Food Safety Testing Market Synopsis

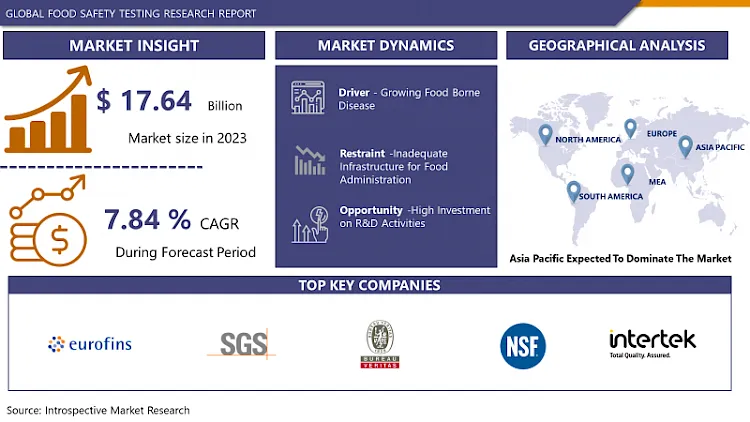

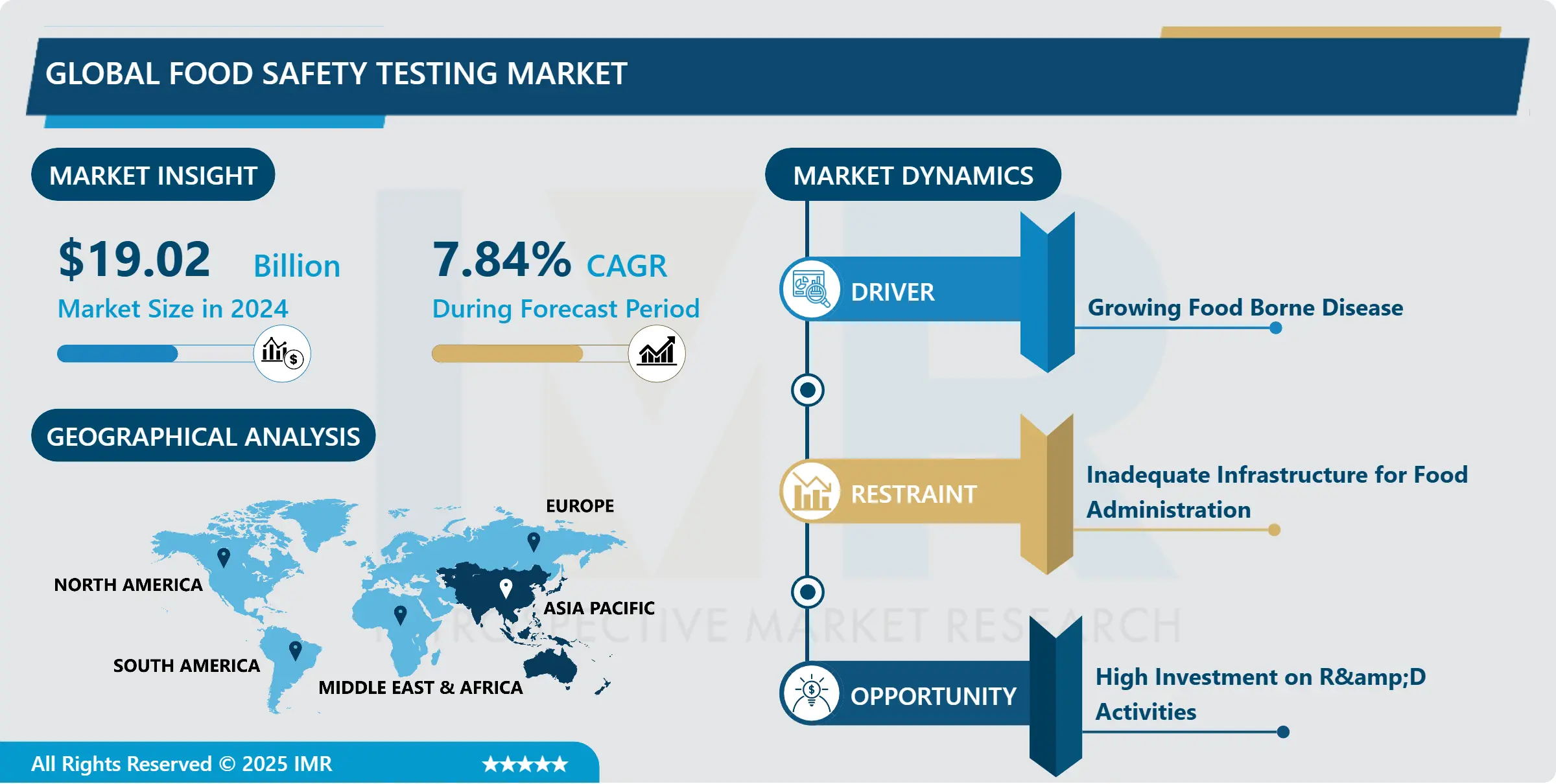

Food Safety Testing Market Size Was Valued at USD 19.02 Billion in 2024, and is Projected to Reach USD 34.79 Billion by 2032, Growing at a CAGR of 7.84% From 2025-2032.

Food safety testing is a crucial process to ensure that food products are free from contaminants, pathogens, and other hazards that may pose health risks to consumers. It involves rigorous analysis of food samples for various parameters, including microbiological, chemical, and physical aspects.

The food safety testing market plays a pivotal role in ensuring the quality and safety of the global food supply. With an increasing awareness of foodborne illnesses and contamination risks, the market has witnessed substantial growth. Stringent regulatory requirements, coupled with a rising demand for high-quality and safe food products, have fueled the adoption of advanced testing methods.

Key factors driving the market include technological advancements in testing techniques, globalization of the food supply chain, and a growing emphasis on preventive measures in the food industry. Various testing methods, such as PCR, immunoassay, chromatography, and rapid testing, are employed to detect contaminants such as pathogens, pesticides, toxins, and allergens.

The market is characterized by a diverse range of stakeholders, including government regulatory bodies, food manufacturers, and testing laboratories. North America and Europe dominate the market due to stringent food safety regulations, while Asia-Pacific is experiencing significant growth driven by increasing food production and a rising focus on quality standards. As the demand for safe and reliable food products continues to surge, the food safety testing market is expected to witness sustained expansion in the coming years.

Food Safety Testing Market Trend Analysis

Growing Food Borne Disease

- The escalating prevalence of foodborne diseases has emerged as a compelling driver propelling the growth of the food safety testing market. With an increasing global population and intricate food supply chains, the risk of contamination and transmission of pathogens has heightened, necessitating stringent measures to ensure food safety.

- Consumers are becoming more conscious of the potential health hazards associated with contaminated food, demanding reliable and comprehensive testing procedures. Governments and regulatory bodies across the globe are also intensifying efforts to enforce stringent food safety regulations, further bolstering the demand for robust testing methodologies.

- Food safety testing plays a pivotal role in identifying and mitigating the risks posed by pathogens, contaminants, and toxins in various food products. The market is witnessing a surge in innovative technologies and methods, such as DNA-based testing and rapid detection techniques, to enhance the efficiency and speed of testing processes.

High Investment on R&D Activities creates an Opportunity

- A substantial investment in Research and Development (R&D) activities presents a significant opportunity for the Food Safety Testing market. As advancements in technology and scientific methodologies progress, the capabilities of detecting and ensuring food safety are greatly enhanced. High R&D investment allows for the development of innovative testing methods, cutting-edge technologies, and more accurate diagnostic tools.

- These advancements can lead to quicker and more reliable detection of contaminants, pathogens, and other potential hazards in food products. Additionally, the implementation of state-of-the-art testing solutions can contribute to increased efficiency and reduced testing time, providing a competitive edge for companies in the food safety testing sector. Improved sensitivity and specificity of testing methods through R&D can address emerging challenges in food safety, offering comprehensive solutions for both industry and regulatory compliance.

Food Safety Testing Market Segment Analysis:

Food Safety Testing Market Segmented on the basis of type, Technology, application.

By Type, Pathogen segment is expected to dominate the market during the forecast period

- Pathogen testing is crucial for identifying and mitigating potential hazards in food products, thereby safeguarding public health. With an increasing focus on preventing outbreaks of foodborne diseases, stringent regulations and standards have been established to mandate thorough testing protocols. This has propelled the demand for advanced and reliable pathogen detection methods within the food safety testing market.

- Technological advancements, such as molecular diagnostic techniques and rapid testing methods, further contribute to the prominence of the Pathogen segment. These innovations enhance the efficiency and speed of pathogen detection, enabling food producers and regulators to respond promptly to potential threats. As the food industry continues to prioritize safety and quality, the Pathogen segment is poised to maintain its dominance in the evolving landscape of food safety testing.

By Application, Bakery & Confectionary Products segment held the largest share in 2024

- The Bakery & Confectionery Products segment is poised to assert dominance in the Food Safety Testing market due to several key factors. With consumers increasingly prioritizing food safety, stringent regulations, and a growing awareness of health concerns, the demand for robust testing measures has surged, particularly in the production of bakery and confectionery items.

- Bakery and confectionery products are highly perishable, and their production involves complex processes and a variety of ingredients, making them susceptible to contamination risks. Stringent testing protocols are crucial to ensure the safety and quality of these products throughout the supply chain. The segment's dominance is further accentuated by the global popularity and consumption of bakery and confectionery items, necessitating extensive testing procedures to meet regulatory standards and consumer expectations.

Food Safety Testing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the food safety testing market, showcasing significant growth and influence. This trend can be attributed to several key factors that underscore the region's prominence in ensuring the safety and quality of food products.

- Asia Pacific region is witnessing a rapid expansion of its food and beverage industry, driven by population growth, urbanization, and changing consumer preferences. As the demand for diverse and processed food products rises, so does the need for robust food safety measures.

- Governments and regulatory bodies in the Asia Pacific are increasingly recognizing the importance of stringent food safety regulations to protect public health. This heightened awareness is fostering a proactive approach to food safety testing, creating a conducive environment for market growth.

- Moreover, advancements in technology and the adoption of innovative testing methods are contributing to the region's dominance in ensuring comprehensive food safety. The implementation of cutting-edge technologies enhances the efficiency and accuracy of testing processes, bolstering consumer confidence in the safety of food products.

Food Safety Testing Market Top Key Players:

- Eurofins Scientific SE (Luxembourg)

- SGS Group (Switzerland)

- Bureau Veritas (France)

- NSF International (United States)

- Intertek Group PLC (United Kingdom)

- Merieux Nutrisciences (France)

- TUV SUD (Germany)

- ALS Limited (Australia)

- Asurequality Limited (New Zealand)

- UL LLC (United States)

- Mérieux NutriSciences (France)

- Covance (United States)

- Silliker (United States)

- SGS Tecnomatic Argentina (Argentina)

- Eurofins Lancaster Laboratories (United States)

- TÜV Austria (Austria)

- Bureau Veritas Italia (Italy)

- QIMA (Switzerland)

- Intertek Testing Services (Malaysia)

- Bureau Veritas Japan (Japan)

- Other Active Players

Key Industry Developments in the Food Safety Testing Market:

- In January 2023, Eurofins, a leading food safety testing company, launched a new rapid pathogen detection platform called BactiQuant MQS+. This platform utilizes molecular sequencing technology to identify foodborne pathogens like Salmonella and Listeria in under 24 hours.

- In May 2023, SGS, another major player in the industry, introduced its "Farm to Fork" traceability solution. This cloud-based platform provides end-to-end visibility of food supply chains, allowing stakeholders to track food products from farm to table and ensure transparency.

- In October 2023, Neogen Corporation, a leader in animal health and food safety testing, launched its Reveal Q+ Max for Mycotoxins test kit. This innovative kit detects multiple mycotoxins simultaneously in grains and other commodities, helping producers ensure the safety of their products.

|

Global Food Safety Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.02 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.84% |

Market Size in 2032: |

USD 34.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Safety Testing Market by Type (2018-2032)

4.1 Food Safety Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pathogen

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Allergens

4.5 Gmo

4.6 Mycotoxins

Chapter 5: Food Safety Testing Market by Technology (2018-2032)

5.1 Food Safety Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Culture Media

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Immunoassay

5.5 Polymerase Chain Reaction

Chapter 6: Food Safety Testing Market by Application (2018-2032)

6.1 Food Safety Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Bakery & Confectionary Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Meat & Meat Products

6.5 Seafoods

6.6 Dairy & Dairy Products

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Food Safety Testing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARGILL INCORPORATED (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADM (US)

7.4 INTERNATIONAL FLAVORS & FRAGRANCES (US)

7.5 EVONIK INDUSTRIES AG (GERMANY)

7.6 BASF SE (GERMANY)

7.7 DSM (NETHERLANDS)

7.8 AJINOMOTO (JAPAN)

7.9 NOVOZYMES (DENMARK)

7.10 CHR. HANSEN (DENMARK)

7.11 TEGASA (SPAIN)

7.12 NUTRECO (NETHERLANDS)

7.13 KEMIN INDUSTRIES INC (US)

7.14 ADISSEO (FRANCE)

7.15 BRF (BRAZIL)

7.16 SOLVAY (BELGIUM)

7.17 GLOBAL NUTRITION INTERNATIONAL (FRANCE)

7.18 CENTAFARM SRL (ITALY)

7.19 BENTOLI (US)

7.20 NUQO FEED ADDITIVES (FRANCE)

7.21 NOVUS INTERNATIONALINC.(US)

7.22 OTHER KEY PLAYERS

Chapter 8: Global Food Safety Testing Market By Region

8.1 Overview

8.2. North America Food Safety Testing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Pathogen

8.2.4.2 Allergens

8.2.4.3 Gmo

8.2.4.4 Mycotoxins

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Culture Media

8.2.5.2 Immunoassay

8.2.5.3 Polymerase Chain Reaction

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Bakery & Confectionary Products

8.2.6.2 Meat & Meat Products

8.2.6.3 Seafoods

8.2.6.4 Dairy & Dairy Products

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Food Safety Testing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Pathogen

8.3.4.2 Allergens

8.3.4.3 Gmo

8.3.4.4 Mycotoxins

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Culture Media

8.3.5.2 Immunoassay

8.3.5.3 Polymerase Chain Reaction

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Bakery & Confectionary Products

8.3.6.2 Meat & Meat Products

8.3.6.3 Seafoods

8.3.6.4 Dairy & Dairy Products

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Food Safety Testing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Pathogen

8.4.4.2 Allergens

8.4.4.3 Gmo

8.4.4.4 Mycotoxins

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Culture Media

8.4.5.2 Immunoassay

8.4.5.3 Polymerase Chain Reaction

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Bakery & Confectionary Products

8.4.6.2 Meat & Meat Products

8.4.6.3 Seafoods

8.4.6.4 Dairy & Dairy Products

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Food Safety Testing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Pathogen

8.5.4.2 Allergens

8.5.4.3 Gmo

8.5.4.4 Mycotoxins

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Culture Media

8.5.5.2 Immunoassay

8.5.5.3 Polymerase Chain Reaction

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Bakery & Confectionary Products

8.5.6.2 Meat & Meat Products

8.5.6.3 Seafoods

8.5.6.4 Dairy & Dairy Products

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Food Safety Testing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Pathogen

8.6.4.2 Allergens

8.6.4.3 Gmo

8.6.4.4 Mycotoxins

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Culture Media

8.6.5.2 Immunoassay

8.6.5.3 Polymerase Chain Reaction

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Bakery & Confectionary Products

8.6.6.2 Meat & Meat Products

8.6.6.3 Seafoods

8.6.6.4 Dairy & Dairy Products

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Food Safety Testing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Pathogen

8.7.4.2 Allergens

8.7.4.3 Gmo

8.7.4.4 Mycotoxins

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Culture Media

8.7.5.2 Immunoassay

8.7.5.3 Polymerase Chain Reaction

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Bakery & Confectionary Products

8.7.6.2 Meat & Meat Products

8.7.6.3 Seafoods

8.7.6.4 Dairy & Dairy Products

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Food Safety Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.02 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.84% |

Market Size in 2032: |

USD 34.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||