Functional Milk Replacers Market Synopsis

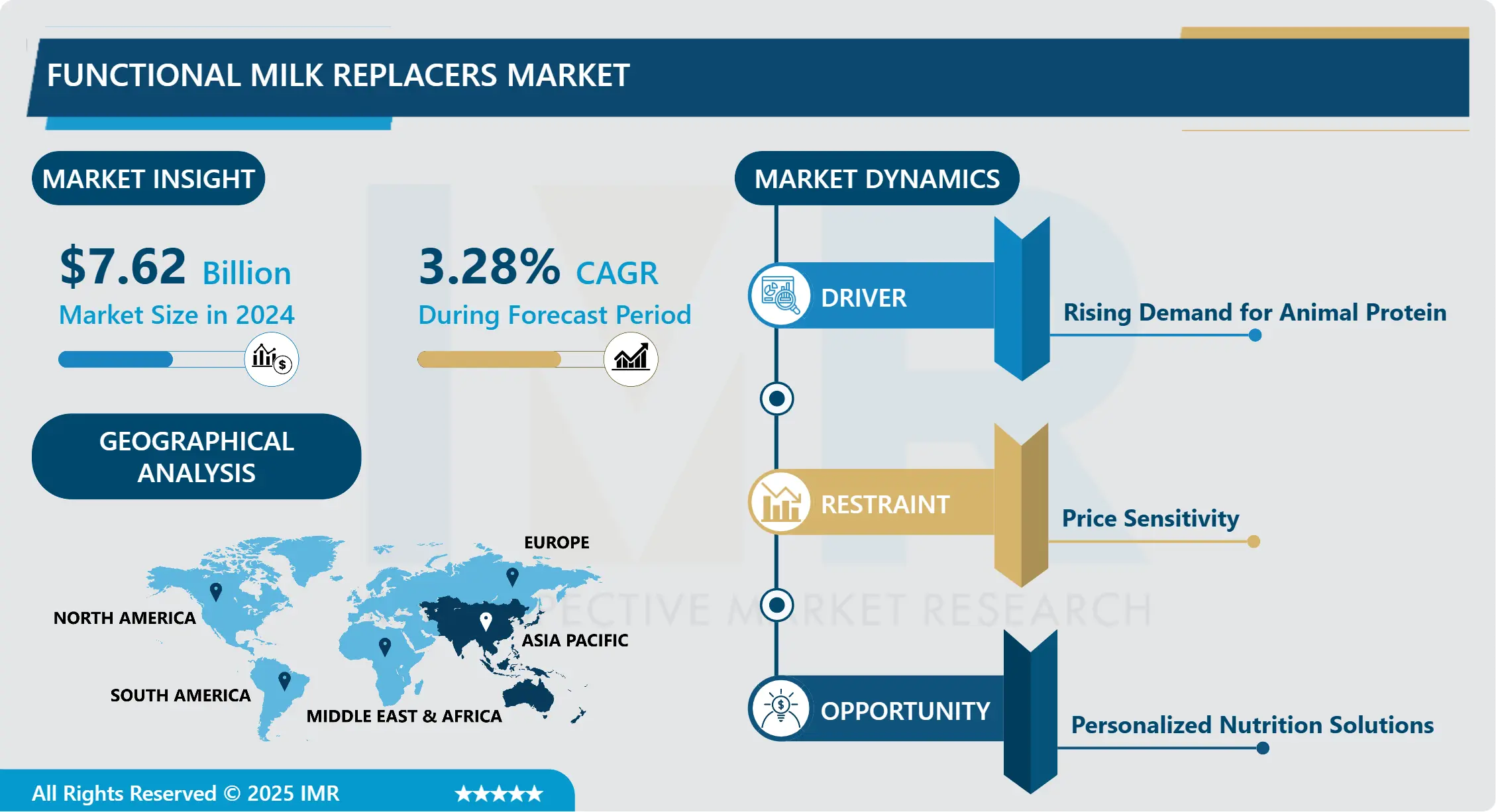

Global Functional Milk Replacers Market Size Was Valued at USD 7.62 Billion in 2024 and is Projected to Reach USD 9.87 Billion by 2032, Growing at a CAGR of 3.28% From 2025-2032.

Functional milk replacers are specialized products designed to replace or supplement traditional milk in various applications. They serve as alternatives to natural milk in situations where specific nutritional, functional, or economic benefits are desired. These replacers are commonly used in animal husbandry, especially in rearing young animals like calves, piglets, or lambs, where they mimic the nutritional composition of natural milk.

The formulation of functional milk replacers involves a blend of ingredients such as proteins, fats, carbohydrates, vitamins, and minerals to closely resemble the nutritional profile of natural milk. They aim to provide essential nutrients crucial for the growth and development of young animals, ensuring they receive adequate nourishment when maternal milk is unavailable or insufficient.

These replacers offer several advantages, including improved digestibility, reduced risk of disease transmission, and enhanced growth rates. Additionally, they offer greater control over nutrient composition, enabling customization to meet specific dietary requirements for different animal species or stages of growth.

Functional milk replacers play a vital role in animal agriculture by supporting healthy development and minimizing reliance on natural milk, contributing to more efficient and sustainable livestock production systems.

Functional Milk Replacers Market Trend Analysis

Rising Demand for Animal Protein

- With an expanding global population and evolving dietary preferences, there is a consequential surge in the consumption of animal-based protein sources. This surge is driven by various factors, including rising incomes, urbanization, and dietary shifts in emerging economies, leading to an increased preference for meat and dairy products.

- Functional milk replacers play a pivotal role in meeting this demand by facilitating efficient livestock production. They enable farmers to rear young animals, such as calves, piglets, and lambs, by providing essential nutrients necessary for their growth and development. This reliance on milk replacers contributes to the production of high-quality meat and dairy products, catering to the growing appetite for animal protein in the market.

- Furthermore, these replacers offer a viable solution to augment livestock output without solely depending on natural milk resources. By enhancing growth rates and supporting healthy animal development, milk replacers become instrumental in meeting the escalating global demand for animal protein while ensuring efficient and sustainable livestock production practices. As a result, the increasing demand for animal protein serves as a significant catalyst propelling the growth trajectory of the functional milk replacer market.

Personalized Nutrition Solutions

- As consumer awareness about the impact of diet on health grows, there's an increasing demand for tailored nutritional options. Functional milk replacers offer a platform for customization, allowing for precise adjustments in nutrient compositions to meet specific dietary needs of different animal species or individual requirements based on health or developmental stages.

- This personalized approach to nutrition aligns with evolving consumer preferences for products that cater to unique health considerations, such as organic, allergen-free, or specialized diets. Milk replacers, with their adaptable formulation capabilities, can address these demands, providing targeted solutions that enhance animal health, growth, and overall well-being.

- Moreover, advancements in technology and data analytics enable a deeper understanding of individual nutritional requirements in livestock. This facilitates the development of more precise and effective formulations, optimizing animal performance while minimizing waste and environmental impact.

- The opportunity to offer personalized nutrition solutions through functional milk replacers not only meets the demand for specialized diets but also aligns with the broader trend towards individualized health and wellness across the agricultural sector, fostering growth and innovation in the market.

Functional Milk Replacers Market Segment Analysis:

Functional Milk Replacers Market Segmented on the basis of source, type, form and distribution channel.

By Type, Non-Milk Source segment is expected to dominate the market during the forecast period

-

The Non-Milk Source segment is anticipated to emerge as a dominant force in the functional milk replacer market during the forecast period. This projection is fueled by several factors, including the growing preference for alternative sources of nutrition, especially among consumers seeking dairy-free or lactose-intolerant options. Non-milk sources, such as plant-based proteins (soy, pea, and rice), offer viable alternatives that mimic the nutritional composition of natural milk, catering to diverse dietary needs and preferences.

- Additionally, advancements in technology and research have led to the development of non-milk-based formulations with improved nutritional profiles, making them increasingly competitive in terms of efficacy and functionality compared to traditional milk-based replacers. The versatility of non-milk sources allows for customization to meet specific animal requirements, driving their adoption across various livestock-rearing practices and contributing significantly to the market's growth during the forecast period.

By Form, Powder segment held the largest market share in 2023

- The Powder segment has secured the largest market share within the functional milk replacer market due to several contributing factors. Powdered formulations offer numerous advantages, including longer shelf life, ease of storage, transportation convenience, and cost-effectiveness compared to other forms such as liquid or gel-based replacers. This form allows for better preservation of nutritional integrity and facilitates precise dosage measurements, ensuring consistent nutrient delivery to young animals.

- Furthermore, powdered milk replacers possess a higher degree of versatility in application across various animal species and production systems. Their adaptability and ease of mixing with water or other feed ingredients make them a preferred choice for livestock farmers worldwide.

- The demand for powdered functional milk replacers is also driven by their ability to be easily manufactured in bulk, catering to the substantial requirements of large-scale livestock operations. This segment's dominance in the market is expected to persist due to its practicality, cost-efficiency, and widespread applicability in animal husbandry practices.

Functional Milk Replacers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to exert dominance over the functional milk replacer market throughout the forecast period. Several key factors contribute to this projection. Firstly, the region's burgeoning population, rapid urbanization, and rising disposable incomes are propelling increased demand for animal protein. This surge in demand for meat and dairy products creates a substantial market for functional milk replacers that aid in efficient livestock rearing.

- Moreover, Asia Pacific countries exhibit a significant livestock farming industry, including dairy and meat production. The adoption of innovative agricultural practices and technological advancements further fuels the use of functional milk replacers to improve livestock health and productivity. Additionally, the region's growing awareness of the benefits of specialized animal nutrition, coupled with an increasing preference for sustainable and efficient farming practices, amplifies the market potential for functional milk replacers.

- The presence of key market players investing in research and development, along with favorable government initiatives supporting livestock production, positions Asia Pacific as the dominant force driving the growth of the functional milk replacer market in the foreseeable future.

Functional Milk Replacers Market Top Key Players:

- Adm (U.S.)

- Alltech (U.S.)

- Amore Proteins (India)

- Bongrain Group (France)

- Cargill Incorporated (U.S.)

- Chs Inc.(U.S.)

- Frieslandcampina (Netherlands)

- Glanbia Plc (Ireland)

- Lactalis Group (France)

- Land O' Lakes (U.S.)

- Maxcare (India)

- Nutreco N.V. (Netherlands)

- Provico Pty. Ltd (Australia)

- Purina Animal Nutrition Llc (U.S.)

- Roquette Frères (France)

- Strauss Feeds (U.S.)

- Trouw Nutrition Gb (U.K.)

- Vandrie Group (Netherlands)

- Viafield (U.S.) and Other Major Players

Key Industry Developments in the Functional Milk Replacers Market:

- In March 2023, Dairy Farmers of America (DFA) launched ‘first-ever’ probiotics-fortified UHT milk as an affordable alternative to kefir, kombucha.

- In August 2022, Maxcare launches three new products in the New Zealand market. The product range includes Maxcare Electrolyte premium, Maxcare probiotic paste premium, and Maxcare whole milk additive. All these products are specifically formulated using high-quality ingredients to ensure optimum health & nutrition in infant animals.

|

Functional Milk Replacers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.28% |

Market Size in 2032: |

USD 9.87 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Type |

|

||

|

By Form |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Functional Milk Replacers Market by Source (2018-2032)

4.1 Functional Milk Replacers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Milk Sources

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Milk Sources

4.5 Blended

Chapter 5: Functional Milk Replacers Market by Type (2018-2032)

5.1 Functional Milk Replacers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Instantized Formula

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Instantized Formula

Chapter 6: Functional Milk Replacers Market by Form (2018-2032)

6.1 Functional Milk Replacers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Powder

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

Chapter 7: Functional Milk Replacers Market by Distribution Channels (2018-2032)

7.1 Functional Milk Replacers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hypermarket/Supermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Store

7.5 Convenience Store

7.6 Online Retail

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Functional Milk Replacers Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SOLPAK

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CAMBRO

8.4 MOLDED FIBER GLASS TRAY COMPANY

8.5 FAERCH A/S

8.6 SONOCO PRODUCTS COMPANY

8.7 HEAT SEALING INCWALLACE PACKAGING

8.8 GOOD START PACKAGING

8.9 ARAVEN S.LAL BAYADER INTERNATIONAL

8.10 HUHTAMAKI

8.11 PACTIV EVERGREEN

8.12 NOVOLEX

8.13 GRAPHIC PACKAGING INTERNATIONAL

8.14 DART CONTAINER CORPORATION

8.15 SEALED AIR CORPORATION

8.16 PLACON

8.17 TRAY-PAK CORPORATION

8.18 RANDELL

8.19 MERICO

8.20 AND OTHER ACTIVE PLAYER

Chapter 9: Global Functional Milk Replacers Market By Region

9.1 Overview

9.2. North America Functional Milk Replacers Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Source

9.2.4.1 Milk Sources

9.2.4.2 Non-Milk Sources

9.2.4.3 Blended

9.2.5 Historic and Forecasted Market Size by Type

9.2.5.1 Instantized Formula

9.2.5.2 Non-Instantized Formula

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Powder

9.2.6.2 Liquid

9.2.7 Historic and Forecasted Market Size by Distribution Channels

9.2.7.1 Hypermarket/Supermarket

9.2.7.2 Specialty Store

9.2.7.3 Convenience Store

9.2.7.4 Online Retail

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Functional Milk Replacers Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Source

9.3.4.1 Milk Sources

9.3.4.2 Non-Milk Sources

9.3.4.3 Blended

9.3.5 Historic and Forecasted Market Size by Type

9.3.5.1 Instantized Formula

9.3.5.2 Non-Instantized Formula

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Powder

9.3.6.2 Liquid

9.3.7 Historic and Forecasted Market Size by Distribution Channels

9.3.7.1 Hypermarket/Supermarket

9.3.7.2 Specialty Store

9.3.7.3 Convenience Store

9.3.7.4 Online Retail

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Functional Milk Replacers Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Source

9.4.4.1 Milk Sources

9.4.4.2 Non-Milk Sources

9.4.4.3 Blended

9.4.5 Historic and Forecasted Market Size by Type

9.4.5.1 Instantized Formula

9.4.5.2 Non-Instantized Formula

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Powder

9.4.6.2 Liquid

9.4.7 Historic and Forecasted Market Size by Distribution Channels

9.4.7.1 Hypermarket/Supermarket

9.4.7.2 Specialty Store

9.4.7.3 Convenience Store

9.4.7.4 Online Retail

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Functional Milk Replacers Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Source

9.5.4.1 Milk Sources

9.5.4.2 Non-Milk Sources

9.5.4.3 Blended

9.5.5 Historic and Forecasted Market Size by Type

9.5.5.1 Instantized Formula

9.5.5.2 Non-Instantized Formula

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Powder

9.5.6.2 Liquid

9.5.7 Historic and Forecasted Market Size by Distribution Channels

9.5.7.1 Hypermarket/Supermarket

9.5.7.2 Specialty Store

9.5.7.3 Convenience Store

9.5.7.4 Online Retail

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Functional Milk Replacers Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Source

9.6.4.1 Milk Sources

9.6.4.2 Non-Milk Sources

9.6.4.3 Blended

9.6.5 Historic and Forecasted Market Size by Type

9.6.5.1 Instantized Formula

9.6.5.2 Non-Instantized Formula

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Powder

9.6.6.2 Liquid

9.6.7 Historic and Forecasted Market Size by Distribution Channels

9.6.7.1 Hypermarket/Supermarket

9.6.7.2 Specialty Store

9.6.7.3 Convenience Store

9.6.7.4 Online Retail

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Functional Milk Replacers Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Source

9.7.4.1 Milk Sources

9.7.4.2 Non-Milk Sources

9.7.4.3 Blended

9.7.5 Historic and Forecasted Market Size by Type

9.7.5.1 Instantized Formula

9.7.5.2 Non-Instantized Formula

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Powder

9.7.6.2 Liquid

9.7.7 Historic and Forecasted Market Size by Distribution Channels

9.7.7.1 Hypermarket/Supermarket

9.7.7.2 Specialty Store

9.7.7.3 Convenience Store

9.7.7.4 Online Retail

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Functional Milk Replacers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 7.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.28% |

Market Size in 2032: |

USD 9.87 Bn. |

|

Segments Covered: |

By Source |

|

|

|

By Type |

|

||

|

By Form |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||