Gaming Market Synopsis

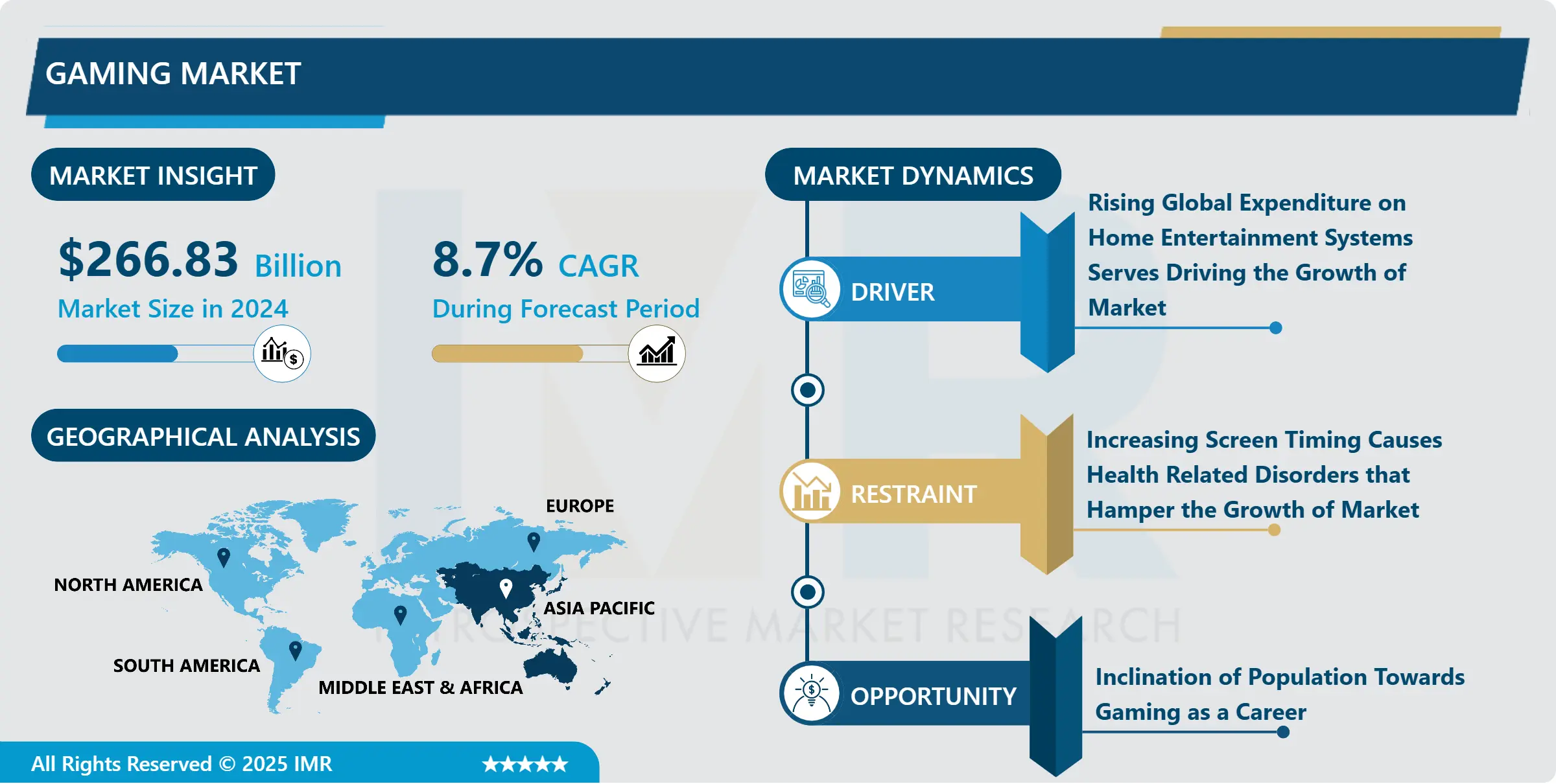

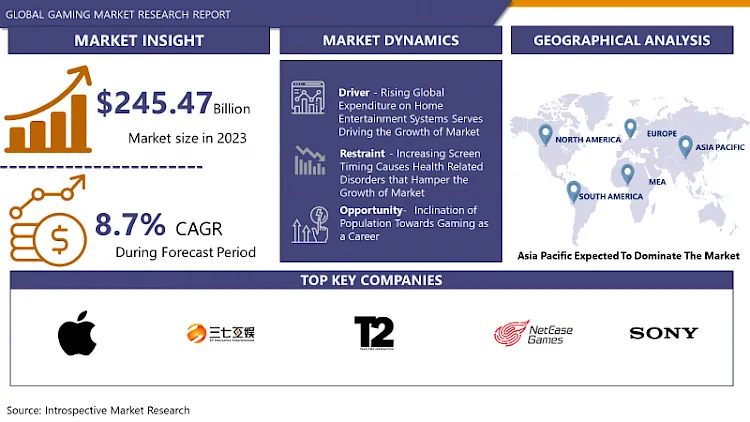

Gaming Market Size Was Valued at USD 266.83 Billion in 2024, and is Projected to Reach USD 520.08 Billion by 2032, Growing at a CAGR of 8.7% From 2025-2032.

Gaming is referred to as playing electronic games conducted through several varieties of means, such as through the application of computers, mobile phones, consoles, or other mediums altogether. There is a rising prevalence of high-speed internet connections, primarily in developing economies, which has made online gaming practical for more individuals in recent years. Game developers in developing countries are continually striving to improve the gamer's experience by launching and rewriting codes for diverse console/platforms, such as PlayStation, Xbox, and Windows PC, incorporated into a standalone product provided to gamers through a cloud platform.

The gaming market is experiencing significant growth due to several interconnected factors that have converged to create a thriving industry. Technological advancements have played a pivotal role in shaping the landscape of gaming, with the continuous improvement of hardware capabilities and graphics rendering technologies. This has allowed developers to create more immersive and visually stunning gaming experiences, attracting a broader audience.

The proliferation of high-speed internet and the widespread availability of online gaming platforms have facilitated the rise of multiplayer and online gaming. This connectivity has transformed gaming from a solitary activity to a social experience, enabling players to connect and compete with others globally. The rise of esports, organized competitive gaming, has further fueled the growth by turning gaming into a spectator sport, drawing millions of viewers and creating lucrative opportunities for sponsors and advertisers.

Additionally, the gaming industry has embraced diverse business models such as free-to-play, microtransactions, and subscription services. These models have not only increased revenue streams but have also made gaming more accessible to a wider audience, lowering the barrier to entry.

Gaming Market Trend Analysis

Rising Global Expenditure on Home Entertainment Systems Serves Driving the Growth of Market

- The advancements in technology have led to the development of sophisticated gaming consoles, high-performance PCs, and virtual reality (VR) systems, providing users with an immersive gaming experience within the comfort of their homes. These cutting-edge technologies have not only enhanced the overall gaming quality but have also spurred interest among a broader demographic, attracting both seasoned gamers and newcomers alike. ?

- Furthermore, the global shift towards remote work and entertainment due to various factors, including the COVID-19 pandemic, has led to an increased focus on home-based leisure activities. As individuals spend more time at home, there is a growing inclination to invest in entertainment systems that offer diverse and engaging experiences, with gaming being a prime choice. Home entertainment systems have evolved beyond traditional gaming consoles to include streaming services, cloud gaming platforms, and mobile gaming, providing a versatile array of options for consumers. ?

- The rise of esports has also played a pivotal role in driving the gaming market. Esports has transformed from niche competitions to mainstream entertainment, with a dedicated fan base and lucrative sponsorship deals. As a result, individuals are investing in high-quality gaming setups to not only play but also spectate and participate in esports events from the comfort of their homes. This has contributed to the growth of the gaming ecosystem, encouraging manufacturers to produce innovative and competitive gaming hardware.

Inclination of Population Towards Gaming as a Career

- Esports, or competitive video gaming, has evolved from a niche subculture into a mainstream phenomenon with a massive global audience. The allure of professional gaming has captivated individuals, primarily the younger demographic, who see it not just as a form of entertainment but as a viable career path. Tournaments for popular games like League of Legends, Dota 2, and Counter-Strike: Global Offensive now boast multimillion-dollar prize pools, providing players with the potential for substantial earnings.

- Moreover, the rise of online streaming platforms, such as Twitch and YouTube Gaming, has democratized the process of becoming a gaming influencer or content creator. Aspiring gamers can now showcase their skills, engage with an audience, and monetize their content through various channels. This avenue has not only attracted gamers but has also created a new breed of celebrities within the gaming community, further fueling the desire for a career in gaming.

- The increasing recognition of gaming as a legitimate sport by educational institutions has further legitimized pursuing a career in gaming. Some universities now offer scholarships for esports athletes, acknowledging the skill, dedication, and strategic thinking required to succeed in competitive gaming. This academic validation has contributed to a shift in societal perceptions, encouraging individuals to pursue gaming not just as a hobby but as a legitimate and respected profession.

Gaming Market Segment Analysis:

Gaming Market Segmented on the basis of Type, Application, Device type, and Region

By Type, Online segment is expected to dominate the market during the forecast period

- Advancements in technology have facilitated seamless online connectivity, enabling gamers to engage in multiplayer experiences with ease. The rise of high-speed internet and widespread access to reliable connections has further fueled this growth. Additionally, the popularity of esports and competitive gaming has attracted a massive audience, driving increased participation in online multiplayer games. The proliferation of digital distribution platforms and the shift towards subscription-based models have also contributed to the online gaming boom.

By End-User, Men segment held the largest share in 2024

- The widespread accessibility of gaming platforms, including consoles, PCs, and mobile devices, has expanded the user base. Additionally, advancements in technology have led to more immersive and high-quality gaming experiences, attracting a broader audience. The rise of online multiplayer games and social gaming has also contributed to the growth, fostering a sense of community and collaboration among players. Furthermore, the COVID-19 pandemic accelerated the trend, with lockdowns prompting increased interest in at-home entertainment.

Gaming Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region accounted for the largest share in the market in 2022. Further in the Asia-Pacific gaming market, China accounted for the largest share in 2022. The rest of Asia-Pacific is anticipated to witness the fastest CAGR over the forecast period. China is one of the major countries in Asia-Pacific, which has a growing technological adoption. The country is home to one of the fastest internet bands and strong players like Tencent and NetEase, Tencent, and others. The country's growing exports and constant innovation practices in new games and consoles are major drivers of gaming in the country.

- The increased adoption of video streaming apps on mobile devices and televisions, to watch movies, TV shows, and live events on-demand, has driven the demand for the gaming industry in the United States country.

Gaming Market Top Key Players:

- Apple Inc. (USA)

- 37 Interactive Entertainment (China)

- Take-Two Interactive Software Inc. (USA)

- NetEase Inc. (China)

- Sony Corporation (Japan)

- Google LLC (Alphabet Inc.) (USA)

- Beijing Kunlun Technology Co. Ltd (China)

- Bandai Namco Entertainment Inc. (Japan)

- Nexon Company (Japan)

- Nintendo Co. Ltd (Japan)

- Activision Blizzard Inc. (USA)

- Electronic Arts Inc. (USA)

- Ubisoft Entertainment SA (France)

- Square Enix Holdings Co. Ltd (Japan)

- ZeptoLab OOO (Russia)

- Tencent Holdings Ltd (China)

- Sega Games Co. Ltd (Japan)

- Capcom Co. Ltd (Japan)

- Microsoft Corporation (USA)

Key Industry Developments in the Gaming Market:

- In January 2023, the biggest gaming news of 2023 was undoubtedly the closing of Microsoft's mammoth $68.7 billion acquisition of Activision Blizzard. This deal, initially announced in 2022, grants Microsoft ownership of iconic franchises like Call of Duty, Overwatch, and World of Warcraft, significantly boosting its position in the console and mobile gaming markets.

- In January 2023, Take-Two Interactive concluded its $12.7 billion acquisition of Zynga, the company behind FarmVille and Words with Friends. This deal solidifies Take-Two's position as a leader in mobile gaming and diversifies its portfolio within the casual games space.

|

Global Gaming Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 266.83 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 520.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gaming Market by Type (2018-2032)

4.1 Gaming Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Online

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Offline

Chapter 5: Gaming Market by End User (2018-2032)

5.1 Gaming Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Men

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Women

Chapter 6: Gaming Market by Device Type (2018-2032)

6.1 Gaming Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mobile Phones

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Console

6.5 Computer

6.6 Tablets

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Gaming Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ICON INC. (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALMAC GROUP (UK)

7.4 CHARLES RIVER LABORATORY (UNITED STATES)

7.5 MICROCHEM LABORATORY (UNITED STATES)

7.6 WUXI APP TEC (CHINA)

7.7 INTERTEK GROUP PLC (UK)

7.8 MERCK KGAA (GERMANY)

7.9 SARTORIUS AG (GERMANY)

7.10 NELSON LABORATORIES (UNITED STATES)

7.11 EUROFINS SCIENTIFIC (LUXEMBOURG)

7.12 OTHER KEY PLAYERS

Chapter 8: Global Gaming Market By Region

8.1 Overview

8.2. North America Gaming Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Online

8.2.4.2 Offline

8.2.5 Historic and Forecasted Market Size by End User

8.2.5.1 Men

8.2.5.2 Women

8.2.6 Historic and Forecasted Market Size by Device Type

8.2.6.1 Mobile Phones

8.2.6.2 Console

8.2.6.3 Computer

8.2.6.4 Tablets

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Gaming Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Online

8.3.4.2 Offline

8.3.5 Historic and Forecasted Market Size by End User

8.3.5.1 Men

8.3.5.2 Women

8.3.6 Historic and Forecasted Market Size by Device Type

8.3.6.1 Mobile Phones

8.3.6.2 Console

8.3.6.3 Computer

8.3.6.4 Tablets

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Gaming Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Online

8.4.4.2 Offline

8.4.5 Historic and Forecasted Market Size by End User

8.4.5.1 Men

8.4.5.2 Women

8.4.6 Historic and Forecasted Market Size by Device Type

8.4.6.1 Mobile Phones

8.4.6.2 Console

8.4.6.3 Computer

8.4.6.4 Tablets

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Gaming Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Online

8.5.4.2 Offline

8.5.5 Historic and Forecasted Market Size by End User

8.5.5.1 Men

8.5.5.2 Women

8.5.6 Historic and Forecasted Market Size by Device Type

8.5.6.1 Mobile Phones

8.5.6.2 Console

8.5.6.3 Computer

8.5.6.4 Tablets

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Gaming Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Online

8.6.4.2 Offline

8.6.5 Historic and Forecasted Market Size by End User

8.6.5.1 Men

8.6.5.2 Women

8.6.6 Historic and Forecasted Market Size by Device Type

8.6.6.1 Mobile Phones

8.6.6.2 Console

8.6.6.3 Computer

8.6.6.4 Tablets

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Gaming Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Online

8.7.4.2 Offline

8.7.5 Historic and Forecasted Market Size by End User

8.7.5.1 Men

8.7.5.2 Women

8.7.6 Historic and Forecasted Market Size by Device Type

8.7.6.1 Mobile Phones

8.7.6.2 Console

8.7.6.3 Computer

8.7.6.4 Tablets

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Gaming Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 266.83 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 520.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||