Forage Analysis Market Synopsis

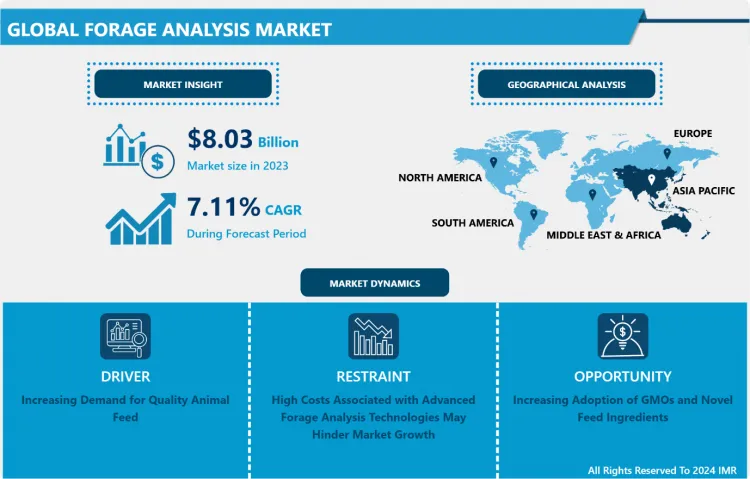

Forage Analysis Market Size is Valued at USD 8.03 Billion in 2023, and is Projected to Reach USD 14.9 Billion by 2032, Growing at a CAGR of 7.11% From 2024-2032.

The forage analysis market is central to improving the nutrient content for livestock as well as feed conversion rates. Forage analysis also points at the suitability of forages including grasses, legumes and silage feeds in relation to their nutritive value for animals. Based on after analyzing different traits like protein, fiber, moisture and mineral qualities about the fodder, farmers and feed makers can get the required feed demands of their animals. It is critical in enhancing the animal health and production to otherwise boost the returns in the animal production business. With demand for meat, dairy and other animal products already on the increasing globally, then the importance of forage analysis cannot be overemphasized.

Increased use of technology has resulted to improvement in the processing of the forage analysis in terms of time and accuracy and also increased accessibility. The utilization of the faster techniques and advanced laboratory tools and equipment ensures the possibility of real-time results to be made available for farmers regarding their forage quality. In addition, the use of the different pieces of digital technology and software for management of the data has made it easy to track and analyze results of the forage analyses. Hence on producers part, feed formulation, feed cost and overall health and productivity among the herds can be enhanced. This trend towards precision nutrition is driving the evolution of forage analysis to provide valuable information for decision making by the involved parties.

Over time, the forage analysis market should continue to exhibit a predictable level of upward trend owing to the increasing focus on nutrition and animal care. Since livestock producers are always looking for better ways to get more miles out of their feed and thus reduce feed conversion rate, the need for forage analysis is expected to increase. Further, advanced concern for food hygiene and environment quality by means of livestock farming is also placing more importance on sustainable practices of forage, which in turn justifies the necessity of forage measurements precisely. The market is expected to grow in the various regions, particularly in NA, EU and Asia-Pacific since this farming of animals is crucial element of agricultural structure in these territories.

Forage Analysis Market Trend Analysis:

Increasing Demand for Quality Animal Feed

- The growing tendency of using high-quality animal feed around the world is stimulating the market for forage analysis. Growing the livestock farming business leads to the improvement of animal feed as well as the health of the animals. For example, When it comes to dairy farming, being proactive when feeding cows on forages affects the amount and quality of the milk produced.. This trend underlines the need for accurate forage analysis technologies and services to supply high nutritional requirements and increase overall performance of cattle globally.

- One of the trends currently visible in the forage analysis market is the growing conception of animal health and, as a result, higher demands for quality animal feeds. In an effort to create improved and healthier conditions for livestock, rearing business have begun to focus sharply in feeding the animals in a manner that would meet certain nutritional needs. This shift is causing more demand for other analyses of forage crops, where the farmers want to determine the quality and nutrient composition. Producers need to know the exact nutrient composition of the forages then they be in a position to produce feeds that will enhance the growth rates, milk production and overall performance of their livestock. Also increased concerns about food quality and safety makes customers also seek better quality for animal feeding and make us have to provide accurate forage analysis for better provision of nutritious foods for the animals.

Increasing Adoption of GMOs and Novel Feed Ingredients

- Growing use of GMOs and other new feed ingredients is a prime factor that is fueling the forage analysis market as well. There is a clear need of specialized testing services to critically evaluate the innovations in terms of quality and concern they pose to safety. For instance, laboratories providing GMO testing for forage can guarantee that they meet the required legal requirements while delivering valuable information concerning the nutritional content, allergenicity and eco-toxicity of the feed to farmers to enable them make the right decisions with regard to feeding their livestock.

- One of the leading trends that affects the growth of the forage analysis market is the growing use of genetically modified organisms (GMOs) as well as the new types of feed ingredients. In the case of livestock production, the use of GMOs and biotechnology and usage of substitute feed resources have attracted interest due to improvements in productivity and feed conversion ratio. These feeds are relatively new in the market and frequently contain certain properties that must be fully investigated before feeding livestock in order to properly meet their nutritional requirements. In this regard, there is the need for forage analysis to offer specific information on nutrient composition for both the conventional and newly identified feed resources so that feed formulation to support efficient animal health may be enhanced. Furthermore, the leading experts and organizations managing forage chains benefit from GMO impacts assessment on the quality and nutritional value of feed resources, making feed strategies more effective and creating a high demand for highly developed forage analysis in the market. It also contributes to the creation of sustainable growth of the livestock industry, while consumers, who are increasingly concerned with corporate transparency and food safety, can also benefit from its results.

Forage Analysis Market Segment Analysis:

Forage Analysis Market Segmented on the basis of By Target, By Livestock , By Forage Type and By Method

By Target, Nutrients segment is expected to dominate the market during the forecast period

- The forage analysis market is segmented on the basis of target parameters such as nutrients, dry matter, mycotoxin, and others; each has specific roles in livestock ration formulation. Nutrient practice involves determination of nutrient like protein, fibre, carbohydrate and minerals for better animal health and production. It is important to assess dry matter content for determination of moisture in forage portion and its qualities for feed, and the later affects fermentation processes in the silage. Accordingly, farmers can develop sound diet prescriptions by categorizing and quantifying these parameters to fit the nutrition profile of livestock and improve growth and reproductive indices.

- Yeast, proteins, vitamins, and mycotoxins are the key factors in the forage analysis market because mycotoxin has negative impacts on animal health and production. Mycotoxins that are found in forages result from fungal infestation of the feed which decreases feed consumption, growth rates, and the overall health of animals. Through forage analysis that goes further and offers mycotoxin testing, producers can then reduce forage risks that may present itself through contaminated feed to benefit the health of their animals and food chain.

By Method, Chemical Method segment held the largest share in 2024

- Different procedures are used in the forage analysis market for analyzing the nutritional content of forage samples, and all of these have their advantages. Chemical methods infer the use of chemical reagents to determine the concentration and or presence of certain elements among them proteins, carbohydrates and minerals among others. These techniques give precise and precise outcomes but involves long duration and necessitate sophisticated laboratory instruments. Physical methods are based on determining properties such as particle size and moisture content; hence it gives an instantaneous analysis that one might need in feeding decisions.

- Two methods used most frequently in forage analysis are wet chemistry and Near-Infrared Reflectance Spectroscopy or NIRS for short. Even though wet chemistry methods are less sophisticated they yield a detailed picture of forage composition based on tests. Thus, the non-invasive Rapid Screening technique like NIRS has come up as a useful tool that promotes quick analysis on multiple samples at one time and so increases the pace of data acquisition. Application of the two methods in the market of forage analysis helps the producers in feeding the livestock and enhancing productivity on the farms.

Forage Analysis Market Regional Insights:

Asia-Pacific is expected to show lucrative growth in the forage analysis market

- It is estimated that the Asia-Pacific region has high potential for growth in the forage analysis market owing to the growing need for enhancing quality animal feed. When the region’s livestock industry is growing to feed the ever-hungry populace, farmers seek forage analysis to improve feed conversion ratio and overall animal health. This aspect has also been driving the general understanding of the nutritional value of the forage crops among farmers hence efficient feed formulation. Moreover the government policies set to enhance livestock production and efficiency also help to cement the forage analysis technologies.

- Furthermore, the new technologies in testing methods and data analysis results in easier forage analysis for farmers in Asia-Pacific. As result of adoption of precision agriculture techniques, producers can use real time information in enhancing feeding patterns with a view of enhancing productivity of the livestock. And therefore the forage analysis market in the region will further gain additional growth to support sustainable and more efficient feeding systems in livestock production.

Active Key Players in the Forage Analysis Market

- SGS Société Générale de Surveillance SA. (Switzerland)

- Eurofins Scientific (Luxembourg)

- Cargill, Incorporated (U.S.)

- CVAS, Inc (U.S.)

- R J Hill Laboratories Limited (New Zealand)

- ServiTech, Inc. (U.S.)

- MASSEY FEEDS (U.K.)

- Dairyland Laboratories, Inc. (U.S.)

- Dairy One (U.S.)

- Bruker (U.S.)

- AgroDyne Inc. (U.S.)

- Cawood Scientific Limited (U.K.)

- others

|

Global Forage Analysis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.11% |

Market Size in 2032: |

USD 14.9 Bn. |

|

Segments Covered: |

By Target |

|

|

|

By Livestock |

|

||

|

By Forage Type |

|

||

|

By Method |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Forage Analysis Market by Target (2018-2032)

4.1 Forage Analysis Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nutrients

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dry Matter

4.5 Mycotoxin

4.6 Others

Chapter 5: Forage Analysis Market by Livestock (2018-2032)

5.1 Forage Analysis Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cattle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Equine

5.5 Sheep

Chapter 6: Forage Analysis Market by Forage Type (2018-2032)

6.1 Forage Analysis Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Ration

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hay

6.5 Silage

Chapter 7: Forage Analysis Market by Method (2018-2032)

7.1 Forage Analysis Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Chemical Method

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Physical Method

7.5 Wet Chemistry

7.6 NIRs

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Forage Analysis Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA. (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EUROFINS SCIENTIFIC (LUXEMBOURG)

8.4 CARGILL INCORPORATED (U.S.)

8.5 CVAS INC (U.S.)

8.6 R J HILL LABORATORIES LIMITED (NEW ZEALAND)

8.7 SERVITECH INC. (U.S.)

8.8 MASSEY FEEDS (U.K.)

8.9 DAIRYLAND LABORATORIES INC. (U.S.)

8.10 DAIRY ONE (U.S.)

8.11 BRUKER (U.S.)

8.12 AGRODYNE INC. (U.S.)

8.13 CAWOOD SCIENTIFIC LIMITED (U.K.)

8.14 OTHERS

8.15

Chapter 9: Global Forage Analysis Market By Region

9.1 Overview

9.2. North America Forage Analysis Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Target

9.2.4.1 Nutrients

9.2.4.2 Dry Matter

9.2.4.3 Mycotoxin

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size by Livestock

9.2.5.1 Cattle

9.2.5.2 Equine

9.2.5.3 Sheep

9.2.6 Historic and Forecasted Market Size by Forage Type

9.2.6.1 Ration

9.2.6.2 Hay

9.2.6.3 Silage

9.2.7 Historic and Forecasted Market Size by Method

9.2.7.1 Chemical Method

9.2.7.2 Physical Method

9.2.7.3 Wet Chemistry

9.2.7.4 NIRs

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Forage Analysis Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Target

9.3.4.1 Nutrients

9.3.4.2 Dry Matter

9.3.4.3 Mycotoxin

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size by Livestock

9.3.5.1 Cattle

9.3.5.2 Equine

9.3.5.3 Sheep

9.3.6 Historic and Forecasted Market Size by Forage Type

9.3.6.1 Ration

9.3.6.2 Hay

9.3.6.3 Silage

9.3.7 Historic and Forecasted Market Size by Method

9.3.7.1 Chemical Method

9.3.7.2 Physical Method

9.3.7.3 Wet Chemistry

9.3.7.4 NIRs

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Forage Analysis Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Target

9.4.4.1 Nutrients

9.4.4.2 Dry Matter

9.4.4.3 Mycotoxin

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size by Livestock

9.4.5.1 Cattle

9.4.5.2 Equine

9.4.5.3 Sheep

9.4.6 Historic and Forecasted Market Size by Forage Type

9.4.6.1 Ration

9.4.6.2 Hay

9.4.6.3 Silage

9.4.7 Historic and Forecasted Market Size by Method

9.4.7.1 Chemical Method

9.4.7.2 Physical Method

9.4.7.3 Wet Chemistry

9.4.7.4 NIRs

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Forage Analysis Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Target

9.5.4.1 Nutrients

9.5.4.2 Dry Matter

9.5.4.3 Mycotoxin

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size by Livestock

9.5.5.1 Cattle

9.5.5.2 Equine

9.5.5.3 Sheep

9.5.6 Historic and Forecasted Market Size by Forage Type

9.5.6.1 Ration

9.5.6.2 Hay

9.5.6.3 Silage

9.5.7 Historic and Forecasted Market Size by Method

9.5.7.1 Chemical Method

9.5.7.2 Physical Method

9.5.7.3 Wet Chemistry

9.5.7.4 NIRs

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Forage Analysis Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Target

9.6.4.1 Nutrients

9.6.4.2 Dry Matter

9.6.4.3 Mycotoxin

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size by Livestock

9.6.5.1 Cattle

9.6.5.2 Equine

9.6.5.3 Sheep

9.6.6 Historic and Forecasted Market Size by Forage Type

9.6.6.1 Ration

9.6.6.2 Hay

9.6.6.3 Silage

9.6.7 Historic and Forecasted Market Size by Method

9.6.7.1 Chemical Method

9.6.7.2 Physical Method

9.6.7.3 Wet Chemistry

9.6.7.4 NIRs

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Forage Analysis Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Target

9.7.4.1 Nutrients

9.7.4.2 Dry Matter

9.7.4.3 Mycotoxin

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size by Livestock

9.7.5.1 Cattle

9.7.5.2 Equine

9.7.5.3 Sheep

9.7.6 Historic and Forecasted Market Size by Forage Type

9.7.6.1 Ration

9.7.6.2 Hay

9.7.6.3 Silage

9.7.7 Historic and Forecasted Market Size by Method

9.7.7.1 Chemical Method

9.7.7.2 Physical Method

9.7.7.3 Wet Chemistry

9.7.7.4 NIRs

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Forage Analysis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.11% |

Market Size in 2032: |

USD 14.9 Bn. |

|

Segments Covered: |

By Target |

|

|

|

By Livestock |

|

||

|

By Forage Type |

|

||

|

By Method |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||