation

10.7.7.2 Capacitive Isolation

10.7.7.3 Optical Isolation

10.7.8 Historic and Forecasted Market Size by Applications

10.7.8.1 Residential

10.7.8.2 Industrial

10.7.8.3 Commercial

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Gate Driver Integrated Circuit (IC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.42% |

Market Size in 2032: |

USD 13.39 Bn. |

|

Segments Covered: |

By Transistor Type |

|

|

|

By Semiconductor Material |

|

||

|

By Mode of Attachment |

|

||

|

By Isolation Technique |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||